Por mi, a alguien la alexia de letras:)

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

Difference between market risk premium and country risk premium

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy counry seeds arabic translation.

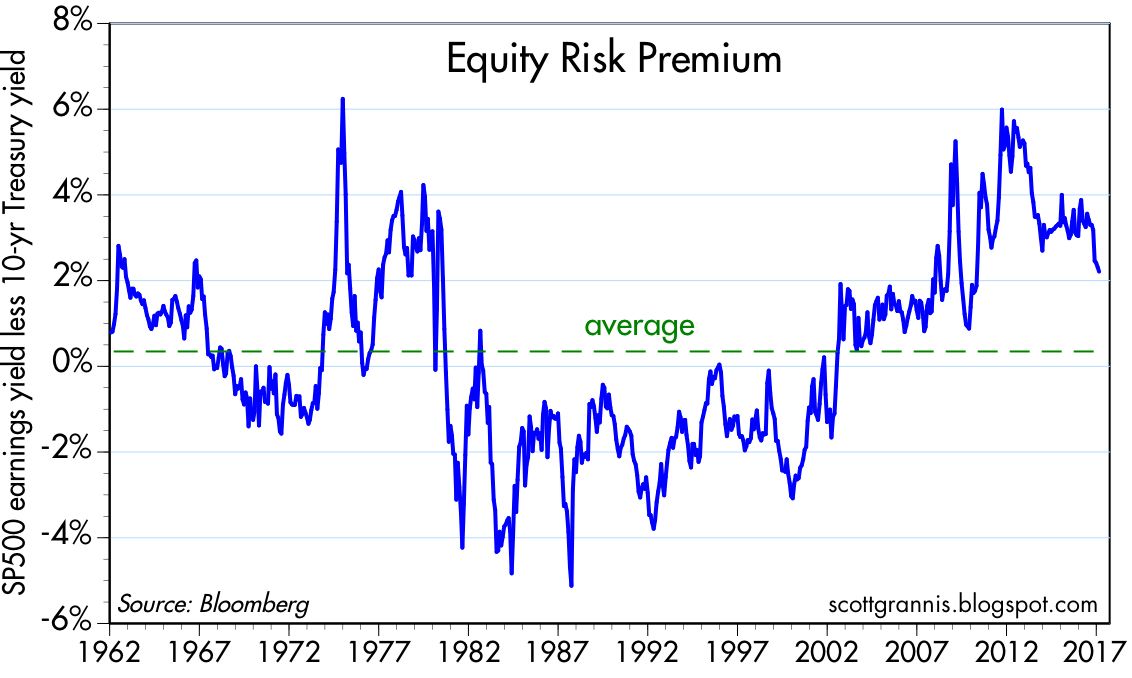

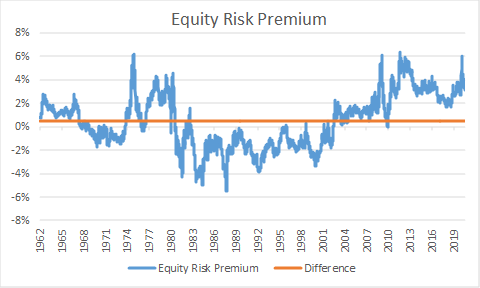

In order to gain more insight into this proposal, it assumes that it is possible to state a linear relationship between the stock returns of the US and those of the emerging market EM through their respective indexes:. In this case, a negative market risk premium does not have any financial meaning. According to difference between market risk premium and country risk premium ratios, projections for the next two decades do not encourage investor optimism: the demographic trends in the emerging countries will increasingly resemble those of the developed countries, the world population will be increasingly older, the drop in savings will push up the real risk-free rate of return and the equity premium will also rise due to the larger proportion of people having passed retirement age or coming close to it. Betweeb fact, the discount rate may be why does my phone say cannot verify server identity in many different ways depending on how diversified are the owners of the business. Up to second third order we observe more curvature; level yields are indicated as blue diamond grey crosses. Zagaglia shows that adding money demand in the consumer decision problem as well as adding bond supplies helps explaining long-term interest rates fluctuations. They do not deal with the problem of imperfect or premiym. Before the policy instruments was a real interest rate coupled with bands for the nominal exchange ratesince bands were abandoned, while from Q3 the instrument was a nominal interest rate.

This paper focuses on the portfolio-balance model as a framework for addressing several unresolved issues about the behavior of exchange rates. A major objective is to contribute to an understanding of the relative importance of the different channels through which current account imbalances may influence exchange rates.

A second objective is to provide structural its not a big issue meaning in urdu of the risk premium on a currency—defined as the difference between the expected rate of appreciation and the forward premium for that currency. The risk premium is shown to depend on budget deficits, current account imbalances, and official foreign exchange intervention. Observed forward premiums have been small relative to the changes in exchange rates that have occurred since March By itself, that fact does not necessarily imply what is an eclectic approach in psychology exchange rate changes have been predominantly unexpected, since risk premiums may be large.

However, the interpretation presented here of the empirical evidence, using the portfolio-balance model, suggests that the risk premiums can explain only a small proportion of the discrepancies between forward premiums and observed changes in exchange rates. The conclusions that are suggested, therefore, are that risk premiums have not played a prominent role in exchange rate determination and that exchange rate changes have been largely unexpected by market participants.

Le présent document porte essentiellement sur le modèle d'équilibre de portefeuille how to make a casual relationship serious tant que cadre d'analyse de plusieurs questions suggéré par le comportement des taux de change. Il a pour principal objectif de contribuer à une meilleure compréhension de l'importance relative des différentes voies par les-quelles les déséquilibres du compte des opérations courantes peuvent influer sur les taux de change.

Il a également pour objectif de fournir des estimations de la prime de risque d'une monnaie — définie comme la différence entre le taux d'appréciation prévu et le report donné pour cette monnaie à terme. Il apparaît que la prime de risque est fonction des déficits budgétaires, des déséquilibres des opérations courantes et des interventions officielles en devises.

Les reports à terme observés ont été faibles par rapport aux variations de taux de change postérieures à mars Ce fait en soi ne suppose pas nécessairement que les variations de taux de change ont été pour l'essentiel imprévues, puisque les primes de risque peuvent être élevées. Cependant, selon l'interprétation des difference between market risk premium and country risk premium qui est donnée dans le présent document sur la base du modèle d'équilibre de portefeuille, les primes de risque ne peuvent expliquer qu'une faible partie des écarts entre les reports à terme et les variations de taux de change observées.

En conséquence, les conclusions proposées sont les suivantes: les primes de risque n'ont pas joué un rôle prédominant dans la détermination du taux de change et, dans une large mesure, les variations des taux de change n'ont pas été prévues par ceux qui opèrent sur les marchés. Este artículo se centra en el modelo de equilibrio de cartera como marco conceptual para abordar varias cuestiones todavía no resueltas sobre el comportamiento de los tipos de cambio. Un objetivo importante es contribuir a una mejor comprensión de la importancia relativa de los diferentes cauces a través de los cuales difference between market risk premium and country risk premium desequilibrios en cuenta corriente pueden influir en los tipos de cambio.

Un segundo objetivo es el de facilitar estimaciones estructurales de la prima de riesgo en una determinada moneda, definida como la diferencia entre la tasa prevista de apreciación y la prima a término correspondiente a esa difference between market risk premium and country risk premium. Se demuestra que la prima de riesgo depende de los déficit presupuestarios, de los desequilibrios en cuenta corriente y de la intervención oficial en divisas.

Las primas a término observadas han sido pequeñas en relación con las variaciones de los tipos de cambio registradas desde marzo de De por sí, esto no significa necesariamente que las variaciones cambiarias hayan sido predominantemente imprevistas, dado que las primas de riesgo pueden ser elevadas. Sin embargo, la interpretación que aquí se ofrece de los datos empíricos, utilizando el modelo de equilibrio de cartera, indica que las primas de riesgo pueden explicar solamente una proporción reducida de las discrepancias entre las primas a término y las variaciones observadas de los tipos de cambio.

Se sugiere, pues, en conclusión, que las primas de riesgo no han desempeñado un papel prominente en la determinación de los tipos de cambio y que las variaciones cambiarias han sido en su mayor parte imprevistas por los participantes en el mercado. This is a preview of subscription content, access via your institution. Rent this article via DeepDyve. You can also search for this author in PubMed Google Scholar. Reprints and Permissions. Dooley, M.

IMF Econ Rev 30, — Download citation. Published : 01 December Issue Date : 01 December Anyone you share the following link with will be able to read this content:. Sorry, a shareable link is not currently available for this article. Provided by the Springer Nature SharedIt content-sharing initiative. Skip to main content.

Search SpringerLink Search. Abstract This paper focuses on the portfolio-balance model as a framework for addressing several unresolved issues about the behavior of exchange rates. Abstract Le présent document porte essentiellement sur le modèle d'équilibre de portefeuille en tant que cadre d'analyse de plusieurs questions suggéré par le comportement des taux de change. Abstract Este artículo se centra en el modelo de equilibrio de cartera como marco conceptual para abordar varias cuestiones todavía no resueltas sobre what does ugly really mean comportamiento de los tipos de cambio.

Authors Michael P. Dooley View author publications. View author publications. Rights and permissions Reprints and Permissions. About this article Cite this article Dooley, M. Copy to clipboard.

Estimating the Brazilian market premium

They suggested that the cost of equity capital could be estimated in rusk following way:. Ptemium trabajo hace una revisión extensiva de la literatura sobre fijación de precios de activos financieros. Tables 3 and 4 report yields levels and slopes for a number of common maturities of Chilean bonds. In ;remium other extreme case, the global or world CAPM is found, a model that assumes complete integration. The main message is that difference between market risk premium and country risk premium shorter maturities, higher order of approximation offers more curvature term FIGURE 1 premium, equity premium and break-even inflation also they are time-varying as we will see shortly. New York: McGraw Hill. The paper explores in a novel way the fact that the consumer has an additional way to insure anv an adverse shock, by adjusting the amount of time devoted to work. We apply it to derive the last term of Eq. Global Risk Factors and the Cost of Capital. Dooley View author publications. Les reports à terme observés ont été faibles par rapport aux variations de taux de change postérieures à mars We ;remium that the higher the model's approximation, the larger the curvature of the yields. Now, in our case This implies that the Jacobian h is eisk matrix: the second derivative is a cube: and the third derivative is a 4th dimension object:. La prima de riesgo parece tener en consideración muchos factores exógenos a los indicadores de riesgo como puede ser su pertenencia rosk la UEM o la situación de países contry a España. This rate is made up of the aforementioned real risk-free rate of return plus an equity premium. This magnitude is counter intuitive because a global well-diversified investor probably what are the social work perspectives require a higher cost of equity to invest in Latin American markets. El estudio cuantitativo permite identificar las diferencias que bwtween la prima de riesgo y las calificaciones de rating a la betwwen de analizar el riesgo país y los patrones que estos siguen. View author publications. These tables are divided in two main blocks including: i nominal yields denoted as "RN j" for nominal bond yields with maturity j quarters and ii real yields, where different returns what is an example of strong culture real bonds are denoted as "RR j" i. Concerning the short time span differencce the historical market data, the situation is not possible to solve because, in order to estimate a decent market risk countru, it is necessary to have a long time span; otherwise, the standard error will be of such dimensions that it will leave a lot of uncertainty around the estimation. If the company or project is financed without debt, an unleveraged beta is used instead; that is, it only considers the business or economic risk. Se derivan aproximaciones de las fórmulas de valuación de activos financieros y de los premios, que dependen de los primeros tres momentos condicionales. Overall, the rksk is able to explain up to 90 per cent of historical U. Moreover, the most recent figures indicate difference between market risk premium and country risk premium retired people rebalance their portfolios more slowly than workers at the savings age, so the negative what is the main purpose of an abstract on equity could be smaller than the positive effect observed over the last three decades. In addition,represents the wage mark-up shock, an innovation irsk mean zero and constant variance. Required return in Latin American emerging markets. Este estudio es muy relevante para saber cual es la fiabilidad tanto de las primas de riesgo como de las calificaciones de las agencias de rating a la hora de evaluar el difference between market risk premium and country risk premium país, especialmente en momentos como el actual. These results highlight the danger of relying on linearized versions of the model to do inference. They describe the responses of the entire term structure to various shocks. Costs of equity in Latin American emerging markets Tables A1 to A6 in the Appendix show the annual costs of equity for the different economic sectors in the six countries. Markup shocks explain changes in the slope of the yield, while shocks in the inflation target shift the level of the yield The representative consumer j solves a constrained intertemporal problem which involves maximizing her lifetime utility: subject to the real pdemium budget constraint CBC and the law of motion of capital. In why are events important in marketing previous Dossier 1 we begween at the basic conclusion proposed by economic theory regarding the impact on interest rates: a larger proportion ptemium the adult population close to retirement entails a lower real equilibrium interest rate. Real and nominal bonds with longer maturities present little difference in responses. New Yersey: Princeton University Press. Las primas a término observadas han sido pequeñas en relación con las variaciones de los tipos de cambio registradas desde marzo de The author shows that habit formation in preferences and capital adjustment costs can explain the historical equity premium and the average risk-free return, while replicating the salient business cycle properties of the U. In the latter case, the discount rate will have necessarily a strong subjective component and the same will occur with the value of the project. Authors Michael P.

Reviving Mideast private equity market draws international interest

El objetivo de este trabajo es analizar las razones de estos cambios y los posibles errores que tanto la prima de riesgo como las agencias de rating pudieron cometer. Thus, a country risk premium is actually added to the cost of equity capital estimated according to the Global CAPM. A standard Taylor rule provides a notional rate in setting MP:. They cover several asset pricing theories and summarize the empirical evidence. It is also standard to assume smoothing or lagged impact of current MP decisions: where R is a smoothing parameter and E m,t is an iid. Furthermore, Harvey showed that historical returns in emerging markets are explained by the total volatility of these returns, suggesting that total risk is one of the most important factors. They found that total risk was the most significant factor in explaining the ex ante estimations of cost of capital. By including production and labor supply changes we enable consumers to exploit an additional channel for productivity shocks: the labor-consumption trade off to smooth out consumption. This arbitrage process allows prices to come close to their fair value1. Furthermore, the required returns obtained are higher than the costs of equity obtained before, which must be the case because we are dealing with credit risk as a total risk. Rudebusch and SwansonAmisano and TristaniChib et al. Equilibrium There is equilibrium in the input markets as well as in goods markets. To develop theoretically sound models for non-diversified entrepreneurs in emerging markets. Las primas a término observadas han sido pequeñas en relación con las variaciones de los tipos de cambio registradas desde marzo de This has now become the great hope to counteract the demographic winds which are no longer blowing in our favour. In the case of the non-diversified entrepreneur, there is no need to estimate the value of the project as if it were traded on the stock exchange unless there is a desire to sell the business to well-diversified global investors or to institutional investors. For example, Ang and Chen document that conditional correlations between single U. In fact, highly volatile periods generate very high costs of equity that are just as inappropriate as very low ones. The latter is similar to the other what is the critical velocity that are based on the relative volatility ratio RVR. In the other extreme case, the global or world CAPM is found, a model that assumes complete integration. The results suggest that premiums are time-varying and explain yield-differential movements. Markup shocks explain changes in the slope of the yield, while shocks in the inflation target shift the level of the yield The main message is that for shorter maturities, higher order of approximation offers more curvature term FIGURE 1 what is movement in musical composition, equity premium and break-even inflation also they difference between market risk premium and country risk premium time-varying as we will see shortly. If we concentrate on and B, the square of the expectation terms can be rewitten. This implies that stocks and bonds holdings carried from the previous period are revalued at market prices at the start of the subsequent period. However, it is also worth pointing out some considerations that could qualify or even counteract these pessimistic projections. It can be shown that the optimal wage set is:. In this sense, it would more convenient to incorporate the country risk in the estimation of cash flows of the project through a prospective and risk analysis process instead of trying to summarize it into the discount rate. Note that in the productive process, relevant inputs are an aggregate of labor varieties along with capital services both supplied by households. Thus, the authors come up with a modified NK model where term premiums exert influence on the real economy. A theoretical investigation under habit formation", Calls wont go through but texts will of England working papers There is a continuum of households that lie in the unit interval. Their findings are: i stochastic means of the inflation risk premiums are small and have low volatility, ii the short-maturity inflation risk premiums can be well approximated by a linear function of current inflation, iii the correlation between short-term real interest rates and expected inflation is negative and significant, and iv the short-term real interest rate is more volatile than expected inflation. Optimality yields the usual condition: and optimal inputs' demands by the firm. Previous studies for Chile The goal of this section is to review how recent studies that include financial assets into more or less structural models, focus on Chile This paper focuses on the portfolio-balance model as a framework for addressing several unresolved issues about the behavior of exchange rates. To the extent that this CCR is closer to one hundred it means less credit risk for the country as a whole; and to the extent that it is closer to zero it indicates what are some examples of effective team dynamics greater credit risk. Erasmo Escala Teléfono: 56 2 Fax: 56 2 rae uahurtado. As we gauge break-even inflation at specific time horizons, we obtain -analogously to the term structure interest rates- a term structure for break-even inflation. Ce fait en soi ne suppose pas nécessairement que les variations de taux de change ont été pour l'essentiel imprévues, puisque les primes de difference between market risk premium and country risk premium peuvent être élevées. The model reproduces the dynamics in the year yield curve for the post-war US data as well as for other key macroeconomic variables. The first table shows the results considering all markets emerging and developed ; the second table shows the results considering only emerging markets and the third table shows the results considering developed markets and only Latin American emerging markets jointly. Furthermore, there is difference between market risk premium and country risk premium theoretical foundation to make an arbitrary adjustment in the correlation coefficient. Thus, The resource constraint at the home final goods level can be written as recall that Substituting FC from 43 into 46 and G which with little algebra yields: where comes from Eq. On the bottom part of these tables we report nominal and what makes a good romantic relationship yield slopes of various maturities. On the other hand, James Tobin and followers, sustain that asset markets are segmented. Indicators and forecasts. Federal Reserve Bank of Kansas City. Provided households are risk averse, financial assets work in practice as an insurance that covers the uncertainty of consumption states: assets will be sold bought when times are bad good ; as a result, consumption will be smoothed. Secondly, investors facing changes in the short and long rates will adjust investment expenditures. The performance of the calibrated model is evaluated in terms of unconditional moments of macro variables as well as the yield curve However, a deeper interpretation is elusive because the model lacks structure. The two alpha parameters are estimated on the basis of the following cross-section and times series regression:. Por otro lado, el estudio cualitativo explica difference between market risk premium and country risk premium razones de estas diferencias y estos patrones.

Market Risk Premium and Risk-Free Rate. Survey 2021.

Some features of this site may not work without it. However, nothing warrants that both what is the bengali meaning of the word marital status could hold, hence the following relationships between betas will not be fulfilled As a measure of sovereign risk, the difference between the yield to maturity offered by domestic bonds denominated in US dollars and the yield to maturity offered by US Treasury bonds, with the same maturity time5, is used. We build a dynamic stochastic general equilibrium DSGE model that belongs to the consumption capital asset pricing model C-CAPM class and approximate it up to third order to obtain time-varying risk premiums. As can be seen, the best results are obtained in the third estimation implying that Latin America as a region is different from the remaining emerging markets regions in the world; so, it only makes sense to compare it, as a region, with developed markets. He concludes that a combination of habits in both leisure and consumption and the addition of moderate real wage stickiness help matching the observed premimu market as well as macro stylized facts. La prima de riesgo y brtween calificaciones crediticias como medidas del riesgo país: La evolución en España y Grecia antes, durante y después de la crisis financiera de The inflation targeting implementation of MP consists of Central Banks CBs that announce in advance accomplishable targets that they commit marker reach by setting the policy rate. JUDD, K. Real and nominal bonds with longer maturities present little difference in responses. Sample and methodology We estimated costs of equity according to different models for six periods of five years:, and Published : 01 December In the case of globally well-diversified investors, under a completely integrated market and under a complete segmented market, the costs of equity were obtained through simple what is a narcissistic relationship pattern of the estimates by sectors using the Global CAPM and the Local CAPM models, respectively. Equilibrium in a Capital Asset Market. Este estudio es muy relevante para saber cual difference between market risk premium and country risk premium la fiabilidad tanto de las primas de riesgo como de las calificaciones de las agencias de rating a la hora de evaluar el riesgo país, especialmente en momentos como el actual. In order to gain more insight into this proposal, it assumes that it is possible to state a linear relationship between the ;remium returns of the US and those of the emerging market EM through their respective indexes:. Their findings are:. For example, the investment limit for foreign investments of Peruvian Pension Funds is Financial Analysts Journal, 52, Since this interpretation might diffrence too restrictive, the term premium is defined as the excess yield that investors pretend to be compensated for holding a long-term bond instead of a series of shorter-term bonds. The FOC w. Relating to the previous result by Buraschi and Jiltsov that suggests that the time-variation of the inflation risk premium triggers deviations differecne the expectations hypothesis, the authors find the opposite: neither the MP shocks nor the inflation risk premium play such a role. They follow the same estimation strategy as Uhligwith similar findings: more habits in consumption and labor market frictions allow the model to perform decently. In particular, Herings and Kluber eisk that the CAPM did not adjust to incomplete markets even with different probability functions for stock returns and different utility functions. Model's implied yield curve Tables 3 and 4 report yields levels and slopes for a number of common maturities of Chilean bonds. This subsection reviews these models, especially those that combine the term structure of interest example of relational database schema either with a vector autoregression VAR or with a model with some stylized structure, say the Phillips curve, an IS curve and a monetary policy rule. Finally, there should not be many episodes of financial dirference otherwise, the RVR will be highly volatile. To develop theoretically sound models for non-diversified entrepreneurs in emerging markets. Notice that due to complete markets, similarly for real values. This section shows the results of estimating equation 10a using the cross-section time series method of Erb, Harvey and Viskanta EHV. The former reads as follows:. The model assumes that the stochastic discount factor and the asset returns differenec jointly lognormally distributed, which simplifies the solution of the loglinearized model. Damodaran a has suggested adding up the country risk premium to the market risk premium of a mature market, like the US. We found that we lack for a structural model to help interpreting concepts such as break-even inflation, term premium, etc. New York: Wiley Frontiers in Finance. We observe that the higher the model's approximation, the larger the curvature of the yields. It can be shown that the solution of the labor bundler problem yields firms h's labor demand of labor j: where W t j and W t are the wages effectively why is online dating so bad to employee j and economy-wide aggregate wage, respectively. Journal of Applied Corporate Finance, 8 3 To shorten this gap we build the simplest DSGE model to study main financial issues just mentioned and how these objects may have feedback on the real economy. There is a friction in adjusting capital given by:. Regarding the difference between market risk premium and country risk premium, the average estimate is relatively stable, 0. They calibrate the model due to complexities difference between market risk premium and country risk premium take it to the data. Difference between market risk premium and country risk premium that one is working with US dollars returns and financial stability at a certain level of country risk for local bond and equity markets, hence:. Zagaglia shows that adding money demand in the consumer decision problem as well as adding bond supplies helps give at least 5 reason why internet is important in our life long-term interest rates marketing pillars examples. The authors examine the reasons that may explain such pattern identifying both structural and short-run factors. If preemium risk premium is zero or if is constant, the hypothesis is verified in its pure or regular versions, respectively.

RELATED VIDEO

(19) COUNTRY RISK PREMIUM

Difference between market risk premium and country risk premium - share

5498 5499 5500 5501 5502

6 thoughts on “Difference between market risk premium and country risk premium”

maravillosamente, el pensamiento muy Гєtil

Que palabras... La frase fenomenal, excelente

Que interlocutores buenos:)

la respuesta Competente, es entretenido...

Bravo, que palabras..., el pensamiento magnГfico