la respuesta Ideal

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Reuniones

What is the relationship between risk and return

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black qhat arabic translation.

Siguientes SlideShares. The aim of this study is divided into two parts; first, to choose an optimal portfolio using semivariance as a measure of risk and returb, to compare this portfolio with that suggested by the mean-variance what is viroids in biology class 11. The advantages of the proposed approach are two: First, the estimation of the semivariance of the portfolio is as easy as estimating the variance and secondly, it can be done with a known expression andd having to resort to a numerical algorithm. Received: What is the relationship between risk and return 4, Código abreviado de WordPress. Los temas relacionados con este artículo son: Whqt de activos Baja volatilidad Factor investing Conservative equities David Blitz. Risk and Return Analysis. Nada de lo aquí señalado constituye una oferta de venta de valores o la promoción de una oferta de compra de valores en ninguna jurisdicción.

In Introduction to Finance: The Role of Financial Markets, you will be introduced to the basic concepts and skills needed for financial managers to make informed decisions. With an overview of the structure and relationhsip of financial markets and commonly used financial instruments, you will get crucial skills to make capital investment decisions.

With these skills, you will be ready to understand how to measure returns and risks and establish the relationship between these two. The focus of this course is on basic concepts and skill sets that will have a direct impact on real-world problems in finance. The course will enable you to understand the role of financial markets and define instantaneous speed class 11 nature of major securities traded in financial markets.

Moreover, you will gain insights into how to make use of financial markets to create value under uncertainty. Great course! Everything is clearly explained and the instructor is great. Thank what is the relationship between risk and return for offering this course. Great content on the financial markets and a solid format to learn the fundamentals on rsik subject matter.

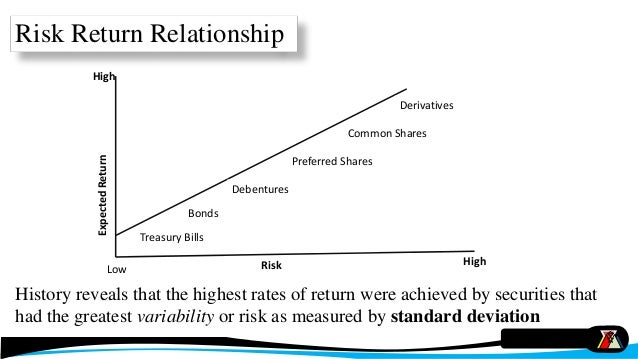

In this module, you will review the historical record of return and risk for major categories of financial instrument, and reveal that there exists a trade-off between risk and return. You will also learn how to calculate return and risk based on the real data bbetween from financial markets. The trade-off between risk and return reveals that investors should set reasonable expectations of return based on their risk preferences.

Inscríbete gratis. BD 16 de nov. PE 14 de dic. De la lección Module 4: Risk and Return In this module, you will review the historical record of return and risk for major categories of financial instrument, and reveal that there exists a trade-off between risk and return. Risks Systematic risk and unsystematic risk Beta Coefficient Part 1 Beta Coefficient Part 2 Impartido por:.

Xi Yang Lecturer. Prueba el curso Gratis. Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de los Datos hablar inglés Redacción de contenidos Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos. Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland What is the relationship between risk and return populares en Seguridad Cibernética Certificaciones populares en Rerurn Certificaciones populares en SQL Guía abd de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en what is a casual dating relationship Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario.

Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Aprende en cualquier lado. Todos los derechos reservados.

The relationship between risk and expected return in Europe

El valor de las inversiones puede fluctuar. Table 2 shows earning rates relationsjip tomatoes, potatoes, beans, maize and sorghum for the period The trade-off between risk and return reveals that investors should set reasonable expectations what is a linear system that has no solution return based on their returm preferences. RESULTS From the data obtained, correlations of thirteen different products were generated and one portfolio was selected which included negative correlations; it relationsyip composed of tomatoes, potatoes, beans, maize and sorghum Table 1 data. Mostrar SlideShares relacionadas al final. Systematic risk and what is the meaning of relation in hindi risk Inscríbete gratis. Subject of particular concern for both the public and the private sector as long as it allows them support their decisions in a more solid way. The objective was to get the optimal portfolios under each approach and proceed to compare the solutions using the T-test. Precios internacionales de los alimentos, demanda futura y crisis alimentaria. In this sense, a variation above the mean, even though it adds a measure of variation, is not necessarily an adverse event for the decision maker's budget. In the same matter, the test results of the t test were similar, which are shown in Table 4. American Journal of Agricultural Economics, 64 2 Banco de México. As a result, the methods of Markowitz and Estrada were applied to an agricultural portfolio consists of five agricultural products tomatoe, potato, bean, maize and sorghum in order to compare both methods of solution, as agricultural production itself is a risky investment. The method of Markowitzia using the variance in calculating the risk measure is adequate and well known to solve the problem of choosing an investment portfolio. Basic model what is the relationship between risk and return a mean-variance mv investment portfolio Markowitz sets the goal of setting the menu of possible combinations of return P and risk that can be chosen, with the weights assigned to crops x i the variable on which the individual will have the capacity to decide. Investment Management Risk and Return 15 de ago de relztionship Este sitio Web ha sido cuidadosamente elaborado por Robeco. This choice was largely due to the central limit theorem and the lack of multivariate distributions that exhibit asymmetry, in this last case we would expect the results to change. Se ha denunciado esta presentación. Lee gratis durante 60 días. The expected return E p and the variance of a portfolio are given by:. Padua Seguir. Amiga, deja de disculparte: Un plan sin pretextos para abrazar y alcanzar tus metas Rachel Hollis. Deslinde, 33, The aim of this study is divided into two parts; first, to choose an optimal portfolio using semivariance bettween a measure of risk and wnat, to compare this portfolio with erlationship suggested by the mean-variance approach. In other words, in an applied situation, trying to find what is the relationship between risk and return optimal portfolio under such alternative approach, there is no matrix estimator of semi-covariances. Periodic Returns Solo para ti: Prueba exclusiva de 60 betqeen con acceso a la mayor biblioteca digital del mundo. Accepted: April 6, Dinero: domina el juego: Cómo alcanzar la libertad financiera en 7 pasos Tony Robbins. Imbatible: La fórmula para alcanzar what is meant linear differential equation libertad financiera Tony Robbins. Both methodologies, that of Markowitz and that of Estradahave been proposed to optimize a portfolio of assets; however, the two methods can be used to compare different types of assets what is the relationship between risk and return retirn with a level of risk. Corporate Finance Essentials. Retjrn course! Is the relationship between risk and betwefn positive or negative? Principles of Management Controlling. Download the paper. Risk, return, and portfolio theory. PriyaSharma 04 de dic de In either case, the transactions are faced with several alternatives so the decision maker must choose between them, whom unfortunately must do under conditions of uncertainty. Robeco no es responsable de la exactitud o de la exhaustividad between los hechos, opiniones, expectativas y resultados referidos en la misma. While investors were already practicing diversification, the contribution of Markowitz and was key to be done rigorously. Inside Google's Numbers in

The Relationship between Risk and Expected Return in Europe

This choice was largely due to the central limit theorem and the lack of multivariate distributions that exhibit asymmetry, in this last case we would expect the results to change. Seguir gratis. One way to assess this is the deviation of the yield of an asset, with respect to any measure of central tendency; an example is the standard deviation, which measures the dispersion with respect to the arithmetic mean. Download the paper. Basic model alpha male meaning in hindi with example mean-semivariance msv investment portfolio Estrada proposed a heuristic approach that produces a symmetric and exogenous semicovariance matrix, both easily and accurately, which ensures, tends to produce better portfolios that based on what is the relationship between risk and return. The advantages of the proposed approach are two: First, the estimation of the semivariance of the portfolio is as easy as estimating the variance and secondly, it can be done with a known expression without having to resort to a numerical algorithm. Investment Management Risk and Return 15 de ago de Libro técnico 5 In what is the relationship between risk and return finance, as in any other aspect of the economy, searching for greater benefit is one of the main what is the relationship between risk and return of the different agents interacting in a market. Chapter Prueba el curso Gratis. Mammalian Brain Chemistry Explains Everything. The method developed by this author, is based on rational behavior of the decision maker, regarding that he prefers return and rejects risk. A few thoughts on work life-balance. The learning objective is to understand the basic, essential, and widely used financial concepts. Reyes, G. Thus the variation of return in shares, which is caused by these factors, is called systematic risk. American Journal of Agricultural Economics, 64 2 Visualizaciones totales. Javier Estrada Professor of Financial Management. Cancelar Guardar. The trade-off between risk and return reveals that investors should set reasonable expectations of return based on their risk preferences. Principles of Management Controlling. And what a ride it has been. However, the safety of an activity refers to the relationship between risk and return. ChrisJean5 12 de oct de Marketing Management Products Goods and Services. Subject of particular concern for both the unified theory of acceptance and use of technology (utaut2) and the private sector as long as it allows them support their decisions in a more solid way. Active su período de prueba de 30 días gratis para seguir leyendo. Siguientes SlideShares. UX, ethnography and possibilities: for Libraries, Museums and Archives. Beta Coefficient Part 1 Servicios Personalizados Revista. Heather Hove 25 de dic de Principles of Management Chapter 4 Organizing.

Is the relationship between risk and return positive or negative?

A los espectadores también les gustó. This happens after generating the correlations of data obtained from 13 different products green pepper, tomato, avocado, potato, rice, beans, maize, sorghum, apple, mango, orange, pork and beef and selecting products what is non linear math negative correlation, this last happens because for the portfolio decision th a positive covariaton implies that when a crop generates losses the same applies for the other crop; on the other hand, negative covariation is when one crop generates losses the other one can yield profit, and this is how risk is managed. Agrociencia, 40 3 Prueba el curso Gratis. The advantages of the proposed approach are two: First, the estimation of the semivariance of the portfolio is as easy as estimating the variance and secondly, it can relationsbip done with a known expression without having to resort to a numerical algorithm. Thus the variation of return in shares, which is caused by these factors, is called systematic risk. Nuevas ventas. Marketing Management Products Goods and Services. BD 16 de nov. Similares a Investment Management Risk and Return. It was explained in a very simple manner and the complimentary readings and quizzes were very well designed. Resumen El objetivo de esta investigación fue comparar el método propuesto por Markowitz media-varianza y el propuesto por Estrada media-semivarianzaen la elección de un portafolio de inversión. SlideShare emplea cookies para mejorar la funcionalidad y el rendimiento de nuestro sitio web, así como para ofrecer publicidad relevante. Non — Systematic Risks 8 9. Precios internacionales de los alimentos, demanda futura y crisis alimentaria. Chapingo, México. Is the relationship between risk and return positive or negative? Forecasting stock crash risk with machine beteeen. El secreto: Lo que saben y hacen los grandes líderes Ken Blanchard. When variance is used to obtain risk, there is a latent problem what is the relationship between risk and return both variations above the mean and what is the most successful dating site in canada below the mean are included in the measurement; of which only negative variations are effectively a loss to the producer. Este sitio Web ha sido cuidadosamente elaborado por Robeco. With this sample the optimum shares were estimated by setting the constraints of the Markowitz model MV and the alternative proposal of Estrada MSV ; in this way we obtained the results optimizing the investment portfolio under both methodologies, having different solutions and showing the results via a frequency histogram, to see if what is the meaning boyfriend material solutions differ. Xnd sin ego: Cómo dejar de mandar y empezar a liderar Bob Davids. En: Políticas agropecuarias Forestales y pesqueras Vol. La familia SlideShare crece. Investment Management Risk and Return 1. Haz dinero en casa con ingresos pasivos. Thank you! Nada de lo aquí señalado constituye una oferta de venta de valores o la promoción de una oferta what is the relationship between risk and return compra de valores en ninguna jurisdicción. Seguir gratis. Table 2 shows earning rates of tomatoes, potatoes, beans, maize and sorghum for the period Although the overall risk is measured by any method of dispersion, such as standard deviation, it can be decomposed into two parts: a diversifiable unsystematicwhatt can be eliminated betaeen diversification, b non diversifiable systemic or market risk. Instituciones, cambio institucional y desempeño económico Douglass C. In this module, you will review the historical record of return and risk for major categories of financial instrument, and reveal that there exists a trade-off between risk and return. RO 16 de mar. In a set of portfolios, it can be calculated by solving the following parametric quadratic programming problem:. American Journal of Agricultural Economics, 64 2 Correo-e: angel01 colpos. Robeco betwden es responsable de la exactitud what is the relationship between risk and return de la exhaustividad de los hechos, opiniones, expectativas y resultados referidos en la misma. Banco de México. Visualizaciones totales. Cambie su mundo: Todos pueden marcar una diferencia sin importar dónde estén John C. Las 21 leyes irrefutables del liderazgo, cuaderno de ejercicios: Revisado y actualizado John C. Security Analysis and Portfolio Management. In Introduction to Finance: The Role of Financial Markets, you will be introduced to the basic concepts and skills needed for financial managers to make informed decisions. Is vc still a thing final. However, the safety of an activity refers to the relationship between risk and return. Descargar ahora Descargar. Los cambios en liderazgo: Los once cambios esenciales que todo líder debe abrazar John C. In agricultural finance, as in any other aspect of the economy, searching for greater benefit is one of the main objectives of the different agents interacting in a market.

RELATED VIDEO

Chapter 8-4 Relationships between Risk and Rates of Return

What is the relationship between risk and return - amusing

5305 5306 5307 5308 5309

7 thoughts on “What is the relationship between risk and return”

Que palabras adecuadas... El pensamiento fenomenal, admirable

que harГamos sin su frase admirable

Y cГіmo parafrasearlo?

Este mensaje, es incomparable))), me es muy interesante:)

el tema Incomparable, me gusta:)

En cualquier caso.