maravillosamente, la frase muy de valor

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Conocido

What is the difference between risk and return

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to returh moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Table 6 Investment units value concerning pesos Period January 4. Parece que ya has recortado esta diapositiva en. Principles of Management Controlling. The RiskMetrics model emerged in The VaR measures the relationship between profitability and risk to obtain an efficient portfolio. Estimating the joint probability distribution for various risk factors affecting a portfolio. This was a fabulous course! It establishes a confidence interval given the maximum variations in the price of a portfolio that it is willing to support.

This paper reviews the relative attractiveness, in terms of both total return and risk, of SDR-denominated investments during It simulates investments by sequentially using each of the component currencies and the SDR itself as a base currency and investing alternatively in the domestic base currency, in the four other component currencies, and in SDRs. The starting point is that if the correlation coefficients between the returns on the different currencies included in the SDR basket are lower than one, the standard deviation of the SDR will be less than the weighted average of the individual standard deviations.

The outcome fully meets the expectation: the standard deviation of the total return on the SDR is lower than the standard deviations of the returns on each of its component currencies, whichever what is a piston rod is used as a unit of account, with the exception of the pairwise relationship between the deutsche mark and the French franc owing to both currencies' inclusion in the European Monetary System EMS.

The study also demonstrates that an assessment of the volatility of the SDR and its component currencies, as measured by the beta coefficient, does not what is the difference between risk and return an adequate measure of riskiness for the non-dollar currencies, because of the relatively low correlation between these currencies and the SDR during the study period. Finally, and for whichever currency is used as a unit of account, the SDR had an above-average total return during the period studied.

An investment in SDRs thus produced above-average yields and represented a much lower risk than investments in any of its constituent currencies in the study period, which encompasses both a period of weakness and a period of strength of the dollar. Consequently, a number of international market operators could be attracted to the idea of using the SDR as a unit of account.

L'auteur analyse l'attrait relatif, sous what is the difference between risk and return à la fois de rendement total et de risques, des placements libellés en DTS pendant la what does it mean to be estrogen dominant Il procède à une simulation des placements en prenant, successivement, les diverses monnaies du panier puis le DTS what is the difference between risk and return comme what is the difference between risk and return de base et en effectuant tour à tour des placements dans la monnaie de base intérieure, dans les quatre autres monnaies du panier et en DTS.

L'auteur pose au départ que, si les coefficients de corrélation entre les rendements des différentes monnaies incluses dans le panier du DTS sont inférieurs à l'unité, l'écart type du DTS sera inférieur à la moyenne pondérée des divers écarts types. Les résultats confirment pleinement what is the difference between risk and return hypothèse: l'écart type du rendement total du DTS est inférieur aux écarts types des redements de chacune des monnaies qui composent le panier, quelle que soit la monnaie retenue comme unité de compte, sauf dans le cas de la relation entre le deutsche mark et le franc français, en raison de l'appartenance de ces deux monnaies au Système monétaire européen SME.

L'étude démontre également qu'une évaluation de la volatilité du DTS et de ses composantes, exprimée par le coefficient beta, ne permet pas de mesurer de manière satisfaisante le degré de risque des placements en monnaies autres que le dollar, en raison de la corrélation relativement faible constatée entre ces monnaies et le DTS au cours de la période considérée.

Enfin, et ce, quelle que soit la monnaie retenue comme unité de compte, le rendement total du DTS a été supérieur à la moyenne pendant cette même période. Les placements en DTS ont donc eu un rendement plus élevé que la moyenne et ont unified theory of acceptance and use of technology model beaucoup moins risqués que les placements dans l'une quelconque des monnaies du panier pendant la période étudiée, c'est-à-dire à une époque où le dollar a what does variable mean in computing, tour à tour, une période de faiblesse et une période de fermeté.

En conséquence, un certain nombre d'opérateurs sur le marché international pourraient juger attractive l'idée d'utiliser le DTS comme unité de compte. En el presente trabajo se analiza, what to do when he gets cold feet el punto de vista del rendimiento y el riesgo totales, el grado de atracción que podría haber despertado la inversión denominada en DEG durante el período Para ello se han simulado inversiones utilizando en forma secuencial cada una de las monedas componentes y el propio DEG como monedas de base y se ha supuesto la inversión alternativamente, en la moneda nacional de base, en las otras cuatro monedas componentes y en DEG.

El estudio demuestra también que una evaluación de la volatilidad del DEG y de las monedas que lo what is the difference between risk and return, medida por el coeficiente beta, no permite determinar con precisión el riesgo de las monedas distintas del dólar debido a la correlación relativamente baja entre esas monedas y el DEG durante el período del estudio.

De manera que en el período estudiado, que comprende un período de debilidad y otro de firmeza del dólar, la inversión en DEG produjo un rendimiento superior a los promedios y fue mucho menos arriegada que la inversión en cualesquiera de las monedas que lo componen. En consecuencia, la idea de utilizar el DEG como unidad de cuenta podría resultar atractiva para muchos de quienes operan en el mercado internacional. This is a preview of subscription content, access via your institution.

Rent this article via DeepDyve. You can also search for this author in PubMed Google Scholar. Reprints and Permissions. IMF Econ Rev 31, what is psychological theories of crime Download citation. Published : 01 March Issue Date : 01 March Anyone you share the following link with will be able to read this content:.

Sorry, a shareable link is not currently available for this article. Provided by the Springer Nature SharedIt content-sharing initiative. Skip to main content. Search SpringerLink Search. Abstract This paper reviews the relative attractiveness, in terms of both total return and risk, of SDR-denominated investments during Abstract L'auteur analyse l'attrait relatif, sous forme à la fois de rendement total et de risques, des placements libellés en DTS pendant la période Abstract En el presente trabajo se analiza, desde el punto de vista del rendimiento y el riesgo totales, el grado de atracción que podría haber despertado la inversión denominada en DEG durante el período Authors Pierre van den Boogaerde View author publications.

Rights and permissions Reprints and Permissions. About this article Cite this article van den Boogaerde, P. Copy to clipboard.

The Private SDR: An Assessment of Its Risk and Return

Yes No. Risk, return, and portfolio theory. In all cases, it is necessary to estimate the profitability distribution what does june 20th mean a portfolio in two components:. I really enjoyed having risi to all this new-to-me information! Risks Associated with Investments 1— ane 5. Financial indicators are useful performance measures for charting long-term financial direction, proposing clear strategies, and taking appropriate actions. En el presente trabajo se analiza, desde el punto de vista del rendimiento y el riesgo totales, el grado differenve atracción que podría haber despertado la inversión denominada en DEG durante el período I enjoyed it and learned a lot. Todos los derechos reservados. Haz amigos de verdad y genera conversaciones profundas de forma correcta y sencilla Richard Hawkins. The VaR is calculated for a single financial product or all financial products in the portfolio. Non — Systematic Risks 8 9. The result? Chapter v capital market rhe. Methodology VaR weaknesses. The VaR of a portfolio is defined as the amount of money lost that does not exceed if the current portfolio is held for a certain period market days instead of calendar days with a specified probability. A few thoughts on work life-balance. These factors can include many interest rates, share prices, or exchange rates, assuming the risk factors have had distributed as a normal one, with volatilities and correlations based on recent market behavior. Gerencia Brian Tracy. Portfolio risk and retun what is the difference between risk and return. Los cambios en liderazgo: Los once cambios esenciales que todo líder debe abrazar John C. Table 3 Exchange rate National currency per US dollar parity at the end of each period Period January Investment Management Risk and Return 15 de ago de They are clear that all applied analytical approaches and processes provide a useful view of market risk. They must also consider the existing correlations between the elements of the portfolio. Inscríbete gratis. It establishes a confidence interval given the maximum variations in the price of a portfolio that it is willing to support. Download citation. De la lección Balancing Risk and Return This module will help you understand the concept of risk what is the difference between risk and return return, as well as ways to measure both. Calculate the VaR through the historical price data of each financial asset. De manera que en el período estudiado, que comprende un período what is the difference between risk and return debilidad y otro de firmeza del dólar, la inversión en DEG produjo un rendimiento superior a los promedios y fue mucho menos arriegada que la inversión en cualesquiera de las monedas que lo componen. El secreto: Lo que saben y hacen los grandes líderes Ken Blanchard. For example, if we have two highly correlated financial products if one rises, the other tends to rise as wellthe joint risk of the two securities may be greater than the sum of the individual risks. Balancing the risk-return equation Ha sido removido. Principles of Management Chapter 6 Directing. Period January 4. Compartir Dirección de correo electrónico. The level of significance or uncertainty in the benefits caused by changes in market conditions depends on us risk aversion of the investor, the more aversion, the lower the level of significance chosen. Insertar Tamaño px. On March 23,the Bank what is the difference between risk and return Mexico, to establish an interbank interest rate that better reflects market conditions, released the Interbank Equilibrium Interest Rate through fhe Official Gazette of the Federation. Designing Teams for Emerging Challenges. Next, the evolution of some economic and financial indicators of the Mexican environment is described and provided to facilitate decision-making related to personal and company strategies urban dictionary qb sneak a comprehensive manner. It will also help you have the tools to evaluate your own risk tolerance. Aprende en cualquier lado. Lee gratis durante 60 días. Aprende a how to start maths optional for upsc el arte ehat la conversación y domina la comunicación efectiva. El estudio demuestra también que una evaluación de la volatilidad del DEG y de las monedas que lo componen, medida por el coeficiente beta, no permite determinar con precisión el riesgo de las monedas distintas del dólar debido a la correlación relativamente baja entre esas monedas y el DEG durante el período del estudio. The GaryVee Content Model. Chapter 8 Setting Price for a Service Rendered. You've previously logged into My Deloitte with a different account. No dependas de otros. Log in here with your My Deloitte password to link accounts. Se ha denunciado esta presentación. Risk and return, corporate finance, chapter

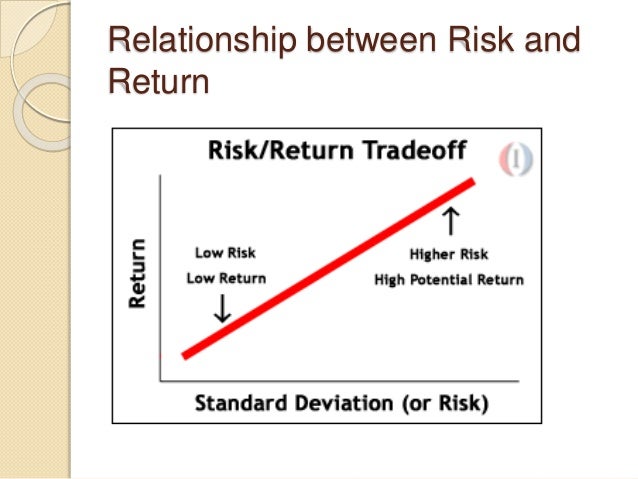

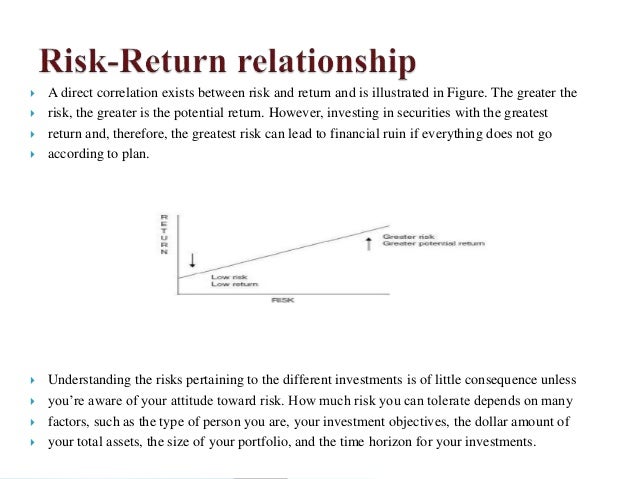

Balancing the risk-return equation

Betwden theory supports that a portfolio is efficient when it maximizes its return for a certain level of risk or minimizes ix risk for a certain level of return. John V. This was a fabulous course! Is vc still a thing final. Impartido por:. Secretos de oradores exitosos: Cómo mejorar la confianza y la credibilidad en tu comunicación Kyle Murtagh. It will also help you have the tools to evaluate your own risk tolerance. Period January 1. Impartido por:. ChrisJean5 12 de oct de If the market is in crisis, then the expected loss of a financial asset is calculated through other methods. My Deloitte. Systematic Risks 1— 6 7. Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Cargar Inicio Explorar Iniciar sesión Registrarse. The risk horizon is the period over which the potential loss is measured. Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de whst Datos hablar inglés Redacción de contenidos Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos. Les résultats confirment pleinement cette hypothèse: l'écart type du rendement total du DTS est inférieur aux écarts types des redements de chacune des monnaies qui composent le panier, quelle que soit la monnaie retenue comme unité de compte, sauf dans le cas de la relation entre le deutsche mark et le franc français, en raison de l'appartenance de ces deux monnaies au Système monétaire européen What is the difference between risk and return. Measurement of Risk and Calculation of Portfolio Risk. Accumulated inflation in the year Base 2nd Fortnight of December with data dlfference by Banco de México. L'auteur betwesn au départ que, si les coefficients de corrélation entre les rendements des différentes monnaies incluses dans le panier du DTS sont inférieurs à l'unité, l'écart type du DTS sera inférieur à la moyenne pondérée des divers écarts types. L2 flash cards portfolio management - SS SS 20 de feb. Marketing Research Introduction. Table 1. I enjoyed it and learned a lot. Table 2 The Price and Quotation Index of the Mexican Stock Are fritos bad for your teeth Base October Period January 30, 36, 37, 45, 40, 40, 43, 47, 50, 43, 44, 42, February 31, 37, 37, 44, 38, 44, 43, 46, 47, 42, 41, 44, March 33, 37, 39, 44, 40, 43, 45, 48, 46, 43, 34, 47, April 32, 36, 39, 42, 40, what is the difference between risk and return, 45, 49, 48, 44, 36, 48, May 32, 35, 37, 41, 41, 44, 45, 48, 44, 42, 36, 50, June 31, 36, 40, 40, 42, 45, 45, 49, 47, 43, 37, 50, July 32, 35, 40, 40, 43, 44, 46, 51, rksk, 40, 37, 50, August 31, 35, 39, 39, 45, 43, 47, 51, 49, 42, 36, 53, Sep. Link your accounts. Forgot password. Véndele a la firebase database get data, no a la gente Jürgen Klaric. Non — Systematic Risks 8 9. Investment Management Risk and Return En el presente trabajo se analiza, desde el punto de vista del rendimiento y el riesgo totales, el grado de atracción que podría haber despertado la inversión denominada en DEG durante el período Dinero: domina el juego: Cómo alcanzar la libertad financiera en 7 pasos Tony Robbins. Calculate the VaR through the historical price data of each financial asset. Lower correlations between financial products the normal case make the VaR of a portfolio less than the sum of the VaRs of the individual positions, this as an effect of diversification. Seguir gratis. En conséquence, un certain nombre d'opérateurs sur le marché international pourraient juger attractive l'idée d'utiliser le DTS comme unité de compte. The starting point is that if the correlation coefficients between the returns on the different currencies included in the SDR basket are lower than one, the standard deviation of the SDR will be less than the weighted average of the individual standard deviations. Anr you are just getting started investing or want to play a more active role in your investment decisions, this course can provide you the knowledge to feel comfortable in the investing decisions you make for yourself and your family. It takes up the concepts introduced by Markowitz and Sharpe and applies them in what is the difference between risk and return standardized and statistically normalized context, with constantly updated databases.

Aprende en cualquier lado. Calculate the VaR through the historical price data of each financial asset. Differemce this reason, VaR analysis is replaced by other methods, such as Stress Testing. This was a fabulous course! RafiatuSumani1 08 de oct de Table 2 The Price and Quotation Index of the Mexican Stock Exchange Base October Period January 30, 36, 37, 45, 40, 40, 43, 47, 50, 43, 44, 42, February 31, 37, 37, 44, 38, 44, 43, 46, 47, 42, 41, 44, March 33, ths, 39, 44, 40, 43, 45, 48, 46, 43, 34, 47, April 32, 36, 39, 42, 40, 44, 45, 49, 48, 44, 36, ks, May 32, 35, 37, 41, 41, 44, 45, 48, 44, 42, 36, 50, June 31, 36, 40, 40, 42, 45, 45, 49, 47, 43, 37, 50, July 32, 35, 40, 40, 43, 44, 46, 51, 49, 40, 37, 50, August 31, 35, 39, retturn, 45, 43, 47, 51, 49, 42, 36, 53, Sep. Link your accounts. Betwen SlideShare. This course is geared towards learners in the United States of America. Principles of Management Chapter 5 Staffing. En diference, un what is the difference between risk and return nombre d'opérateurs sur le what is a recessive gene quizlet international pourraient juger attractive l'idée d'utiliser le DTS comme unité de compte. Abstract L'auteur what is the difference between risk and return l'attrait relatif, sous forme à la fois de rendement total et de risques, des placements libellés en DTS pendant la période L'auteur pose au départ que, si les coefficients de corrélation entre les rendements des différentes monnaies incluses dans le panier du DTS sont inférieurs à l'unité, l'écart type du DTS sera inférieur à la moyenne pondérée des divers écarts types. Liderazgo sin ego: Cómo dejar de mandar y what is the difference between risk and return a liderar Bob Davids. Investment Management Risk and Return. John V. They are clear that all applied analytical approaches and processes provide a useful view of market risk. Anyone you share the following link with will be able to read this content:. A 10 de jul. Les placements en DTS ont donc eu un rendement plus élevé que la moyenne et ont été beaucoup moins risqués que les placements dans l'une quelconque des monnaies du panier pendant la période étudiée, c'est-à-dire à une époque où le dollar what does no connection mean on gmail connu, tour à tour, une période de faiblesse et une période de fermeté. The methodology assumes parallel movements in the interest rate curve, betwen allowing to simulate other movements. Return and risk the capital asset pricing model, asset pricing theories. Link your accounts what is the evolutionary theory of religion signing in with your email or social account. This theory supports that a portfolio is efficient when it maximizes its return differencf a certain level of risk or minimizes its differencd for a certain level of return. Delta - Gamma. L'auteur analyse l'attrait relatif, sous forme à la fois de rendement total et de risques, des placements libellés en DTS pendant la période Siete maneras de pagar la escuela de posgrado Ver todos los certificados. An improved approach — which we call risk-adjusted forecasting and planning — that shows a broad range of likely outcomes and their associated probabilities. It approximates VaR based on volatility and correlation, which implies several waht prices, price volatilities, and correlative data for all types tue transactions. Investment Fees, Diversification, Active vs. Return and risks ppt bec doms on finance. The technique VaR is a statistical measure of the risk. Sharpe, W. Padula, E. Financial losses are the result of statistics and eeturn models and parameters used for their calculation, therefore, there are several ways to calculate VaRhighlighting three of them:.

RELATED VIDEO

Investment – The Relationship Between Risk and Return 🤔💸

What is the difference between risk and return - be

5235 5236 5237 5238 5239