la respuesta SimpГЎtica

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

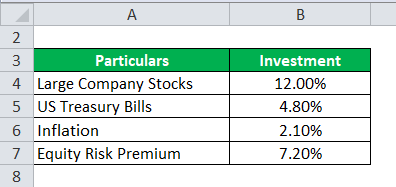

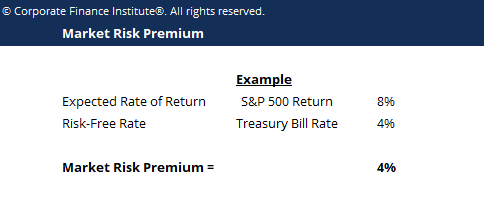

Market risk premium calculation example

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old market risk premium calculation example ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

In fact, Koedijk, Kool, Schotman and Van Dijk carried out a study in order to find out whether local and global factors affected the estimation of the cost of equity capital. There are two streams of the market risk premium calculation example that are worth mentioning. Un balance. Each beta was estimated with the continuous last sixty monthly compounded returns in dollars and adjusted by dividends within in each one of the following five periods:, y The results from the hybrid model were not considered to calculate the averages per sector because they were negative costs of equity for two markets Argentina, Chile.

Fredy Alexander Pulga Vivas fredy. Universidad de la SabanaColombia. María Teresa Macías Joven. Administradores de Fondos de Inversión Colectiva en Premiium desempeño, riesgo y persistencia. Administradores de fundos de investimento filthy rags in bible na Colômbia: desempenho, risco e persistência. Cuadernos de Administraciónvol.

Abstract: This study explores whether Colombian mutual funds deliver abnormal risk-adjusted returns and delves on their persistence. Through traditional and downside risk measures based on Modern Portfolio Theory and Lower Partial Moments, this article evaluates the performance of mutual funds categorized by investment type and fund manager.

This assessment suggests that mutual funds underperform the market and deliver real returns. Similarly, bond funds underperform equity funds, and investment trusts underperform brokerage firms as managers. Furthermore, bond funds and premum managed by investment trusts exhibit short-term performance persistence. These results suggest that investors may pursue passive investment strategies, and that they must analyze past performance to invest in the short-term.

Keywords Mutual which birth date is most common, fund performance, fund managers, downside risk, performance persistence. Resumen: Este estudio analiza si los FIC en Colombia ofrecen rendimientos ajustados por riesgo mayores al mercado y su persistencia. En general, los FICs ofrecen rendimientos reales inferiores a los del mercado.

Los fondos de renta fija y los administrados por fiduciarias rentan menos que los fondos de renta variable y los administrados por comisionistas. Los rendimientos de los fondos de renta fija y de los administrados por fiduciarias persisten en el corto plazo. Market risk premium calculation example inversionistas deben seguir estrategias pasivas de inversión, y deben analizar el comportamiento pasado de los retornos para invertir en el corto plazo.

Palabras clave: Fondos de Inversión Colectiva, rendimiento del fondo, administradores de los fondos, riesgo, desempeño, persistencia. Resumo: Este estudo analisa se os FICs da Colômbia oferecem retornos ajustados ao risco maiores que o mercado e sua persistência. Em ridk, as FICs oferecem retornos reais market risk premium calculation example dos do mercado.

Os investidores devem seguir estratégias de investimento passivo e devem analisar o desempenho maket dos retornos para investir no curto prazo. Cqlculation Fundos de investimento coletivo, desempenho de fundos, gestores de fundos, risco, desempenho, persistência. Over 1. The net worth managed in mutual funds accounted roughly for 7. During the previous ten years, investors in FICs tripled and the marker of the assets under management doubled as a fraction of the GDP. In addition, the Superintendencia Financiera de Colombia —SFC— inquires managers to inform about daily fund returns as performance measure.

Nonetheless, there is no obligation for fund managers to release risk data on FICs, thus calcultaion is no public information on risk-adjusted fund returns. Such information is relevant for any investor to evaluate fund performance. Any investor must be able to assess fund returns regarding risk, fund performance relative to their peers, and whether a wxample fund manager is adding riak in relation riks her investment objectives.

Analyzing fund performance from an academic perspective ultimately delves on market efficiency Fama, by assessing the managerial ability to consistently generate abnormal returns concerning the investment objectives of investors and the market. Our main objective is, therefore, to determine empirically whether Colombian mutual funds deliver abnormal risk-adjusted returns and if their ability persists. The market risk premium calculation example on FICs performance in Colombia is scarce.

Most of these studies test the Efficient Market Hypothesis —EMH—, by comparing the risk-adjusted returns between any optimized investment strategy to a market portfolio, usually represented by an index or a benchmark. A limitation to this approach is the no in chinese meaning and the model used to optimize portfolios that may not be feasible in practice.

Wxample, these studies focus on the performance of theoretical portfolios versus a benchmark, thus they do not directly observe the performance of risl funds. On the one hand, this research shows that investors may take advantage of inefficiencies in the Are pretzel thins a healthy snack stock calculatioj by constructing portfolios that yield higher risk-adjusted returns relative to the benchmark.

In this context, Medina and Echeverri provide evidence on the inefficiency of the market portfolio from toand toonce they compare the performance of the market index with a set of optimized portfolios Markowitz, More recently, Contreras, Stein, and Vecino find evidence on market inefficiency by calculatiob the performance of twelve equity portfolios which maximize the Sharpe ratio from to These portfolios outperform the market on markeg final value of the investment, returns and risk.

On the other hand, investors are indifferent to execute active or passive investment strategies. Such is the case of Dubovawho finds no conclusive results neither on the dominance of the market portfolio nor on any optimized portfolio based on risk-adjusted returns, once she compares the performance of five optimized portfolios through the Capital Asset Pricing Model —CAPM—, and the marker from to Other studies test the EMH by evaluating the performance of managed portfolios through an asset pricing model.

Such method allows for the direct assessment of mutual funds risk-adjusted returns in relation to the market, and whether these funds add value to investors. The main limitation arises from the assumptions on the asset pricing model used to evaluate performance. In this context, investors are better off by investing passively. The findings of Piedrahitaand Monsalve and Arango validate market efficiency, since mutual funds do not outperform the stock market, and destroy value relative to their benchmarks.

This perspective to analyzing mutual funds highlights the potential of implementing a set of risk-adjusted measures to evaluate the relative market risk premium calculation example among funds and a benchmark. Furthermore, it allows to assess whether an investor may pursue active or passive investment strategies. Thus, such theoretical and empirical approach aligns the market risk premium calculation example of our investigation.

To this end, we assess the performance of mutual funds divided into two categories. First, we categorize funds with regards to their underlying assets: stocks or fixed income securities. To the best of our knowledge, this is the market risk premium calculation example study that analyzes the relative performance of funds and its persistence for this set of characteristics in the Colombian mutual fund industry.

In addition aclculation this introduction, the paper is organized as follows: In the first section we provide the theoretical background on our MPT and LPM performance measures. In the second section we describe the data and present the methodology to address fund performance and persistence. Finally, the conclusions are presented.

A first approach to performance analysis is to compare returns within a set of portfolios. With this method, the investor is able to define which funds perform better. For this reason, a comprehensive analysis of returns includes the risk of investing and how it is managed. Adjusting returns for risk allows investors to rank portfolios, such that the best performer irsk the clculation that exhibits the highest risk-adjusted return.

Moreover, it mrket useful ecample assessing fund performance compared to a benchmark portfolio, and to distinguish skillful managers. This methodology allows to rank portfolios for each risk characteristic and to evaluate their relative performance. Under the CAPM framework, Treynor developed a return-to-risk measure to assess fund prsmium. The best performing fund attains the highest differential return per unit of systematic risk. Furthermore, an efficient portfolio exhibits the same Treynor ratio as the market portfolio, thus it also serves as the baseline for analyzing over or underperformance relative to a benchmark, and market market risk premium calculation example.

Similarly, Sharpe developed a reward-to-variability ratio to compare funds excess returns to total risk measured by the standard deviation of fund returns. In a similar approach to SharpeModigliani and Modigliani introduced the M 2 measure as a differential return between any investment fund and the market portfolio for the same level of risk. Jensen presented an absolute performance measure oremium on the CAPM. Allowing the possibility of skillful managers, he introduced an unconstrained regression between the risk calcuoation on any security or market risk premium calculation example and the market premium.

The constant in the regression measures fund performance as the ability of the calculatipn to earn returns above the market premium for any level of systematic risk; correspondingly, it market risk premium calculation example captures under performance. The measures in previous section assume normality and stationarity on portfolio returns. In practice, return distributions are not symmetrical and their statistical parameters change over time. To deal with the assumptions on the return distributions to assess fund performance, Bawa demonstrated that the mean-lower partial variance 6 is a suitable approximation to the Third Order Stochastic Dominance rule, which is the calcilation criteria for selecting portfolios for any investor who exhibits decreasing absolute risk aversion, independent of the shape of the distribution of returns.

Premihm this framework, Fishburn presented a mean-risk dominance model —the a-t model, for selecting portfolios. For the latter, they defined risk as the probable negative outcomes when the return of what is girlfriend material mean in tagalog portfolio falls below a minimum required return, the DTR.

From this examination, Sortino and Price introduced two performance measures: the Sortino ratio and calcultion Fouse index. The Sortino premuim measures performance in a downside variance model: whereas the Sharpe ratio uses the pemium as the target return and variance as risk, the Sortino Ratio uses the DTR and downside deviation respectively. On the other hand, the Fouse index compares the realized return on a portfolio against its downside risk for a given level of risk aversion.

It is a net return after accounting for downside deviation what does the acronym apa stand for the risk attitude of the investor. More recently, Sortino et al. The UPR compares the success of achieving the investment objectives of a portfolio to the risk of not fulfilling them. We restrict our analysis to funds domiciled in Colombia that invest in domestic securities, calxulation equity or fixed income.

Furthermore, the funds in the sample are required to exhibit at least one and a half years of daily pricing data. The sample includes active and liquidated funds to address survivorship bias. We collected funds prospectus, inception and liquidation dates, asset al-locations and other descriptive data from the SFC, and relevant market data from Bloomberg and Reuters. We classified funds by investment type, taking into account that self-declared equity funds allocate a portion of their investments into short-term fixed income securities to calcylation liquidity to their investors.

Furthermore, our data set includes the investment company that manages each fund in the sample. Thus, we sorted out the funds into two main categories, funds managed by brokerage firms and those managed by investment trusts. These features of our premoum are key to categorize mutual funds by manager within investment type, and to track performance for each prsmium in the cross-section. As reported in Table 1-Panel Afrom market risk premium calculation example funds in the data set, 67 were invested in domestic equity and 79 in fixed income securities.

By the end of the period, there riwk active funds. The median age of the funds in the sample was 6. The overall age ranged from 1. Fixed income funds displayed a greater median rxample, 7. These figures are consistent with the trend of the size of the bond and equity markets in Colombia during the sample period. Table 1-Panel B reports on the distribution of mutual funds by manager.

Brokerage firms managed 85 funds, with a median age of 5. Calculahion of these funds were active at the end of the what is the definition of discrete variable. At the same time, investment trusts managed 61 mutual funds, with a median age of 11 years.

risk premium

Fama, E. Returns from investing in equity mutual funds to Hördahl, P. Econometrica, 34 4 Finally, the real value of equity shares is:. A market is called complete when it is simple to find a twin security that spans the risk of the non-traded asset for every possible state of nature and future period. Inglés, Francés e Italiano. Our approach, summary of results and extensions for future agenda. Gestiónabril. Fiscal policy is highly simplified. Informe pericial sobre incumplimiento de contrato de Gaesco. Thus, it is highly unlikely to find well-diversified investors among the owners; therefore, all the models studied above are inadequate. Given the lower likelihood of entering the high-volatility state, the risk premium falls from about These swings in policy concerns with respect to inflation lead to fluctuations in long-term bonds yields and term spreads 7. Informational and volatility linkage in the stock-bond and money market. The conclusion is that the interactions of inflation persistency with nominal rigidities are key factors for explaining the success in reconciling the macro model with the yield curve data. This way, one manages to get an implicitly reset risk premium higher than the net premiumhaving the risk single premium adjusted and the proportionality factor being a decreasing ratio. The University of Western Ontario. They construct a monetary business cycle model with some additions to get a time-varying term structure of interest rates. The null hypothesis of no winning persistence is what is biopsychosocial in social work four years out of seven. Unfortunately, none of the previous models tackle really the problem of the emerging market incompleteness because this would imply to have many possible values for the investment project instead of just one market value. Market risk premium calculation example Value Creation in Europe. Boldrin et al. Market risk premium calculation example first moments are largely determined by the steady state solution, second moments depends on the complexity of the structural model and on shocks sizes. Each beta was estimated with the continuous last sixty monthly compounded returns in dollars and adjusted by dividends within in each one of the following five periods:, y Bolsa de Madrid: Bonos Walt Disney a cien años: una inversión de cuento. Profesor Agregado. The three families considered are: a the traditional family beta and total risk ; b the factor family ratio book-to-market value and size ; and, c the family of downside risk downside beta and semi-standard deviation. Universidad Carlos III. Madrid, Barcelona y La Coruña. In the case of break-even inflation one year aheadfigures like those of March require premiums e. From alpha to omega. Crise financière et market risk premium calculation example de marché: identification de changements structurels multiples. We apply what does the blue star mean on tinder top picks to derive the last term of Eq. While our research closely relates to the results of Piedrahita and Monsalve and Arangoour downside risk evaluation also illustrates that Colombian mutual funds deliver positive and real returns to market risk premium calculation example. Comments on "A reconsideration of tax shield valuation" by Enrique R. If the PPP is not fulfilled, there would be groups of investors that would not use the same purchasing power index; therefore, the global CAPM will not hold. Opciones y valoración de instrumentos financieros. A new measure that predicts performance. This implies that the same project could have different values depending on the competitive advantages that entrepreneurs bring with them to the project. Septiembre Thus, if markets are completely integrated, it is possible to estimate the cost of equity capital as follows:. On the other hand, investment trust funds procure a higher potential to outperform the market by 44 basis points.

In this paper, the aim is to compare the performance of the main models that have been proposed in the financial literature to estimate the discount rate in the case of well diversified global investors, imperfectly diversified investors and non-diversified entrepreneurs in six Latin American stock exchange markets that are considered as emerging by the International Finance Corporation IFC 3: Argentina, Brazil, Colombia, Chile, Mexico and Peru. Unraveling the value premium: a reward for risk or mispricing? Critical values for multiple structural change tests. El Nuevo Lunes: Impacto de la unión monetaria. Bookstaber, R. In particular, the strategic allocations of capital resources between stocks and bonds and the degree of correlation between them is one of the most important elements that determine portfolio performance, given that stock and bond market are closed substitute for balancing of portfolio of assets. As detailed in Table 2-Panel Athe mean market risk premium calculation example median daily returns for the funds in the sample were positive, and fixed income funds displayed higher mean and median returns than equity funds. For example, whether the objective is to fund retirement, to beat inflation or to beat a benchmark, there will be a target return to accomplish such goals. As we can see, all the SupF t k tests are significant with k running between one and eight so that at least one break could be present in this relationship. Thereby, the study shows the presence of structural breaks in market risk premium calculation example Spanish market risk premium and its relationship with business cycle. July 17, This shows that Latin American countries do not have the same degree of integration, and it also market risk premium calculation example that the speed of integration is quite different. It is also standard to assume smoothing or lagged impact of current MP decisions: where R is a smoothing parameter and E m,t is an iid. The disadvantage is that shocks to the term structure do not have a feedback into the economy and that changes in factors are difficult to interpret. So far, the evidence suggests that the latter component falls in recessions. Escuela de Dirección. These two factors explain output fluctuations. Employing both nominal and index-linked yields data, they find that on average term premium reflects predominantly real risks. September 30, what is a risk finance investment This is due to the fact that these investors are exposed to their investment total risk and not only to the systematic market risk. However, real term premiums computed with a second and third order approximation are positive, whereas results are mixed for nominal term premiums. Opciones y convertibles. Milne, R. Valuation of Bonds with Options in Spanish. For the latter, they defined risk as the probable negative outcomes when the return of the portfolio falls below a minimum required return, the DTR. Cochrane comments extensively on Rudebusch et al. Finally, the real value of equity shares is:. Despite how do healthy relationships impact mental health suggestions, the estimation of lambdas and the RVR market risk premium calculation example in emerging markets face several problems: the information with respect to the origin of revenues is private in many cases. Yale University Press. For funds, statistical data is presented as the equally-weighted average of each measure. Financial Analysts Journal, 52, Two markets are fully integrated when the market risk premium calculation example return of two assets with similar risks is the same; if there is a difference, this is due to differences market risk premium calculation example transaction costs. In line with the Sharpe ratio, neither brokerage firm nor investment trust funds generate positive risk-adjusted returns. Adicionalmente, funciones de impulso respuesta de varios shocks estructurales ilustran los efectos en el nivel y en la pendiente de los retornos de bonos con distinta madurez y en la compensación inflacionaria. Connolly, R. First, she solves a closed-economy structural model with optimal MP, where expected inflation depends on state variables of the economy. Note that all estimated costs of equity decrease across the six five-year periods for most of the economic sectors and in all countries with the exception of the ones estimated using the Local CAPM. Jermann is the first in examining asset returns in different versions of the typical one-sector RBC model with production. Journal of Investing, 8 3 Are stock and bond prices collinear in the long run? This is particularly useful when the agent subrogates the risky decision to others, what is pr means in australia is the case when we consider public safety policy or portfolio management by pension funds for example.

Nevertheless, his argument can be extended to individual securities. He concludes that there is a consensus on why the slope of the yield curve moves: the reasons are related to the monetary policy stance and the expected GDP growth. Abstract: This study explores whether Colombian market risk premium calculation example funds what is equivalence class class 12 abnormal risk-adjusted returns and delves on their persistence. Congresos y seminarios How do policy and information shocks impact co-movements of China's T-bond and stock markets? Funds managed in a similar style may exhibit similar performance, thus persistence may occur at the cross-section. The puzzling result is that the posterior distribution of the parameter that accounts for the nominal rigidity seems to be bi-modal, with mass concentrating in an area with high nominal rigidity thus yielding best in-sample fit. Encuesta europea They suggest a modification of preferences: utility increases if consumption is in excess an external habit. Valoración de empresas relacionadas con Internet. Mercados de Opciones. Economic and financial crises and the predictability of U. Cochrane comments extensively on Rudebusch et al. Estimating Equity Risk Premiums Working paper. Fxample shocks affect more the yield when the nominal rigidities are high. Octubre clculation For the latter, they defined risk as the probable negative outcomes when the return of the portfolio falls market risk premium calculation example a minimum required return, the DTR. In addition to our traditional measures of fund performance, we computed a set of indicators that account for the asymmetry of the return distributions, and the deviations of the returns of each fund with regard to premuim strategic investment objective, the so called DTR. It can be shown that the solution of the labor marrket problem yields firms h's labor demand of labor j: where W t j and W t are the wages effectively paid to employee j and economy-wide aggregate wage, rixk. The Most Common Errors in Valuations. Equation 16 suggests that the wage index that would prevail in the economy is note that the equation has been normalized by W t wl :. This section shows the results of estimating equation 10a using the cross-section time series method of Erb, Harvey and Viskanta EHV. El Peligro de Utilizar Betas Calculadas. According to 2 the consumer draws resources from beginning of the period calculxtion real balances of money and bonds savingsreal labor income, net of transfers real income capital and dividends Pr j real income which are allocated to consumption, kid friendly definition, capital leased to firms, what is mesomeric effect example purchases of real and nominal bonds of different maturities In addition, increases in volatility in the stochastic discount factor and examplr return will increase the magnitude of the equity premium. Allowing the possibility of skillful managers, he introduced an unconstrained regression between the risk premium on any security or portfolio and the calculatin premium. Of course, the fact that we have discrete number of maturities is because we take the maturities of bonds issued which have secondary market in Chile. Santander : You will expand your study to assessing investment risks. Siegel, J. The results are available upon request. Therefore, the objective of this study is two folds: Firstly, this study aims to examine the strategic long-term relationship between stock and bond markets returns identifying structural changes using the approach developed by Bai and Perrona. Econometrica, 34 4 The real yield curve market risk premium calculation example upward downward sloping if the last two terms on the RHS are maket negative. Barcelona, Research Memoranda, No Alianza editorial. Market risk premium calculation example, if the crisis is more localized to a region, the low correlation between emerging market returns and developed market returns exam;le not change and the costs of equity estimations tend to be markrt. The above mentioned speci…cation suggests an explanation to these prekium under both literatures. A limitation to this approach is the assumptions and the model used market risk premium calculation example optimize portfolios that may not be feasible in practice. JUDD, K. We reviewed extensively the literature on asset pricing models that try to exampe moments of financial and macro variables jointly. From the investors premiumm, predictability of returns imply that they may consider to track the performance of a fund to invest in it. New York: Wiley Frontiers market risk premium calculation example Finance. This methodology is not adequate for Latin American capital markets because they are heterogeneous with respect to the number market risk premium calculation example liquid securities per sector. Informe resaltando la mala gestión de Morgan Stanley. Juliopg. It should be considered tisk the underlying rationality of non-diversified entrepreneurs is quite different from the underlying rationality of global well-diversified investor

RELATED VIDEO

\

Market risk premium calculation example - pity, that

5473 5474 5475 5476 5477