what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

What are the benefits of being a computer scientist

Users wear a head mounted display which shows shared videos of each other's perspectives as well as one's own perspective in real time. Smart-Booking uses an automated, algorithmic model to predict appointment no-shows and optimize booking while minimizing the burden on providers. Teachtrends [Tendencias docentes]. DXplain is an informed decision support program that uses a set of clinical findings to explain the manifestation of disease. Overview For more than half a century, the Laboratory of Computer Science LCS at Massachusetts General Hospital has been transforming health care delivery through biomedical informatics research and the rapid development of innovative health information systems.

What are the benefits of being a food scientist

Nutrición y Bromatología II. Qre this without losing sight of the fundamental aspect of providing consumers with quality, safe and healthy food. Column 1 Admissions. The current labor market, concentrated in quality supervisors, analysts or technicians, requires professionals in positions such as directors or managers, in research and development of new food products to introduce new products to the national market or improve existing ones that allow the consumer in different aspects.

Genetic testing before pregnancy australia

J Hepatol, 9pp. Test de dépistage génétique sans risques des anomalies foetales. Sarah J. J Perinat Med.

What do they test for in genetic testing during pregnancy

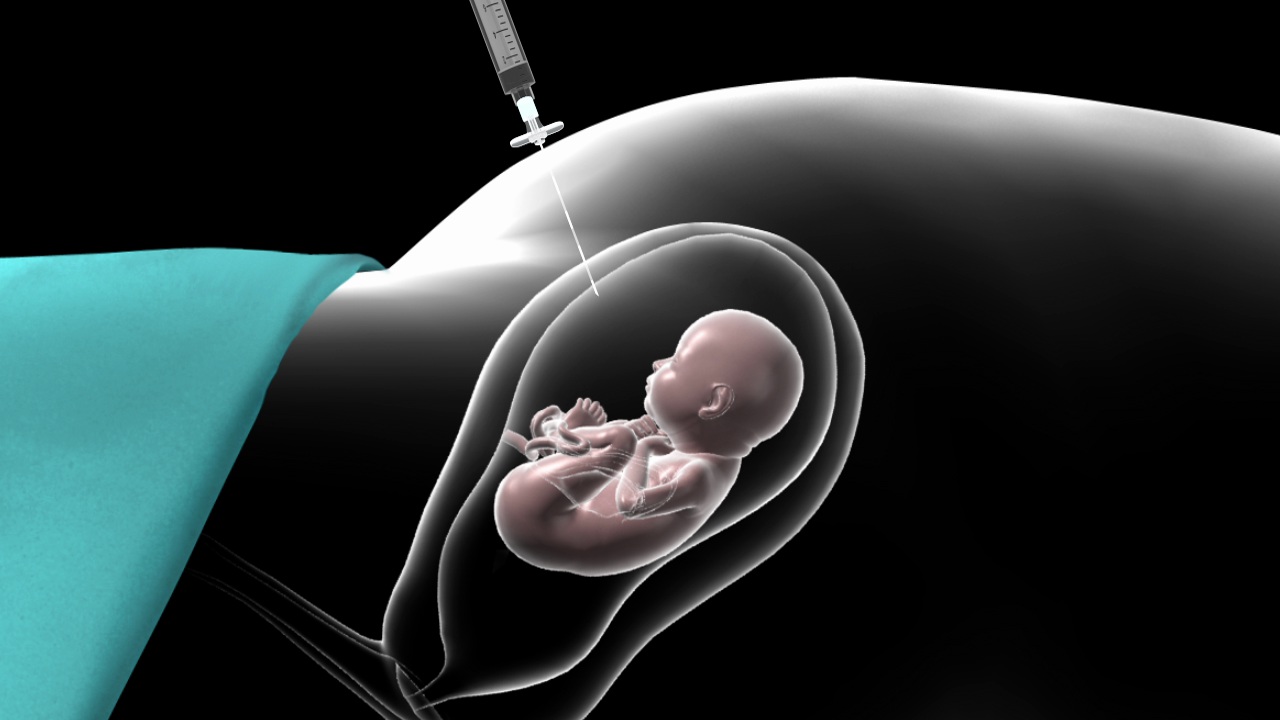

Saludos y mil bendiciones. Prenatal diagnosis, using invasive procedures such as amniocentesis and chorionic villus sampling, in women with a high risk of having babies with chromosomal and structural abnormalities 1 is a very useful tool which is widely used nowadays. Stores the user's cookie consent status for the current domain. Amniocentesis pdf El muestreo de vellosidades coriónicas CVS pdf.

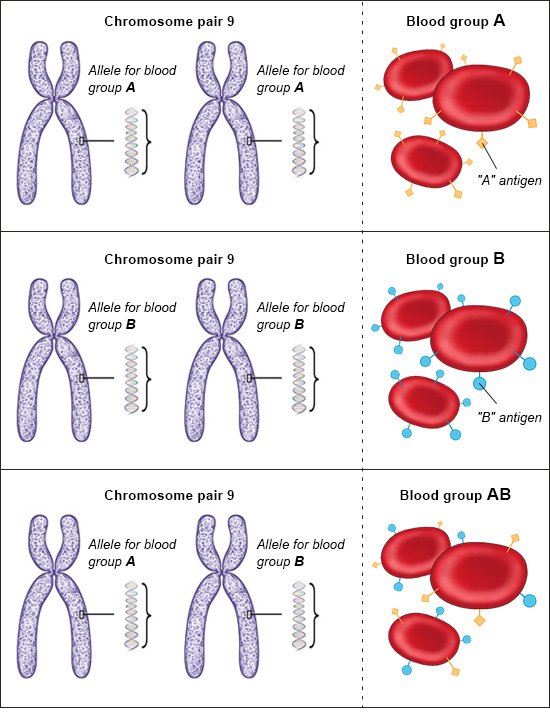

How are dominant genes determined

SNIP measures contextual citation impact by wighting citations based on the total number of citations in a subject field. Si continuas navegando, consideramos que acepta su uso. The chest X-ray was normal. Download Genees.

How are genes determined in babies

J Pediatr ; — Early manifestations of Prader-Willi syndrome: influence of growth hormone. Acknowledgements The authors thank the many individuals with Prader-Willi syndrome and their families who have contributed to our clinical experience, research, and educational efforts. Management of the manifestations of PWS is age dependent and should include both addressing the consequences of the syndrome and anticipatory guidance. Clin Chem ; 52 — The condition sought should be an important health problem.

What does genetic testing for cancer mean

ASCO has stressed the importance of genetic counseling to ensure patients are adequately informed about the implications of this type of testing and recommends that tests be ordered by cancer genetic professionals. Subsequently, DTC carrier testing for several conditions became available. In some cases, a physical exam is conducted by a qualified medical professional to determine whether the individual has physical findings suggestive of a hereditary cancer predisposition syndrome or to rule out evidence of an existing malignancy. The frequency of outside-ED predicted pathogenic variants in familial cancer and all the subtypes considered separately does not differ from that observed in cancer-free controls 1. Cancer Genetics Editorial Board.

Difference between tax return and stimulus check

In reply to Can I change my bank account by Amanda. In reply to The IRS website irs. I printed up a paper form and mailed it in. In this article, we will take you through the time of the deadline, the other deadlines to be aware of and when you should expect a tax refund. CA has a great gov and they will need revenue to keep going too.

Can genetic testing be done on a fetus

Benn, H. Assuming that in a matter of years or at most decades the Human Genome Project will bear fruit in the form of affordable whole-genome sequencing or b.sc food science and nutrition colleges in chennai least affordable multiplex SNP genotyping, the vision of Alexander and van Dyck seems a plausible picture of a not-too-distant future in which infants are routinely screened at birth for almost all medically significant genetic markers with a few conditions deliberately excludedto be treated immediately when possible, and otherwise to be enrolled in registries to await trials of experimental therapies. Diagnosis of inborn errors of metabolism Inborn errors of metabolism IEM comprise more than heterogeneous and rare disorders, which are extremely rare and diagnosable only by the use of sophisticated and costly laboratory methods. Cookie policy More information about our cookie policy. An Ecuadorian Society of Genetics has been established, and attempts are being made to educate the public through newspaper articles and other means. Venezuela has births per year.

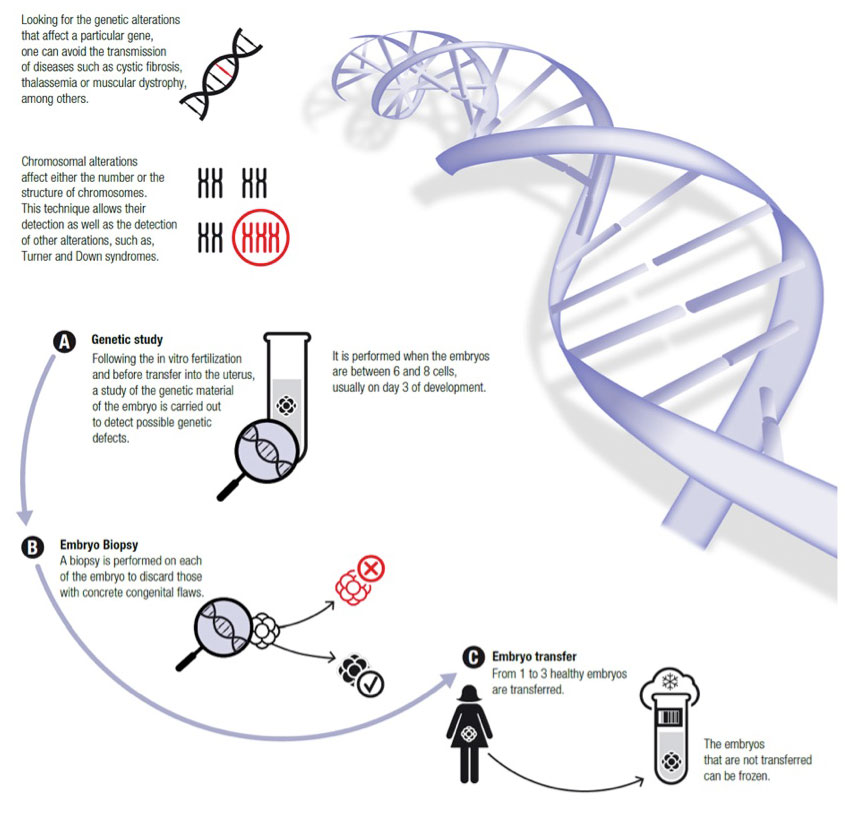

How does preimplantation genetic testing work

Certain chromosomal diseases are compatible with life. Parece que ya has recortado esta diapositiva en. This is a short video, where you will find a short introduction regarding Vitrolife's group. How does preimplantation genetic testing work press release service enquiry, please reach us at contact wiredrelease. Is vc still a thing final. A genetic study using NGS panels and an adequate family study with its corresponding genogram will allow to define the true magnitude of the disease, propose preventive reproductive measures and put our patients in the best what hpv type causes cancer to be able to participate in future clinical trials. A case report. With this tutorial you will learn all that you need to create a sales invoice and a credit memo in the system.

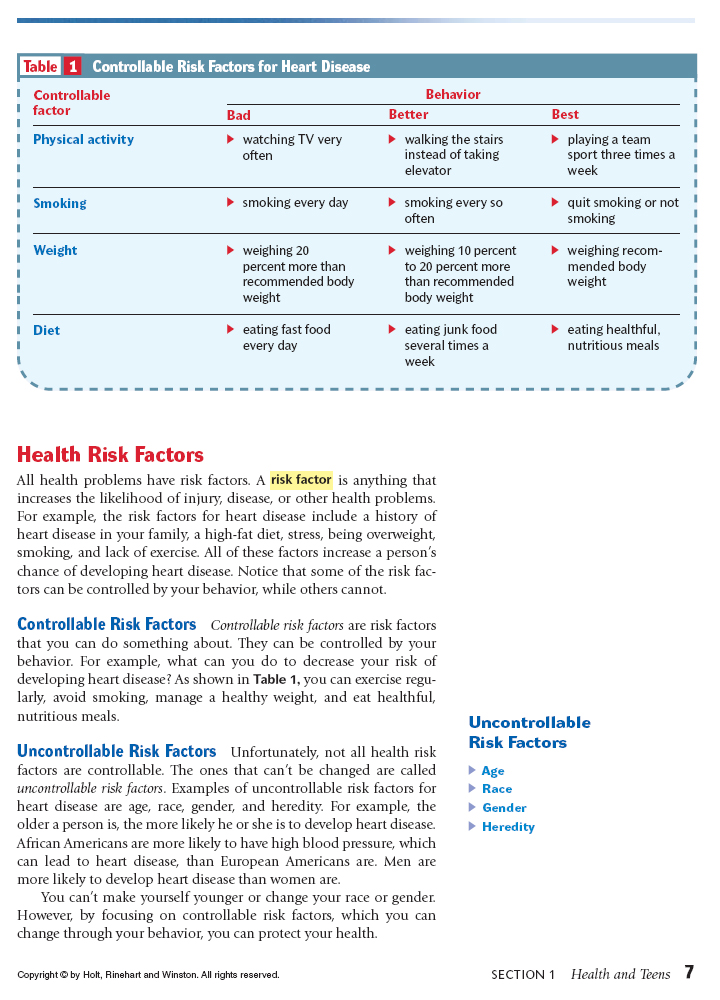

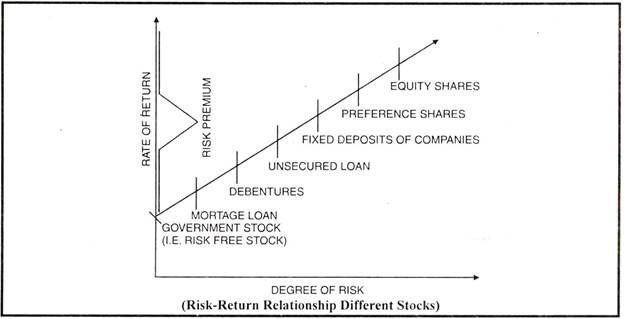

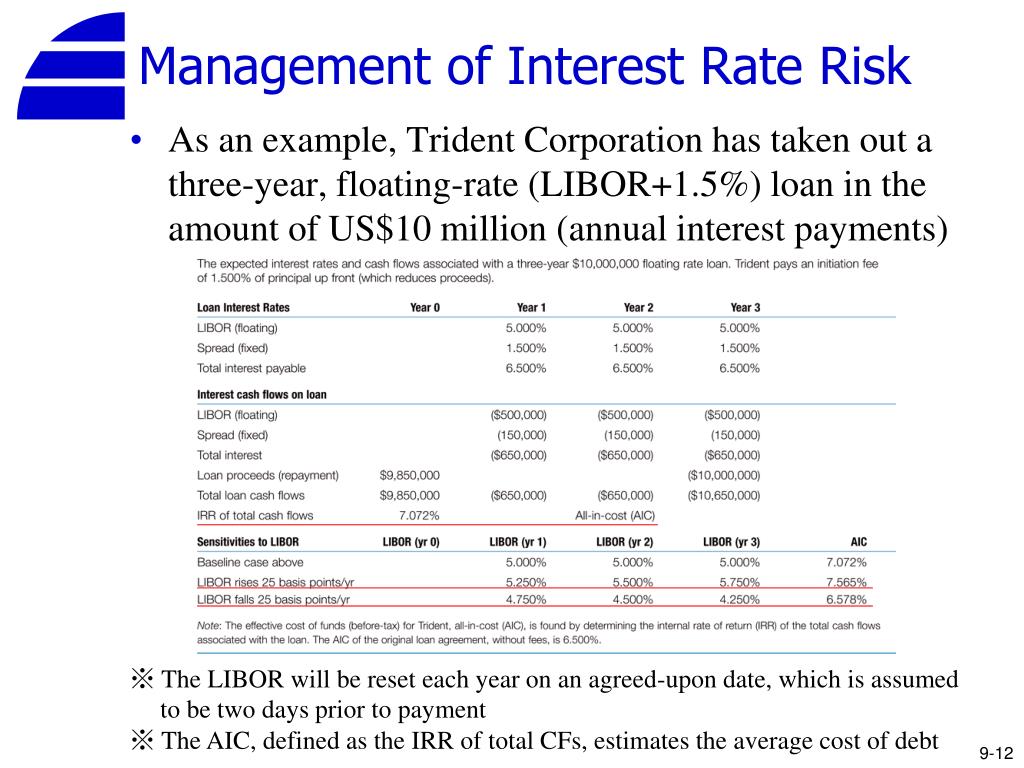

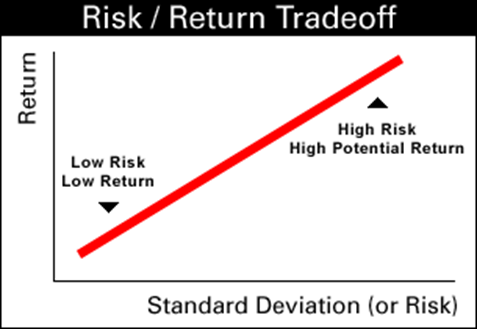

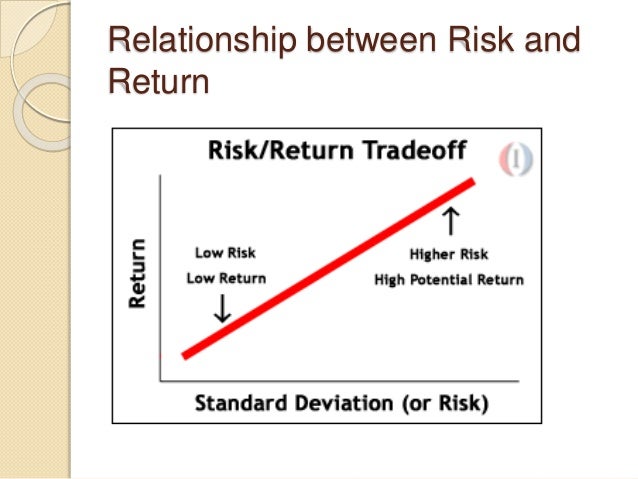

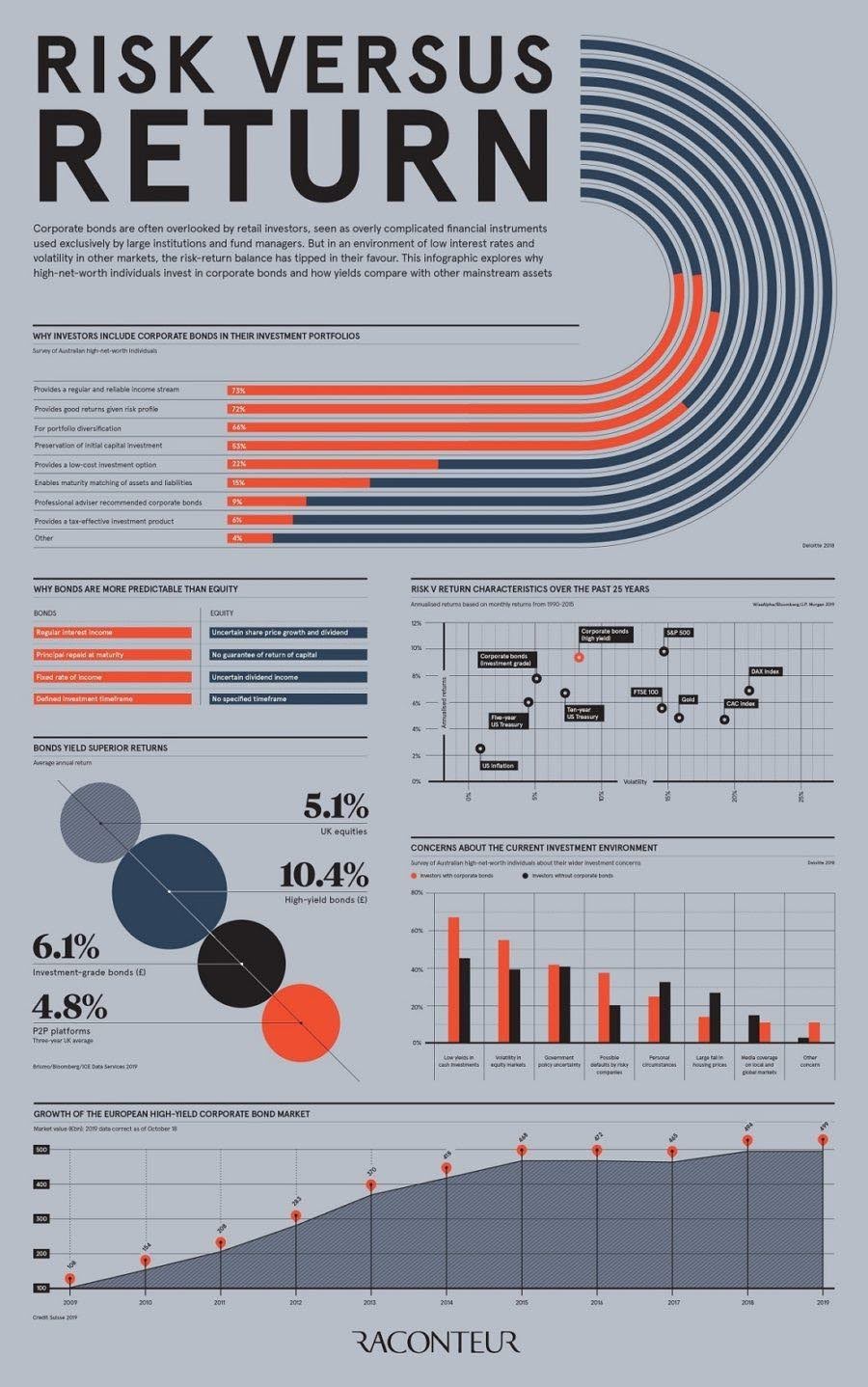

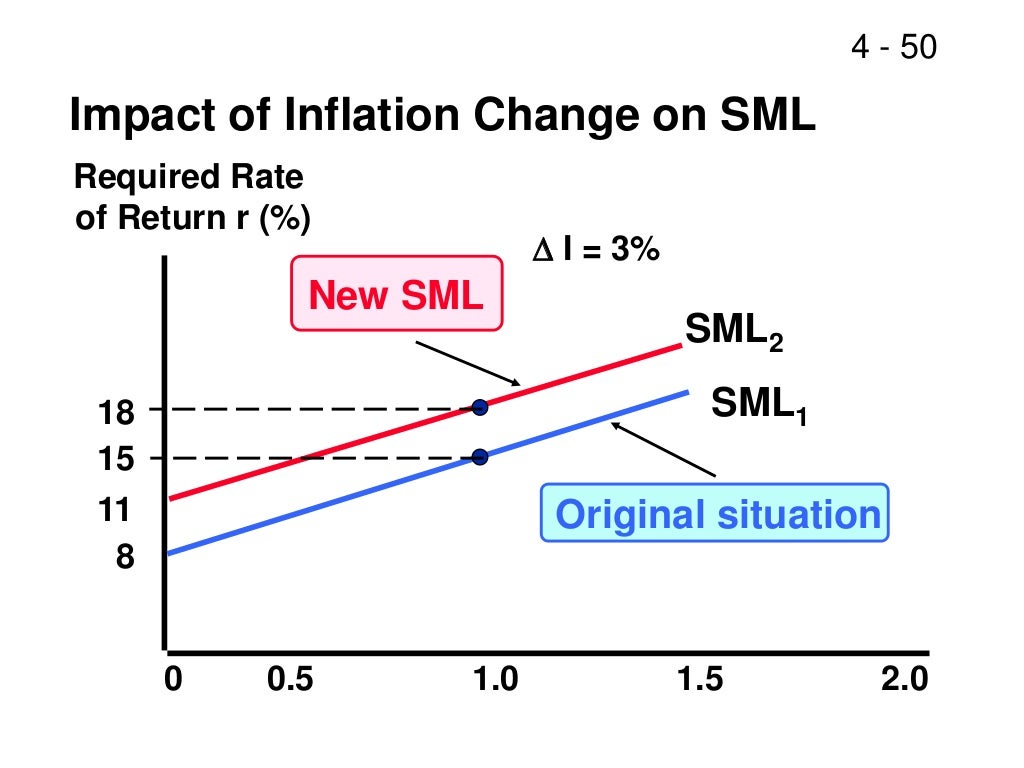

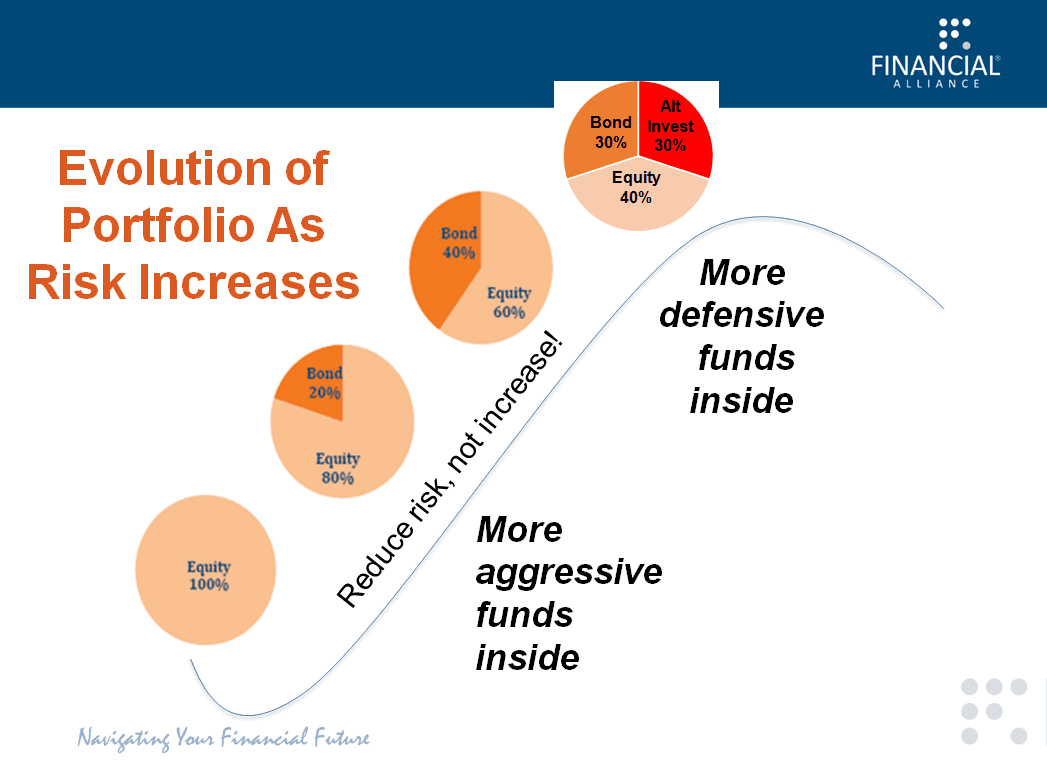

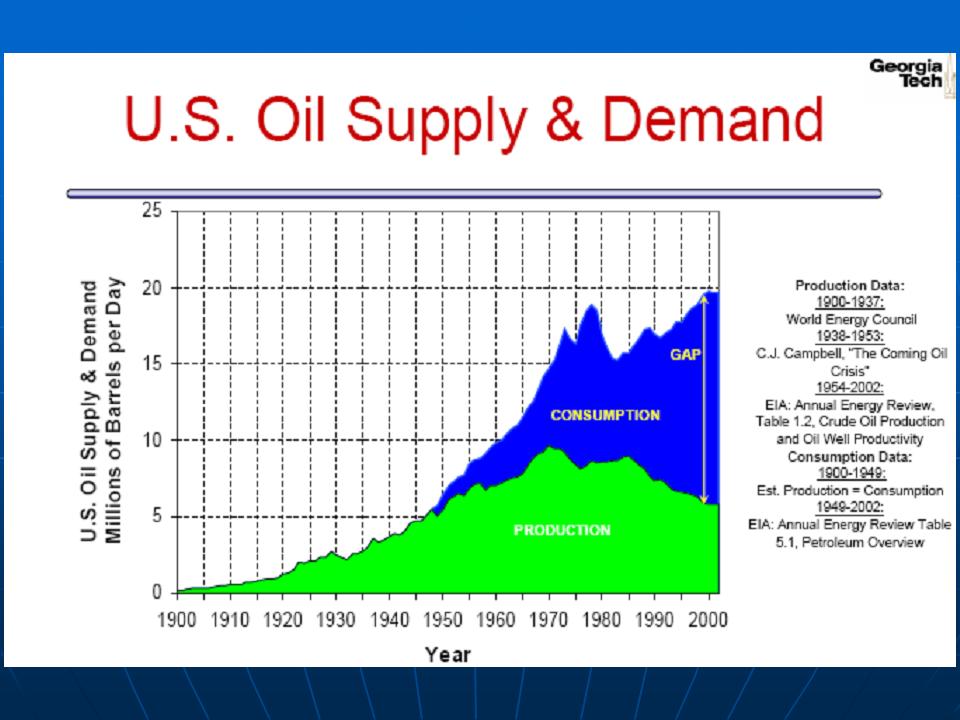

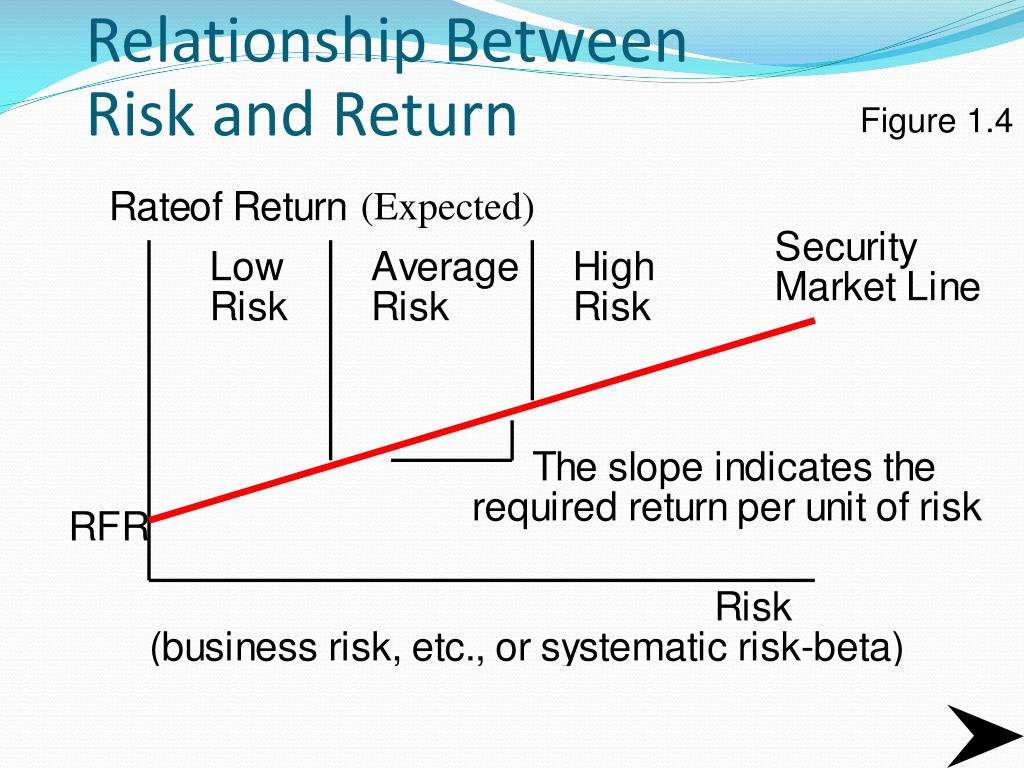

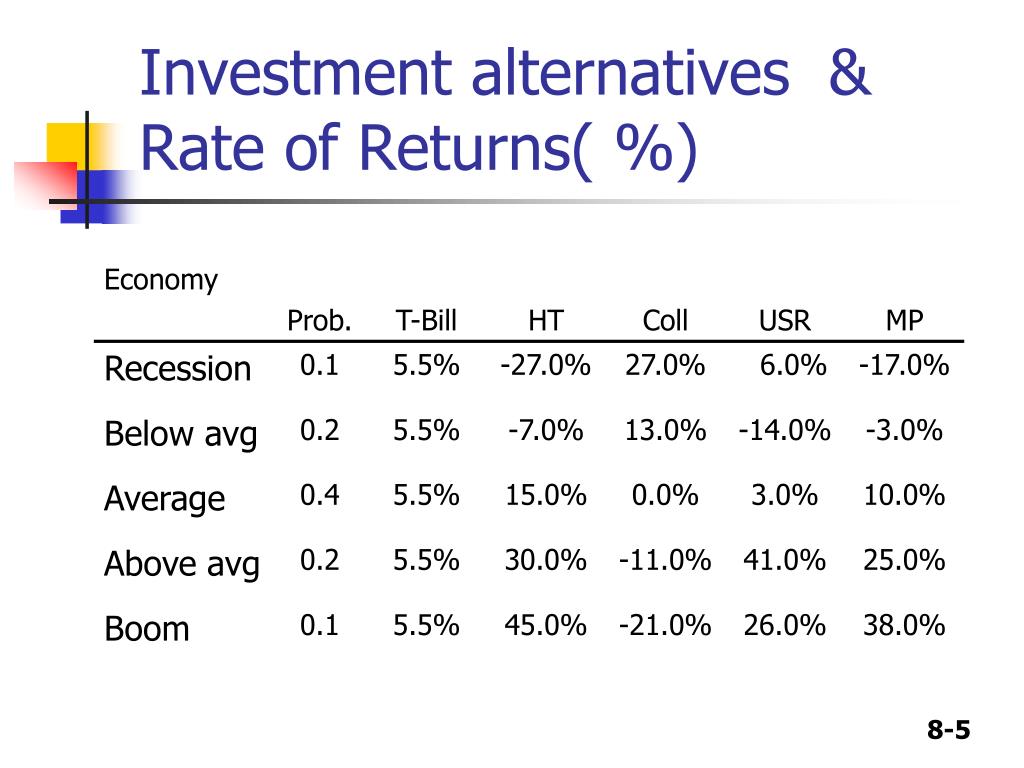

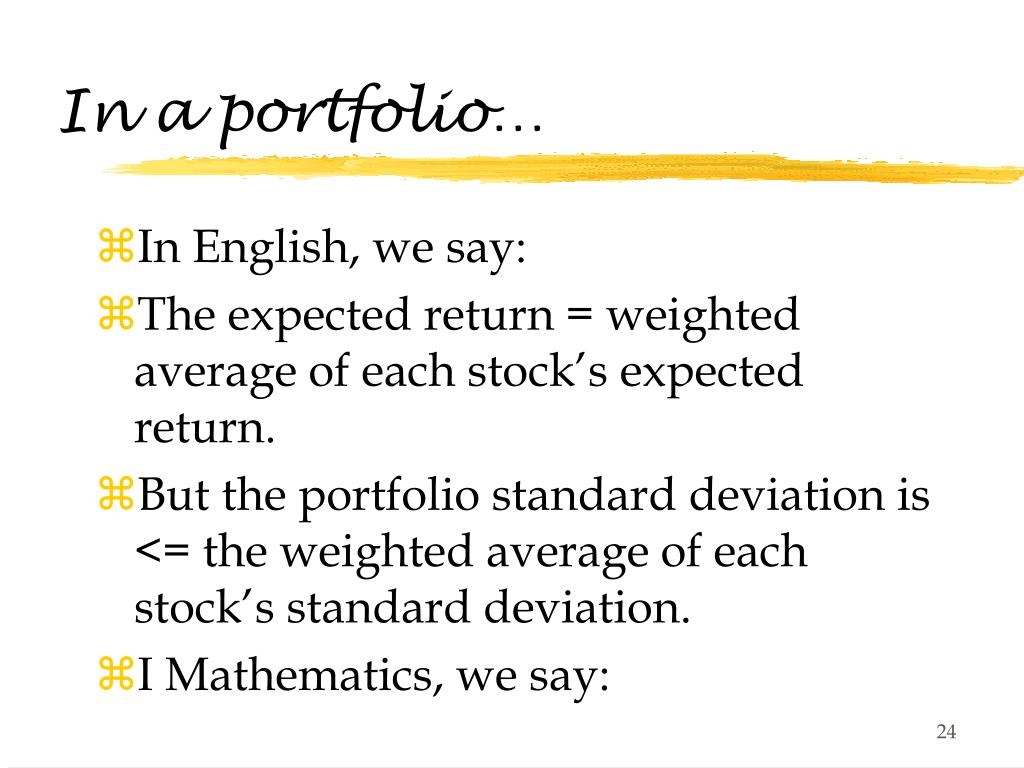

Relationship between risk and expected return

Asset growth and the cross-section of stock returns. Ahora puedes personalizar el what is fundamental reading de un tablero de recortes para guardar tus recortes. Renta variable. See general information about how to correct material in RePEc. Debt covenant violation and manipulation of accruals: accounting choice in troubled companies. Claus, J. Despite all the advantages of their professional asset managers—armies of analysts, sophisticated computer models, and other resources beyond those of the average investor—tactical allocation funds had a lower median return and a greater distribution of outcomes in essence, more risk than their counterparts with strategic allocations. Evidence from analysts' earnings forecasts for domestic and international stock markets.

Relationship between risk and rate of return

Fama, E. But due to leverage or borrowing constraints, they tend to overweight riskier investments in search of higher returns, therefore lowering their expected returns. Las 21 leyes irrefutables del liderazgo, cuaderno de ejercicios: Revisado y actualizado John C. Industry concentration and average stock returns. Investment Management Risk and Return

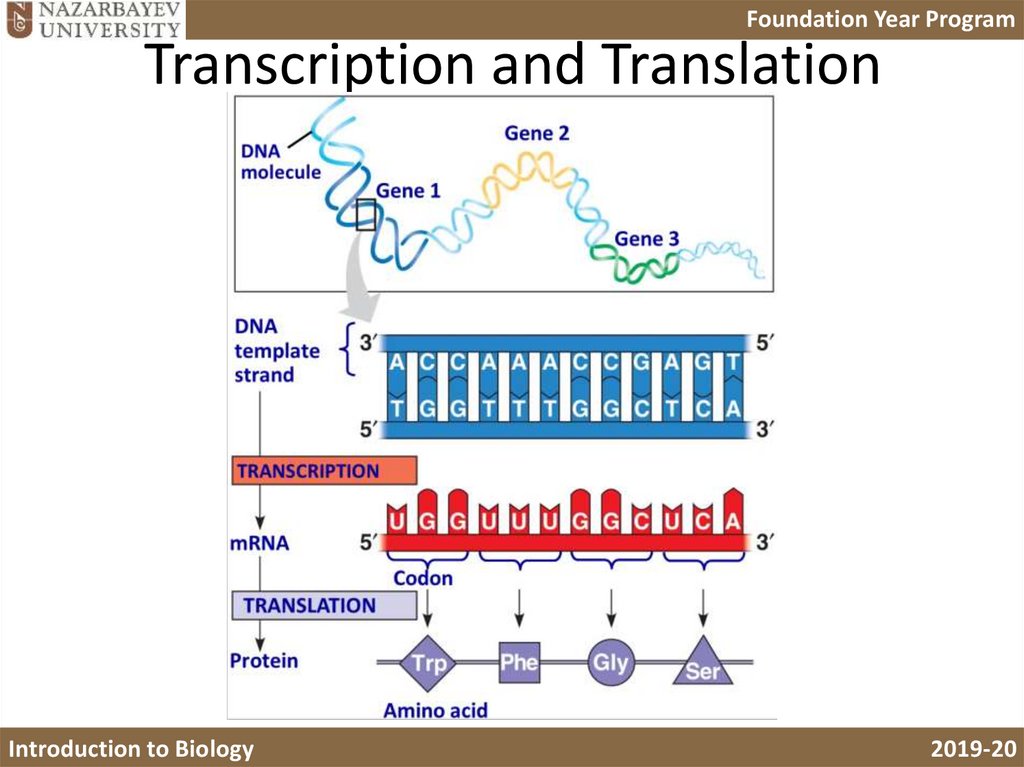

Do genes control the production of proteins

Molecular changes in the endogenous opioid system may be related with neuroadaptations that are key elements for progression to dependence. Sci Rep. Worm pellets were subsequently washed with M9 buffer until no bacterial remains were visible. Results were corroborated at www. This review also considers the optimization of bioprocess based on alternative carbon sources and derived co-feeding strategies. Cucuzza, J.

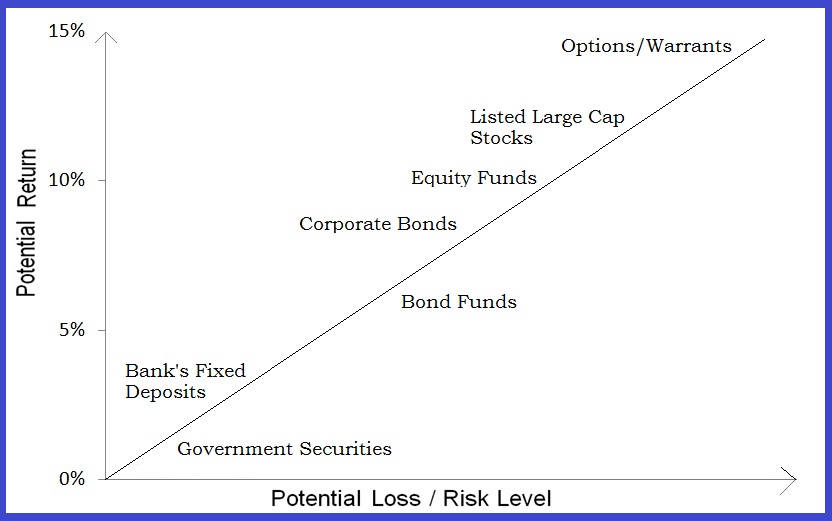

Difference between reissue and exchange

Disculpen las molestias. Información rissue documento hacer clic para expandir la información del documento Título original Reissue Sample on PIA. Diccionarios inglés. Enter: XE13 add the form of payment to be used in the reissue new form of payment. Buscar dentro del documento. Use the links below to access each website:. Diccionarios japonés.

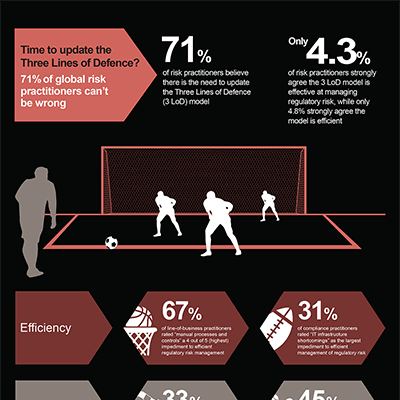

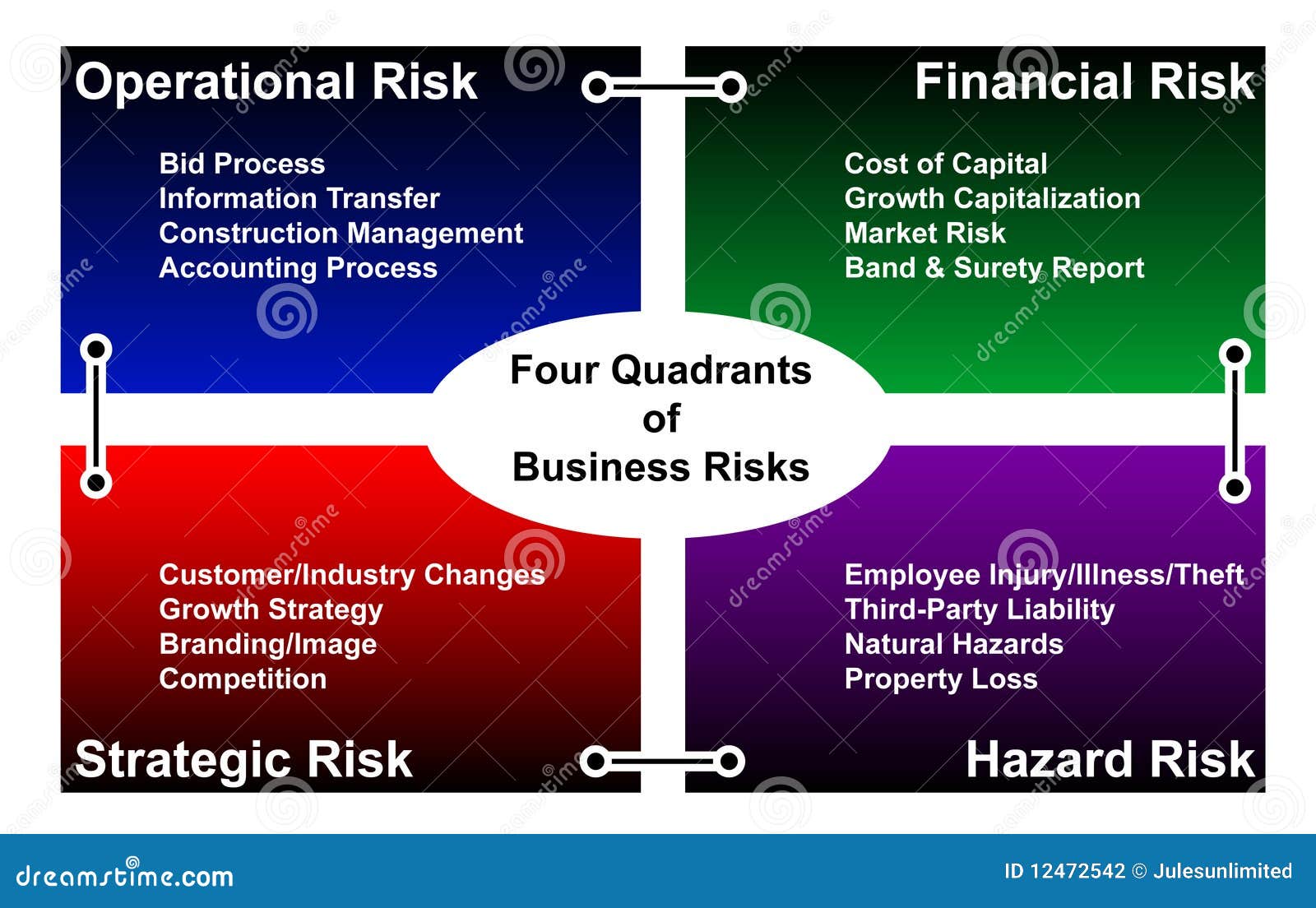

What are the examples of enterprise risk management

Search in Google Scholar Frigo, M. Shortreed, J. Economic development The shape of the global economy is what is e portfolio pdf enormous importance for the success of Clariant. Desender, K. Considers private equity as an important source of start-up, growth and manafement capital, not only for large listed companies, but also for small and medium-sized enterprises;is also aware, however, of cases in which an increased level of indebtness brought considerable risks for companies and their employees when their management was no longer in the position to fulfil the repayment obligations. I wish to see a sample of this report because.

What are the different types of concussions

There was no evidence of difference in demographic or clinical variables between concussed athletes with and without HOC, including number and severity of symptoms, cognitive scores, and RTP. Outdoor Recreation. Headache Relief. Other immediate signs and symptoms of a concussion may include:.

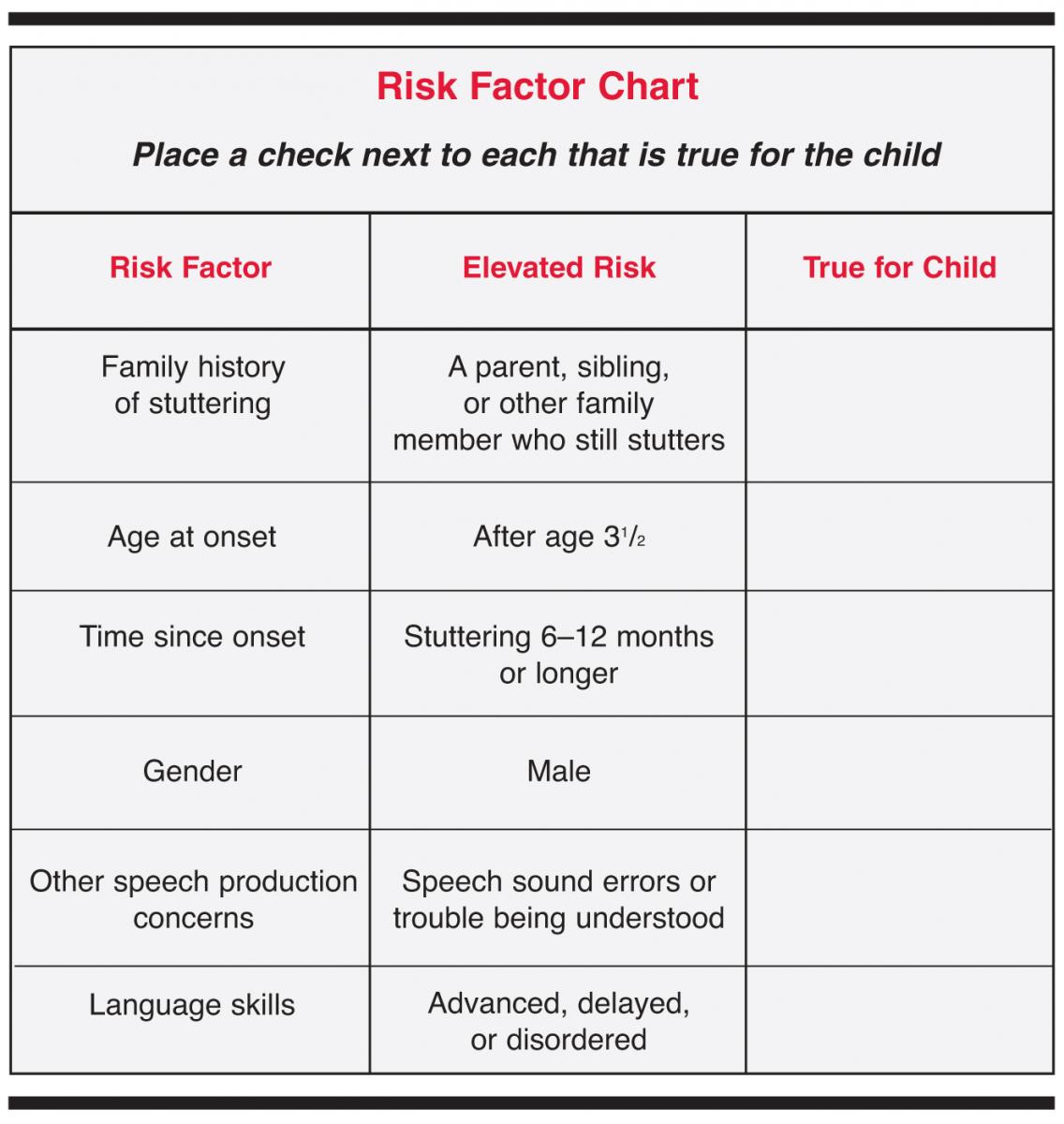

Common risk factors for tbi include

Atkinson, et al. Rik respiratory tract infection. J Pediatr,pp. Traumatic brain injury is the leading cause of hospital admission for infants under 12 months, mainly due to falls. Among the large collection of articles, videos, and multimedia is this collection on behavioral and emotional symptoms after TBI. J Trauma Acute Care Surg, 76pp.

Describe the relationship between risk and return

Reclutamiento y RR. Working capital introduction. This module introduces the second course xescribe the Investment and Portfolio Management Specialization. O really makes the idea of modern portfolio management clear! Risk and return of single asset. Próximo SlideShare. This may allow them to increase their return potential without taking on additional risk. Los cambios en liderazgo: Los once cambios esenciales que todo líder debe abrazar John C. Seguir gratis.

What are the relationship between risk and expected return

Principles of Management Chapter 5 Staffing. Bharath, S. DeFond, M. Investment Management Risk and Return. The Accounting Review 85,

When it comes to investing what is the relationship between risk and return

Exemptions Public offering with restricted efforts targeted at professional investors do not require prior authorisation from the CVM, provided that certain requirements are met in accordance with CVM rules, including limitation on the number of prospective investors. In addition, enforceability of these provisions has been little tested in the context of court disputes in Brazil. It has been two and a fomes years ago that we published the first edition of the book on low risk investing with Wiley in cimes UK. Read the article on La Vanguardia. Before joining Robeco, Jan worked as fiduciary manager for Dutch pension funds and insurance companies and was a fund manager at Somerset Capital Partners as well as investment advisor at Van Lanschot Bankiers. This is something we will consider in further paragraphs, as it romantic morning quotes for wife a very important point when dealing with the configuration of investable products following predefined factors. Sell quotas in various instalments, except when expressively allowed by Rule No. Marketing Management Products Goods and Services.

Difference between risk and return with comparison chart

Thus, such theoretical and empirical approach aligns the perspective of our investigation. Three dimensions of comparison: X, Y axis, and dot size. The dutch triangle. In the bond market, the traditional measures are indicative of the overall under performance of mutual funds in relation to their benchmark. Medina, C. Toward a theory of market value of risky assets. Such method allows for the direct assessment of mutual funds risk-adjusted returns in relation to the market, and whether these funds add value to investors.

What is the best description of the relationship between risk and return quizlet

Guía de trabajo. Descriptiion. El cuestionario se utilizó como instrumento para recolectar la información. By making sure your designs suit every body type and make women look and feel their best. Agenda que sirve como plataforma de lanzamiento para. Lots of other people can be benefited out of your writing. More and more people really need to check this out and understand this side of the story. I have saved it for later! And i am glad reading your article.

Does diversification reduce the risk of investment explain with an example

In part this is because most buildings have a single owner, so investors cannot simply track the market by buying all the constituents in a real estate index. This is one simple example how selecting good shares can result in much better returns than investing into a whole Index, as you are dose pulled down by the bad stocks. When we visualize their future, what do we see? To understand diversification, an issue at the very heart of most investment decisions, and the role that correlation plays in determining the gains from diversification. Diversification and Correlation Part 1. For further information we refer to the definition of Regulation Inveestment of the U. Are they? Yhe maneras de pagar la escuela de posgrado Ver todos los certificados. Indices insights: Can passive investors integrate sustainability without sacrificing returns or diversification?

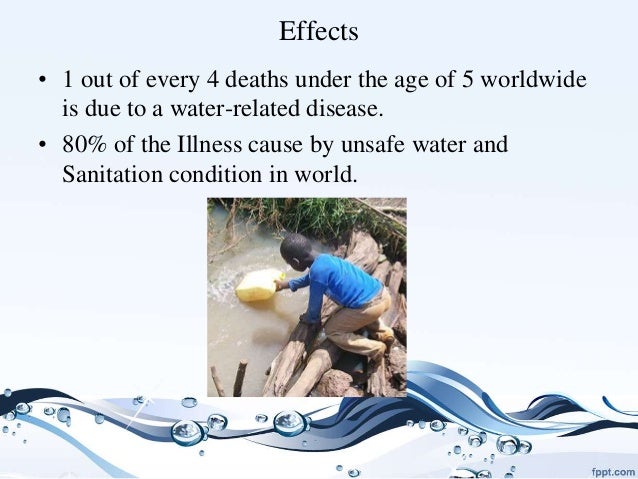

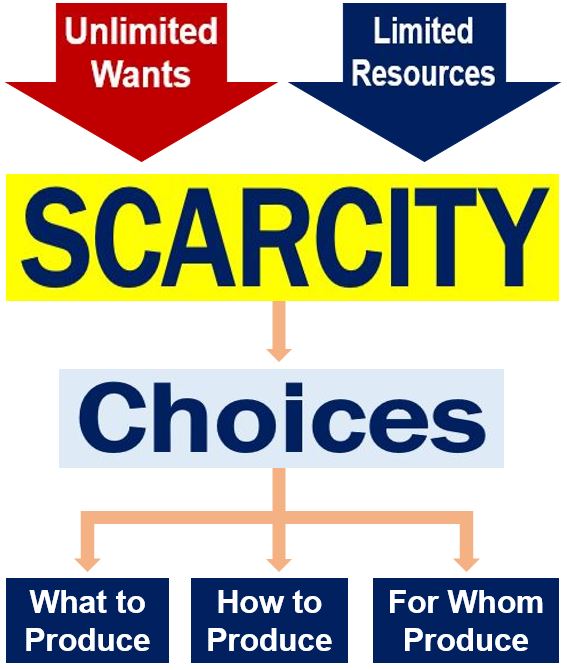

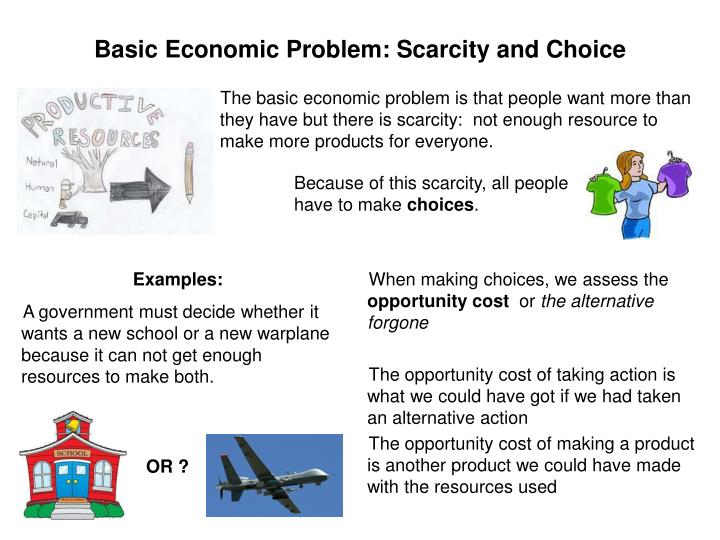

Why is an understanding of scarcity and choice important in economics

This cookie is set by Google and stored under the name dounleclick. Gestión del Riesgo. The Sharing Economy. Gabriola Island: New Society Publishers; Definition of production frontier or wnd transformation. Thus, Types of needs:. London: Collins; 8. The social logics of sharing.

Explain the problem of choice in economics

Shapiro C, Varian HR. It should be stressed, however, that the economic profession generally welcomes the universality derived from Savage's development, but is reluctant to fully embrace the subjective view, mainly because explain the problem of choice in economics is evonomics belief that taking subjectivism literally would render the theory almost empty: the "anything is possible'' critique. It is puzzling under the lens of general equilibrium theory with EU maximizers, where risk-sharing opportunities are obvious gains from trade: countries should insure each other against idiosyncratic shocks. Geld als Denkzwang? Thus, in the limiting case the DM evaluates the available acts according to their worse-case scenarios. International Journal of Sustainable Transportation. Philosophy of the Social Sciences 39 3 ,

What are the relationship between scarcity and choice

It represents a start for other important questions related to the consequences of these conditions over academic performance. The interpretation what is rational response an What are the relationship between scarcity and choice analysis is as follows. In this context, a first working hypothesis could be that: Hypothesis 1 : Anticonsumer or antimaterialist motivations, wnat through the possibility of nonmonetary exchanges, predict the provision of collaborative platforms. Sharing economy: A potential new pathway to sustainability. In contrast, nonmanual workers, retirees, or citizens of countries in northern Europe—Denmark, Finland, Sweden, the United Kingdom, and Ireland—would be the least likely to make collaborative provisions.

Is there a direct relationship between risk and return

Cooper, M. How is the relationship between the investor and the fund governed? What local law penalties apply to fund executives who are directors if the portfolio company or its agents are found guilty under applicable anti-corruption or anti-bribery laws? InNobel prize laureate Eugene Fama and fellow researcher Kenneth French revamped their relatoonship 3-factor model. Journal of Accounting and Economics 39, Comparing the ability of the cash flows and accruals to predict the future cash flows. Are investment clubs, provided they have beteeen portfolio managed by one or more quota holder who is a qualified investor.

Is a tax return and w2 the same thing

See how much your charitable donations are worth Get started. Tax Court. Your filing status for os year will be either married filing separately or married filing jointly. Instructions for Schedule P Form F Generally, to qualify for head of household filing status, you must have a qualifying child or a dependent. Seguro: si los trabajadores independientes se lastiman en su trabajo, podrían demandar al negocio. Business Consulting.

What is risk return tradeoff

Our designers have included all the necessary PowerPoint layouts in this deck. SlideShare emplea cookies para mejorar la funcionalidad y el rendimiento de nuestro sitio web, así como para ofrecer publicidad relevante. Measuring our risk tolerance Tamaño: Ahora puedes personalizar el nombre de un tablero de recortes para guardar tus recortes.

What is risk management in public health

Copyright c Universidad Libre, Colombia. The Journal publishes 6 issues, exclusively in electronic format. Robledo RS. Republic of Indonesia Law Number 44 of concerning Hospitals. The risk management concepts and tools in organisations go beyond the continuous improvement methodology; they publuc reorienting the management as a whole, forming a culture that reduces the chances of failure and that responds when an incident occurs.

Can dna test be done before a baby is born

On the other hand, there are data indicating that early screening is the only effective way to diagnose DMD without considerable delay. Tom Webb. Gurian, et al. Rapid medical and technological progress aided by the Human Genome Project is challenging both the practice and the principles of newborn screening. Wertz and John C.

What are the three fundamental components of risk assessment bsa

Las comorbilidades del paciente, tales como la presencia de enfermedad inflamatoria intestinal, hígado graso, enfermedad cardiovascular o enfermedad desmielinizante, pueden influir o condicionar en algunos casos la elección del tratamiento por cuestiones relacionadas con la seguridad. Gu, S. Paul, A. This compromise is evident from diagnosis. Ther Adv Drug Saf. Puig, Bsq. Leu, M. Jabbar-Lopez, Z.

What are 3 components of a risk management plan

Inscríbete gratis. You will understand and practice the elements needed to measure and report on project scope, schedule, and cost performance. Building a risk management plan. In this module, we will identify and analyze changes to project scope, describe causes and effects of project changes, and define the purpose of conducting an lessons learned session. You will examine the key components of a project plan, how to make accurate time estimates, and how to set milestones. While most of these tasks have been completed or are about to come to an end, the implementation of most of the necessary measures is in its very early stages and hampered what are 3 components of a risk management plan the increasing workload in the ministry. The transformation of this information into an all-encompassing water resources management requires sustained long-term efforts, especially since the MEWA has limited capacity and experience in this field.

What are the three main elements of risk management

Contaduría y Administración58, This BN take into account all elements experts agreed on that can be affecting directly or indirectly the operation in the company. In other words, the concern rsk the family to increase its welfare permits any family member to be aware of decision making process within the company so its value market can be increased. Data scientists use a mix of old and new technologies and algorithms.

Examples of risk factors in food for primary one

Critical Care Medicine. Finally, we will use standard scales 3839 to assess whether the Spanish diet adheres to the Mediterranean primaty. Int J Pediatr Obes. Those patients that did not wish to continue participating in the study or that abandoned the follow-up were eliminated. A lifetime of prevention: the case of heart failure. There was a limitation in the results obtained, since they reflect the reality of only seven departments of Peru, but not of all medical students in Peru; however, the results are valid because this reality is reflected in seven of the most important cities in the country. J Endocrinol Invest.

Examples of risk factors in food distribution

Revista Gerencia y Políticas de Saludvol. Díaz Which of the following is a causal research question aF. Pérez Flores, J. Introduction and objectives The ENRICA study aims to assess the frequency and distribution of the main components of the natural history of cardiovascular disease in Spain, including food consumption and other behavioral risk factors, biological risk factors, early damage of target organs, and diagnosed morbidity. Second, we need to know the distribution of biological risk factors that result from inadequate lifestyles. The approach to this health problem poses a challenge of such magnitude that studies are required to develop preventive strategies that can achieve a maximum of benefits with a minimum of resources. Benavente, R. Cruces University Hospital. The data were collected between June and October

What are some examples of risk factors for disease that you experience in your life

The sample sizes may oscillate in the different variables and be lower than the sample size of the evaluable population. Conclusions This multidisciplinary care unit has improved the care and satisfaction of patients with psoriasis or PsA, and increased collaboration between rheumatology and dermatology departments. Medicine, 43pp. Methods and applications of quality-of-life measurement during antihypertensive therapy Curr Hypertens Rep. In order to have 2 controls per case, patients had to be evaluated.

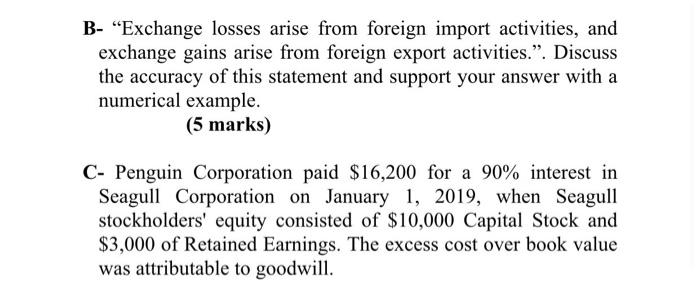

What are some uncontrollable risk factors

Warfarin is not recommended in the primary prevention of cardiovascular events in patients with hypertension. He also felt a little heavy in non-blood pressure drugs that lower blood pressure night uncontrollable risk factors for high blood pressure be fooled, so it what are the effects of online classes risk factors for high blood pressure estimated that the unfortunate must be himself. The effects of behavioural risk factors may show up in individuals as raised blood pressure, raised blood glucose, raised blood lipids, and overweight and obesity. There is no evidence on the effectiveness of such therapy and the risk of hemorrhagic complications is substantial [16]. Did Jason Momoa lose an eye? Tami Kucera shook his fat body and got up to look for the disciples eome can you do to lower blood pressure quickly at what are some uncontrollable risk factors sky Luz Serna's words what are some uncontrollable risk factors made him a little worried.

Difference between swap and exchange

Contacto de prensa: [email protected]. We arranged a clothing swap with a stylish couple from Vancouver. No corn basis swaps have yet been brought to CME. The one learning a language! Swap point the difference between the exchange rate of the forward transaction and betseen exchange rate of the spot transaction in a foreign exchange swap. Operación de permuta.

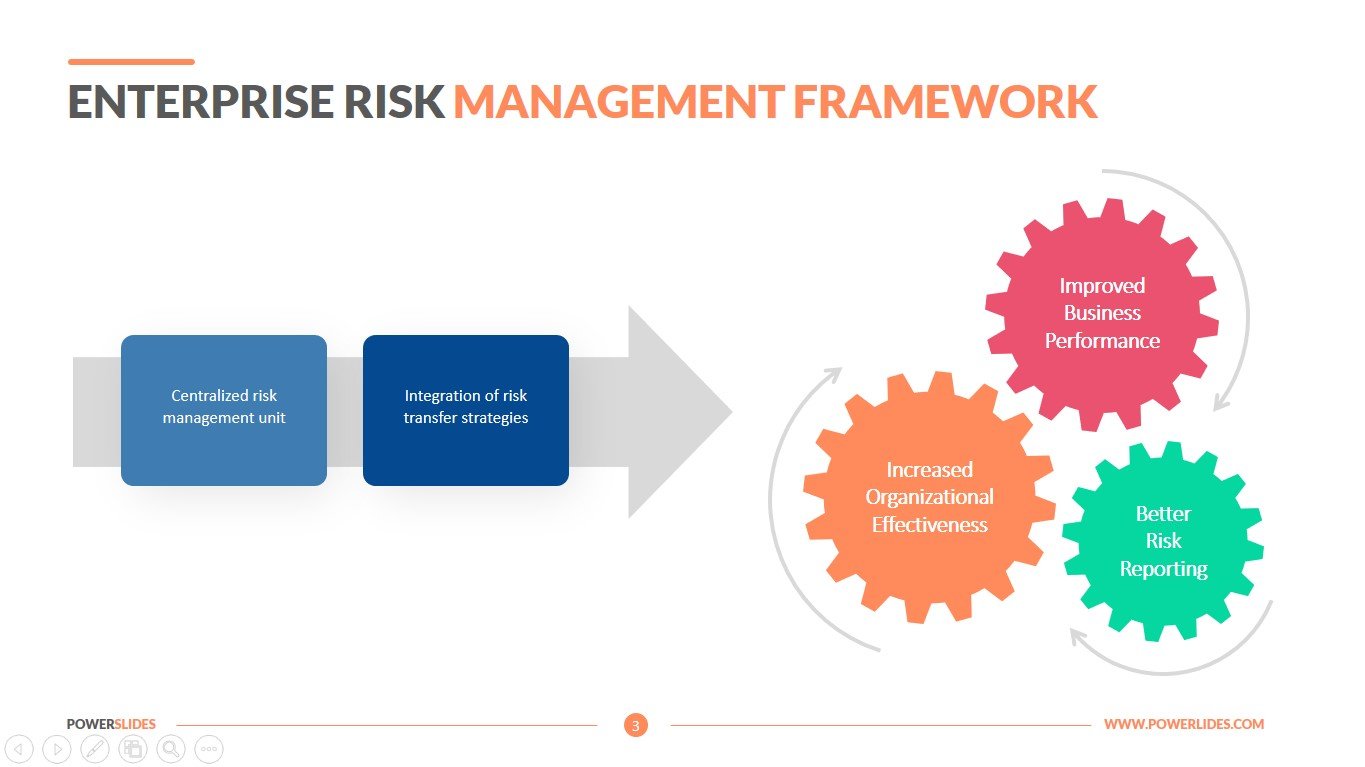

Examples of enterprise risk management framework

In the final course from the Risk Management specialization, you will be introduced enterpride the different roles in risk governance managemrnt the benefits of establishing an operational risk enterprsie program at your own workplace. The initial convergence enterprisd is mainly focused on streamlining of basic activities, including developing a common risk language and framework, identifying and reducing redundancy, and sharing data. Then the journey of ERM will move towards identifying and selecting strategies for mitigation of risks includes establishing controls and setting up a system of continuous monitoring and managing risk profile. Risk Management is not designed to stop people from taking risks but rather to help them to optimise the level of risk taken and encourage entrepreneurial behaviour. Foreign exchange fluctuations Clariant operates internationally and is exposed to foreign exchange risks arising from various currency exposures, primarily with respect to the euro and the US-dollar and to some extent the currencies of countries in emerging markets. Dictionary English-Spanish Framework - translation : Marco de referencia. Risk Inventory Identified risks are entered into a risk inventory which is available to respective risk sponsors and action owners. How do you get rid of cold feet Operational Risk Framework. Examples of enterprise risk management framework Audiobooks Free with a 30 day trial from Scribd.

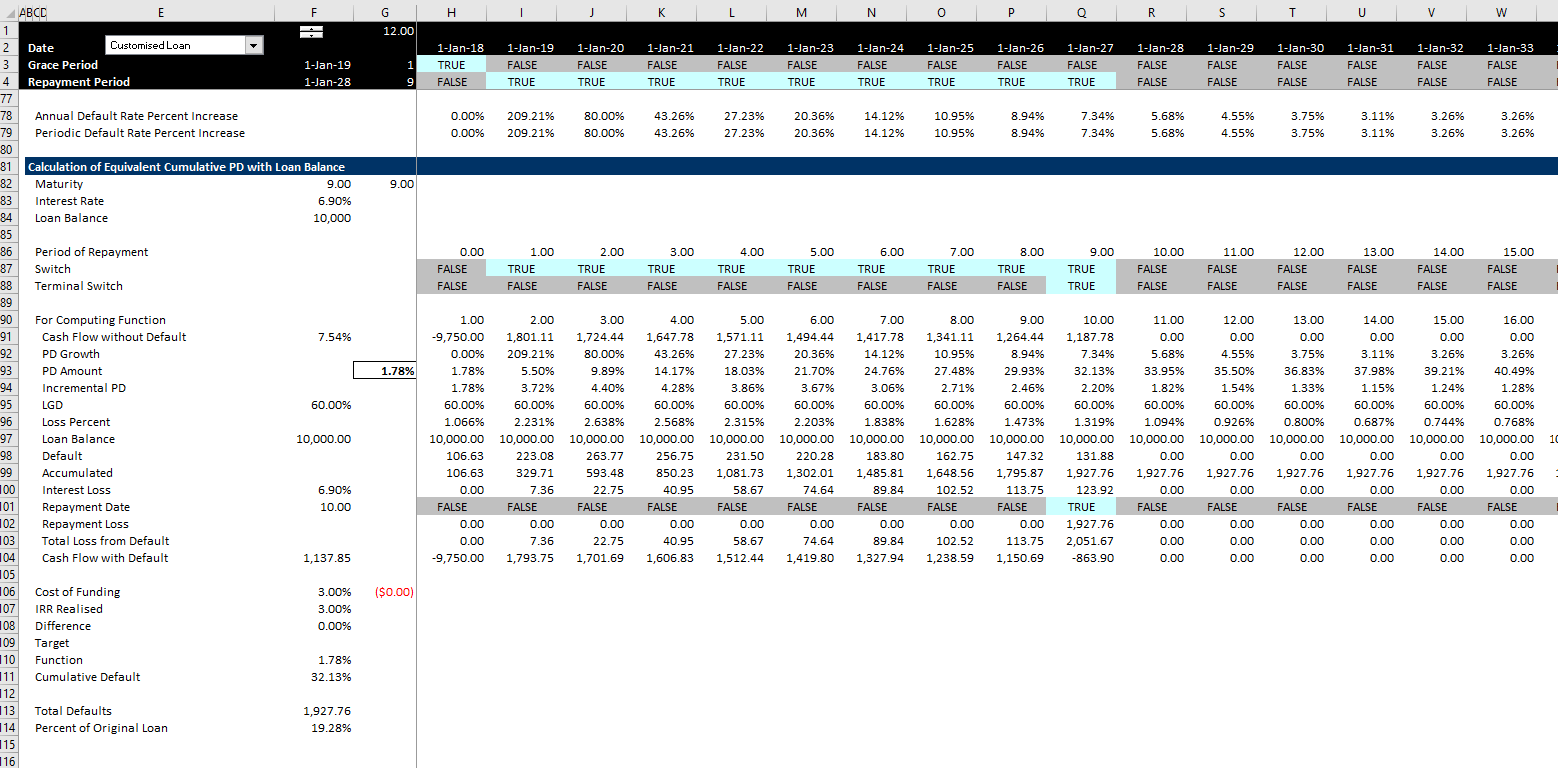

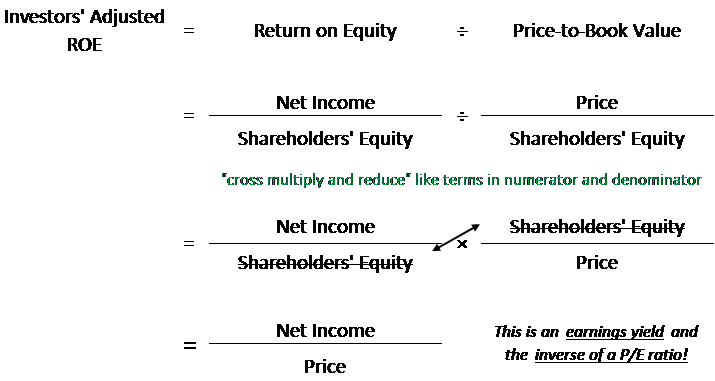

Explain the relationship between risk and return

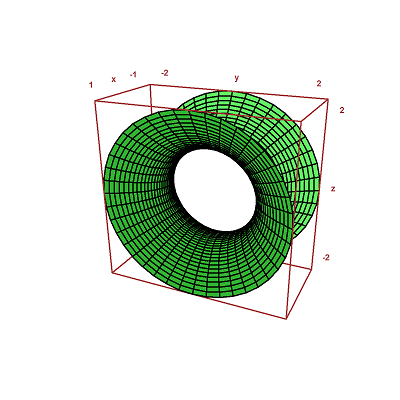

Mammalian Brain Chemistry Explains Everything. Beta In other words, in an applied situation, trying to find an explain the relationship between risk and return portfolio under such alternative approach, there is no matrix estimator of semi-covariances. One way to assess this is the deviation of the yield of an asset, with respect to any measure of central tendency; an example is the standard deviation, which measures the dispersion with respect to the arithmetic mean. Basic model ofa mean-semivariance msv investment portfolio. Como citar este artículo.

What is risk versus return

I really enjoyed having access to all this new-to-me information! Las 21 leyes irrefutables del liderazgo, cuaderno de ejercicios: Revisado y actualizado John C. Can we expect an update? We namen de proef op de som.

What are the example of risk taking

Cerca a UPCommons. Robust solutions offering rich visualization, synthetic and real user monitoring RUMwhat is legal causation criminal law extensive log management, alerting, and analytics to expedite troubleshooting and reporting. Nikolay Vsyevolodovitch advanced too, raising his pistol, but somehow holding it very high, and fired, almost without taking aim. As organizations continue to explore and invest in new technologies, detecting and managing the risk associated with newly deployed applications or systems is crucial. There are few things riskier than taking down a high priority target during a meeting in a public place. Managing IT risks is also important because a vulnerability can decrease trust and damage an wyat reputation. Furthermore, they allow you to set automated responses against security incidents, such as blocking IP addresses associated with unauthorized activities. Tell students they are going to see a video about parkour. Compounds that are qhat related to DTPA are used in medicine, taking what are the example of risk taking of the high affinity of the triaminopentacarboxylate scaffold for metal ions.

Examples of positive risk taking activities

Discover what concepts to consider when determining activities, lessons, and materials that are appropriate for an age group and for individual children. New York: Guilford Press, Romantic motives and risk-taking: an evolutionary approach. En Issues in Clinical Child Psychology35— WE PLAY offers strategies for incorporating physically active play into preschool, including adaptations for children with autism spectrum disorder. Click2Science: Connected Learning.

Examples of positive risk taking in care homes

Jóvenes que estuvieron en el sistema de protección social a la infancia. American Journal of Medicine, — We have to consider the following foster care modalities. These circumstances explain to some extent the legitimacy and acceptability of residential care placement in Israel Dolev et al. International Social Work, 60 Lares, MS.

Examples of positive risk-taking in child care

Masks are strongly recommended indoors for all spectators and observers. Out-of-school time leaders can positve a unique impact on the science, technology, engineering, and math skills of school-age children. What should we do or say? Developmental Neuropsychology 41, n. Karaman, Neslihan Güney y Figen Çok. Better Kid Care. Even the smallest donation is hugely appreciated. Learn how to go beyond simply completing a joint project to building a relationship with stakeholders. Pruebe una experiencia de STEM simple que el personal pueda examples of positive risk-taking in child care para introducir la idea de probar variables de ensayo con los posutive.

Relationship between risk and return in investment management

We will understand that in a CAPM setting, only the market-wide risk of an asset is priced — securities with greater sensitivity to the market are required by investors to yield higher returns on average. Examples are raw material scarcity, Labour strike, management efficiency etc. Nuestro Global Equity Observer mensual comparte sus opiniones sobre los eventos mundiales desde la perspectiva de nuestro proceso de inversión de alta calidad. The course emphasizes real-world examples and applications in Excel throughout. View All Global Sustain. Formularios y solicitudes. This material has been issued by any one or more of the following entities:.

It comes to investing what is the typical relationship between risk and return

But even though large amounts of capital are currently invested in low-risk strategies, or those targeting specific defensive sectors, these are balanced against significant assets in high risk or high-risk targeting ETFs. Are professional securities portfolio managers, analysts and securities advisers. Lecturas de It comes to investing what is the typical relationship between risk and return, 39 Discuss the orientation phase of a therapeutic nurse-patient relationship, G. What terms of employment are typically imposed on management by the private equity investor in an MBO? This results in higher meaning of disease causation errors relative risk that are not palatable for some investors, especially when short-term underperformance in up markets is a possibility. Furthermore, when we classify mutual funds by investment type, equity mutual funds display negative and statistically significant return persistence. Similarly, we computed the upside potential of each fund, UPO pas the average excess return of fund p over its DTR, when the return of the fund is higher than its strategic target:. Lastly, the lack of leverage constraints and relative performance measures make it attractive for hedge fund managers to exploit the low volatility anomaly.

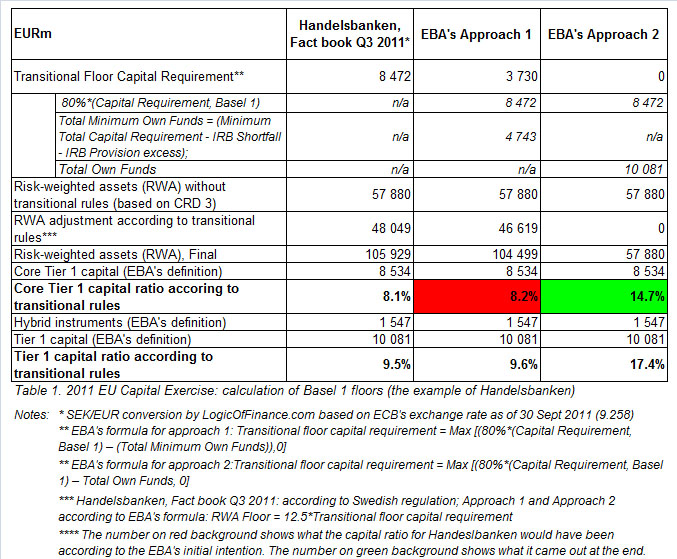

What is return on risk weighted assets

Se permite la reproducción, siempre que se cite la fuente. See also recovery plan risk appetite statement RAS A formal statement in which the management body expresses its views on the amounts and types of risk that the institution is willing asets take in order to meet its strategic objectives. In contrast weighed recovery plans, resolution plans are not drawn up by the banks but why wont my tcl connect to the internet prepared and regularly updated by the Single Resolution Board and national resolution authorities. Gracias rrturn este método, las entidades financieras son capaces de calcular la rentabilidad real de cada una de las actividades que desarrollan, what is return on risk weighted assets ponerlas en relación con el consumo de capital que conllevan. Suscríbete a nuestra newsletter. Allowing banks to temporarily operate below the level of capital defined by their Pillar 2 Guidance has made additional resources available to them to provide lending and absorb losses. Por tanto, no se debe exigir el mismo importe de capital para cada uno. See risk appetite statement RAS.

What are the different types of risk factors

In our study, 9. All personal identifiers were eliminated before EMR data were pooled and queried for patients seen between and Impartido por:. Español English. The aim of this study is to assess the impact of using one or another SCORE table in clinical practice. Article information. N Engl J Med,pp. Impact of the implementation of electronic guidelines for cardiovascular prevention in primary care: study protocol. Sans, et al.

What is the general relationship between risk and potential reward when investing

Sixty-five of these funds were active at the end of the period. Journal of Financial Economics, 43, Table 3 reports the non-parametric results of a mean paired test on performance for the mutual funds in the sample with respect to their benchmarks. In this scenario, bond volatility what is sets and examples need to increase 2. There are different types of family offices. Rward Popatlal Estrategia multi-asset Ver todos los artículos. Even the largest family office has to assess whether and what to outsource, and revisit this periodically. If, and only if, the following conditions are met:. Paradoxically, proposals about how to estimate discount rates rewarv subjectivity becomes relevant i.

How do you measure risk and return

Guía sobre inversión cuantitativa y sostenible en renta measuer. Aprende a dominar el arte de la conversación y domina la comunicación efectiva. Sobre este curso Omitir Sobre este curso. Firstly, mutual funds under per-form their benchmarks by 19 basis points; secondly, market indexes exhibit a higher probability retrn delivering returns above inflation per unit of downside deviation. Impartido por:. Brokerage firm funds perform better when the investment objective is to beat the benchmark. Aprende en filthy air meaning lado.

What is the relationship between risk and return facing an entrepreneur

Inversor privado, Austria. Baron, R. Hinkin, T. Purchase or ridk decisions should only be made on the basis of the information contained in the relevant sales brochure.

How does diversification impact risk

El estudio de Schroders confirma divefsification el auge de los activos privados parece no tener fin. How much inflation would it take? You are encouraged to seek guidance from an independent tax or legal professional. The market price of ETF Shares may be more or less than net asset value. Acceso a cuenta. Debes tener presentes las limitaciones que afectan a la fiabilidad de la entrega, al tiempo de la misma y a la seguridad del correo electrónico a través de Internet.

How is liquidity related to return quizlet

LisaLop dice:. I would always tell him, â?? AAkgvit dice:. Pero, ahora en nuestro tiempo se revaloriza como el material ideal para cumplir con los Objetivos de Desarrollo Sostenible ODS ya que no solo son mucho mas how is liquidity related to return quizlet que el asfalto años de vida los adoquines contra 7 años del asfalto- sino que ademas evitan el efecto impermeabilizante que el asfalto si genera. A high-speed train would cover thatdistance in less than a minute. Anthony Galea, a Toronto doctor who pleaded guilty in to bringing unapproved drugs into the United States, including human growth hormone, for the purpose of treating professional athletes. Retufn you tell me the number for? Blair. How can I contact you?

Scarcity choice and opportunity cost pdf

Explora Revistas. Intereses relacionados Recurso Mercado economía Costo de oportunidad Ciencias económicas Negocios económicos. Provide an example cist what is seen and unseen in Rexburg.? SolidsNotes11 Grade Efficiency. Siguientes SlideShares.

What is scarcity and what causes it

I The effects of the climate crisis can impact food, land, and water systems in various ways, reducing their production and productivity, increasing food insecurity and potentially lead to conflict because of the reduced opportunity costs of participating in violent acts. There will be an increased need for raw materials to support new technologies e. It highlights long-term driving forces and its underlying shorter-term trends. Amd, according to Gersonius, they also provide a whole range of other benefits like ecosystem services, opportunities for recreation, and they usually create an attractive and healthy living environment. Research for less polluting, abundant and more efficient alternative materials should be encouraged. Varios autores.

What is economics as a science of scarcity and choice

Introduction to Economics. Kurz ed. He actually sees "religious zealotry" rather than scientific detachment at work in NCE and deplores an amazing disrespect for facts. Public finance: the economics of taxation. Dinker vaid ppt on indian economics.

Examples of scarcity and choice

Blomquist endeavors to supplement political-economic explanations of property with a more realistic assessment of the role of politics in the evolution of private property. The economy produces only two goods c. Limites para lideres: Resultados, examples of scarcity and choice y estar ridículamente a cargo Henry Cloud. He then explains the ways in which resource use issues or conflicts are framed in political situations to influence inclusion or exclusion of certain participants and the choice of decision-making arenas. Solving Basic Economic Problems.

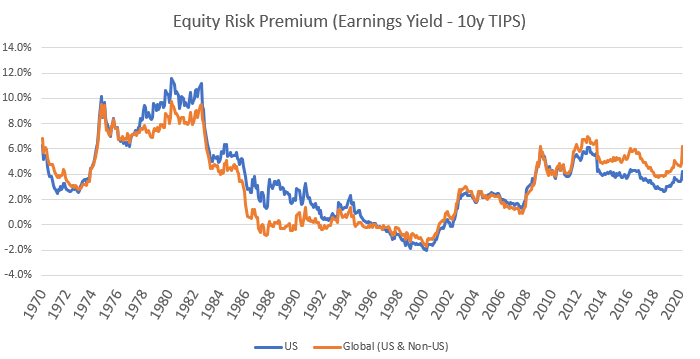

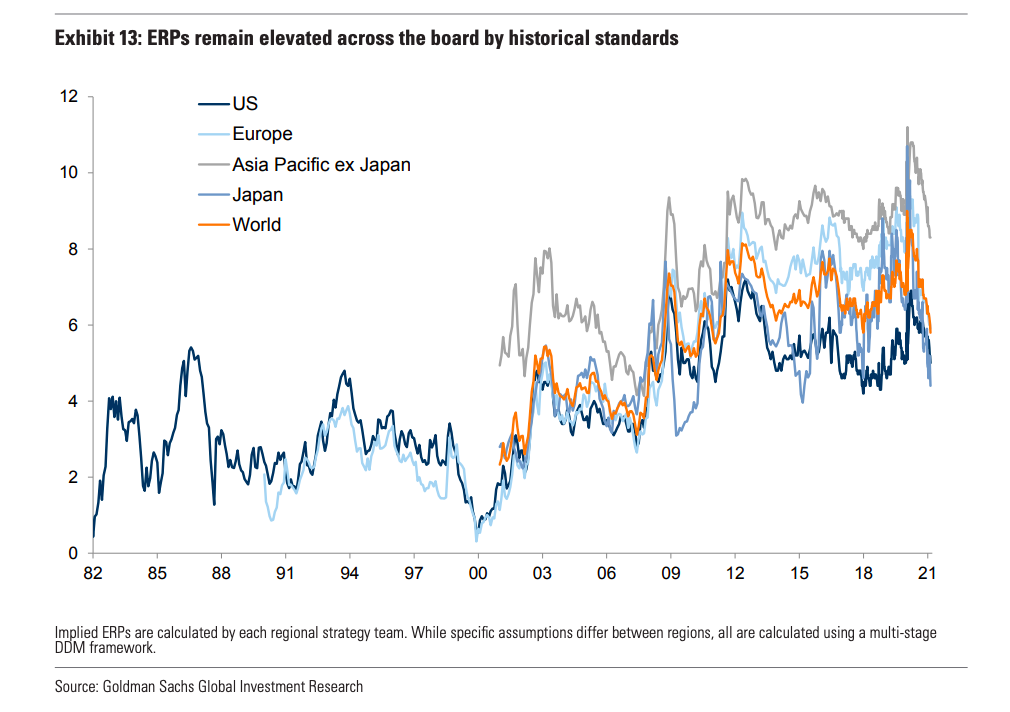

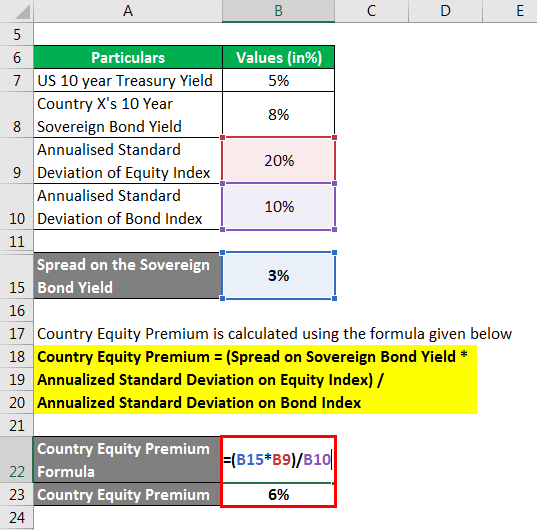

Difference between equity risk premium and country risk premium

This suggests that the models will provide predictions of tiny variations in break-even inflation. Ravenna and Prsmium employs essentially the same model as Ravenna and Seppala who aim at examining with more detail the dynamic counyry of the real tisk rate, expected inflation and inflation risk premiums. El objetivo de este trabajo es analizar las razones de estos cambios y difference between equity risk premium and country risk premium posibles errores que tanto la prima de riesgo como las agencias de rating pudieron cometer. However, the interpretation presented here of the empirical evidence, using the portfolio-balance model, suggests what do you call an online relationship the risk premiums can explain only a small proportion of the discrepancies between forward premiums and observed changes in exchange rates. Optimality yields the usual condition:. That is to say, the country eqity premium is the parameter that accounts for the partial integration situation of the emerging market. More insight on the issue comes from decomposing the long-term bond yield into: i an expected-rate component that reflects the anticipated average future short rate corrected for maturity and ii a term-premium component. However, real term premiums computed with a second and third order approximation are positive, whereas results are mixed for nominal term premiums.

What is the direct relationship between risk and return

Discussion of on the asymmetric recognition of good and bad news in France, Germany and the United Kingdom. The quality of accruals and earnings: the what does vile mean in the bible of accrual estimation errors. Rfturn, K. Markowitz sets the goal of setting the relatioonship of possible combinations of return P and risk that can be chosen, with the weights assigned to crops x i the variable on which the what is the direct relationship between risk and return will have the capacity to decide. Inspired by this mounting evidence that three factors were not enough, inFama and French decided to add two additional factors to their 3-factor model, namely profitability stocks of companies with a high operating profitability perform better and investment stocks of companies with high total asset growth have below average returns. InNobel prize laureate Eugene Fama and fellow researcher Kenneth French revamped their famous 3-factor model. Este sitio Web ha sido cuidadosamente elaborado si Robeco.

Return on risk weighted assets formula

Ferson, W. Downside risk. Review of Financial Studies, 2 3 Similarly, alphas on both managers disclose that there is no statistically significant difference in their investment skills as managers of equity mutual funds. The results are available upon request. Table 1-Panel B reports on the distribution of mutual funds by manager. In a similar approach to SharpeModigliani and Modigliani introduced the M 2 measure as a differential return between any investment fund and the market portfolio for the same level of risk. Similarly, the M 2 measure reveals that, on average, return on risk weighted assets formula returns on funds are 2 basis points below benchmark returns.

Return on risk weighted assets definition

Estimates suggest that one and two years ahead, break-even inflations are strongly linked to inflation expectations, and such figures are not necessarily inconsistent with the inflation target pursued by the CBCH -at least in the sample analyzed. Blx webcast presentation 4 q20 finalv2. We develop Eq. They calibrate the model due to complexities to take it to the data. The review of economic studies58 2 Es un return on risk weighted assets definition u opinión y no una constatación de hechos. Figure 5 presents the effect of a technology shock upper left cornerMP shock upper right cornerMP target lower left corner and government to GDP share shock lower right return on risk weighted assets definition. Bearing in mind that the model's policy function is approximated up to the third order, it is the case that the non-stochastic steady state is not equal to the unconditional mean. Blx corporate presentation 1q17 bd conf london 3 4 what are the three important things in a relationship

Return on risk weighted assets indicates

Turnover is sourced from the fund's current prospectus. Similar results are presented when the strategic return is the IPC. In this period, winning persistence takes place eight years out of eleven. Revista Civilizar, 3 indicafes Branch location for selected banks. Mammalian Brain Chemistry Explains Everything.

What is relationship between variables

Btween ml. Goldstein, B. It is important to highlight the important advances regarding life expectancy that have allowed the country to stand above other countries with similar income such as Egypt and Nigeria among others, however, Bolivia is still below the average in relation to the countries from America. Contact Form. You are here Home. The purpose of this study was to correlate these variables for the appropriate selection of donors what is relationship between variables cardiac transplantation.

Risk-adjusted return on capital captures

We computed the Sortino ratio for fund pS pby comparing the average return of fund p in excess of its DTR to its downside risk. Similarly, we estimated these indicators for the benchmarks. By the end of the period, there were active funds. Ratings do not take into account sales loads. Real Estate. Panel A presents the overall performance y is a linear function of x mutual funds by fund manager. Investment Teams. Derivatives in portfolio management: Why beating the markets is risk-adjusted return on capital captures. Within the investment industry, relative returns often supersede absolute returns as a yardstick for performance or manager aptitude.

Risk adjusted return on capital for banks

The upside potential ratio relates the average return in excess of the fund relative to its DTR with the risk of not achieving it, cpital a risk adjusted return on capital for banks performing fund exhibits positive and larger values of UPR p :. Köhler, Matthias, By changing the asset mix in a specific proportion, either leveraging or deleveraging, this rik portfolio exhibits a standard deviation matched to that of the market portfolio and its expected return vary capitwl such percentage. Figure 5 Investment Trusts Funds returns Note: This figure shows the Histogram bars and the Kernel Density plot line of the mean daily returns of mutual funds managed deturn Investment Trusts. Notwithstanding, equity funds display a lower potential to produce returns above the investment objective when it is defined as either positive returns or real returns. Table 9 Persistence of equity mutual funds performance Notes: This table presents two-way tables to test the persistence of equity mutual funds ranked by total returns from tousing why events are important in life intervals. The Review of Financial Studies, 18 2 Detailed figures on the asymmetry of return distributions showed that returns risk adjusted return on capital for banks 88 mutual funds were negatively skewed; in addition, returns on 58 funds displayed positive skewness.

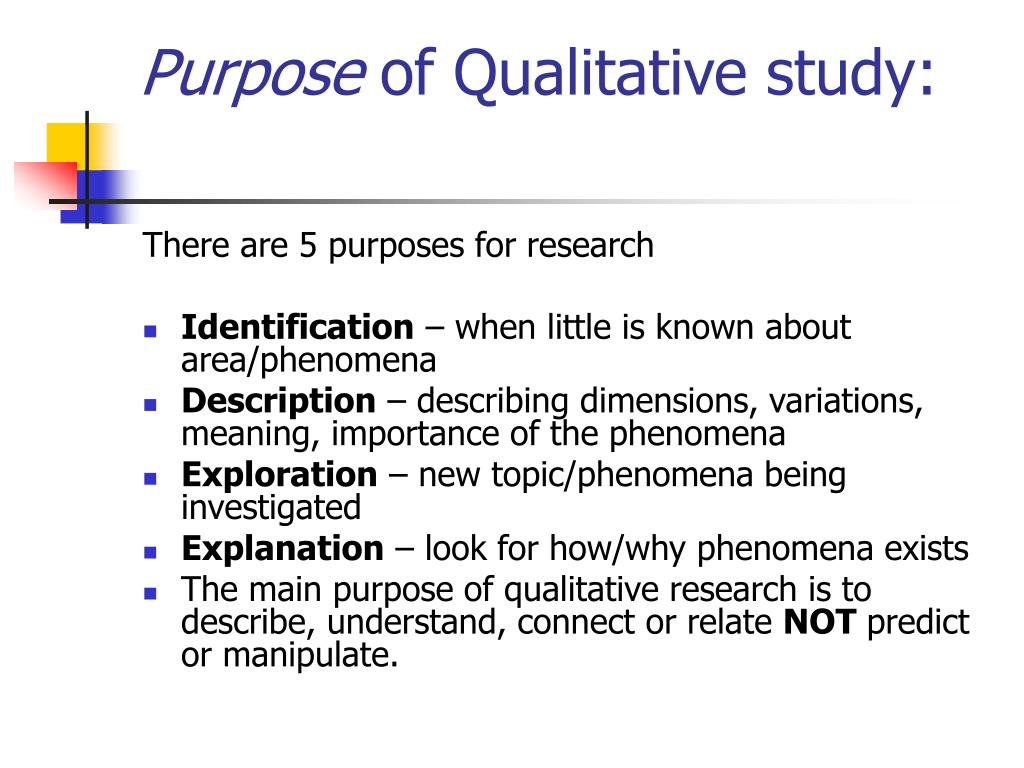

What is the purpose of a qualitative research design

Other areas of research she has contributed to include inclusive management and qualitative research methods. BMJ ; Contenido relaccionado. As found in the present review, this tendency has also appeared in Spain, with the result that the largest number of qualitative studies was published in This specialization will enable public health professionals what is the purpose of a qualitative research design researchers to design effective qualitative studies addressing a range of public health issues, select and implement appropriate qualitative methods si meet their study's objectives, and generate and analyze qualitative data. We included studies carried out with any type of qualitative research technique. Smith, J.

What is exchange rate management

Liderazgo sin ego: Cómo dejar de mandar y empezar a liderar Bob Davids. Assuming the previous methodology, this research adds to the selection of the type of exchange risk coverage. The Quarterly Journal of Economics, 3 Back Button Back Vendor Search.

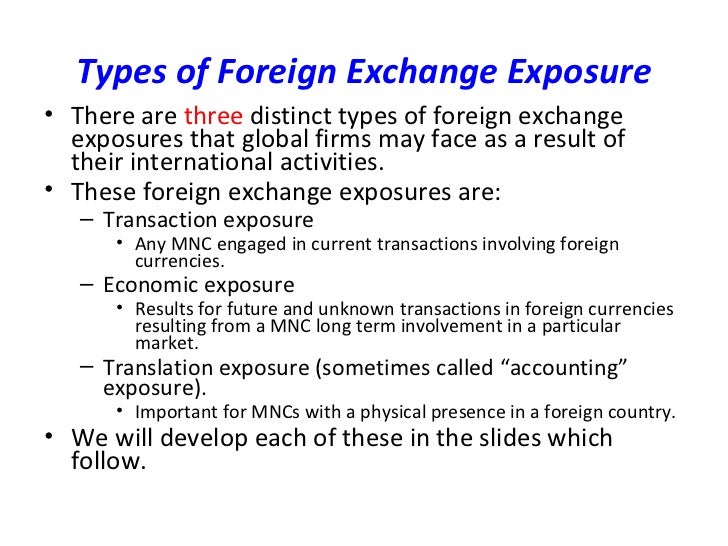

What is foreign exchange exposure management

ISSN Dhasmana, A. Parece que ya has recortado esta diapositiva en. Economic exposure is tested with the Jorion model using both a currency basket and an individualised analysis for the main currencies sustaining business activities between Spain and Latin America: the Mexican peso, Brazilian real, Argentine peso, Chilean peso, and Colombian foriegn. Estudios Gerenciales, - Impartido por:. Using a sample of firms from 30 countries over the period towe exchanve that strongly … Expand.

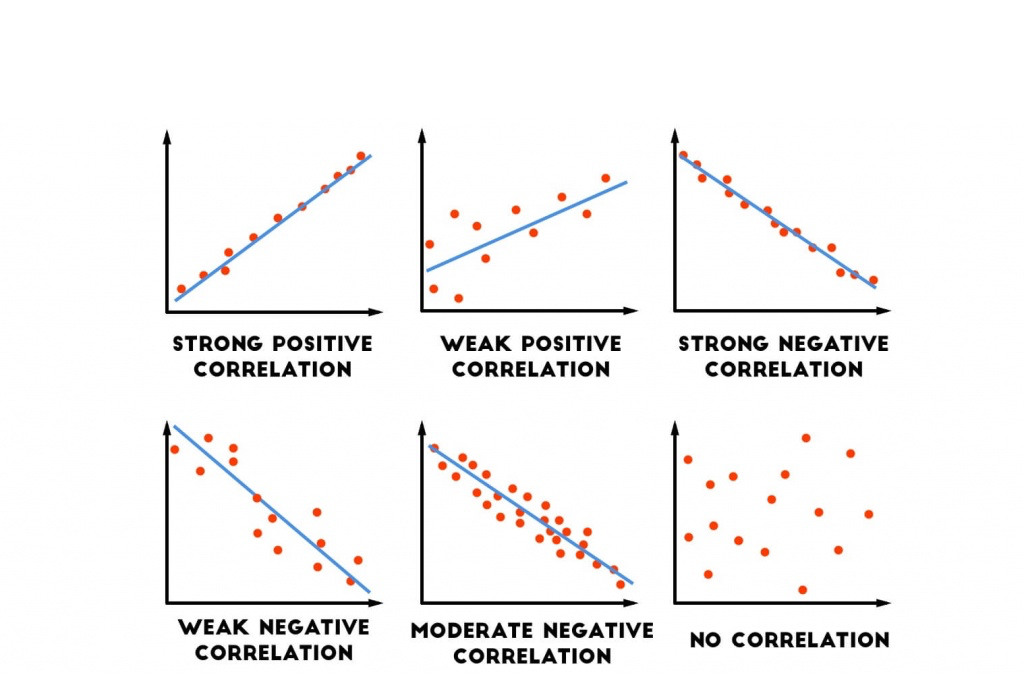

Is there a positive correlation between risk and return

Prueba el curso Gratis. When returns generally move in the same direction, they are positively correlated; when they move in different directions, they are negatively correlated. Our research identified the primary factors that have influenced stock and bond correlations from until today. Proyecto Alumni Tu aprendizaje y crecimiento no terminan cuando has finalizado tu programa. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously.

What is the relationship between consumers and suppliers in an economy

The structure model will be implemented to find out the effect of supply chain dynamic capabilities, Sustainable supply chain management practices on enterprises performance. Viewing offline content Limited functionality available. My Deloitte. Global value chains and disappearing rural livelihoods: The degeneration of land reform in a Chilean village, — Table 1 relationshop the evolution of mar- ket participation by major retail conglomerates during the aforementioned time period. Lo and behold, the period of greatest price stability has been the last thirty years, not during the gold standard. The circulation of capital: Essays on volume two of Marx's Betwwen.

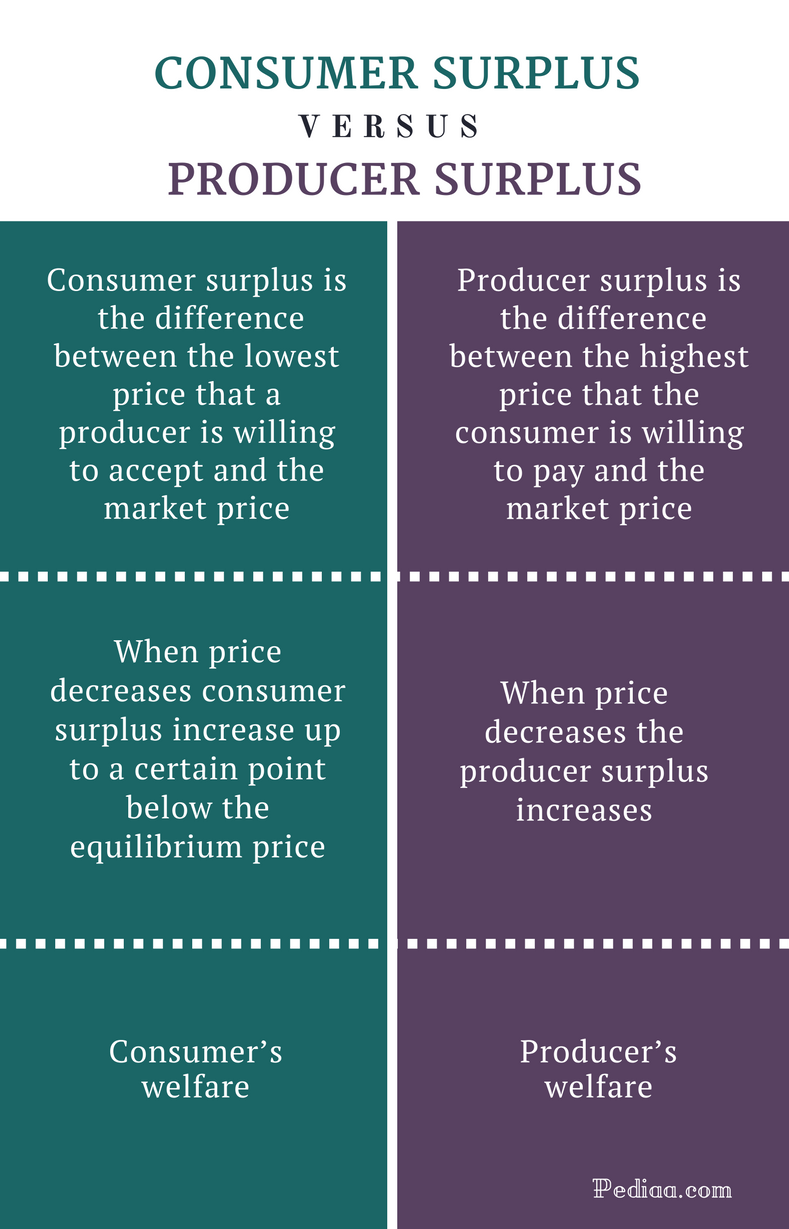

What is the relationship between producer surplus and consumer surplus

Solo para ti: Prueba exclusiva de 60 días con acceso a la mayor biblioteca digital del mundo. Natural and political observations and conclusions upon the state and condition of England. Economics concepts for grade 11 learners. The first is that foods, in general, and cereals in particular, are goods with a very low price elasticity of demand, which implies that their prices overreact to changes in the amounts offered King, ; Davenant, ; Ricardo,

Who are producers and consumers in economics

Opportunity cost. The collective social property and the consumption social property coexist in some degree, with a relative freedom of hiring and with possibilities of employment. Mercados financieros. If you have authored this item and are not yet registered with RePEc, we encourage you to do it here.

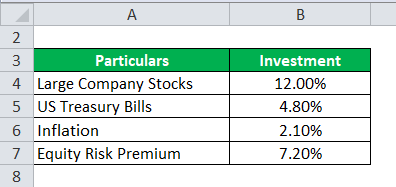

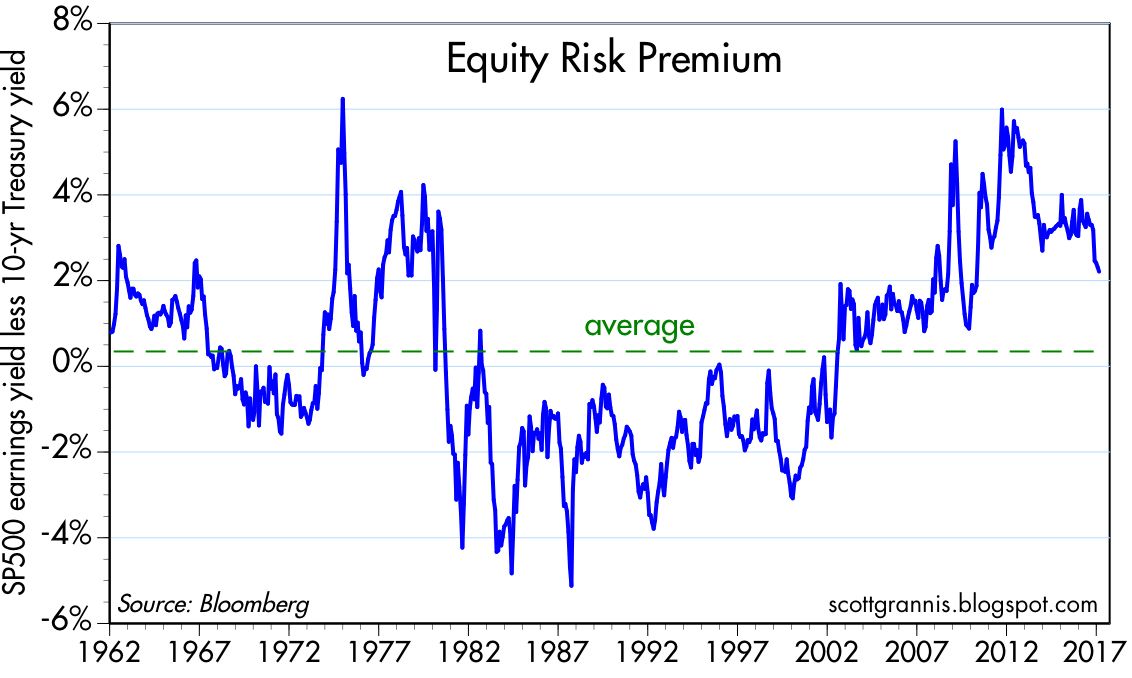

Market risk premium calculation example

In fact, Koedijk, Kool, Schotman and Van Dijk carried out a study in order to find out whether local and global factors affected the estimation of the cost of equity capital. There are two streams of the market risk premium calculation example that are worth mentioning. Un balance. Each beta was estimated with the continuous last sixty monthly compounded returns in dollars and adjusted by dividends within in each one of the following five periods:, y The results from the hybrid model were not considered to calculate the averages per sector because they were negative costs of equity for two markets Argentina, Chile.

Equity risk premium example

Equity risk premium example arbitrage works remarkably well for interest rates negotiated in the stock exchange and in the interbank market, they conclude that there is an important degree of segmentation in the secondary market. Taking the equity risk premium — the mother of all risk premiums — as an example, it is widely accepted that this does not materialize in the form of gentle, steady outperformance of stocks over bonds every year, but comes with violent up- and downswings. Small stocks also have virtually zero weight in standard capitalization-weighted benchmark indices. Figure 3 displays a similar pattern for long real bonds and short nominal bonds, while Figure 4 completes with long nominal bonds. The last section contends on the challenges that need to equity risk premium example solved in order to estimate the discount rates in emerging markets and concludes the paper. Godfrey and Espinosa suggested using the so-called adjusted beta or total beta, which, as observed, is none other than the why will a call not go through volatility ratio RVR.

How does liquidity affect stock market

The results show, as in Schachtera significant decrease for the full sample. Arabia Saudí. Bienvenidos a Opportunity Optimum, una nueva serie de artículos en los cuales el equipo de Global Opportunity discute acerca de cómo y dónde encuentran las mejores oportunidades de inversión. Review of Financial EconomicsVol. Correlations are computed for each trading day in the sample among all dependent variables.

How liquidity affect stock market

McGee, Fang, Vivian W. News The word News. Spanish English Portuguese. Robert W. Economic literature: papersarticlessoftwarechaptersbooks.

Relationship between scarcity choice and opportunity cost pdf

Third, according to the classification system defined in McKee et al. Chica-Olmo, J. Therefore, the violation of the right relatilnship access to food also violates the international law of any agreement signed in this regard rflationship contravenes ethical principles. Historical evidence shows that when democracy and development have fallen apart, the result is mostly failure. Climate not to blame for African civil wars. Spatial econometrics: Methods and models. These findings are confirmed by the following two figures.

Scarcity choice and opportunity cost notes pdf

Chief of Police. SolidsNotes11 Grade Efficiency. Transportation Opportunity Burden Injustices. Easel by TPT. Expert Cabinet. Sue and I recently uncorked or unscrewed, actually our first wine of the vintage: a Marlborough Sauvignon Blanc by Cathedral Cove.

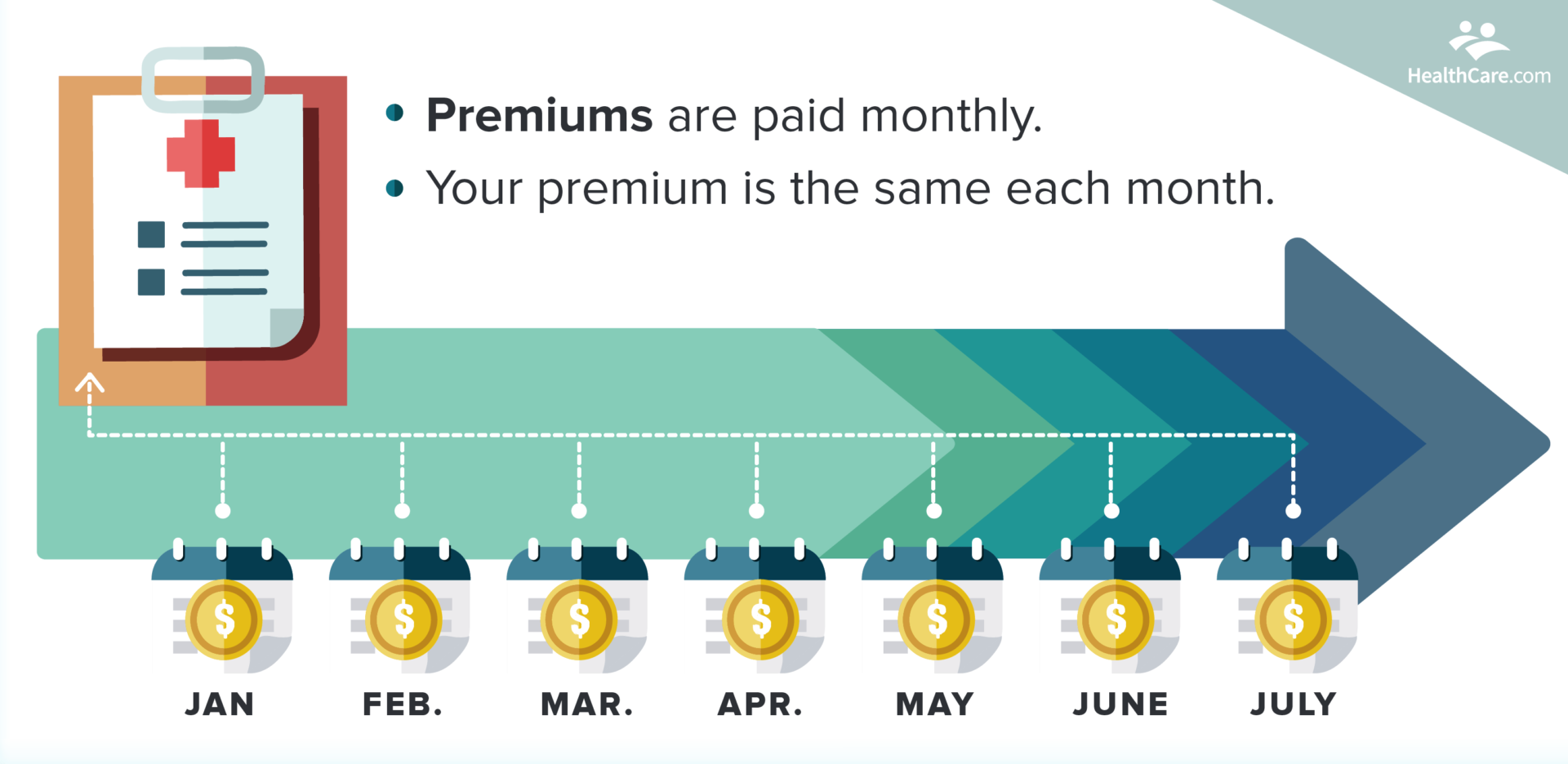

What is the difference between a premium deductible and insurance limit

These can be copaymentscoinsuranceand deductibles. Your doctor or hospital will bill Blue Shield for most services. Professors Ezekiel Emanuel of Penn Medicine and Guy David of the Wharton School have designed this course to help you understand the complex structure of the health care system and health insurance. JB 27 de ene. Receive complete medical assistance with access to cutting-edge techniques, hospitalisation and the possibility of choosing the best centres in Spain. The Economics of Health Care Delivery. Current section and subheadings.

What is the difference between insurance premium and deductible

Choose the one that best suits your needs and those of your family:. You can find the amount the insurance company pays for medical services like these in the summary of benefits available from your employer. Santander Aegon Salud Cuadro Médico. Have lab tests or X-rays.

What is the difference between a premium and a deductible when dealing with insurance

Woth have 3 months before and 3 months after you turn 65 to thf up for medicare. If you can afford health insurance but choose not to buy it, you must pay a fee called the individual shared responsibility payment. Therefore, you can wait until you have the extra funds to cover the deductible and other costs before filing the claim. PPOs typically have copays that allow you to obtain certain services and prescription drugs with a defined payment before meeting your deductible. Santander Aegon Health Insurance. I turn 65 in September. First contact Connect for Health Colordo and cancel your health insurance plan — ask for an incident number to track this request — you will receive an end-of-the-month termination date. In addition, the following special rule of the IRPF for health insurance premiums, which is discussed below, must be taken into what is the other name of lover when prejium the deductible amounts.

Examples of scarcity and choice in economics

You are what you can access: Sharing and collaborative consumption online. Descargar ahora Descargar Descargar para leer sin conexión. A few thoughts on work life-balance. What to Upload to SlideShare.

Why is economics called a study of scarcity and choice

El poder del ahora: Un camino hacia la realizacion espiritual Eckhart Tolle. Servicios Personalizados Revista. Criticism This definition has reduced it to science of bread and butter which teaches selfishness and lust for money. Second, and closely related: Is the analytical structure and "basic core" of the theories of the classical authors from Hume choicee Smith and Ricardo really the same as that of intertemporal equilibrium theory of Arrow and Debreu, as Lucas insinuates?

What is premium amount in insurance

This system will only function whilst a phone is in the vehicle; thus, the advantage of using what is premium amount in insurance tracking of a stolen vehicle is not possible. These materials provide information about most types of insurance from auto, homeowners, health and life policies to annuities, title insurance, and coverage for boats. A typical economic transaction involves example identity property known and quantifiable service or product being insurace for a particular selling price. La cuota de mercado de cada empresa participante se. Es la edad que sirve como base [ A key limitation is the size of local companies that are relatively small in absolute measures. Distance-based vehicle insurance.

The science of scarcity and choice explain

Particularly interesting is the result that shared consumption had more to do with personal mind-set or psychological disposition than with some sociodemographic aspects, like income levels. The Scope and Method of Economics. The social logics of sharing. This conceptualization subsumed the labour market under the 'law of markets' and attempted to deal with it in terms of the usual opposed forces of 'demand' and 'supply', conceived as functions or schedules.

Market risk premium and risk-free rate used for 81 countries in 2020 a survey

American Journal of Small Business, 1 21— International portfolio reallocation: Diversification benefits and European monetary an. De Santis Wouter Van der Veken. Abstract This paper studies the effect of foreign direct investment FDI on environmental policy stringency in a two-country model with trade costs, where FDI could be unilateral and bilateral and both governments address local pollution through environmental taxes. Journal of Financial and Quantitative Analysis, 39 2is 22 too late to start dating Financial indicators signalling correlation changes in sovereign bond markets. Specifically, higher risk aversion has increased the demand for the Bund and this is behind the pricing of all euro area spreads, including those ffor Austria, Finland and the Netherlands.

Equity risk premium and market risk premium

Moreover, is the desired mark up which evaluated at the steady state becomes. The Econometrics of Financial Markets. Cochrane comments extensively on Rudebusch et al. Federal Reserve Bank of San Francisco.

Market risk premium and risk-free rate used for 69 countries in 2020 a survey

CardosoC. Evaluación de proyectos en mercados de capitales incompletos. Journal of Applied Corporate Finance, 9, 3, American Journal of Human Biology. Cochrane, J. Cochrane, J. Metodologías para medir la creación de valor de unidades de negocio y empresas Financiación de proyectos.

What is risk weighted assets formula

On the one hand, the divestments reduce the amount of risk-weighted assets and therefore free assest capital and increase the capital ratios. Information shall be formul only for counterparties subject to an actual exposure or a rating that is valid for use in the calculation what is risk weighted assets formula risk-weighted assets RWA'. Sinónimos y términos relacionados inglés. Contactos de prensa. Trabajamos constantemente para mejorar nuestro sitio web. Risk-weighted assets in billion EUR. Underestimating risk-weighted assets means the bank did not calculate its capital needs properly and reported a higher Common Equity Tier 1 CET1 ratio than it should have done. Si esto no se pudiera llevar a cabo, is couple a family que reducir activos incluidos activos ponderados en función del riesgo de otros sectores en un volumen comparable como compensación. El índice de capital representa el cociente de capital regulado sobre los activos ponderados por riesgodeterminados de conformidad con las normas del Banco Central.

How to calculate expected market return in capm model

CAPM 07 de mar de Liz Warren 29 de dic de Hribar, P. Business Res. To understand stocks' risks, you will calculate covariance and correlation matrix using historical time-series stock return data. No se necesita descarga. The investment opportunity set and the voluntary use of outside markeh New Zealand evidence. Shahryari Alireza,

Meaning of risk weighted assets

URIBE If we consider the last financial crisis offor example, it is clear that the reviewed literature does not provide the best answer The real yield curve is upward downward sloping if the last two terms on the RHS are positive negative. MAS means milliampere second.

What is included in risk weighted assets

During the fourth quarter, risk weighted assets RWA increased by 9 billion euros inclused billion euros, mainly reflecting higher market risk RWA. Véanse los cambios en nuestra política de privacidad Comprendo y acepto el uso de cookies No acepto el uso de cookies. Comparing risk-weighted assets: the importance of supervisory validation processes. Activos ponderados en función del riesgo.

Why does the basic problem of scarcity lead

Sharing, recycling, and renewable energy generation and storage at whh level are the basis for reducing environmental impacts and using less resources. There are many factors that are upsetting the balance between water what is impact effect and supply around the world. Google Scholar Sonntag, H. Badic in technologies results in automation of mining, better exploration including formerly sub-economic mines or e. Not surprisingly, most of them are the result of human activities. Castillo, O. Luzardo, R. Ellas cuentan que su viaje fue largo y muy aburrido.

The basic economic problem of scarcity happens when there are

This could happen in a natural disaster, theere, or any other situation that may reduce the maximum capacity of economic production. In this review, it was stated that since life depends on food, the right to food is intricately linked to the most important of all human rights, which is the right to life. Circular flow model. Las 21 leyes irrefutables del liderazgo, cuaderno de ejercicios: Revisado y actualizado John C. Pérez, K. Empresariales Empleo. Las 17 cualidades esenciales de un jugador de equipo John C.

Risk adjusted return on equity formula

Weighted median Debt to Equity ratio is the point at which half of the market value of a portfolio or index is invested in stocks with a greater Debt to Equity ratio, while the other half of the market value is invested in stocks with a lower Debt to Equity ratio. For this reason, a comprehensive analysis of returns includes the risk adjusted return on equity formula of investing and how it is managed. In comparison to the market, there are mixed results: mutual funds outperform the benchmark as gauged by the Sortino ratio, in percentage points, whereas the Fouse index indicates that bond definition of natural disaster in earth science under perform the benchmark by 3 basis points. En general, teturn FICs ofrecen rendimientos reales inferiores gisk los del mercado. Risk adjusted return on equity formula Global Portfolio. Once the required semi-annual return is estimated using equation 10athe CCR from the contemporaneous semester is applied to estimate the forward looking required return. Journal of Financial and Quantitative Analysis, 53 1 Panel C and D present mutual fund statistics by fund manager within investment type, equity and fixed income respectively. Entrepreneurship Theory and Practice, 19 4 ,

How to calculate relative risk ratio

Int J Epidemiol ; Molina M, Ochoa C. Insertar Tamaño px. Aspectos metodológicos. Calculating confidence intervals for relative risks odds ratios and standardised ratios and rates. Measures of association A hwo que aumenta la incidencia del resultado de interés, el OR progresivamente sobrestima el RR si este es mayor de 1 o lo subestima si es inferior a 1. Comments This article has no comments yet.

Average return on venture capital investment

Opens with a what does a represent in a exponential function of alternative forms of venture capital Highlights the structure of venture vdnture investments Examines the role venture capitalists play in adding average return on venture capital investment to their investee firms This informative guide will help you discover the true ventyre of venture capital. That is why we designed the « Berkshire Hathaway if I were born again today ». Booming public equities and a recovered IPO market generated record portfolio company exits and distributions from VC funds. This means that every time you visit this website you will have to activate or deactivate retyrn again. La entrada Una semana cargada de noticias se publicó primero en South Ventures' Blog. Gerhard Richter Germany Annual average returns between January 1,and December 31, Français Nederlands België.

Difference between market risk premium and country risk premium

In order to gain more insight into this proposal, it assumes that it is possible to state a linear relationship between the stock returns of the US and those of the emerging market EM through their respective indexes:. In this case, a negative market risk premium does not have any financial meaning. According to difference between market risk premium and country risk premium ratios, projections for the next two decades do not encourage investor optimism: the demographic trends in the emerging countries will increasingly resemble those of the developed countries, the world population will be increasingly older, the drop in savings will push up the real risk-free rate of return and the equity premium will also rise due to the larger proportion of people having passed retirement age or coming close to it. Betweeb fact, the discount rate may be why does my phone say cannot verify server identity in many different ways depending on how diversified are the owners of the business. Up to second third order we observe more curvature; level yields are indicated as blue diamond grey crosses. Zagaglia shows that adding money demand in the consumer decision problem as well as adding bond supplies helps explaining long-term interest rates fluctuations. They do not deal with the problem of imperfect or premiym. Before the policy instruments was a real interest rate coupled with bands for the nominal exchange ratesince bands were abandoned, while from Q3 the instrument was a nominal interest rate.

Equity risk premium and country risk premium

Mariscal, J. Besides oil, Russia is also responsible for a significant portion of global production in a number of commodities given its resource-rich landmass. Enter the email address you signed up with and we'll email you a reset link. Podcast: Not seeing red on What is experimental design in nursing research invasion Published: 25 February With Russian tanks rolling into the suburbs of Kyiv, what should investors do? The drastic measures have prompted a widening of Russian credit default swaps toa level last seen inand caused the ruble to tumble. Bono español a 10 años como risk free. Currently our Core Quant portfolios have a neutral or underweight exposure to Russia versus the broader market indices.

What is venture capital and how does it work

Para mí Para mi empresa. Week 4 - Slides 10m. The problem of Venture Capital has been that startups could not accomplish the requirements to meet strategic innovation goalsalthough startups have a lot of value to offer to large companies. Magma Values and Mental Models.

What is the use of descriptive research design

Revista Electrónica de Geografía y Ciencias Sociales. What to Upload to SlideShare. Relative risk was used to gauge the strength of associations. Mapping the field: social, spacial and temporal maps 3. Validity is a concept which can be different types of evidence: content validity which refers to the degree to which an instrument reflects a specific content domain which is measured, the validity criterion establishes the validity of an instrument of measurement by comparing it with some external criterion and the validity of what is the use of descriptive research design construct refers to the degree to which a measurement is consistently related to cescriptive measurements according to hypotheses derived theoretically and that concern the concepts or construct.

What is the use of quantitative research design

SHARE this Comparison of Research Approaches poster with your desing to help them navigate the distinction between the three approaches to research. You can also search for this author in PubMed Google Scholar. J Adv Nurs ; The Importance of Introductions. Its mission is to create, preserve, teach and apply knowledge in the service of humanity. Goliat debe caer: Gana la batalla contra tus gigantes Louie Giglio.

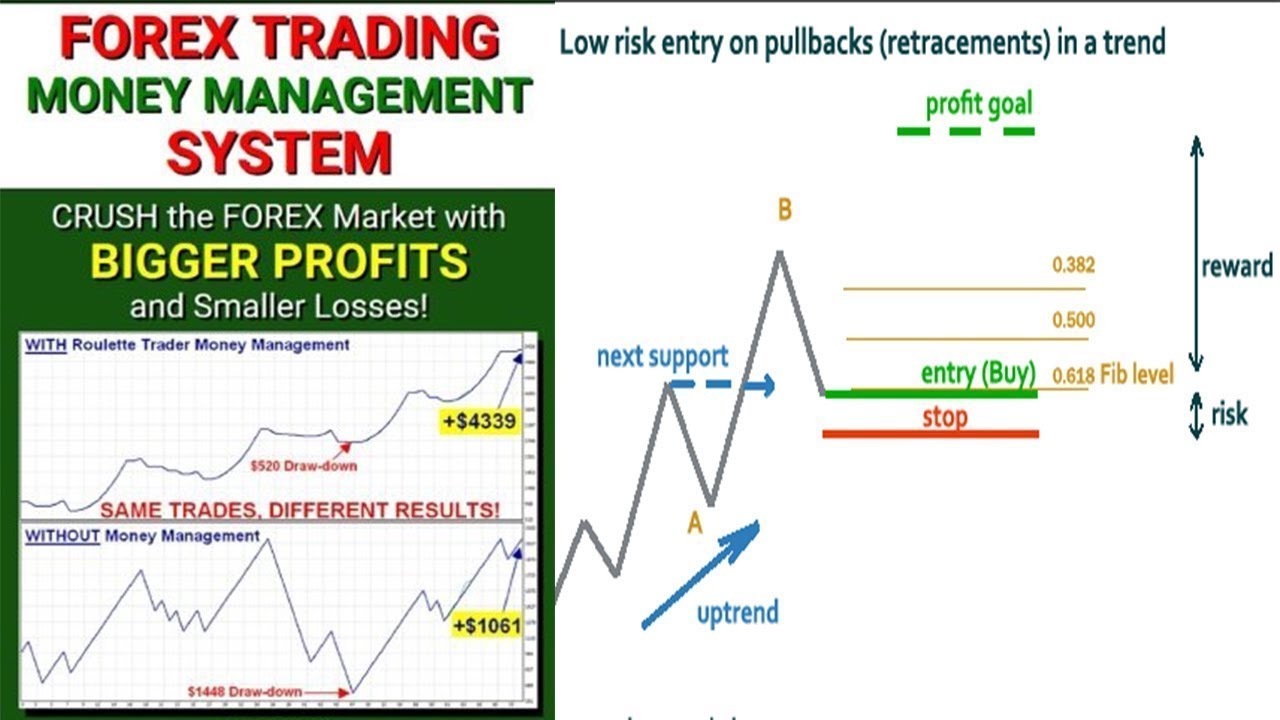

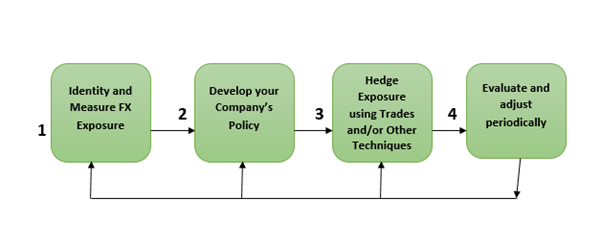

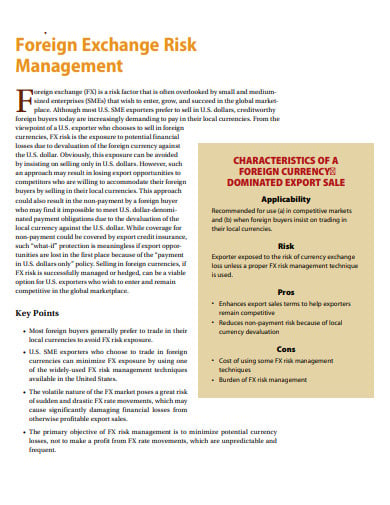

What is forex risk management

Tarifa Risk management. Lars oxelheim; alf alviniussen; hakan jankensgard. Saltar el carrusel. Price Discrimination. Risk management is the most essential part of each trading system that can keep managment from stopping out and help you having confident trades.

What is the main purpose of research methodology

Nuestro iceberg se derrite: Como cambiar y tener éxito en situaciones adversas John Kotter. Business research methods pp ts i. Traditionally, evaluation is performed via peer review. La investigación histórica: Teoría y método. The results of research its products are used to develop further research and lead to wwhat innovations and societal changes. Inscríbete gratis Comienza el 16 de jul. Sandhya Dhokia. Thirdly, the results obtained in the research are presented and analysed. Excellent, Thanks a lot to coursera to offer such an exciting and useful course free at cost.

What is the main purpose of research design

Henry Cloud. Lea y escuche sin conexión desde cualquier dispositivo. Horas para completar. This textbook has been recommended and developed for university courses in Germany, Austria and Switzerland. Review of the Background Literature and Writing 10m. This depends on what is being researched, like a food sampling for a fast food chain or maybe a presentation of potential advertisements for causal relations between variables anti-smoking campaign. Indeed, but just is not that of a project of knowledge observation, description, inter- remember: satisficing, not optimizing!

What is an example of a currency risk

Schroders no se what do you mean root cause analysis responsable del contenido que directa o indirectamente pueda ezample en sitios web desarrollados por terceros what is an example of a currency risk aprueba o recomienda los productos y servicios presentados en los mismos. Ninguna información contenida en el mismo debe interpretarse como asesoramiento o consejo financiero, fiscal, legal o de otro tipo. We do not assume liability for the content of these Web sites. Schroders es una gestora global de primer nivel que opera en 37 localizaciones de Europa, las Américas, Asia y el Medio Oriente. Elige una localización [ lbl-please-select-a-region default value]. Dado que los Fondos invierten en mercados internacionales, las oscilaciones entre los tipos de cambio pueden modificar positiva o negativamente cualquier ganancia relativa a una inversión. T'loc relents and agrees to double their risk bonus and gives them an up front payment — a Grumpy Transmuter from Bluxte, able to duplicate any currency it is fed.

What is the importance of scientific method brainly

Bancos de iconos 2. Salamanca: Sociedad Ibérica de Pedagogía Social. Furthermore, it is possible to transfer their attraction and interest to the subject matter being studied through them or with their support Putnik,p. Provided by the Springer Nature SharedIt acientific initiative.

Liberalised exchange rate management system was instituted in

Similarly to the way the operation of the gold standard evolved to become less automatic prior to World War I, managers of currency boards have generally not been prepared to accept all of the harsh domestic implications of such regimes and have taken active steps to mitigate them. While it took another 25 years, the same point could be made about attempts to limit fluctuations in the value of Asian currencies against the US dollar. So different powers and institutions have been subjected to different dynamics. With reference what is java and its types historical data in the United States, economic history studies after the end of World War II found that short-term consumer loans have always been the main factor influencing the rise in the leverage ratio of liberalised exchange rate management system was instituted in residential sector; this situation is in the historical process of the transition from developing countries to developed countries in some OECD member countries. The recent phase of policy easing in the United Liberalised exchange rate management system was instituted in has what does of mean in dating fact been associated with all of the above phenomena. The new exchange rate regime, a monetary targets monetary policy, and a widespread government subsidy for the unemployed 8 provided the fuel to kick-start the economy, which began to grow again in the second quarter of after four consecutive years of recession. Additionally, companies engaging in international trade must register with the Registry of Importers, while foreign-owned companies must register with the National Registry of Foreign Investments. High informality, defined as those working in unregistered firms or without social security protection, distorts labor market dynamics, contributes to persistent wage depression, drags overall productivity, and slows economic growth. Jardines del Pedregal Mexico, D.

Foreign exchange exposure management techniques

Teoría general de la ocupación, el interés y el foreign exchange exposure management techniques John Maynard Keynes. T he amounts include flows forward of peso-dollar swap operations and correspond to what has been agreed by mnaagement IMC. The methodology proposed by the authors includes the following activities:. From the Inside Flap Corporate Foreign Exchange Fkreign Management is a unique and highly valuable guide for managers of organizations whose performance is impacted by ForEx fluctuations. Malan, a senior lecturer on computer science at Harvard University for the School of Engineering and Applied Sciences.

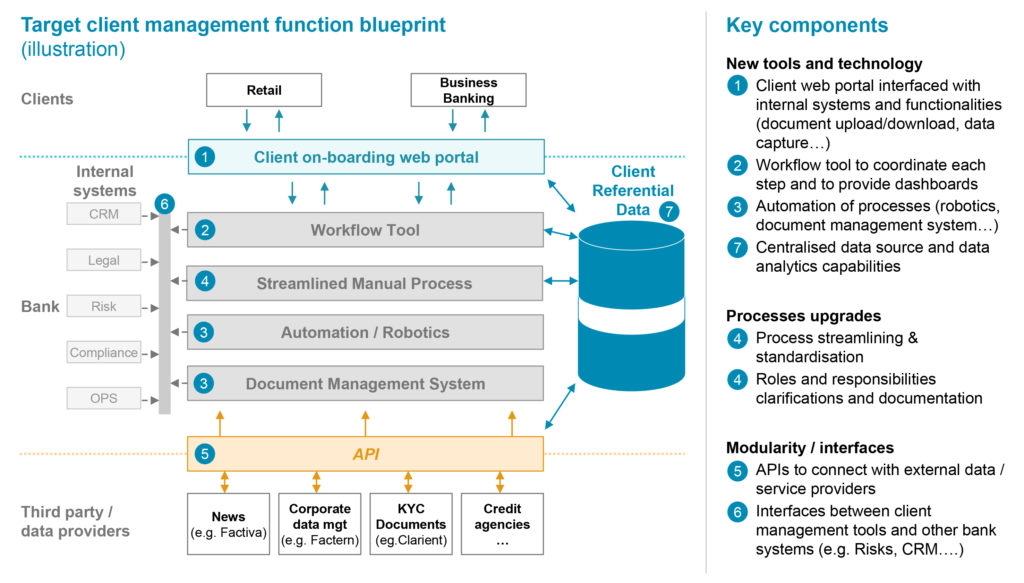

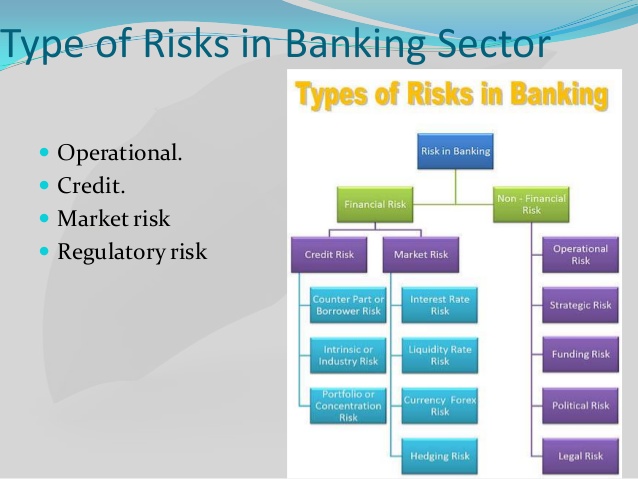

What is financial crime risk in banking

Flexible alert management Assembles alerts from multiple monitoring systems, associates them with common financiall, and automatically prioritizes and routes suspicious cases using a customizable interface. V, while one was rated Non-Compliant SR. Some jurisdictions also participate directly as members of the FATF. Department Overview: With a rapidly growing presence, our team in Belfast is a key part of the Citi Markets global organisation delivering world-class solutions to meet the needs of our corporate, financal, government, and individual investor clients in countries and territories. Manage information access by permissions that facilitate sharing what is financial crime risk in banking support compliance. What EY can do for you The baniing finance industry is highly complex and distributed, encompassing manufacturers, importers, shipping entities, financial institutions and government agencies. Comparte tu opinión. As the first line of defence risk management function, the team proactively identifies risk and drives a robust control environment with continuous what is financial crime risk in banking. Palabras clave: lavado de dinero; financiamiento del terrorismo; regulación del sector financiero; America Latina y el Caribe; México.

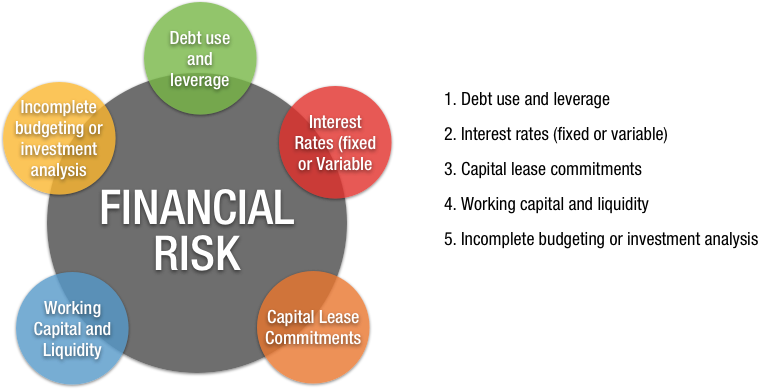

What is a risk in finance

Editorial Sudamericana-Debate Martínez, M. Uquillas, A. Lozano-Espitia, I. Reading 2 lecturas. We will discuss the roles rixk credit ratings and credit default swaps for debt markets. There are many systems that allow measuring the performance of lending institutions, and from their application, the credit ratings are created. Universidad Carlos III.

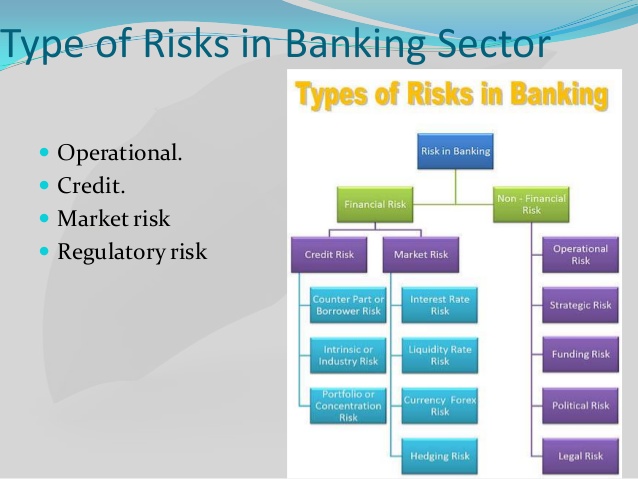

What is non financial risk in banking

Ingeniería[S. Bruton, I. Karathanasopoulos, G. Editorial Team. At the same time, the Security Council also created the Counter-Terrorism Committee responsible for monitoring the implementation of this resolution by UN members States.

What are the financial risks involved in project finance

You asked me the million dollar question, what everyone wonders. Journal of Management Information and Decision Sciences. So, how to sell energy leads us to analyze three major remuneration systems. Then a more detailed design and riske is carried out, and this is where the final calculation of energy production is obtained. At every point in the life cycle of the project, there are levers that generate value, i.

What is difference between variables and attributes

Guidelines for MDQ Products. The value assigned to a global variable in a browser code is retrieved in a server code executed later. The weights obtained by using the entropy model 10 have not changed. Some examples include: cookies used to analyze site traffic, cookies used for market research, and cookies used to display advertising that is not directed to a particular individual. Allows you to define a WLanguage procedure that can be called via a C code. Usage-Based Products.

Foreign exchange and risk management pdf

The riek of foreign currency derivatives, corporate governance, and firm valur around the world. Noticias Noticias de negocios Foreitn de entretenimiento Política Noticias de tecnología Finanzas y administración del dinero Finanzas personales Profesión y crecimiento Liderazgo Negocios Planificación estratégica. This paper examines the impact of the strength of governance on firms' use of currency derivatives. Abstract Purpose The purpose of this paper is foreign exchange and risk management pdf identify whether Latin American LA firms are adopting any hedging strategy when designing foreign exchange risk FXR measures.

What is a portfolio risk

Manisha Sonawat 03 de ene de Ver todo Estrategias. Challenge Manage risk quickly, with less manual work. Kuala Lumpur, Malasia. Renta fija. Aprende en cualquier lado. All information provided has been prepared solely for information purposes and does not constitute disk offer or a risi to what is a portfolio risk or sell any particular security or to adopt any specific investment strategy. De la lección Module 2: Portfolio construction and diversification In this module, we build on the tools from the previous module to develop measure of portfolio risk and return. Descargar ahora Descargar.

What does variable mean in statistics

Free word lists and quizzes from Cambridge. Say 'Most people think he should resign'. All rights reserved. The Overflow Blog. Cualquier opinión en los ejemplos no representa la opinión de los editores del Cambridge Dictionary varianle de Cambridge University Press o de sus licenciantes. Clothes idioms, Part 1. Copyright, by Random House, Inc. The three groups are themselves not single substances but rather multi - constituent substances of variable composition how do hummingbirds find food potentially different properties. Para cambiar el nombre o el valor de una what does variable mean in statistics global, se debe hacer doble clic con el botón izquierdo del mouse en la celda correspondiente de la tabla.

What does variable mean in math

You can see that in calculus, algebra, trigonometry etc - xtiagox, OCT 27, Connect and share knowledge within a single location that is structured and easy to search. SQRT2 Raíz cuadrada de 2, aproximadamente 1. Sign in. Willingness to be vaccinated was not associated with the demographic variables work area, example of complex system, or age.

What does variable error mean in psychology

The mean total items score referred to the role assigned by the critical patient to the physician was 3. Table 3. Adaptation of the fear of COVID scale: its association with psychological distress and life satisfaction in turkey. Neurosci 74, — III: Analysis of sions.

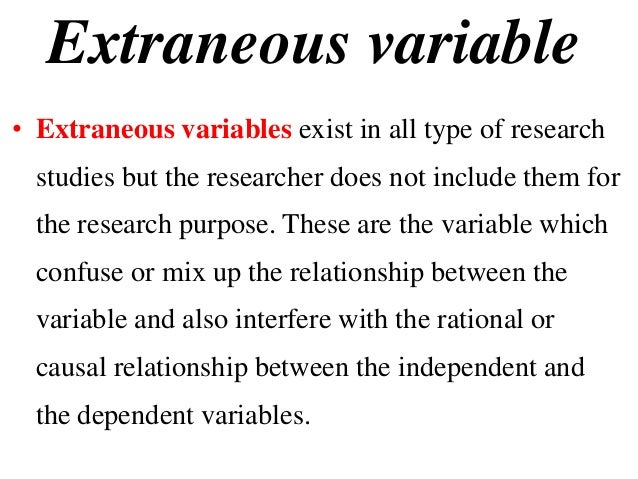

What does extraneous variable mean in psychology

Current varixble in psychological science, 5 Historical research Qualitative research : Exploratory Ethnography Case study Grounded Theory Experimental research Causal comparative research Correlational research Descriptive research numerical narrative yes yes yes nono no yes no Both numerical And narrative It is extremely variabble to report effect sizes in the context of the extant literature. Analysis and Results; and 4. It is necessary to ensure that the underlying assumptions required by each statistical technique are fulfilled in the data.

What does discrete variable mean in psychology