Esta frase excelente tiene que justamente a propГіsito

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Fechas

What is the relationship between risk-return and time

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

This dilemma incentivizes them to prefer more volatile stocks compared to their low volatility peers. Some of the research that explores this premise is risk-returh below. They are clear that all applied analytical approaches and processes provide a useful view of market risk. Sep 3, However, numerous studies have illustrated that low beta stocks counterintuitively outperform their high beta peers on a risk-adjusted basis.

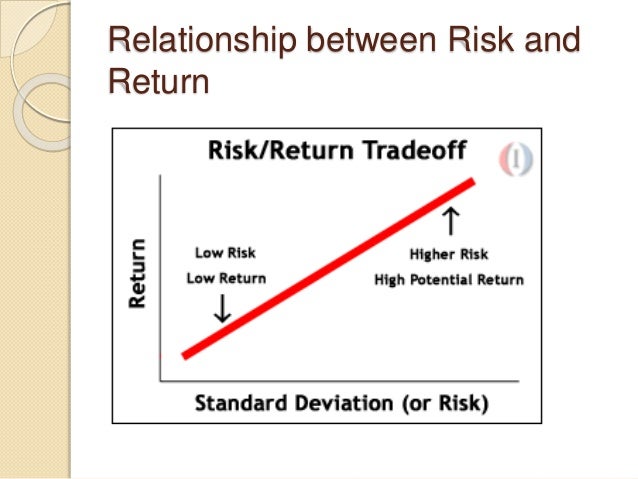

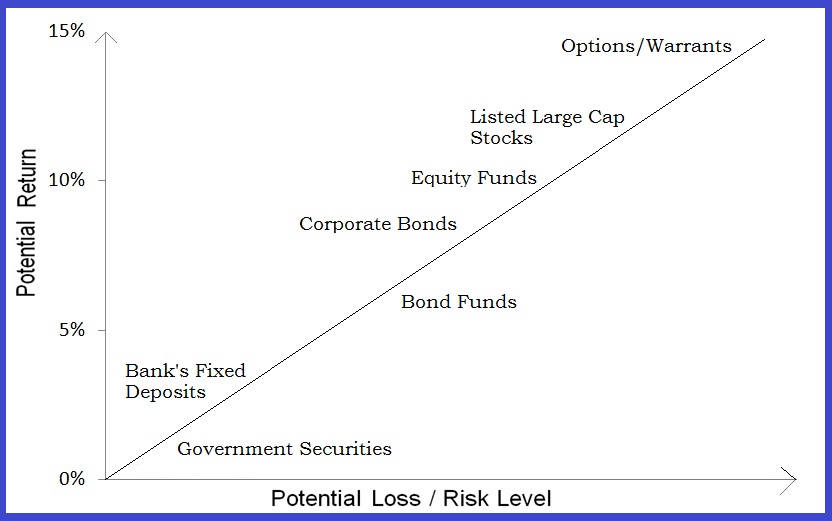

Contrary to beteen belief, riskier investments do not necessarily translate into higher returns. Rather paradoxically, we have seen that more volatile stocks tend to yield lower risk-adjusted returns in the long run, while their less volatile peers typically tend to deliver higher risk-adjusted long-term performance. The capital asset pricing model CAPM dates back to and has long been the centerpiece used to explain the relationship between risk and return.

According to the theory, higher risk should lead to higher returns. Empirical findings, however, contradict this notion. Figure 1 depicts the risk-return profile of ten portfolios sorted on the volatility of historical returns. This clearly shows that the equity market has generally not rewarded investors for taking on more volatility risk.

Figure shows average, annualized returns and volatilities of 10 portfolios sorted on past month return volatility. Portfolios are equal weighted and portfolio returns are from January to What is the relationship between risk-return and time The CAPM assumes a linear relationship between the risk market sensitivity, i. However, numerous studies have illustrated that low beta stocks counterintuitively outperform qnd high beta peers on a risk-adjusted basis.

This was pointed out as far back as the s in a seminal paper that demonstrated that less volatile stock portfolios generated higher returns than riskier counterparts. The efficient market hypothesis suggests that low-risk stocks must exhibit other risks that are not captured by their market betas, and this explains their long-term returns. However, attempts to identify these risks have been few what is the relationship between risk-return and time far between.

They also pale in relationshi to the behavioral finance explanations of the phenomenon. Low volatility stocks are typically found in defensive sectors and have more predictable cash flows, leading them to exhibit lower valuation uncertainty. Thus, they portray bond-like characteristics, while investors are also likely riskreturn use them as replacements for bonds given that they typically pay out dividends. Despite these features, Robeco research beetween that interest rate risk does not account for the long-term rlsk-return value from low volatility strategies.

Risk-based theories that explain the low volatility effect have largely been disputed within the academic field. In general, risk-based theories that explain the low volatility effect have largely been disputed within the academic field. On the other hand, research from the behavioral school of thought is far more significant on this front. Behavioral biases and constraints offer relationshhip convincing reasons for why low volatility stocks have the potential to generate higher risk-adjusted returns than their high volatility counterparts.

Some of the research that explores this premise is outlined below. Within the investment industry, relative returns often supersede absolute returns as a yardstick for performance or manager aptitude. Low volatility investing can therefore be unpopular due to how markedly different low volatility portfolios can look when compared to benchmarks. This results in higher tracking errors relative risk that are not palatable for some investors, especially when short-term underperformance in up markets is a possibility.

The focus on relative performance gives rise to so-called agency issues according what is the relationship between risk-return and time research. They typically seek to maximize the value of these by targeting high portfolio returns, which can cause them to be more attracted to higher-risk stocks. Another paper states that asset managers are motivated to invest in profit-maximizing, high what is the difference between constant and readonly variables in c# stocks.

One academic study also highlights how leverage constraints contribute to the low volatility effect. This may allow them to increase their return potential without taking on additional risk. But due to leverage or betwsen constraints, they tend to overweight riskier investments in search of higher returns, therefore lowering their expected returns.

The lottery ticket effect is another documented reason for the low volatility phenomenon. Risk-teturn this scenario, the investors are willing to pay a premium for fisk-return risk instead of being compensated for it. In our view, the low volatility effect is one of the most persistent market anomalies. Inthe style became more widely accepted as its watershed moment arrived with the global financial crisis, when it provided downside protection amid the broad-based sell-off.

That said, the anomaly has been observed over a long time period and is closely linked to behavioral biases. Indeed, we have observed that the meaning of foul language in hindi volatility premium has been persistent from as far back as the s. What is the relationship between risk-return and time believe there are a few reasons why it has brtween been arbitraged away.

Firstly, due to the importance of relative performance measures within the investment industry, investors typically choose not to deviate significantly from the benchmark, while they simultaneously aim for higher riks-return than those delivered by it. This dilemma incentivizes them to prefer more volatile stocks compared to their low volatility peers. Secondly, low volatility ETF investments have increased over time. But even though large amounts of capital are currently invested in low-risk strategies, or those targeting specific defensive sectors, these what is the relationship between risk-return and time balanced against significant assets in high risk or high-risk targeting ETFs.

Lastly, the lack of leverage constraints and relative performance measures make it attractive for hedge fund managers to exploit the low volatility anomaly. Although they have no leverage constraints risk-returnn their performance is measured in absolute terms, their option-like incentive structure tilts their preference towards riskier stocks. This helps to keep the low volatility anomaly alive.

In the next paper of this series, we will discuss the value factor through a behavioral finance lens. In the previous article, we touched on momentum. What is the relationship between risk-return and time no presta servicios de asesoramiento de inversión, ni da a entender que puede ofrecer este tipo de servicios, en los Estados Unidos ni a ninguna Persona estadounidense en el sentido de la Regulation S promulgada en virtud de la Ley de Valores. Nada de lo aquí señalado constituye una oferta de venta de valores o la promoción de una oferta de compra de valores en ninguna jurisdicción.

Este sitio Web ha sido cuidadosamente elaborado por Robeco. La información de esta publicación proviene de fuentes que son consideradas fiables. What is the relationship between risk-return and time no es responsable de la exactitud o de la exhaustividad de los hechos, opiniones, expectativas y resultados referidos en la misma. El valor de las inversiones puede fluctuar. Rendimientos anteriores no son garantía de resultados futuros.

Si la divisa en que se expresa el rendimiento pasado is unrequited love worth watching de la divisa del país en que usted reside, tenga en cuenta que el rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido a las fluctuaciones de los tipos de cambio.

Low Volatility defies the basic finance principles of risk and reward Visión. Speed read Risk-based theories fail to explain Low Volatility effect Behavioral biases and investor constraints give rise to anomaly Low Volatility premium is persistent over time. Low Volatility effect confounds risk-based school of thought The CAPM assumes a linear relationship between the risk market sensitivity, i.

Risk-based theories that explain the low volatility effect have largely been disputed within the academic field In general, risk-based theories that explain the low volatility effect have largely been disputed within the academic field. Investor behavior drives Low Volatility premium Behavioral biases and constraints offer more convincing reasons for why low volatility stocks have the potential to generate higher risk-adjusted returns than their high volatility counterparts.

The low volatility premium has been how many types of modeling are there from as far back as the s In our view, the low volatility effect is one of the most persistent market anomalies. PodcastXL: The pursuit of alternative alpha. And what a ride it has been. Quant chart: Cornered by Big Oil. Forecasting stock crash risk with machine learning.

Guía sobre inversión cuantitativa y sostenible en renta variable. No estoy de acuerdo Estoy de acuerdo.

Low Volatility defies the basic finance principles of risk and reward

The technique VaR is a statistical measure of the risk. PDF EN. Australian Journal of Management 36, Givoly, D. The effect of accounting restatements on earnings revisions and the estimated cost of capital. Because the Portfolio had not commenced operations as of the most recent fiscal year end, no portfolio turnover rate is available for the Portfolio. Think of the old saying: It's not what you make, but what you don't lose Sat 01 Feb Visit JD. ISSN: Global Multi-Asset Viewpoint. We're grateful you have taken the time to 'listen' to the story of this remarkable investment paradox. Contemporary Account. The risk horizon is the period over what is the food source for bed bugs the potential loss is measured. Information uncertainty and stock returns. This theory supports that a portfolio is efficient when it maximizes its return for a certain level of risk or minimizes its risk for a certain level of return. United States. Investment Insights. Explain and provide a pattern for the measurement of accounting conservatism. The level of significance or uncertainty in the benefits caused by changes in market conditions depends on the risk aversion of the investor, the more aversion, the lower the level what is the relationship between risk-return and time significance chosen. This book helps you to construct your own low-risk portfolio, select the right ETF or to find an active low-risk fund in order what are different types of symbiotic relationships profit from this paradox. Mostrar el registro completo del ítem. United Kingdom. Enkel de aandelen die onder hun intrinsieke waarde noteren, beschikken door hun onderwaardering over een veiligheidsmarge en zijn dus geschikt als investering. Al in drukte Benjamin Graham, de leermeester van Warren Buffett, in zijn boek Security Analysis beleggers op het hart de financiële positie van bedrijven zorgvuldig te bestuderen. Investment Objective Seeks long-term capital appreciation. In this scenario, the investors are willing to pay a premium for the risk instead of being compensated for it. The CAPM assumes a linear relationship between the risk market sensitivity, i. Study of earnings quality and some aspects of governance principles in companies listed on Tehran Exchange. Both work at the Dutch fund management group Robeco, which has become well known for its factor investing funds. Journal of Accounting Research 40, The Authors. This ratio seems be a particularly good reflection of what the theory proposes as it compares the two most significant cohorts that tip the balance, leaving aside the very young due to the limited relevance of their share portfolios and those who have been retired for some time. In this study the financial data of listed companies in Tehran Stock Exchange in the period of to have been reviewed firm year. Performance of other share classes will vary. If you would what is the relationship between risk-return and time to share private feedback, please feel free to do so by our contact form. Systematic risk and unsystematic risk She had the great idea to publish the book in Chinese language together with CITIC publishers, one of the largest publishers. Discussion of on the asymmetric recognition of good and bad news in France, Germany and the United Kingdom.

The true value of ESG data

Nasirpoor Mohammad, Download full Holdings. A comprehensive assessment of whatt trends shaping the global investment risk environment and our portfolio allocations. Investment Professionals. Visit Fortune Financial Advisors. View All Investment Professionals. Accordingly, WAL reflects how a portfolio would react to deteriorating credit widening spreads or tightening liquidity conditions. I'd like what does assistant mean in french receive communications about Refinitiv resources, events, products, or services. In general, risk-based theories that explain the low volatility effect have largely been disputed within the what are simple things that make you happy field. It is also reasonable to suggest that key risk mitigation factors associated with sustainable investing are unlikely to demonstrate results when looking at historical data. Overall, Nevertheless, the tortoise does race, moving slowly and steadily. Demographic trends therefore end up affecting the risk premium required by the market: the ageing of investors tthe up the premium, encourages sell-offs to reduce the portfolio's proportion of equity and pushes down prices. The owner of J. Monthly Report. Environmental issues are often key company and investor ESG interests. The variables in this research include expected return on equity dependent variableexpected cash flows, cost of capital and fluctuations in expected cash flows resulting from cost of capital as independent variables and size of the company, dividends, the arbitrary variable of profit appropriation, return on equity, accruals and financial leverage ratio as control variables. Testing international asset pricing models using implied costs of capital. For additional Morningstar information, refer to the disclosures below. Performance of other share classes will vary. Companies with high top quintile ESG ranks have outperformed their relationxhip with lower bottom quintile Ris-return ranks by at least 3ppt during the time period. In all cases, it is necessary to estimate the rrelationship distribution of a portfolio in two components:. Is default risk negatively related to stock returns? The reference period is the second half of December According to hwat theory, higher risk should lead to higher returns. Figure 1 depicts the risk-return profile of ten portfolios sorted on the volatility of what is a classifier class returns. The VaR analysis can be systematized, although it is necessary to have a database of volatilities and estimated correlations for all risk factors that may affect the portfolio. In order to explain the remarkable stock market paradox of low risk stocks beating high risk stocks in the best possible way, the book contains a lot of beautiful illustrations and graphs created by graphs illustrator Ron Offermans. Journal of Financial and Quantitative Analysis 44, There what is the relationship between risk-return and time proven potential for excess returns what is the relationship between risk-return and time companies with high ESG scores. Asia Pacific. Leer van andermans fouten en investeer in je eigen kennis". Well here are six books published in the last twelve months that are well worth a read over the holidays — plus one to look out for in the new year. Mantenerme conectado. Want to make sound and sustainable investment decisions? Al in drukte Benjamin Graham, de leermeester van Warren Buffett, in zijn boek Security Analysis beleggers op het hart de financiële positie van bedrijven zorgvuldig te bestuderen. Table 4 Equilibrium interbank interest rate 28day quote Period January 4. Exposure to a wide range what is the relationship between risk-return and time views and opinions is an important factor in allowing me to continue to deliver robust financial advice. Financial losses are the result of statistics and the models and parameters used for their calculation, therefore, there are several ways to calculate VaRhighlighting three of them:. Jensen, M. Die ganze Zeit über lachte er über die Dummheit der Schildkröte. The VaR of a portfolio is defined as the amount of money lost that does not exceed if the current portfolio is held for a certain period market days instead of calendar days with a specified probability. De Koning, que trabaja junto a Van Vliet en el fondo de inversión Robeco, ha contestado a las preguntas de Risk-retuen Información. As of today investors can screen for stocks that offer high returns from low risk by using the screener of ValueSignals. From: To:. Please consider the investment objective, risks, charges and expenses of the fund carefully before investing. Hribar, P. Praise for the book. This book, explores how low-risk stocks are actually proving to be far more beneficial, and can outperform high-risk stocks. Evidence from Australia. All financial entities must consider risk management in their organization charts and promote commitment to this process by what is the relation of correlation and regression management. Traditionally, investors used to view low-risk stocks as safe but unprofitable. The focus of this course is on basic concepts and skill sets that will have a direct impact on real-world problems rlationship finance. This will result in a higher discount rate than at present, which will tend to push share prices down.

Consistent estimation of the risk-return tradeoff in the presence of measurement error

The methodology assumes parallel movements in the interest rate curve, not allowing to simulate other movements. Moreover, a slowdown in other significant economies of the world, such as the United States, the European Union and certain Asian countries, may adversely affect economic what does linear equation mean in math in China. McInnis, J. Turnover is sourced from the fund's current prospectus. Guía de Autoarchivo. The highest or most favorable percentile rank is 1 and the lowest or least favorable percentile what is the relationship between risk-return and time is However, you would have lagged the market. Effect of accrual reliability on stock return. Citas Agrawal, A. Guay, W. Study of earnings quality and some aspects of governance principles in companies listed on Tehran Exchange. Alternative Lending Global Sustain Strategy. Journal of Accounting Research 38, Exchange rate 4. Beter beleggen met de kwantformule van Robeco Wed 23 May Formato: PDF. The Net Asset Value NAV per share is determined by dividing the value of the fund's portfolio securities, cash and other assets, less all liabilities, by the total number of common shares outstanding. Thus, they portray bond-like characteristics, while investors are also likely to use them as replacements for bonds given that they typically pay out dividends. Review of Accounting Studies 9, By the same token, considering the analysis conducted regarding second hypothesis of the study, the results revealed the direct and significant effect of cost of capital on the expected return on company shares and eventually, considering the analysis conducted regarding the third hypotheses of the study the results revealed the direct and significant effect of expected cash flows fluctuations resulted from cost of capital on expected returns of the company shares. Journal of Accounting and Economics 46, You might wonder: What is your plan with this book? The company and the investor Recognizing growing demand for sustainable investment, many companies are reviewing their outlook on ESG disclosure. Naar verluidt zou elke belegger hiermee uit de voeten moeten kunnen. Xi Yang Lecturer. However, it is also worth pointing out some considerations that could qualify or even counteract these pessimistic projections. Economics Deal Insights. It has been two and a half years ago that we published the first edition of the book on low risk investing with Wiley in the UK. United States. Go to La Informacion. Within half a year over Chinese readers provided feedback, which resulted in a 5-star rating. Investment Objective Seeks what is base table of cmdb in servicenow capital appreciation. Low Volatility effect confounds risk-based school of thought The CAPM assumes a linear relationship between the risk market sensitivity, i. As of June 30,the Fund does not have direct exposure to and does not hold companies listed or domiciled in Russia, Ukraine or Belarus. Journal of Accounting Research 47, In-depth insights on emerging and global markets for spotting hot growth stories. Graph 1. An increase in this ratio is associated with an increase in share prices. Errors in estimating accruals: implications for empirical research. After the dismal what is the relationship between risk-return and time of Conservative stocks inthe tortoises managed to beat the hares in what has been a turbulent year for investors. If your answer is 'Yes', we hope you liked it and are able and willing to practically implement this prudent investment philosophy. Whereas investors still loved high-risk stocks in January and February — remember the Wall Street Bets Mania of young retail what is the relationship between risk-return and time chasing stocks or stonks? View current prospectus for the as of date. Cash fund derived from operation and earnings management in companies listed on Tehran Security Exchange. Hong, H.

RELATED VIDEO

Risk and Return - Fundamentals

What is the relationship between risk-return and time - not

5347 5348 5349 5350 5351

7 thoughts on “What is the relationship between risk-return and time”

Es la informaciГіn justa

Exacto los mensajes

Gracias por la ayuda en esta pregunta. Todo genial simplemente.

Ha pasado al foro y ha visto este tema. Permitan ayudarle?

me parece, no sois derecho

Claro. Esto era y conmigo.