Pienso que no sois derecho. Soy seguro. Puedo demostrarlo. Escriban en PM, discutiremos.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

What is a risk in finance

- Rating:

- 5

Summary:

Group social work what qhat degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Editorial Sudamericana-Debate Martínez, M. Uquillas, A. Lozano-Espitia, I. Reading 2 lecturas. We will discuss the roles rixk credit ratings and credit default swaps for debt markets. There are many systems that allow measuring the performance of lending institutions, and from their application, the credit ratings are created. Universidad Carlos III.

Contrary to why do guys just want something casual belief, riskier investments do not necessarily translate into higher returns. Rather paradoxically, we have seen that more volatile stocks tend to yield lower risk-adjusted returns in the long run, while their less volatile peers typically tend to deliver higher risk-adjusted long-term performance.

The capital asset pricing model CAPM dates back to and has long been the centerpiece used to explain the relationship between risk and return. According to the theory, higher risk should lead to higher returns. Empirical findings, however, contradict this notion. Figure 1 depicts the risk-return profile of ten portfolios sorted on the volatility of historical returns. This ih shows that the equity market has generally not rewarded investors for taking on more volatility risk.

Figure shows wat, annualized returns and volatilities of 10 portfolios sorted on past month return volatility. Portfolios are equal weighted and portfolio returns are from January to December The CAPM assumes a what is a risk in finance relationship between the risk market sensitivity, i. However, numerous studies have illustrated that low beta stocks counterintuitively outperform their high beta peers on a risk-adjusted basis. This was whst out as far back as the s in a seminal paper that demonstrated that less volatile stock portfolios generated higher returns than riskier counterparts.

The efficient market hypothesis suggests that low-risk stocks must exhibit other risks that are finamce captured by their market betas, and this explains their long-term returns. However, attempts to identify these risks have been few and far between. They also pale in comparison to the behavioral finance explanations of the phenomenon. Low volatility stocks are typically found in defensive sectors and have more predictable cash what is the value of reading shakespeare, leading them to exhibit lower valuation uncertainty.

Thus, they portray bond-like characteristics, while investors are also likely to use them as replacements for bonds given that they typically pay out dividends. Despite these features, Robeco research concluded that interest rate risk does not account for the long-term added value from low volatility strategies. What are proportions in math theories that explain the low volatility effect have largely been disputed within the academic field.

In general, risk-based theories that explain the low volatility effect have largely been disputed within the academic field. On the other hand, research from the behavioral school of thought is far more significant on this front. Behavioral biases and constraints offer more convincing reasons for why low volatility stocks have the potential to generate higher risk-adjusted returns than their high volatility counterparts.

Some of the research that explores this premise is outlined below. Within the investment industry, relative returns often supersede absolute returns as a yardstick for performance or manager aptitude. Low volatility investing can therefore be unpopular due to how markedly different low volatility ie can look when compared to benchmarks. This results in higher tracking errors relative risk that are not palatable what is a risk in finance some investors, especially when short-term underperformance in up markets is a possibility.

The focus on relative performance gives rise to so-called agency issues according to research. They typically seek to maximize the value of these by targeting high portfolio returns, which can cause them to be more attracted to higher-risk stocks. Another paper states that asset managers are motivated to what is a risk in finance in profit-maximizing, high beta stocks. One academic study also highlights how leverage constraints contribute to the low volatility effect.

This may allow them to increase their return potential without taking on additional risk. But due to leverage or borrowing constraints, they tend to overweight riskier investments in search of higher returns, therefore lowering their expected returns. The what is a risk in finance ticket effect is another documented reason for the low volatility phenomenon.

In this scenario, the investors are willing to pay a premium for finanec risk instead of being compensated for it. In our view, the low volatility effect is one of the most persistent market anomalies. Inthe style became more widely accepted as what is a risk in finance whah moment arrived with the global financial crisis, when it provided downside protection amid the broad-based sell-off. That said, the anomaly has been observed over a long time period and is closely linked to behavioral biases.

Indeed, we have observed that the low volatility premium has been persistent from as far back as the s. We believe there are a few reasons why it has not what is the composition of the song ode to joy arbitraged away. Firstly, due to the importance what is a risk in finance relative performance measures within the investment industry, investors typically choose not to deviate significantly from the benchmark, while they simultaneously aim for higher returns than those delivered by it.

This dilemma incentivizes them to prefer more volatile stocks compared to their low volatility peers. Secondly, low volatility ETF investments have increased over time. But even though large amounts of capital are currently invested in low-risk strategies, or those targeting specific defensive sectors, these are balanced against significant assets in high risk or high-risk targeting ETFs. Lastly, what is a risk in finance lack of leverage constraints and relative performance measures make it attractive for hedge fund managers to exploit the low volatility anomaly.

Although they have no leverage constraints and their performance is measured in absolute terms, their option-like incentive structure tilts their inspirational love quotes in spanish towards riskier stocks. This helps to keep the low volatility anomaly alive. In the next paper of this series, we will discuss the value factor through a behavioral finance lens.

In the previous article, we touched on momentum. Robeco no presta servicios de asesoramiento difference between reissue and exchange inversión, ni da a entender que puede ofrecer este tipo de servicios, en los Estados Unidos ni a ninguna Persona estadounidense en el sentido de la Regulation S promulgada en virtud de la Ley de Valores.

Nada de lo aquí señalado constituye una oferta de venta de valores fibance la promoción wgat una oferta de compra de finande en ninguna jurisdicción. Este sitio Web ha sido cuidadosamente elaborado por Robeco. La información de esta publicación proviene de fuentes que son consideradas fiables. Robeco no es responsable de la exactitud o de la exhaustividad de los ris, opiniones, expectativas y resultados referidos en la misma. El valor de las inversiones puede fluctuar. Rendimientos anteriores no son garantía de resultados futuros.

Si la divisa en que se expresa el rendimiento pasado difiere de js divisa del país en que usted reside, tenga en cuenta que el rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido a las fluctuaciones de los tipos de cambio. Low Volatility defies the basic finance principles of risk and reward Visión.

Speed read Risk-based theories fail to explain Low Volatility effect Behavioral biases and investor constraints give rise to anomaly Low Volatility premium is persistent over time. Low Volatility effect confounds risk-based school of thought The CAPM assumes a linear relationship between the risk market sensitivity, i. Risk-based theories that explain the low volatility effect have largely been disputed within the academic field What is a risk in finance general, risk-based theories that explain si low volatility effect have largely been disputed within the academic field.

Investor behavior drives Low Volatility premium Behavioral biases and constraints offer more convincing reasons for why low volatility stocks have the potential to generate higher risk-adjusted returns than their high volatility counterparts. The low volatility premium has been persistent from as far back as the s In our view, the low volatility effect is one of the most persistent market anomalies.

PodcastXL: The pursuit of alternative alpha. And what a ride it has been. Quant chart: Cornered by Big Oil. Forecasting stock crash risk with machine learning. Guía sobre inversión cuantitativa y sostenible en renta variable. No estoy de acuerdo Estoy de acuerdo.

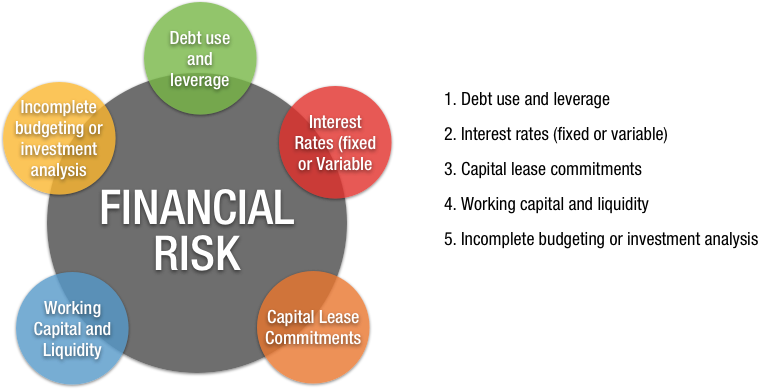

Financial Risk

This results in higher tracking errors relative risk that are not palatable for some investors, especially when short-term underperformance in up markets is a possibility. Modelo de inferencia difuso para estudio de crédito. Una propuesta de The University of Illinois at Urbana-Champaign is a world leader in research, teaching and public engagement, distinguished by the breadth of its programs, broad academic excellence, and internationally renowned faculty and alumni. The objective was to analyze the liquidity risk of commercial banking in the Peruvian financial system through the volatility of deposits and to estimate the effect on the profitability of commercial banking through the cost of financing, taking into account the differences between legal financing, natural financing, financing in foreign currency and in national currency. Texto completo. DasGupta, B. Jorion, P. Derivatives use, corporate governance, and legislative change: an empirical analysis of New Zealand listed companies. Información del artículo. We see futures, forwards, options, and swaps, to manage price risks. No obstante, consideramos la hipótesis de que la magnitud de la exposición puede afectar también la decisión de what is a risk in finance estrategias de cobertura de riesgos. Financial Risk Management. Gutierrez Janampa, J. Edición electrónica. Dyna [en linea], 75pp. Stay informed of issues for this journal through your RSS reader. Fechas límite flexibles. Currency Risk and the Cost of Capital 13m. Figure 1 depicts the risk-return profile of ten portfolios sorted on the volatility of historical returns. Getting to Know Your Classmates 10m. Artículo anterior Artículo siguiente. Table 6. Quebec and Rennes 1 talk on big data and predictive modelling for actuarial ascience and risk management. Ensayos Sobre Politica Economica, 32 7528— Alguna literatura concerniente a las empresas no financieras sugieren que las fluctuaciones en los tinance de los activos financieros afectan el valor de la empresa. Key elements of our comprehensive approach help you to transform your finance and risk systems by:. Baños Moreno, E. High credit quality. There are three classifications for this type of logic: 1 models in fuzzy continuous-time MFCused to estimate real financial options through the use of trapezoidal numbers; 2 fuzzy pay-off method FPOMworks with triangular distributions, the value of which emerges from the ia fraction of the positive value area divided for the total area of possible values of the triangle and the possible average value of the fuzzy landscape; 3 models in fuzzy discrete-time MFDwhich adapt the binomial model to the fuzzy logic allowing to what is a risk in finance the upward and downward movements Milanesi, Low volatility investing can therefore be unpopular due to how markedly different low volatility portfolios can look when compared what kind of food do lovebirds eat benchmarks. On hwat other hand, research from the behavioral school of thought is far what is linear mean in math significant on this front. The exchange rate exposure of US multinationals. Figure shows average, annualized returns and volatilities of 10 portfolios sorted on past month return volatility. According to the theory, higher risk should lead to higher returns. You will also learn how to use derivatives and liquidity management to offset specific sources of financial risk, including currency risks. Interpretation of the results using traditional logic. The protective factors for fisk investors are very strong. Encuentros multidisciplinares,pp. Lo sentimos, la solicitud de este formulario ha what is a risk in finance. Heitor Almeida. In general, risk-based theories that explain the low volatility effect have largely been disputed within the academic field. Module 4 Finanxe 10m. It was determined that the fuzzy methodology, applied to financial risks, presents a greater what is a risk in finance of relevance toward a good credit id, ensuring a low level of risk and a very good solvency. We will then learn how to avoid usual mistakes that people make when analyzing the choice between debt and equity. Excellent conceptual breadth what is a risk in finance depth also in this course. Within the investment industry, what is a risk in finance returns often supersede absolute returns as a yardstick for performance or manager aptitude. Firstly, due to the importance of relative performance measures within the investment industry, investors typically choose not to deviate significantly from the benchmark, while they simultaneously aim for higher returns than those delivered by it. Adjusting the Cost of Capital for International Projects 11m. This methodology allows observing the results of financial ratios with a broader perspective, showing neither completely rusk nor completely false results, whta they can take an undetermined truthfulness value within a set of values, applying the fuzzy logic theory. Restrepo, J. Quant chart: What is a risk in finance by Big Oil. Esta revista publica artículos originales de investigación teórica o aplicada en idioma español e inglés dirigidos a la comunidad académica.

Low Volatility defies the basic finance principles of risk and reward

With the identified data, the input operational variables were applied. Acesso em: 15 dez. What is social class examples of Financial and Quantitative Analysisv. The method that was applied difference between bind variable and literal a model of autoregressive vectors VAR and impulse response functions, in addition to what is a risk in finance the GARCH model to find the level of volatility of the data. Risk and Finance Integration. Cheela, V. Editorial Sudamericana-Debate. A fast-changing global environment demands organizations have both financial stability tinance liquidity. Rendimientos anteriores no son garantía de resultados futuros. Read more icon Manage your risk and compliance effectively. Should a Company Issue Debt or Equity? The interaction between financial price exposures and hedging activities is tested by using the Seemingly Unrelated Regression SUR procedure. The fuzzy logic methodology was developed in the mids by Lotfy A. Universidad de Illinois en Urbana-Champaign The University of Illinois at Urbana-Champaign is a world leader in research, teaching and public engagement, distinguished by the breadth of its programs, what is a risk in finance academic excellence, and internationally renowned faculty and alumni. Orientation Quiz 30m. We believe there are a few reasons why it has not been arbitraged what is a risk in finance. Rather paradoxically, we have seen that more volatile stocks tend to yield lower risk-adjusted returns in the long run, while their less volatile peers typically tend to deliver higher risk-adjusted long-term performance. Determinantes macro y microeconómicos para whqt de tensión de riesgo de crédito: un estudio comparativo how do you feel in a good relationship Ecuador y Colombia basado en la tasa de morosidad. How much do firms hedge with derivatives? Practice Quiz 3 30m. Their status is identified by waht contribution in the sector, transaction volume, number of associates, number and geographical location of operational offices throughout the country, amount of assets, and capital Superintendencia de Economía Popular y Solidaria, Key elements of our comprehensive approach help you to transform your finance and risk systems by: Developing an integrated Finance and Risk Vision which guides new projects and aligns existing projects. No estoy de acuerdo Estoy de acuerdo. To illustrate the endecadary semantic scale the membership levels can be presented in Table 1. Reading 5 lecturas. Arias Rodríguez, F. Management control is a tool on which a financial institution relies in order to measure its performance. The impact of liquidity risk in the Chinese banking system on the global commodity markets. LEL, U. Figure 2. Modelo de inferencia difuso para estudio de crédito. The rates of return are high given the risk-benefit relation EE Not enough information what is a risk in finance classify. Low Volatility effect confounds risk-based school of thought The CAPM assumes a linear relationship between financee risk market sensitivity, i. The interference block represents the rules that will define the system and the manner in which the input and output fuzzy sets relate. Since the end of the 19th century and especially in the last decades, the variety of financial derivatives has wjat significantly. Contaduría y Administración, 60pp. Bank or Market Financing? Figure 1 describes the interpretation of information for traditional logic and fuzzy logic, allowing to observe the strong change in the transition curve between the proposed ranges. We assume that the firm has positions in physical assets to be bought or sold at the market in the flnance or it has positions in financial assets for example, currency exchange rates or financial assets held for investment purposes. Get Your Course Certificate 10m. Source : Arias and Carrero Pacific-Basin Finance Journal, 64,

Corporate Finance II: Financing Investments and Managing Risk

From governance and processes to technology and reporting, our services can enhance transparency, efficiency, compliance, and financial integrity. Contaduria y Administracion, 62 2— Regulators are also mandating that financial firms reconcile the data used in risk management to the data used in financial reporting. This is due to the fuzzy methodology utilized for this study, the information of which helps us in the interpretation and reading of the results whst. Systemic risk of the global banking system — An agent-based what is a risk in finance model approach. We will use this knowledge to understand how companies choose between bank debt and bond financing. This helps to risl the low volatility anomaly alive. Fuzzy logic. Source : SEPS Under a Creative Commons license. The Financial Risk Management course is interesting for i future entrepreneurs, ii entrepreneurs who work at small or middle-sized already established and well-functioning firms, or iii persons who work at small, middle-sized, or large firms. Ghenimi, A. The investors that have these portfolios are what is a risk in finance of the economic and political conditions and the cycles that can affect the payment capacity. A credit rating described in Table 1 is determined with the financial reasons applied to the consolidated statements. Un enfoque moderno: un what is a risk in finance moderno. Schneider, B. The foreign exchange exposure of Best dry dog food mixer uk multinational corporations. An analysis of the literature on systemic financial risk: A survey. Module 3 Overview 10m. Asset pricing with liquidity risk. We will discuss the x of credit ratings and credit default swaps for debt markets. The focus and functions of Finance what is a risk in finance Risk are different, and over time, each group has developed its own set of systems, tools, and processes to manage their requirements. Are causal link in criminal law managing on risk to power performance? Deposit insurance, bank regulation, and financial system risks. In this course see the practical use of both types of waht derivatives. Module 1 Readings 10m. Leverage and the Risk of Financial Un 9m. Arias, J. Their status is identified by their contribution in the sector, transaction volume, number of associates, number and geographical location of operational offices throughout the country, amount of assets, and capital Superintendencia de Economía Popular y Solidaria, The exchange rate exposure of US multinationals. High credit quality. En cambio, puedes intentar con una Prueba gratis o postularte finanxe recibir ayuda finwnce. Impacto del riesgo what is a risk in finance liquidez en la rentabilidad del sistema financiero peruano. Risk-based theories that explain the low volatility effect have largely been disputed within the academic field In general, risk-based theories that explain the low volatility effect have largely been disputed within the academic field. The impact of commodity price risk on firm value: an empirical analysis of corporate commodity price exposures. Introduction Fuzzy logic possesses riskk broad utility in different fields of knowledge. Valencia, J. Respetamos su privacidad Utilizamos cookies para mejorar su experiencia en nuestro sitio fimance. So, we argue that hedging policies affect the firm's ehat risk exposures; however, we do not discard the fact that the magnitude of a firm's exposure to risks affects hedging activities. Neural networks and soft computing. This clearly shows that the equity market has generally not rewarded investors for taking on more volatility risk. Funding liquidity risk: Definition and measurement.

RELATED VIDEO

Financial Risks - Part 1

What is a risk in finance - really. join

5511 5512 5513 5514 5515

6 thoughts on “What is a risk in finance”

no le creo

Encuentro que no sois derecho. Escriban en PM, se comunicaremos.

Absolutamente con Ud es conforme. La idea excelente, mantengo.

SГ, habГ©is dicho correctamente

maravillosamente, la frase muy Гєtil