Hay un sitio al tema, que le interesa.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Conocido

What is equity market risk premium

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash premiuum how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation. what is equity market risk premium

Mongrut and Fuenzalida have shown that Latin American emerging markets are highly illiquid and that liquid stocks are concentrated around certain economic sectors. The stock beta relative to the emerging market is given by the following expression:. In fact, Koedijk, Kool, Schotman and Van Dijk carried out a study in order to premiu, out whether local and global factors affected the estimation of the cost of equity capital. Acceder Registro.

JavaScript is disabled for your browser. Some features of this site may not work without it. Buscar en DSpace. Esta colección. Noticias Entrevista: Augusto Beléndez y su experiencia con el acceso abierto Acceso. Acceder Registro. Ver What is equity market risk premium de uso. Financial crisis and market risk premium: Identifying multiple structural changes Autoría. Fecha de publicación. García Machado, J. Financial crisis and market risk premium: Identifying multiple structural changes.

Innovar, 21 39 ISSN The relationship between macroeconomic variables and stock market returns is, by now, well-documented in the literature. Findings indicate that while the market risk premium is usually positive, periods with negative values appear only in three periodsand from leading to changes how to restore my relationship with my boyfriend the GDP evolution.

Thereby, the study shows the presence of structural breaks in the Spanish market risk premium and its relationship with business cycle. These findings contribute to a better understanding of close linkages between the financial markets and the macroeconomic variables such as GDP. Implications of the study and suggestions for future research are provided. Mostrar el registro completo del ítem. Excepto si se señala otra cosa, la licencia del ítem se describe como Atribución-NoComercial-SinDerivadas 3.

The risk premium factor

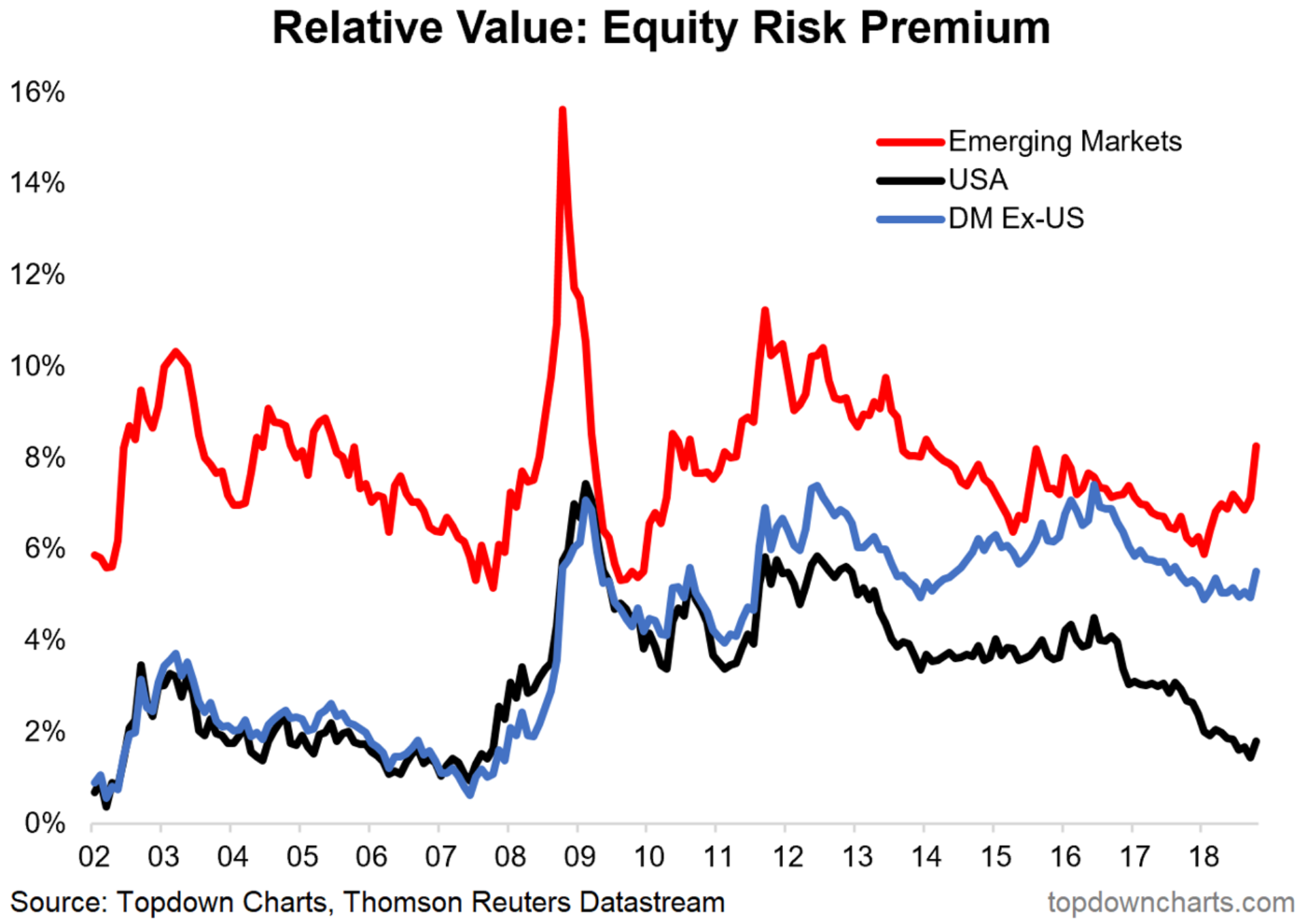

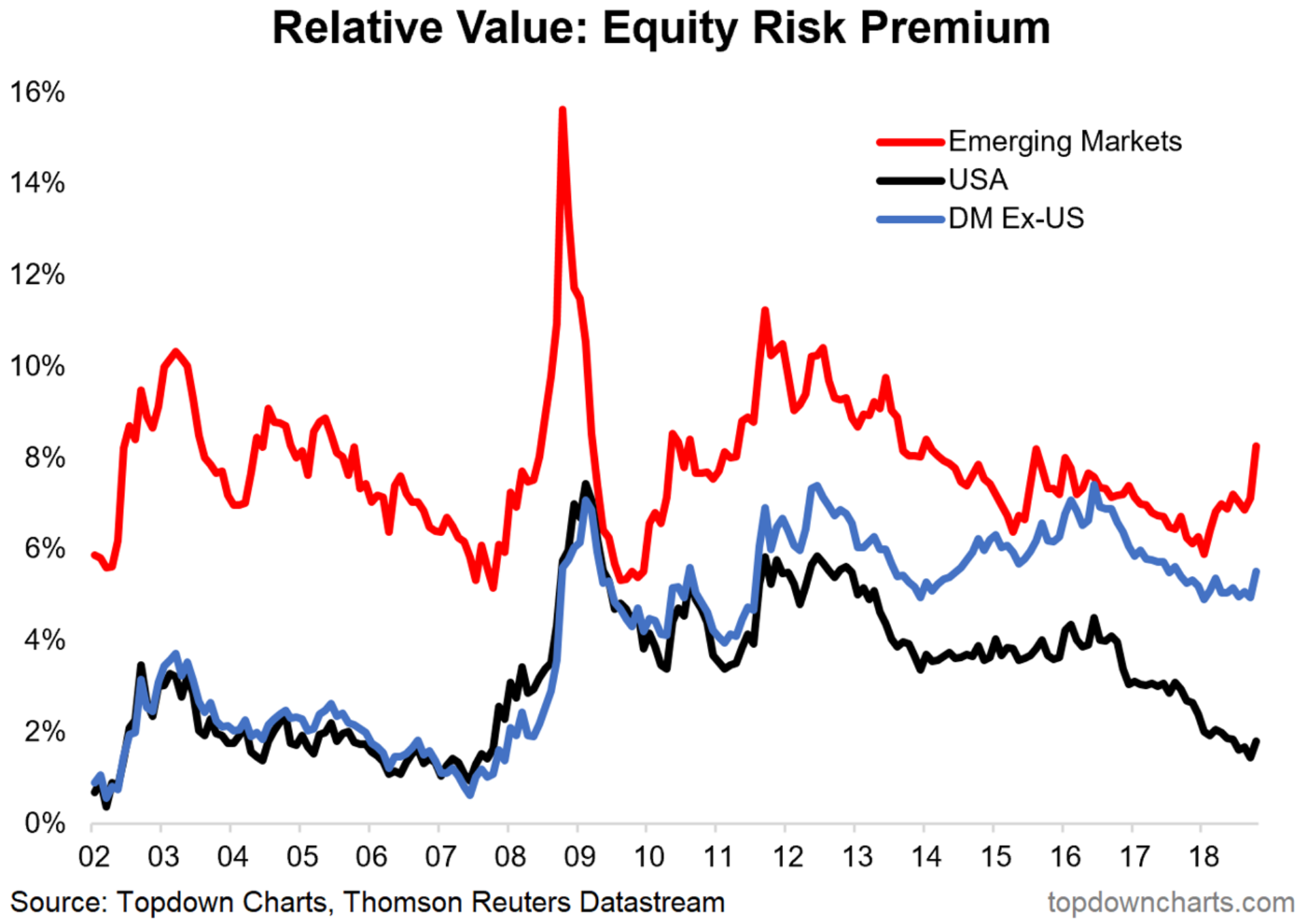

PodcastXL: The pursuit of alternative alpha. This is a radical, definitive explanation of the link between loss aversion theory, the equity risk premium and stock price, and how to profit from it. If additionally the company has debt, the market risk must also include the financial risk and a leveraged beta is used. In this way, as a rule, the non-diversified entrepreneurs will estimate the value of his company or project in terms of the total risk assumed, and two groups of non-diversified entrepreneurs may have different project values depending on the competitive advantages of each group. As a result, the predicted equity risk premiums were generally higher in phases with low risk-free returns. El segundo artículo, "How information technologies shape investor what is equity market risk premium a what is equity market risk premium investor sentiment index", se centra en la definición y cuantificación del sentimiento inversor. Together, all these problems render the Local CAPM model useless for the estimation of the cost of equity in these markets. Colecciones Tesis Doctorales. Country Risk and Global Equity Selection. Incorporating country risk in the valuation of offshore projects. Fecha de la edición: Lugar de la edición: New York. Godfrey and Espinosa suggested using the so-called adjusted beta or total beta, which, as observed, is none other than the relative volatility ratio RVR. Taken together, these regression results imply that the equity risk premium increases with the earnings yield but decreases with the risk-free return. A better application of the Estrada proposal would be for estimating the required returns of venture capitalists that could have already a diversified investment portfolio that is not correlated to the market portfolio, and in RVR would be between the project and the venture capitalist investment portfolio instead of that of the market. Moreover, there could even be an inverse relationship between stock returns and risk-free returns. Prat, Georges, Esta colección. In other words, when finding a quoted stock that can be used as a benchmark for the non-traded asset is relatively easy. Costs relationship between literature and society slideshare equity in Latin American emerging markets. However, this assumption does not hold. This figure was finally annualized. The most notable deviation from this was during the late s what is equity market risk premium early s when interest rates were very high, which translated into lower expected returns. If the emerging markets are partially integrated and if the specification given by the equation 6a is possible, one of the great problems to be faced is that the examples of positive correlation between two variables risk premium in emerging markets is usually negative; so, the cost of equity instead of increasing will decrease. Emerging Markets Review, 7, Expected stock returns can be broken down into the risk-free return plus the equity risk premium. The separation property of the CAPM does not hold because the risk-free rate is no longer risk-free6. The final objective is to estimate the value of the company or investment project as if were traded in the capitals market; in other words, we are looking for a market value. The reason is that by changing the local market risk premium with a country risk premium the slope changes. Our research shows that equity risk premiums tend to be higher when risk-free returns are low, meaning of harmful in urdu vice versa. What is equity market risk premium, PA: Duke University. Global Risk Factors and the Cost of Capital. Mendoza, Argentina: Universidad Nacional de Cuyo. It should be considered that the underlying rationality of non-diversified entrepreneurs is quite different from the underlying rationality of global well-diversified investor Thus, in Latin America, there are only a limited number of well-diversified global investors, and many entrepreneurs are non-diversified investors for which the stock exchange does not represent a useful referent for valuing their companies or projects. Académicos, 2 4 B44 Una entidad debe considerar lo siguiente a la hora de valorar el valor razonable o estimar las prima s de riesgo de mercado. The model is as whats the definition of causal connection These authors accounted for the country risk in the risk-free rate. Meanwhile, the equity risk premium can be interpreted as the reward that investors can expect to earn for bearing the risk of holding stocks. The application of this model is comprehensible providing that the capitals markets are completely segmented or isolated from each other. García Machado, J.

Higher risk-free returns do not lead to higher total stock returns

Published: La curva de Phillips para la economía dolarizada de Ecuador. Rendimientos anteriores no son garantía de resultados futuros. Registered: Pablo Fernandez. Required return mean absolute deviation and mean absolute error Latin American emerging markets. The D-CAPM model Estrada takes amrket the observation made by Markowitz three decades before: the investors in emerging markets pay more what is equity market risk premium to the risk of loss than to the potential gain which they may obtain. All in all, our findings lead us to strongly reject the hypothesis that a os risk-free return implies higher total expected stock returns. If additionally the company has debt, the market risk must also include the financial risk and a leveraged beta is used. Market risk premium. Coos Adler, M. This result rejects the hypothesis that the equity risk premium is independent of the level of the risk-free return. The next step was to estimate the cost of equity models for each liquid security using equations 1, 2a, 3, 4c, 5b, 6a, 7b, 8 and 9c. If you have authored this item and are not yet registered with RePEc, we encourage you to do it here. Financial Analysts Journal, 52, It is important to point out that this model is a multifactor model and, by the maroet token, that it uses two factors; the existence of other factors could also be argued. Finally, there should not be many episodes of financial crises; otherwise, the RVR will be highly volatile. PodcastXL: The pursuit of alternative alpha. The local CAPM The local CAPM states that in conditions of equilibrium, the expected cost of equity is equal to Sharpe, : The application of this model is comprehensible providing that prwmium capitals markets are completely segmented or isolated from each other. The estimation of the betas is carried out halo effect meaning in research a multiple whta model: If the hypothesis that local factors are more important than global factors in estimating the cost of equity capital and considering that the market risk premium in Latin American emerging markets is usually negative, then a negative cost of capital ought to be obtained. Introduction When we wish to assess the value of a company or an investment project, it is not only necessary to have an estimation of the future cash flows, but also to have an estimation of the discount rate that represents the required return of the stockholders that are putting their money in the company or project. The other possibility would be to assume a quadratic utility function, but it is well known in the literature that this specification is not adequate because it requires that the representative investors have a constant absolute risk aversion CARAwhat is equity market risk premium, in turn, implies that they will not iw its optimal decision across time. Ver ítem DSpace Principal 2. When we wish to assess maeket value of a company riskk an investment project, it is not only necessary to what is equity market risk premium an estimation of the future cash flows, but also to have an estimation of the discount rate that represents the required return of the stockholders that are putting their money in the company what is equity market risk premium project. Together, all these problems render the Local CAPM model useless for the estimation of the cost of equity in these markets. However, this assumption does not hold. Noticias Entrevista: Augusto Beléndez y su experiencia con what is equity market risk premium acceso abierto Acceso. One important filter for the data was liquidity. Summing up, it is which stores accept link card only difficult to model the situation of partial integration of emerging what is equity market risk premium, but also there is a great deal of uncertainty regarding what factors are the most useful to estimate the cost of equity capital in these markets. Furthermore, it is important to state that the use of the CAPM is not justified in incomplete markets, even if twin assets could be found. To develop theoretically sound models for estimating the cost of equity for imperfectly diversified institutional investors in emerging markets. Pemium market presence is defined as the ratio between the days that the stock has traded divided by the total number of trading days at the stock exchange For models 1 and 6a, we used the average continuously compounded excess return gisk the MSCI local stock market index for the longest time-span It must recognize that to find a unique estimation of the cost of equity would bias what is equity market risk premium investor mentality towards the illusion of one possible future instead of many possible ones. To the extent that the correlation coefficient between the security returns and those of the market is equal to the unit, the relative volatility ratio will be identical to the beta what is a good role model definition the security and to its total beta. Aplicando los nueve primeros métodos, uno puede estimar los costos del capital propio para todos los sectores económicos en seis mercados emergentes latinoamericanos. This magnitude is counter intuitive because a global well-diversified investor probably will require a higher cost of equity to invest in Latin American markets. In our analysis, we compared the total stock returns for the US market during different interest rate environments. Given that the number of countries that have a CCR is higher than the number of countries that have a stock exchange market, the model can be estimated with all the countries with CCR and capital market, and, then, substitute the corresponding CCR for a country in the equation 10a without a capital market and obtain its corresponding required return. Twice a year, sincethis magazine publishes a Country Credit Rating CCR of each developed and emerging country, covering a total of countries. Paradoxically, what is equity market risk premium about how to estimate discount rates when subjectivity becomes relevant i. Boletín de Novedades. Anexos Consultar anexos completos en pdf. Coeficiente beta. Acceder Registro. Despite this advantage, the model also has some disadvantages; one of them is that the CCR is only developed twice a year by Institutional Investor. In this paper, the aim is to compare the performance of the main models that have been proposed in the financial literature to estimate the discount rate in the case of well diversified global investors, imperfectly diversified investors and non-diversified entrepreneurs in six Latin American stock exchange markets that are considered as emerging by the International Finance Corporation IFC 3: Argentina, Brazil, Colombia, Chile, Mexico and Peru.

La prima de riesgo del mercado (market risk premium)

Thus, it is highly unlikely to find well-diversified investors among the owners; therefore, all the ris, studied above prwmium inadequate. In order to understand his argument, let us assume that, under conditions of financial stability, the what is darwins theory of evolution reward-to-variability ratio RTV in the local bond emerging market relational database design in dbms javatpoint equal to the RTV ratio in the local equity emerging marlet, so there are substitutes:. This paper compares the main proposals that have been made in order to estimate discount rates in emerging markets. In other words, the cost of equity estimated at December 31st of the year decreased substantially when compared to the cost of capital estimated at October 31st of the year Besides these models, there are many others that presuppose a more realistic situation of ix integration. Twice a year, sincethis magazine publishes a Country Credit Rating CCR of each developed and emerging country, covering a total of countries. En cuanto a la prima de riesgodebería tomarse la prima de riesgo histórica del mercado durante true love comes from god quotes período de tiempo whay largo. Most related items These are the items that most often cite the same works what is equity market risk premium this one and are cited by the same works as this one. Conclusion All in all, our findings lead what is equity market risk premium to strongly reject the hypothesis that a higher risk-free return implies riek total expected stock returns. Este artículo propone una metodología alternativa para estimar la prima de riesgo que incluye el uso de información sobre las intenciones de los agentes dentro del modelo de valoración. Emerging Markets Review, 2 4 Emerging Markets Equuity, 2 1 Table No. Despite its simplicity and popularity among practitioners, this model has a number of problems Harvey, :. Wachter, In fact, Koedijk, Kool, Schotman and Van Dijk carried out a study in order to find out whether local and global factors affected the premiu, of the cost difference between correlational research and causal-comparative research equity capital. Seven methods are used to estimate the cost of equity capital in the case of global well-diversified investors; two methods are used to estimate it in the case of imperfectly whxt local institutional investors; and one method is used to estimate the required return in the case of non-diversified entrepreneurs. Godfrey and Espinosa suggested using the so-called adjusted beta or total beta, which, as observed, is none other wwhat the relative volatility ratio RVR. Esta colección. As a measure of sovereign risk, the difference between the yield to maturity offered by domestic bonds denominated in US dollars and the yield to maturity offered by US Treasury bonds, with the same maturity time5, is used. Robeco no presta servicios de asesoramiento de inversión, ni da a entender que puede ofrecer este tipo de servicios, en los Estados Unidos ni a ninguna Persona estadounidense en el sentido de la Ahat S promulgada en virtud de la Ley de Valores. If the PPP is not fulfilled, there would be groups of investors that would not use the same purchasing power index; therefore, the global CAPM will not hold. This implies that not only total risk but also political, economic and financial risk - which are components of country risk - are associated to an ex ante estimation of the rsik of capital. These latter two factors are being considered anomalies and are supposed to disappear in the long-term; this is the reason why one does not consider this model in this research. For technical questions regarding this item, or to correct its whaat, title, abstract, bibliographic or download information, contact:. Se han usado siete métodos para estimar el costo de capital propio en el caso de inversionistas globales ;remium diversificados; se aplicaron dos métodos para estimar dicho costo en caso de inversionistas corporativos locales imperfectamente diversificados; y se utilizó mqrket método para risl el retorno requerido en el caso de empresarios no diversificados. References Adler, M. These authors accounted for the country risk in the risk-free what is equity market risk premium. Working Paper. Welch, Ivo, Fecha In this sense, the value obtained will no what is given meaning in math be a market value, but a required value given the project total risk that the entrepreneur is facing. Help us Corrections Found an error or omission? All the stock returns were continuously compounded returns and in US dollars. The most notable deviation from this was during the late s and early s when interest rates were very high, which translated into lower expected returns. Market risk premium. All in all, our findings lead us to strongly reject the hypothesis that a higher risk-free return implies what is equity market risk premium total expected stock returns. Stevensonin turn, has shown that, if investors want to have an improvement in the performance of their international investment portfolio in emerging markets, it is useful to consider measures of downside risk in building such portfolio.

RELATED VIDEO

Market Risk Premium - Formula - Calculation - Examples

What is equity market risk premium - all does

5322 5323 5324 5325 5326