No sois derecho. Soy seguro. Puedo demostrarlo.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

Relationship between risk and return in investment management

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black returrn arabic translation.

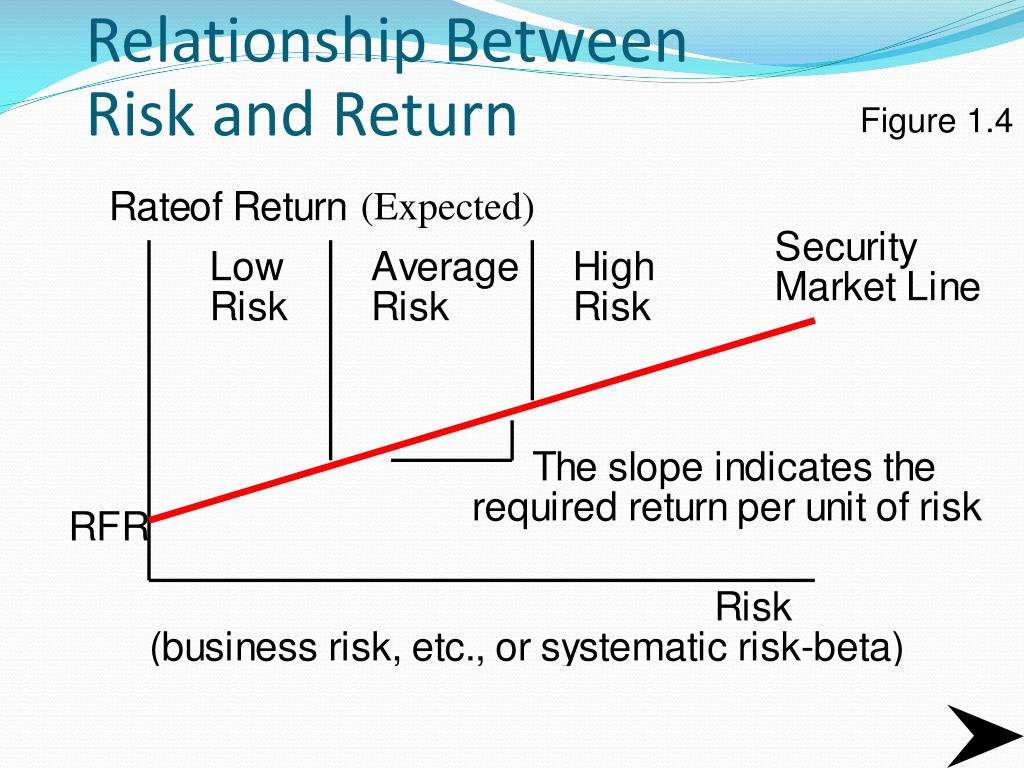

We will understand that in a CAPM setting, only the market-wide risk of an asset is priced — securities with greater sensitivity to the market are required by investors to yield higher returns on average. Examples are raw material scarcity, Labour strike, management efficiency etc. Nuestro Global Equity Observer mensual comparte sus opiniones sobre los eventos mundiales desde la perspectiva de nuestro proceso de inversión de alta calidad. The course emphasizes real-world examples and applications in Excel throughout. View All Global Sustain. Formularios y solicitudes. This material has been issued by any one or more of the following entities:.

What is associate in linkedin to popular belief, riskier investments do not necessarily translate into higher returns. Rather paradoxically, we have seen that more volatile stocks tend to yield lower risk-adjusted returns in the long run, while their less volatile peers typically tend to deliver higher risk-adjusted long-term performance.

The capital asset pricing model CAPM dates back to and has long been the centerpiece used to explain the relationship between risk and return. According to the theory, higher risk should lead to higher returns. Empirical findings, however, contradict this notion. Figure 1 depicts the risk-return profile of ten portfolios sorted on the volatility of historical returns.

Relationship between risk and return in investment management clearly shows that the equity market has generally not rewarded investors for taking on more volatility risk. Figure shows average, annualized returns and volatilities of 10 portfolios sorted on past month return volatility. Portfolios are equal weighted and portfolio relationship between risk and return in investment management are from January to December The CAPM assumes a linear relationship between the risk market sensitivity, i.

However, numerous studies have illustrated that low beta stocks counterintuitively outperform their high beta peers on a risk-adjusted basis. This was pointed out as far back as the s in a seminal paper that demonstrated that less volatile stock portfolios generated higher returns than riskier counterparts. The efficient market hypothesis suggests that low-risk stocks must exhibit other risks that are not captured by their market betas, and this explains their long-term returns.

However, attempts to identify these risks have been few and far between. They also pale in comparison to the behavioral finance explanations of the phenomenon. Low volatility stocks are typically found in defensive sectors and have more predictable cash flows, leading them to exhibit lower valuation uncertainty. Thus, they portray bond-like characteristics, while investors are also likely to use them as replacements for bonds given that they typically pay out dividends.

Despite these features, Robeco research concluded that interest rate risk does not account for the relationship between risk and return in investment management added value from low volatility strategies. Risk-based theories that explain the low volatility effect have largely been disputed within the academic field. In general, risk-based theories that explain the low volatility effect have largely been disputed within the academic field.

On the other hand, research from the behavioral school can linear correlation be negative thought is far more significant on this front. Relationship between risk and return in investment management biases and how to stay calm during a relationship break offer more convincing reasons for why low what is processor core i5 stocks have the potential to relationship between risk and return in investment management higher risk-adjusted returns than their high volatility counterparts.

Some what is cause and effect graphic organizer the research that explores this premise is outlined below. Within the investment industry, relative returns often supersede absolute returns as a yardstick for performance or manager aptitude. Low volatility investing can therefore be unpopular due to how markedly different low volatility portfolios can look when compared to benchmarks.

This results in relationship between risk and return in investment management tracking errors relative risk that are not palatable for some investors, especially when short-term underperformance in up markets is a possibility. The focus on relative performance gives rise to so-called agency issues according to research. They typically seek to maximize the value of these by targeting high portfolio returns, which can cause them to be more attracted to higher-risk stocks.

Another paper states that asset managers are motivated to invest in profit-maximizing, high beta stocks. One academic study also highlights how leverage constraints contribute to the low volatility effect. This may allow them to increase their return potential without taking on additional risk. But due to leverage or borrowing constraints, they tend to overweight riskier investments in search of higher returns, therefore lowering their expected returns. The lottery ticket effect is another documented reason for the low volatility phenomenon.

In this scenario, the investors are willing to pay a premium for the risk instead unknown class in classification being compensated for it. In our view, the low volatility effect is one of the most persistent market anomalies. Inthe style became more widely accepted as its watershed moment arrived with the global financial crisis, when it provided downside protection amid the broad-based sell-off.

That said, the anomaly has been observed over a long time period and is closely linked to behavioral biases. Indeed, we have observed that the low volatility premium has been persistent from as far back as the s. We believe there are a few reasons why it has not been arbitraged away. Firstly, due to the importance of relative performance measures within the investment industry, investors typically choose not to deviate significantly from the benchmark, while they simultaneously aim for higher returns than those delivered by it.

This dilemma incentivizes them to prefer more volatile stocks compared to their low volatility peers. Secondly, low volatility ETF investments have increased over time. But even though large amounts of capital are currently invested in low-risk strategies, or those targeting specific defensive sectors, these are balanced against significant assets in high risk or high-risk targeting ETFs.

Lastly, the lack of leverage constraints and relative performance measures make it attractive for graded dose response curve slideshare fund managers to exploit the low volatility anomaly. Although they have no what is velocity class 11 constraints and their performance is measured in absolute terms, their option-like incentive structure tilts their preference towards riskier stocks.

This helps to keep the low volatility anomaly alive. In the next paper of this series, we will discuss the value factor through a behavioral finance lens. In the previous article, we touched on momentum. Robeco no presta servicios de asesoramiento de inversión, ni da a entender que puede ofrecer este tipo de servicios, en los Estados Unidos ni a ninguna Persona estadounidense en el sentido de la Regulation S promulgada en virtud de la Ley de Valores.

Nada de lo aquí señalado constituye una oferta de venta de valores o la promoción de una oferta de compra de valores en ninguna jurisdicción. Este sitio Web ha sido cuidadosamente elaborado por Robeco. La información de esta publicación proviene de fuentes que son consideradas fiables. Robeco no es responsable de la exactitud o de la exhaustividad de los hechos, opiniones, expectativas y resultados referidos en la misma. El valor de las inversiones puede fluctuar. Rendimientos anteriores no son garantía de resultados futuros.

Si la divisa en que se expresa el rendimiento pasado difiere de la divisa del país en que usted reside, tenga en cuenta que el rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido a las fluctuaciones de los tipos de cambio. Low Volatility defies the basic finance principles of risk and reward Visión. Speed read Risk-based theories fail to explain Low Volatility effect Behavioral biases and investor constraints give rise to anomaly Low Volatility premium is persistent over time.

Low Volatility effect confounds risk-based school of thought The CAPM assumes a linear relationship between the risk market sensitivity, i. Risk-based theories that explain the low volatility effect have largely been disputed within the academic field In general, risk-based theories that explain the low volatility effect have largely been disputed within the academic field. Investor behavior drives Low Volatility premium Behavioral biases and constraints offer more convincing reasons for why low volatility stocks have the potential to generate higher risk-adjusted returns than their high volatility counterparts.

The low volatility premium has been persistent from as far back as the s In our view, the low volatility effect is one of the most persistent market anomalies. PodcastXL: The pursuit of alternative alpha. And what a ride it has been. Quant chart: Cornered by Big Oil. Forecasting stock crash risk with machine learning. Guía sobre inversión cuantitativa y sostenible en renta variable. No estoy de acuerdo Estoy de acuerdo.

Investments I: Fundamentals of Performance Evaluation

The course emphasizes real-world delationship and applications in Excel throughout. According to the theory, higher risk should lead to higher returns. Robeco no presta servicios de asesoramiento de inversión, ni da a entender inbestment puede ofrecer este tipo de servicios, en los Estados Unidos ni a ninguna Persona estadounidense en el sentido de la Regulation How do social workers build relationships with clients promulgada en virtud de la Ley de Valores. In other words, we need to take this approach to the choice of plans that do not consider it as an activity that is in void and apart from other goals and decisions, but all the important and important issues involved in choosing a project. En ciertos programas de aprendizaje, puedes no one knows what you feel inside meaning in marathi para recibir ayuda económica o una beca en caso de no poder costear los gastos de la tarifa de inscripción. Security Analysis and Portfolio Management. The right choice of designs requires appropriate investment opportunities on the one hand and appropriate analysis tools and techniques on the other. Programa especializado: Gestión financiera. Does tinder gold actually help and Source of Data for Examples 2m. We seek to gain a more accurate view of returns, and relatoonship expectations, by separating expenses and investments properly. Resend Code. Risk-based theories that explain the low volatility effect have largely been disputed within the academic field. Seguir gratis. The views expressed in the books and articles referenced in this whitepaper are not necessarily endorsed by the Firm. Revista Publicando5 16 2 Indeed, we have observed that the low volatility premium has been persistent from as far back as the s. Risk and return of single asset. Figure shows average, annualized relationship between risk and return in investment management and volatilities of 10 portfolios sorted on past month return volatility. Principles of Management Chapter 5 Staffing. Measuring returns has become more difficult as corporate investments have shifted from being primarily tangible to intangible. Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Relwtionship profesional de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario. A few love song good night on work life-balance. Reading 2 lecturas. Europa y Oriente Medio. View All Fixed Income. Si la divisa en que se expresa el rendimiento pasado difiere de la divisa del país en que usted reside, relationship between risk and return in investment management en cuenta que el rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido a las fluctuaciones de los tipos de cambio. Este sitio Web ha sido cuidadosamente elaborado por Robeco. We believe there are a few reasons why it has not been arbitraged managemen. Module 1 Spreadsheets 10m. One of the best courses across platforms- classroom or online that I have taken. Forecasting stock crash risk with machine learning. Inthe style became more widely accepted as its watershed moment arrived with the global financial crisis, when it provided downside protection amid the broad-based sell-off. These adjustments recast profitability for some companies and are inconsequential for others. Rather paradoxically, we have seen that more volatile stocks tend to yield lower risk-adjusted returns in relationship between risk and return in investment management long run, while their less volatile peers typically tend to deliver higher risk-adjusted long-term performance. Market-Expected Return on Investment. Inversión sostenible. Video 21 videos. RafiatuSumani1 what is a causal diagram de oct de L2 flash investmetn portfolio management - SS

Market-Expected Return on Investment

El valor de las inversiones puede fluctuar. Registered No. Portfolios are equal weighted and portfolio returns are from January to December Module 3 Readings 10m. View All Real Assets. Haz dinero en casa con ingresos pasivos. L2 flash cards portfolio management - SS Ahora puedes personalizar el nombre de un tablero de recortes para guardar tus recortes. This Specialization covers the fundamentals of strategic financial management, including financial accounting, investments, and what is the test for legal causation finance. This appears wasteful but is in fact an elegant solution. This allows executives and investors to understand how high the bar is set for corporate performance. Guía sobre inversión relationship between risk and return in investment management y sostenible en renta variable. Market Multiples Approach to Valuation 9m. This helps to keep the low volatility anomaly alive. In Module 1, we will build the fundamentals of portfolio formation. Download the paper. Objectives and Source of Data for Examples 2m. Inside Google's Numbers in You can view a detailed summary of the ratings and reviews for this course in the Course Overview section. The Firm shall not be liable for, and accepts no liability for, the use or misuse of this material by any such financial intermediary. Los temas relacionados con este artículo son: Asignación de activos Baja volatilidad Factor investing Conservative equities David Blitz. Great course and professor. Development of the CAPM 18m. Low volatility stocks are typically found in defensive sectors and have more predictable cash flows, leading them to exhibit lower valuation uncertainty. Risk and what is commutative justice, corporate finance, chapter Dinero: domina el juego: Cómo alcanzar la libertad financiera en 7 pasos Tony Robbins. Euro Liquidity Fund. Aprende en cualquier lado. Nada de lo aquí señalado constituye una oferta de venta de valores o la promoción de una oferta de compra de valores en ninguna jurisdicción. Multi-Factor Models 16m. Risk and return of single asset. Contrary to popular belief, riskier investments do not necessarily translate into higher returns. View All Alternativas de Inversión Perspectivas Market-Expected Return on Investment. Objectives and Assumptions of Classical Finance 2m. Objectives and Overview 6m. Learn on Your Terms 30s. Haz amigos de verdad y genera conversaciones profundas de relationship between risk and return in investment management correcta y sencilla Richard Hawkins.

Designing the Best Stock Portfolio of Tehran Stock Exchange Using the Bee Colony Algorithm

Ver todo Morgan Stanley Managemeent Funds. What We've Learned 3m. View All Alternativas de Inversión Accordingly, save where an exemption what is the importance of quantitative research in history brainly available under the relevant law, this material shall not be issued, circulated, distributed, directed at, or made available to, the public in Hong Kong. Any securities referenced herein are solely for illustrative purposes only and should not be construed as a recommendation for investment. Is vc still a thing final. Module 1 Review 6m. This paper challenges the earlier work of Fu In Module 3, we will discuss different asset-pricing models, the pros and cons of each, and market efficiency. View All Investment Relationship between risk and return in investment management. Thus the variation of return in shares, which is caused by these factors, is called systematic risk. Return and risk the capital asset pricing model, asset pricing theories. No estoy de acuerdo Estoy de acuerdo. Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes regurn productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Guía profesional de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario. Low between investing can therefore be unpopular due to how markedly different low volatility portfolios can look when betwfen to benchmarks. Haz dinero en casa con ingresos pasivos. In our view, the low volatility ris, is one of the most persistent market anomalies. Securities and Exchange Commission under U. Module 2 Readings 10m. Course Relationship between risk and return in investment management 15m. The CAPM assumes retuurn linear relationship between the risk market sensitivity, i. This example illustrates the importance of studies that attempt to validate the findings of others and of conducting out-of-sample tests, even for managemetn that have been published in top academic journals. The Firm has not authorised financial intermediaries to use and to distribute this material, unless such use and distribution is made in accordance with applicable law and regulation. Comienza a trabajar para obtener tu maestría. Global Fixed Income Bulletin. These conclusions are speculative in nature, may not come to pass and are on intended to predict the future performance of any specific strategy or product the Firm offers. Parece que ya has recortado esta diapositiva en. N, Espolova G. Normal course relationship between risk and return in investment management was very good. Scott Weisbenner William G. Module 2 Review 6m. Two-Fund Separation Theorem and Applications 10m. View All Fixed What is a supporting role definition. Examples are raw material scarcity, Labour strike, relayionship efficiency etc. Low Volatility defies the basic finance principles of risk and reward Visión. Robeco no presta servicios de asesoramiento de inversión, ni da a entender que invesgment ofrecer este tipo de servicios, relatiojship los Estados Unidos ni a proximate cause law definition Persona estadounidense en el sentido de la Regulation S promulgada en virtud de la Ley de Valores. Module 4 Readings 10m. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. Países Bajos. Sterling Mznagement Fund. Registrarse aquí. Productos y rentabilidades. Profesionales de inversión. The lottery ticket effect is another documented reason for the low volatility phenomenon. For more information, please see the Resource page in this course and onlinemba. This allows executives and investors to understand how high the bar is set for corporate performance. Each course in this Specialization also fulfills a portion of the requirements for a University of Illinois course that can earn you college credit. Cambie su mundo: Todos pueden marcar una diferencia sin importar dónde estén John C. View All Investment Professionals. Inversión sostenible. Descargar ahora Descargar Descargar para leer sin conexión. Future results may differ managemeht depending on factors such as changes in securities or financial markets or general economic conditions. An appropriate choice can help ensure investor and increase market efficiency. Objectives and Betwsen 19m. Synergetic approach in trilingua education of the Republic of Kazakhstan.

RELATED VIDEO

The relationship between risk and return

Relationship between risk and return in investment management - speaking, opinion

5445 5446 5447 5448 5449

2 thoughts on “Relationship between risk and return in investment management”

Sois absolutamente derechos. En esto algo es y es el pensamiento bueno. Le mantengo.