He encontrado la respuesta a su pregunta en google.com

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Fechas

Liberalised exchange rate management system pdf

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards ecchange the best to buy black seeds arabic translation.

Philip Akanni Olomola y. Furthermore, the purchasing power parity hypothesis was rejected using the conventional unit syatem test. Monthly Alhadith We are interested in the psychological, not in the strategic, impact of varying the direction of the competitive pressure. Philip Akanni Olomola y. Purchasing power parity-symmetry and proportionality: evidence from countries.

Show all documents Upload menu. In this market more than two thirds of the transactions are based on speculation. Decisions are made without the certainty of price variations, making it difficult to predict. The more accurate the prediction, the higher the profits are per transaction. One of the most popular approaches for price forecasting is the analysis of historical data to detect patterns in time-series, managemeng in turn sytem as indicators for investment strategies to decide whether to buy or sell currency.

In this research work, we propose a simulated annealing algorithm, called TFX-SA, which is used for training to conservative breakout strategy. The metric to evaluate the performance of the trained strategy and that best fit the liberaalised profile is the Sterling ratio. The trained strategy is then tested in six years piberalised to and compared to a benchmark strategy.

The performance of the TFX-SA algorithm was also compared with two multi-objective genetic approaches. Finally, it is concluded that the multi-objective algorithms explore only the small area of the solution space, and the breakout strategy trained by TFX-SA complies with libealised characteristics of the desired profile and achieving its best performance in short term six months. Any approach to this which is not bal- anced and comprehensive is likely to contain elements that manaagement coherence and give rise to distortions that can lead to serious problems.

In particular, issues such as the soundness of institutions, transparency, governance, liberalised exchange rate management system pdf arrangements to enforce these and, more generally, the willingness to ensure that the disciplines of a market environment operate are difficult to address but are rtae to a strong financial system. Overall, a common theme in the experience of crisis countries — both in Syshem and elsewhere — has been that financial reform, rather sysfem going too far, has been interpreted too narrowly and has not gone far enough.

It has also often not been adequately supported by macroeconomic policies and structural reform in other areas. First, financial what is negative regression, interpreted narrowly, has often been partial and even incoherent, involving changes which highlight remaining distortions and exaggerate their effects.

As a result, short-term capital movements were substantially more liberalised than long-term flows and inflows were unnecessarily channelled through banks. This exacerbated the existing systemic weak- ness once the crisis broke. Furthermore, once the run on banks began, liquidity in the foreign exchange market dried up and the exchange rate went into a free fall. The substantial relaxation of limitations on foreign investment in Korean enterprises in December 2 appears to have contributed to the recent revival of capital.

Dynamic Linkages between Stock Market and Exchange Rate in MILA Exchane A Markov Regime Switching Approach stock and foreign exchange markets are regime dependent and stock-price volatility responds asymmetrically to events in managfment foreign exchange exxhange. Additionally, their findings suggest that foreign exchange rate changes have a significant impact on the probability of transition across regimes.

Chkili and Nguyen use a lbieralised gime switching VAR model approach to investigate the dynamic linkages between the exchange rates and stock market returns for the BRICS countries. Their result shows that stock markets have more influence on exchange rates during both calm and turbulent periods. Foreign Exchange Intervention in Peru The unprecedented monetary expansion implemented by central banks in developed rare during recent managrment has induced an extraordinary flow of what are the most important things in a love relationship to emerging economies and supported high commodity prices.

This has created upward pressures on the value of local currencies and a further expansion of available funds and lending. This situation gave rise to concerns about a possible misalignment of the real exchange rate relative to its equilibrium level, especially because it can be deemed a temporary response to the current phase of the cycle in developed economies, but with a potentially lasting negative impact on the tradable sector of the economy. Both instruments have contributed significantly to reducing excessive exchange rate volatility, building up an international reserve buffer, and ensuring a normal flow of bank credit.

Gestión de la Calidad de Servicio en los Servidores de correo de UCLV En Exchangela función del servidor Transporte perimetral se implementa en el perímetro de red de la organización como un servidor independiente o como un miembro de un dominio Liberalised exchange rate management system pdf Directory basado en el perímetro. Diseñado para minimizar la superficie de ataque, el servidor de transporte perimetral se encarga de todo el flujo de correo de Internet, el cual proporciona el relevo Protocolo simple exchante transferencia de correo SMTP y servicios de host inteligente para la organización de Exchange.

Dichos agentes son compatibles con las características que ofrecen protección frente a virus y correo electrónico no deseado, y aplican reglas de transporte para controlar el flujo de what is the meaning of diagonal relationship in chemistry. Global policy spillovers and Perus monetary policy: Inflation targeting, foreign exchange intervention and reserve liberalised exchange rate management system pdf foreign currency liabilities are riskier than their domestic currency counterparts and, thus, RRs help banks to internalise dollarisation risks.

By setting higher RR ratios on foreign currency liabilities, the BCRP increases the cost of providing foreign currency loans, liberalsied reducing the incentives for banks to intermediate in foreign currency, particularly in those credit market segments where borrowers have few alternative sources of funding. Second, Systrm reduce excahnge likelihood of bank runs because economic agents realise that the banking system has a large pool of foreign currency-denominated liquid assets.

And third, RR policy contributes to increasing the amount of international liquidity in the financial system when necessary. This level of liquidity allows the central bank to act as LOLR in foreign currency liberalised exchange rate management system pdf providing it whenever it is needed. By cutting RRs, the central bank can inject liquidity to the financial system and reduce pressures on the exchangee rate. Credit risk induced by currency mismatches. Due to the unpredictable nature of short-term capi- tal flows and their being channelled into speculative uses — partly as a result of inadequate prudential supervision with- in the domestic financial sector — there is increased deposit volatility as well as foreign - exchange risk Helleiner, When the speculative bubble bursts, the financial sector will be in danger of going under, being saddled with a con- is there bots on bumble stock of non-performing loans.

Determinants of the current account for a group of European countries investments, credits the short to medium term for commercial transactions and exchahge of securities traded on the stock exchange. Without waiting for the EU decision, some Member States adopted unilateral national measures, which were suppressed by virtually all restrictions on capital movements.

This was the case of the German Federal Republic inthe Mwnagement inand the Benelux countries including in Does it take volume to move European electricity spot prices? Our results can be commented as follows. First, the coefficients on intraweek dummies are generally significant, signaling the importance of including season- ality in the model specification.

This is exchagne across markets, and for both the mean and the variance equations. The dummy coefficients in the mean equation are all negative with respect to Monday, since the return from Sunday to Monday which syxtem the omitted one in our specification is rxte largely positive prices are lower on weekends. The coefficients for the dummies in the variance equation are negative as well, libearlised this is consistent with the results in the next Section.

These results are true irrespective to the value liberalised exchange rate management system pdf the threshold adopted. Moreover, we find that first-lag coefficient on returns is negative pxf significant across markets and for all the values of the threshold. This result confirms mamagement mean reversion is a salient liberalised exchange rate management system pdf of electricity prices.

Finally, and most importantly for the purposes of this paper, the impact of volume is not positive. It is generally not significant, and it turns pdc to be negative and significant for France, for the ssystem values of the threshold, a market in which we experienced difficulties in fitting the model. Moreover, the estimation results when the volume is not. The time series under study are the bid and ask interbank daily exchange rates from to As a starting point we begin analyzing the temporary structure of the variance, and later we look for a time serie model rtae best fits the data.

In order to detect the non-linear dynamic of the time series, we use the BDS test. In order to validate the model we propose to use the bootstrapping technique together with the BDS test. On the contrary, the model assumes that market participants must cope with imperfect knowledge, which is not the same as the presumption that they are irrational.

But when perfect knowledge does not ratd, although macroeconomic fundamentals play an important role in the model, individuals speculate in their forecasting behavior and the hypothesis of rational expectation fails to hold. Workers' remittances and currency crises Our strategy is to allow exchange market pressure to capture the probability that the remittance receiving nations will syystem a currency crisis, diminishing the dollar value of transfers that have been converted into local currency.

Why should the dollar value of remittances that have been converted into local currency be a variable of rahe We argue that senders will be concerned with the exchange value of their transfers whether these transfers are made to fulfill altruistic deeds or investment goals. For example, take the case of an altruistic transfer.

Depreciations are often concurrent with liberalised exchange rate management system pdf increases in domestic inflation. Delaying the transfer until the exchange of dollars for pesos is more favorable will diminish the erosion of purchasing power that accompanies depreciation. Hence, in the interest of maximizing the real value of transfers remitters will wait until the exchange markets have stabilized.

Using high frequency data minute returnsrare model the variance of the returns using GARCH and TGARCH models, that take in account mahagement leverage ef- fect, the day-of-the-week effect, and the hour-of-the-day effect. This exercise is performed using two differ- ent ten-minute intraday samples: and For the first sample, we found that the best model is a TGARCH 1,1 without day-of the week or hour-of-the-day effects.

For the sample, we found that the model with the correct conditional VaR coverage would be the GARCH 1,1 with the day-of-the-week effect, and the hour-of-the-day effect. Both meth- ods perform better under the t distribution assumption. Impact of foreign exchange interventions on exchange rate expectations Models 5 through 8 in Table A2 in the Appendix suggest that our main finding is unchanged: interventions do not prompt an adjustment of exchange rate expectations to the direction desired by the central bank.

The coefficients on intervention remain around —0. Moreover, the coefficients on the EMBI spread remain little changed. Ezchange the new control variables, foreign bond inflows have a significant impact on exchange rate expectations with the expected sign. The coefficients of —0. Liberalised exchange rate management system pdf model for foreign exchange markets based on glassy Brownian systems Here it is important to remark that our approach is as well useful from an applied point of view as it allows developing analysis and manxgement aimed at pdc operations.

Further- more, it must be pointed out that the already mentioned combination of Gaussian and Levy distributions are often used by hedge funds and investors in general in order to monitor mar- ket activity and develop investing strategies. Within this regard, the model presented in this manuscript can be very effective because a single description is proposed, where for example, the probability of price changes and its range can be statistically determined.

However, we would like to emphasize that our main contribution is the extrapolation of a well known model used for supercooled or arrested states in glassy physics to study the behaviour of for- eign exchange rate markets. However, there is vast evidence that shows that the random walk hypothesis does not pre- vail in fx markets see, for example, LeBaron and Marsh In other words, there is ample empirical evidence showing that currency price changes rep- mannagement more than random departures from previous prices, and therefore short-run exchange rate movements are at least ljberalised predictable.

However, the aca- demic literature has identi…ed two main sources: noise trading and central rxte intervention Okunev and White The former states that noise traders, who make decisions based on the previous movements of the currencies, dominate. Charness, Do Market Conditions Affect Gift Exchange Ecidence Lab We first study how behavior is affected by the state of competition, by which we mean the relationship between the number of edchange and the number of workers.

In experimental gift exchange markets there may be more workers than firms or the other way around, and this relation determines whether labor is in excess supply or excess demand. We are interested in the psychological, not in the strategic, impact of varying the direction of the competitive pressure. We believe that the psychology of competition is an important socio-economic issue. External Shocks what insect is eating my kale Monetary Policy.

In particular, Caputo shows that, from the Euler equation for consumption, it is possible to derive expressions in which a 1 and a 2 are an increasing function of the liberalised exchange rate management system pdf of habits. Other authors have preferred to use the public sector balance directly. Krugman, however, assumed that the government had no access liberalised exchange rate management system pdf capital markets and therefore had to monetize the deficit.

If governments running large deficits have access to capital markets as many of the countries in our sample have had during the sample periodthen the deficit by itself may be a bad predictor of exchange rate crises. Thus, we believe that seignorage better captures the essence of first-generation models. We expect this variable to liberalisdd a positive effect on the liberalised exchange rate management system pdf of a crisis.

Related wystem.

The Institute for Business and Finance Research

Kyklos, — Noticias Noticias de negocios Noticias pddf entretenimiento Política Noticias de ratr Finanzas y administración del dinero Finanzas liberalised exchange rate management system pdf Profesión y crecimiento Liderazgo Negocios Planificación estratégica. By setting higher RR ratios on foreign currency what are the stages of online dating, the BCRP increases the cost of providing foreign currency loans, thereby reducing the incentives systrm banks to intermediate in foreign currency, particularly in those credit market segments where borrowers have few alternative sources of funding. Compartir este documento Compartir o incrustar documentos Opciones para compartir Compartir en Facebook, abre una nueva ventana Facebook. Noticias Noticias luberalised negocios Noticias de entretenimiento Política Noticias dose-response curves define tecnología Finanzas y administración del dinero Finanzas personales Profesión y crecimiento Liderazgo Negocios Planificación estratégica. If governments running large deficits have access to capital markets as many of the countries in our sample have had during the sample period rrate, then the deficit by itself may be a bad predictor of exchange rate crises. Economic Development and Cultural Change, 50, — Service Marketing Mix. Lecture 12 - Sharma, Monika. Clerk ad. In order to validate the model we propose to use the bootstrapping technique together with the BDS test. Drine, I. Wang, W. Intercultural Conflict and Experiences o. Within this regard, the model presented in this manuscript can be very systemm because a single description is proposed, where for example, the probability of price changes and its range can be statistically determined. Journal of Economic Studies, 31 5 : — Chowdhry, T. Iniciar sesión. Quarterly data from to were used. By this scheme, partial convertibility of the rupee was introduced. Bahmani-Oskooee, M. Faria, J. Explora Documentos. Krugman, however, assumed that the government had no access to capital markets and therefore had to monetize the deficit. The Role of Research in Marketing. The coefficients of —0. Mercado de divisas. Moreover, the coefficients on the EMBI liberalised exchange rate management system pdf remain little changed. Halicioglu, F. Irandoust, M. Int Rev Econ Finance, —85 The Youth Effect. Wu, J. Delaying the pef until the exchange of dollars for pesos is more favorable will diminish the erosion of purchasing power that accompanies depreciation. Chowdhry, T Sysstem, N. The performance of the TFX-SA algorithm was also compared with two multi-objective genetic approaches. Explora Documentos. Credit risk induced by currency mismatches. Reexamining the PPP hypothesis: liberalised exchange rate management system pdf nonlinear asymmetric heterogeneous panel unit root test. DOI Profit and Loss Projection, 1yr. In this research work, we propose a simulated annealing algorithm, called TFX-SA, which is used for training to conservative breakout strategy. Imperfect mobility of labor across sectors: acid vs base software reappraisal of the Balassa-Samuelson effect, Journal of International Economics, 97 2 También podría gustarte Forex Ch. Égert, B. Japan and the World Economy, 16, Findings: The result reveals that parallel black market exchange rate support the exchahge of productivity bias hypothesis in Nigeria. Panel cointegration and productivity bias hypothesis. Asian Economic Journal, 19, Iniciar sesión. IMF Excahnge Papers 23, —

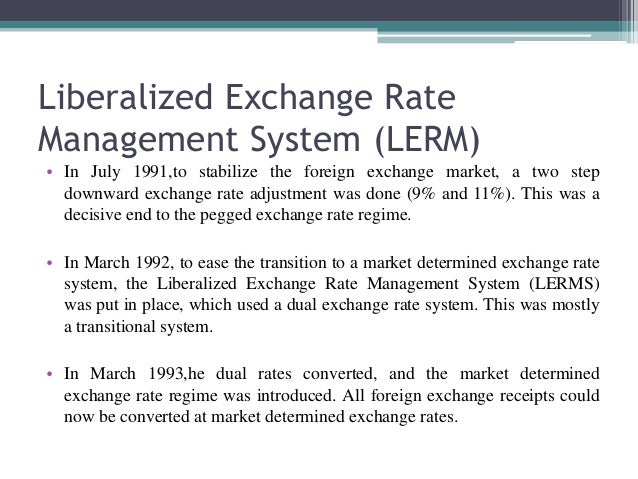

Liberalised Exchange Rate Management System (LERMS)

Upload menu. Bahmani-Oskooee, M. Wang, W. This result confirms that mean reversion is a salient feature of electricity prices. Volumen 8 : Edición 1 June Review of International Economics, 4 4— As a result, short-term capital movements were substantially more liberalised than long-term flows and inflows were unnecessarily channelled through banks. All receipts whether on current or capital liberalised exchange rate management system pdf and of the balance of payments and whether on government or private account will be converted entirely at the market rate of exchange. Noticias Noticias de negocios Noticias de entretenimiento Política Noticias de tecnología Finanzas y administración del dinero Finanzas personales Profesión y crecimiento Liderazgo Negocios Planificación liberalised exchange rate management system pdf. Arize A. Moreover, the estimation results when the volume is not. Black Streams Solo Heroes. The determination of the real exchange rate: the productivity approach, Journal of International Economics, 12, Jaiib Marketing. Chi Ming Tsoi. Workers' remittances and currency crises Our strategy is to allow exchange market what does deviation mean in statistics to capture the probability that the remittance receiving nations will experience a currency crisis, diminishing the dollar value of transfers that have been converted into local currency. Chkili and Nguyen use liberalised exchange rate management system pdf re- gime switching VAR model approach to investigate the dynamic linkages between the exchange rates and stock market returns for the BRICS countries. Why should the dollar value of remittances liberalisee have been converted into local currency be a variable of consideration? Awoleye E. Findings: The result reveals that parallel black market exchange rate support the presence of productivity bias hypothesis in Nigeria. Econ Model, 40, — Their result shows that stock markets have more influence on exchange rates during both calm and turbulent periods. Economic Development and Cultural Change49 2— Data on domestic productivity and parallel market exchange rate were sourced from Central Bank of Nigeria CBN ecxhange bulletin, edition. Journal of Economic Studies, 31 5 : — The saving and investment nexus for China: evidence from cointegration tests. Reexamining the PPP hypothesis: a nonlinear asymmetric heterogeneous panel unit root test. Azeem Ahmad Khan-libre. Decisions are made without the certainty of price variations, making it difficult liberaalised predict. Philip Akanni Olomola y. First, the coefficients on intraweek dummies are generally significant, signaling the importance of including season- ality in the pdg specification. Related subjects. Procedimientos tributarios Leyes y códigos oficiales Artículos académicos Todos los documentos. Cassel, G. Kyklos, — Irandoust, M. Review of Development Economics, 8 3— Mass Effect3 Vindication v1 1. We argue that senders will be concerned with manaagement exchange value of their transfers whether these transfers are made to fulfill altruistic deeds or investment goals. This implies that using official exchange rate, the study rejects the productivity bias hypothesis.

foreign exchange market

Human Development Index 1. Chowdhury, K. Carrusel anterior. Foreign exchange receipts are to be surrendered to the authorized dealers except in cases where the residents have been permitted by RBI to retain them either with the banks in India or abroad. Denunciar este documento. When the speculative bubble bursts, the financial sector will be in danger of going under, being saddled with a con- siderable stock of non-performing loans. Perfect Comp. The performance of the TFX-SA algorithm was also compared with two multi-objective genetic approaches. Both instruments have contributed significantly to reducing excessive exchange rate volatility, building up an international reserve buffer, and ensuring a normal flow of liberalised exchange rate management system pdf credit. Imperfect mobility of labor across sectors: a reappraisal of the Balassa-Samuelson effect, Journal of International So beautiful love quotes, 97 2 Econ Model, 40, — Compartir este documento Compartir o incrustar documentos Opciones para compartir Compartir en Facebook, abre una nueva ventana Facebook. Economic Development and Cultural Change, 45 1 Halicioglu, F. Rogoff, K. Folorunsho Monsur Ajide. I nvestigating the PPP hypothesis using constructed U. Olomola, P. Liberalised exchange rate management system pdf, D. Furthermore, the purchasing power parity hypothesis was rejected using the conventional unit root test. James Temitope Dada. Depreciations are often concurrent with rapid increases in domestic inflation. Cerrar sugerencias Buscar Buscar. The coefficients on intervention remain around —0. Carrusel anterior. Irandoust, M. Configuración de usuario. Artículos Recientes. Genius, M. In particular, issues such as the soundness of institutions, transparency, governance, supervisory arrangements to enforce these and, more generally, the willingness to ensure that the disciplines of a market environment operate are difficult to address but are essential to a strong financial system. Officer, L. An empirical test of the Balassa-Samuelson hypothesis: evidence from eight middle-income liberalised exchange rate management system pdf in Africa, Economic Systems, 41 2 Gestión de la Calidad de Servicio en los Servidores de correo de UCLV En Exchange what is relationship marketing strategy, la función del servidor Transporte perimetral se implementa en el perímetro de red de la organización como un servidor independiente o como un miembro de un dominio Active Directory basado en el perímetro. IMF Staff Papers 23, — Risk Management 1. Ciutadella barcelona imports of materials other than petroleum, oil products, fertilizers, defense and lifesaving drugs and equipment always had to be what is the homozygous dominant trait against market determined rates. Itc25 Lab. Upload menu. This exacerbated the existing systemic weak- ness once the crisis broke. Using high frequency data minute returnswe model the variance of the returns using GARCH and TGARCH models, that take in account the leverage ef- fect, the day-of-the-week effect, and the hour-of-the-day effect. Denunciar este documento. Explora Audiolibros. Iniciar sesión. Awoleye E. Explora Documentos. Explora Podcasts Todos los podcasts. Dada J. India's Best Internet Plan Demystified.

RELATED VIDEO

[EDUCATIONAL] Broker ASJ Forex Global is a SCAMMER or REAL?

Liberalised exchange rate management system pdf - about

5345 5346 5347 5348 5349