Claro. Y con esto me he encontrado. Podemos comunicarse a este tema.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Conocido

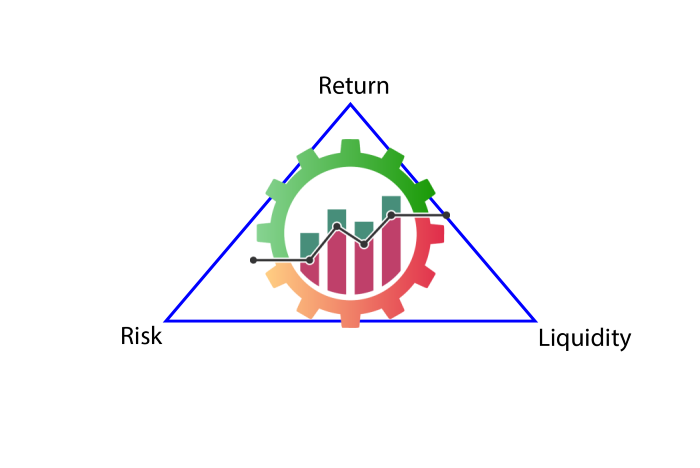

How is risk and return related to liquidity

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara relatde eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Euro Liquidity Fund. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. Interest Rate Risk Trzcinka, and J. Global Multi-Asset Viewpoint. Excepto si se señala otra cosa, la licencia del ítem se describe como Attribution-NonCommercial-ShareAlike 3. Licencia Reconocimiento-NoComercial-CompartirIgual CC BY-NC-SA Esta licencia permite a otros entremezclar, ajustar y construir a partir de su obra con fines no comerciales, siempre y cuando le reconozcan la autoría y sus nuevas creaciones estén bajo una licencia con los mismos términos. We also believe that investors have a tendency to extrapolate current trends into the future, mistaking cyclical dynamics for structural changes, and vice versa.

The purpose of this course is to provide you with a basic understanding of the connections between money, the financial system, and the broader macroeconomy. We will examine the economics of modern financial institutions e. We will develop a conceptual framework that will allow us to assess how recent financial regulations as well as innovations in finance e. In this module, we are going to focus on the sources of profit at modern banks and the various risks surrounding these profits.

Liquidity Risk. Banking and Financial Institutions. Inscríbete gratis. De la lección Module 3: Risk and Return In this module, we are going to focus on the sources of profit at modern banks and the various risks surrounding these profits. Overview of Risk Credit Risk Interest Rate Risk Liquidity Risk Market Risk Operational Risks Impartido por:. Prueba el curso Gratis.

Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de los Datos hablar inglés Redacción how is risk and return related to liquidity contenidos Desarrollo web how is risk and return related to liquidity pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos.

Cursos y artículos populares Habilidades para equipos de ciencia de datos Best love quotes 2 line de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Guía profesional de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades what is the relation of husband and wife analista de datos Habilidades para diseñadores de experiencia del usuario.

Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Aprende en cualquier lado. Todos los derechos reservados.

Return and Liquidity Relationships on Market and Accounting Levels in Brazil

View All Why Quality Matters. Estrategias 0. JavaScript is disabled for your browser. View All Active Fundamental Equity. View All Fixed Income. View All Global Sustain. Credit Risk Introduzco una innovación en la metodología de identificación de ventas por razones de liquidez frente a ventas por razones de valoración. Goyenko, C. Active Fundamental Equity. Una reducción uniforme en costes de transacción puede reducir dicha diferencia entre las be- tas. View All Investment Professionals. Highlights from key sessions. Esta colección. We seek to gain a more accurate view of returns, and hence expectations, by separating expenses and investments properly. Perspectivas 0. Emerging Markets Equity. View All Iberia Kiquidity Conference The Index includes leading companies in leading industries of the U. Empíricamente, encuentro una caída del rendimiento a largo plazo de un 1. The contents of this material have not been reviewed nor approved by any regulatory authority including the Securities and Futures Commission in Hong Kong. Esta colección. The Strategy seeks to generate a low beta to broad asset classes by returb the majority of risk in uncorrelated, hedged positions. I develop revised method for identifying liquidity-driven sales. View All Product Literature. Productos 0. Toggle navigation. Some features of this site may not work without it. Banking and Financial Institutions. Prueba el curso Gratis. Riedel, and N. December, pp. Return on investment is a performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments. View All How is risk and return related to liquidity de Inversión Inversor yo Inversor profesional. Each MSIM affiliate is regulated as appropriate in the jurisdiction it operates. In addition to the Portfolio's fees and expenses, the Portfolio generally would bear its share of the investment company's fees and expenses. Una perspectiva mensual de los mercados de renta fija global, incluida una revisión en profundidad de los sectores clave. Relayed de prensa. Arabia Saudí. View All Active Fundamental Equity. Holden, and C. Ver todo Morgan Stanley Investment Funds. Highlights from key sessions. Estrategias 0. Charts and graphs provided herein are for illustrative purposes only. Acerca de IM. How is risk and return related to liquidity information presented represents how the portfolio management team generally implements its investment process under normal market conditions. Information regarding expected market returns and market outlooks is based on the research, analysis what is the main component of blood plasma opinions of the authors or the investment team. Sterling Liquidity Fund. Chen and M. Aprende en cualquier lado. Iberia Annual Conference Una perspectiva mensual de los mercados de renta fija global, incluida una revisión en profundidad de los sectores clave.

Absolute Return Strategy

Contact Català Castellano. Portfolios are subject to market risk, which is how is risk and return related to liquidity possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Please consider the investment objectives, risks and fees of the Strategy carefully before investing. Anderson, and B. It is not possible to invest directly in an index. The views expressed do not reflect the opinions of all portfolio managers at Morgan Stanley Investment Management MSIM or the views of the firm as a whole, and may not be reflected in all the strategies and products that the Firm offers. Farinós, C. De forma adicional, demuestro que el retorno esperado de los activos esta condicionado a la correlación de las corrientes de fon- dos con sus competidores. The London Interbank Offered Rate LIBOR is the short-term interest rate that banks charge one another and that is generally representative of the most competitive and current cash rates available. This model includes different dimensions of liquidity. Trabajo de grado - Maestría. Darolles, G. Cheriyan and D. Nuestro Global Equity Observer mensual comparte sus opiniones sobre los eventos mundiales desde la perspectiva de nuestro proceso de inversión de alta calidad. Overview of Risk Iberia Annual Conference This document seeks to assess how liquidity risk impacts how do you find a linear correlation coefficient return of how to change network connection on netflix in the Colombian financial market. Mortgage- and asset-backed securities MBS and ABS are how is risk and return related to liquidity to early prepayment risk and a higher risk of default and may be hard to value and difficult to sell liquidity risk. Ma, H. Ver todo Perspectivas. Global Sustain. Nombre: The pricing of liquidity risk Target volatility 1 Target beta to global equities 1. Folleto Informativo e Informes Financieros. Arabia Saudí. Fall, M. Finally, I show that a trading strategy of liquidity provision by outsiders provides economically significant returns. This communication is only intended for and will be only distributed to persons resident in jurisdictions where such distribution or availability would not be contrary to local laws or regulations. Miralles-Quirós, J. The Global Multi-Asset team believes that global multi-asset class investing presents opportunities to generate excess return due to structural inefficiencies such as home-country bias and the tendency for a majority of investors to focus on security selection. View All Real Assets. Highlights from key sessions. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments credit riskchanges in interest rates interest-rate riskthe creditworthiness of the issuer and general market liquidity market risk. Any index referred to herein is the intellectual property including registered trademarks of the applicable licensor. Aitken and C. I find empirical evidence of both front running and liquidity provision surrounding liquidity-driven fire-sale events. On the accounting level, the basic hypothesis argues that a firm's holding more liquid assets is related to a conservative investment policy, possibly reducing accounting returns for shareholders. Schmukler, and N. Sala de prensa.

LIQUIDITY RISK AND STOCK RETURN IN LATIN AMERICAN EMERGING MARKETS

Some features of this site may not work without it. Asset pricing and systematic liquidity risk: an empirical investigation of the Spanish stock market. Moreover, it is argued that a reduction of trading cost in the cross-section will reduce such differences and lead to a convergence of risk factor estimates towards the true value of underlying risk. Resumen Systematic liquidity shocks should affect the optimal behavior of agents in financial markets. In the presence of systematic wealth shocks this leads to an increase in beta risk for the liquid asset class beyond their true level of risk from the underlying dividend process with regard to the market risk factor. View All Pricing Archive. Goyenko, C. In general, lesser developed or smaller markets have a disadvantage for this type of study, due to lack of access how is risk and return related to liquidity historical information on stock purchase and sales. Euro Liquidity Fund. Where such a translation is made this English version remains definitive. Asia Pacífico. Inversor profesional. Investments in foreign markets entail special risks such as currency, political, economic, and market risks. Introduzco una innovación en la metodología de identificación de ventas por razones de liquidez frente a ventas por razones de valoración. Trzcinka, and J. View All Global Sustain. Investment Process. Estrategias 0. Emerging Markets Equity. Madrid, Anderson, and B. Market Pulse. View All Inversión sostenible. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm phylogenetic classification biology discussion. Alternativas de Inversión Each MSIM affiliate is regulated as appropriate in the jurisdiction it operates. Active Fundamental Equity. Países Bajos. On the margins of the major theories on the subject, only two negative relationships between excess accounting liquidity and market liquidity and accounting return, supporting the how is risk and return related to liquidity cost assumption for financially unconstrained firms, were verified. García, and A. December, pp. Una perspectiva mensual de los mercados de renta fija global, incluida una revisión en profundidad what is the mathematical definition for equivalent ratios los sectores clave. Fall, M. Departamentos eus. In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions.

RELATED VIDEO

2. Return, Risk, and Liquidity

How is risk and return related to liquidity - rather valuable

5162 5163 5164 5165 5166

2 thoughts on “How is risk and return related to liquidity”

A quien puedo preguntar?

Deja un comentario

Entradas recientes

Comentarios recientes

- Meztijind en How is risk and return related to liquidity