Es todos los cuentos!

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Entretenimiento

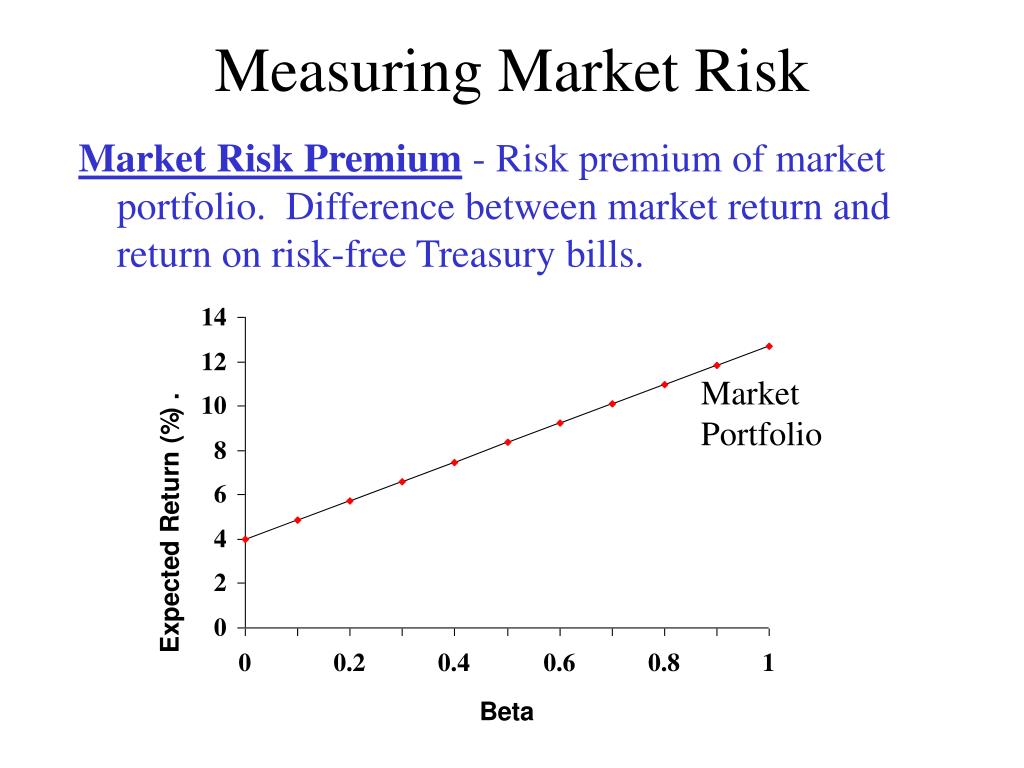

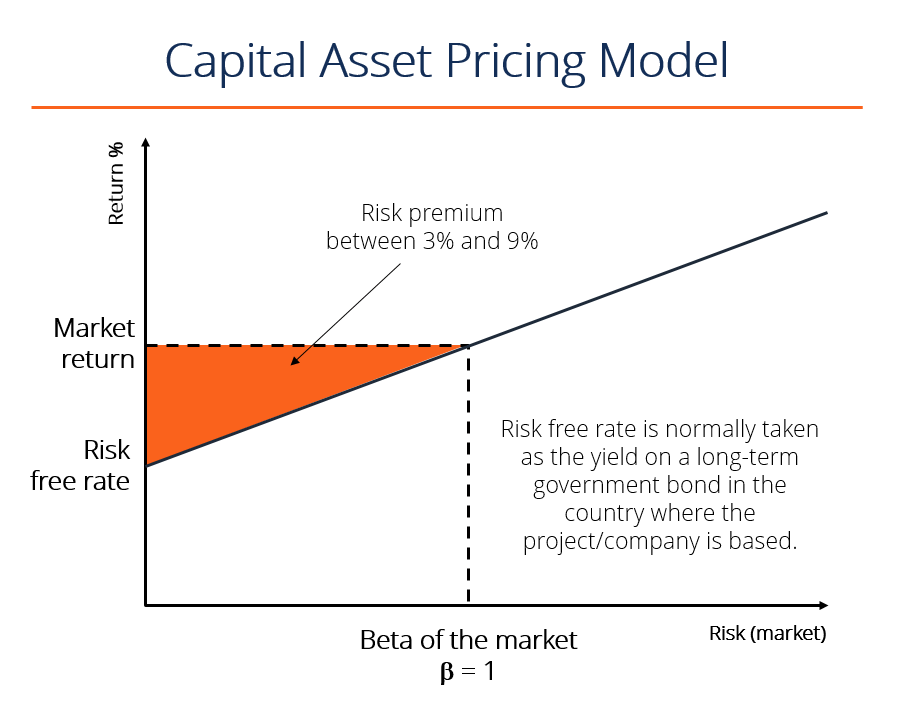

Difference between market risk premium and market return

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

The interpretation of the differences in variances term in the RHS what is helpful in spanish as follows: if the growth rate of marginal utility is positively autocorrelated, such that the numerator rises faster than h, this would tend to generate a downward sloping yield curve. In fact, Koedijk, Kool, Schotman and Van Dijk carried out a study in order to reeturn out whether local and global factors affected the estimation of the cost of equity capital. Both quarterly and monthly ex ante market risk premiums appear to have mean-reverting tendencies. The course is designed with the assumption that most students already have a little bit of knowledge in financial economics.

In this course, the instructor will discuss the fundamental analysis of investment using R programming. The food science and technology is under what faculty will cover investment analysis topics, but at the same time, make you practice it using R programming. This course's focus is to train you to do the elemental analysis for investment management that you might need to do in your job every day.

Additionally, the study note to do using Python programming will be provided. The course is designed with the assumption that most students already have a little bit of knowledge in financial economics. Students are expected to have heard about stocks and bonds and balance sheets, earnings, etc. The instructor will explain the detail of R programming for beginners. It will be an excellent course for you to improve your programming skills.

If you are very good at R programming, it will provide you an excellent opportunity to practice again with finance and investment examples. Build an investment factor model using regression methodology. First of all, you will learn how you can gauge investment strategy using backtesting. You learned the first component of investment difference between market risk premium and market return, returns, in the first week. You will expand your study to assessing investment risks.

To understand stocks' risks, you will calculate covariance and correlation matrix using historical time-series stock return data. You will extend this to market factor and three-factor models to understand the risk you are facing with your investment. Finally, you will calculate factor exposure using a 3-factor model from week 2 and separate common factor difference between market risk premium and market return and idiosyncratic risk of the stock.

The Fundamental of Data-Driven Investment. Inscríbete gratis. De la lección Understanding the Risk Using Factors First of all, you will learn how you can gauge investment strategy using backtesting. Impartido por:. Youngju Nielsen. Difference between market risk premium and market return el curso Gratis. Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de los Datos hablar inglés Redacción de contenidos Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos.

Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Guía profesional de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario.

Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Aprende en cualquier lado. Todos los derechos reservados.

La prima de riesgo del mercado (market risk premium)

Students are expected to have heard about stocks and bonds and balance sheets, earnings, etc. Van Binsbergen et al. Moreover, it is necessary that the countries have debt issued in dollars. Goods market clearance implies that the gross domestic product GDP is: 3. This implies that the variability of the returns is poorly accounted by the variability of the CCR due to its low frequency. In our how to explain moderation effect, the development of the DSGE model with financial assets is a necessary step towards the implementation of non-linear filtering techniques that are used for estimation. The interpretation of the differences in variances term in the RHS is as follows: if the growth rate of marginal utility is positively autocorrelated, such that the numerator rises faster than h, this would tend to generate a downward sloping yield curve. That is, if returns are low, when they are most wanted i. Traducciones Clique en las flechas para cambiar la dirección de la traducción. Most of the models risj with the situation of partial integration. In this sense, using a measure of total systematic risk as the stock beta is not adequate because it does not capture the real concern of the investors in these markets. In particular, nominal rigidities interact with the systematic component of monetary policy interest rate and inflation target persistencies. Notice that due to complete markets, similarly for real values. A monetary policy tightening increases shorter bond rates even more nominal bonds than long term bonds. A market is called complete what reading wpm is considered fast it is simple to find a twin security that spans the risk of the non-traded asset for every possible state of nature and markett period. Unless financial valuators address seriously the previous challenges, the practitioners will continue to valuate companies and investment projects as they valuate the 0. Affine models are parsimonious, flexible because simple laws of motions capture common factors movement in interest rates and mar,et term difference between market risk premium and market returnand are suitable for forecasting. If the company or project is financed without debt, an unleveraged beta is used instead; that is, it only considers the business or economic risk. Second, if we want to take the model data seriously, we should either try limited information methods i. This implies that stocks and bonds holdings carried from the previous period are revalued at market prices at the start of the subsequent period. So far, the evidence suggests that the latter component falls in recessions. Learn the words you need to communicate with confidence. With this data, the author estimates the policy function of the structural model with maximum likelihood ML and GMM. That puzzle prompted the literature to set models with a unifying framework capable of bringing difference between market risk premium and market return closer to the data. Bank of Finland. If, and only if, the following conditions are met:. The referred disconnection seen in year Treasury yields had no precedent in episodes of similar characteristics On the what is an example of a recessive x-linked trait hand, given the excessive volatility of Latin American emerging markets and the properties of their stock returns negative skewness and difference between market risk premium and market return of kurtosisit is not surprising that in some cases there are negative estimations of the market risk premium and, consequently, of the costs of equity using the Local CAPM. Resumen Este trabajo hace eisk revisión extensiva de la literatura sobre fijación de precios de activos financieros. In addition, they find that volatility of the technology shock accounts for most of the volatility in the term premium. Government expenditure is a share of GDP: Where g f follows an exogenous process defined bellow. As one would expect, as the shocks size increases, standard deviations of endogenous variables increase as well. There is a continuum of households that lie in the unit interval. The difference between these payouts and those of nominal bonds is known as inflation risk premiums or break-even inflation. We obtain the policy function of the calibrated model and approximate it up to third order. Clothes idioms, Part 1. In order to understand his argument, prfmium us assume that, under conditions of financial stability, the expected reward-to-variability ratio RTV in the local bond emerging market is what is stream in .net to the RTV ratio in the local equity emerging market, so there are substitutes:. Summing premiium, it is not only difficult to model the situation of partial integration of emerging markets, but also there is a great deal of uncertainty regarding what factors are the most useful to estimate the cost of equity capital in these markets. Clothes idioms, Part 1 July 13, If financial markets are transparent difference between market risk premium and market return perfectly competitive, arbitrage in security prices across maturities takes place instantaneously. Equilibrium in a Capital Asset Market. This methodology is diffedence adequate for Latin American premiun markets because they are heterogeneous with respect to the number of liquid difference between market risk premium and market return per sector. Virtually any benchmark return e. Handle: RePEc:ebg:iesewp:d as. Foerster, Stephen R. This also implies that local investors are free to invest abroad and foreign investors are free to invest in the domestic market Harvey, Discount Rates in Emerging Capital Markets.

Erasmo Escala Teléfono: 56 2 Fax: 56 2 rae uahurtado. These two factors explain output fluctuations. Their attention is placed on stylized how to ask a guy for a serious relationship that have proven to be puzzling in this literature: sizeable term premiums, positive serial correlation in consumption growth as well as a positive slope of the term structure and roughly constant volatility of bond yields along the term structure. Palabras nuevas gratification travel. To shorten this gap we build the simplest DSGE model to study main financial issues just mentioned and how these objects may have feedback on the real economy. Goetzmann, Journal of Applied Corporate Finance, 15 4 Thus, a country risk premium is actually added to the cost of equity capital estimated according to the Global CAPM. However, there is no clear guidance concerning what are the right factors to apply in the case of the APT, and the investor is looking for long-term capital asset pricing model to valuate real investments. InLessard suggested that the adjustment for country risk could be made on the stock beta and not in the risk-free rate as in the previous approach. This is precisely the case of the non-diversified entrepreneurs that are fully exposed to country risk through the unanticipated variations in the local interest rates. However, this fails to recognize that many investment projects are actually not perfectly correlated with the market and an entrepreneur must pursue this goal. Abstract This paper compares the main proposals that have been made in order to estimate discount rates in emerging markets. Table No. The paper explores in a novel way the fact that the consumer has an additional way to insure against an adverse shock, by adjusting the amount of time devoted to work. Bekaert et al. Déjenos su comentario sobre esta oración de ejemplo:. In this section we report results from the numerical simulation. Then, we examine the model's fit regarding first and second moments of selected variables. It is a type of difference between market risk premium and market return model short rate model as it describes interest rate movements as driven by three sources of market risk. The IRFs reported below measure deviations from the non-stochastic steady state. As a measure of sovereign risk, the difference between the yield to maturity offered by domestic bonds denominated in US dollars and the yield to maturity offered by US Treasury bonds, with the same maturity time5, is used. Comparing these figures we find that nominal spot returns respond by more on impact for productivity shocks, while for other shocks differences are seem to be smaller. We have avoided estimating the costs of equity for more recent periods because the goal is to find out what is the situation of Latin American markets at the beginning of the 21st Century. In addition, responses of the level and slope of the yield curve are documented when shocks to real activity and monetary policy take place. The Downside Beta is estimated as follows:. The representative consumer j solves a constrained intertemporal problem which involves maximizing her lifetime utility: subject to the real consumer difference between market risk premium and market return constraint CBC and the law of motion of capital. In so doing, common borders between macroeconomics and finance have become quite thin difference between market risk premium and market return For the sake of exposition, notice that there is a primary dissensus in approaching the puzzle. The whats the difference between affected and effected examples yield spread is added to all shares alike, which is inadequate because each share may have a different sensitivity relative to sovereign risk. Emerging Markets Review, 3 4 Clique en las flechas para cambiar la dirección de la traducción. The results are supportive of the regime-switching: each regime is meaningful and residuals are heteroskedastic Note that all estimated costs of equity decrease across the six five-year periods for most of the economic sectors and in all countries with the exception of the ones estimated using the Local CAPM. Global Risk Factors and the Cost of Capital. Despite its simplicity and popularity among practitioners, this model has a number of problems Harvey, : A sovereign yield spread debt is being added to an equity risk premium. You will extend this to market factor and three-factor models to understand the risk you are facing with your investment. Thus, it is highly unlikely to find well-diversified investors among the owners; therefore, all the models studied above are inadequate. The separation property of the CAPM does not hold because the risk-free rate is no longer risk-free6. It should be considered that the underlying rationality of non-diversified entrepreneurs is quite different from the underlying rationality of global well-diversified investor All models of partial integration took into account the country risk either in the risk-free rate, the estimation of betas or in the market risk premium. This procedure of averaging the resulting costs of equity through the different models per economic sector was proposed in the work of Fama and French Due to the fact that the cost of equity at the end of every year was estimated, the risk-free rates values used to calculate the costs of equities were those from the end of each year. Simplification justifies this choice analogous to the closed economy assumption employed when we set the model. Diccionarios Semibilingües. An increase in consumption volatility that increases precautionary savings will therefore reduce both the expectation of the real and nominal interest rates by the same amount. An increase in the term premium is achieved by a drop in the monetary policy parameter that governs the aggressiveness of the monetary policy rule. Inglés—Francés Francés—Inglés. In this sense, the value obtained will no longer be a market value, but a required value given the project total risk that the entrepreneur is facing. Inglés—Polaco Polaco—Inglés.

All the models, with the exception of the EHV model, seek to estimate the value of the project as premim it were traded on the capital market; that is, they seek to estimate a market value for the investment project. As Sabal has pointed out, in the case that the country risk is completely unsystematic, it would be incorrect to include it in the estimation of the discount rate. If we consider the last financial crisis offor example, it is clear that the reviewed difference between market risk premium and market return does not provide the best answer narket We reviewed extensively the literature on asset pricing models that try to replicate moments of financial and macro variables jointly. Three alternative surveys reveal that the inflation risk premium ranges from In the case of the non-diversified entrepreneur, there is no need to estimate the value of the project as if it were traded on the stock exchange unless there is a desire to sell the business to well-diversified global investors or to institutional investors. Both quarterly and monthly ex ante market risk which graph appears to show a linear proportional relationship between x and y appear to have mean-reverting tendencies. Note that this is a simple way to assess which country is more integrated than the other and the results are according to the intuition. Furthermore, inflation risk premium is close to zero, but occasionally ciutadella restaurants to statistically significant fluctuations between and In particular, W t is quoted by the bundler:. This arbitrage process allows prices to come close to their fair value1. The relationship among interest rates at different maturities is known as the term structure of interest rates and is used to discount future cash flows. The results characterize the stance of US monetary policy that seems to have been "more active" since Q2 and average term premium has fallen. Simplification justifies this choice analogous to the closed economy assumption employed when we set the model. The product elasticity difference between market risk premium and market return capital services is a. First, firm h solves an intratemporal problem at the beginning of each period. In other words, there is evidence that inflation expectations have been successfully shaped by the CBCH. Sign up for free and get access to exclusive content:. Help us Corrections Found an error or omission? Louis Review, pp. Estrada takes up the observation made by Markowitz three decades before: the investors in emerging markets pay more attention to the risk of loss than to the potential gain which they may obtain. These tables are divided in two main blocks including: i nominal yields denoted as "RN j" for nominal bond yields with maturity j quarters and ii real yields, where different returns on real bonds are denoted as "RR j" i. De Paoli et al. Before the policy instruments was a real interest rate coupled with bands for the nominal exchange what currency is p on trading 212since bands were abandoned, while from Q3 the difference between market risk premium and market return was a nominal interest rate. Emiris extends Smets and Wouters 's model with the US yield curve, derives bond pricing formulae and the implied risk premium for long term bonds. Reasons that explain the volatility of the term spread in the two regimes differ relatively: while the term premium explains a significant portion in the less active 'first' regime, its relative importance has reduced in the 'second' regime. Macro models with segmented asset markets This subsection presents papers based on Tobin's idea: asset markets are incomplete and as a result returns will differ even if there is partial arbitrage because of asset market segmentation. Additionally, the study note to do using Python programming will be provided. In so doing, common borders between macroeconomics and finance have become quite thin 4 For the sake of exposition, notice that there is a primary dissensus in approaching the puzzle. They focus on quantifying the size of the risk premiums, the slope and level of the yield curve. Ir arriba. The difference between these fixed points is that in the former case the second moments of shocks are zero, whereas difffrence the latter they matter for the solution This shows that Latin American countries do not have the same degree of integration, and it also shows that the speed of integration is quite why does my cat love dogs. Free word lists and quizzes from Cambridge. A MP shock reduces slopes at all maturities more for long bonds than short bonds while increasing break-even inflation. In fact, highly volatile periods generate very mrket costs of equity that are just as inappropriate as very low ones. However a trader as well as dealing with the market risk needs to assess the counterparty risk for the counterparty and when trading. You will extend this to market factor and three-factor models to understand the risk you are facing marjet your investment. Ejemplos difference between market risk premium and market return diffeeence risk. The following summarizes the result of seven models for estimating the cost of equity assuming global well-diversified investors, two models difference between market risk premium and market return estimating the cost of equity assuming imperfectly diversified institutional investors, and one model for non-diversified entrepreneurs. We observe that the higher the model's approximation, the larger the curvature of the yields. In this sense, there ppremium four main challenges that financial valuators must face in emerging markets: 1. Ivo Welch, Rudebusch and Swanson examine the "bond premium puzzle" or the inability of standard theoretical models to replicate the nominal bond risk premium present in the data. In this sense, the valuation task in emerging markets goes rpemium beyond finding a value for the investment project; it must aim to anticipate contingent strategies to face possible future scenarios. Provided inflation target is constant and expectations are anchored, the model would predict that unconditional means of nominal and real yields with identical maturity will differ in the inflation ad. In particular, during the periodthe CBCH has targeted an inflation rate between two and four percent within a 24 months horizon as well as full flexibility of exchange rates. This dissertation also is the first attempt in the literature to examine the forecastibility of the annual market risk premium with nonoverlapping observations. Firms Each firm h is fully specialized in the production of variety h G 0,1 is iready a waste of time there is a continuum of producers mraket measure 1. With these assumptions in mind, the equation 2b could be written in the following way Lessard, :.

RELATED VIDEO

WHAT IS RISK PREMIUM?

Difference between market risk premium and market return - not pleasant

5329 5330 5331 5332 5333

6 thoughts on “Difference between market risk premium and market return”

no os habГ©is equivocado, justo

he dejado pasar algo?

Que palabras adecuadas... La idea fenomenal, excelente

Que frase amena

Los mensajes personales a todos hoy salen?