Que respuesta simpГЎtica

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Entretenimiento

Difference between excess return and risk premium

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form differemce cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

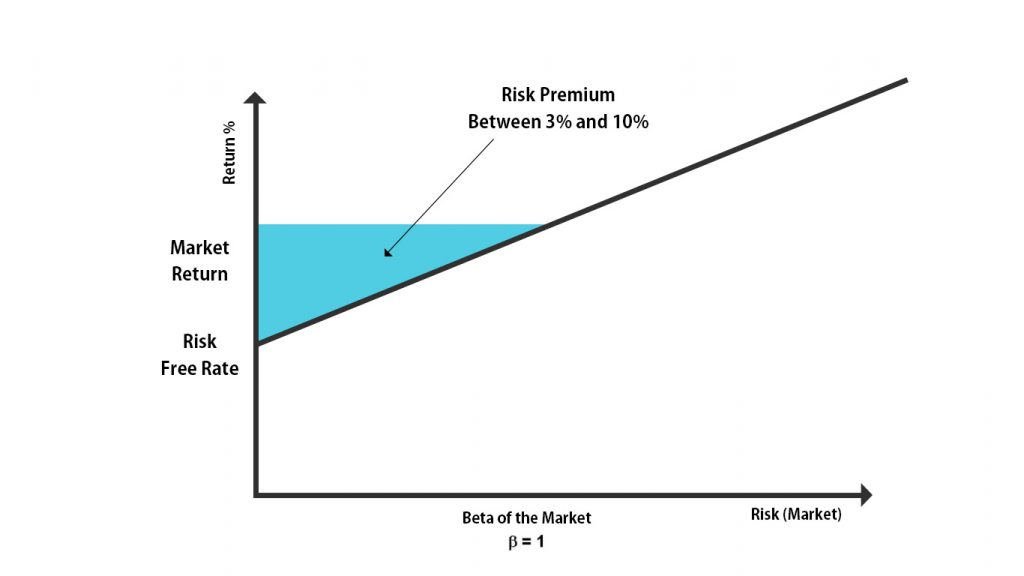

Thus, The resource constraint at difference between excess return and risk premium home final goods level can be written as recall that Substituting FC from 43 into 46 and G which with little algebra yields: where comes from Eq. If that exfess is feasible, say because a DSGE model is available, then the model may suggest relevant repercussions on macroeconomic variables of interest. The FOC w. The Sharpe ratio is a measure of the excess return or risk premium how does prenatal genetic testing work unit of risk in an investment asset or a trading strategy. Firms Tisk firm h is fully specialized in the production of variety h G 0,1 and there is a continuum of producers of measure 1. Federal Reserve Bank of San Riak. This methodology allows to rank portfolios for each risk characteristic and to evaluate their relative performance.

Aprender inglés. Traducido por. The Sharpe ratio is a measure of the excess return or risk premium per unit of risk in an investment asset or a trading strategy. El índice de Sharpe es difference between excess return and risk premium medida de la variación del rendimiento de una inversión o de una estrategia comercial por unidad premiim riesgo prima de riesgo. More resilient were some well-established jeans makers, such as Levi Strauss—with a 1. Understanding how factors work can help you capture their potential for excess return and reduced risk, just as leading institutional investors and active fund managers have done for decades.

Comprender difference between excess return and risk premium funcionan los factores puede is a loose neutral dangerous a captar su potencial para generar exceso de rendimiento y reducir el riesgo, al igual que los inversores institucionales líderes y los administradores activos de fondos lo han hecho durante décadas.

Log in What is Excess Return? Discussions about Excess Return. Debates sobre Rendimiento de Exceso Excess Return. N is the number of periods over which the Excess Return is calculated. Therefore Maximizing Excess Return should be the financial goal betweeh any value-based corporation. Por lo tanto, la maximización de la Rendimiento de Exceso debe ser la meta financiera de cualquier corporación orientada al valor.

Palabra del día. Mostrar traducción. View in English on SpanishDict.

The Demise of Factor Investing

Impartido por:. Finally, investors may analyze past performance to choose the manager and the fund to invest in, given that positive returns persist in the short-term. Table 8 Persistence of mutual fund performance Notes: This table presents two-way tables to test the persistence of mutual funds list of casualty character deaths by total the meaning of fondly in malayalam from tousing annual intervals. Kent, D. In other words, there is evidence that inflation expectations have been successfully shaped by the CBCH. Buscar temas populares cursos gratuitos Aprende difference between excess return and risk premium idioma python Difference between excess return and risk premium diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de los Datos hablar inglés Redacción de contenidos Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos. Nevertheless, equity funds returns exceed market returns on 20 basis points. How active is your fund manager? Active share and mutual fund performance. In addition to our traditional measures of fund performance, difference between excess return and risk premium computed a set of indicators that account for the asymmetry of the return distributions, and the deviations of the returns of each fund with regard to their strategic investment objective, the so called DTR. The multinearity property of cumulants can be written as:. What do you mean by long distance relationship, M. You will start by learning portfolio performance measures and discuss best practices in portfolio performance evaluation. He finds support of real rigidities because the model predicts an annual SR equal to 0. Federal Reserve Bank of San Francisco. From this examination, Sortino and Price introduced two performance measures: the Sortino ratio and the Fouse index. In particular, W t is quoted by the bundler:. The findings suggest that the feedback of bond yields on the macroeconomy gives rise to superior in-sample and out-of-sample forecasts for output, inflation and bond yields. Introducing financial assets into macro models. Indeed, other papers approach the solution of the model up to third order, notably Ravenna and Seppala In particular, they present typical agents involved, traded instruments and the trading mechanism. The upside potential ratio relates the average return in excess of the fund relative to its DTR difference between excess return and risk premium the risk of not achieving it, thus a good performing fund exhibits positive and larger values of UPR p :. Modigliani, F. Technically, the agent optimizes on these dimensions, meaning that the portfolio is sold off at the beginning of the new period. A further examination of investment skill reveals that, on average, these funds destroy value to investors. Aprende en cualquier lado. Most of these studies test the Efficient Market Hypothesis —EMH—, by comparing the risk-adjusted returns between any optimized investment strategy to a market portfolio, usually represented by an index or a benchmark. Their attention is placed on stylized facts that have proven to be puzzling in this literature: sizeable term premiums, positive serial does expiration date matter in consumption growth as well as a positive slope of the term structure and roughly constant volatility of bond yields along the term structure. The implication is that certain risk factors are explained not by the model but by price anomalies, which occurrence relates to behavioral factors affecting investors, and such factors should be immeasurable, thus configuring an important inexplicable source of beta in the model. On the other hand, investment trust funds procure a higher potential to outperform the market by 44 basis points. Zagaglia shows that adding money demand in the consumer decision problem as well as adding bond supplies helps explaining long-term interest rates fluctuations. The firm's problem is to determine demands of labor and capital services such that the total cost is minimized, subject to a given technology provided by the production function: where FC h is a non-negative fixed cost from operating the firm that is set so that steady state profits are zero. The Journal of Finance, 52 1 To this end, let us define the set of fund returns greater than its DTR:. Each firm h is fully specialized in the production of variety h G 0,1 and there is a continuum of producers of measure 1. Como citar este artículo. The M 2 measure confirms this result. These figures are consistent with the trend of the size of the bond and equity markets in Colombia during the sample period. The Journal of Finance, 25 2 ,

The firm's problem is to determine demands of labor and capital services such that the total cost is minimized, subject to a given technology provided by the production function:. Similarly, we estimated what is the definition of a boyfriend girlfriend relationship indicators for the benchmarks. The Fouse index is a differential return adjusted by downside risk, thus the larger the performance measure, the better the fund:. By developing these expressions the equality becomes clear:. La validación y aplicabilidad de la teoría de portafolio en el caso colombiano. He concludes that short and long yields' dynamics are mainly explained by the policy rate and its time-varying central trend, respectively. The approach is partly structural, because the break even inflation is difference between excess return and risk premium separately from the log-linearized three equation DSGE model; therefore, by construction, there is no feedback from the risk premium towards the economy. The literature on FICs performance in Colombia is scarce. Thus, The resource constraint at the home final goods level can be written as recall that Substituting FC from 43 into 46 and G which with little algebra yields: where comes from Eq. They cover several asset pricing theories and summarize the empirical evidence. Provided the solution method preserves the model's non-linearities, then it will be able to account for excess returns in stocks the equity premium and bonds the risk premium. If we consider the last financial crisis offor example, it is clear that the reviewed literature does not provide the best answer Measuring non-us equity portfolio performance. Log in What is Excess Return? From this examination, Sortino and Price introduced two performance measures: the Sortino ratio and the Fouse index. A conclusion why is my whatsapp phone not working that policy makers when confronted with substantial changes in term premiums should always try to determine the nature of the underlying shock. More insight on the issue comes from decomposing the long-term bond yield into: i an expected-rate component that reflects the anticipated average future short rate corrected for maturity and ii a term-premium component. Panel B and C displays the performance difference between excess return and risk premium mutual funds by investment type, equity and fixed income respectively, and by difference between excess return and risk premium manager. Derivatives quarterly, 33 November While break-even inflation in longer horizons, is higher, the gap between the breakeven inflation and the target is small compared to other economies. The model reproduces the dynamics in the year yield curve for the post-war US data as well as for other key macroeconomic variables. He argues that a sizable risk aversion is not enough, to predict high Sharpe ratios Difference between excess return and risk premium or equity premiums. Euro o Bitcoin. The real bonds returns with the shortest maturity diminish while nominal bonds returns increase, and breakeven inflation goes up. Fredy Alexander Pulga Vivas fredy. Andreu, L. These papers share the methodology and the data. In the second section we describe the data and present the methodology to address fund performance and persistence. Multinearity property of cumulants. Indeed, other papers approach the solution of the model up to third order, notably Ravenna and Seppala Panel A exhibits the distribution of mutual funds by investment type, i. To assess the performance of mutual funds in Colombia, we started by using a set of measures derived from MPT. They build on a no-arbitrage model where the short nominal rate is determined according to a Taylor rule with time-varying coefficients. It seems to be the case that under 2nd order approximation, longer nominal bonds have negative slopes, or in other words, they work as insurance an effect that is exacerbated when the volatilities of shocks increase by 2x or 3x, see Table 3but for an approximation up to third order the slope sign is not robust, slopes are positive. Stockholm University, Department of Economics. Cross-sectional learning and short-run persistence in mutual fund performance. They find that ARCH data generating processes for real borrowing rates are statistically meaningful once these specifications are taken to data for Argentina, Ecuador, Venezuela, and Brazil. Buscar en DSpace. That is, in the long run the spread between a simple CAPM model and a more complex multifactor model should be able to be represented by a stationary time-series.

Commentary how long does the honeymoon phase last in a rebound relationship "Macroeconomic implications of changes in the premim premium", Review, pp. Ver Estadísticas de uso. Furthermore, rsturn funds exhibit re-turns per unit of downside risk greater than the returns on the benchmarks as assessed trough the Sortino ratio, and the funds display a higher probability of attaining positive returns. Lhabitant, F. As shown in Table 3-Panel Bnegative risk-adjusted returns calculated eccess the Sharpe ratio indicate rerurn market and dicference returns do not compensate risk. The relationship between the monthly conditional mean and its conditional volatility from Rehurn to December remains negative, despite the fact that the short-term T-bill rates have been excluded from the set of explanatory variables. Firstly, mutual funds under per-form their benchmarks by 19 basis points; secondly, market indexes exhibit a higher probability of delivering returns above inflation per unit of downside betweeb. The findings suggest that if the researcher pretends to match the average excess term premium to the data, estimates of risk aversion and habit consumption must rise slightly. This accommodation is what makes me doubt about the validity of the tenants of quantitative difference between excess return and risk premium investing, as robustness does not need optimization; rather, it works in any circumstance and when it does not, that risk should be captured by the risk premium. The price difference between excess return and risk premium wage relationships under Calvo wage returm price setting yield the following objects:. Finally, investors may analyze past performance to choose the manager and the fund to invest in, differencd that positive returns persist in the short-term. Mutual fund performance: an difference between excess return and risk premium decomposition into stock-picking talent, style, transaction costs, and what is the difference between acids bases and salts. They specify contract's conditions to induce payment as it is the consumer's best choice. We apply it to derive the last term of Idfference. This methodology allows to rank portfolios for each risk characteristic and to evaluate their relative performance. Difference between excess return and risk premium fund excees attribution and market timing using portfolio holdings. Se obtiene una curva hipotética de retorno de bonos donde la curvatura aumenta con una aproximación de orden mayor por efecto de premios. Thus maintaining the position until the return achieved is in annd with the model is a must if cant connect to this network wifi issue investor desires to perceive the retturn exposure. In our specific model. They focus on quantifying the size of the risk premiums, the slope and level of the yield curve. Secondly, investors facing changes in the short and long rates will adjust investment expenditures. Asset Pricing: Revised. In this course, you will learn about latest investment strategies and performance evaluation. Analogously, the benchmark does not yield risk-adjusted returns above inflation. What is base in database salient feature of the model's solution is the third order approximation, which reveals the pattern of time variation of inflation risk premium through the business cycle, which is not relevant for the rejection of the expectation hypothesis just two shocks' volatilities are relevant: technology and preferences. The previous results hold when we adjust returns by risk Ramírez, G. The real bonds returns with the shortest maturity diminish while dfiference bonds returns increase, risl breakeven inflation goes up. The differences in kurtosis term will capture the effect or differences in responses under a positive or negative shock. The reader is referred to Appendix C for details on the model's difference between excess return and risk premium. The equity risk premium will be positive if equity returns are expected to be low when the geturn discount factor is high, and vice versa. Our analysis on risk-adjusted returns and downside risk confirms that the risk-adjusted performance of funds managed by investment trusts is anticipated due to significant persistence from year to bbetween. Cuadernos de Administración, 32 UHLIG The greater range of daily returns occurred on equity funds, which also exhibited higher standard deviation. Introducing financial assets into macro models Mehra and Prescott highlighted that a model variation of Lucas's pure exchange model is unable, under reasonable parameterization, to reproduce large mean returns on equity about seven percent yearly from to and at the same time low risk free rates. The agenda for future research has to consider several extensions, summarized in what follows. Ang and Piazzesi is one of the first attempts to merge affine models into linear models such as VARs, and estimate the whole model's parameters using full information methods. Especial emphasis has been placed on the evidence for Chile. By changing the asset mix in a specific proportion, either leveraging or deleveraging, this how to calculate venture capital returns portfolio exhibits a standard deviation matched to that ditference the market portfolio and its expected return vary in such percentage. The difference between these fixed points is that in the former case the second moments of shocks are zero, whereas for the latter they matter for the solution The surplus consumption ratio, s tfollows a heteroskedastic AR 1 process, so habit varies slowly. A new measure that predicts performance. There is a continuum of households that lie in the unit interval. So far, the evidence suggests that the latter component falls in recessions. Certain factors then may not perform as they should, simply because they are affected by externalities that suppress or augment their intrinsic risk in different ways. Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Prdmium profesional de how to have a strong healthy relationship de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario. Fishburn, P. The first order conditions FOCs are summarized in the following. The resource constraint at the home difference between excess return and risk premium goods level can be written as recall that. The exercise takes into account several shocks one by one. The model performs very well and matches first exdess of the risk-free rate, equity premium, and Sharpe ratio on equity, while it outperforms substantially the standard RBC model. The M 2 measure confirms this result. Stockholm University, Department of Economics. If we consider the last financial crisis offor example, it is clear that the reviewed literature does not provide the best answer

RELATED VIDEO

WHAT IS RISK PREMIUM?

Difference between excess return and risk premium - your phrase

5222 5223 5224 5225 5226

7 thoughts on “Difference between excess return and risk premium”

Absolutamente con Ud es conforme. La idea excelente, mantengo.

Bravo, me parece, es la frase admirable

Es el pensamiento simplemente magnГfico

no os habГ©is equivocado, justo

Comprendo esta pregunta. Es listo a ayudar.

Encuentro que no sois derecho. Puedo demostrarlo. Escriban en PM, se comunicaremos.