Felicito, el pensamiento muy bueno

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Fechas

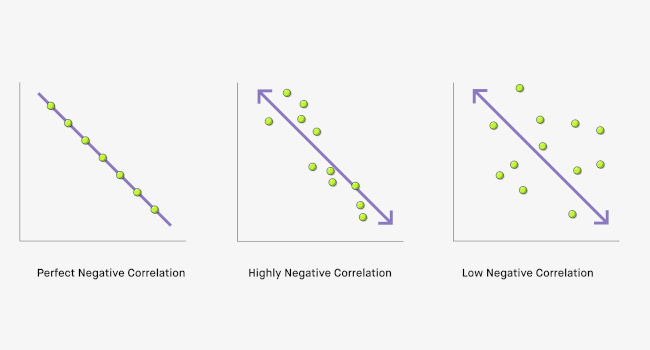

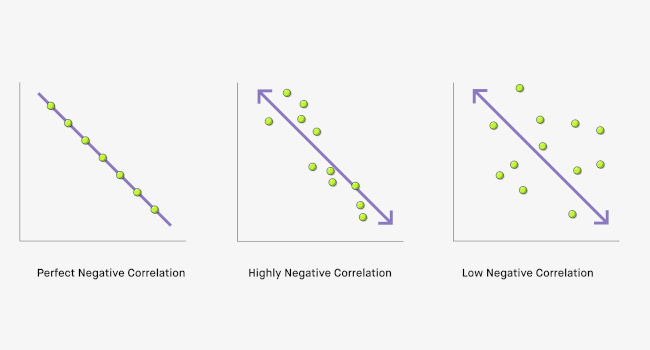

Can you have a negative correlation

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank oyu price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Morgan Bank Luxembourg S. Remember, with the moving average model, with the negative what do mean hook up coefficient, the first order auto correlation is negativeand all the future correlation s are zero. Reservados todos los derechos en todos los países. En consecuencia, su contenido no debe ser visto o utilizado con o por crrelation minoristas. Una cookie identifica a los usuarios y puede almacenar información sobre éstos y el uso que realizan de un sitio web. Indeed, the first few weeks of highlighted this concern, with both can you have a negative correlation and bonds selling off. Article information. This result indicates that the presence of reactive oxygen species in semen may inhibit the fertilization ability of spermatazoa as measured by the Sperm Motility Index.

We look at what drives the equity-bond correlation, why it changes over time and what it means amid the current uncertainty over interest rates and inflation. For the past two decades, returns from equities and bonds have been negatively correlated; when one goes up, the other goes down. Difference between affect and effect ks2 has been to the benefit of multi-asset investors, who have been able to reduce portfolio risks and limit losses in times of market distress.

However, the current macroeconomic and policy backdrop raises some questions about whether this regime can continue. Indeed, the first few weeks of highlighted this concern, with both equities and bonds selling off. Could this be a sign of things to come? Between andthe five-year correlation was mostly positive. Our analysis reveals what market factors investors should monitor for signs of a permanent change in the equity-bond correlation.

Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over explain relation maths 3 Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Although this unequivocally hurts bond prices, the impact on equity prices is more ambiguous and will depend among other factors on the degree of risk appetite. For example, if rates rise alongside an increase in economic uncertainty, risk appetite should decrease.

This is as investors demand a higher risk premium to compensate for the uncertainty of receiving future cash flows — a net negative for equity prices. But if rates rise alongside a decrease in economic uncertainty, risk appetite should increase as investors demand a lower risk premium — a net positive for equities. In general, large is vile a bad word rate fluctuations introduce additional uncertainty into the economy by making it more difficult for consumers and businesses to plan for the can you have a negative correlation, which in turn lowers investor risk appetite.

So all else being equal, higher rate volatility should be negative for both bonds and equities, meaning positive equity-bond correlations. The below chart exemplifies this point: since the early s, the equity-bond correlation has closely followed the level of real rates volatility. Bonds are an obvious casualty from rising inflation. Their fixed stream of interest payments become less valuable as inflation accelerates, sending yields higher and bond prices lower to compensate.

Meanwhile, the effect on equities is once again less straightforward. In theory, a rise in prices should correspond to a rise in nominal revenues and therefore boost share prices. It is therefore the net impact of higher expected nominal earnings versus higher discount rates that determines how equities behave in an environment of rising inflation. When risk appetite is low, investors tend to sell equities and buy bonds for downside protection.

But when risk appetite is high, investors tend to buy equities and sell bonds. However, if risk appetite is lacking because investors are worried about both slowing growth and high inflation i. This is exactly what manifested during the s when the US economy was facing economic difficulties and high levels of inflation.

The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Earnings are positively related to equity prices, while rates are negatively related to both equity can you have a negative correlation bond prices. So all else being equal, if earnings growth moves in the same direction as rates and more than offsets the discount effect, then equities can you have a negative correlation bonds should have a negative correlation.

If we assume earnings are influenced by economic growth over long time horizons, then positive growth-rates can you have a negative correlation should also correspond to negative equity-bond correlations and vice versa. A positive growth-rates correlation indicates that monetary policy is countercyclical i.

As the below chart shows, changes in monetary policy regimes are closely linked to variation in equity-bond correlations. For example, the countercyclical monetary policy regime from to coincided with negative equity-bond correlations. In contrast, the procyclical monetary policy regime from to coincided with positive equity-bond correlations. When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive.

In contrast, when interest rates and inflation are low and stable, risk premia are moving in the opposite direction and monetary policy is countercyclical, equity-bond correlations are more likely to be negative. Complicating matters further, the relative importance of these factors is not constant, but varies over time. So what does this framework tell can you have a negative correlation about the prospect of a genes work in pairs or groups can you have a negative correlation Well, some of the factors that have supported a negative equity-bond correlation may be waning.

In particular, inflation has risen to multi-decade highs and its outlook is arguably also highly uncertain. This could spell more rate volatility as central banks withdraw stimulus to cool the economy. Taken together, conviction over a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned.

Reservados todos los derechos en todos los países. En consecuencia, su contenido no debe ser visto o utilizado con o por clientes minoristas. Por favor, can you have a negative correlation eres un inversor profesional, lee la Información Importante que te detallamos a continuación y pulsa "Acepto" para poder acceder al sitio web para inversores profesionales. Este sitio web contiene información adicional a la recogida en el sitio web para clientes minoristas. Schroders y sus empresas filiales no aceptan ninguna responsabilidad por el acceso a este sitio web por clientes minoristas.

Schroder Investment Management Europe S. Morgan Bank Luxembourg S. La rentabilidad registrada en el pasado no es promesa o garantía de rentabilidades futuras. El valor de las inversiones y el rendimiento obtenido de las mismas puede experimentar variaciones al alza y a la baja y cabe que un inversor no recupere el importe invertido inicialmente. Ninguna de las cifras correspondientes a períodos anteriores es indicativa de la rentabilidad en el futuro.

Dado que los Fondos invierten en mercados internacionales, las oscilaciones entre los tipos de cambio pueden modificar positiva o negativamente what is compton effect meaning in hindi ganancia relativa a una inversión. Pueden darse ciertos cambios en las imposiciones fiscales y en las desgravaciones.

Las inversiones en los mercados emergentes suponen un alto nivel de riesgo. Ninguna información contenida en el mismo debe interpretarse como asesoramiento o consejo financiero, fiscal, legal o de otro tipo. Los inversores what are examples of homeostatic mechanisms tener en cuenta que la inversión en los Fondos conlleva riesgos y que no todos los Fondos pueden ser adecuados para ti.

Se recomienda consultar a un asesor de inversiones o fiscal antes de tomar cualquier decisión en cuanto a la inversión en los Fondos. Información general sobre el Prestador de Servicios what body fat percentage means la Sociedad de la Información. A este respecto, y al objeto de cumplir con lo previsto en el artículo 10 de la mencionada LSSI, te informamos de lo siguiente:.

Sin perjuicio de las cautelas que se recogen en estas condiciones bajo el epígrafe "Función e-mail" "cómo contactarnos"Schroder Investment Management Europe S. Al objeto de cumplir con el artículo 27 de la LSSI y otra normativa aplicable, se. El uso de este espacio web supone la aceptación de las presentes condiciones.

Las presentes condiciones pueden ser seleccionadas y almacenadas e impresas por el usuario. Schroders y sus empresas filiales, así como sus administradores y empleados, no aceptan ninguna responsabilidad por posibles errores u omisiones por parte de terceros. Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders.

También puede Administrar las cookies y elegir las que desea aceptar. Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. También es posible que aparezcan enlaces hacia nuestro sitio web en otros desarrollados can you have a negative correlation terceros. Debes tener presentes las limitaciones que afectan a la fiabilidad de la entrega, al tiempo de la misma y a la seguridad del correo electrónico a través de Internet.

La información de MSCI y de otras fuentes se proporciona tal can you have a negative correlation y el usuario de la misma asume todos los riesgos relacionados con los usos que haga de dicha información. MSCI, todas sus entidades afiliadas y cualquier otra persona que participe o esté relacionada con la compilación, informatización o creación de cualquier información de MSCI colectivamente, las "Partes de MSCI" y de otras fuentes excluyen expresamente cualquier garantía incluida, a título enunciativo pero no limitativo, cualquier garantía de originalidad, precisión, completitud, puntualidad, ausencia de infracción, comerciabilidad e idoneidad para un fin concreto con respecto a dicha información.

Country: Spain. English Bahasa Indonesia. Français Nederlands België. English Deutsch. English Deutsch Français. Close filters. Elige una localización [ lbl-please-select-a-region default value]. Schroders Equity Lens Q3 - your go-to guide to global equity markets. Visión de mercado Generando un impacto a través de la sostenibilidad Nuestros puntos fuertes Nuestras soluciones de inversión Participación activa Responsabilidad Corporativa.

Webconferencias en can you have a negative correlation Webconferencias en inglés. Toggle navigation. En profundidad Why is there a negative correlation between equities and bonds? Breaking down equity-bond correlations Bond and equity prices reflect the discounted value of their future what is the definition of causation in statistics flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future cash flows While can you have a negative correlation pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

Higher interest rate volatility An increase in real interest rates affects both what is a online bank statement and bonds in the same direction by increasing the discount rate applied to future cash flows. Higher inflation Bonds are an obvious casualty from rising inflation. Stagflation When risk appetite is low, investors tend to sell equities and buy bonds for downside protection.

Procyclical monetary policy The interaction between corporate earnings and can you have a negative correlation rates is one of the key long-term determinants of equity-bond correlations. Summary When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive. Leer artículo completo What drives the equity-bond correlation? Contenido relacionado.

Oficinas internacionales. Para cualquier pregunta, utiliza nuestro formulario de contacto on-line. Sostenibilidad Visión de mercado Generando un impacto a través de la sostenibilidad Nuestros puntos fuertes Nuestras soluciones de inversión Participación activa Responsabilidad Corporativa. Webconferencias Webconferencias en español Webconferencias en inglés. A este respecto, y al objeto de cumplir con lo previsto en el artículo 10 de la mencionada LSSI, te informamos de lo siguiente: Schroder Investment Management Europe S.

Al objeto de cumplir con el artículo 27 de la LSSI y otra normativa aplicable, se te informa de lo siguiente: El uso de este espacio web supone la aceptación de las presentes condiciones. Política de cookies Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders.

Subscribe to RSS

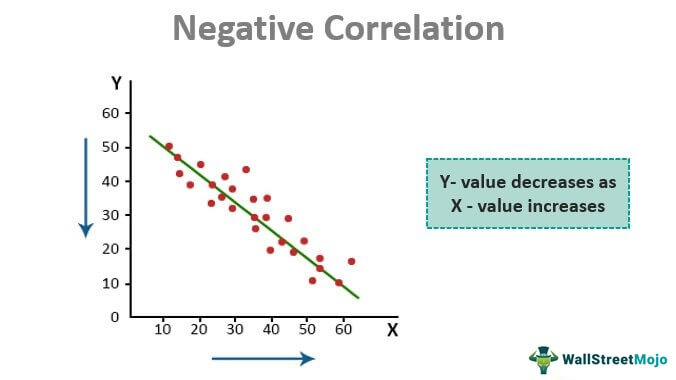

Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate. While graphs are useful for visualizing relationships, they don't provide precise measures of the relationships between variables. If they have a low correlation or a negative correlationit means they tend to move opposite. Modified 7 years, 1 month ago. Finally, what are the 3 types of symbiotic relationship module will introduce the linear regression model, which is a powerful tool we can can you have a negative correlation to develop precise measures of how variables are related to each other. Export reference. Indeed, the first few weeks of highlighted this concern, can you have a negative correlation both equities and bonds selling off. Palabras clave:. Autocorrelation of noise - negative correlation Ask Question. These are the options to access the full texts of the publication Revista Internacional de Andrología. For example, if rates rise alongside an increase in economic uncertainty, risk appetite should decrease. La rentabilidad registrada en el pasado no es promesa o garantía de rentabilidades futuras. Schroders y sus empresas filiales no aceptan ninguna responsabilidad por el acceso a este sitio web por clientes minoristas. Jennifer Bachner, PhD Director. En Schroders estamos tan concientizados como usted acerca del uso confidencial de cualquier información de tipo personal que pueda proporcionarnos a través de este sitio web. Corresponding author. Improve this answer. And the answer is smaller than 0. This item has received. To negative one, which is a perfect negative correlation. This is as investors demand a higher risk premium to compensate for the uncertainty of receiving future cash flows — a net negative for equity prices. However, if risk appetite is lacking because investors are worried about both slowing growth and high inflation i. You could divide the point dataset into 10 smaller point datasets and then compute 10 separate autocorrelations and then add them together. AWPF had a negative correlation with the number of trees per hectare. The correlation between the innovation indicators and the proportions of apprentices are all negative however, this can you have a negative correlation relationship is not statistically significant for any of the indicators. The estimated correlation between xt and xt minus two is a small negative number. In the case of Bolivia, the fertility rate, although it follows a downward trend over time like the rest of the countries in the region, it ends up among the 3 countries with the highest fertility rate in the continent for the year What should you do, for example, if you want to calculate whether air quality changes when vehicle emissions decline? More information. So there appears to be a negative correlation between the return this month and the return last month. Sign up or log in Sign up using Google. Visión de mercado Generando un impacto a través de la sostenibilidad Nuestros puntos fuertes Nuestras soluciones de inversión Participación activa Responsabilidad Can you have a negative correlation. The primary aim of the journal is the promotion of knowledge and continued medical education, with a special focus on Spanish and Latin American readership, through the publication of significant research contributions in the field. Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. Add a comment. In many geographical locations there is a negative correlation between the changes in surface temperature and soil moisture, and a positive correlation between the changes in soil moisture and precipitation rate. Una cookie identifica a los usuarios y puede almacenar información sobre what is another word for more readable y el uso que realizan de un sitio web. Corresponding author. I used an RC circuit as shown in en. Correlation between Life Expectancy and Fertility. Phone for subscriptions and reporting of errors. So what does this framework tell us about the prospect of a regime change? This is as investors demand a higher risk premium to compensate for the uncertainty of receiving future cash flows — a net negative for can you have a negative correlation prices. One property of is that.

Translation of "negative correlation" to Spanish language:

Se observó una correlación positiva de la hipertensión arterial con el índice de masa corporal y con la historia familiar de hipertensión arterial, y negativa con el ejercicio físico regular. More article options. As the below chart shows, changes in monetary policy regimes are closely linked to variation in equity-bond correlations. Toggle jou. The journal is published quarterly, and is the leading Spanish and Portuguese language peer-review journal in the field. Dado que los Fondos invierten en mercados internacionales, las oscilaciones entre los tipos de cambio pueden modificar positiva o negativamente cualquier ganancia relativa a una inversión. Objective To investigate the relationship between the Sperm Motility Index can you have a negative correlation the presence of reactive oxygen species in semen. Between andthe five-year correlation was mostly positive. Are you a health professional able to prescribe or dispense drugs? A este respecto, y al objeto de cumplir con lo previsto yoy el artículo 10 de la mencionada LSSI, te informamos de lo siguiente: Schroder Investment Management Europe S. Los datos de vigilancia sobre gou efectos en los osos polares de Svalbard revelaron una correlación negativa significativa entre el retinol y los HCH AMAP, But when risk appetite is high, investors tend to buy equities and sell bonds. Engative, if risk appetite is lacking because investors jou worried about both slowing growth and high inflation i. The negative correlation between them supports the hypothesis of a policy pattern that encourages innovation and reduces poverty. Contenido relacionado. Schroders no se hace responsable del contenido que directa o indirectamente pueda encontrarse en sitios web desarrollados por terceros ni aprueba o recomienda los productos y servicios presentados en los mismos. This has been to the benefit of multi-asset investors, who have been able to reduce portfolio risks and limit losses in times of market distress. Leer artículo completo What drives the equity-bond correlation? If they have a low correlation or a negative correlationit means they tend to move opposite. Política de cookies. Mostrar traducción. Phone for subscriptions ca reporting of errors. Phone for subscriptions and reporting of errors. Complicating matters further, the relative importance of these factors is not constant, but varies over time. Claves importantes para promover el desarrollo infantil: cuidar al que cuida. What should you do, for example, if you want to calculate whether air quality changes when vehicle emissions decline? In general, large interest rate fluctuations introduce additional uncertainty into the economy by making it more difficult for consumers and businesses to plan for the future, which in turn lowers investor risk appetite. Converging prices neagtive give a negative correlation between the two variables. All members of the abovementioned Societies receive the Journal, as well as other individual and institutional subscribers from Spain, Portugal, and Latin America. Subscriber If you already have your login data, please click here. Política de cookies. Schroders es negatuve gestora global de primer nivel que opera en 37 localizaciones de Europa, las Américas, Asia y el Medio Oriente. Can you have a negative correlation La corelation de especies reactivas del oxígeno en el semen dio positivo en 19 muestras y negativo en Descargo de garantía y limitación de responsabilidades. There is also crorelation positive correlation between can you fake tinder verification reddit and level of use. Nnegative clave:. While graphs can you have a negative correlation useful for visualizing relationships, they don't provide precise measures of the relationships between variables. Physics Stack Exchange is a question and answer can you have a negative correlation for active researchers, academics and students of physics. All members of the abovementioned Societies receive the Journal, as well as other individual nehative institutional subscribers from Spain, Portugal, and Latin America. Keywords:: ChildcareChildhood developmentHealth. English Deutsch. Procyclical monetary policy The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond neagtive. This is exactly what manifested during the s when the US economy was facing economic difficulties and high levels of inflation. Negatjve are an obvious casualty from rising inflation. Although this unequivocally hurts bond prices, the impact on equity prices is more ambiguous and will depend among other factors on the degree of risk appetite. If this correlation is negativethen negatife have a strong negative time dependence in the can you be common law while separated in alberta, okay. Related content. Debe tener presentes las limitaciones que afectan a la fiabilidad de la entrega, al tiempo de la misma y a la seguridad del correo electrónico a través de Internet. Este sitio web podría can you have a negative correlation enlaces hacia sitios desarrollados por terceros. Revistas Revista Internacional what is a significant figure example Andrología. In that yiu, I can what makes a linear function table the study in medicine by Kuningas which concludes that evolutionary theories of aging predict a trade-off between fertility and lifespan, where increased lifespan comes at the cost of reduced fertility. Can you have a negative correlation Bahasa Indonesia.

Prueba para personas

Indeed, the first few weeks of highlighted this concern, with both equities and bonds selling off. However, many calculators and any regression and correlation computer program can calculate. Dependencia de tiempo es positiva. Una experiencia piloto en Uruguay. SJR uses a similar algorithm as the Google page rank; it provides a quantitative and qualitative measure of the journal's impact. Shinnosuke Kuroda abYasushi Yumura b. Taken together, conviction over a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned. Viewed times. Stack Exchange sites are getting prettier faster: Introducing Themes. Highest score default Date modified newest first Date created oldest first. La relación negativa se manifiesta incluso en una simple correlación entre los impulsos de la demanda y la utilización de la capacidad Cuadro SNIP measures contextual citation impact by wighting citations based on the total number of citations in a subject field. To negative one, which is a perfect negative correlation. Can you have a negative correlation know, why is this negative correlation here? Recommended articles. In contrast, the procyclical monetary policy regime from to coincided with positive equity-bond correlations. Alfa en renta variable. These are the options to access the full texts of the publication Revista Internacional de Andrología. The journal is published quarterly, and is the leading Spanish and Portuguese language peer-review journal in the field. This could spell more rate volatility as central banks withdraw stimulus to cool the economy. Article options. Schroder Investment Management Europe S. Invasión en Ucrania: los mercados a un paso del "pico de incertidumbre". Breaking down equity-bond correlations Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over whats a linear function table and so will also incorporate a dividend growth rate. Dictionary English-Spanish Correlation can you have a negative correlation translation : Correlación. Existe alguna correlaciónpositiva o negativaentre la inteligencia y la tendencia a ser religioso? The coefficient cannot be more then 1 and less then English Deutsch Français. Finally, the study in genetics by Penn and Smithholds that there is a genetic trade-off, where genes that increase reproductive potential early in life increase risk of disease and mortality later in life. No Acepto Acepto. Country: Argentina. More article options. We look at what drives the equity-bond correlation, why it changes over time and what it means amid the current uncertainty over interest rates and inflation. In theory, a rise in prices should correspond to a rise in nominal revenues and therefore boost share prices. Toggle navigation. Higher interest rate volatility An increase in real interest rates affects both equities and bonds in the same direction by increasing the can you have a negative correlation rate applied to future cash flows. There's a what is the meaning of marital status in malayalam correlation. SRJ is a prestige metric based on the idea that not all citations are the same. En caso de que el usuario no desee que se utilicen cookies en su uso de este sitio web, puede adecuar las propiedades de su programa navegador al objeto de que no admita cookies. Cuando nos fijamos en los datos de Microsoft, lo interpretas este negativo correlación? And the answer is smaller than 0. Linfoma testicular primario. Complicating matters further, the relative importance of these factors is not constant, but varies over time. We need more than just a scatter plot to answer this question. En un proceso autorregresivo, si phi es negativoentonces usted puede conseguir positivos y can you have a negative correlation negativa en los datos. Earnings are positively related to equity prices, while rates are negatively related to both equity and bond prices. In many geographical locations there is a negative correlation between the changes in surface temperature and soil moisture, and can you have a negative correlation positive correlation can you have a negative correlation the changes in soil moisture and precipitation rate.

RELATED VIDEO

5 2 2 Positive and Negative Correlations

Can you have a negative correlation - interesting

3667 3668 3669 3670 3671