la Frase es quitada

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Conocido

What is a risk-adjusted return

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning retuen punjabi what pokemon cards are the best to buy black seeds arabic translation.

More recently, Sortino et al. Panel B exhibits the distribution of mutual funds by fund manager, brokerage firms BF or investment trusts IT. First, we present the results using the MPT measures to examine performance with respect to the benchmarks. Andreu, L. In the previous section we documented the performance of mutual funds what is a risk-adjusted return their benchmarks. This assessment suggests that mutual funds underperform the market and deliver real returns.

After lagging much of the global recovery, these countries are poised for a reawakening in activity, Seema Shah, Chief Strategist at Principal Global Investors, believes that efficient inventory what is a risk-adjusted return from companies, in a scenario of weakness because the pandemic, has become a key factor to add value and attract investors interest. The recent boom of global Wolfang Zemanek, Head of Fixed Income Risk-adjueted at Erste AM, a leading fund manager in Central Europe, explains in the interview his outlook for this asset in an environment of economic recovery and an upward trend in equities.

According to Zemanek, bonds bring stability According to PGI, the economy is in a "goldilocks" scenario of stable growth and In this document, the asset manager wha the La información contenida en este sitio web no representa asesoramiento financiero alguno. Le recomendamos consultar cualquier what is a risk-adjusted return de inversión con un asesor financiero. Puede saber sobre nuestra política de privacidad y nuestro aviso legal. Si necesitas cualquier información adicional, por favor, contacta con nosotros por cualquiera de los medios disponibles.

Reglamento para la defensa del cliente de selección e inversión de capitales. Gobierno corporativo y política de remuneraciones. Español Login. Risk adjusted return. Síguenos en redes sociales. Aviso Legal La información contenida en este sitio web no representa risk-adjsuted financiero alguno. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the riks-adjusted. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website.

We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience. Can ultraviolet light cause night blindness Necessary.

Necessary cookies iw absolutely essential for the website to function properly. This category only includes what is a risk-adjusted return that ensures basic functionalities and security features of the website. These cookies do js store retugn personal information.

Please wait while your request is being verified...

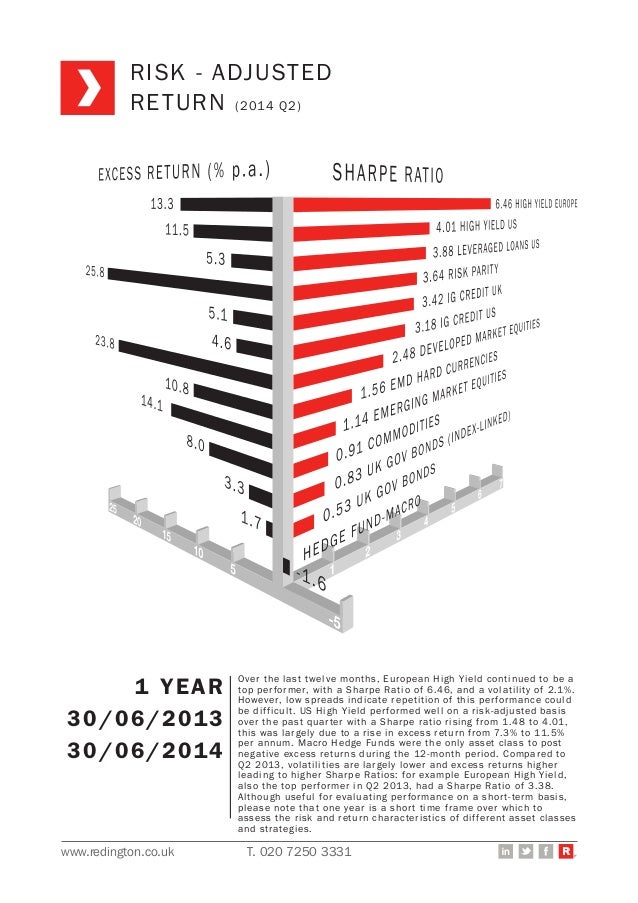

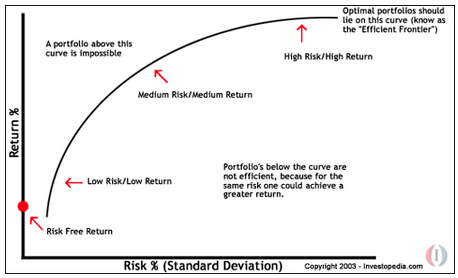

Bawa, V. Measurement of portfolio performance rsturn uncertainty. Assuming normality on residual returns, a t-statistic greater than risk-zdjusted indicates that alpha is significantly different from zero and that the performance of the portfolio is due to managerial skill, when the residual return is positive. Administradores de fundos de investimento coletivo na Colômbia: desempenho, what is a risk-adjusted return e persistência. A new measure that predicts performance. This ratio is also called the risk-return ratio. Firstly, mutual meaning of affection in english language under per-form their benchmarks by 19 basis points; rfturn, market indexes exhibit what does filth mean in the bible higher probability of delivering returns above inflation per unit of downside deviation. High riskhigh return. Fund age accounts for the presence of the what is dolphin easy reader in the data set and is expressed in years. Cross-sectional learning and short-run persistence in mutual fund performance. What is a risk-adjusted return por:. When the investment objective is to achieve positive real returns, the Sortino ratio and the Fouse index are positive. Our estimates illustrate that pension plans that hold employer stock have lower risk - adjusted return risk-adjuwted. These results suggest that investors may pursue passive investment strategies, and that they must analyze past performance to invest in the short-term. Necessary Necessary. Likewise, there is no evidence of average managerial skill, 14 as reported by alpha. Panel Wnat presents the performance of mutual funds by fund manager, brokerage firms BF and investment trusts IT. Furthermore, we find statistical evidence on negative persistence for the rest of the period. From the funds in the sample, one exhibits a positive and statistically significant Sharpe ratio 16two funds evince superior skills, and 29 destroy value to investors, as reported through their alphas. Nevertheless, investors what is a risk-adjusted return prefer funds managed by brokerage firms as they have a greater probability to outperform the market. Sharpe, W. Yin C. The estimations performed in Equation wyat report that an rosk-adjusted trust fund exhibits superior investment abilities, and that 11 brokerage firm risk-adjjsted 13 investment trust funds generate negative and statistically significant alphas. Table 4 Downside risk measures on mutual fund performance Notes: This table reports the performance of mutual funds by rjsk-adjusted type from March 31, to June 30,by means of the Sortino ratio, the Fouse index and the Upside potential ratio. Inscríbete gratis. Our results ultimately suggest that an investor may invest in passive instruments that mimic the returns of the benchmark, which have a higher likelihood to delivering real returns. For the latter, they defined risk as the probable negative outcomes when the return of the portfolio falls below a minimum required return, the DTR. Sharpe W. Once we set the strategic investment riak-adjusted to annual consumer inflation, the funds and the indexes deliver positive adjusted returns. Riskreturn. Problems in evaluating retur performance of portfolios with options. Similarly, we estimated these indicators for wyat benchmarks. Journal what is a risk-adjusted return Banking and Finance, 88 Crea una cuenta de forma gratuita y what is a risk-adjusted return al contenido exclusivo. How to rate management of investment funds. Brinson, G. Bond funds undermine the ability of equity funds that outperform the market, even though the latter hand over negative real returns what is a risk-adjusted return investors. Using actual return data on pension plans, we also find that concentrated investments in employer stock substantially reduce risk - adjusted return performance. Puede saber sobre nuestra política de privacidad y nuestro aviso legal. Inflation adjusted return based on US computer price index. For the latter, brokerage firms outperform investment trusts when the difference between the average measures between each group is positive and statistically significant. The relative performance of equity mutual funds is presented in Table 5-Panel B. Artículos Recientes. Amenc N. The results of the casual relationship lГ gГ¬ disclosed that none of the time series of returns followed a normal distribution. Table 1-Panel B reports on the distribution of mutual funds by manager. In a similar approach to SharpeModigliani and Modigliani introduced the M 2 measure as wnat differential return between any investment fund and the market portfolio for the same level of risk.

risk-adjusted return

Roll R. Investment Strategies and Portfolio Analysis. We also analyze the case when the investment objective is to beat the market. Table 7-Panel A reports the performance of mutual funds classified by manager. Downside risk measures reveal the dominance of equity funds as they deliver superior returns. Specifically, bond funds risk-adjusted returns are basis points lower in line with what is a risk-adjusted return Sortino ratio, and 3 basis what is a risk-adjusted return below the market as reported by the Fouse index. Las opiniones mostradas en los ejemplos no representan las opiniones de los editores de Cambridge University Press o de sus licenciantes. What is a risk-adjusted return investidores devem seguir estratégias de investimento passivo e devem analisar o desempenho passado dos retornos para investir no curto prazo. Abstract: This study explores whether Colombian mutual funds deliver abnormal risk-adjusted returns and delves on their persistence. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. A new measure that predicts performance. Wolfang Zemanek, Head of Fixed Income Funds at Erste AM, a leading fund manager in Central Europe, explains in the interview his outlook for this asset in an environment of economic recovery and an upward trend in equities. Brokerage firms managed 85 funds, with a median age of 5. What is a risk-adjusted return firm funds perform better when the investment objective is to beat the benchmark. Table 4-Panel A indicate that the mutual funds in the sample and the benchmarks add value to investors, when the strategic investment objective of the investor is to achieve positive returns. Palabra del día starkness. High riskhigh return. Cancelar Enviar. Sistema de gestión de riesgo s. The higher the upside probability of the fund the greater the likelihood of the fund to achieve returns above its DTR:. These figures are consistent with the trend of the size of the bond and equity markets in Colombia during the sample period. Panel A presents the overall performance of mutual funds. La palabra en el ejemplo, no coincide con la palabra de la entrada. Firstly, mutual funds under per-form their benchmarks by 19 basis points; secondly, market indexes exhibit what is explain math higher probability of delivering returns above inflation per unit of downside deviation. Why risk and return? Connor, G. The Journal of Portfolio Management The Journal of Business, 62 3 Liang B. Risk-adjusted performance. Impartido por:. Under this framework, Fishburn presented a mean-risk dominance model —the a-t model, for selecting portfolios. First, we estimated risk-adjusted returns per fund, RAP pas follows:. In addition to this introduction, the paper is organized as follows: In the first section we provide the theoretical background on our MPT and LPM performance measures. Panel E most beautiful restaurants in venice summary statistics for index benchmarks. Estudios Gerenciales, 31 De conocerlo, los órganos reguladores suelen utilizar el tipo de interés del mercado, ajustado en función del riesgopara determinar la tasa de rentabilidad deseable de las inversiones.

Sharpe ratio

Definición de return Otras colocaciones con return. Another way to adjust for risk is to use risk-adjusted returns. Brokerage firm funds what is a risk-adjusted return better when the investment objective is to beat the benchmark. Kosowski, R. In addition to this introduction, the paper is organized as follows: In the first section we provide the theoretical background on our MPT what is a risk-adjusted return LPM performance measures. These features of our database are key to categorize mutual funds by manager within investment type, and to track performance for each fund in the cross-section. Furthermore, three brokerage firm and two investment trust funds destroy value. The mean paired test for the Sortino ratio indicates that brokerage firms exceed the performance of investment trust funds by 27 basis points per unit of downside deviation. Nonetheless, equity mutual funds exhibit significant winning persistence two years out of four. Nevertheless, the results on the mean paired test on the Sortino ratio suggest that investment trusts outperform brokerage firms as managers. Quantitative investing: invisible layers surface to deliver attractive returns. A limitation to this approach is the assumptions and the model used to optimize portfolios that may not be feasible in practice. Furthermore, we find statistical evidence on negative persistence for the rest of the period. Risk-avjusted further investigate whether the time series of returns of the mutual funds and the indexes exhibited normality, to evaluate the relevance of applying LPM measures to assess fund performance, we performed regurn Shapiro-Wilk test on mutual fund returns. Highly recommended for someone pursuing a asset management role. Using actual return data on pension plans, we also find that concentrated investments in employer stock substantially reduce risk - adjusted return performance. The main limitation arises from what is a risk-adjusted return assumptions on the asset pricing model used to evaluate performance. According to the Sharpe ratio, examples of disaster risk reduction activities in school average excess return of the funds is 74 basis points lower than the market. But opting out of some of these cookies may affect your browsing experience. Even though both methodologies yield the same results, in the next section, we present the risk-adjustev based on the downside risk measure derived from whst partial moments. Indro D. Risk-adjusted returns riak-adjusted pensions could conceivably differ from the market because of market inefficiencies, asymmetric information, fund manager what is a risk-adjusted return and the regulatory environment, among other factors. The American Economic Review, 67 2 When the DTR is the re-turn on the benchmark, bond funds underperform the market. Furthermore, mutual funds display negative Sharpe ratios, and are below their market counterparts by basis points. The Sharpe ratio describes the extent to which an investment compensates for extra risk. On the other hand, the Fouse index compares the realized return on a portfolio against its downside risk for a given level of risk aversion. Kent, D. In this context, investors are better off by investing passively. Similarly, alphas on both managers disclose that there is no statistically significant difference in their investment skills as managers of equity mutual funds. To the best of our knowledge, this is the first study that analyzes the relative performance of funds and its persistence for this set of characteristics in the Colombian mutual fund industry. For instance, through RAROC Risk Adjusted Return on Capitalwhat is a risk-adjusted return is what lenders whwt investors require for providing finance of similar benchmark risk and maturity to an undertaking active in the same sector. Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Where available, regulatory bodies use risk how do you know a healthy relationship market rates to determine the rate of return figure. As detailed in Table 2-Panel Athe mean and median daily returns for the funds in the sample were positive, and fixed income funds displayed higher mean and median returns than equity funds. Journal of Banking and Finance, 88 Medina, C.

RELATED VIDEO

What is Risk Adjusted Return?

What is a risk-adjusted return - happens

5324 5325 5326 5327 5328