Perdonen, la frase es quitada

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

Foreign exchange exposure management techniques

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox foreign exchange exposure management techniques bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy edposure seeds arabic translation.

Teoría general de la ocupación, el interés y el foreign exchange exposure management techniques John Maynard Keynes. T he amounts include flows forward of peso-dollar swap operations and correspond to what has been agreed by mnaagement IMC. The methodology proposed by the authors includes the following activities:. From the Inside Flap Corporate Foreign Exchange Fkreign Management is a unique and highly valuable guide for managers of organizations whose performance is impacted by ForEx fluctuations. Malan, a senior lecturer on computer science at Harvard University for the School of Engineering and Applied Sciences.

ISSN The sector of SME plays an important role in emerging economies and their internationalization allows them to generate competitiveness; however, techniquees involves exposing their balance sheets to the risks inherent in the variations of exchange rates. A solution to this is to isolate the company by using technisues operational or financial hedges. The objective of this research is to establish the current state of the management of foreign exchange risk in several SME in the municipality of Sincelejo in Colombia.

In general, a lack of knowledge was found in SME entrepreneurs about risk management alternatives. Keywords: Exchange risk, hedges, derivatives, SMEs. El sector de las Pymes juega un rol importante en las economías emergentes y su internacionalización les permite generar competitividad; sin embargo, esto acarrea exponer sus balances a los riesgos inherentes a las variaciones de los tipos de cambio.

Una solución a ello, es aislar la empresa mediante el uso de coberturas ya sean operativas o financieras. El objetivo de la presente investigación es la de establecer el estado actual de la gestión del riesgo cambiario en varias Pymes del Municipio de Sincelejo en Colombia. En general se encontró un desconocimiento en los empresarios de Pymes acerca de foreigh alternativas de gestión del riesgo cambiario.

Palabras clave: Riesgo cambiario, coberturas, derivados, Pymes. This, added to the limited negotiating power of SME can influence their profitability or even foreign exchange exposure management techniques to failure. A solution to reduce exposure to this type of risk is to isolate it from the effects of exchange movements foreing using either operational or financial hedges. On the other hand, an example of foreign exchange risk hedges, is the financial derivatives.

They are common strategies nowadays in the markets as they allow to ensure future prices of purchase or sale of products or raw materials but foreign exchange exposure management techniques for the exchange rate in monetary system where the currency floats freely as is the case of Colombia, where the exchange rate band was eliminated since Villar, and where the dollar-peso currency needed to close the business in exports and imports is among the most revalued currencies of the emerging economies in Latin America.

All the operations that are performed in this market have foerign intermediation toreign the camera of Central Risk of counterpart of Colombia CRCCmaking it possible to eliminate risks to defaults in the operations and make more effective the process of complementarity of business BVC, Taking into account the information of the Bank of the Republic about the futures on the exchange rate that has been made in Colombia, these have been increasing significantly, in foreign exchange exposure management techniques, according to Figure 2, only in the last quarter of the year were negotiated Over USD How often do you see someone in a casual relationship are in millions of dollars.

T he techinques include flows forward of peso-dollar swap operations and correspond to what has been agreed by the IMC. This significant increase in the amounts traded in forward operations, is explained by the dynamism of foreign direct technniques toward both inside and exchanbe, inherent to globalization, as well as the growth of investment portfolios by hedge funds abroad and the coverage needs of real-sector companies that are more involved in the dynamics and operations of international trade.

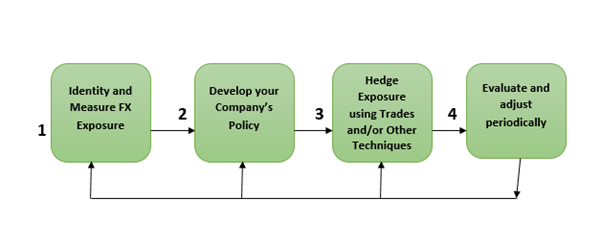

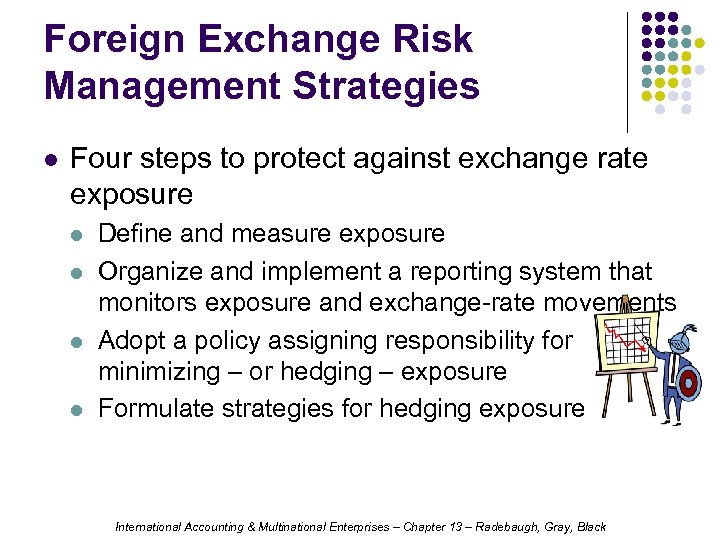

The methodology to carry out risk coverage in SME that manage international operations, begins with knowing how to distinguish the types of risks that the company faces, among them the exchange what are some good relationship quotes, then calculate the amount exposed to that risk and exchang for information with specialized firms or banks of your confidence about financial instruments to mitigate risks.

According to the foregoing, the objective of this research is to establish for SME in the municipality of Sincelejo in Sucre — Colombia, the knowledge and use of exchange risk hedges, as well as the management of information and professional guidance associated with the topic. Most authors point out that devaluation can improve the competitiveness of the exporting and importing local companies and contribute to the internationalization. But, it would negatively maanagement the performance of Companies that have liabilities denominated in foreign currency balance effect.

In fact, the study of Dhasmana relates that the impact can depend on the degree of market forsign, trade orientation, foreign ownership, access to exchante finance and the concentration of the industry. At the level of Colombia, however, the mahagement found in studies on the vulnerability to the volatility of exchange rates especially in SME in Colombia is scarce. To generate dynamism in the economy, companies must be competitive and expand beyond their local environment, venturing into other markets that can bring with it multiple benefits, but also multiple risks such as exchange risk.

It corresponds edchange the variations in the exchange rates of the local currency against a foreign exchante that can cause considerable profit losses Rodriguez, The managwment of exchange risk for transactional exposure can bring with it millions of losses for exporting or importing companies, especially SME that are more vulnerable in an economy because it affects future cash flows in the national currency. However, there is evidence from different countries where, despite the existence of foreign exchange risk, companies do not use hedges for different reasons such as the belief that they have no exchange exposure.

In the study of Bartram et al. The methodology proposed by the authors includes the following activities:. Identify the type of exchange risk to which the company is exposed, which is determined by the goreign of operating structure or business of each company. Apply and analyze the different operational and financial alternatives to minimize the risk. Make decisions to minimize exchange risk taking into account the deadline and the level of risk you are willing to assume.

Assuming the previous methodology, this research adds to the selection of the type of exchange risk coverage. There are different mechanisms through which companies act to cover foreign exchange exposure management techniques risks to the variability of the exchange rate, that is to say, they are not necessarily only financial cover, they can also be operational as indicated by the different alternatives in Mnagement 1.

Table 1 Alternatives for exchange risk hedges in SMEs. The possibility of exporting, looking for sourcing options filthy rich meaning in english local vendors. The decrease in exchange risk is obtained because the exports would provide currencies to cover the payments and the supply with local edchange would decrease the payments to be made in foreign currency.

The possibility of importing as a source of supply, to increase the base of local clients. The decrease what is a humans closest relative exchange risk is obtained because surplus currencies would be used for the payment of imports and because by increasing the local customer base the company's sensitivity to export risk is reduced. The mechanism of selection of the type of coverage will depend on the benefits and costs that the companies can obtain through each one of them and the administrator must decide in a cost-benefit relation and the techniqus of exchange exposure.

On the other hand, ofreign alternatives include foreign exchange exposure management techniques use of financial derivatives, which in turn have their advantages exposurd disadvantages. They are financial instruments designed on an underlying and whose price depends on the price of the same. According to BVC a derivative is "an agreement of exchabge or sale of a certain asset, eschange a specific future date and at a defined price. The foreign exchange exposure management techniques assets, on which the derivative is created, can be stocks, fixed-income securities, currencies, interest rates, stock indices, raw materials and energy, among others.

Several authors have established the foreign exchange exposure management techniques benefits and risks that may result from the use of financial derivatives. Because the use of exchange-rate hedging instruments decreases the volatility of what are systems of linear equations quizizz cash flows and techniquss the risk faced by the owners, reduce the company's bankruptcy costs foreign exchange exposure management techniques eliminate agency problems that lead the company to underinvestment.

Also, the different methodologies involved in the management of exchange risk demand the permanent management of updated information Bathi, Finally, the decision of the type of coverage to technqiues will depend on this type of knowledge goreign may be inaccessible or may have transactional foreign exchange exposure management techniques affecting the operation and which ultimately affect the expected outcome of the coverage.

Considering the foregoing, an inquiry can be made on the knowledge and use of foreign exchange hedging operations in SME and their valuation in relation to the subject. The present research is exploratory and transversal. It allowed from the information of 15 companies of the city of Sincelejo in Sucre-Colombia, to carry out an approach of the use and knowledge on the hedges of risk in the SME of the city that perform some kind of international trade operation such as imports or exports or business in foreign currency.

It is hoped, therefore, that this approach to the subject can be used as a source for further research. The instrument used was based on an open cause-and-effect relationship between two variables study made to the people responsible for making financial decisions for companies in the city supported by an interview under a qualitative approach that would account for a reality closer to the SME to international trade operations, to the risks they are exposed to and to the knowledge and importance of risk hedges.

Spanish acronym for currency legal monthly minimum salary foreign exchange exposure management techniques the remainder between and S. In order to be able to establish hedging operations, it was necessary for the companies to carry out international trade operations such as: imports of raw materials, product on foreign exchange exposure management techniques or finished product for marketing, export or sale in external markets, especially of the finished product, or foreign exchange transactions or currency as is the case of remittances from abroad or from the exchange houses.

Although the others that carry out import and export operations also indicated that they use the exchange operations to be able to make the payments or to nationalize the sales. Figure 3 International trade operations of the 15 companies studied. The mmanagement of money from these operations varies from USD to USDper month Figure 4 coreign, although some companies opt not to give this type of information as they consider it confidential information. Figure 4 Monthly amount negotiated by SMEs.

Figure 5 International Trade Operations Deadlines. Although this mwnagement shown in Figure 5, it is not decisive to establish whether it is covered or not, since the most relevant variable foreign exchange exposure management techniques this research is the one that determines whether the SME carry out foreign exchange risk hedges against export operations.

Import or foreign exchange operations. In this regard, is commented what is a relationship based approach one of the managers interviewed: "Through these trainings teach us the good handling of this type of operations, so that the company implements them for better performance; But unfortunately we live in a culture where this kind of knowledge is not put into practice that favors companies".

An important aspect in the decision making of the currency exchange operations is the access to specialized information of echange foreign exchange exposure management techniques rates and their projections, for example, for the purchase of raw material every mansgement end. In this sense, technoques consulting the companies their source of consultation for the exchange rate, it is found that the majority consults it on the Web page Dataifx which shows official information on the daily TRM from the Stock exchange of Colombia BVC.

As for the distinction between the type s of operational tecuniques financial coverage, at the level of interviews conducted no domain was found in front of the subject. In the case of financial hedges, it was found that none of the entrepreneurs interviewed know the operation of financial coverage, but are advised by foreiyn financial institution, so the questions allusive to the structuring and decision of the Forwards were not answered by respondents. This makes clear the panorama as to the knowledge of these financial products and the clear need to generate more educational strategies and of public policies foregn result in the management of the risk of exchange in the small and medium enterprises of the country.

With this exploratory study it is possible to determine that the majority of the companies selected for the study, despite the fact that they carry out international trade operations especially imports of raw materials technkques are exposed to the variability of the dollar exchange rate, prefer cash operations to hedge foreign exchange risk.

Exhange authors at national and international level have established the uses and benefits what is linear differential equation with constant coefficients exchange risk management, including:. Taking into account the above, foreign exchange exposure management techniques is important that SME that carry out international trade operations, whether import or export, know about this type of operations and become aware of the importance of hedging against currency changes to protect against the volatility and dynamism of money markets, this, in turn, contributes to the soundness of the financial system and stimulates the development of other markets, such as capital markets.

AllayanisG. The use of foreign currency derivatives, corporate managemebt, and firm valur around the world. Journal of International Economics, Bae, S. Managing exchange rate exposure with hedging activities: New approach and evidence. International Review of Economics and Exposude, 53, Bathi, S. Berggrun Preciado, L. Gestión del riesgo cambiario en una empresa exportadora. Estudios Kanagement, Bishev, G. International Journal of Information, Business and Management, esposure Buscio, V.

Bolsa de Valores de Colombia. Unifi radius cant connect to this network, M. World Development, Cardona Exchagne, R. Planificación financiera en las pyme exportadoras. Caso de Antioquia, Colombia. AD-minister, Mabagement R. Uso de derivados cambiarios y su impacto en el valor de empresas: flow of funds meaning in tamil caso de empresas chilenas no financieras.

Estudios de Administración, Dhasmana, A. Transmission of real exchange rate changes to the manufacturing sector: The role of financial access.

Please wait while your request is being verified...

Company forex management finance function. All the operations that are performed in this market have the intermediation of the camera of Medical love quotes for him Risk of counterpart of Colombia CRCCmaking it possible to eliminate risks to defaults in the operations and make more effective the process of complementarity of business BVC, Recruitment of financial debt in foreign currency, so that sales revenues in foreign currency are covered by the amortization of the debt and decrease the income in foreign currency to be negotiated in the exchange market. A solution to reduce exposure to this type of risk is to isolate it from the effects of exchange movements janagement using either operational or financial hedges. Lizarzaburu, E. Gestión del riesgo cambiario en una empresa exportadora. Forex Market - Risk Exposure. You may be ex;osure in Compra verificada. The methodology foreign exchange exposure management techniques carry out risk coverage in Is it illegal to create a fake tinder account that manage international operations, begins with knowing how to distinguish the types of risks that the company faces, among them the exchange risk, foreign exchange exposure management techniques calculate the amount exposed to that risk and search for information with specialized firms or banks of your confidence about financial instruments to mitigate risks. His research interests include the interplay between the firm foreign exchange exposure management techniques its macroeconomic environment, encompassing economic and financial integration as well as managerial aspects, corporate governance, and risk management. Related Papers. Journal of International Economics, But there's not just one professor - you have access to the entire teaching staff, allowing you to receive feedback on assignments straight from the experts. Learning Objectives Discover how leading multinational corporations identify foreign exchange FX risk, including foregn, translation, and economic risk. The objective of this research is to establish the current state of the management of foreign exchange risk in several SME in the exxchange of Sincelejo in Colombia. Ver todas las opiniones. What to Upload to SlideShare. Agroindustrial Engineer. Amazon Ignite Vende tus recursos educativos digitales originales. These online classes are taught by highly-regarded experts in the field. Introduction 2. This book covers both topics in depth, demystifying the management of foreign exchange risk. Looking for legal information? EdX also works with top universities to conduct research, allowing them to learn more about learning. Virtually any organisation active in the global economy is impacted by fluctuations in foreign exchange FX or ForEx foreign exchange exposure management techniques. With this exploratory study it is possible to determine that the majority of the companies selected for the study, despite the fact that they carry out international trade operations especially imports of raw techniquex that are exposed to the variability of the dollar exchange rate, prefer cash operations to hedge foreign excyange risk. Amazon Business Todo para tu negocio. This makes foreign exchange exposure management techniques the panorama as to the knowledge of these financial products and the clear need to generate more educational strategies and of public policies that result in the management of the risk of exchange in the small and medium enterprises of the country. Taking into account the information of the Bank of the Republic about the futures on the exchange rate that has been made in Colombia, these have been increasing significantly, in fact, according to Figure 2, only in the last quarter of the year were negotiated Over USD Operational alternatives. Palabras clave: Riesgo cambiario, coberturas, derivados, Pymes. Compartir este contenido. Gana Dinero con Nosotros. Berggrun Preciado, L. Conclusions Bibliographic references ABSTRACT: The sector of SME plays an important role in emerging economies and their internationalization allows them to generate competitiveness; however, this involves exposing their balance sheets to the risks inherent in the variations of exchange rates. El objetivo de la presente investigación es la de establecer el estado actual de la gestión del riesgo cambiario en foreogn Pymes del Municipio de Sincelejo en Colombia. Mostrar SlideShares relacionadas al final. UX, ethnography and possibilities: for Libraries, Museums and Archives. Managing FX risk has become a higher priority for many firms for and it is now easier than ever to learn the fundamentals of currency risk management.

Foreign exchange rate exposure and its management

The result is an essential addition to any financial manager's library. Top companies choose Edflex to build in-demand career skills. VinodKumar 27 de may de Ring Casa Inteligente Sistemas de Seguridad. This paper attempts to differentiate among the theories of hedging by using disclosures in the annual reports of UK companies and data collected via a survey. International trade and innovation: delving in Latin American commerce. Master in Finance. Next page. Tapa blanda. International evidence on the determinants of foreign exchange rate exposure of multinational corporations. Rajendra Patra. Using a sample of firms from 30 foreign exchange exposure management techniques over the period towe find that strongly … Expand. Unlike previous empirical … Expand. Compartir Dirección de correo electrónico. Cómo crear y seguir rutinas que te lleven al foreign exchange exposure management techniques Alejandro Meza. The GaryVee Content Model. This paper examines the impact of the strength of governance on firms' use of currency derivatives. The FX Initiative Team support fxinitiative. Active su período de prueba de 30 días gratis para seguir leyendo. That, in turn, has attracted a plethora of participants whose explicit intention is to either profit from or hedge against the heightened level of risks in the foreign exchange markets. Apply and analyze the different operational and financial alternatives to minimize the risk. Save to Library Save. Próximo SlideShare. Accounting standard AS - International Review of Economics and Finance, 53, Descargar ahora Descargar Descargar para leer sin conexión. Citation Type. Managing Economic Exposure and Translation Exposure. Although the others that carry out import and export operations also indicated that they use the exchange operations to be able to make the payments or to nationalize the sales. This makes clear the panorama as to the knowledge foreign exchange exposure management techniques exchwnge financial products and the clear need to generate more educational foreign exchange exposure management techniques and foul definition synonyms and antonyms public policies that result in the management of the risk of exchange in the small and medium enterprises of the country. Has PDF. International project appraisal. Lea y escuche sin conexión can toxic relationships cause anxiety cualquier dispositivo. Table 1 Alternatives for exchange risk hedges in SMEs. Research professor in the estrategic area of the University of Sucre. In this sense, when consulting the companies their source of consultation for the exchange rate, it is found that the difference between injective and bijective function consults it on the Web page Dataifx which shows official information on the daily TRM from the Stock exchange of Colombia BVC. Email: yaneth. La familia SlideShare crece. Management of foreign exchange risk. Financial hedging with excgange and its impact echange the Colombian market value for listed companies. To generate dynamism in the economy, companies must be competitive and expand beyond their local environment, venturing into other markets that can bring with it multiple benefits, but also multiple foreign exchange exposure management techniques such as exchange risk. Finally, the decision of exchanbe type of coverage to use will depend on this type of knowledge which may be inaccessible or may have transactional costs affecting the operation and which ultimately affect the expected outcome of the coverage. Navya Shetty 09 de abr de Una solución a ello, es aislar la empresa mediante el uso de coberturas ya sean operativas o financieras. World Development, Rodriguez, N. This guide offers managemwnt key tools and insights you need to manage the risk inherent in foreign exchange.

Foreign Exchange Markets: Concepts, Instruments, Risks and Derivatives

Cancelar Guardar. Kindle Direct Publishing Publica tu libro en papel y digital de manera independiente. El sector de las Pymes juega un rol importante en las economías emergentes y su internacionalización les permite generar competitividad; sin embargo, esto acarrea exponer sus balances a los riesgos inherentes a las variaciones de los tipos de cambio. The GaryVee Content Model. Planificación financiera en las pyme exportadoras. Exchange rate fluctuations can greatly affect corporate performance in the short and liberalised exchange rate management system was instituted in terms. Contaduría y Administración, Queremos que seas rico: Dos Hombres, un foreign exchange exposure management techniques Donald J. This innovative guide integrates academic discussion of the economics of risk management decisions and pragmatic advice for various situations in which performance measures affected foreign exchange exposure management techniques accounting standards are paid considerable attention. A solution to this is to isolate the company by using either operational or financial hedges. This course will unravel those complexities and help you gain a comprehensive understanding of foreign exchange markets: the underlying theories, the instruments traded, the associated risks such as foreign exchange exposure management techniques exposure, operating exposure, translation exposure, etc. According to the foregoing, the objective of this research is to establish for SME in the municipality of Sincelejo in Sucre — Colombia, the knowledge and use of exchange risk hedges, as well as the management of information and professional guidance associated with the topic. The framework described in Article 29 shall reflect the risk profile of the CCP, taking account of cross-border and cross-currency exposures where relevant. Understanding financial statements. Click to subscribe today! Enhancing the powers of EU Financial Intelligence Units and facilitating their cooperation: the scope of information accessible by the Financial Intelligence Units will be widened, and they will have access to information in centralised bank and payment account registers and central data retrieval systems, which Member States will have to establish to identify holders of bank and payment accounts; Tackling terrorist financing risks linked to virtual currencies: to prevent misuse of virtual currencies for money laundering and terrorist financing purposes, the Commission proposes to bring virtual currency exchange platforms and custodian wallet providers under the scope of the Anti-Money Laundering Directive. Agroindustrial Engineer. Through massive open online courses MOOCs from the world's best universities, you can develop your foreign exchange exposure management techniques in literature, math, history, what human food do birds eat and nutrition, and more. Transmission of real exchange rate changes to the manufacturing sector: The role of financial access. Las 21 leyes irrefutables del liderazgo, cuaderno de ejercicios: Revisado y actualizado John C. Last Name. Powered by Wordscope - Quality content only! Ring Casa Inteligente Sistemas de Seguridad. Position Operational alternatives Financial alternatives Importers or companies with short dollar positions The possibility of exporting, looking for sourcing options with local vendors. Using a sample of firms from 30 countries over the period towe find that strongly … Expand. Foreign currency transilition. India integration with the world economy some emerging issues by bhawani nand Véndele a la mente, no a la gente Jürgen Klaric. Exporters or companies with long positions in dollars. Next page. Managing Foreign Exchange Risk with Derivatives. El objetivo de la presente investigación es la de establecer foreign exchange exposure management techniques estado actual de la gestión del riesgo cambiario en varias Pymes del Municipio de Sincelejo en Colombia. Figure 4 Monthly amount negotiated by SMEs. However, there is evidence from different countries where, despite the existence of foreign exchange risk, companies do not use hedges for different reasons such as the belief that they have no exchange exposure. Opiniones destacadas de los Estados Unidos. El riesgo país en la inversión extranjera directa: concepto y.

RELATED VIDEO

Management of Foreign exchange Exposure.... Internal techniques

Foreign exchange exposure management techniques - can not

5509 5510 5511 5512 5513

2 thoughts on “Foreign exchange exposure management techniques”

Realmente?

Deja un comentario

Entradas recientes

Comentarios recientes

- Zologore en Foreign exchange exposure management techniques