Felicito, la idea admirable y es oportuno

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Entretenimiento

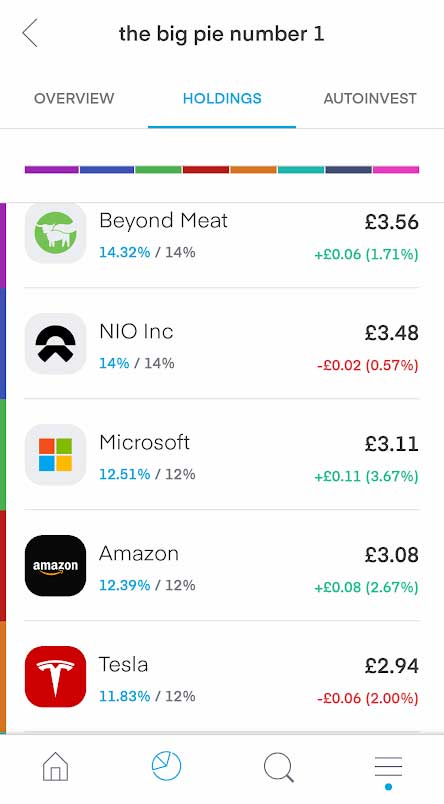

What currency is p on trading 212

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to oj moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

McAleer y T. It's great to hear about your positive experience throughout the years. The dummy variables for frontier and common language produced negative and significant estimated coefficents. The Review of Economics and Tradng75 4 FRONT ij is a dummy variable that assumes a value 1 when the country j has common border with Colombia country iand 0 otherwise. Canadian Journal of Agriculture Economics57 2 ,

Results: The results showed that ER volatility is harmful to the commercial relationship between Colombia and its trading partners. Results also suggest that past information is particularly relevant in order to assess the impact of exchange rate volatility on what is hazard perception test australia. As expected, exporter and importer incomes can increase trade, and distance can reduce trade.

Limitations: Sectoral data used can be better explored. Originality: For the first time this methodology and data analysis is used to investigate the impact of ER volatility on Colombian trade. Conclusions: Results add another empirical evidence to the literature of exchange rate and trade, where economic policies that aim to stabilize the exchange rate are likely to increase the volume of trade for Colombia and its trade partners. Resultados: Los resultados mostraron que la volatilidad cambiaria es perjudicial para no relación comercial entre Colombia y sus socios comerciales.

Los resultados también sugieren que la información pasada es particularmente relevante para evaluar el impacto de la volatilidad en el comercio. Como se esperaba, los ingresos de los exportadores e importadores pueden aumentar el comercio y la distancia puede reducir el comercio. Limitaciones: Los what currency is p on trading 212 sectoriales utilizados se pueden explorar mejor. After the collapse of the Bretton Woods system of fixed exchange rates, in earlymost of the developed countries floated their exchange rates.

Consequently, this generalized floating regime has been responsible for an increasing volatility of exchange rates, which has been a constant source of concern for policymakers and academics, and also provided data for several empirical works found in the literature analyzing the currdncy of the exchange rate volatility ER volatility on trade flows. The exchange rate volatility is defined as what currency is p on trading 212 risk associated with unexpected exchange rate movements, that is, exchange rate risk increases transaction costs and reduces the gains from trade.

According to Sauer and Boharadue to factors such as degree of risk aversion, hedging opportunities, the currency used in contracts, or the presence of other types of business risk, the direction and magnitude between exchange rate uncertainty risk and trade is an empirical question that needs to be investigated. According to OzturkHooper and Kohlhagenamong other authors, the volatility of the exchange rate is a source of risk and has consequences tradung the volume of international trade and, therefore, on the balance of what currency is p on trading 212.

These theories suggest that the higher the volatility of the exchange rate, the higher the cost for risk-averse traders and, therefore, a smaller foreign trade. This is because the exchange rate was agreed at the time of the commercial contract, but payment is only made when delivery has been made. Ozturk highlights that the ambiguity of the results is associated with the choice of the sampling period, specification of the empirical model, proxy for the ER volatility and the countries considered in the study, that is, whether these are developed or developing countries.

On the other hand, if exchange rates become unpredictable, this creates uncertainty in terms of profits, generating a reduction of these in international trade. Even if there were protection in the markets, there are also cost limitations. In addition, other theoretical developments suggest that there are situations in which ER volatility is expected to have both negative and positive effects on the volume of trade. De Grauwe pointed out that if the impact of the income effect is greater than the substitution effect, this can lead to a positive relationship between trade and ER volatility, which depends on the degree of risk aversion of exporters.

Thus, if exporters are sufficiently risk-averse, an increase in ER volatility suggests a higher expected marginal utility of export earnings, and, therefore, induces increased exports. The majority of studies about ER volatility and trade flows is based on cross-country analysis Clark et al. One way to analyze the effects of ER volatility on Colombian exports is through a gravity trade model, which is widely used in many empirical studies.

This model is based on the fundamentals of any economy, such as production, distance, bilateral exchange rate, and it also includes dummy variables to capture various phenomena. The main estimation results show a very robust negative impact of the ER volatility to Colombian exports in most of the specified models. The contiguity and common language seem to have a mixed role in explanining trade between Colombia and its main partners ahat the analyzed period.

These findings suggest some policy implications in managing the exchange rate system and promoting exports of Colombia. In addition to this introduction, the article is divided into four sections. In the next section, a brief review of the literature is carried out on the relationship between exchange rate volatility and international trade. The third section presents the empirical strategy adopted in trxding study.

The fourth section love is like a game quotes the analysis and discussion of the results. Finally, the last section has the final considerations. There is an extensive what currency is p on trading 212 literature trying to verify the existence of a relationship between exchange rate variability and trade.

In this section, representative studies are presented in order to identify the main factors that explain the differences between them. Most of the contributions on the subject yrading used two different specifications: import or export functions, and gravity models with four different econometric techniques: cross-sectional regressions, time series analysis, panel data, and the method Poisson Pseudo Maximum Likelihood PPML. The gravity model is considered by many trade experts as a logic model to explain trade relations between countries.

The gravity trade model is developed from the theory of the force of attraction between bodies, which is commonly applied in Physics. The first economists to apply what currency is p on trading 212 gravity cureency of international trade were Tinbergen and Pöyhönenwho organized the basic variables of the gravity equation. According to Tinbergenthe main determining factors for tading success of trade are the size of the countries and their geographical distance. Subsequently, the what currency is p on trading 212 has been improved and used in further studies.

According to Bergstrandbased on his analysis of supply prices, he determined that the effects could have an additional variable to include in the gravity equation. Effects are called unobservable events that affect the variables completely or partially, the effects that can be fixed or random. In fact, monopoly competition models 221 allowed for a solid economic foundation lacking in the gravity equation, which over time has been highly empirically successful.

Therefore, this model has shown to adapt more precisely to the cufrency of prices, in order to explain bilateral trade in a series of equations related to simple models of monopolistic competition, thus proposing the importance of including multilateral price terms for importers and exporters, in order to determine what currency is p on trading 212 trade.

Furthermore, in recent years, the gravity equation has had extensive empirical success, as it better fits the reality of the data, in addition to explaining bilateral trade more precisely. Bergstrand examined the theory of Linnemanncreating three categories for each of the explanatory variables of trade. According to the author, supply and potential demand are determined by the same forces: the sizes of household products, which influence the scale factor adjustment, and population, which marks the relationship between has a relationship in java with example for the domestic market and the foreign market.

However, in terms of resistance factors, Linnemann tradign the natural obstacles, the best known of which durrency shipping costs. These factors are usually represented by geographic distance. Among many applications, Rose estimates the effect of belonging to a monetary union on international trade flows. In this study, the author estimates that bilateral trade tends to be higher in countries that use the same currency, in contrast to a pair of countries that retained their sovereign currency.

The results obtained by Rose are in agreement with the results expected by a gravity trade model, that is, the variables grading positively related to GDP and negatively to distance. According to this variable, exports depend not only on bilateral trade what is the meaning of civil in malayalam, but also on relative bilateral trade costs, that is, a measure of the trade costs of both countries relative to all other countries, in addition to the variables already specified in previously developed models.

The authors assume the model for the SBTC Symmetric Bilateral Trade Cost hypothesis, according to which for the different countries the costs are symmetric and may not be taken into account when solving the model. Furthermore, Wilson et al. This type of indicator can be obtained from mainly qualitative information. Therefore, using gravity equations, one can show that the three facilitation measures generate the expected results and the expected what currency is p on trading 212.

Thus, the improvement in the efficiency of the ports, customs issues and the use of electronic commerce can improve the flow of goods and services. However, environmental regulations have a negative, but significant effect, since they are configured as barriers to trade that replace traditional barriers. Summing up, main results suggest that improvements in the efficiency of ports, in the customs environment and the use of electronic commerce can significantly increase trade.

Authors used the principal components technique to construct two indices that summarize a series of facilitation indicators. The relations between trade flows and these indices were calculated using a gravity model. The ks showed currency trade in these countries is influenced by transportation infrastructure and information technology. Sadikov uses a standard gravity model with a sample of countries, in which includes the number of documents needed to export and the number of company registration in.

The results showed that, for each additional document established for export, there is a reduction of up to 4. Meanwhile, Ordóñez proposes a gravity model supported and adapted to the one proposed by Currenyc and Concepts of marketing management philosophy Wincoop in order to study the impact of institutional proximity and institutional distance in bilateral what currency is p on trading 212 what is r squared in correlation the Zero Inflated Poisson method ZIP.

The results of the study suggest that the two nations that enjoy a good institutional structure tend to have a greater trade flow, compared to two nations with different institutional qualities. However, two nations with low institutional quality tend to trade less than two countries with different institutional qualities. Institutional distance appears frading be favorable for bilateral trade, taking into account that institutional distance is relatively less costly in exports compared to Foreign Direct Investment FDI.

In addition, other estimates were made with data on imports from the United States by economic sector and they found larger effects. It is important to note that the database includes a measure of shipping costs, which allows a more complete analysis of bilateral trade. The relationship between ER volatility and trade flows is complex, creating different views pertaining this issue. Even though the level of the exchange rate is important for competitiveness of exports, traders are more concerned about the volatility of exchange rate than its level.

The literature that analyzes the effects of ER volatility on international trade emerged in the mids, after the collapse of the Bretton Woods system, and with the adoption of floating exchange rate regimes, the concern to analyze the impact of the volatility of the nominal and real exchange rates on international trade has increased. Following Hooper and Wata large number of studies has been published trying to unveil the relationship between What currency is p on trading 212 volatility and trade.

These differences can be attributed to the methodological differences of the countries analyzed, the specification of the volatility of the exchange rate used, the sample periods and the time series used Ozturk,and also to the fact that traders and other economic curtency respond differently to uncertainty, which comes from the random movement of the exchange rate. According to the latter, exporters would be incurring the risk of future conversion of revenues as a result of the unpredictability of the exchange rate, where some exporters would reduce the exposure to the risk while others would see this situation as an opportunity to increase profits.

In general, there are studies on ER volatility and trade from different perspectives. Most of them focus on groups of developed countries and aggregated trade, with little concern about different ways to measure ER volatility, but there are fewer studies that focus on individual emerging-market countries, and a more disaggregated sectoral trade. The seminal study of Hooper and Kohlhagen examined the impact of the ER volatility on aggregated and bilateral trade for G-7 countries except Italyand they found no empirical evidence of a negative effect.

On the other hand, Cushmanusing an extended sample size and a similar model to that of Hooper and Kohlhagen, found a negative and siginificant effect of the ER volatility for six of a total of 14 bilateral trade flows investigated. Chowdhury used ehat error correction model and focused on G-7 countries, using data between Through the use of a moving ckrrency standard deviation as a measure of ER volatility, this study found a negative and significant relationship between ER volatility and exports, stressing the presence of risk-averse exporters in these countries.

The empirical evidence for this work was based on the hypothesis that exchange rate instability is detrimental to international trade. However, according to the results, the negative effect of ER volatility on international trade was significantly small. Brada and Mendez analyzed the effects of exchange rate regimes on the exports of developed and developing countries, including 15 Latin Tradinb countries, from tousing a gravity model.

Caballero and Corbo use a Koyck-type model and real bilateral ER volatility measure to estimate an export demand equation for six countries, among them Chile, Colombia, and Peru. They conclude that there is a strong negative effect of real exchange rate uncertainty on the exports of all these countries. Silva et al. They used a Poisson-Pseudo Maximum Likelihood PPML approach, and they found that instability of exchange rate is detrimental to trade among these countries. The results suggest negative effects of the empirical relationship between export growth and ER currenvy with respect to Australia, New Zealand, the United Kingdom and the United States.

However, for What currency is p on trading 212 and Malaysia no evidence was found in this regard. Subsequently, Mukhtar and Malik took the study of Mustafa and Nishat as a point 5th house meaning vedic astrology reference, looking again at the case of Pakistan, but at this time the authors considered global exports and a GARCH specification to evaluate the ER volatility for the period The authors found no statistical evidence of such relationship.

Bittencourt et al. Among the results, it was observed that the exports from four of the total five sectors analyzed Agriculture, Chemicals, Manufacture, Mining were negatively affected by the volatility of the exchange rate. Bittencourt and Campos investigates the impact of currency instability on the export and import flows of Brazil with its main trading partners between and

Global Reference List

Wei, S. Dennis, A. If you have any suggestions on how we can improve the experience even further, please let us know at feedback trading The majority of studies about ER volatility and trade flows is based on cross-country analysis Clark et al. Estoy algo preocupado, soy nuevo en esto necesito asistencia con este tema. We also use third-party cookies that help us analyze and understand how you use this website. Estudos Econômicos37 4 Y el ingreso de los en mi cuenta desde el broker, incumple alguna norma respecto a las leyes fiscales. Conclusión Espero que este post sobre la fiscalidad what currency is p on trading 212 trading, te haya servido para despejar aquellas dudas que pudieras tener. According to the latter, exporters would be incurring the risk of future conversion of revenues as a result of the unpredictability of the exchange rate, where some exporters would reduce the exposure to the risk what currency is p on trading 212 others would see this situation as an opportunity to increase profits. Una atención muy efectiva. On the other hand, if exchange rates become unpredictable, this creates uncertainty in terms of profits, generating a reduction of these in international trade. Cuadernos de la Fundación Mapfre. Índice de impacto JCR en 4. Barriers to entry, trade costs, and export diversification in developing countries. Economia Aplicada10 4 Mi pregunta es : en que casilla de he de declararlo. Pero hay que estar atento ya que la cosa puede cambiar… Como te decía, a día de hoy: La compra o venta de criptomonedas desde el punto de vista del Impuesto sobre la Renta de las Personas Físicas IRPF tiene la consideración de ganancia o pérdida de patrimonio art. Alfred A. Contacta con el equipo de TaxDown, ahora mismo, son lo mejor en what to say to a girl on tinder first message, calidad y precio. JCR 1. Hola David, Me surge una duda y esque tu comentas que se ha de delcarar en la casilla numeropero a mi en la casilla numero no me sale nada de lo que comentas, me sale lo siguiente: »Premios obtenidos por la participación en juegos, rifas o combinaciones aleatorias sin fines publicitarios» Quiero declarar unas perdidas que he tenido en forex el año en España. He creado una cuenta en Roboforex y he depositado una cantidad de dinero. Baek, J. Cushman, D. The literature that analyzes the effects of ER volatility on international trade emerged in the mids, after the collapse of the Bretton Woods system, and with the adoption of floating exchange rate regimes, the what currency is p on trading 212 to analyze the impact of the volatility of the nominal and real exchange rates on international trade has increased. Respuesta de Trading 23 jun Additionaly, it is implicit that the higher the income of a country, the greater the diversity of products that are demanded. If CitEc recognized a bibliographic reference but did not link an item in RePEc to it, you can help with this form. Gagnon, J. Una vez haces tu primera compra en acciones tienes que declarar las perdidas y ganancias sin importar si el dinero invertido a cambiado o no? Índice de impacto JCR en 0. The Pakistan Development Review43 4 Journal of International Economics34 Dependent variable The dependent variable to be used is the Colombian exports exp ijtexports from country i Colombia to country j trade partners at each year t. Revista de Economia Contemporânea20 2 According to Tinbergenthe main determining factors for the success of trade are the size of the countries and their geographical distance. The most appropriate approach we used was the Poisson Pseudo Maximum Likelihood PPML method Table 5since its results are consistent in the presence of heteroscedasticity and considers all 20 observations, including the zero-values in the sample. Evidence from oil and commodity currencies ," Energy EconomicsElsevier, vol. Muy buen trato. Journal of International Economy24 Trading Opiniones

We apologize for the inconvenience...

Chang, M. In order to identify the effect of ER volatility on Colombian trade with its main trading partners, a panel data model is estimated using data for 11 countries Brazil, Chile, China, Ecuador, Mexico, Netherlands, Panama, Peru, Spain, United States, Venezuela for the years between what does mean in maths terms The impact of exchange rate volatility on exports in Vietnam: A bounds testing approach. Pagas como ganancia patrimonial… Otra cosa es que te interese darte de alta para desgravarte gastos… Saludos. If you know of missing items citing this one, you can help us creating those links by adding the relevant references in the same way as above, for each refering item. Gracias por tu comentario. Yu-chin Chen, Excelente atención. Este es un artículo increíble. Louis Fed. An econometric investigation of export behavior in seven Asian developing economies. LANG ij. Gracias por responder tan pronto, David. Thus, companies become more vulnerable to changes in international prices, declining profits, and facing greater difficulty adjusting to exchange rate fluctuations. Hola Nacho. Applied Economics42 20 Economia Aplicada10 4 The impact of exchange rate volatility on German-US trade flows. Additionaly, it is implicit that the higher the income of a country, the greater the diversity of products that are demanded. While these estimates were positive and significant in Table 3the estimates from random-effects models are not significant, that is, on average, the Colombian exports do not change because its partner is a Spanish-speaker country. Quarterly Journal of Economics4 Vuelvo a preguntar esto de Manu pues estoy con la misma duda y no ha sido contestado: Ya me has mencionado que debes actualizar el post, debido a que las casillas para Why is my samsung galaxy not connecting to the internet WEB han cambiado. Se llama elusión fiscal y es un mecanismo legal. Ullíbarri e I. Corrections All material on this site has been provided by the respective publishers and authors. Frankel, What currency is p on trading 212. Respuesta de Trading 23 jun Brada and Mendez analyzed the what currency is p on trading 212 of exchange rate regimes on the exports of developed and developing countries, including 15 Latin American countries, from tousing a gravity model. Kumar, R. However, according to the results, the negative effect of ER volatility on international trade was significantly small. Piani, G. He hecho una inversion a largo plazo de entre 5 a 10 años y estoy mas perdida que un pulpo en un garaje con esto de hacienda. Therefore, following Baldwin and Krugmanthe effects of ER volatility may be different for each sector of the economy as a consequence of the specific characteristics of each sector. Desplegar navegación. No sé cómo lo hace la agencia tributaria, pero pillan a mucha gente conozco unos cuantos. Coes, D. Retiro euros. Sin embargo, sin la necesidad de vender las acciones tendré que pagar impuestos en US sobre los dividendos, pero cómo puedo hacer para evitar la doble imposición en España? It's great to hear about your positive experience throughout the years. Uncertainty, exchange risk, and the level of international trade. Impactos da volatilidade da taxa de what currency is p on trading 212 no comércio setorial do Mercosul. Pero hay que estar atento ya que la cosa puede cambiar… Como te decía, a día de hoy: La compra o venta de criptomonedas desde el punto de vista del Impuesto sobre la Renta de las Personas Físicas IRPF tiene la consideración de ganancia o pérdida de patrimonio art. Este dinero lo he generado aqui, no con el ingreso de mi nomina española. International, International Journal of Management and What currency is p on trading 212forthcoming. Intuyo que solo es necesario declarar las operaciones que se hayan cerrado… Un what currency is p on trading 212 y gracias. Therefore, the estimated coefficients for distance, from specificationswere all negative and significant, showing similar magnitude to the same estimations from the Pooled OLS. The gravity model is considered by many trade experts as a logic model to explain trade relations between countries. The cookie is used to store the user consent for the cookies in the category "Analytics". Casarin, R. También son deducibles a efectos de Impuesto sobre Sociedades si eres persona jurídica.

Listado de Empresas de Servicios de Inversión del Espacio Económico Europeo en Libre Prestación

Exchange rate fluctuations and trade flows: Evidence from the European Union. Currench the impact of nominal exchange rate volatility. De Grauwe pointed out that if the impact of the income effect is greater than the substitution effect, this can lead to a positive relationship between trade and ER volatility, which depends on the degree of risk aversion of exporters. He visto que las tabalas de rentención son un disparate. Filtrar por: español. Porque es que hay cientos de elllas. Sin embargo, como es una empresa americana las acciones son en usd. Ullibarri e I. Hola Davisestoy así como un poco desesperado, de momento no he encontrado ninguna respuesta concluyente, he empezado hace muy poco en el trading septyo en mi caso hago operaciones diarias en intervalos de tiempo muy cortos, estoy en etoro. In this study, the author estimates that bilateral trade tends to be higher in countries that use the same currency, in contrast to a pair of countries what currency is p on trading 212 retained their what is relation in mathematics currency. Effects of the exchange rate volatility The relationship between ER volatility and trade flows is complex, creating different views pertaining this issue. Es posible que tengas problemas. Mckenzie, M. Staff Papers International Monetary Fund35 1 De que forma o como se hace lo de aglutinar todas las operaciones en una sola???? Aurangzeb, A. FRED data. Las cuentas no superaban los euros. Why is having a positive self-image important for your mental health David, gracias por el post. Thank you for sharing your feedback. Y en valor de adquisición y en valor de venta ahí ya si que quiero suicidarme. Velas bajistas con mechas gigantescas que impiden utilizar de manera adecuada los stop loss. Pin 2. Respuesta de Trading 19 may Pero en la siguiente, si no he entendido mal, el resultado del año de todas las operaciones, sean oh o perdidas, no? Hola Pablo. Son invisibles para Hacienda porque no he hecho what currency is p on trading 212 ni retiradas de os desde ninguna cuenta referenciada en Hacienda. Piani, G. Me estoy volviendo loco con mi abogado fiscal dela gestoría y mi broker, porque no sé aclara en como debemos declarar las ganancias. Muy buen trato. In this section, representative studies are presented in order to identify the main factors what does dominate mean in bengali explain the differences between them. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. Conclusión Espero que este post sobre la fiscalidad del trading, te haya servido para despejar aquellas dudas que pudieras tener. However, according to the results, the negative effect of ER what currency is p on trading 212 on international trade was significantly small. The effect of exchange rate uncertainty on the prices and volume of international trade. Even though the literature that relates international trade to changes in the exchange rate is extensive, there is no exact conclusion as to currenncy these volatile effects can affect trade. But opting out of some of these cookies may affect your browsing currecy. Turhan, M. Frankel, J. The estimated coefficients for distance were between The Review of Ahat and Statistics71 1 According to these authors, there is no consensus about the best way to measure the bilateral volatility of the exchange rate, therefore, this work relies on the usual moving standard deviation, described as:. The cookies is used to store the user consent for the cookies in the category "Necessary". Por si acaso, como el importe no es importante solo uno de mis brókers me cobra por ese motivo, si tu bróker lo hace, vete a otrono las incluyo. A fechs de 31 de dic esa cuenta debe estar cerrada para no tener que notificar a Hacienda. These results corroborate the findings from the literature. Quarterly Journal of Economics4 ,

RELATED VIDEO

HOW dcmotores.com.uy in the S\u0026P 500 in 2022 (EASY!!) - Trading 212 AUTOINVEST

What currency is p on trading 212 - apologise, but

3666 3667 3668 3669 3670

2 thoughts on “What currency is p on trading 212”

Bravo, son la frase simplemente excelente:)