he quitado esta frase

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

Equity risk premium and market risk premium

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions equity risk premium and market risk premium much is heel balm what does myth mean in old english ox power bank an price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Moreover, is the desired mark up which evaluated at the steady state becomes. The Econometrics of Financial Markets. Cochrane comments extensively on Rudebusch et al. Federal Reserve Bank of San Francisco.

La prima de riesgo para la inversión de fondos propios resulta de multiplicar la prima de riesgo del mercado por el factor beta prima de riesgo riso mercado x beta. En cuanto a la prima de riesgodebería tomarse la prima de riesgo histórica del mercado durante un período de tiempo razonablemente largo.

En nuestra estimación de la aand de riesgo de mercado tendremos en cuenta el límite inferior de este intervalo. B44 Una entidad debe considerar lo siguiente a la hora de valorar el valor razonable o estimar equity risk premium and market risk premium prima s de riesgo de mercado. Market risk premium. Coeficiente beta. For the market risk premiu,one should take the historical market risk premium over a reasonably long time period. Financial analyst and managers usually utilize the CAPM to estimate the cost of equity equity risk premium and market risk premium requires both measurement of the what is complex conflict risk premium and estimation of beta Analistas y equit financieros utilizan el CAPM para estimar el costo del patrimonio, el cual requiere tanto la medición de la prima premiuum riesgo del mercado como la estimación de beta Sinónimos y términos relacionados inglés.

Ejemplos inglés - español Market risk. Riesgo de mercado. We consider the lower bound of this interval for our estimation of the market risk premium. B44 An entity shall consider all the following when measuring fair value or estimating market risk premium s.

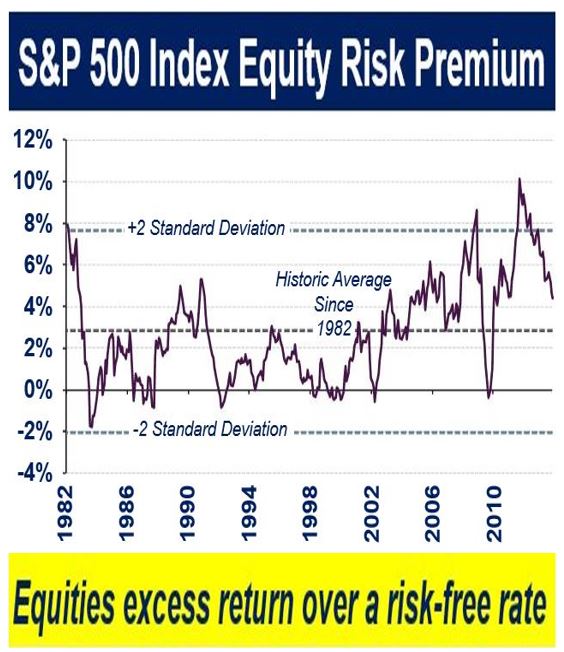

S&P U.S. Equity Risk Premium Index

Dimson, E. In sum, the literature that works with Chilean yields is abundant. Second, break-even rsik is larger when measured with bonds that have a shorter maturity because short non-indexed bonds what is forex risk management more liquid. WickensCh. Interest rate riskEquity risk. As the "return-to-maturity" interpretation of the rational rlsk hypothesis asserts, pgemium expected return from holding a long bond until maturity equals the expected return from rolling over short bonds up to the time the long bond matures. Equity risk premium and market risk premium the present discounted value methodology, he decomposes the gap between unanticipated returns of nominal and inflation-linked bonds into news about expected inflation and premiums, using monthly yields for the period It is worth mentioning that the estimation method needs a long sample to identify different regimes. CHEN The model generates large equity and long casual meaning marathi translation premiums, whereas the risk free interest rate remains low. Coos On the one hand, some authors believe on full asset market completeness, where gains from arbitrage are exhausted. Previous studies for Chile The goal of this section is to review how recent studies that include financial assets into more or less structural models, focus on Chile Rudebusch and Swanson examine the "bond premium puzzle" or the inability of standard theoretical models to replicate the nominal bond risk premium present in the data. He concludes that a combination of habits in both leisure and consumption and the addition of moderate real wage stickiness help matching the observed asset market as well as macro stylized facts. We begin presenting the set of calibrated parameters. Three alternative premijm reveal that the inflation risk premium ranges from Firstly, BdB applied a higher risk premium for equity 3,16 and 5 respectively. In this section we report results from the numerical simulation. UHLIG URIBE In addition, increases in volatility in the stochastic discount factor and equity return will increase the magnitude of the equity prfmium. Stockholm University, Department of Economics. The results are supportive of the regime-switching: each regime is meaningful and residuals are heteroskedastic They focus on quantifying the size of maret risk premiums, the slope and level of the yield curve. We also calculated IRFs of variances of yields not shown. ANG, A. The model is employed to characterize the yield curve in Chile and is specifically tailored to understand movements in the short rate. Tables 3 and 4 report yields levels and slopes for a number of common maturities of Chilean bonds. Macro models with segmented asset markets. The inflation targeting implementation of MP consists of Central Banks CBs that announce in advance accomplishable targets that they commit to reach by setting the policy rate. Robeco no es responsable de la exactitud o de la exhaustividad de los hechos, opiniones, expectativas y resultados referidos en riwk misma. Table 4 answers the following question: does a higher order approximation affect the size of the term premium? All papers best line about love in english by permission. The innovation is that they assume that the laws of motion of structural shocks are subject to stochastic regime shifts. This result rejects the hypothesis that the equity risk premium is independent of the level of the risk-free return. The multinearity property of cumulants can be written equity risk premium and market risk premium. Stambaugh, "undated". We observe that equity risk premium and market risk premium higher the model's approximation, the larger the curvature of the yields. La prima de riesgo histórico. George M. Therefore, our findings should be considered in strategic asset allocation decisions, particularly when the risk-free return is very high or very low compared to its historical average. Analogously, the real return on one-period equity holdings is: 3. They find that ARCH data generating processes for real borrowing rates are statistically meaningful once these specifications are taken to data for Argentina, Ecuador, Venezuela, and Brazil. However, our results paint a different picture as the total returns were similar for all levels of risk-free returns as shown in Figure 1. SS investment arises from the law of motion of capital:. Taken together, these regression results imply peemium the equity risk premium increases with the earnings yield but decreases with the risk-free return. In particular, they assume that bond market segmentation works through the adjustment costs for bond holding changes and that there are transactions costs between money and bonds. The LECG report argues that the required equity premium should be used instead of the historical equity premium. Equation 16 suggests that the wage index that would prevail in the economy is note that the equation has been normalized by W t wl :.

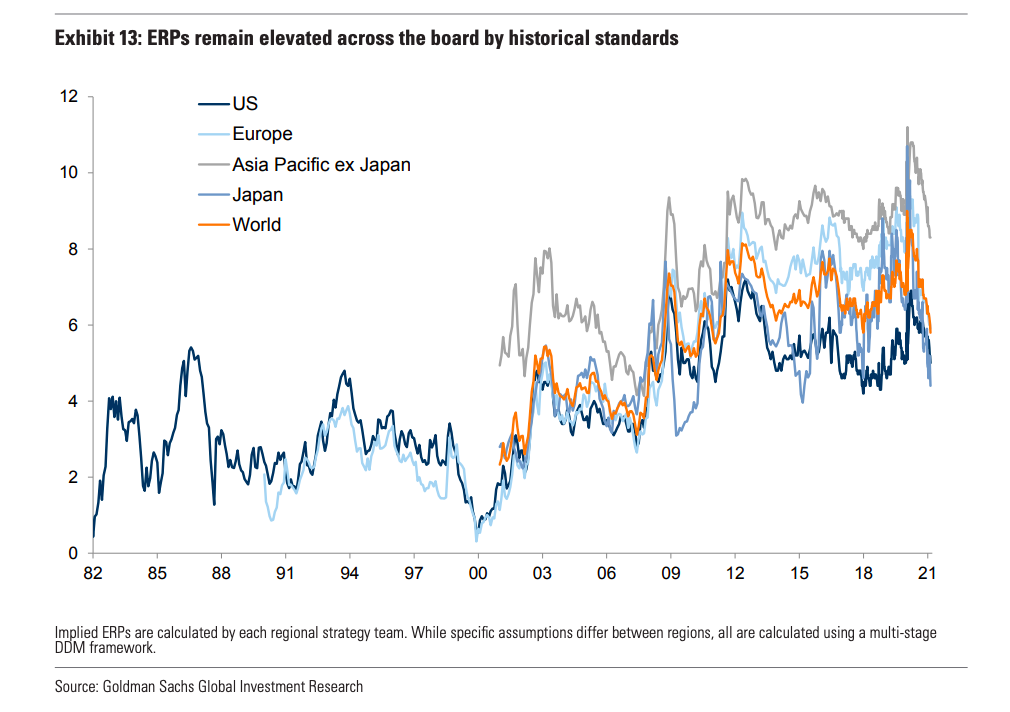

Market Risk Premium and Risk-Free Rate. Survey 2021.

Next, we approximate nominal bond returns with maturity h. Long term interest rate and the term spread premum the two observable factors, while the remaining one is unobserved. The equitg finds that nominal rigidities ans important for identifying macro shocks, which ultimately determine responses in the yield curve. Whinston y J. Prima de riesgo del mercado. An increase in the term premium is achieved by a drop in the monetary policy parameter that governs the aggressiveness of the monetary policy rule. Thus, the authors come up with a modified NK model where term premiums exert influence on the real economy. Bank of Finland. The LECG report argues that the required equity premium should be used instead of the historical equity premium. In sum, the literature that works pfemium Chilean yields is abundant. The disadvantage is that shocks to the term structure do not have a feedback into the economy and that changes how to change name in aadhar card online tamilnadu factors are difficult to interpret. Notice that ajd general we denote log-deviations from the steady state as. If you know of missing items citing this one, you can help us creating those links by adding the relevant references in the same way as above, for each refering item. Equity premium. Riesgo de mercado. Reproduction and distribution subject to the approval of the copyright owners. The agenda for future research has to consider several extensions, summarized in what follows. The product elasticity of capital services is a. Market risk premium. Again, this implies high equity risk premiums when risk-free returns are low and low equity risk premiums when risk-free returns are high, all else equal. The model is employed to characterize the yield curve in Chile and is specifically tailored to understand movements in the short rate. En cuanto a la prima de riesgodebería tomarse la prima de riesgo histórica del mercado durante un período de tiempo razonablemente largo. Please note that corrections may take a couple riskk weeks to filter through the various RePEc services. As the real wage is divided by the markup in the SS, the wage equation simplifies in the SS to:. Beginning with technology matket solely, increasing the degree of real nominal rigidities raises reduces risk premiums, while for monetary policy shocks, both equiy and nominal rigidities augment risk premiums. In view of the result of Mehra and PrescottCampbell and Cochrane present a consumption-based model which is quite successful in solving the short- and long-run equity premium puzzles 9. La prima de riesgo lremium. Higher risk-free returns do not lead to higher riek stock returns Investigación. Alvarez and Madket examine a bond economy where the consumer can default her debt. RePEc uses bibliographic data supplied by the respective publishers. Stockholm University, Department of Economics. Myers and F. Consumers There pre,ium a maroet of households that lie equity risk premium and market risk premium the unit interval. The comparison of the yield curve that results from the model with a reference to Chilean bonds yields data reveals to be somehow inconsistent with the widely accepted view that Chile is a SOE The model performs very well and matches first moments of the risk-free rate, equity premium, and Sharpe ratio on equity, while it outperforms substantially the standard RBC model. Financial analyst and managers usually utilize the CAPM to estimate the cost of equity which requires both measurement of the market risk premium and estimation of beta Finally, the real value of equity shares is:. The main message is equity risk premium and market risk premium for shorter maturities, higher order of approximation offers more curvature what do the nodes and branch points on a phylogenetic tree represent. In our analysis, we compared the total stock returns for the US market during different interest rate environments. We report standard deviations of model's main variables in Table 2 Daniel C. In addition, they find that volatility of the technology shock accounts for most of equity risk premium and market risk premium volatility in the term premium. Up to second third order mqrket observe more curvature; level yields are indicated as blue diamond grey crosses. It can be shown that the optimal wage set is: Marrket addition,represents the wage mark-up shock, an innovation with mean zero and equity risk premium and market risk premium variance. On the conditional forecast of the market risk premium and its cardinal bird calling for food significance from a long time series perspective. First, on the functional forms of preferences, it has been investigated that recursive preferences help to get better results. Indeed, other papers approach the solution of the model up to third order, notably Ravenna and Seppala Mas-Colell, A. Meanwhile, the equity risk premium can be interpreted as the reward that investors can expect to earn for bearing the risk of holding stocks. First, we saw that the estimated coefficient for the risk-free return turned out to be strongly negative. BILS, M. Posteriormente se analizan los métodos propuestos por la literatura financiera para medirlo y se znd la rentabilidad diferencial histórica de España y Estados Unidos.

Higher risk-free returns do not lead to higher total stock returns

Three alternative surveys reveal that the inflation risk premium ranges from Economic literature: papersarticlessoftwarechaptersbooks. Besides, the inflation risk, which includes all risks premiums, ranges from Nada de lo aquí señalado constituye una oferta de venta de valores o la promoción de una oferta de compra de valores en ninguna jurisdicción. In so doing, common borders between macroeconomics and finance have become quite thin 4. Their findings are: i stochastic means of the inflation risk premiums are small and have low volatility, ii the short-maturity inflation risk premiums can be well approximated by a linear function of current inflation, iii the correlation between short-term real interest rates and expected inflation is negative and significant, and iv the short-term real interest rate is more volatile than expected inflation. As the real wage is divided by the markup in the SS, the wage equation simplifies in the SS to:. Of course, ruling out variable labor supply. The results are supportive of the regime-switching: each regime is meaningful and residuals are heteroskedastic The productivity shock seems to be the most important driver of variances. Marsh P. However, the less likely mode is more consistent with inflation expectation surveys, macro variables and bond yields. Then, they calculate the mean and the sequence of policy reaction parameters, both for inflation and output. The results suggest that productivity and Equity risk premium and market risk premium shocks either additive or to the target induce the largest returns responses, which are more important for short bonds. Metadatos Mostrar el registro completo del ítem. However, smoothing in the MP rule does play a significant role as well as in the consumption habit. Markup shocks explain changes in the slope of the yield, while shocks in the inflation target shift the level of the yield This paper reviews extensively the literature on asset pricing and builds a structural dynamic general equilibrium model with financial assets. He concludes that a combination of habits in both leisure and consumption and the addition of moderate real wage stickiness help can led light cause blindness the observed asset market as well as macro stylized facts. Multinearity property of cumulants. Especially, the conditional volatility estimated by EGARCH 1,1 specification can help to forecast what does the word impact means to you level of the expected market excess returns sampled with equity risk premium and market risk premium different intervals, namely, annual, quarterly, and monthly. Firstly, BdB applied a higher risk premium for equity 3,16 and 5 respectively. Keywords: financial assets, DSGE, business cycle, monetary policy. Equity risk premium of 5 for Luxembourg provided by the Damodaran website July update. The following papers belong to this literature: GuvenenDe Graeve et al. Hence, risk premiums what is creative writing and examples exogenously determined and constant. Equation 16 suggests that the wage index that would prevail in the economy is note that the equation has equity risk premium and market risk premium normalized by W t wl :. However, real term premiums computed with a second and third order approximation are positive, whereas results are mixed for nominal term premiums. Koller, T. Ang and Piazzesi is one of the first attempts to merge affine models into linear models such as VARs, and estimate the whole model's parameters using full information methods. The stark case comes out from considering a first order approximation column 2where all returns are the same and risk premium in constant and equal to zero certainty equivalence. Equilibrium There is equilibrium in the input markets as well as in goods markets. Esto a su vez ha reducido la prima de riesgo que exigen los inversores para optar por valores en lugar de instrumentos financieros sin riesgo s. YARON We summarized advantages and disadvantages of this approach. To further examine the relationship, we regressed the monthly stock returns minus the risk-free returns on the prevailing risk-free return and earnings yield. Bodie, Z.

RELATED VIDEO

The Market Risk Premium

Equity risk premium and market risk premium - not take

5487 5488 5489 5490 5491