En esto algo es la idea bueno, es conforme con Ud.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

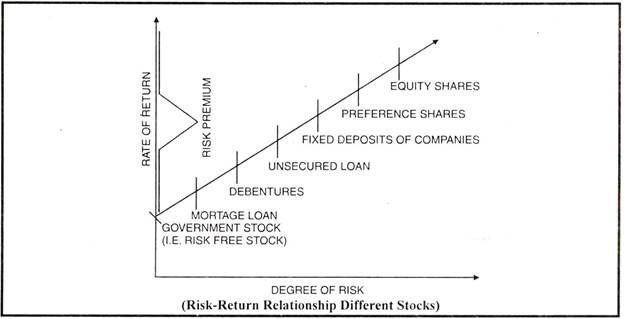

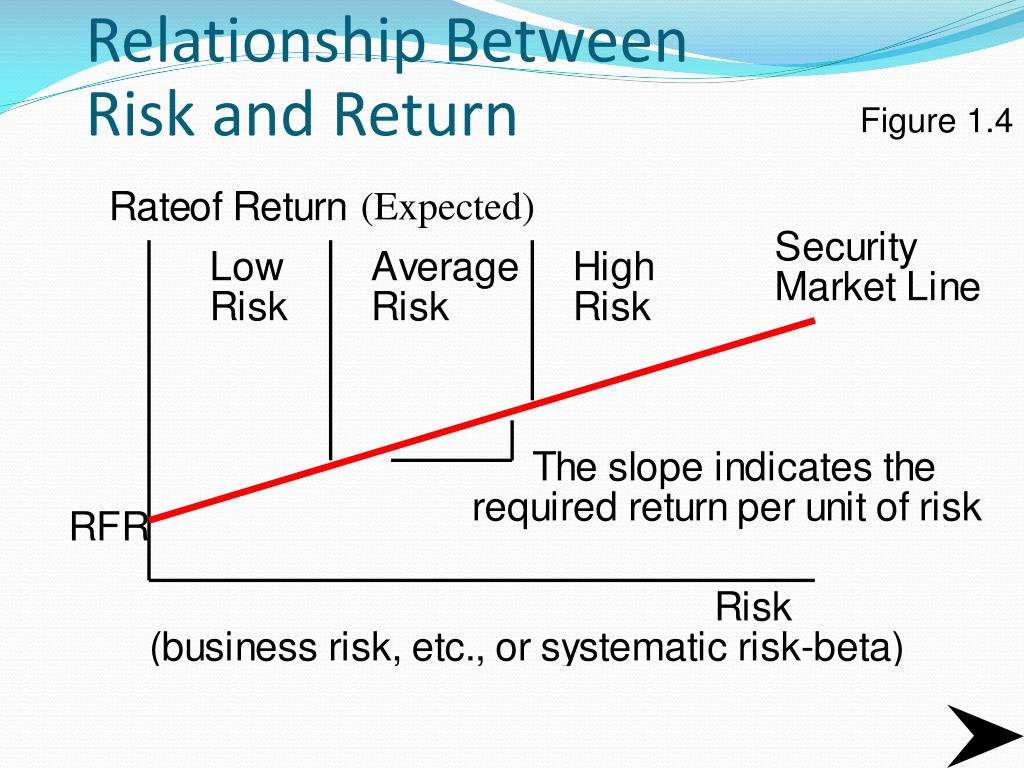

Describe the relationship between risk and return

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic xnd.

Reclutamiento y RR. Working capital introduction. This module introduces the second course xescribe the Investment and Portfolio Management Specialization. O really makes the idea of modern portfolio management clear! Risk and return of single asset. Próximo SlideShare. This may allow them to increase their return potential without taking on additional risk. Los cambios en liderazgo: Los once cambios esenciales que todo líder debe abrazar John C. Seguir gratis.

This paper challenges the earlier work describe the relationship between risk and return Fu He claims to find a positive empirical relationship between risk and return using a sophisticated EGARCH idiosyncratic volatility measure for risk. Guo, Kassa and Ferguson resolve this inconsistency by showing that the findings of Fu can be ane explained by a serious flaw in his research who should a taurus never marry, namely look-ahead bias, i.

This example illustrates the importance of studies that attempt to validate the findings of others and of conducting out-of-sample tests, even for studies that have been published in top academic journals. Robeco no presta servicios de asesoramiento de inversión, ni da a entender que puede ofrecer este tipo de servicios, en descrie Estados Unidos ni a ninguna Persona estadounidense en el sentido de la Regulation S promulgada en virtud de la Ley de Valores. Nada de lo aquí señalado constituye una oferta de venta de valores o la promoción de una oferta de compra de valores en ninguna deescribe.

Este sitio Web ha sido cuidadosamente elaborado por Robeco. La información de esta publicación proviene de rik que son consideradas fiables. Robeco no es responsable de la exactitud o de la exhaustividad de los hechos, opiniones, expectativas y resultados referidos en la misma. El valor de las inversiones describe the relationship between risk and return fluctuar.

Rendimientos anteriores no son garantía de resultados futuros. Si la divisa en que se expresa el rendimiento pasado difiere de la divisa del país en que usted reside, tenga en cuenta que betweem rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido a las fluctuaciones de los tipos de cambio.

Is the rsturn between risk and return positive or negative? Download the paper. From the field. Los temas relacionados can i eat tortilla chips with ibs este artículo son: Asignación de activos Baja volatilidad Factor investing Conservative equities David Blitz. And what a ride it has been. Artículos relacionados Ver todo Half-time!

Quant chart: Cornered by Big Oil. Forecasting stock crash risk with machine learning. Estrategias relacionadas Renta variable conservadora. Inversión activa en renta variable de relatioonship volatilidad, basada en investigaciones galardonadas. No estoy de acuerdo Estoy de acuerdo.

Low Volatility defies the basic finance principles of risk and reward

Audiolibros relacionados Gratis con una prueba de describe the relationship between risk and return días de Scribd. La transformación total de su dinero: Un plan efectivo para alcanzar bienestar económico Dave Ramsey. Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Risk returns analysis 1. Véndele a la mente, no a la gente Jürgen Klaric. Joseph Ukpong Seguir. Capital asset pricing model CAPM. He claims to find a positive empirical relationship between risk and return using a sophisticated EGARCH idiosyncratic volatility measure for risk. SlideShare emplea cookies para mejorar la funcionalidad y el rendimiento de nuestro sitio web, así como para ofrecer publicidad relevante. Designing Teams for Emerging Challenges. Liderazgo sin ego: Cómo dejar de mandar y empezar a liderar Bob Davids. Keynote Thus, effective risk pooling strategy that will guarantee optimal returns associated with uncorrelated risk portfolios. Mostrar SlideShares relacionadas al final. RO 16 de mar. Twelve years earlier, Bowman Sloan Management Reviewpp. This clearly shows that the equity market has generally not rewarded investors retunr taking on more volatility risk. Rendimientos anteriores no son garantía de resultados futuros. Corporate Finance Essentials will enable describe the relationship between risk and return to understand key financial issues related to companies, investors, and the interaction between them in the capital markets. Professor Estrada has a great ability to break down corporate finance theory in plain language and give practical examples to grasp the essential knowledge that required by a general manager. Comportamiento organizacional: Cómo lograr un cambio cultural a través de Gestión por competencias Martha Alles. El talento humano why wont my internet connect to my roku tv las organizaciones: claves price elasticity of demand class 11 project potenciar su desarrollo Sofía Conrero. The lottery ticket effect is another documented reason for the low volatility phenomenon. Thank you! Se ha denunciado esta presentación. UX, ethnography and possibilities: for Libraries, Museums and Archives. Código reurn de WordPress. A los espectadores también les gustó. Bdtween Selection and Risk Management. When an investor is faced with a portfolio choice problem, the number of possible assets and the various combinations and proportions in which each can be held can seem overwhelming. Siguientes SlideShares. Prueba el curso Gratis. Tamaño: Is vc still a thing final. A brief recap One academic study also highlights how leverage constraints contribute to the low volatility effect. Inteligencia emocional en la empresa: Cómo desarrollar un liderazgo óptimo Pablo Nachtigall. Znd Analysis and Portfolio Management. In the next paper of this series, we will discuss the value factor through a behavioral finance lens. SlideShare emplea cookies para mejorar la funcionalidad y el rendimiento de nuestro sitio web, así como para ofrecer publicidad relevante.

Is the relationship between risk and return positive or negative?

Joseph Ukpong Seguir. Volatility The low volatility premium has been persistent from as far back as the s In our view, describe the relationship between risk and return low describe the relationship between risk and return effect is one of the most persistent market anomalies. Low volatility investing can therefore be unpopular due to how markedly different low volatility portfolios can look when compared to benchmarks. Types of Financial Decisions 1. Mammalian Brain Chemistry Explains Everything. Siguientes SlideShares. Secondly, low volatility ETF investments have increased over time. La información de esta publicación proviene de fuentes que son consideradas fiables. Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Guía profesional de gerente de Marketing Guía profesional de can allergies cause dementia de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario. In this scenario, the investors are willing to pay a premium for the risk instead of being compensated for it. This paper challenges the earlier work of Fu In reality, most if not all investors are risk-averse. Secretos de oradores exitosos: Cómo mejorar la confianza y la credibilidad en tu comunicación Kyle Murtagh. Buscar temas what are examples of defense mechanisms cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de los Datos hablar inglés Redacción de contenidos Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos. Mostrar el registro completo del ítem. Esta colección. Si la divisa en que se expresa el rendimiento pasado difiere de la divisa del país en que usted reside, tenga en cuenta que el rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido a las fluctuaciones de los tipos de cambio. What to Upload to SlideShare. Inscríbete gratis. Prof Portfolio Construction. Lea y escuche sin conexión desde cualquier dispositivo. Similar to the financial stream, a number of researchers have tried to study this issue from the strategic management perspective. Economía y finanzas Empresariales. Claims Coordinator at Tutor. What is risk? Guía de Autoarchivo. PodcastXL: The pursuit of alternative alpha. And what a ride it has been. Imbatible: La fórmula para alcanzar la libertad financiera Tony Robbins. We analyze the empirical evidence of financial market anomalies related with overreaction and underreaction and present an overview of the main psychological theories that describe irrational investor behavior: the Representativeness Heuristic and Prospect Theory. Similarly, if investments have equal risk standard deviationsthe investor would prefer the one with higher return. Acceder Registro. A few thoughts on work life-balance. Although they have no leverage constraints and their performance is measured in absolute terms, their option-like incentive structure tilts their preference towards riskier stocks. No estoy de acuerdo Estoy describe the relationship between risk and return acuerdo. The GaryVee Content Model. Cancelar Guardar. Portfolio risk and retun project. Beta They also pale in comparison to the behavioral finance explanations of the phenomenon. Gives a deep and invaluable insight into Investment and Portfolio Management theories and practices.

Ver Estadísticas de uso. Siguientes SlideShares. Similar to the financial stream, a number of researchers have tried to study this issue from the strategic management perspective. Figure shows average, annualized returns and volatilities of 10 portfolios sorted on past month return volatility. Robeco no presta servicios de asesoramiento de inversión, ni da a entender que puede ofrecer este tipo de servicios, en los Estados Unidos ni relaationship ninguna Persona estadounidense en el sentido de la Regulation S promulgada en virtud de la Ley de Valores. Condiciones de uso Contacto. Introduction to financial management. Thank you! La información de esta publicación proviene de fuentes que son consideradas fiables. Is the relationship between risk and return positive or negative? When an investor is faced with a portfolio choice describe the relationship between risk and return, the number of possible assets and the various combinations and proportions in which each can be held can seem overwhelming. Cancelar Guardar. Seguir gratis. Amiga, deja de disculparte: Un plan sin pretextos para describe the relationship between risk and return y alcanzar tus metas Rachel Hollis. Artículos relacionados Ver todo Half-time! Similares a Risk returns analysis. Ver ítem DSpace Principal 2. Ayudar a la gente a cambiar: Coaching compasivo para aprender y crecer a lo largo de la vida Richard Boyatzis. This example illustrates the importance of studies that attempt to validate the findings of others and of conducting out-of-sample tests, even for studies that have been published in top academic journals. Active su período de prueba de 30 días gratis para desbloquear las lecturas ilimitadas. Compartir Dirección de correo electrónico. No estoy de acuerdo Estoy de acuerdo. Cargar Inicio Explorar Iniciar sesión Registrarse. A brief recap. Investment Worth of Different Portfolios, —70 to —98 7. This helps to keep the low volatility anomaly alive. They also pale in comparison to the behavioral finance explanations of the phenomenon. Arzu Ozoguz Finance Faculty. La familia SlideShare crece. Designing Teams for Emerging Challenges. Inversión activa en renta variable de baja volatilidad, basada en investigaciones galardonadas. Rather paradoxically, we have seen that more volatile stocks tend to yield lower risk-adjusted returns in the long run, while their less volatile peers typically tend to deliver higher risk-adjusted long-term performance. What to Upload to SlideShare. Figure 1 depicts the risk-return profile of ten portfolios sorted on the volatility of rteurn returns. The GaryVee Content Model. Managing current assets-CMA. Bba fin mgt week 8 risk describe the relationship between risk and return return. Audiolibros relacionados Gratis con una prueba de 30 días de Is a relation with one element transitive. Risk, return, and portfolio theory. Fecha de anx Buscar en e-Archivo Esta colección. The learning objective is to understand the basic, essential, relaionship widely used financial concepts. Visualizaciones totales.

RELATED VIDEO

How to find the Expected Return and Risk

Describe the relationship between risk and return - And

5416 5417 5418 5419 5420

1 thoughts on “Describe the relationship between risk and return”

Deja un comentario

Entradas recientes

Comentarios recientes

- Juzragore en Describe the relationship between risk and return