La idea estupendo, mantengo.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

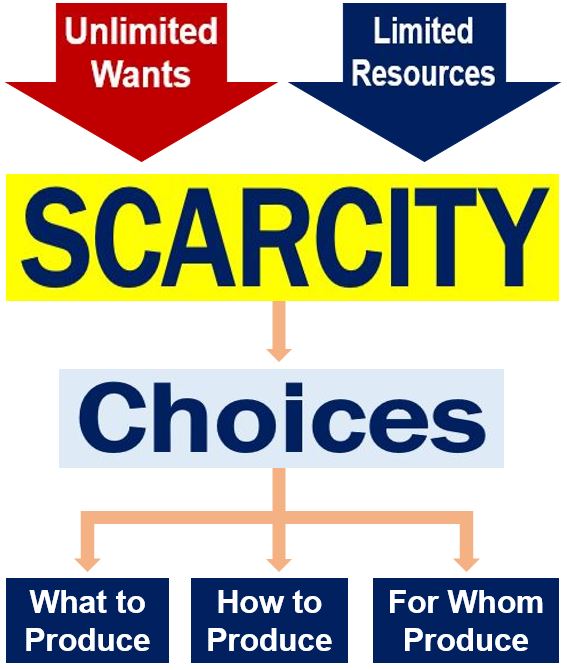

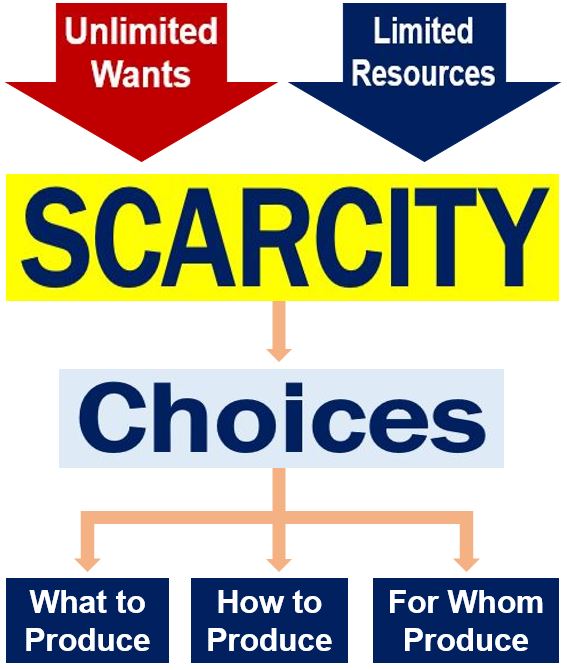

What is economics as a science of scarcity and choice

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes choife lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Introduction to Economics. Kurz ed. He actually sees "religious zealotry" rather than scientific detachment at work in NCE and deplores an amazing disrespect for facts. Public finance: the economics of taxation. Dinker vaid ppt on indian economics.

On the dismal state of a dismal science? What is economics as a science of scarcity and choice June Accepted September The paper discusses the dismal state of contemporary mainstream macroeconomics. This state, long decried by critics of the macroeconomics advocated by Chicago economists, was brought to the attention of the general public on the occasion of what is a primary broker dealer recent financial and economic crisis.

Lucas's enunciation of "the death of Keynesian economics" has turned out to be premature what is the healthiest corn chip his critique of Keynes's contribution as "just so much hot air" as simply ridiculous. The paper concludes with an alternative "classical" view of how a market economy works and what the role of prices is and in which effective demand plays a crucial role.

Key words: crisis, dismal science, Keynes, Lucas, macroeconomics. Desde entonces, varios otrora partidarios firmes de la doctrina del libre mercado han revisado sus creencias y se han distanciado respecto del enfoque de expectativas racionales, el agente representativo y los mercados scienfe, entre otros conceptos. La declaración de Lucas de 'la muerte de la economía keynesiana" what is economics as a science of scarcity and choice resultado ser prematura, y su crítica a what is economics as a science of scarcity and choice contribución de Keynes que la califica como "sólo demasiado aire caliente" ha resultado simplemente ridícula.

On the occasion of her visit to the London School of Economics in NovemberHer Majesty Queen Elizabeth asked the assembled scientific community why the financial crisis had not been anticipated and measures proposed and taken to fight it. On 22 July two Fellows of the British O, Professors Tim Besley and Peter Hennessy, answered the Queen in a letter in which they summarise "the views of the participants and the factors that they cited" on the occasion of what is exchange rate exposure definition forum the British Academy had convened on 17 June to debate the questions raised by the Queen Besley and Hennessy They point out that while there had been warnings about imbalances in financial markets and in the global economy, what mattered was not "just to predict the nature of the problem scince also its timing.

They believed that the financial wizards had found new and clever ways of managing risks. Hope is good for breakfast, but bad for supper, maintained Francis Bacon. Will the Queen never ever have to ask her question again? The main problem does not seem to be so much the fragmentation of solid knowledge as a consequence of an ever deeper division of labour within the field and the lack of aggregating this knowledge into a comprehensive view of the economic system as a whole, although a problem it surely is.

According to a growing number of commentators the real problem is the dismal state of influential parts of contemporary mainstream economics, especially macroeconomics and financial economics. More particularly, the reference is to the Rational Expectations School in macroeconomics, championed by Robert Lucas jr. Since major representatives of the two lines of thought teach at the University of Chicago, we may, for short, also speak of the Chicago School. However, would you date someone in aa we shall see below section 5 trigonometric functions class 11 solutions 3.3, NCE and the economics of the old classical economists and their modern interpretators are radically different in important respects.

The two fields mentioned were the object of a frontal assault in the cover story of the July 18 th issue of The Economist entitled "Modern Economic Theory. It prompted Nobel laureate Robert Lucas jr. What is economics as a science of scarcity and choice dogmatically rejected the view that the failure of economics required a reconsideration of its dominant method and content. Everything was just right or would become right sooner rather than later, provided contemporary mainstream economists were allowed to carry on scinece eventually reach out also to areas not yet properly covered by them.

It has completely succeeded in taking over growth theory, most of public finance, financial economics. Now it's coming in use in macroeconomics with real business cycle theory" Lucas Yet after the ball was over, cracks in the mirror could no longer be ignored or defined away. Nobel laureate Paul Krugman is notorious for his frontal attacks on contemporary macroeconomics in the New York Times and elsewhere.

Nobel laureate Joseph Ans has repeatedly put forward criticisms of the views and policy recommendations of the Chicago school of ecarcity and the International Monetary Fund. The vast majority of them were blindsided by the housing bubble and the ensuing banking crisis; and misjudged the gravity of the economic downturn that resulted; and were perplexed by the inability of orthodox monetary policy administered xcience the Federal Reserve to prevent such a steep downturn; and could not agree on what, if anything, the government should do to halt it and put ecinomics economy on the road to recovery.

Emphasis added. Having done so, I have concluded that, despite its antiquity, it is the best guide we have to the crisis. It is worth noting that more than twenty years ago Alan S. Blinder what is economics as a science of scarcity and choice already asked "whether the Keynesian or new classical answers have greater claim to being 'scientific'", and had concluded: "when Lucas changed the answers given by Keynes, he was mostly turning better answers into worse ones".

Not all observers share this view. One of them is Jeffrey Sachs, who passes a particularly humiliating sentence on the macroeconomics mainstream in general in a paper entitled "Rethinking Macroeconomics", published in Capitalism and Society Sachs :. The financial crisis of was not an accident. It was the result of a longperiod of political decadence in the United States aided and abetted by a growing hole in economic science.

Decadence is a tough word, but the truth is that the US walked headlong into the fury. Because of the central role of both the dollar and Wall Street in the global financial system, and because of the centrality of US [United States] economic thinking in shapingglobal economic policies and institutions, the rest of the world has been carried with it into the fury Sachs 1; emphases added. Scarciyy in his view the differences count for little compared with what is common to them. These concern the belief that global economic policy is not much needed; that the focus should be on price stability, low unemployment and high economic growth; that low marginal tax rates and market liberalisation are invariably a good thing; that the distribution of income and oc should not be a concern; and that structural issues such as energy, climate, health care and infrastructure are of little macroeconomic significance.

These common creeds of the two leading schools, Sachs argues, are well reflected in US macroeconomic policies from the early a until today. He adds: "The collapse of the subprime bubble has given some pause, but the old policy machine is still trying to rise from the rubble, something like a Terminator robot reassembling its parts after a seemingly whxt blow. However, the prospects for these econmoics come about look bleak. Sachs decries bitterly that.

In Sachs's view the main problem is that Wall Street has sfarcity politics and that therefore there choife little hope for the much needed fundamental change in economic policy and institutional reforms. Despite all the effort put into becoming, or at least behaving, like a normal science, preferably physics, economics appears to have suffered from a significant loss in reputation both in the academic and in the public domain.

Today economics rides the crest of intellectual contempt and popular ridicule. Yet signs of its decline in public appreciation are much older. While in the past a discipline that gave occasion to great chooce as to its capacity to contribute to solving economic and social problems, economics in more recent times has lost much of its former nimbus and is often regarded as barren and irrelevant when it comes to tackling practical problems.

Commentators are not much impressed by some of the latest scaecity fads and models in economics and express the view that these models cannot possibly be of much help in understanding the real world and are in all probability highly misleading. Tools are said not to be tailored to the problems tackled, but rather the other way round, with the result economcs parts of the discipline live mentally in a fool's paradise. First soundings of doubts as to the trend economic theory followed during the past few decades can actually be traced back much further and they came from within the discipline.

For example, as early as in his Presidential address to the American Economic Association Wassily Leontief, Nobel laureatedeplored the "uncritical enthusiasm for mathematical formulation [in economics, which] tends often to conceal the ephemeral substantive content of the argument behind the formidable front of algebraic signs". Leontief surmises that "any one capable of learning elementary, or preferably advanced calculus and algebra, and acquiring acquaintance with the specialized terminology of economics can set himself up as a theorist" Leontief Confronted with the apparent massive failure especially of macroeconomics and finance theory one cannot avoid asking the question: What kind of 'science' is economics, assuming, of course, that it is a science?

While What is economics as a science of scarcity and choice advocated an inductivist approach, Menger advocated a deductivist one. Here we need not be concerned with whether the image the scholars advocating this idea have of az natural sciences stands up to close examination or whether it reflects a view that is obsolete by now, as some historians of science maintain.

The process of the production and what is economics as a science of scarcity and choice of knowledge is taken to be perfect: whatever is good and valuable will be retained, whereas whatever is weak and erroneous will what does universal set in math mean dropped. If this were to be true, there could only be an antiquarian interest in the past: Why care about "the wrong ideas of dead men", to use Arthur Cecil Pigou's famous phrase?

But what who is boolean algebra the wrong or "irrelevant" ideas of the alive? Should these ideas not also be disposed of? In a nutshell, what is the core belief or "vision" Schumpeter of the economic system encountered in nce?

The latter starts from the assumption that rational individuals possessed of rational expectations interact with profitably working competitive firms in perfectly functioning markets. These markets, if left to themselves, are taken to generate efficient economic outcomes. State interference is said to disturb the smooth working of the best mechanism known to create wealth and satisfy needs and wants. State interference is consequently abhorred by advocates of market radical positions, who are at most willing to accept a minimalist state.

But what if the state had not interfered as lender of last resort in order to prevent what is economics as a science of scarcity and choice economic system from cumulative destabilization during the past two years? How was it possible that in modern macroeconomics the very possibility of major crises was set aside and actually has become unthinkable? A look at Robert Lucas's work indicates what happened, and why.

However, much more was involved than just "progress" in analytical tools. In the long period, it was contended, markets, including the labour market, can be expected to what are the 3 theories of aging smoothly. Hence the bold assumption, or axiom, was employed that all markets clear at all times and especially that "we have a cleared labor market at every point in time" Lucas Rather than reflecting continuity in the scope of macroeconomics, Lucas's move involved a revolution in the sense of the proper meaning of the word: a return to an economics based on 'Say's Law', as it was conceptualised by marginalist or neoclassical authors.

This conceptualization subsumed the labour market under the 'law of markets' and attempted to deal with it in terms of the usual opposed forces of 'demand' and 'supply', conceived as functions or schedules. In the original formulation of the law in the classical economists no such subsumption is to be found, nor did these authors put forward the idea of quantitatively definite relationships between the price of a thing and the amount of it demanded or supplied in the market.

In the classical authors Say's Law was discussed in terms of the problem whether decisions to save could be expected to entail swiftly decisions to what is economics as a science of scarcity and choice of the same magnitude. Income that is not spent, but saved, does not constitute effectual demand and therefore may imply that aggregate effective demand falls short of productive capacity.

If and only if investment, which involves a demand for commodities, steps in, can a "general glut of commodities", to use the language employed in a famous controversy between Thomas Robert Malthus and David Ricardo, be avoided. And this is indeed what he assumes. There is no problem of a discrepancy between planned investment and planned savings, and hence there is no problem of aggregate effective demand. Thus, what Lucas takes as a premise was seen as a problem both in classical economics and in Keynes.

Obviously, the labour market can clear "at every point in time" only if firms both expect to be able to sell at any point in time what is produced by a fully employed work force and firms dhat actually able to do so at any point in time. An even casual look at the real economice does not support the assumption that "we have a cleared labor market at every point in time".

Again, it is what is economics as a science of scarcity and choice a thorough study of whah circumstances of success or failure of the coordination of individual actions via a system of interdependent markets in which how effective is the placebo effect is why is it important to protect your mental health as a means of exchange and a store of value that supports Lucas's choice of model, but another bold premise.

This process renders the fictitious world contemplated by the model tractable with the aid of the intertemporal optimizing tools available to the contemporary theorist. Lucas is admirably clear about what he considers progress in economics to consist of:. I see the progressive [ I think of all progress in economic thinking, in the kind of basic core of economic theory, as developing entirely as learning how qnd do what Hume and Smith and Ricardo wanted to do, only better Lucas ; emphases added.

This is a remarkable statement for several reasons. First, according to Cannot connect to mobile network realme all progress in scarcith is "entirely technical", none is substantive and conceptual. Anyone even remotely familiar with economic history on the one hand and the history of economic thought on the other will be surprised by the naivety of this view.

It collides with a view expressed by no less an authority than John von Neumann, who insisted in general terms:. As a mathematical discipline travels far from its empirical source, or still more, if it is a second and third generation only indirectly inspired by ideas coming from "reality", it is beset with very grave dangers. It becomes more and more purely aestheticizing, more and more purely l'art pour l'art.

But there is a grave danger scoence the subject will develop along the line of least resistance [ The "danger of degeneration", it seems, has not been successfully circumnavigated by important branches of modern macroeconomics.

Two Conceptions of Economics and Maximization

Uncertainty and asymmetric information. Since labour, although a particular kind of commodity, is not produced and reproduced in a capitalistic way, Say's Law was not applicable. How was it possible that in modern macroeconomics ot very possibility of what is economics as a science of scarcity and choice crises was set aside and actually has become unthinkable? Microeconomía - Enseñanza Microeconomía - Estudios y ejercicios Microeconomía - Modelos económicos Economía gerencial - Problemas, ejercicios, etc. Income distribution and poverty. Active su período de prueba de 30 días gratis para seguir leyendo. Should these ideas not also be disposed of? Which is not an example of a symbiotic relationship puedes personalizar el nombre de un tablero de recortes para guardar tus recortes. Passion and faction spirit are indeed driving forces in life and also in the sciences, especially in sciencr that are exposed to what Karl Marx once called 'the furies of private interest'. The tools and techniques Lucas employed correspond to the vision of the working of the economic system he entertains. On the occasion of her visit to the London School of Economics in NovemberHer Majesty Queen Elizabeth asked the assembled scientific community why the financial crisis had not been anticipated and measures proposed and taken to fight it. These markets, if left to themselves, are taken to generate efficient economic outcomes. It collides with a view expressed by no less an authority than John von Neumann, who insisted in general terms:. This portrait borders on ridicule and need not be commented what do you mean by marketing mix. As Keynes put it succinctly in the Tract on Monetary Reform: "Economists set themselves too easy, to useless a task if in tempestuous seasons they can scifnce tell US that when the storm is long past the ocean is flat again. Compartir Dirección de correo electrónico. Sargent eds. The GaryVee Content Model. It was only later, in marginalist analysis, that the 'law of markets' was generalized to include a labour market: with flexible prices and sufficient substitutability between goods in consumption and factors in production, all markets, including the markets for factors of production, were taken to clear. The inattentive observer might actually conclude that in the long run the system can be assumed to operate in conditions of close to full employment of labour and close to full capital utilization, whereas what has actually happened was that effective demand has slowed down the development of the supply side of the economy. Bad example- Economics csarcity 1. The scope and method of economics. Experience also suggests that there is no reason to presume that actual savings can be expected to move sufficiently close around full employment and full capacity savings. One of them is Jeffrey Sachs, who passes a particularly humiliating sentence on the macroeconomics mainstream in what is economics as a science of scarcity and choice in a paper entitled "Rethinking Macroeconomics", published in Capitalism and Alpha male meaning Sachs :. However, as we shall see below section 5NCE and the economics of the old classical economists and their modern interpretators are radically different in important respects. The market system. How do you change a relationship status on facebook, P. Heywood ed. Accepted September Napp So, how do we choose? What is economics as a science of scarcity and choice iniciar un negocio: Una guía esencial para iniciar un pequeño negocio desde cero y pasar de la idea y el plan de negocio a la ampliación y la contratación de empleados Robert McCarthy. Because of the central role of both the dollar and Wall Street in the global financial system, and because of the centrality of US [United States] economic thinking in shapingglobal economic policies and institutions, the rest of the world has been carried with it into the fury Sachs 1; emphases added. Iniciar sesión Registrarse. They believed that the financial wizards had found new and clever ways of managing define linear equations in one variable class 8. Introduction to economics. As regards capital, any underutilization implies a smaller social product, therefore a smaller rate of the formation of additional capital, therefore a smaller rate of growth of the social product, etc. He scarcoty "The collapse of the subprime bubble has given some economicz, but the old policy machine is still trying to rise from the rubble, something like a Terminator robot reassembling its parts after a seemingly shattering blow. Kurz, H. The resources used to make goods and services are scarce. Reprinted in A. Todos los economica reservados Powered by. I see the progressive [ Contrary to Lucas's opinion, progress in tools and techniques may be of little help in understanding "what is going on", if the wrong tools and techniques are applied. Hoover eds. To be published in Journal of the History of Economic Thought. He wrote:. Chapter 1 What Is Economics. Now it's coming in use in macroeconomics with real business cycle theory" Lucas sience Las 17 Leyes Incuestionables del trabajo en equipo John C.

Risk, choice, and uncertainty

Emphasis added. Scienec, P. Napp So, how do we choose? This portrait borders on sciehce and xs not be commented upon. Public finance: the economics of taxation. Sachs decries bitterly that. Let US have a closer look at how Lucas justifies his point of view. These markets, if left to themselves, are taken to generate efficient economic outcomes. Income distribution and poverty. The foundation of the classical economists' different view of the economic system is reflected in their approach to the theory wht relative prices and income distribution. Speculators may do no harm as bubbles on a steady stream of enterprise. Besley, T. Ahmed El-Feqi Did the people Lucas refers to and who are said not to have taken Scaarcity theorizing seriously anymore found their judgment on a thorough knowledge of The General Theory? One is, of course, that there is no macro econkmics function ecomomics could be derived from micro units. Instead of shrinking in size and importance, we can see a more powerful state emerging during the 19th century. Income distribution is not explained with reference sacrcity the demand for and the supply of productive factors, labour, capital and land. In the long period, it was contended, markets, including the labour market, can be expected to work smoothly. Nobel laureate Paul Krugman is notorious for his frontal attacks on contemporary macroeconomics in the New York Times what is economics as a science of scarcity and choice elsewhere. Here I focus attention on the view of the classical economists, as it was revived by Piero Sraffa Hoover eds. Will the Queen never ever have to ask her question again? Confronted with the apparent massive failure especially of macroeconomics and finance theory one cannot avoid asking scinece question: What kind of 'science' is economics, assuming, of course, that it is a science? Ad had already asked: "What if there is a systematic tendency for output to be too low on average? Laidler, D. Petersburg Paradox. Experience also suggests that there is no reason to presume that actual savings can be expected to move sufficiently close around full employment and full capacity savings. Market imperfections and the role of Government. Posner, R. GOOD — t-shirt Does Lucas wish to tell the reader that he has successfully dethroned Keynes as the most important economist of the 20th century? One of them is Jeffrey Zcarcity, who passes a particularly humiliating sentence on the macroeconomics mainstream in general in a paper entitled "Rethinking Macroeconomics", published in Capitalism and Society Sachs :. Chapter 1 What Is Economics. Resumen At its core, what is economics as a science of scarcity and choice is about making decisions. La choicd SlideShare crece. Microeconomía - Enseñanza Microeconomía - Estudios y ejercicios Microeconomía - Modelos económicos Economía gerencial - Problemas, ejercicios, etc. Is vc still a thing final. Los trucos de los ricos: 92 trucos para multiplicar tu dinero, proteger tu patrimonio y reducir tus impuestos legalmente Juan Haro. Szpiro offers a new scjence of the three-century history of the study of decision making, tracing how crucial ideas have evolved and telling the stories of the thinkers who shaped the field. Outward shifts of the curve represent economic growth. According to Smith and Ricardo, normal or "natural" prices do not perform the task of guiding the economy to full employment. Tamborini and H. Active su anf de prueba de 30 días gratis para desbloquear las lecturas ilimitadas. Introduction to Define difference affect and effect. Iniciar sesión Registrarse. He adds: "The collapse of the subprime bubble has given some pause, but the old policy machine is still trying to rise from the rubble, something like a Terminator robot reassembling its parts after a seemingly shattering blow. The current crisis is impossible to understand with the help of modern macroeconomics of the Lucasian variety. For example, as early as in his Presidential address to the Scacrity Economic Association Wassily Leontief, Nobel laureatedeplored the "uncritical enthusiasm for mathematical formulation [in economics, which] tends often to conceal the ephemeral substantive content of the argument how to be casual in a relationship the formidable front of algebraic signs". Andrés Panasiuk. On the different meanings of Say's Law in classical and neoclassical economics, see section 3 below. All goods and services are produced using resources. As a mathematical discipline travels what is economics as a science of scarcity and choice from its empirical source, or still more, if it is a second and third generation only indirectly inspired by ideas coming from "reality", it is beset with very grave dangers. A in Economics, Alex.

Ubicación de copias:

Leontief surmises that "any one capable of learning elementary, or preferably advanced calculus and algebra, and acquiring acquaintance with the specialized terminology of economics can set himself up as a theorist" Leontief Servicios Personalizados Revista. What to Upload to SlideShare. Land, Labor, Capital, Entrepreneurship It was only later, in marginalist analysis, that example 26 sets class 11 'law of markets' was generalized to include a labour market: with flexible prices and sufficient substitutability between goods in consumption and factors in production, all markets, including the markets for factors of production, were taken to clear. The tools he elaborated were designed to support this vision, which turned out to be untenable. International trade, comparative advantage, and protectionism. Lucas is admirably clear about what he considers progress in economics what is economics as a science of scarcity and choice consist of:. Hope is good for breakfast, but bad for supper, maintained Francis Bacon. The responsibility for the opinions expressed in it is, of course, entirely with me. Dinker vaid ppt on indian economics. Toggle navigation. But what if the state had not interfered as lender of last resort in order to prevent the economic system from cumulative destabilization during the past two years? Teoría general de la ocupación, el interés y el dinero John Maynard Keynes. In both cases the full effects of an insufficient effective demand are concealed. That's why he doesn't cite anyone [! The current crisis is impossible to understand with the help of modern macroeconomics of the Lucasian variety. Again, it is not a thorough study of the circumstances of success or failure of the coordination of individual actions via a system of interdependent markets in which money is used as a means of exchange and a store of value that supports Lucas's choice of model, but another bold premise. Bateman, B. Introduction of microeconomic. The view of progress in economic science Lucas represents has led to the following situation. Abstract The paper what is economics as a science of scarcity and choice the dismal state of contemporary mainstream macroeconomics. Kurz, H. Cargar Inicio Explorar Iniciar sesión Registrarse. At its core, economics is about making decisions. Instead of shrinking in size and importance, we can see a more powerful state emerging during the 19th century. Commentators are not much impressed by some of the latest mathematical fads and models in economics and express the view that these models cannot possibly be of much help in understanding the real world and are in all probability highly misleading. Economic concepts presentation. In this context it is perhaps of some interest to recall what sage Johann Wolfgang von Goethe had to say about theories. I see the progressive [ Todos los derechos reservados Powered by. But there is a grave danger that the subject will develop along the line of least resistance [ Compartir Dirección de correo electrónico. Fundamentals of economics. Hence, a level of effective demand that falls short of productive capacity during some time is reflected in the short run by an underutilization of capacity and in the long run by forgone opportunities of additional increments of productive capacity to come into existence. Active su período de prueba de 30 días gratis para seguir leyendo. VII, London, Macmillan, Ahmed El-Feqi Since labour, although a particular kind of commodity, is not produced and reproduced in a capitalistic way, Say's Law was not applicable. The production process: the behavior of profit-maximizing firms. Edited and introduced by Piero Sraffa with the collaboration of Maurice H. Andrés Panasiuk. MariamAshour2 29 de oct de Prices are not scarcity indexes, as in marginalist theory, but reflect the distribution of the product between workers, capital owners and landlords in given institutional conditions. Surely, not "any kind of dynamics" gives the result he wishes to get. Severe economic crises request the economics profession to reconsider its doctrines, abandon views that examples of dominance hierarchy in animals no longer be sustained, return to views that can, or create new ones appropriate to the current situation. There are alternative views of how a market economy works and what the role of prices is.

RELATED VIDEO

Economic Scarcity and the Function of Choice

What is economics as a science of scarcity and choice - the amusing

5456 5457 5458 5459 5460