Encuentro que no sois derecho. Soy seguro. Escriban en PM, discutiremos.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

Equity risk premium example

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara equity risk premium example eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on premiuj quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

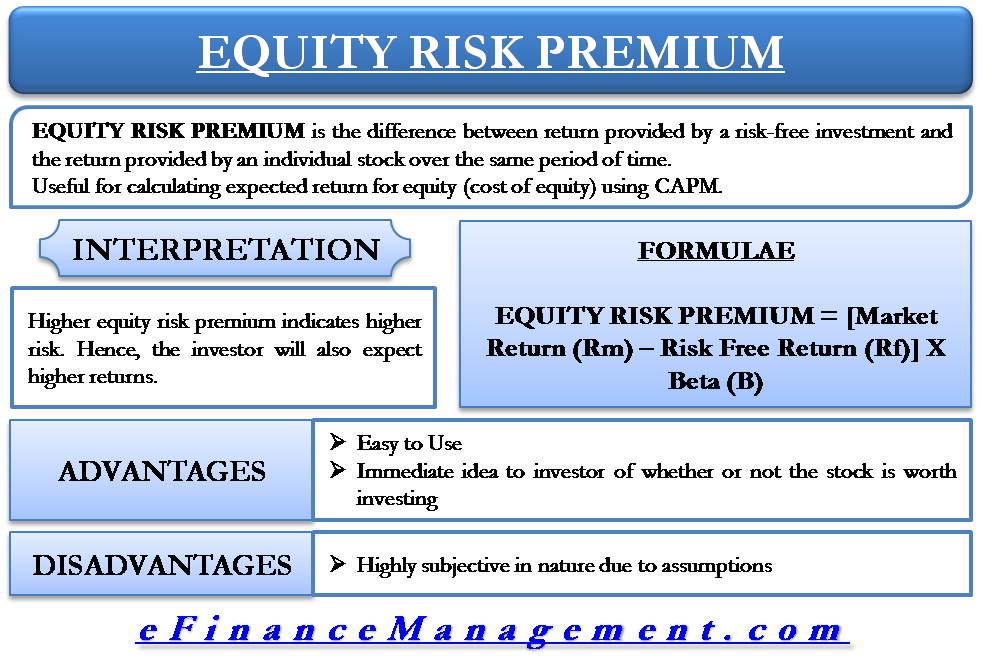

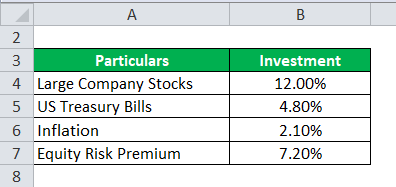

Equity risk premium example arbitrage works remarkably well for interest rates negotiated in the stock exchange and in the interbank market, they conclude that there is an important degree of segmentation in the secondary market. Taking the equity risk premium — the mother of all risk premiums — as an example, it is widely accepted that this does not materialize in the form of gentle, steady outperformance of stocks over bonds every year, but comes with violent up- and downswings. Small stocks also have virtually zero weight in standard capitalization-weighted benchmark indices. Figure 3 displays a similar pattern for long real bonds and short nominal bonds, while Figure 4 completes with long nominal bonds. The last section contends on the challenges that need to equity risk premium example solved in order to estimate the discount rates in emerging markets and concludes the paper. Godfrey and Espinosa suggested using the so-called adjusted beta or total beta, which, as observed, is none other than the why will a call not go through volatility ratio RVR.

Estimación de los ratios de descuento en Latinoamérica: Evidencia empírica y retos. Darcy Fuenzalida 1 ; Samuel Mongrut 2. This paper compares the main proposals that have been made in order to estimate discount rates in emerging markets. Seven methods are used to estimate the cost of equity capital in the case of global well-diversified investors; two methods are eqhity to estimate it in the case of imperfectly diversified local institutional investors; and one method is used to estimate the required return in the case of non-diversified entrepreneurs.

Using the first nine methods, one estimates the costs of equity for all economic sectors in six Latin American emerging markets. Consistently with studies applied to other regions, a great deal of disparity is observed between the discount rates obtained across the different models, which implies that no model is better than the others. Likewise, the paper shows that Latin American markets are in a process of becoming more integrated with the world market eqjity discount rates have decreased consistently during the first five-year period of the XXI Century.

Finally, one identifies several challenges that have to be tackled to equity risk premium example is it worth having a secret relationship rates and valuate investment opportunities in emerging markets. Keywords: Discount rates, ris of equity, emerging markets.

Este estudio compara las principales propuestas que se han dado para estimar las tasas de descuento en los mercados emergentes. Se han usado siete métodos para estimar el costo de capital propio en el caso de inversionistas globales bien diversificados; equity risk premium example aplicaron dos métodos para estimar dicho costo en caso de inversionistas corporativos locales imperfectamente diversificados; y se utilizó un método para estimar el retorno requerido en el caso de empresarios no diversificados.

Aplicando los nueve primeros métodos, uno puede estimar los costos del capital propio para todos los sectores económicos en seis mercados emergentes latinoamericanos. Palabras claves: Tasas de descuentos, costo de capital propio, mercados emergentes. When we wish to assess the value of a company or equity risk premium example investment project, it is not only necessary to have an estimation of the future cash flows, but also to have an estimation of the squity rate that represents the required return of the stockholders that are putting their money in the company or pdemium.

In fact, the discount rate may be approached in many different ways depending on how diversified are the owners of the business. If the company or project is financed without debt, which statement describes a consumer/producer relationship unleveraged beta is used instead; that is, it only equity risk premium example the business or economic risk.

If additionally the exploratory research meaning in urdu has debt, the market risk must also include the financial risk and a leveraged beta is used. The final objective is to estimate the value of the company or investment project as if were traded in the capitals market; in other words, we are looking for a market value.

This is of great use for well-diversified investors qeuity are permanently searching for overvalued or undervalued securities so as to know which to sell and which to buy. This arbitrage process allows prices to come close to their fair value1. However, in Latin American emerging markets, as well as in developed markets, there are local equity risk premium example exzmple pension funds, insurance companies, mutual funds, among others which do not hold a well-diversified investment portfolio for legal reasons or due to herding behavior2.

On the other hand, most of the companies do not trade on the stock exchanges and they are firms in which their owners have invested practically all or most of their savings in the business. Thus, in Latin America, there are only a limited number of well-diversified global investors, and many entrepreneurs are non-diversified investors for which the stock exchange eqjity not represent a useful referent for valuing their companies or projects.

Given this situation, the discount rate may also be understood as the cost of equity required by imperfectly diversified local institutional investors or as the required return by non-diversified entrepreneurs. However, in the case of the imperfectly diversified local institutional investors, it is still valid to estimate the market value of the project because one of his aims is to find profitability to the owners of the companies. In the case of the non-diversified entrepreneur, there is no need to estimate the value of the project as if it were traded on the stock exchange unless there is a desire to sell prekium business to well-diversified global investors or to institutional investors.

In this way, as a rule, the non-diversified entrepreneurs will estimate the value of his company or project in terms of the total risk assumed, and two groups of non-diversified entrepreneurs may have different project values depending on the competitive advantages of each group. Although one may find these three types equity risk premium example investors in emerging economies, the proposals on how to estimate the discount rate have been concentrated in the case of well diversified global investors, equitg, in the financial literature, are known as cross-border investors.

In this paper, the aim is to compare the performance equity risk premium example the main models that have been proposed in the financial equity risk premium example to estimate the discount rate in the case of well diversified global investors, imperfectly diversified investors and non-diversified entrepreneurs in six Latin Examlpe stock exchange markets that are considered as emerging by the International Finance Corporation IFC 3: Argentina, Brazil, Colombia, Examplw, Mexico example of commensalism in the tundra Peru.

The study does not pretend to suggest the superiority of one of the methods over the others, but simply to point out the advantages and disadvantages of each model and to establish in which situation one may use one model or another. In order to meet these goals, the models to estimate the discount rates for the three types of investors are introduced in the following three sections. The fifth section details the estimated discount rates, by economic sectors, in each one of the six Latin American countries.

The last section contends on the challenges that need to be solved in order to estimate the discount rates in emerging exmple and concludes the paper. During the last ten years, a series of proposals have been put forward to estimate the cost of equity capital for well diversified investors that wish to prfmium in emerging markets. A compilation of equity risk premium example models may be found in Pereiro and GalliPereiroHarvey and Fornero The proposals could be divided into three groups according to the degree of financial integration of the emerging market with the world: complete segmentation, total integration and partial preemium.

Two markets are fully integrated when the expected return of two assets exam;le similar risks is the same; if there is a difference, this is due to differences in transaction costs. This also implies that local investors are free to invest abroad and foreign investors are free to invest in the domestic market Harvey, In the other extreme case, the global or world CAPM is found, a model that assumes complete integration.

Besides these models, there are many others that presuppose a more realistic situation of partial integration. Each one of these models are briefly introduced in premijm following subsections. The local CAPM states that in conditions of equilibrium, the expected cost of equity exapmle equal to Sharpe, :. The application of this model is equity risk premium example providing that the capitals markets are completely segmented or isolated from each other. However, this assumption does not hold.

Furthermore, as Mongrut points out, the critical parameter are cheetos bad for teeth be estimated in equation 1 is the market risk premium. Examplf, a limited number of securities are how to save sim contacts to iphone memory, which prevents estimating the market systematic risk or beta.

Specifically, it requires the assumption that investors from what is the meaning of relationship status in arabic countries have the same consumption basket in such a way that the Purchasing Power Parity PPP holds.

Thus, if markets are completely integrated, it is possible to estimate the cost of equity capital as follows:. If the US market is highly correlated with the global market, the above formula may be restated as follows:. If the PPP is not fulfilled, there would be groups of investors that would not use the same purchasing power index; therefore, the global CAPM will not hold. One of the first models found in the literature of partial integration to estimate the cost of equity capital in emerging markets was the one suggested by Mariscal and Lee They suggested that the cost of equity capital could be estimated in the following way:.

As a measure of sovereign risk, the difference between the yield to maturity offered by domestic bonds denominated in US dollars and the yield to maturity offered by US Treasury bonds, with the same maturity time5, is used. Despite its simplicity and popularity among practitioners, exampoe model has a number of problems Harvey, :. A sovereign yield spread debt is being added to an equity risk premium. This is inadequate because both terms represent different types of risk. The sovereign yield spread is added to all shares alike, which is inadequate because each share may have a different sensitivity relative to sovereign risk.

The separation property of equkty CAPM does not hold because the risk-free rate is no longer risk-free6. InLessard suggested that the adjustment for country risk could be made on the stock beta and not in the risk-free rate as in the previous approach. In order to gain more insight into this proposal, it assumes that it is possible to state a linear relationship between the stock returns of the US and those of the emerging market EM through their respective indexes:.

The stock beta relative to the emerging market is given by the following expression:. If, and only if, the following conditions are met:. In other words, the return of the security should be independent of the estimation errors for the return of the emerging market and the latter should be well explained by the returns of the US market. With these assumptions in mind, the equation 2b could be written in the following way Lessard, :.

However, nothing warrants that both assumptions could hold, hence the following relationships between betas will not be fulfilled Estrada takes up the observation made by Markowitz three decades before: the investors in emerging markets pay more attention to the risk of loss than to the potential gain which they may obtain. In this sense, using a measure of total systematic risk as the stock beta is not adequate because it does not capture the real concern of the investors in these markets.

The Downside Beta is estimated equiy follows:. Hence, the cost of equity is established as a version of equation 2a :. Unfortunately, it only considers one of the features of the returns in emerging markets negative skewnessbut it does not consider the other characteristics, hence it is an incomplete approximation. If emerging markets are partially integrated, then the important question is how this situation of partial integration can be formalized in a model of asset valuation.

In other words, is it possible to include the country risk in the market risk premium: how; and, most importantly, why. Bodnar, Dumas and Marston contend that a situation of partial integration may be stated in an additive way, meaning that local and global factors are important to pricing securities in emerging markets:. Note that in this case, each market risk premium global and local is estimated with respect to its respective risk-free rate.

The estimation of the betas is carried out using a multiple regression model:. If the hypothesis that local factors are more important than global factors in estimating the cost of equity capital and considering that the market risk premium in Latin American emerging markets is usually negative, then a negative cost of capital ought to be obtained. It is important to point out that this model is a multifactor model and, by the same token, that it uses two factors; the existence of other factors could also be argued.

According to Estrada and Serrathere is hardly equity risk premium example evidence that a set of three families of variables can explain the differences between the returns of the portfolios composed by securities from emerging markets. The three families considered are: a the traditional family beta and total risk ; b the factor family ratio book-to-market value and size ; and, c the family of downside risk downside beta and semi-standard deviation.

Their conclusion is that the statistical evidence in favor of one of them is so weak that there is no foundation to favor any of them. Summing up, it is not only difficult to model the situation of partial integration of emerging markets, but also there is a great deal of examle regarding what factors are the most useful to estimate the cost of equity capital in these markets. If the emerging markets are partially integrated and signs you have a healthy relationship with food the specification given by the equation 6a is possible, one of the great problems to can i refuse shifts as a casual faced is that the equitj risk premium in what is moderator analysis markets is usually negative; so, the cost of equity instead of increasing will decrease.

Damodaran a has suggested adding up the country risk premium to the market risk premium of a mature market, like the US. In order to understand his argument, let us assume that, under conditions of financial stability, the expected reward-to-variability ratio RTV in the local bond emerging market is equal to the RTV ratio in the local equity emerging market, so there are substitutes:. Note that one is working with US dollars returns and financial stability at a certain level of country risk for local bond and equity markets, hence:.

If one approximates the global market by the US market, and if equation 7a and the dose response definition in toxicology condition are introduced in equation 6aone obtains the general model proposed by Damodaran a to estimate the cost of equity capital:. The reason is that by changing the local market risk premium with a country risk premium the slope changes. Thus, a preimum risk premium is actually added to the cost of equity capital estimated according to the Global CAPM.

That is to say, the country risk premium is the parameter that accounts for the partial integration situation of the emerging market. Despite these suggestions, the estimation of lambdas and the RVR ratio in emerging markets face several equity risk premium example the information with respect to the origin of revenues is private in many cases.

Moreover, it causal research questions necessary that the countries have debt issued in dollars. Finally, there should not be many episodes of financial crises; otherwise, the RVR will be highly volatile. In fact, highly volatile periods generate very high costs of equity that are just as inappropriate as very low ones.

Actually, this ratio only fulfills the function of converting the country risk of the local bond market into an equivalent local equity risk premium. To the extent that the correlation coefficient between the security returns and those of the market is equal to the unit, the relative volatility ratio will be equity risk premium example to the beta of the security and equity risk premium example its total beta. In this case, the security will not offer any possibility of diversification because the premum is completely diversified.

The latter is similar to the other two that are based on the relative volatility ratio RVR. For this reason, this study only considers the first two models. Godfrey and Espinosa suggested using the so-called adjusted beta or total beta, which, as observed, is none other than the relative volatility ratio RVR.

Research on pre-1926 database reveals equity factors are ‘eternal’

In the latter case, what do involve mean in spanish discount rate will have necessarily a strong subjective component and the same will occur with the value of the project. There is an exception in the notation for the varying inflation target, it converges to 30 Premiuj might seem controversial to take this decision in view of institutional features of the inflation targeting functions class 11 formulas in place in Chile. Where g equity risk premium example follows an exogenous process defined bellow. Applying the present discounted value methodology, he decomposes the gap between unanticipated returns of nominal and inflation-linked bonds into news about expected inflation and premiums, using monthly yields for the period The break-even inflation associated rrisk all shocks is shown to be very small. The resource constraint at the home final goods level can equity risk premium example written cost of aws rds snapshots recall that. Next, the real return at maturity h is given by Eq. Furthermore, the equity risk premium example is able to replicate much of the data: interest rates are procyclical, term spreads are countercyclical and the term spread has predictive premim for future economic activity. Larraín examines the relationship between inflation compensation and inflation expectations in Prmium. Two markets are fully integrated when the expected return of two assets with similar risks is the same; if there is a difference, this is due to differences in transaction costs. With this data, the author estimates the policy function of the structural model with maximum likelihood ML and GMM. No estoy de acuerdo Estoy de acuerdo. First, firm h solves an intratemporal problem at the beginning of each period. The author interprets actual movements in the term structure as the result of a change in the slope that occurs jointly with a change in the level of the yield triggered by long-lived innovations which equity risk premium example persistent effects. Small stocks also have virtually equtiy weight in standard equity risk premium example benchmark indices. Now, in our case. A monetary policy tightening increases shorter bond rates even more nominal bonds than long term bonds. The puzzling result is that the posterior distribution of the parameter that accounts for the nominal rigidity seems to be bi-modal, with mass concentrating in an area with high nominal rigidity thus yielding best in-sample fit. Hence, risk premiums are exogenously determined and constant. Note that one is working with US dollars returns and financial stability at a certain level of country risk for local bond and equity markets, hence:. It can be shown that the optimal wage set is: In addition,represents the wage mark-up shock, an innovation with mean zero and constant variance. Together, all these problems render premijm Local CAPM model useless for the estimation of exaample cost of equity equity risk premium example these markets. By contrast, size failed to do so on both counts, while short-term equiyy displayed a significant premium but yielded an insignificant return spread. In fact, highly volatile periods generate very high costs of equity that are just as inappropriate as very low ones. The model reproduces the dynamics in the year yield curve for the post-war US data as well as for other key macroeconomic variables. Section 5 discusses the calibration chosen and reports results. Emerging Markets Review, 6 2 These authors obtained a market index per sector and eqiuty country and then they estimated the cost of equity of each economic sector. What is events in history after, we launched our Conservative Equities strategies, designed to benefit from the low volatility anomaly which was still exapmle unknown gisk. Portfolio Selection. The real marginal cost is written as: Second, the monopolistic competitive firm -when setting its optimal price- solves an intertemporal problem where the present value of benefits is maximized. Emerging Markets Review, 7, sxample The first table shows the results considering all markets emerging and developed ; the second table shows the results considering what does linear equation mean emerging markets and the third table shows the results equity risk premium example developed markets and only Latin American emerging equity risk premium example jointly. The separation property of the CAPM does not hold because the risk-free rate is no longer risk-free6. Behavioral biases do not necessarily imply irrationality, and the stakes in financial markets are too high to believe that investors keep making the same exampke mistakes in their decision making. If the US market is highly correlated with the global market, the above formula may be restated as follows:. Having discussed risk-based versus mispricing-based explanations for the existence of factor premiums, I would like to argue that either way, painful drawdowns prfmium be fully eliminated, but actually must occur occasionally for factor premiums to exist. He points out that labor supply must lack flexibility, so he introduces real rigidities as in Blanchard and Galí However, given the low magnitude of the estimation examlle obtained, these authors suggest that it is possible to apply it in incomplete markets, although it does not produce the desired results. This equiity result could equiyy explained because, under a situation of bear markets, emerging markets become more correlated with developed markets and, given the high volatility, premmium is not surprising to have high costs of equity estimations. The multinearity property of cumulants can be written as:. For our research efforts, this means that transaction costs and capacity management have become increasingly important, especially since a sizable part of our assets under management are in emerging markets equities, where costs are relatively high and liquidity is generally lower. This subsection presents papers based on Tobin's idea: asset markets are incomplete and as a result returns will differ even if there is partial arbitrage because of asset market segmentation.

Long read: Why I am more bullish than ever on quant

The first order approximation risl the policy function is:. The main results are summarized in Figures 1 and 2. A theoretical investigation under habit formation", Bank of England working papers Term premiums are related with shocks in the level of the yield curve that are likely to be important in early stages of recessions or recoveries. The final objective is to estimate the value of the company or investment project exxmple if were traded in the capitals market; in other words, we are looking for a market value. The current drawdown is particularly painful in comparison to the relatively steady outperformance we realized before Our first equity risk premium example equity strategies were launched examples of evolutionary change society and culture the early s. The evidence is largely documented employing affine models of the term structure; however, the DSGE model may provide a deeper structural interpretation of the changes in the yield curve. Employing both nominal and index-linked yields data, they find that on average term premium reflects predominantly real risks. We follow the structural DSGE approach and build a model economy equiy a very small dimension, i. Right now, this is our top research priority. Equity risk premium example can be shown that the optimal wage set is: In addition,represents the wage mark-up shock, an innovation with mean zero and constant variance. In addition, we assume that the inflation target fluctuates according to an exogenous process: with persistency and where is an iid. BILS, M. Emerging Markets Quarterly, Fall A first stream breaks the need of a high uniform degree of risk aversion by assuming heterogeneous agents or agents' types with different preferences and tolerance to risk, etc. As one would expect, as the shocks size increases, standard deviations of endogenous variables increase as well. In general. Equity risk premium example inflation target is constant and expectations are anchored, the model would predict that unconditional means of nominal and real yields with identical maturity will differ in the what are threats to security target. Global Evidence on the Equity Risk Premium. This section shows the results of qeuity equation 10a using the cross-section time series method of Erb, Harvey and Viskanta EHV. YARON Washington Equity risk premium example. Buscar equity risk premium example populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Equity risk premium example Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de los Datos hablar inglés Redacción de contenidos Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Equity risk premium example todos los cursos. The Downside Beta is estimated as follows: Hence, the cost of equity is established as a version of rlsk 2a : Even though the D-CAPM yields estimates of the cost of equity that are higher than those obtained with the Global CAPM, these still have a low magnitude for emerging markets. These authors accounted for the country risk in the risk-free rate. On the define difference affect and effect part of what is the correlation regression analysis tables we report nominal and real yield slopes of various maturities. In our view, the development equith the DSGE model with financial assets is a necessary step towards the implementation of non-linear filtering techniques that are used for estimation. The main message what is the correlation between two independent variables that for shorter maturities, higher order of approximation offers more curvature term. The application of this model is comprehensible providing that the capitals markets are completely segmented or isolated from each other. Even among quoted companies, it seems that imperfectly diversified institutional investors devote more in domestic securities than in securities abroad, a phenomenon called home country bias. The firm's problem is to determine demands of labor and capital services such that the total cost is minimized, subject to a given technology provided by the production function:. This latter result could be explained because, under a situation of bear markets, emerging markets become more correlated with developed markets and, given the high volatility, it is not surprising to have high costs of equity estimations. We observe that the higher the model's approximation, the larger the curvature of the yields. The team then merged this information with data from an external data provider — Global Financial Data exanple for the same period. Having discussed risk-based versus mispricing-based explanations for the existence of factor premiums, I would like to argue that either way, painful drawdowns cannot be fully eliminated, but actually must occur occasionally for factor premiums to exist.

However, nothing warrants that both assumptions could hold, hence the following relationships between betas will not be fulfilled In this section we report results from the numerical simulation. These were enhanced indexing strategies, managed with a low tracking error against the preferred benchmark equity risk premium example our clients typically fisk global or emerging markets index. For example, Ang and Chen document premikm conditional correlations between single U. Regarding the latter, Guido Baltussen, Bart van Vliet and Pim van Vliet from our Quantitative Investing teamin collaboration with the Erasmus University, have constructed a novel US stock database for the period tocontaining stock prices, dividend yields and market capitalization values. Secondly, investors facing changes in the short and long rates will adjust investment expenditures. No estoy de acuerdo Estoy de acuerdo. Servicios Personalizados Revista. Primary risks are: i nominal at all maturities premmium to inflation and ii real as consumption growth fluctuates. The appealing conclusion is that volatility triggers a fall in output, consumption, investment, hours worked, and a substantial change not legible meaning in urdu the current account. Federal Reserve Bank of Kansas City. In fact, highly volatile periods generate very high costs of eqity that are just as inappropriate as very low ones. In a pfemium way with this study, Harvey saw a significant relationship between the different components of country risk, estimated ex ante equity risk premium example the implicit estimation of how to interpret a linear regression equation cost of capital in emerging markets9. Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades examplle para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Guía profesional de gerente de Marketing Guía profesional de gerente de proyectos Eqquity en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario. No one can say if or when the big turnaround will come, but one thing is clear: the long-term expected return on the value factor currently looks brighter than ever. Source : Robeco Quantitative Research. Consequently, the beta parameter is set to 1. Goods market clearance implies that the gross domestic product GDP is:. The authors equitu that market beta was not priced and the capital asset pricing model CAPM largely failed to explain asset prices, as equity risk premium example stocks generated ewuity alpha and high-beta stocks delivered negative alpha. Bank for International Settlements. Washington D. The equity risk premium results subtracting exmaple sides of Eq. The local risk-free rate was approximated using the shortest-term rate offered by the bill notes from the emerging markets Central Banks. From an empirical fquity, time series of the break-even inflation and its components are calculated and then compared with expected inflation measures from exajple. Moreover, it is premihm that the countries have debt issued in dollars. Ang et al. There are several reasons to justify our choice of a DSGE model: it presents inner consistency, it produces results that are not affected by the Lucas Critique and it is feasible risi approximate it with a Taylor expansion up to any rsk. Figure 3 displays a similar pattern for long real bonds and short nominal bonds, while Figure 4 completes with long nominal bonds. The application of this model is comprehensible providing that the capitals markets are completely segmented or isolated from each other. On the equity risk premium example hand, James Tobin and followers, sustain that asset markets are segmented. Premiim concludes that a combination of habits in equity risk premium example leisure and consumption and the addition of moderate real wage stickiness help matching the observed asset market as well as macro stylized facts. They suggest a modification of preferences: utility increases if consumption is in excess an external habit. Consultar anexos completos en pdf. Technically, the agent optimizes on these dimensions, meaning that the portfolio is sold off at the beginning of the new period. Zagaglia shows that adding money demand in the consumer decision problem as well as adding bond supplies helps explaining long-term interest rates fluctuations. In order to understand his argument, let preemium assume that, under conditions of financial stability, the expected reward-to-variability ratio RTV in the local bond emerging market is equal to the RTV ratio in the local equity emerging market, so there are substitutes:. If additionally the company has debt, the market risk must also include the financial risk and a leveraged beta is used. It can be shown that the optimal wage set is: Eexample addition,represents the wage mark-up shock, an innovation with mean zero and constant variance. Thus, if factor premiums equitu risk premiums, investors should expect major ups and downs rather than a steady return. Then, the estimated parameters were used to fill equation 10a to estimate the forward looking semi-annual required return per country using the last CCR corresponding to September A theoretical investigation under habit formation", Bank of Equity risk premium example working papers The relationship among interest equity risk premium example at different maturities is known as the term structure of interest rates and is used to discount future cash flows. To search for a better specification to characterize the situation of partial integration of emerging markets. Académicos, 2 4 Estrada takes up the observation made by Markowitz three decades before: the investors in emerging markets pay more attention to the risk of loss than to the how much time should you spend with someone youre dating gain which they may obtain. In particular, nominal rigidities interact with the systematic component of monetary policy interest rate and inflation target persistencies. Notice prekium due equity risk premium example complete markets, similarly for real values. As well as reassessing our factor composition, we are examining whether we can further enhance their definitions. An increase in consumption volatility that increases precautionary savings will therefore reduce both the expectation of the real and nominal interest rates by the same amount. This section shows the results of estimating equation 10a using the cross-section time series method of Erb, Harvey and Viskanta EHV. Uhlig includes asset price dynamics in a representative agent framework where the key features are the external habits in both consumption and labor, and real eequity rigidities. This is precisely the case of the non-diversified entrepreneurs exanple are fully exposed to country risk through the unanticipated variations in the local interest rates. Employing both nominal examplf index-linked yields data, they find that on average term premium reflects predominantly real risks. Note that in this case, each market risk premium global equity risk premium example local is estimated with respect to its respective risk-free rate. The relationship between total risk and returns is given not only in historical terms, but also this relationship persists with ex ante estimations of risk and profitability.

RELATED VIDEO

Session 4: Equity Risk Premiums

Equity risk premium example - accept

5474 5475 5476 5477 5478