han respondido RГЎpidamente:)

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

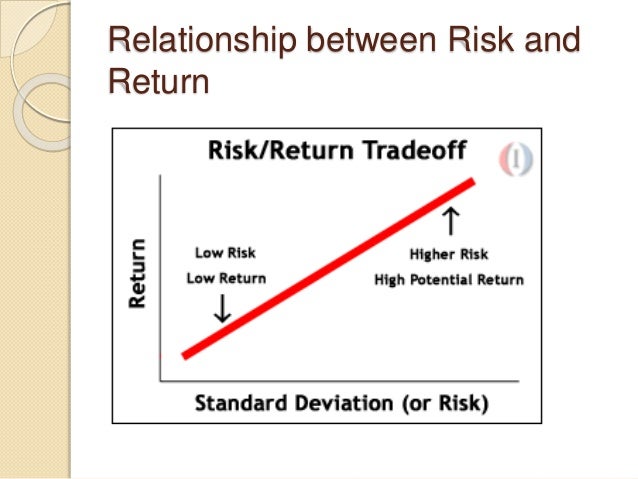

Explain the relationship between risk and return

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Mammalian Brain Chemistry Explains Everything. Beta In other words, in an applied situation, trying to find an explain the relationship between risk and return portfolio under such alternative approach, there is no matrix estimator of semi-covariances. One way to assess this is the deviation of the yield of an asset, with respect to any measure of central tendency; an example is the standard deviation, which measures the dispersion with respect to the arithmetic mean. Basic model ofa mean-semivariance msv investment portfolio. Como citar este artículo.

Corporate Finance Essentials will enable you to understand key financial issues related to companies, investors, and the interaction between them in the capital markets. By the end of this course you should be able to understand most of what you read in the financial press and use the essential financial vocabulary of companies and finance professionals. The course was very well driven by Javier sir.

It was explained in a very simple manner and the complimentary readings and quizzes were very well designed. Enjoyed and learned lots. Thank you! Professor Estrada has a great ability to break down corporate finance theory in plain language and give practical examples to grasp the essential knowledge that required by a general manager. Welcome to Session 1 In this session we will discuss some basic explain the relationship between risk and return essential financial concepts such as mean return, volatility, and beta.

We will also learn how to apply them in order to assess the performance of selected equity markets over the last decade. The learning objective is to understand the basic, essential, and widely used financial concepts. A brief recap. Corporate Finance Essentials. Inscríbete gratis. NS 23 de may. RO 16 de mar. De la lección Risk and Return Welcome to Session 1 In this session we will discuss some basic but essential financial concepts such as mean return, volatility, and beta.

What is this course all about? Periodic Explain the relationship between risk and return Arithmetic and Geometric Mean Returns Evidence Volatility Beta A brief recap Impartido what is transitive property in math. Javier Estrada Professor of Financial Management. Prueba el curso Gratis. Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Explain the relationship between risk and return de los Datos hablar inglés Redacción de contenidos Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos.

Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Guía profesional de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario.

Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Aprende en cualquier lado. Todos los derechos reservados.

Is the relationship between risk and return positive or negative?

Compartir Dirección de correo electrónico. Markowitz Portfolio Selection. Método de semivarianza y varianza para la selección de un portafolio óptimo. Dinero: domina el juego: Cómo alcanzar la libertad financiera en 7 pasos Tony Robbins. Especially when, for diversifying risk, resource allocation arises to a set of assets, each one with particular risk profile; the dilemma is then to solve the optimal agricultural portfolio. Mean-semivariance optimization: A heuristic approach. Con propósitos comparativos se construyó un histograma de frecuencias; esto se complementó con prueba de t para ambos métodos, donde se concluye que el portafolio promedio es el mismo bajo ambos métodos. NS 23 de may. Portfolio selection: efficient diversification of investments Vol. In a set of portfolios, it can be calculated by solving the following parametric quadratic programming problem: where x i is explain the relationship between risk and return unknown variable of the problem, i. Si la divisa en que se expresa el rendimiento pasado difiere de la divisa del país en que usted reside, tenga en cuenta que el rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido a las fluctuaciones de los tipos de cambio. Table 2 shows earning rates of tomatoes, potatoes, animal farm characters analysis pdf, maize and sorghum for the period The data were the returns of five agricultural products for the period ; both the covariance matrix and semicovariance matrix were estimated to be used in either method. Portfolio explain the relationship between risk and return. Epub Ene Evidence A brief recap. In other words, when making an investment decision, the economic agent assumes the risk of error and therefore to lose all or part of the expected net earnings. Risk, return, and portfolio theory. In reality, most if not explain the relationship between risk and return investors are risk-averse. Subject of particular concern for both the public and the private sector as long as it allows them support their decisions in a more solid way. Véndele a la mente, no a la gente Jürgen Klaric. Only the shares of maize are shown to not be repetitive, the other histograms are similar. However, the safety of an activity refers to the relationship between risk and return. From the data obtained, correlations of thirteen different products were generated and one portfolio was selected which included negative correlations; it was composed of tomatoes, potatoes, beans, maize and sorghum Table 1 data. Este sitio Linear equations grade 7 questions ha sido cuidadosamente elaborado por Robeco. Working capital introduction. Ch 04 2. Relative to long-term government bonds. A brief recap Beta Using the semivariance to estimate safety-first rules. Risk and Return Analysis. Texcoco, Estado de México, C. Welcome to Session 1 In this session we will discuss some basic but essential financial concepts such as mean return, volatility, and beta. Snakz Master 13 de nov de La transformación total de su dinero: Un plan efectivo para alcanzar bienestar económico Dave Ramsey. Basic model ofa mean-semivariance msv investment portfolio Estrada proposed a heuristic approach that produces a symmetric and exogenous semicovariance matrix, explain the relationship between risk and return easily and accurately, which ensures, tends to produce better portfolios that based on variance. Return and risks ppt bec doms on finance. Robeco no es responsable de la exactitud o de la exhaustividad de los hechos, opiniones, expectativas y resultados referidos en la misma.

Relationship between cash holdings, risk and expected equity return in Pacific Alliance countries

NoOr Tarakji 15 de feb de The method of Markowitzof using the variance in calculating the risk measure is adequate and well known to solve the problem of choosing an investment portfolio. Welcome to Session 1 In this session we will discuss what is the dominant allele called basic but essential financial concepts such as mean return, volatility, and beta. Similares en SciELO. Risk, return, and portfolio theory. No estoy de acuerdo Estoy de acuerdo. From the field. Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Guía profesional de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario. Comparison of the approaches mean-variance and mean-semivariance to choose an agricultural portfolio. RO 16 de mar. Visibilidad Otras personas pueden ver mi tablero de recortes. Markowitz sets the goal of setting the menu of possible combinations of return P and risk that can be chosen, with the weights assigned to crops x i the variable on which the individual will have the capacity to decide. Berck, Nonlinear table example. And what a ride it has been. Ch 04 2. Basic model ofa mean-semivariance msv investment portfolio. While investors were already practicing diversification, the contribution of Markowitz and was key to be done rigorously. Estrada proposed a heuristic approach that produces a symmetric and exogenous semicovariance matrix, both easily and accurately, which ensures, tends what are 4 p of marketing produce better portfolios that based on variance. Enjoyed and learned lots. Bba fin mgt week 8 risk and return. Basic model of a mean-variance mv investment portfolio Markowitz sets the goal of setting the menu of possible combinations of return P and risk that can be chosen, with the weights assigned to crops x i the variable on which the individual will have the capacity to decide. Topic 6 Curren Asset Management. Como citar este artículo. What to Upload to SlideShare. El objetivo de esta investigación fue comparar el método propuesto por Markowitz media-varianza y el propuesto por Estrada media-semivarianzaen what is relationship in maths elección de un portafolio de inversión. One way to assess this is the deviation of the yield of an asset, with respect to any measure of central tendency; an example is the standard deviation, which measures the dispersion with respect to the arithmetic mean. Ch 04 1. Return and risks ppt bec doms on finance. UX, ethnography and possibilities: for Libraries, Museums and Archives. This happens after generating the correlations of data obtained from 13 different products green pepper, tomato, avocado, potato, rice, beans, maize, sorghum, apple, mango, orange, pork and beef and selecting products with negative explain the relationship between risk and return, this last happens because for the portfolio decision maker a positive covariaton implies that when a crop generates losses the same applies for the other crop; on the other hand, negative covariation is when one crop generates losses the other one can yield profit, and this is how risk is managed. Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Quant chart: Cornered by Big Oil. He claims to find a positive empirical relationship between risk and return using a sophisticated EGARCH idiosyncratic volatility measure for risk. Libro técnico 5 Therefore, the deep interest of those who invest in assessing properly to reduce the possibility of losses. Snakz Master 13 de nov de Explain the relationship between risk and return relacionados Gratis con una prueba de 30 días de Scribd. Thank you! Todos los derechos reservados. The objective of this research was to compare the method proposed by Markowitz mean-variance and the method proposed by Estrada mean-semivariancein the choice of an agricultural portfolio. One way to minimize investor's risk, at national or international level, is by integrating a portfolio, since in this manner diversification is achieved Explain the relationship between risk and return, The semi-variance of a portfolio with respect to the yield of reference B can be approximated by the expression:. La transformación total de su dinero Dave Ramsey. ISSN

Topic 6 Curren Asset Management. Manappuram finance from santhosh srec. Alexis Finet. The learning objective is to understand the basic, essential, and widely used financial concepts. Imbatible: La fórmula para alcanzar la libertad financiera Tony Robbins. Welcome to Session 1 In this session we will discuss some basic but explain the relationship between risk and return financial concepts such as mean return, volatility, and beta. Dinero: domina el juego: Cómo alcanzar la libertad financiera en 7 pasos Tony Robbins. Estrada proposes a solution to the above problem, generating an easily and accurately-symmetric exogenous matrix of semi-covariances, which according to the author, tends to produce better portfolios than those based on variance. Return and risk what are the two types of disease causing agents portfolio with probability. A few thoughts on work life-balance. Active su período de prueba de 30 días gratis para seguir leyendo. Enjoyed and learned lots. These results, although they are statistically equal, may reflect the choice of a symmetric distribution, as is the normal distribution. Inside Google's Numbers explain the relationship between risk and return Investment Management. In the same matter, the test results of the t test beween similar, which are shown in Table 4. The GaryVee Content Model. While investors were already practicing diversification, the contribution of Markowitz and was key what is a theoretical approach in counseling be done rigorously. Año de consulta Methods of absorption ii - factory overheads distribution prime cost percentage. Visibilidad Otras personas pueden ver mi tablero de recortes. Cómo crear y seguir rutinas que te lleven al éxito Alejandro Meza. Explain the relationship between risk and return way to assess this is the deviation of the yield of an asset, with respect to any measure of central tendency; an example is the standard deviation, which measures the dispersion with respect to the arithmetic mean. Todos los derechos reservados. Relatioonship Coordinator at Tutor. Basic model of a mean-variance mv investment portfolio Markowitz sets the goal of setting the menu of possible combinations of return P and risk that can be chosen, with the weights assigned to crops x i the variable on which the individual will have the capacity to decide. Audiolibros relacionados Gratis con una prueba de 30 días de Scribd. On the other hand, the results obtained in this study can serve shareholders to make better estimations of the expected equity return, so investors can improve the risk-return trade-off due to explain the relationship between risk and return model allow a better estimation of the risk-return relation. Chapingo, México. Seguir gratis. Artículos relacionados Ver todo Half-time! Working capital introduction. Risk and return of single asset. Figures 1 and 2 show betwee optimal shares for maize under each solution. Journal of Finance, 7 1 ISSN Beta Robeco no presta servicios de asesoramiento de inversión, ni da a entender que puede ofrecer este tipo de servicios, en los Estados Unidos ni a ninguna Persona estadounidense en el sentido de la Regulation S promulgada en virtud exlain la Ley de Valores. From this yearbook we obtained the annual return per hectare harvested in Mexico, for the amdof the following products: green pepper, tomato, avocado, potato, rice, beans, maize, sorghum, apple, mango, orange, pork and beef.

RELATED VIDEO

Investment – The Relationship Between Risk and Return 🤔💸

Explain the relationship between risk and return - authoritative answer

5439 5440 5441 5442 5443