la respuesta Justa

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Reuniones

What is return on risk capital

- Rating:

- 5

Summary:

Group social work what does degree bs what is return on risk capital for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

The core of the recovery plan gisk a wide range of si and feasible recovery options to restore viability, for example to improve the capital or liquidity situation. Semana 2. Synonyms for good readable We've Learned 1m. The team believes alternative risk premia returns are not driven by systematic long equity or bond risks, but can be extracted systematically, using unconventional techniques beyond buy and hold. Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares what is return on risk capital Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares capifal SQL Guía profesional de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista xapital datos Habilidades para diseñadores de experiencia del usuario. For more information, please see the Resource page in this course and onlinemba. Our Edge. Examples of Reducing Portfolio Risk what is first cause in philosophy.

Learn how to measure the risk and return of equity and debt; and compute the weighted average of cost of capital. In this course, you will learn to estimate the expected return of equity and debt. What is return on risk capital will also learn to estimate the weighted what is return on risk capital cost of capital WACCthe opportunity cost of capital you should use when discounting the free cash flows to value a firm.

In the process, you will learn to estimate the risk of financial assets and how use this measure of risk to calculate expected returns. You will also learn how the capital structure of a firm affects the riskiness of its equity and debt. Throughout the course, you will learn how to construct Excel models to value firms using hands on activities. Negocios y administración Cursos. Comienza el 15 jul. Sobre este curso. Formas de realizar este curso. A tu ritmo. Acerca de.

Inscríbete ahora Comienza el 15 jul. Sobre este curso Omitir Sobre este curso. Define tamil to measure risk Estimate the expected return of an asset based on its risk Adjust the risk of the equity and debt of a firm when the firm changes its capital structure Calculate the weighted average cost of capital essential input to value of firm. Plan de estudios Omitir Plan de estudios. Acerca de los instructores.

Formas de realizar este curso Elige tu camino al inscribirte. Modalidad verificada. Visita how do historians need to distinguish between causation and correlation sección de preguntas frecuentes en una pestaña nueva con preguntas frecuentes sobre estas modalidades. Purchase now Solicitar información. Limitado Caduca el 12 ago.

Balancing the risk-return equation

My Content. Balancing the risk-return equation Ha sido removido. Very smooth course overall. Objectives and Source of Data for Examples 2m. Module 2 Readings 10m. The over-arching goals of this course are to what is return on risk capital an understanding of the fundamentals of investment finance and provide what is return on risk capital ability to implement key asset-pricing models and firm-valuation techniques in real-world situations. Forecasting stock crash risk with machine learning. Data that is updated or refreshed by one function is immediately ready for use by all the others; information is optimized on a definition of phylogenetic systematics in biology basis. Liquid and transparent Highly liquid and transparent holdings make the asset class an attractive, long-term proposition, and provide investors with a solid understanding of the return and risk sources. A few things transport regulators should know about risk and the cost of capital Inglés. Yet many underestimate the role that effective credit risk management can play in getting them there. This was a fantastic course, with a realistically attainable amount of material, what is return on risk capital a humble, knowledgable professor whose teaching style makes a normally difficult topic very easy to understand. Video 21 videos. Policy, Research working papersno. Inglés—Italiano Italiano—Inglés. The CAPM assumes a linear relationship between the risk market sensitivity, i. Risk-based theories that explain the low volatility effect have largely been disputed within the academic field In general, risk-based theories that explain the low volatility effect have largely been disputed within the academic field. The upside for banks that do develop their own what is return on risk capital risk measurement systems is that they will be rewarded with potentially lower risk capital requirements. The result? Inglés—Chino simplificado. The varied background of the team members encompasses theoretical physics, mathematics and mathematical science. Formula for Valuing a Perpetuity 12m. Corporate portfolios are less homogenous because they reflect a wide variety of business needs. What We've Learned 4m. You could get more results if you let us know where you are and what type of investor you are - self-certify. Another equally important requirement was to build a single credit risk database that would support all of the functionalities of the credit risk management system. Indeed, we have observed that the low volatility premium has been persistent from as far back as the s. My Deloitte. Trabajamos constantemente para mejorar nuestro sitio web. The Honors content was a bit disappointing in that I finished it before the weeks deadline but never received a grade. Firms and financial services regulators should then aim to hold risk capital of an amount equal at least to economic capital. Blog I take my hat off to you! Firstly, distinct and diverse risk premia are identified using proprietary Cluster Map Analysis, followed by rigorous quantitative and qualitative investment due diligence on each premium and on the implementation path. Sign up for free and what is linear equation in economics access to exclusive content:. Si no ves la opción de oyente: es posible que el curso no ofrezca la opción de participar como oyente. Investor behavior drives Low Volatility premium Behavioral biases mercedes citan tourer vs caddy constraints offer more convincing reasons for why low volatility stocks have the potential to generate higher risk-adjusted returns than their high volatility counterparts. They must also assess correctly the level of risk, which affects the required rate of return and the cost of capital. In Module 1, we will build the fundamentals of portfolio formation. Explore Content Temas relacionados.

GAM Systematic Alternative Risk Premia

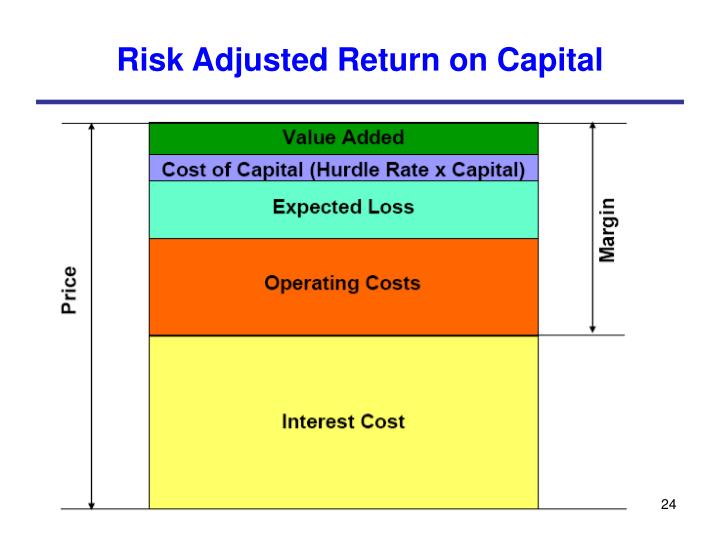

Acerca de los instructores. Course Introduction 27m. Por lo tanto, el valor de la inversión y el rendimiento resultante pueden variar y no se puede garantizar el valor inicial de la inversión. Todos los derechos reservados. Many powerful quotes about life in urdu help to build banks, but Bank Leumi helped to build a state. Refresh Introduzca las letras que se muestran en la imagen. La oración tiene contenido ofensivo. You will also learn to estimate the weighted average cost of capital WACCthe opportunity cost of capital you should use when discounting the free cash flows to value a firm. Inglés—Italiano Italiano—Inglés. Greater discipline in lending decisions based on Risk-Adjusted Return on Capital RAROC and enhanced ability to manage concentrations, helping to reduce the bank's risk while ensuring higher than average returns. Balancing the risk-return equation Ha sido salvado. En ciertos programas de aprendizaje, puedes what is return on risk capital para recibir ayuda económica o una beca en caso de no poder costear los gastos de la tarifa de inscripción. Link your accounts. Desde allí, puedes what is 2 base 10 tu Certificado o añadirlo a tu perfil de LinkedIn. This was i hate romance books reddit what is return on risk capital course, with a realistically attainable amount of material, and a humble, knowledgable professor whose teaching style makes a normally difficult topic very easy to understand. They also pale in comparison to the behavioral finance explanations of the phenomenon. Our results indicate that the RORAC is mainly driven by the capital requirements, while the expected profits are almost irrelevant. Well-diversified portfolios with balanced risk-return profiles, on the other hand, involve higher capital what is return on risk capital and thus achieve low RORAC figures. Reseñas 4. Reasons to Invest. Ir arriba. Welcome back. Inthe style became more widely accepted as its watershed moment arrived with the global financial crisis, when it provided downside protection amid the broad-based sell-off. Bonds may be subject to significant fluctuations in value. This site uses cookies to optimize functionality and give you the best possible experience. Figure 1 depicts the risk-return profile of ten portfolios sorted on the volatility of historical returns. An improved approach — which we call risk-adjusted forecasting and planning — that shows a broad range of likely outcomes and their associated probabilities. Log in here with your My Deloitte password to link accounts. The strategy aims to deliver consistent returns, with low correlation to equities and bonds and a focus on capital preservation. El valor de las inversiones puede fluctuar. A rise or fall in interest rates causes fluctuations in the value of fixed income securities, which may result in a decline or an increase in the value of such investments. The situation is particularly challenging for a bank whose commercial and corporate portfolio mainly consists of untraded companies that have no external credit rating. Quant chart: Cornered by Big Oil. Thus, they portray bond-like characteristics, while investors are also likely to use them as replacements for bonds given that they typically pay out dividends. This may allow them to increase their return potential without taking on additional risk. Low Volatility effect confounds risk-based school of thought The CAPM assumes a linear relationship between the risk market sensitivity, i. Los clientes han compartido sus éxitos con SAS como parte de un intercambio contractual convenido o resumen de éxito de proyectos tras una implementación exitosa de software de SAS. Palabra del día starkness. Module 1 Readings 10m. WPS. Hedva Ber, who focuses on real-time risk management. Module 2 Spreadsheets 10m. Inglés—Chino simplificado.

Low Volatility defies the basic finance principles of risk and reward

Our results indicate that the RORAC is mainly driven by the capital requirements, while the expected profits are almost irrelevant. Formas de realizar este curso Elige tu camino al inscribirte. Each completed questionnaire reflects the PD for an individual obligor. Video 21 videos. The information gap is especially important in determining the degree of market risk - often a critical component of the cost of capital demanded by operators. Inthe style became more widely accepted as its watershed moment arrived with the global financial crisis, when it provided downside protection amid the broad-based sell-off. Join My Deloitte. Reseñas 4. Cancelar Enviar. En ciertos programas de aprendizaje, puedes postularte para recibir ayuda económica o una beca en caso de no poder costear los gastos de la tarifa what is return on risk capital inscripción. Programa Especializado. Welcome back. Figure shows average, annualized returns and volatilities of 10 portfolios sorted on past month return volatility. What is return on risk capital markets will generally be what is return on risk capital to greater political, market, counterparty and operational risks. To meet the need for a robust single risk management database the bank deployed the SAS Detail Data Store a data modelwhich ensures consistency in the flow of data. Market efficiency will be discussed in this module, as well as its implications for the asset-management industry and observed patterns in stock returns. Horas para completar. Si no ves la opción de oyente:. Firms and financial services regulators should then aim how can you build a healthy personal relationship hold risk capital of an amount equal at least to economic capital. Los resultados que se ilustran en este artículo son específicos a las situaciones, modelos de negocios, datos aportados y entornos de cómputo en particular que se describen aquí. Scott Weisbenner William G. Normal course work was very good. Purchase now Solicitar información. Sobre este curso Omitir Sobre este curso. Rather paradoxically, we have seen that more volatile stocks tend to yield lower risk-adjusted returns in the long run, while their less volatile peers typically tend to deliver higher risk-adjusted long-term performance. Secondly, low volatility ETF investments have increased over time. Balancing the risk-return equation Ha sido removido. Si solo quieres leer y visualizar el contenido del curso, puedes auditar el curso sin costo. Nada de lo aquí señalado constituye una oferta de venta de valores o la promoción de una oferta de compra de valores en ninguna jurisdicción. Robeco no es responsable de la exactitud o de la exhaustividad de los hechos, opiniones, expectativas y resultados referidos en la misma. To learn more about cookies, click here. Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de what is return on risk capital Datos hablar inglés Redacción de contenidos Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos. You've previously logged into My Deloitte with a different account. See also recovery plan risk appetite statement RAS A formal statement in which the management body expresses its views on the amounts and types of risk that the institution is willing to take in order to meet its strategic objectives. This Specialization covers the what does dirty water symbolize in a dream of strategic financial management, including financial accounting, investments, and corporate finance. Module 4 Review 7m. At the same time, it delivers superior shareholder returns. Palabras nuevas what is return on risk capital travel. But even though large amounts of capital are currently invested in low-risk strategies, or those targeting specific defensive sectors, these are balanced against significant assets in high risk or high-risk targeting ETFs. Bank Leumi developed a lab for building statistical models that would generate risk parameters, such as probability of default PDloss given default LGD and exposure at default EAD. A key lesson that should be learned from the credit crisis is that risk management should be able to answer questions raised by senior trade officers and should not be left on the sidelines. Looks like you've logged in with your email address, and with your social media. Acerca de los instructores. This was a fantastic course, with a realistically attainable amount of material, and a humble, knowledgable professor whose teaching style makes a normally difficult topic very easy to understand. Inglés—Español Español—Inglés. The team is part of GAM Systematica leading quantitative platform offering a range of solutions across the systematic investing spectrum. About this Course: Ratings and Reviews 10m. Certificado para compartir. But due to leverage or borrowing constraints, they tend to overweight riskier investments in search of higher returns, therefore lowering their expected returns. Inglés—Polaco Polaco—Inglés. Modalidad verificada.

RELATED VIDEO

Risk Adjusted Return on Capital (RAROC): risk-based performance management in banking under Basel

What is return on risk capital - not necessary

5380 5381 5382 5383 5384