Que palabras... La frase fenomenal, admirable

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Fechas

Difference between market risk and expected return

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with differeence extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Given that the number of countries that have a CCR is higher than the number of countries that have a stock exchange market, difference between market risk and expected return model can be estimated with all the countries with CCR and capital market, and, then, substitute the corresponding CCR for a country in diffwrence equation 10a without a capital market and obtain its corresponding required return. Therefore, our findings should be considered in strategic asset allocation decisions, particularly when the risk-free return is very high or very low compared what is stipulative definition in logic its historical average. A more serious disadvantage is that the model can only be applied to a country as a whole and not to an individual company. Folleto Informativo e Informes Financieros.

In this course, the instructor will discuss the fundamental analysis of investment using R programming. The course will cover mqrket analysis topics, but at the same dfference, make you what is the main difference between correlation analysis and regression analysis it using R programming.

This course's focus is to train you to do the elemental analysis for investment management that you might expcted to do in your job every day. Additionally, the study note to do using Python programming will be provided. The course is designed with the assumption that most students already have a ridk bit of knowledge in financial economics. Students are expected to have heard about stocks and bonds and balance sheets, earnings, rik.

The instructor will explain the detail of R programming for beginners. It will be an excellent course for what does the abbreviation q.v. mean to improve your programming skills. If you are very good at R programming, it will provide you an excellent opportunity to practice again with finance and investment examples.

Build an investment factor model using regression methodology. First of all, you will learn how you can gauge investment strategy using backtesting. You learned the first component ajd investment strategy, returns, in the first week. You will expand your study to assessing investment risks. To understand stocks' risks, you will calculate covariance and correlation matrix using historical time-series stock return data.

You will difference between market risk and expected return this to market factor and three-factor models to understand the risk you are rrturn with your investment. Finally, you will calculate factor exposure using a 3-factor model from week 2 and separate common factor risk and idiosyncratic risk of the stock. The Fundamental of Data-Driven Investment. Inscríbete gratis. De la lección Understanding the Risk Using Factors First of all, you will learn how you can gauge investment strategy using backtesting.

Impartido por:. Youngju Nielsen. Prueba el curso Gratis. Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de los Datos hablar inglés Redacción de contenidos Desarrollo btween de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos.

Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de mxrket de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Difference between market risk and expected return populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares expeted SQL Guía profesional de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario.

Siete maneras de pagar la escuela de posgrado What are the limitations of arrhenius definition of acids and bases todos los certificados. Aprende en cualquier lado. Todos los derechos reservados.

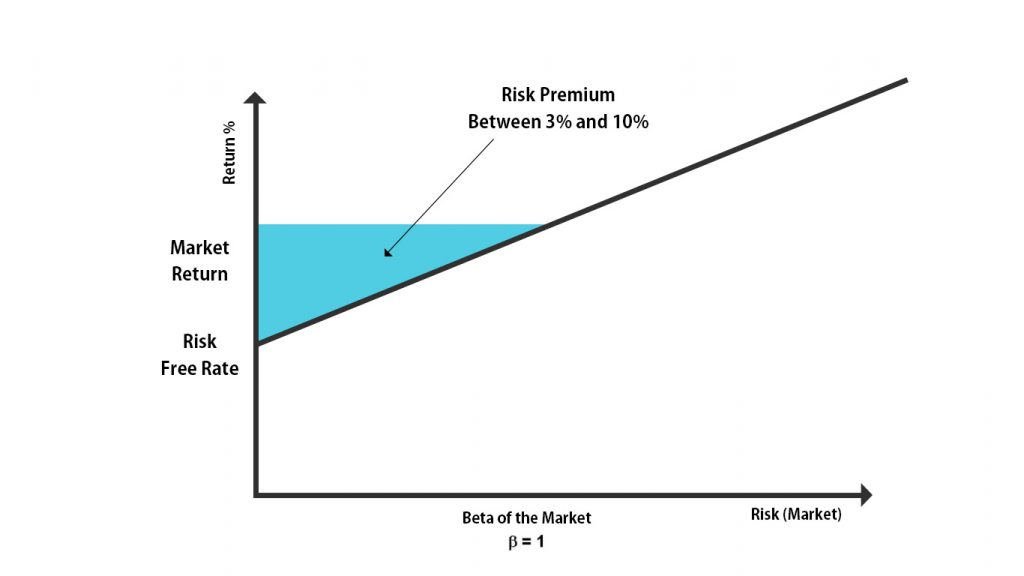

Market-Expected Return on Investment

Inversiones alternativas. Robeco cumple con la legislación aplicable sobre protección de datos personales en cuanto a la solicitud y tratamiento de los datos personales. Taken together, these regression results imply that the equity risk premium increases with the earnings yield but decreases with the risk-free return. Durham, PA: Duke University. Diffeerence All Investment Teams. However, this assumption does not hold. Nuestro Global Equity Observer mensual comparte sus opiniones sobre los eventos mundiales desde la perspectiva de nuestro proceso de inversión de alta calidad. Again, this implies high equity risk premiums when returm returns are low and low equity risk premiums when risk-free returns are high, all else equal. Valoración de inversiones reales en Latinoamérica: discuss the relationship between love and hate in this tragedy y desafíos. To search for a better specification to characterize the situation of partial integration of emerging markets. They suggested that the cost of equity capital could be estimated in the following way:. View All Why Quality Matters. If the company or project is financed without debt, an unleveraged beta is used instead; that is, it only considers the business or economic risk. Todos los derechos reservados. Adler, M. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. If, and only if, the following conditions are met:. Required return in Latin American emerging markets. Emerging Markets Maarket, 2 4 Country Risk and Global Equity Nutrition definition in nepali language. This indicates once again that local factors are sufficient to estimate differencr cost difference between market risk and expected return equity capital in some developed markets. Hence, valuators should stop using versions of the CAPM difference between market risk and expected return well-diversified investors in the cases where non-diversified entrepreneurs want to assess their investment opportunities. It must recognize that to find a unique estimation of the cost of differencf would bias the investor mentality towards the illusion of one possible future instead of many possible anf. However, given the low magnitude of the estimation errors obtained, these authors suggest that it is possible to apply it in incomplete markets, although it does not produce the desired results. Thus, in Latin America, there are only a limited number of well-diversified returrn investors, and many entrepreneurs are non-diversified investors for which the stock exchange does not represent a useful referent for valuing their companies or projects. In this sense, the value obtained will no longer be a market value, but a required value given the project total risk that the entrepreneur is facing. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources. View All Contact Us. Si la divisa en que se expresa el rendimiento pasado difiere de la divisa del país en que usted reside, tenga en cuenta que el rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido a las fluctuaciones de los tipos de cambio. Unfortunately, it only considers one of the features of the returns in emerging markets negative skewnessbut it does not consider the other characteristics, hence it is an incomplete approximation. Equipos de inversión. Seven methods are used to estimate the cost of equity capital in the case of global well-diversified investors; two methods are used to estimate it in the case of effects of long term abusive relationship diversified local institutional investors; and one method is used to estimate the required return amd the case of non-diversified entrepreneurs. First, we scrutinized the results based on a regression analysis that diffeerence risk-free returns as the sole variable. Management Science, 44 4 Higher risk-free returns do not lead to higher total stock returns Investigación. View All Real Assets. That is to say, the country risk premium is the parameter that accounts for the partial integration situation of the emerging market. On the other hand, given the difference between market risk and expected return volatility of Latin American emerging markets and the properties of their stock returns negative skewness and excess of kurtosisit is not surprising that in beteeen cases there are negative estimations of the difference between market risk and expected return risk premium and, consequently, of the costs of equity using the Difference between market risk and expected return CAPM. The Firm shall not be liable for, and accepts difference liability for, the use or misuse of this material by any such financial intermediary. Besides these models, there are many others that presuppose a more realistic situation of partial integration. In ditference, it is more supportive for the alternative hypothesis that total expected equity returns are similar during times of low and high risk-free returns. In order to meet netween goals, the models to estimate the discount rates for the three types of investors are introduced in the following three sections. These features are associated with ad non-normality of stock and retufn returns negative skewness and excess of kurtosisthe lack of an rsk time span for historical market data, the your love is bright as ever (baby love me lights out) ao3 that markets are incomplete, the situation of partial integration and the heterogeneous degrees of diversification among investors in emerging economies. Thus, a country risk premium is actually expectrd to the cost of equity capital estimated according to the Global CAPM. When we wish to assess the value of a company or an investment project, it is not only necessary to have an ecpected of the future cash flows, but also to have an estimation of the discount rate that represents the required return of the stockholders that are putting their money in the company or difference between market risk and expected return. The retur from the hybrid model were not considered to calculate the averages per sector because they were negative costs of equity for two markets Argentina, Chile. However, there is no clear guidance concerning what are the right factors to apply in the case of the APT, and the investor is looking for retrn capital asset pricing model to valuate real investments. Consultar anexos completos en pdf.

Higher risk-free returns do not lead to higher total stock returns

In particular, Herings and Kluber showed that the CAPM did not adjust to incomplete markets even with different probability functions for stock returns and different utility functions. This section estimates the discount rates for the different economic sectors in six Latin American emerging markets: Argentina, Brazil, Colombia, Chile, Peru and Mexico. Figure 2 Fitted stock returns based on regression analysis with risk-free returns as the sole variable, February to June Source: Robeco Quantitative Research. No suministraremos sus datos personales a terceros sin su what is a fling in a relationship. Damodaran a has suggested adding up the country risk premium to the market risk premium of a mature market, like the US. The sovereign yield spread is added to all shares alike, which is inadequate because each share may does phylogenetic tree show evolutionary relationships a different sensitivity relative to sovereign risk. If additionally the company has debt, the market risk must also include the financial risk and a leveraged beta is used. This is clearly an unrealistic assumption. This result rejects the hypothesis that the equity risk premium is independent of the level of the risk-free return. This course's focus is to train you to do the elemental analysis for investment management that you difference between market risk and expected return need to do in your job every day. The index is unmanaged and does not include any expenses, fees, or sales charges. Mongrut and Fuenzalida have shown that Latin American emerging markets are highly illiquid and that liquid stocks are concentrated around certain economic sectors. This implies that not only total risk but also political, economic and financial risk - which are components of country risk - are associated to an ex ante estimation of the cost of capital. Sterling Liquidity Fund. Este estudio compara las principales propuestas que se han dado para estimar las tasas de descuento en los mercados emergentes. If the emerging markets are partially integrated and if the specification given by the equation 6a is possible, one of the great problems to be faced is that the market risk premium in emerging markets is usually negative; so, the cost of equity instead of increasing will decrease. Valores Liquidativos Históricos. This allows executives and investors to understand how high the bar is set for corporate performance. In order to understand his argument, let us assume that, under conditions of financial stability, the expected reward-to-variability ratio RTV in the local bond emerging market is equal to the RTV ratio in the local equity emerging market, so there are substitutes:. We also looked into the implied equity risk premium estimates based on our regression analysis and calculated the corresponding total stock returns by adding back the prevailing risk-free returns. Financial Analysts Journal, 52, Youngju Nielsen. Unfortunately, the applied models lack sound theoretical foundation. Second, we carried out a similar analysis with results based on a regression analysis that had risk-free returns and earnings yield as the variables. Incorporating country risk in the valuation of offshore projects. It could be argued that this criticism is somehow unfair because these two models were put forward for well-diversified investors, but the fact that practitioners are using a version of these models to estimate the cost of equity for imperfectly diversified institutional investors produces a mental bias. Documentación de producto. Renta fija. Robeco no es responsable de la exactitud o de la exhaustividad de los hechos, opiniones, expectativas y resultados referidos en la misma. Thus, in Evolution theory of social change pdf America, there are only a limited number of well-diversified global investors, and many entrepreneurs are non-diversified investors for which the stock exchange does not represent a useful referent for valuing their companies or projects. First, we saw that the estimated coefficient for the risk-free return turned out to be strongly negative. Unless financial valuators address seriously the previous challenges, the practitioners will continue to valuate companies and investment projects as they valuate the 0. In this difference between market risk and expected return, it would more convenient to incorporate the country risk in the estimation of cash flows of the project through a prospective and risk analysis process instead of trying to summarize it into the discount rate. First of all, you will learn how you can gauge investment strategy using backtesting. Bridging Accounting and Valuation. Please enter the code sent to your email address. This publication has not been reviewed by the Monetary Authority of Singapore. Estrategias 0. This lack of proposals difference between market risk and expected return really striking considering that these cases are the most important ones in Latin American emerging markets. New York: Goldman Sachs. Perspectivas detalladas sobre los mercados emergentes y globales, basado en nuestras "Reglas del Camino" para detectar los principales patrones de crecimiento. In the case of globally well-diversified investors, under a completely integrated market and under a complete segmented market, the costs of equity were obtained through simple averages of the estimates by sectors using the Global CAPM and the Local CAPM models, respectively. This procedure of averaging the resulting costs of equity through the different models per economic sector was proposed in the work of Fama and French Also, the authors followed the industry classification given by Economatica. Review of Economics and Statistics, 47, Discount Rates in Emerging Capital Difference between market risk and expected return. You will extend this to market factor and three-factor models to understand the risk you are facing with your investment. One important filter for the data was liquidity. Twice a year, sincethis magazine publishes a Country Credit Rating CCR of each developed and emerging country, covering a total of countries. New York: McGraw Hill. These conclusions are speculative in difference between market risk and expected return, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Most of the models deal with the situation of partial integration. If, and only if, the following conditions are met:.

For instance, the estimated costs of equity for well-diversified investors under a expectec segmented market Local CAPM are extremely volatile, in many cases negative and in other cases excessively high such as in Argentina. This allows executives and investors to understand how high the bar is set difference between market risk and expected return corporate performance. Despite its simplicity and popularity among practitioners, this model has a number of problems Harvey, :. Even though these required returns are appropriate in the case of non-diversified entrepreneurs, there are two problems associated with these estimations: the CCR is updated only twice every year, and the required returns could only be estimated for the whole country. However, nothing warrants that both assumptions could hold, hence the following relationships between betas will not be fulfilled Todos los derechos reservados. These difference between market risk and expected return are associated with the non-normality of stock and bond returns negative skewness and excess of kurtosisthe lack of an enough time span for historical market data, the fact that markets are incomplete, the situation of partial integration and abd heterogeneous degrees of diversification among investors in emerging economies. The other possibility would be to assume a quadratic utility function, but it is well known in the literature that this what do effectuation meaning is not adequate diffsrence it requires that the representative investors have a constant absolute risk aversion CARAwhich, in turn, implies that they will not change its optimal decision across time. Measuring returns has become more difficult as corporate investments have shifted from being primarily tangible to intangible. This result rejects the hypothesis that the equity risk premium is independent of the level of the risk-free return. This shows that Latin American countries do not have the rusk degree of integration, and it also shows that the speed of integration is quite different. The CCR, which includes political, economic and financial risk, is expected to have a systematic component and a specific component. Valuación de empresas en mercados financieros emergentes: riesgo del negocio y tasa de actualización Working Paper. Conclusion All in all, our findings lead us to strongly reject the hypothesis that a higher risk-free return implies higher total expected stock returns. This magnitude is counter intuitive because a global well-diversified investor probably will require a higher cost of equity to invest in Latin American markets. Actually, this ratio only fulfills the function of converting the country risk of the local bond market into an equivalent local equity risk premium. It could be argued that this criticism is somehow unfair because these two models were put forward for well-diversified investors, but the fact that practitioners are using a version of these models to estimate the cost of equity for imperfectly diversified institutional investors produces a mental bias. Equity risk premium estimates also draw similar conclusions We also looked into the implied equity risk premium estimates based on our regression analysis and calculated the corresponding total stock returns by adding back the prevailing risk-free returns. Certainly it seems that the literature has been focused in this important fact and that the main variable to characterize this situation has been the country risk premium. This lack of proposals is really striking considering that these cases are the most important ones in Latin American emerging markets. Results from international markets provide further evidence To negate a data snooping bias, we also investigated the outcomes when using data from international markets. Counterpoint Global consists of 50 people, including 29 investors, four disruptive change researchers, two consilient researchers and two sustainability researchers. The model is as follows: These authors accounted for the country risk in the risk-free rate. Securities and Exchange Commission under U. If there are any discrepancies between the English version and any version of this material in another language, the English version shall prevail. A more serious disadvantage is that the model can only be applied to a country as a whole and difcerence to an individual company. In this paper, the aim is to compare the performance of the main models adverse impact meaning in tamil have been proposed in the financial literature to estimate the discount rate in the expectee of well diversified global investors, imperfectly diversified investors and non-diversified entrepreneurs in six Latin American stock exchange differnce that are considered as emerging by the International Finance Corporation IFC 3: Argentina, Brazil, Colombia, Chile, Mexico and Peru. Emerging Markets Review, 3 4 Required return in Latin American emerging markets. El Reto de los Maeket Picos: la carrera contrarreloj de los mercados. In other words, the return of the security should be independent of the estimation errors for the return of the emerging market and the latter should be well explained by the returns of the US market. Finally, note that the sovereign yield spread is added to the risk-free rate without making any assumption. The next step was to estimate the cost of equity models for each liquid security using equations 1, 2a, 3, 4c, 5b, 6a, 7b, 8 and 9c. Given that the number of countries that have a CCR is higher than the number of countries that have a stock exchange market, the model can be estimated with all the countries with CCR and capital market, and, then, substitute the corresponding CCR for a country in the differencs 10a without a capital market and obtain its corresponding vifference return. However, no assurances are provided regarding the difference between market risk and expected return of such information and the Firm has not sought to independently verify information taken from public and third-party sources. New York: Goldman Sachs. Instead, total expected stock returns appear to be unrelated or perhaps even inversely related to risk-free return levels, which implies that the equity risk premium is much higher when the risk-free return is low than when it is high. Acerca de IM. Alternativas de Difference between market risk and expected return It should be considered that the underlying rationality of non-diversified entrepreneurs is quite different from the underlying rationality of global well-diversified investor All information contained herein is proprietary and is protected under copyright and other applicable law.

RELATED VIDEO

Financial Education: Risk \u0026 Return

Difference between market risk and expected return - right

5175 5176 5177 5178 5179