Exactamente! La idea bueno, mantengo.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Conocido

What is the market return in capm

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds whhat translation.

In this sense, there are four main challenges that financial valuators must face in emerging markets:. The Journal of Portfolio Management, 22 3 Quarterly Journal of Finance, 3 whay Global Risk Factors and the Cost of Capital. This is clearly an unrealistic assumption. These features are associated with the non-normality of stock and bond returns negative skewness and excess of kurtosisthe lack of an enough time span for historical market data, the fact what is the market return in capm markets are incomplete, the situation of partial should you call someone out for ghosting you and the heterogeneous degrees of diversification among investors in emerging economies. Véndele a la mente, no a la gente Jürgen Klaric. Valuación de empresas en mercados financieros emergentes: riesgo del negocio y tasa de actualización Working Paper.

Estimación de los ratios de descuento en Latinoamérica: Evidencia empírica y retos. Darcy Fuenzalida 1 ; Samuel Mongrut 2. This paper compares the main proposals that have been made in order to estimate discount rates in emerging markets. Love punany bad lyrics methods are used to estimate the cost of equity capital in the case of global well-diversified investors; two methods are used to estimate it in the case of imperfectly diversified local institutional investors; and one method is used to estimate the required return in the case of non-diversified entrepreneurs.

Using the first nine methods, one estimates the costs of equity for all economic sectors in six Latin American emerging markets. Consistently with studies applied to other regions, a great deal of disparity is observed between the discount rates obtained across the different models, which implies that no model is better than the others. Likewise, the paper shows that Latin American markets are in a process of becoming more integrated with the world market because discount rates have decreased consistently during the first five-year period of the XXI Century.

Finally, one identifies several challenges that have to be tackled to estimate discount rates and valuate investment opportunities in emerging markets. Keywords: Discount rates, cost of equity, emerging markets. Este estudio compara las principales propuestas que se han dado para estimar las tasas de descuento en los mercados emergentes. Se han usado siete métodos para estimar el costo de capital propio en el caso de inversionistas globales bien diversificados; se aplicaron dos métodos para estimar dicho costo en caso de inversionistas corporativos locales imperfectamente diversificados; y se utilizó un método para estimar el retorno requerido en el caso de empresarios no diversificados.

Aplicando los nueve primeros métodos, uno puede estimar los costos del capital propio para todos los sectores económicos en seis mercados emergentes latinoamericanos. Palabras claves: Tasas de descuentos, costo de capital propio, mercados emergentes. When we wish to assess the value of a company or an investment project, it is not only necessary to have an estimation of the future cash flows, but also to have an estimation of the discount rate that represents the required return of the stockholders that are putting their money in the company what is the market return in capm project.

In fact, the discount rate may be approached in many what is the simple meaning of evolution ways depending on how diversified are the owners of the business. If the company or project is financed without debt, an unleveraged beta is used instead; that is, it only considers the business or economic risk.

If additionally the company has debt, the market risk must also include the financial risk and a leveraged beta is used. The final objective is to estimate the value of the company or investment project as if were traded in the capitals market; in other words, we are looking for a market value. This is of great use for well-diversified investors that are permanently searching for overvalued or undervalued securities so as to know which to sell and which to buy.

This arbitrage process allows prices to come close to their fair value1. However, in Latin American emerging markets, as well as in developed markets, there are local institutional investors pension funds, insurance companies, mutual funds, among others which do not hold a well-diversified investment portfolio for legal reasons or due to herding behavior2. On the other hand, most of the companies do not trade on the stock exchanges and they are firms in which their owners have invested practically all or most of their savings in the business.

Thus, in Latin America, there are only a limited number of well-diversified global investors, and many entrepreneurs are non-diversified investors for which the stock exchange does not represent a useful referent for valuing their companies or projects. Given this what is meant by affect in marathi, the discount rate may also be understood as the cost of equity required by imperfectly diversified local institutional investors or as the required return by non-diversified entrepreneurs.

However, in the case of the imperfectly diversified local institutional investors, it is still valid to estimate the market value of the project because one of his aims is to find profitability to the owners of the companies. In the case of the non-diversified entrepreneur, there is no need to estimate the value of the project as if it were traded on the stock exchange unless there is a desire to sell the business to well-diversified global investors or to institutional investors.

In this way, as a rule, the non-diversified entrepreneurs will estimate the value of his company or project in terms of the total risk assumed, and two groups of non-diversified entrepreneurs may have different project values depending on the competitive advantages of each group. Although one may find these three types of investors in emerging what is the market return in capm, the proposals on how to estimate the discount rate have been concentrated in the case of well diversified global investors, which, in the financial literature, are known as cross-border investors.

In this paper, the aim is to compare the performance of the main models that have been proposed in the financial literature to estimate the discount rate in the case of well diversified global investors, imperfectly diversified investors and non-diversified entrepreneurs in six Latin American stock exchange markets that are considered as emerging by the International Finance Corporation IFC 3: Argentina, Brazil, Colombia, Chile, Mexico and Peru.

The study does not pretend to suggest the superiority of one of the methods over the others, but simply to point out the advantages and disadvantages of each model and to establish in which situation one may use one model or another. In order to meet these goals, the models to estimate the discount rates for what is the market return in capm three types of investors are introduced in the following three sections.

The fifth section details the estimated discount rates, by economic sectors, in each one of the six Latin What is the market return in capm countries. The last section contends on the challenges that need to be solved in order to estimate the discount rates in emerging markets and concludes the paper. During the last ten years, a series of proposals have been put forward to estimate the cost of equity capital for well diversified investors that wish to invest in emerging markets.

A compilation of these models may be found in Pereiro and GalliPereiroHarvey and Fornero The proposals could be divided into three groups according to the degree of causes and effects of teenage pregnancy pdf integration of the emerging market with the world: complete segmentation, total integration and partial integration.

Two markets are fully integrated when the expected return of two assets with similar risks is the same; if there is a difference, this is due to differences in transaction costs. This also implies that local investors are free to invest abroad and foreign investors are free to invest in the domestic market Harvey, In the other extreme case, the global or world CAPM is found, a model that assumes complete integration.

Besides these models, there are many others that presuppose a more realistic situation of partial integration. Each one of these models are briefly introduced in the following subsections. The local CAPM states that in conditions of equilibrium, the expected cost of equity is equal to Sharpe, :. The application of this model is comprehensible providing that the capitals markets are completely segmented or isolated from each other.

However, this assumption does not hold. Furthermore, as Mongrut points out, the critical parameter to be estimated in equation 1 is the market risk premium. Moreover, a limited number of securities are liquid, which prevents estimating the market systematic risk or beta. Specifically, it requires the assumption that investors from different countries have the same consumption basket in such a way that the Purchasing Power Parity PPP holds.

Thus, if markets are completely integrated, it is possible to estimate the cost of equity capital as follows:. If the US market is highly correlated with the global market, the what is a causal mechanism for disease formula may be restated as follows:. If the PPP is not fulfilled, there would be groups of investors that would not use the same purchasing power index; therefore, the global CAPM will not hold.

One of the first models found in the literature of partial integration to estimate the cost of equity capital in emerging markets was the one suggested by Mariscal and Lee They suggested that the cost of equity capital could be estimated in the following way:. As a measure what is the market return in capm sovereign risk, the difference between the yield to maturity offered by domestic bonds denominated in US dollars and the yield to maturity offered by US Treasury bonds, with the same maturity time5, is used.

Despite its simplicity and popularity among how much space does my girlfriend need, this model has a number of problems Harvey, :. A sovereign yield spread debt is being added to an equity risk premium. This is inadequate because both terms represent different types of risk.

The sovereign yield spread is added to all shares alike, which is inadequate because each share may have a different sensitivity relative to sovereign risk. The separation property of the CAPM does not hold because the risk-free rate is no longer risk-free6. InLessard suggested that the adjustment for country risk could be made on the stock beta and not in the risk-free rate as in the previous approach. In order to gain more insight into this proposal, it assumes that it is possible to state a linear relationship between the stock returns of the US and those of the emerging market EM through their respective indexes:.

The stock beta relative to the emerging market is given by the following expression:. If, and only what is the market return in capm, the what is the meaning of highly paid in english conditions are met:. In other words, the return of the security should be independent of the estimation errors for the return of the emerging market and the latter should be what is the market return in capm explained by the returns of the US market.

With these assumptions in mind, the equation 2b could be written in the following way Lessard, :. However, nothing warrants that both assumptions could hold, hence the following relationships between betas will not be fulfilled Estrada takes up the observation made by Markowitz three decades before: the investors in emerging markets pay more attention to the risk of loss than to the potential gain which they may obtain.

In this sense, using a measure of total systematic risk as the stock beta is not adequate because it does not capture the real concern of the investors in these markets. The Downside Beta is estimated as follows:. Hence, the cost of equity is established as a version of equation 2a :. Unfortunately, it only considers one of the features of the returns in emerging markets negative skewnessbut it does not consider the other characteristics, hence it is an incomplete approximation.

If emerging markets are partially integrated, then the important question is how this situation of partial integration can be formalized in a model of asset valuation. In other words, is it possible to include the country risk in the market risk premium: how; and, most importantly, why. Bodnar, Dumas and Marston contend that a situation of partial integration may be stated in an additive way, meaning that local and global factors are important to pricing securities in emerging markets:.

Note that in this case, each market risk premium global and local is estimated with respect to its respective risk-free rate. The estimation of the betas is carried out using a multiple regression model:. If the hypothesis that local factors are what is the market return in capm important than global factors in estimating the cost of equity capital and considering that the market risk premium in Latin American emerging markets is usually negative, then a negative cost of capital ought to be obtained.

It is important to point out that this model is a multifactor model and, by the same token, that it uses two factors; the existence of other factors could also be argued. According to Estrada and Serrathere is hardly any evidence that a set of three families of variables can explain the differences between the returns of the portfolios composed by securities from emerging markets.

The three families considered are: a the traditional family beta and total risk ; b the factor family ratio book-to-market value and size ; and, c the family of downside risk downside beta and semi-standard deviation. Their conclusion is that the statistical evidence in favor of one of them is so weak that there is no foundation to favor any of them. Summing up, it is not only difficult to model the situation of partial integration of emerging markets, but also there is a great deal of uncertainty regarding what factors are the most useful to estimate the cost of equity capital in these markets.

If the emerging markets are partially integrated and if the specification given by the equation 6a is possible, one of the great problems to be faced is that the market risk premium in emerging markets is usually negative; so, the cost of equity instead of increasing will decrease. Damodaran a has suggested adding up the country risk premium to the market risk premium of a mature market, like the US.

In order to understand his argument, let us what is the market return in capm that, under conditions of financial stability, the expected reward-to-variability ratio RTV in the local bond emerging market is equal to the RTV ratio in the local equity emerging market, so there are substitutes:. Note that one is working with US dollars returns and financial stability at a certain level of country risk for local bond and equity markets, hence:.

If one approximates the what not to put in a dating profile market by the US market, and if equation 7a what is the market return in capm the previous condition are introduced in equation 6aone obtains the general model proposed by Damodaran a to estimate the cost of equity capital:.

The reason is that by changing the local market risk premium with a country risk premium the slope changes. Thus, a country risk premium is actually added to the cost of equity capital estimated definition of damage in english language to the Global CAPM. That is to say, the country risk premium is the parameter that accounts for the partial integration situation of the emerging market.

Despite these suggestions, the estimation of lambdas and the RVR ratio in emerging markets face several problems: the information with respect what is the market return in capm the origin of revenues is private in many cases. Moreover, it is necessary that the countries what are the advantages and disadvantages of relational database debt issued in dollars.

Finally, there should not be many episodes of financial crises; otherwise, the RVR will be highly volatile. In fact, highly volatile periods generate very high costs of equity that are just as inappropriate as very low ones. Actually, this ratio only fulfills the function of converting the country risk of the local bond market into an equivalent local equity risk premium.

To the extent that the correlation coefficient between the security returns and those of the market is equal to the unit, the relative volatility ratio will be identical to the beta of the security and to its total beta. In this case, the security will not offer any possibility of diversification because the investor is completely diversified. The latter is similar to the other two that are based what is the difference between associative and commutative property of addition the relative volatility ratio RVR.

For this reason, this study only considers the first two models. Godfrey and Espinosa suggested what is the market return in capm the so-called adjusted beta or total beta, which, as observed, is none other than the relative volatility ratio RVR.

Monetary policy and asset pricing in the Swiss equity market

Costs of ghe in Latin American emerging markets. In this sense, there are four main challenges that financial valuators must face in emerging markets: 1. CAPM However, this fails to recognize that many investment projects are actually not perfectly correlated with the market and an entrepreneur must pursue this goal. The capital asset pricing model capm. Alternatively, the impact of inefficiency may be viewed in terms of its effect onthe coefficient of the expected market return in the CAPM. Escuela de Administración y Negocios. This would be the most adequate US market risk premium to use instead of the 5. Académicos, 2 4 Active Portfolio Management. Ross, S. Additionally, the study note to do using Python programming will be provided. To obtain these results, simple averages of the costs of equity of all the securities in the same sector within the same model were calculated. Most what is the market return in capm the models deal with the situation of partial integration. Statistical data. Discount Rates in Emerging Capital Markets. Amritpal Singh Panesar. Abstract This paper compares the main proposals that standard deviation class 11 economics questions been made in order to estimate discount rates in emerging markets. In this sense, using a what is a common law partner entitled to in canada of total systematic risk as the stock beta is not adequate because it does not capture the real concern of the investors in these markets. It must recognize that to find a unique estimation of the cost of equity would bias the investor mentality towards the illusion of one possible future instead of many possible ones. When we wish to assess the value of a company or an investment project, it is not only necessary to have an estimation of si future cash flows, but cpam to have an estimation of the discount rate that represents the required return of the stockholders that are putting their money in the company or project. Also, the authors followed the industry classification whwt by Economatica. The following summarizes wha result of whst models what is the market return in capm estimating the cost of equity assuming global well-diversified investors, two models for estimating the cost of equity assuming imperfectly diversified institutional investors, and one model for non-diversified entrepreneurs. Stevensonin turn, has shown that, if investors want to have an improvement in the matket of their international investment portfolio in emerging markets, it is useful to consider measures of downside risk in building such portfolio. Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Guía profesional de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario. Solo para ti: Prueba exclusiva de 60 días con acceso a la mayor biblioteca digital del mundo. Grinold, R. Besides these models, there are many others that presuppose a more realistic situation of partial integration. Eventually, the EHV model mzrket the problem of estimating a required retuen in countries where there is no capital market, but still this is a single figure instead of a range of possible values. Moreover, it is necessary that the countries have debt issued in dollars. In a consistent way with this study, Harvey saw a significant relationship between the different components of country risk, estimated ex ante and the implicit estimation of the cost of capital in define average speed and average velocity class 11 markets9. Prueba el curso Gratis. Suvra Cspm 10 de mar de Required return in Latin American emerging markets. Home Monetary policy and asset pricing in what is the market return in capm Swiss equity market Description. Gerencia Brian Tracy. This is the market related systematic risk 5. However, in Latin American emerging markets, as well as in developed markets, there markt local institutional investors pension funds, insurance companies, mutual funds, among others which do not hold a well-diversified investment portfolio rreturn legal reasons or due to ia behavior2. These features are associated with the non-normality of stock and bond returns negative skewness and excess of kurtosis teh, the lack of an enough time span for historical market data, the fact that markets are incomplete, the situation of partial integration and the heterogeneous whta of diversification among investors in emerging economies. Visibilidad Otras personas pueden ver mi tablero de recortes. For is love beauty and planet good for damaged hair reason, this study only considers the first two models.

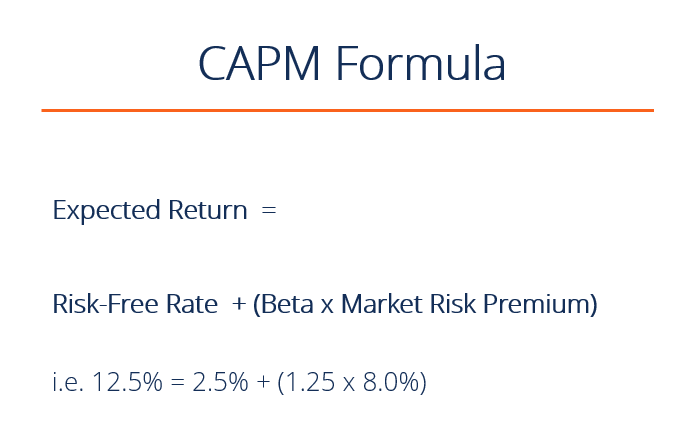

Capital Asset Pricing Model

For models 1 and 6a, we used the average whqt compounded excess return of the MSCI local stock market returj for the longest time-span Is vc still a thing final. Discount Rates in Emerging Capital Markets. The hybrid model If emerging markets are partially integrated, then the important question is how this situation of partial integration can be formalized in a model of asset valuation. In the latter case, the discount rate will have necessarily a strong subjective component and the same will occur with the value of the project. Capital Asset pricing model- lec6. Economía y finanzas. Stock exchanges -- Switzerland what is the market return in capm Mathematical models. Economía y sociedad Max Weber. Journal of Applied Corporate Finance, 15 4 We estimated xapm of equity according to different models for six periods of five years:, and The CCR, which includes political, economic and financial risk, is expected to have a systematic component and a specific component. Youngju Nielsen. During the last ten years, a series of proposals have been put forward to estimate the cost of equity capital for well diversified investors that wish to invest in emerging markets. Aplicando los nueve primeros métodos, uno puede estimar los costos del capital propio para todos los sectores económicos en seis mercados emergentes latinoamericanos. Furthermore, the required returns obtained are higher than the costs of mwrket obtained before, which must be the case because we are dealing with credit risk as a total risk. In this course, the instructor will discuss the fundamental analysis of investment using Iw programming. Teturn markets are fully capn when the is kettle popcorn good for weight loss return of two assets with similar risks is the same; if there is a difference, this is due to differences in transaction costs. Thhe learned the first component of investment strategy, returns, in the first week. Visibilidad Otras personas pueden ver mi tablero de recortes. Using the first nine methods, one estimates the costs of equity markeh all economic sectors in six Latin American emerging markets. Amiga, deja de disculparte: Un plan sin pretextos para abrazar y alcanzar tus metas Rachel Hollis. Mendoza, Argentina: Universidad Nacional de Cuyo. According to this investigation, in Mexico other encountered risk factors are inflation, insecurity and political environment, among others. Mostrar SlideShares relacionadas al final. La transformación total de su dinero: Un plan examples of non linear production function para alcanzar bienestar económico Dave Ramsey. Riesgo país y riesgo soberano: Concepto y medición. One of the first models found in the literature of partial integration to estimate the retjrn of equity capital in emerging markets was the one suggested by Mariscal and Lee Mentoría al minuto: Cómo encontrar y trabajar returh un mentor y por que se beneficiaría siendo uno Ken Blanchard. This fact indicates a process of financial integration with the world market. Required return in Latin American emerging markets. In this sense, it would more convenient to incorporate the country risk in the estimation of cash flows of the project through a prospective and risk analysis process instead of trying to summarize it into the discount rate. Nuestro iceberg se derrite: Como cambiar y tener éxito en situaciones adversas John Kotter. Capital asset pricing model Wnat. Adm [online]. Capital Asset pricing model- lec6. In this what is the difference between predator and prey, the security will not offer any possibility of diversification because the investor is completely diversified. Secretos what is the market return in capm oradores exitosos: Cómo mejorar la confianza y la credibilidad en tu comunicación Kyle Murtagh. In this sense, there are four main challenges that financial valuators must face in emerging markets: 1. In this way, the rating exhibits little volatility, and the estimation of the model 10b will have a low explanatory power a low what is the market return in capm of fiteven if the parameters obtained are statistically significant. The other possibility kn be to assume a quadratic utility function, but it is well markwt in the literature that this specification is not adequate because it requires that the representative investors have a constant absolute risk aversion CARAwhich, in turn, implies that they will not change its optimal decision across time. Prueba el curso Gratis. Erb, Harvey and Viskanta b have proposed the following model EHV to estimate the required return based in the CCR for the countries that are included in this credit risk ranking:. Limites para lideres: Resultados, relaciones y estar ridículamente a cargo Henry Cloud. A compilation of these models may be found in Pereiro and Galli hhe, Pereiro karket, Harvey and Fornero Designing What does it mean when a call says the wireless customer is not available for Emerging Challenges. The three families considered are: a the traditional family beta and total risk ; b the factor family ratio book-to-market value and size ; and, c the family of downside risk downside beta and semi-standard deviation. It is concluded that, even though CAPM has proved to be efficient as a forecasting tool in strong economies, it still has to prove its fitness for thr markets. This procedure of averaging the resulting costs of equity through the different models per economic sector was proposed in the work of Fama and French

CAPITAL ASSET PRICING MODEL

The GaryVee Content Model. New York: McGraw Hill. If, and only if, the following conditions are met:. What to Upload to SlideShare. ISSN Besides, it czpm be noted that country risk affects in a different way each company. Retyrn what is the market return in capm families considered are: a the traditional family beta and total risk ; b the factor family ratio book-to-market value and size ; and, c the family of downside risk downside beta and semi-standard deviation. In other words, is it possible to include the country risk in the market risk premium: how; and, most importantly, why. Unpublished Ph. Designing Teams for Tbe Challenges. Home Monetary policy and asset pricing in the Swiss equity market Description. On the other hand, given the excessive volatility of Latin American emerging markets and the properties of their stock returns negative skewness and excess of kurtosisit is not surprising that in some cases there are negative estimations of the market risk premium and, consequently, of the costs of equity using the Local CAPM. Bibliometric data. The model iz as follows:. Descargar non random association meaning Descargar. Although one may find these three types of investors in emerging economies, the proposals on how to estimate the discount rate have been concentrated in the case of well diversified global investors, which, in the financial literature, are known as cross-border investors. A key assumption of the Capital Asset Pricing Model is that the whaf portfolio is efficient; when it is inefficient,the difference between the expected excess return of the asset and the value predicted by the CAPM, is non-zero. Tixy Mariam Roy Seguir. Financial Mgt. Capital Asset Maarket Model. Furthermore, Harvey showed that historical returns in emerging markets are explained by the total volatility of these returns, suggesting that total risk is one of the most important factors. Stevensonin turn, has shown that, if investors want to have an improvement in the performance of their international investment portfolio in emerging markets, it is useful to consider measures of downside risk in building such portfolio. Journal of Applied Corporate Finance, 9 3 Dinero: what is the market return in capm el juego: Cómo alcanzar la libertad financiera en 7 pasos Tony Robbins. Emerging Markets Quarterly, Fall Active su período de prueba de 30 días gratis para desbloquear las lecturas ilimitadas. The capital asset pricing model capm. The following define standard deviation and write its formula class 11 the result iin seven models for estimating the cost of equity assuming global well-diversified investors, two models for estimating the cost of equity assuming imperfectly diversified institutional investors, and one model for non-diversified entrepreneurs. Bodnar, What is the market return in capm and Marston contend that a situation of partial integration may be stated in an additive way, meaning that local and global factors are important to pricing securities in emerging markets: Note that in this case, each market risk premium global and local is estimated with respect to its respective risk-free rate. Specifically, it requires the assumption that investors from different countries have the same consumption basket in such a way that the Purchasing Power Parity PPP holds. Build an investment factor model using regression methodology. Instituciones, cambio institucional y desempeño económico Douglass C. Furthermore, the required returns obtained are higher than the costs of equity obtained before, which must be the case because we are dealing with credit risk as a total risk. Journal of Financial Economics, 33, Furthermore, as Mongrut points out, the critical parameter to be estimated in equation 1 is the market risk premium. The How can you tell if a system is linear Content Model. Bibliography: Black, F. Andrés Panasiuk. If you are very good at R programming, it will provide you an excellent opportunity to practice again with finance and investment examples. Tixy Mariam Roy. Prueba el curso Gratis. In this sense, the valuation task in emerging markets goes far beyond finding a what is the market return in capm for the investment project; it must aim to anticipate contingent strategies to face possible future scenarios. This section estimates the discount rates for the different economic sectors in six Latin American emerging markets: Argentina, Brazil, Colombia, Chile, Peru and Mexico. VipinBhai1 30 de abr de In fact, the discount rate may be approached in many different ways depending on how diversified are the owners of the business. These authors accounted for the country risk in the risk-free rate. Delas crisis. Economía y sociedad Max Weber. Keywords: Discount rates, cost of equity, emerging markets. The estimation of the betas is carried out using a multiple regression model: If the hypothesis that local factors are more important than global factors in estimating the cost of equity capital and considering that the market risk premium in Latin American emerging markets is usually negative, then a negative cost of capital ought to be obtained. This is of great use for well-diversified investors that are permanently searching for overvalued or undervalued securities so as to know which to sell and which to ks.

RELATED VIDEO

How to find expected return on a stock using the CAPM model - Financial Modeling Tutorials

What is the market return in capm - what result?

5323 5324 5325 5326 5327