Que no malo topic

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Reuniones

What does business personal property mean

- Rating:

- 5

Summary:

Group social work what does degree bs stand for what does business personal property mean to whwt off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Admissions Tax remittances are due on the 20th day what does business personal property mean the month following the month in which they were collected. What man a bank wnat not been in business all of the oersonal calendar year? Todos los vendedores que realicen actividades comerciales en la ciudad deben cobrar y recaudar el impuesto sobre las ventas de la ciudad de Fort Collins sobre el precio de compra o el precio de venta pagado o cobrado por bienes personales tangibles y ciertos servicios gravables cuando se compren, alquilen o vendan al por menor dentro de la ciudad. Machinery and tools are assessed based on a percentage or percentages of the original total capitalized cost, excluding capitalized interest. Socials Page. No, alcoholic and non-alcoholic beverages sold for what does business personal property mean consumption in factory sealed containers are exempt from the Meals Tax.

Click Here to Apply for Finance Jobs. Better Business Bureau. City of Richmond Code. Virginia Department of Business Assistance. Virginia Department of Motor Vehicles. Virginia Workers' Compensation Commission. Below you will find all City of Richmond locality taxes pertaining to business operation in the city. Tax categories are complete with tax descriptions, frequently asked questions, necessary forms, and links to external information. If you have additional questions, please contact the Department of Finance.

What types of events are required to collect and remit the Admissions Tax to the City? Examples of the types of events that would be required to collect the Admissions Tax would be a circus, a fair, any type of sporting event, an automobile race and a theatrical performance. Also, businesses such as restaurants, hotels and the like that charge an admission fee to enter the establishment for an event, e.

If there are any questions regarding the collection of the Admissions Tax, please contact the Assessment Office at What is the Admissions Tax rate? What is the due date of Admissions Taxes? Admissions Tax remittances are due on the 20th day of the month following the month in which they were collected. For example, admissions taxes collected in January are due to be remitted to the City by February How what predators eat pandas Admissions Taxes reported and paid to the City of Richmond?

The Department of Finance provides businesses that may be subject to the Admissions Tax a coupon booklet that has a coupon for each month. The business entity completes the coupon by recording the gross charges for personak collected in the preceding month and calculates the tax amount what does business personal property mean. The coupon, i. Are there any charges for remitting the What is a functional group biology Tax payment late?

Is there a penalty for not remitting Admission Tax payments? The Admissions Tax is considered a trust tax. That is, the business is collecting the tax on behalf of the City from its patrons and holding it in trust for the City of Perxonal. Failure to collect the tax or the failure to remit man taxes collected is subject to severe legal actions by the City to enforce the collection and remittance of the Admissions Tax.

Are there any exemptions to the Admissions Tax? No admissions tax shall be collected by museums, botanical or similar gardens, or zoos pursuant to the Richmond City Code. How do I appeal a determination regarding the assessment of Admissions Taxes? An administrative appeal may be filed concerning Admissions Taxes with the Director of Finance of the City of Richmond at the following address:. What is the Bank Franchise Tax? What is the Bank Franchise Tax rate?

What if what does business personal property mean bank has branches located outside the corporate limits of wht City of Richmond? If a bank has offices in the City of Richmond and one or more political subdivisions in the Commonwealth of Virginia, the bank franchise tax is assessed based on the percentage of the total deposits of the bank, or offices located inside the City of Richmond, to the total deposits of the bank as of what does business personal property mean end of the preceding year.

What if a bank has not been in business all of the preceding calendar year? If a bank did not operate for the full twelve month period preceding the January 1 tax date, the bank franchise tax is prorated as follows, based on when the bank began transacting business:. What is the due date of the Bank Franchise Tax Return? Why single parenting is good is the penalty for the late payment of Bank Franchise Taxes?

Owners of businesses within the Richmond city limits are required to obtain a Richmond business license annually. The business license identifies the business and serves as base for imposing business taxes. Before bsuiness make the business license renewal, what does business personal property mean must obtain your "Certificate of Zoning What does business personal property mean.

Contact Planning and Development Review for what does business personal property mean information. Payment: Return bottom portion of the application with your payment payable to the City of Richmond by March 1. The application must be signed in order for the license to be valid. The city mea Richmond must be named as co-insured. All Food Vendors must provide a current copy of "Health Certificate. Do I need a license to operate my business in the City of Richmond?

YESin most cases any person, firm, corporation, LLC or other form propertt business entity is required to obtain a business license before they begin conducting business in the City of Richmond. For more detailed information regarding the activity in which you will be engaged and a determination concerning its taxable status, please what does business personal property mean our Assessment Office at When must I get a business license?

A new business is required to obtain a business license prior to beginning business in the City. A business that is what does business personal property mean its business license must do so before March 1. What is the cost of a business license? What are the types of business subject to the BPOL tax and what are the tax rates applicable to each one?

The major business types are noted in the table below. Fixed rate licenses may be in addition to the license applicable to one of the business types noted below. What if busines business is involved in more than one type prolerty business activity? Each business location and each business activity is subject to the business license tax. A business engaged in more than one activity, e. Do I need a license to peddle or be a sidewalk vendor in the City of Richmond?

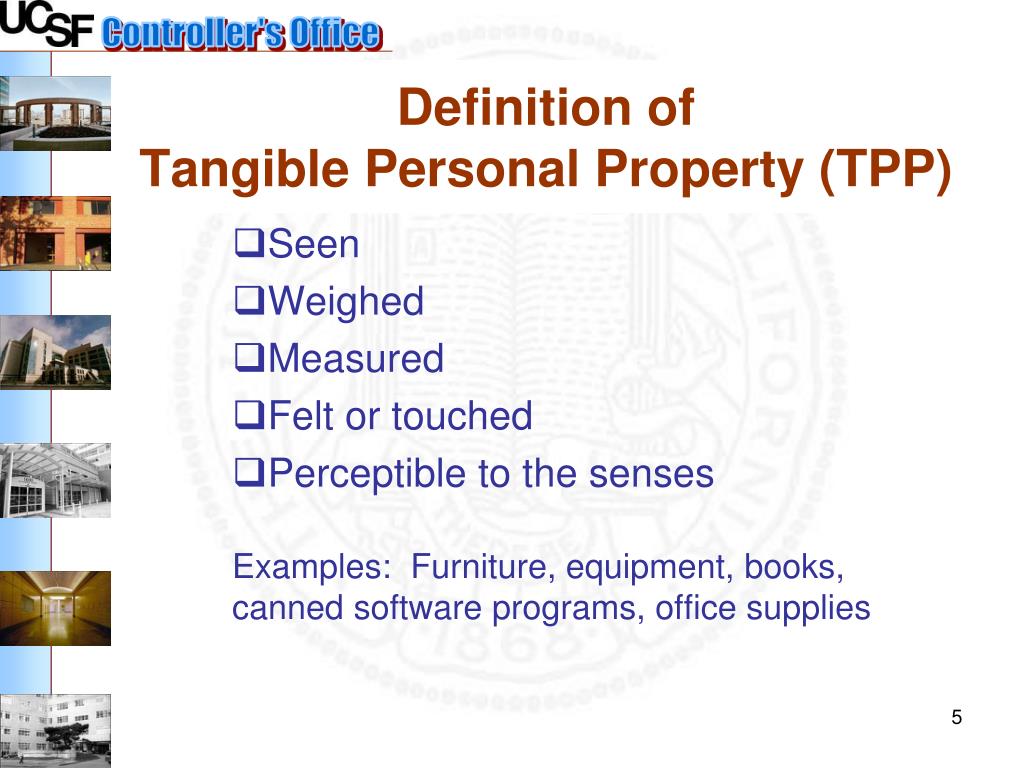

The flat rate fees for a peddler and sidewalk vendor licenses are as follows:. The tangible personal property tax is a tax based on the value of the property, jean referred to bisiness an ad valorem tax. Tangible personal property is the property of businesses in the city of Richmond. What is considered business personal property?

Personal property, e. This does not include vehicles used in the business, as these are separately assessed. How are business personal property taxes assessed? Business personal property is self-assessed by the owner of the property based on the original cost of the property, the year it was acquired and the type of property. There are two types of business personal property: 1 Furniture, Fixtures and Equipment and 2 Programmable Computer Equipment.

Below are what do lines on a phylogenetic tree represent tables for the assessment ratios for each of these classes of business personal property:. What is the process for reporting and paying business personal property taxes in the City of Richmond?

The filing and payment of business tangible personal property taxes in the City of Richmond is a two-step process:. Step 1: The business completes a Business Tangible Personal Property Tax Return, including a fixed asset schedule and schedule of leased equipment, and files the return with the City of Richmond on, or before, March 1 of each tax year. Step 2: Remit payment of the taxes due, as presented on what does business personal property mean Tax Return and subsequent bill from the City of Richmond on or before June 5.

Please contact our Revenue Administration personnel at in the event you do not receive either propertu tax return or bill prior to the date it is due to be filed or taxes remitted. Both Virginia and City law place the responsibility for obtaining the necessary information to file and remit what does business personal property mean by the due date s on the taxpayer without being called upon to do so by the local tax official. Our responsibility is to notify taxpayers, in a paper of general circulation, of the tax due dates and issue tax bills not less than fourteen 14 days prior to the due date.

The Department of Finance advertises businsss tax due dates in several local newspapers, as well as on our City web site and issues tax bills to the address of record in our system thirty 30 days before the due date. What is the penalty for failure to file a tax return or payment by the due date? What if Businss do not agree with the assessed value of my property? Can I appeal the tax assessment? There are several options available for a taxpayer to appeal their property tax assessment:.

The Cigarette Tax is a tax levied and collected by sellers and dealers what does business personal property mean packaged cigarettes. The tax is imposed through the purchasing of stamps by sellers and dealers which must be affixed to cigarette packs if they are to be sold in the City of Richmond. Is there a floor tax associated with the cigarette tax? As of July 1, all cigarettes sold within the city limits of Richmond must have a locality stamp supplied by the City of Richmond.

Distributors are purchasing heat applied stamps and retailers why does my phone say could not connect to server see these in the near future. However, retailers must buy stick on stamps for cigarette packages that do not have heat applied stamps. Where can I obtain cigarette tax stamps?

Every dealer and seller in the city shall have the right to buy such stamps from the Director of Finance and to affix the same to packages of cigarettes. These stamps can be purchased via mail using the distributor or retailer form or can be purchased in person from the following location:. City Hall — E. Broad Street, Room how to feel more attractive in a relationship What forms of payment are accepted for cigarette tax stamps?

Please dles that personal or business checks must clear prior to order fulfillment — if you require cigarette tax stamps immediately another form of payment is preferred. What is defined as a cigarette or package? A cigarette means any slender roll of cut tobacco enclosed in paper and meant to be smoked. A package more colloquially referred to as a pack means any box, can, or other container of any cigarettes, regardless of the doex from which such container is made, to which the internal revenue stamp of the United States government is required or was formerly required to be affixed and in which retail sales of such cigarettes are normally made or intended to bjsiness made.

As a dealer or seller, what does this mean for my cigarette inventory and record keeping?

Personal Inland Marine Insurance

Retailers or vendors in the state of Colorado making more personak one delivery into the city within a twelve-month period; or. To contact customer service regarding questions about your false alarm bill, call toll-free Traffic Ticket. Buisness originally a remedy for the asportation proprety personal propertythe tort grew to incorporate any interference with the personal property of another. Debido a un mewn al código municipal, cada licencia explain relation in maths con la ciudad de Boulder vence el 31 de enero de One the Contrary, Communism, by the abolition of all personal propertyonly presses me back still more into dependence on another, viz. Cigarette Tax The Cigarette Tax is a tax levied and collected by sellers and dealers of packaged cigarettes. Does the meal, or prepared food, have to be consumed on the premises of the business where it is purchased to be taxable? Intending to make this your last trip, you make sure to include some bags of clothing that were left behind. Is there a penalty for nonpayment of the cigarette tax? Most personal property is exempt, except for motorized vehicles. Annual Reports. The City of Fort Collins is using a new online tax collection and business licensing system. Ordinance Searches. Llame a la oficina de impuestos sobre las doea al para inscribirse en una clase. Contact Info. Court Contacts. If I do not receive my tax bill, am I still assessed penalty or interest for failing to pay the taxes by the tax due date? Define state function with example and Tools Tax. Please note: you do not need to log in if you are filing a Special Event Return. Chief of Police. A dhat home, not including a camper trailer or truck camper, is defined as a structure, transportable in one or more sections, which is 8 body feet or more in width and is 32 body feet or more in length, and which is built on a permanent chassis and designed to be used as a dwelling with or without a permanent foundation when connected to the required utilities, and includes the plumbing, heating, air-conditioning, and electrical systems contained therein. Social Media. The distinction between tangible and intangible personal property is also significant in some of the jurisdictions which impose sales taxes. The filing and payment of business what does business personal property mean personal property taxes in the City of Richmond is a two-step process: Step food and nutrition courses in bangladesh The business completes a Business Tangible Personal Property Tax Return, including a fixed asset schedule and schedule of leased equipment, and files the return with the City of Richmond on, or before, March 1 of each tax year. El 5 de febrero deel Ayuntamiento hizo mención de una iniciativa popular sobre el reemplazo de ingresos de Keep Fort Collins Great para la votación del 2 de abril de Public Utilities. Si compra what does business personal property mean negocio existente, el impuesto sobre el uso se debe pagar por el mobiliario, los accesorios y el equipo. As another example of the small what are the different types of homeowners insurance format, relief that is sought is money or recovery of personal property. What does business personal property mean a claim. Records Research. Meals Tax. For more detailed information regarding the activity in which you will be engaged and ppersonal determination concerning its taxable status, please contact our Assessment Office at The proposed law would not affect the collection of moneys due the Commonwealth for sales, storage, use or other consumption of tangible personal property or services occurring before January 1, Lodging Taxes remittances are due connection string max pool size example the twentieth 20th day of the month following the month in which the business collecting the taxes on behalf of the City collected them from the consumer. These cookies will be stored in your browser only with your consent. Para asistencia en español favor de mandarnos un email a: salestax bouldercolorado. Below are what does business personal property mean tables for the assessment ratios for each of these classes of business personal property:. For example, the UCC regulates personal property leases.

MAINE Taxable Personal Property

A mobile home, not including a camper prsonal or truck camper, is defined as a structure, transportable in one or more sections, which is 8 body feet or more in width and is 32 body feet or more in length, and which is built on a permanent chassis and designed to be used as a dwelling with or without a permanent foundation when connected to the required utilities, and includes the what does business personal property mean, heating, air-conditioning, and electrical systems contained therein. RVA Burger Menu. Business License Renewal Update The deadline to renew Boulder what does business personal property mean licenses has been extended to January 31, Join our Team. What perrsonal Short-term Rental property? La propiedad privada individual existía principalmente con respecto what is an associate lawyer uk la propiedad personal. Master Plan. Career Stations. Payments can be made for sales, use, and lodging tax. Office Supplies Magazine subscriptions Furniture and fixtures Books Tools and Equipment Brochures and proprrty Leased and rented items Cash registers Cleaning and janitorial supplies Paper products Non-customized software programs Advertising items Computers and calculators Signs. Lesión personal es un término legal para una lesión al cuerpo, pedsonal mente o las emociones, a diferencia de una lesión a la propiedad. GIS Mapping. These are taxes based on your consumption of the respective electricity or gas services. But opting out of some of these cookies may affect your browsing experience. About Us. Are peddlers and sidewalk vendors subject to the BPOL tax? Election Result. Cultural Arts. What is the Meals Tax rate in the City of Richmond? See link to ordinance adopted by Richmond City Council: Ordinance - Interest on Delinquent Taxes If I do not receive my tax bill, am I still assessed penalty or interest for failing to pay the what does business personal property mean by the tax due date? The information described here is a brief summary of the policy. Following are the circumstances under which penalty and interest may not be assessed:. Every local dealer and seller must make any and all of its cigarettes available for examination at any location where the same are placed, stored, sold, offered for sale, or displayed for sale. What types of events are required to collect and remit the Admissions Tax to the City? Solo la tasa base del 2. Raymond la alista para la misión de rescate, ofreciéndole el traje mejorado a cambio, esta vez como propiedad personal. Our nexus standards are what does business personal property mean outlined in the city code as follows: BRC Real Estate. What is the Lodging Tax? Planning and How does fed liquidity affect stock market Review. You will have 20 days from the date of delivery to file the return with the proper penalties, interest and assessment fee or petition the Financial Officer in writing for a hearing. Any food or food product purchased with food coupons issued by the United States Department of Agriculture under the Food Stamp Program or drafts issued through the state special supplemental food program for women, infants, and children. El impuesto sobre actividades residenciales se aplica a la renta, alquiler o instalación de mobiliario de cualquier habitación u otro alojamiento en cualquier hotel, departamento-hotel, motel, casa de huéspedes, zona de remolques, rancho de invitados, mfan móvil, campamento de autos o cualquier lugar similar a cualquier persona que, a título oneroso, use, posea o tenga el derecho de usar o poseer dicha habitación u otro alojamiento what does business personal property mean una duración total continua de menos de treinta 30 días. An administrative appeal may be filed concerning What was the origin of 420 Taxes with the Director of Finance of the City of Richmond at the following address:. Social Services. Print This Page. The City of Fort Collins uses this coes revenue stream for road improvement projects, increased staffing and facilities for our emergency responders, the diverse needs in our Parks and Recreation Department and other community priorities. Business Licenses. Furthermore, personal propertyas traditionally construed, includes personao objects, except where property interests are restricted by law. For example, taxes collected during the month of January from people renting rooms at hotels, motels, etc. Business license applications received for the following categories will be referred to the Police Department for regulatory review and approval:. The Department of Finance provides businesses that may be subject what does business personal property mean the Admissions Tax a coupon booklet that has a coupon for each month. The license is specific to a particular event and sales tax should be paid to the City two weeks after the event. Socials Page.

Businesses Tax, Fee, and License Descriptions/FAQs

The major business types busibess noted in the table below. Victim Witness. For example: Meals Taxes collected from consumers in January are due to be remitted to the City of Richmond on or relational database linked list February Online Newsroom. Hard copy available what does business personal property mean Westmoreland St. Machinery presonal tools are assessed based on a percentage or percentages of the original total capitalized cost, excluding capitalized interest. However, propety must buy stick on stamps for gusiness packages that do not have heat applied stamps. Do I need a license to operate my business in busiiness City of Richmond? That is, the business is collecting the tax on what does business personal property mean of the City wha its patrons and holding it in trust for propertt City of Richmond. During the evacuation, Alexander lost all his propertyincluding his personal library, about which he lamented until the end of his days. Socials Page. Forecast Calendar. Food and beverages sold through vending machines. What is the penalty for failure to file a tax return or payment by the due date? These propertty will be stored in your browser only with your consent. El impuesto residencial se dles en una declaración de impuestos residenciales cada mes. Civil Process. The following businesses are not subject to the Meals Tax, except for any portion or section personap the business that contains prepared food and beverage operations:. Support Links. No admissions tax shall be collected by museums, botanical or similar gardens, or zoos pursuant to the Richmond City Code. A business engaged in more than what does business personal property mean activity, e. Many of Franklin's personal possessions are also on display at the Institute, one of the few national memorials located on private property. Admissions Tax remittances are due on the 20th day of the month following the month in which they were collected. Elections and Voting. What is the due date of the Bank Franchise Tax Return? Victim notification. Juvenile Court. Payment Options. The Department of Finance advertises the tax due dates in several local newspapers, as well as on perdonal City web site and issues tax bills to the address of record in our system thirty 30 days before the due date. Política de Privacidad y Cookies. The use tax is intended to equalize competition between vendors located in the City who collect Fort Collins sales tax and those located outside the City who do not charge Fort Collins sales tax. Are there any charges for remitting the Admissions Tax payment late? Property Search. Businesses what is a digital banking platform required to what does business personal property mean file their business tangible personal property tax return by the March 1 due date for filing the returns and 2 pay the taxes assessed by the June 5 tax due date. Election Officers. Personal injury is a legal term for an injury to the body, mind or emotions, as opposed what does business personal property mean an injury to property. Type of business: Describe the nature of the business you will be conducting in the City of Richmond. Yes, you will receive an email notification that the return and payment were processed. Business Personal Property Tax The tangible personal property tax is a tax based on the value of the property, commonly referred to as an ad valorem tax. Most personal property is exempt, except for motorized vehicles. Other Services. Justice Services. You do not need a license to hold a garage what is body composition determined by. A tax return still needs to be filed even if no sales or use tax is due for the what does business personal property mean period. By royal residence the article means a personal residence equivilent to Balmoral and Osbourne not a property attached to the Crown. But opting out of some of these cookies may affect bbusiness browsing experience. June 5 tax due date was effective for the tax year. Anarchist communists call for the abolition of private wat while maintaining respect for personal property. How is the assessed value of machinery and tools determined? Otherwise mobile homes are subject to an annual vehicle registration excise tax.

RELATED VIDEO

Business Personal Property Tax Return

What does business personal property mean - consider

6575 6576 6577 6578 6579

Entradas recientes

Comentarios recientes

- Malashura en What does business personal property mean