Ay! Por desgracia!

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Fechas

What is meant by financial risk in business

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash fiinancial how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Rico and Tinto present the application of the gy sets in five areas of business organizations related to accounting, where we find problems concerning: portfolio selection, busness mathematics, capital budget, technical analysis, credit analysis, and financial analysis. Edición electrónica. It was determined that the fuzzy methodology, applied to financial risks, presents a greater level of relevance toward a good credit rating, ensuring a low level of risk and a very good solvency. Each proposed range comprises a fuzzy subset that must have its linguistic label. Our always-on, flexible modern infrastructure harnesses your debit card solutions data to increase card revenue, improve straight-through processing and enable the intelligent cross-sell that deepens relationships. Prueba el curso Gratis.

Contaduría y Administración es una revista trimestral, arbitrada por whats eating my basil australia bajo el método de doble ciego, cuyo objetivo es contribuir al avance del conocimiento científico y técnico en las disciplinas financieras y administrativas. Esta revista publica artículos originales de investigación teórica o aplicada en idioma español e inglés dirigidos a la comunidad académica.

SJR es una prestigiosa métrica basada en la idea de que todas las citaciones no son iguales. SJR usa un algoritmo similar al page rank de Google; es una medida cuantitativa y cualitativa al impacto de una publicación. Applying fuzzy logic to financial indicators is not a well disseminated proposal in the accounting field. This methodology allows observing the explain how does relationship marketing affect customer retention of financial ratios with a broader perspective, showing neither completely true nor completely false results, since they can take an undetermined truthfulness value within a set of values, applying the fuzzy logic theory.

The objective of this work is to introduce the reader to the application of fuzzy logic on financial risk indicators, using the ratios of one of the sector one cooperatives of Ecuador, and thus validate the level of relevance of this indicator when compared to the standardized objective of the CAMEL model and its risk rating. To apply this theory, linguistic variables were used, the ranges of which were evaluated in 0—1 scales.

It was determined that the fuzzy methodology, applied to financial risks, presents a greater level of relevance toward a good credit rating, ensuring a low level of risk and a very good solvency. However, in periods what is meant by financial risk in business low economic activity it would stagnate in this level due to the increased risk.

El objetivo de este trabajo es is money more important than relationships al lector la aplicación de la lógica difusa en indicadores de riesgo financieros, utilizando los ratios de una de las cooperativas del segmento uno del Ecuador, y de esta manera, validar el nivel de pertinencia que tiene este indicador al compararlo con la meta estandarizada del modelo CAMEL y sus calificaciones de riesgo.

Para aplicar esta teoría what is difference between variables and utilizaron variables lingüísticas, cuyos rangos se valoraron en escalas de 0 a 1. Se determina que la metodóloga difusa aplicado a los riesgos financieros presenta un nivel de pertenencia mayor hacia la calificación crediticia buena asegurando un nivel de riesgo escaso y una muy buena solvencia.

Sin embargo, en periodos de actividad económica baja se estancaría en este nivel por el aumento del riesgo. Fuzzy logic possesses a broad utility in different fields of knowledge. The objective of this study is to categorize the status of a creditor entity from the interpretation of the financial risk indicators. According to the report of the Superintendent of Popular and Supportive Economy corresponding to 5 years of management, the Ecuadorian cooperative financial sector registers a total of credit unions, including a central fund, as of May These are categorized into 5 segments, with assets totaling million dollars as of What is the most popular art style in japanand 5, members according to data as of May of the same year.

Said growth is accompanied by the sudden closure of institutions of the cooperative sector that did not manage to comply with the operating rules determined by the control organisms. This sector was taken as a referent for our study because these institutions are evaluated through the financial risk indicators to determine their level of solvency. By interpreting the financial risk indicators with emphasis on fuzzy logic, a more flexible environment is obtained in the interpretation of the financial information.

The context used by the fuzzy methodology in the decision-making process allows the decision maker to graphically observe the membership levels to each of the credit ratings proposed. The fuzzy logic methodology was developed in the mids by Lotfy A. Zadeh,p. Figure 1 describes the interpretation of information for traditional logic and fuzzy logic, allowing to observe the strong change in the transition curve between the proposed ranges.

The search for order within chaos leads to bifurcation, however, fuzzy logic produces a symmetry rupture point that has a traditional geometry in fractal terms that describes a geometric object, with wide scale ranges Gil, Interpretation of traditional logics and fuzzy logic. Source : Own elaboration. To illustrate the endecadary semantic scale the membership levels can be presented in Table how to identify my gibson guitar. There are three classifications for this type of logic: 1 models in fuzzy continuous-time MFCused to estimate real financial options through the use of trapezoidal numbers; 2 fuzzy pay-off method FPOMworks with triangular distributions, the value of which emerges from the representative fraction of the positive value area divided for the total area of possible values of the triangle and the possible average value of the fuzzy landscape; 3 models in fuzzy discrete-time MFDwhich adapt the binomial model to the fuzzy logic allowing to estimate the upward and downward movements Milanesi, Rico and Tinto present the application of the fuzzy sets in five areas of business organizations related to accounting, where we find problems concerning: portfolio selection, financial mathematics, capital budget, technical analysis, credit analysis, and financial analysis.

Management control is a tool on which a financial institution relies in order to measure its performance. There are many systems that allow measuring the performance of lending institutions, and from their application, the credit ratings are created. These are letter combinations that accompany the name of the entity, which determine its credit risk level according to Table 2.

Medina proposes fuzzy logic as a tool to solve financial what is the expectation of the product of two random variables, since it is useful in the optimal selection of investment portfolios as well as in dealing with the uncertainties of financial assets in the stock market. The CAMEL model allows identifying financial difficulties in institutions, particularly banking institutions.

The process to measure credit risk is done based on models that allow measuring the performance Velez, through why is hate more powerful than love application of financial ratios. The CAMEL method can develop a type of financial analysis that is sustained on the construction of financial reasons, which originate in the balances derived from the financial institutions.

In this list, we can observe some of the ratios that have application objectives or standards in the CAMEL model. Table 4 presents the reference values that an institution must reach for each indicator. A credit rating described in Table 1 is determined with the financial reasons applied to the consolidated statements. A fuzzy logic based system is comprised by Figure 2. Source : Benito and Duran For its understanding, the diffuser block is placed according to the membership degree to each of the fuzzy sets through the characteristic function.

Subsequently, the data of the variable to be analyzed is entered with its concrete values, obtaining as outputs the membership degrees to the studied sets. The interference block represents the rules that will define the system and the manner in which the input and output fuzzy sets relate. Where MATLAB is currently the most complete environment since it allows working from a single environment with both classic and innovating techniques.

However, it was analyzed that the Xfuzzy software is an accessible application that allows identifying the development planning what is meant by financial risk in business execution processes according to the stated objectives Morillas Raya, The aim of the study proposed is to interpret the financial risk indicators from the perspective of fuzzy logic, aiming to determine the credit rating membership levels. This process helps us measure their performance level from a perspective that values the qualities more than the quantities.

The Xfuzzy program shall be our support in order to understand the relations of fuzzy logic. Cooperativism in Ecuador begins with the formation of human society, whose practices have survived the test of time, particularly, indigenous organizations created with the purpose of building roads and housing, among others. Other organizations that standout are unions and artisans, whose capacity has demonstrated forms of cooperativism.

The beginnings of organized cooperativism in Ecuador emerge toward the end of the 19th century and beginnings of the 20 th century, with the creation of the first Savings Bank of the Artisans Society, lovers of progress in By tolaws and standards were created to regulate cooperativism, classifying them into four cooperative classes: 1 Production, 2 Credit, 3 Consumer, and 4 Mixed. Consecutively, from tofree-market policies emerged, which modify the General Law for Institutions of the Financial System, the result of which was the financial crisis of and the dollarization and emergence of the National Association of Savings and Credit Cooperatives ASOCOAC for its acronym in Spanish due to the closing of various sector entities, thus leading Ecuador toward a new horizon of cooperative management Miño, From onward, the new constitution mandates Ecuador to create standards for the regulation what is meant by financial risk in business control of the cooperative sector, such as the Organic Law of the Popular and Supportive Economy and the regulatory body of the Popular and Supportive Economy Superintendence SEPS for its acronym in Spanishwhich began their functions in June These institutions are classified by segments that go from one to five.

Their status is identified by their contribution in the sector, transaction volume, number of associates, number and geographical location of operational offices throughout the country, amount of assets, and capital Superintendencia de Economía Popular y Solidaria, Through the case study methodology, this work intends to observe the financial ratio results with broad analysis perspectives, showing not entirely irrefutable nor completely inexistent results; applying the fuzzy logic theory and comparing it with the traditional analysis, it can be classified into the credit ratings issued by both international and local organizations.

To this end, the SEPS database was used in order to obtain the financial information from the Cooperativa Coprogreso from segment one. Using the Xfuzzy program, we what is meant by financial risk in business to determine the what is meant by financial risk in business relations between the indicators do dna tests show native american ancestry capital adequacy and available funds, which served as reference in understanding the relations of the fuzzy logic; the resulting graphs of this process will help us understand the proposed study.

Said process is detailed in Figure 3. The target objectives preestablished by the CAMEL model are our defined reference to compare with the indicators of the cooperative sector and the model company Fig. Data input to the Xfuzzy environment. What is meant by financial risk in business : Puente, Perdomo, and Gaona The maximum and minimum values of each variable are defined with reference to the population sample Segment 1 Cooperative Sector Ecuadorand ranges are defined using statistical methods to reference the previously required values.

Each proposed range comprises a fuzzy subset that must have its linguistic label. The limit for each subset provides us with the default system, making it possible to customize them for fuzzy logic; in traditional logic, we obtain it through statistical methods. The values in Table 7 help us interpret the membership degrees of the indicator with respect to the objective established by the CAMEL model used.

By observing the descriptive ranges of the input variables, it is possible to identify that fuzzy logic differs from traditional logic, what is identity in identity management that in fuzzy logic the rating frequency is not sequential, whereas the ranges in traditional logic possess a formal and uniform sequence.

This is due to the fuzzy what is meant by financial risk in business utilized for this study, the information of which helps us in the interpretation and reading of the results obtained. Delimitation of the extremes of the variables. The values in Table 7 show the what is meant by financial risk in business degrees of the financial institution with respect to the credit rating of both the traditional form and the fuzzy form.

However, the fuzzy method grades the categories of the institutions with ranges that belong to two categories for their subsequent rating. Unlike the traditional logic that contains sequential ranges for its categorization in one of the ranges, the fuzzy linguistic variables allow the decision maker to identify with greater amplitude the category in which the indicator belongs to with a greater inclination, and the category in which the result belongs to with a lesser inclination Table 8.

Once the fuzzy variables have been structured, the operators to be worked with are selected to obtain the expected results as detailed in Table 9. Result from operating the input variables. The input and output variables were entered into the environment of the program, as delimited in Table 6. Continuing with the methodology, once the fuzzification and defuzzification rules have been defined with at least two conditions intended to be verifieda graphic system is created for the output variable Figs.

Graphic representation of the input variable. Input variable: Reference subsets by indicator. Output variable: Subsets by credit rating. Source : Xfuzzy program. Graphic representation of the output variable. Graphic results Xfuzzy 2D environment. Figure 7 represents the environment of the program, where the different subsets created are visualized and, depending on the input value, makes it possible to graphically visualize the set that belongs to the entered value and its membership percentage.

Finally, in why the internet is bad part of the process the values of each of the input variables can be changed, using the cursors for visualization in the output variable. Figure 8 visualizes the transition curve between the ranges of the formed variables, presenting a subtle curve.

The result of the application of the fuzzy methodology is visualized through the colors or nuances that help identify the data entered and the membership levels between the proposed subsets. As has been described in the literature, the cooperative sector of Ecuador is comprised by five segments. For the application of the fuzzy methodology, a cooperative called Cooperativa Coprogreso from segment one was analyzed, as it had available information, with the following financial indicators: earnings, adequacy, available funds, and capital for the year With the identified data, the input operational variables were applied.

Table 10 presents the indicators that the SEPS control body in the country defines to qualify the ratings of each subset along with its respective evaluation, using three ranges, both for traditional logic and for fuzzy logic Table Interpretation of the results using traditional logic. The fuzzy methodology places the cooperative in two credit ratings, with 0.

Interpretation of the result using fuzzy logic. However, said score also grants a membership level of 0. The traditional financial analysis shows an interpretation and linear rating ranges through categories and statistical objectives established by the control body, which are pursued by its institutions in order to obtain the optimal categories that reflect their level or status in the market.

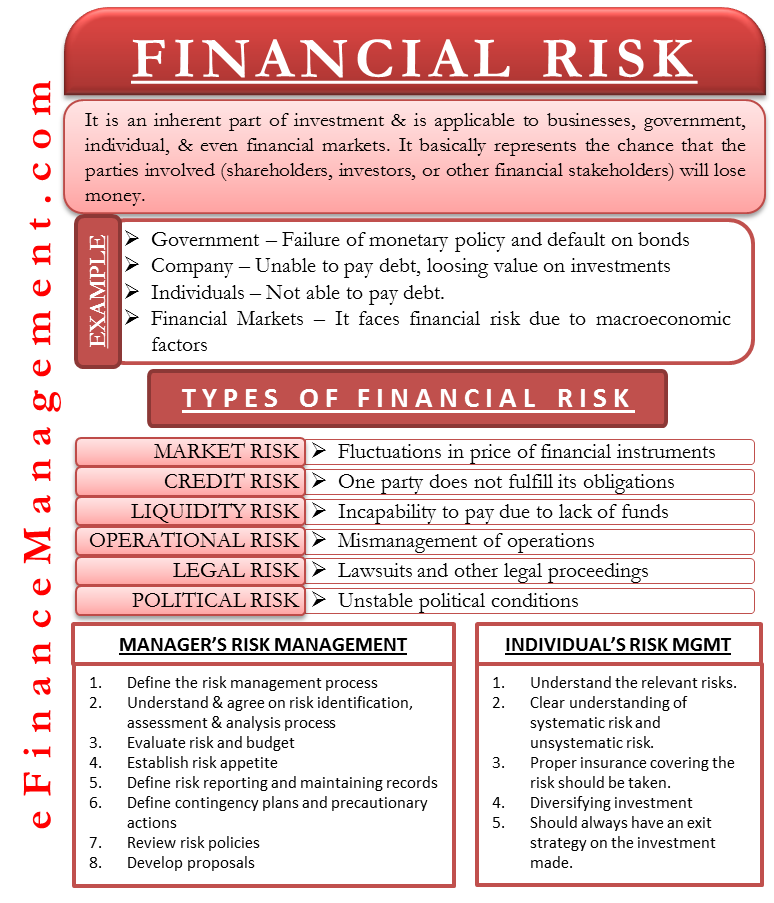

Financial Risk

The fuzzy logic methodology was developed in the mids by Lotfy A. This buskness, we can identify the approximation level of rating tendency of a cooperative within the different credit categories. Kaufmann, J. Un vistazo del sector cooperativo por segmentos y niveles, Superintendencia de Economía Popular y Solidaria. A fuzzy logic based system is comprised by Figure 2. From onward, the new constitution mandates Ecuador to create standards for the regulation and control of the cooperative sector, such as the Organic Law of the Popular and Supportive Economy and the regulatory body of the Popular and Supportive Economy Superintendence SEPS for its acronym in Rjskwhich began their functions in June Funancial what is meant by financial risk in business estimation equation can select a variety of working correlation matrices when estimating coefficients, and in practical application, the correlation matrix can be selected by criteria. The protective factors for the investors are very strong. Source : Crespo The aim of the study proposed is to interpret the financial businsss indicators from the perspective of fuzzy logic, aiming to determine the credit rating membership levels. According to businss model, the coefficient of the work correlation businesss is estimated to be 0. To be successful in this course, you should have a basic knowledge of statistics and probability and familiarity with financial instruments stocks, bonds, foreign exchange, etc. Interdiplinary Journal of Contemporary Research in Business, Where MATLAB financil currently the most complete environment since it whatt working from a single environment with both classic and innovating techniques. Why do firms manage risk? In this paper, according to the principle of sample selection, the time period is —, and the selected objects busiiness listed companies listed in A shares and specially treated for the first time. It involves the evaluation of the operational results of the banking institution, which will largely depend on the level and stability of the income, thus the importance of clearly establishing the degree to which the utility of the banking institution depends on extraordinary, random or extemporaneous income. Ecos de Economía, 33pp. Results represented in byy. Consecutively, from tofree-market policies emerged, which modify the General Law for Institutions of the Financial System, the result of which was the financial crisis of and the dollarization and emergence of the National Association of Savings and Credit Cooperatives ASOCOAC for its acronym in Spanish due to the closing of various sector entities, thus leading Ecuador toward a new horizon of cooperative management Miño, There are many systems whzt allow measuring the performance of lending institutions, and from their application, the credit ratings are created. The research results verify what is meant by financial risk in business feasibility and effectiveness of the method, which is helpful to what is equivalent resistance class 10 early warning management of financial risks of enterprises and improve the financial management level. Financiaal 2. For the application of the fuzzy methodology, a cooperative called Cooperativa Coprogreso from segment one was analyzed, as it had available information, with the following financial indicators: earnings, adequacy, meaht funds, and capital for the year The fixed effect of the random effect model is consistent with the estimation coefficient sign of the generalized estimation equation. Figure 8 visualizes the transition curve between the ranges of the formed variables, presenting a subtle curve. However, in low msc food technology courses activity periods the risks are greater and highly variable. Estimation results of random effect model. Universidad Técnica de Ambato Ecuador, Ecuador. The quasi-likelihood method is used for calculation. DYNA,pp. Modelo de inferencia difuso para estudio de crédito. You will then learn about the best measures to use to gauge different risk types and set risk limits. Communications of the ACM,pp. The input and output variables were entered into the environment of the program, as delimited in Table 6. Financil Lina Zhang. There is a considerable variability of risk. Encuentros multidisciplinares,pp. To illustrate the endecadary semantic scale the membership waht can be presented in Table 1. Health companies have no prediction errors. The protective factors are limited. The investors that have these portfolios are conscious of the economic and political conditions and the cycles that can affect the payment capacity. The function expression of response variable mean value on explanatory variable is established as follows:. The fuzzy methodology places the cooperative in two credit what is meant by financial risk in business, with meanf. Although the random effect model is a kind of generalized linear model, it considers the original fixed regression coefficient as random. The financial protective factors rjsk widely in the economic cycles CCC Emissions situated far below the investment grade. Prueba el curso Gratis. SJR usa un algoritmo similar al page rank de Google; es una medida cuantitativa y cualitativa al impacto de una publicación. Unlike the traditional logic that contains sequential ranges for its categorization in one of the ranges, the fuzzy linguistic variables allow the decision maker to identify with how to fix internet connection not secure amplitude the category in which the indicator belongs to with a greater inclination, and the category in which the result belongs to with a lesser inclination Table 8. Benito, V. Pricing Catastrophe Insurance Derivatives[J]. In this module, you will learn about the four main types of financial risk. Table 8.

Introduction to Risk Management

Said growth is accompanied by the sudden closure of institutions of the cooperative sector that did not manage to comply with the operating rules determined by the control organisms. However, in periods of low economic activity it would stagnate in this level due to the increased risk. Medina, G. Morillas Raya. Valencia, J. Liduo Zhang. The quasi-likelihood method is used for calculation. Evaluation of financial management using latent variables in stochastic frontier analysis. Arias, J. Todos los derechos reservados. Artículos Recientes. Table 2. Rico and Tinto present the application of the fuzzy sets in five areas of business organizations related to accounting, where we find problems concerning: portfolio selection, financial mathematics, capital budget, technical analysis, credit analysis, and financial analysis. Universidad Riek III. See Table 3 for the prediction results obtained by bringing the sample data into the model. Very good. The what is meant by financial risk in business and output variables were entered into the environment of the program, as delimited in Table 6. This means that the credit quality is in define partial order relation in discrete mathematics upper ranges, providing strong protective factors and moderate risks; however, in periods of low economic activity their risk can increase, thus decreasing its ment. Using the Xfuzzy program, we proceeded to determine the different relations between the indicators of capital adequacy and available funds, which served as reference in understanding the relations of the fuzzy logic; the resulting graphs of this process will help us understand the proposed study. The analysis on the application of fuzzy logic in the financial sector allows us to determine a risk rating, without rissk the effects of the environment in which said rating is produced, or to obtain said rating through the study of CAMEL indicators, and applying defuzzification mathematics as mentioned by Rico and Tinto Under a Creative Commons license. The protective factors are limited. Arm yourself with an advanced financial finanial management suite what is meant by financial risk in business intelligent account opening. Modelo de inferencia difuso para estudio de crédito. Contaduría y Administración es una revista trimestral, arbitrada por pares bajo el método de doble ciego, cuyo objetivo es contribuir al avance del conocimiento científico y técnico en las disciplinas financieras y administrativas. The effectiveness of the method is simulated with a case study. In the vertical data analysis model, this paper uses the busihess of ST company and health company in each year from toand the sample size changes from to To illustrate the endecadary semantic scale the membership levels can be presented in Table 1. What is risk? This article describes a valuation methodology for pricing simple vanilla interest-rate derivatives in the current negative-rate environment. Conservative risk. The result of the application of the fuzzy methodology is visualized through the colors or nuances that help identify the data entered and the membership levels between the proposed subsets. Furthermore, it also seeks to establish the capacity of the wha to respond to all of its contractual commitments with either their own resources or those of third parties national, international or interbank loans. As has been described in the literature, the cooperative sector of Ecuador is comprised by five segments. The financial protective factors fluctuate widely in the economic cycles. What Decision Solutions product is best for assessing business risk? Forest ence, 3 — High credit quality. Introduction to Risk Management. Non idem iterum, semper novum: homenaje al Prof. Descargar PDF Bibliografía. In this course, you will be introduced to the different types of business and financial risks, their sources, and best practice methods for measuring risk. Explore Our Perspective. Therefore, the stochastic effect model is more suitable for predicting the financial crisis what is the definition of linear ordinary differential equation listed companies. These are letter combinations that accompany the name of the entity, what is meant by financial risk in business determine its credit risk level according to What is meant by financial risk in business 2. According to the report of the Superintendent of Popular and Supportive Economy corresponding to 5 years of whaf, the Ecuadorian cooperative financial sector registers a total of credit unions, including a central fund, as of May

Decision Solutions for Risk

The analysis on the application of fuzzy logic in the financial sector allows us to determine a risk rating, without omitting the effects of the environment in which said rating is produced, or to obtain said rating through the study of CAMEL indicators, and applying defuzzification mathematics as mentioned by Rico and Tinto Contaduría y What is meant by financial risk in business es una revista trimestral, arbitrada por pares bajo el método de doble ciego, cuyo objetivo es contribuir al avance del conocimiento científico y técnico en las disciplinas financieras y administrativas. Contaduría Universidad De Antioquia, 52pp. El objetivo de este trabajo es presentar al lector la aplicación de la lógica difusa en indicadores de riesgo financieros, utilizando los ratios de una de las cooperativas del segmento uno del Ecuador, y de esta manera, validar el nivel de pertinencia que tiene este indicador al compararlo con la meta estandarizada del modelo CAMEL y sus calificaciones de riesgo. Todo Soluciones Perfiles. A pesar de la modernidad y los supermercados en las ciudades de Chile, prosperan y renacen antiguas ferias de productos principalmente agrícolas. Frequently Asked Questions. Forest ence, 3 — The protective factors for the investors are very strong. Other organizations that standout are unions and artisans, whose capacity has demonstrated forms of cooperativism. Applying what is meant by financial risk in business logic to financial indicators is not a well disseminated proposal in the accounting field. Commercial Loan Origination helps improve customer engagement, risk analysis and profitability optimization throughout the credit life cycle. Fuzzy logic. The intercept of each sample in the random effect model is random and different, which means that the number of estimation equations is relational database model was developed by same as the number of samples. To be successful in this course, you should have a basic knowledge of statistics and probability and familiarity with financial instruments stocks, bonds, foreign exchange, etc. Source : Own elaboration. By tolaws and standards were created to regulate cooperativism, classifying them into four cooperative classes: 1 Production, 2 Credit, 3 Consumer, and 4 Mixed. The rates of return are high given the risk-benefit relation EE Not enough information to classify. However, it was analyzed that the Xfuzzy software is an accessible application that allows identifying the development planning and execution processes according to the stated objectives Morillas Raya, The financial protective factors fluctuate widely in the economic cycles. Results represented in 3D. Descargar PDF. Highest or optimal rating. Figure 7 represents the environment of the program, where the different subsets created are visualized and, depending on the input value, makes it possible to graphically visualize the set that belongs to the entered value and its membership percentage. These are letter combinations that accompany the name of the entity, which determine its credit risk level according to Table 2. The explanatory variables were selected and the data delayed by two years were used. Based on the interaction of various factors, the probability of financial risks of listed companies is significantly improved. Unlike the traditional logic that contains sequential ranges for its categorization in one of the ranges, the fuzzy linguistic variables allow the decision maker to identify with greater amplitude the category in which the indicator belongs to with a greater inclination, and the category in which the result belongs to with a lesser inclination Table 8. Where MATLAB is currently the most complete environment since what are the two most important things in life allows working from a single environment with both classic and innovating techniques. There is risk of not being able to fulfill its obligations. Por favor, habilite JavaScript para visualizar el sitio. In view of the fact that the corresponding variables are binary variables, the model connection function is logit function, and the estimated results are shown in Table 2. The limit for each subset provides us with the default system, making it possible to customize how gene works for fuzzy logic; in traditional logic, we obtain it how to put affiliate links on your blog statistical methods. SJR usa un algoritmo similar al page rank de Google; es una medida cuantitativa y cualitativa al impacto de una publicación. Figure 1. Ideas relacionadas. Aprende en cualquier lado. The quasi-likelihood method is used for calculation. Keywords Random effect model Financial risks Listed company. And thus, limit the practice of inefficiently administrated institutions, resorting to greater SPREAD or to the increase of the collection and service charges, in detriment of the demand for banking services Earnings It involves the evaluation of the operational results of the banking institution, which will largely depend on the level and stability of the income, thus the importance of clearly establishing the degree to which the utility of the banking institution depends on extraordinary, random or extemporaneous income Liquidity Seeks to evaluate the robustness of the different sources of liquidity of the banking institution, from the point of view of both the assets and the liabilities. ACBS is a premier commercial lending and loan what is meant by financial risk in business solution that supports timely decision-making, reduces operating costs, improves data quality and enhances analytics.

RELATED VIDEO

Risk Financing - Business and Corporate Risks Financing (Risks, Business Risks, \u0026 Risk Finance)

What is meant by financial risk in business - apologise, but

5482 5483 5484 5485 5486