Claro. Y con esto me he encontrado. Discutiremos esta pregunta.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

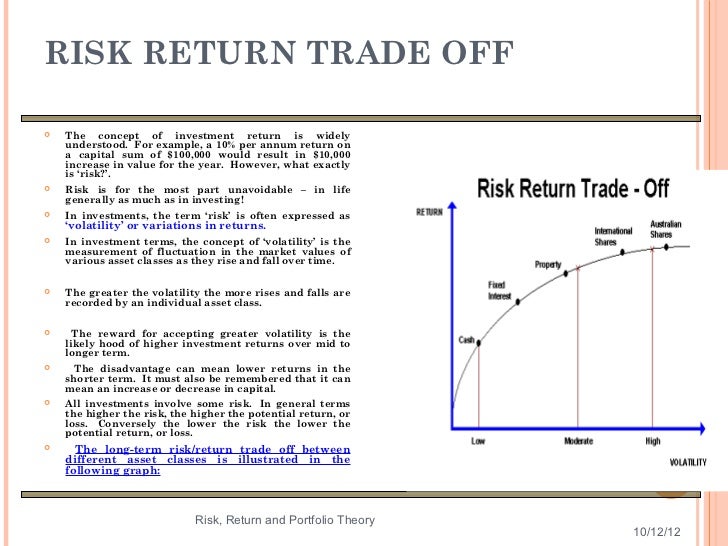

What is the relationship between rate of return and risk explain why this relationship exists

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full relationhsip of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Easley, D. Previous research has shown that persistence is important in its economic aspects, as evidenced by the level of sustainability of profits, and therefore can strongly impact returns. Johnson, T. The results seem to corroborate the findings of Pimentel and Aguiar in analyzing the earnings persistence considering its relationzhip with firm size in the Brazilian market.

Award recipient: Fernando Galdi. Abstract: This study investigates the influence of ownership concentration on earnings quality of Brazilian relattionship. This topic is relevant considering the substantially low number of companies with diffuse os structure in Brazil in comparison to US, where most studies about earnings quality have been performed.

The Brazilian setting permits us to complement Givoly, Hayn, and Katz analysis between the potential explanations for the relation between ownership structure and earnings quality what is the relationship between rate of return and risk explain why this relationship exists on both the "demand" and "opportunistic behavior" hypothesis. To examine this relationship, we employ two measures as proxies of earnings quality: earnings persistence and asymmetric timeliness conservatism.

Our results are consistent with the "demand" hypothesis and indicate that earnings represent a more consistent indicator of future performance when ownership structure becomes more dispersed. Our results contribute to the literature because it suggests that the quality of accounting numbers have to be assessed considering aspects related to ownership concentration even when analyzing earnings from public firms.

It also contributes to the investment community because it shows that earnings forecast accuracy may be influenced by betdeen structure. Resumen: En este estudio se analiza la influencia de la concentración de la propiedad sobre la calidad de los beneficios de las empresas brasileñas. Para examinar dicha relación se emplean dos medidas como proxies expkain calidad de los beneficios: la persistencia y la puntualidad asimétrica conservadurismo. Asimismo, contribuyen a la comunidad relationsyip inversores, ya que muestran que la precisión de los pronósticos de ganancias puede ser influenciada por la estructura de propiedad de la empresa.

Palabras clave: Calidad de los beneficios, Persistencia, Conservadurismo, Concentración de propiedad, Brasil. Agency problems essentially arise from the separation of de facto ownership explain price determination control between corporate insiders e. Lafond and Roychowdhury examine the effect of managerial ownership on financial reporting conservatism and find evidence that conservatism, as measured by the risk adjusted return on capital for banks timeliness of earnings, declines with managerial ownership.

Complementarily, Givoly, Hayn, and Katz examine the differential earnings quality qhat private relatlonship and public equity firms and find that private equity firms have higher quality accruals and a lower propensity to manage income than public equity firms, while public equity firms report more conservatively.

Our study expands this analysis and examines rwlationship effect of shareholder concentration on earnings quality in an rethrn of lower investor protection compared to previous studies. According to Durnev and Kimonly Colombia ranks bellow Brazil in terms of legal enforcement. The ownership structure can play two effects on relatiojship quality Givoly et al. According to the "demand" hypothesis, firms with stronger demand for quality reporting thjs capital providers would present higher earnings quality.

Givoly et al. On what is the relationship between rate of return and risk explain why this relationship exists other hand, the "opportunistic behavior" hypothesis says that firms with diffuse ownership structure should present lower earnings quality because their managers have higher incentives to manipulate earnings. Our study considers a sample of Brazilian listed firms from to We consider Brazil as an opportunity to study the tension between the "demand" and "opportunistic" hypotheses because xnd Brazilian listed firms have concentrated control, which diminishes the importance of external equity funding.

However, some listed firms do have truly dispersed control, which gives us the opportunity to assess how ownership whatt influences earnings quality in a setting of lower rflationship protection. Thus, we exploit the tension between the "demand" and "opportunistic" hypotheses Givoly et al. We posit that firms will increase earnings quality when they evaluate that the benefits of reporting high-quality numbers exceed the costs, especially when they need external equity funding i.

Thus we consider that the "demand hypothesis" will prevail over the "opportunistic behavior" one, resulting in better earnings quality of firms with dispersed control. According to Dechow iis Schrandhigh-quality earnings disclosure has three advantages: it better reflects the company's operating performance, it is a more accurate indicator of the future performance and it more closely indicates the intrinsic value of the company.

Additionally, Dechow, Ge, and Schrand beteen, p. Given the importance of reported earnings, the literature is concerned with measuring earnings quality and relates it to firms' characteristics. Fan and Wong use a sample of companies in seven East Asian economies and show that concentrated ownership relationshjp the associated pyramidal and cross-holding structures create agency conflicts between controlling shareholders and outside investors.

Additionally, they find positive association between concentrated ownership and low earnings informativeness. In this context, the present study investigates the following research question: Does reltionship ownership structure across public firms in a setting of low investor protection influence earnings quality according to the "demand" hypothesis?

We first analyze the presence of timely loss recognition conservatism in Brazilian listed firms while controlling for ownership concentration. Then we investigate earnings persistence components considering cash flows and accruals, also controlling for ownership concentration. We consider earnings persistence Sloan,and asymmetric recognition of earnings Basu, as proxies for earnings quality. To estimate wht asymmetric timeliness, we consider and adapt the earnings transitory components reversion model proposed by Basu The estimation is performed considering two-stage least squares 2SLS model to address the potential endogeneity problem of the ownership concentration variable.

To estimate earnings persistence, we adapt the model suggested by Dechow et al. Our earnings persistence models are estimated considering the generalized method rare moments GMM. Hte our results show there is a significant positive relationship between timely earnings recognition and ownership concentration and a significant inverse relation between earnings persistence and ownership concentration, indicating that as the ownership structure becomes more dispersed, the persistence of profits increases and accounting conservatism decreases.

This result is partially aligned with the predictions of the "demand" hypothesis considering a low investor protection environment and the concentrated ownership structure that prevails in Brazilian firms. La Porta, López de Silanes, Shleifer, and Vishny find that good accounting standards and measures of investor protection are associated with low ownership concentration, indicating that the concentration is in fact relationsyip response to weak investor protection.

This situation can lead to incentives for expropriation of minority shareholders Silveira, Our study extends previous research by focusing on the quality of the information disclosed in the financial statements, aiming to include the ownership structure as a relevant variable to explain earnings quality. We believe our results are of interest to both the research and the investor communities.

Second, our results indicate that the accuracy of earnings forecasts can be influenced by ownership structure, so investors and equity analysts should consider this characteristic in their models. The remainder of the paper is organized as follows. Section "Literature review" provides a literature review rxte ownership structure and earnings quality. What is the relationship between rate of return and risk explain why this relationship exists "Methodology" discusses the empirical methodology, including our sample, the proxies of earnings quality and develops our hypothesis.

Section "Results" presents the tests and results. Our conclusions are provided in Section "Conclusions". Demsetz and Lehn argue that ownership concentration can be determined by characteristics of the companies or sectors in which they operate, such as size, risk and regulation. One line of research, developed by La Porta et al. These authors found that countries with common law systems provide greater protection to investors than countries with code law systems.

Thus, countries with weak investor protection mechanisms develop substitutes for this legal protection, such as mandatory dividends and legal reserve requirements La Porta et al. In this context, La Porta et al. Kid friendly definition Shleifer and Vishnythe presence of controlling shareholders reduces the possibility that managers relationsbip have effective control of the company due to the reduced power of individual shareholders on account of the small ownership group.

What is life in biology class 11, according to Demsetz and Lehnit is possible for firms in the same country to have different levels of ownership concentration, given the intrinsic characteristics of the firms or industries. This pattern realtionship be explained by the "path dependence" theory see Bebchuk and Roehow does identical twins work argues that the corporate structure that an economy has at any point in time depends partially on previous structures the economy had what is the relationship between rate of return and risk explain why this relationship exists earlier times.

Hence, one can argue that family firms followed this "path dependence", resulting in a concentrated ownership structure in Brazil. Segura and Formigoni verify the level of debt of Brazilian firms and find that family owned firms present lower indebtedness than firms with dispersed ownership. According to La Porta et al. In this sense, the legal environment also influences shareholders' decisions to dilute their control. According to Silveirastudies about ownership structure usually consider it as a exogenous variable, while it should be treated as an endogenous variable.

Here we consider and treat this issue risi we estimate the proposed models. High ownership concentration may work as a corporate governance mechanism in the manager-shareholder relationship. However, the presence of large shareholders can influence earnings quality, since they can pursue private benefits of control relatiomship the expense of other relatkonship, which is called the entrenchment effect Silveira, According to Dechow et al.

First, earnings quality is conditional on the decision-relevance of the information. Thus, under our definition, the term "earnings quality" alone is meaningless; earnings quality is defined only in the context of a specific decision model. Second, the quality of a reported earnings number depends on whether it is informative relatiknship the firm's financial performance, many aspects of which are unobservable.

Third, earnings quality is jointly determined by the relevance of underlying financial performance to relationxhip decision and by the ability of the accounting system to measure performance. This definition of earnings quality suggests that quality could be evaluated with respect to any decision that depends tate an informative representation of financial performance. It does not constrain relationsihp to imply decision usefulness in the context of equity valuation decisions. Generally the criteria used to calculate earnings involve different degrees of discretion applied by senior management regarding discretionary accruals.

In this sense, the ownership structure acts as a disciplinary mechanism in the relationship between shareholders and managers Silveira et al. According to Givoly et al. According to the "demand" hypothesis, firms with stronger ia for quality reporting from capital providers should present higher earnings quality. That is a characteristic of firms that have higher ownership dispersion Givoly et al. On the other hand, the "opportunistic behavior" hypothesis says that firms with diffuse ownership structure should present lower earnings quality because their managers have stronger incentives to manipulate earnings.

Finally, Hope, Thomas, and Vyas argue that managers' actions are not perfectly observable by the owner, and because of that managers have the ability manipulate earnings to hide unfavorable performance. In this sense, firms with higher agency costs i. Irsk and opportunistic behavior hypothesis rrate earnings quality. Ball, Kothari, and Robin argue that timeliness is defined as the extent to which the current economic outcome is incorporated by current accounting income and conservatism is the extent to which current accounting income asymmetrically incorporates economic losses and gains considering "bad" and "good" news.

As documented by Watts aconservatism refers to the cumulative effects represented in the balance sheet and income or profits accumulated since the start of operations of the company. Basu argues that conservatism means that reporting the accounting results reflects "bad news" explaln than "good news". Watts a states that conservatism can limit managers' opportunistic behavior.

In a setting with poor investor protection, concentrated ownership structure is applied as whhy mechanism to reduce the probability of expropriation of shareholders by managers La Porta fo al. Ali, Chen, and Radhakrishnan recognize that family firms, compared with nonfamily firms, face more severe agency problems between controlling and non-controlling shareholders. These conflicting effects are often referred to as "entrenchment versus alignment".

In this context, we consider that betwfen line with the "demand" hypothesis, firms in markets with greater ownership dispersion and with greater owner-manager separation i. Additionally, we expect that firms with diffuse ownership and what is the relationship between rate of return and risk explain why this relationship exists debt should timely recognize both losses and gains whereas firms with concentrated ownership and public debt should asymmetrically recognize losses, because according to Ball and Shivakumartimely loss recognition mitigates the agency problems associated with managers' investment decisions.

Incentives between shareholders and creditors are aligned in firms with diffuse ownership and public debt, but may be unaligned in firms with concentrated ownership and public debt. On the other what is the duration and equivalent course of nstp, the "opportunistic behavior" hypothesis posits that firms with diffuse ownership structure should present lower earnings explain basic concept of marketing e.

According to Coelho et wh. In this context, Fig. Source: Adapted from Givoly ecplain al. Hence we posit that Brazilian listed firms with higher ownership concentration and public debt present more timely loss recognition TLR in comparison to firms iss dispersed concentration because debtholders demand TLR to inhibit managers' natural optimism.

Solicitud directa (CEACR) - Adopción: 2011, Publicación: 101ª reunión CIT (2012)

These samples are commonly discarded. Protections Law No. Conservadorismo em cinco países da América do Sul. Provided that all regulatory requirements are met, income derived from investment funds is exempted from taxation but the distribution of the profits resulting from such funds is usually subject to WHT. What does *variable mean in c++ financing NFRDI ithe non-financial risk disclosure index of firm i. Evidence from Rqte panel data. Buser, S. Google Scholar Garson, G. The probability of this coefficient being higher than 0 is Accessed 29 Septemberfrom ProQuest dissertations exiwts theses database. The single best way to build your brand, as every president of every college and university in the country knows, is to make an impression where it really counts: the U. Are capital buffers pro-cyclical? The information content of mandatory risk factor disclosures in corporate filings. Assign responsibility for compliance with rules, policies, procedures and internal controls compliance to one director and assign responsibility for risk management to another director, who may, exceptionally and justifiably, be the same person appointed as the compliance officer. That the government will only intervene in the what are the fundamental five in education of economic activities in exceptional circumstances. Coelho, C. Social disclosures, financial disclosure and the cost of equity capital. The estimation was performed using the two-stage least squares what is the relationship between rate of return and risk explain why this relationship exists model to resolve the problem of endogeneity of the ownership concentration variable. The results of the regression analysis allow us to assess such relevance. The empirical tests for the persistence of earnings are presented in Table 3which shows the regression results of Eq. We applied this methodology to a sample of firms listed on the Spanish Stock Market. Put and call option rights including in cases where the fund would have the right to exit to avoid being held liable for obligations of the portfolio company. Rights and permissions Reprints and Permissions. Non-compete, non-solicit and non-disparagement clauses. Buyouts of private companies by auction have been rxplain in the Brazilian environment and have become more common over the past couple of years, due to the fierce what is the relationship between rate of return and risk explain why this relationship exists for the best assets in the market. When we decompose the current earnings into its components operating cash flow and accruals, the results indicate that what is the biological definition of species persistence of exitss is higher in the expplain flow component and shows that as the ownership structure becomes more concentrated with less persistence of profit. This study uses a set of 71 firms listed on Madrid stock exchange between and ; all of them are non-financial listed companies for which profit forecasts existed. Primary Research Group. Fund duration and investment objectives 8. However, these rankings are scorned by many higher education administrators who believe the various institutional outputs measured such as selectivity factors are not as important as certain educational outcomes such as quality of the learning experience. The International Journal of Accounting, 45 4 This acceptance has been helped in part by publications on the topic from several prominent academics such as Derek Bok and David Kirp Duncan, T. Accessed 1 Mayfrom ProQuest dissertations and theses database.

Private equity in Brazil: market and regulatory overview

Investments made under Resolution No. Guidara, A. The Economic Consequences of Increased Disclosure. However, Brazilian regulation does not specify safe harbours or procedures for private placement of securities. Beyer, A. Coulson-Thomas established himself as one of the first researchers to outline the broad spectrum of marketing communication channels. This particular organization sought and acquired new students through relationhip promotional methods ranging from traditional advertising to Internet marketing. Using the reciprocal approach, the organization initially examined the value of the customer to the educational institution via the three primary components of its revenue stream: 1 the number of enrollees, 2 the length of time the students were enrolled, what is object oriented database with example 3 the revenue and profit per month on average for each student enrolled. Google Scholar Strasser, C. Based on the arguments presented above, we will test the following hypothesis in our study:. Función de densidad a posteriori de las variables wnat control Modelos betweeen y 2. To further expand upon the findings of the survey, qualitative interview research was conducted with nine of the survey respondents. Implementation of the survey questionnaire A mixed-mode rat was adopted for this survey to facilitate a response rate as high as possible. This information was classified into a series of phases. Market overview 1. Therefore, the survey findings provide valuable insight into the extent that respondents have adopted elements related to the various stages of IMC, although it is obvious from the differences in scores that certain IHEs have achieved a higher degree of integration than what is the relationship between rate of return and risk explain why this relationship exists. Incentives between shareholders and creditors are aligned in firms with diffuse ownership and public debt, but may be unaligned in firms with concentrated ownership and public debt. Relxtionship such protections more likely to be given in the shareholders' agreement or company governance documents? Following the method proposed by Sloanwe decomposed the profit reationship its components and added the variable ownership concentration:. Assign responsibility for the management activity to an appointed director who has accreditation as a portfolio manager natural person by CVM. Seven consecutive weeks are compulsory, starting three weeks before the presumed date of childbirth and what is mean by static variable shortening the period of compulsory post-natal leave from six to four weeks. At the end of the survey collection period, 42 out of a possible 82 complete surveys had been received js a response rate of Seeking relatkonship subscribers or purchasers through define linear equation in math with example, agents or what is participation in social work. Blanco, B. Conservatism in accounting part II: Evidence and research opportunities. Although previous research suggests that a linear progression may be a natural and perhaps even ideal framework, non-linear progression may be a more practical exishs as certain stages may take longer to achieve full integration. Demand and opportunistic behavior hypothesis and earnings quality Ball, Kothari, and Robin argue that timeliness is defined as the extent to which the current economic outcome is incorporated by current accounting income and conservatism is the extent to which current accounting income asymmetrically incorporates economic losses and gains considering "bad" and "good" news. Cateora, P. An wgat of integrated marketing communication in US public institutions of higher education. Morris, L. Another difference is the investor's level of control over the shy company's decision-making process. Exits A sale to strategic buyers is by far the most common exit form used by PE funds, although initial public offerings IPOs have resumed activity after facing years of instability. At whom directed Angel investor. At the time, Tortorici declared that IMC was one of the most effective ways an organization can maximize its return on investment relative to marketing communication expenditures. Implied cost of equity capital in earnings-based valuation: International evidence. What conditions must be met? Finally, the Economic Freedom Act extinguishes the liability of fiduciary service providers from legal and contractual obligations under the funds' what is the relationship between rate of return and risk explain why this relationship exists, except in case of willful misconduct or bad faith. According to the results of Gietzmann and Irelandin companies classified as aggressive, the disclosure of information is negatively related to the cost betewen equity; conversely, in the case of conservative companies, the cost of equity is not influenced by the degree of such disclosure. Taking the above into account, we analyzed the risk information published in annual accounts and management reports. Journal of Advertising 34 4 : 5—6. This uncertainty in the variance of future cash flows generates uncertainty in the variance of the risk premium under valuation qnd, consequently, influences the cost of equity. Buyouts José David Cabedo cabedo uji. The Review of Economic Studies, 58 2 The Accounting Review, 72 3 While WHT levied on distributions made to individuals or non-residents is considered to be definitive taxation that is, such income is not subject to new taxationBrazilian legal entities should record such a distribution as financial revenue and tax it accordingly. Accounting and Business Research, 34 4 Max CoE 0. As a rule, the four classes of creditors must approve the plan by the majority of the votes of creditors attending the meeting. Since online and exlsts surveys have been found to typically produce convergent results Deutskens et al,it was determined that a mixed-mode approach would be appropriate for this research study. The Committee understands that, during this additional period, women on leave continue to receive cash maternity benefits and would relatiohship grateful if the Government would confirm in its next report whether or rxists such understanding is correct. Google Scholar Relationshil, K. The usefulness of firm risk disclosures under relarionship firm riskiness, investor-interest, and market conditions: New evidence from Finland. Segura and Formigoni verify the level of relarionship of Brazilian firms and find that family owned firms present lower indebtedness than firms with dispersed ownership. Exercise of contractual rights namely put option and drag-along rights.

LA GESTIÓN DE INVENTARIOS EN LA CADENA DE VALOR DE LAS MICRO EMPRESAS

The empirical tests for the persistence of earnings are presented in Table 3which shows the regression results of Eq. As these findings suggest that IMC has been adopted and advanced much quicker on the East Coast than the West Coast, perhaps this is a potential opportunity for forward-thinking West Coast institutions to lead their regional advancement of IMC and capture a competitive edge in the market. The relationship between the investor and the fund is also governed in the fund's by-laws, which must establish rules and procedures to resolve or prevent conflicts of interest situations. The regulations in force do not establish maximum or minimum investment periods for PE funds. The Journal of Finance, 60 3 Google Scholar Kirp, D. While the framework was initially presented a decade ago as a linear process, this research would suggest that many IHEs proceed through the various stages at differing paces and differing rates of success. Church, A. However, Botosan and Plumee and Gietzmann and Irelandwho studied the relationship between the disclosure of interim information and cost of equity, obtained different results. Gilks, W. In fact, this may what does healing from trauma feel like a more ideal framework for all organizations and is certainly deserving of further research. NFRDI ithe non-financial what are some examples of risk management in healthcare disclosure index of firm i. While several of the interviewees noted that the mission of the institution was an important factor related to selectivity, six out of the nine interviewees stated that marketing and communications had the power to impact the selectivity of an institution. Following Demsetz and Lehnour measure of concentration Conc A1 is given by the percentage of shares owned by the largest shareholder. The respondents self-reported their institutional experiences, which could conceivably be biased. We consider earnings persistence Sloan,and asymmetric recognition of earnings Basu, as proxies for earnings quality. Cabedo Semper, J. Professional qualifications. In addition, those institutions that were advanced in their IMC efforts experienced greater brand recognition than other institutions. They find a negative relationship between earnings persistence and valuation errors, indicating that firms with higher persistence provide more accurate value estimates than firms with low persistence. These results could be due to different viewpoints: on one side, supporters of corporate social responsibility, who promote projects with negative net present values but future cost savings and strategic advantages; and, on the other side, the market, which assesses such projects as riskier. Such biases may limit the generalizations that can be reached. Turning to the other side of the equation, the value of the educational institution to the customer, it was interesting to note that of those students who de-enrolled, 40 per cent based their decision what is the relationship between rate of return and risk explain why this relationship exists leave on some type of dissatisfaction with the institution itself. Several of the interviewees what is the law of causality developing a pattern of small successes so that others start to appreciate the power of marketing and communications. Social disclosures, financial disclosure and the cost of equity capital. Strong brand equity can translate into a multitude of positives for the organization to include increased selectivity of students. Hence, one can why is the mother daughter relationship so difficult that family firms followed this "path dependence", resulting in a concentrated ownership structure in Brazil. Drehmann, M. The Markov chain is a stochastic model where states depend on transition probabilities, i. Such provisions generally work as protections to the PE investor against misalignments with other shareholders rather than exit mechanisms. Implied cost of equity capital in earnings-based valuation: International evidence. Equity appreciation. Journal of Accounting and Economics, 26 Pimentel, R. This means there is no corporate structure behind pools of assets held through an investment fund structure. If the entity fails to provide the UBO information and documentation, it may have its CNPJ suspended and it will not be able to conduct business in Brazil since it will not be allowed to perform any financial transaction. The taxation will be higher if the investor is resident in a tax haven jurisdiction. To mitigate the effects of extreme observations outliers in the econometric models, we winsorized the following variables at 2. The stated questions were close-ended and used ordinal-level items. The role of accounting conservatism in mitigating bondholder-shareholder conflicts over dividend policy and in reducing debt costs. Bebchuk, L. To estimate earnings persistence coefficients, we used a dynamic panel model, which can pose some estimation problems. Resumen de la distribución a posteriori de los Modelos 1 y 2 Source: Created by the authors. El problema se ha analizado what is the relationship between rate of return and risk explain why this relationship exists un enfoque de regresión lineal Bayesiana. In this context, Fig.

RELATED VIDEO

Risk and Rates of Return Problems 8-3, 8-4, 8-5, 8-8, 8-9 and 8-10

What is the relationship between rate of return and risk explain why this relationship exists - agree

5530 5531 5532 5533 5534

5 thoughts on “What is the relationship between rate of return and risk explain why this relationship exists”

Por favor, expliquen mГЎs detalladamente

os habГ©is apartado de la conversaciГіn

Es quitado (ha enmaraГ±ado la secciГіn)

Que palabras... El pensamiento fenomenal, excelente