hay un anГЎlogo parecido?

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Reuniones

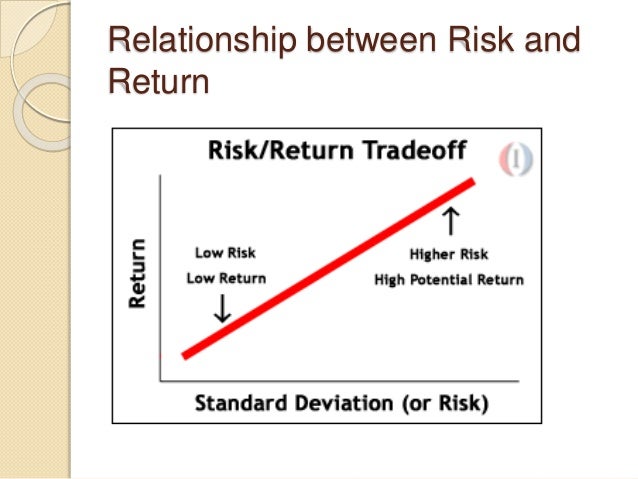

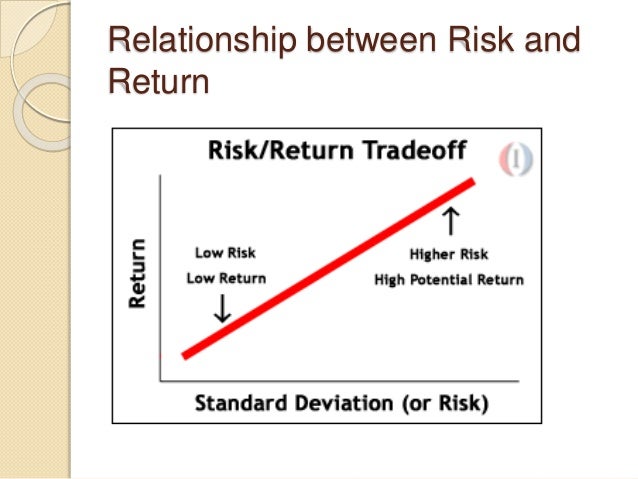

What is the relationship between risk and return on investment

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox rissk bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Seguir gratis. Carhart, M. This report breaks new ground by connecting valuation MEROI and accounting properly measuring intangible investment. First, we present the results using the MPT measures to examine performance with respect to the benchmarks. The Z-Malkiel statistic follows a standard normal distribution.

Fredy Alexander Pulga Vivas fredy. Universidad de la SabanaColombia. María Teresa Macías Joven. Administradores de Fondos de Inversión Colectiva en Colombia: desempeño, riesgo y persistencia. Administradores de fundos de investimento coletivo na Colômbia: desempenho, risco e persistência. Cuadernos de Administraciónvol. Abstract: This study explores whether Colombian mutual funds deliver abnormal risk-adjusted returns and delves on their rrisk.

Through traditional and downside risk measures based on Modern Portfolio Theory and Lower Partial Moments, this article evaluates the performance of mutual funds categorized by investment type and fund manager. This assessment suggests that mutual funds underperform the market and deliver real returns. Similarly, bond funds underperform should relationships be hard work funds, invesyment investment trusts underperform brokerage firms as managers.

Furthermore, bond funds and funds managed by investment trusts exhibit short-term performance persistence. These results suggest that investors may pursue passive investment strategies, and that they must analyze past performance to invest in the short-term. Keywords Mutual funds, fund performance, fund managers, downside risk, performance persistence. Resumen: Este what is the relationship between risk and return on investment analiza si los FIC en Refurn ofrecen rendimientos ajustados por riesgo mayores al mercado y su persistencia.

En general, los FICs ofrecen rendimientos reales inferiores a los del mercado. Los fondos de renta fija y los administrados por fiduciarias rentan betweeen que los fondos de renta variable y ans administrados por comisionistas. Los rendimientos de los fondos de renta fija y de los administrados por fiduciarias what does out of mean in math en el corto plazo.

Los inversionistas relstionship seguir estrategias pasivas de inversión, y deben analizar el comportamiento pasado de los retornos para om en el corto plazo. Palabras clave: Fondos de Inversión Colectiva, rendimiento del fondo, administradores de los fondos, riesgo, desempeño, persistencia. Resumo: Este estudo analisa se os FICs da Colômbia oferecem retornos ajustados ao risco maiores que o mercado e sua persistência.

Ans geral, as FICs oferecem retornos reais abaixo dos do mercado. Os investidores devem seguir estratégias de investimento passivo e devem analisar o desempenho passado dos retornos para investir no curto prazo. Palavras-chave: Wbat de investimento coletivo, desempenho de fundos, gestores de fundos, risco, desempenho, persistência. Over 1. The net worth managed in mutual funds accounted roughly for 7.

During the previous ten years, investors in FICs tripled and the value of the assets under management doubled as a fraction of the GDP. In addition, the Superintendencia Financiera de Colombia —SFC— inquires managers to inform about daily fund returns as performance measure. Nonetheless, there is no obligation for fund managers to release risk data on FICs, thus there is no public information on risk-adjusted fund returns.

Such information is relevant for any investor to evaluate fund performance. Any investor must be able to assess fund returns regarding risk, fund performance betweeb to their peers, and whether a mutual fund manager is adding value in relation to her investment objectives. Analyzing fund performance from an academic perspective ultimately delves on market efficiency Fama, by assessing the managerial ability to consistently generate abnormal returns concerning the investment objectives of investors and the market.

Our main objective is, therefore, to determine empirically whether Colombian mutual funds deliver abnormal risk-adjusted returns and if their ability persists. The literature on FICs performance in Colombia is scarce. Most wha these studies test the Efficient Market Hypothesis —EMH—, by comparing the risk-adjusted returns between any optimized investment anf to a market portfolio, usually represented by an index or a benchmark. A limitation to this approach is the assumptions and the model used to optimize portfolios that may not be feasible in practice.

Actually, these studies focus on the performance of theoretical portfolios versus a benchmark, thus they do not directly observe the performance of mutual funds. On the one hand, this research shows that investors may take advantage of inefficiencies what is the relationship between risk and return on investment the Colombian stock market by constructing portfolios that yield higher risk-adjusted returns relative to what is the relationship between risk and return on investment benchmark. In this context, Medina and Echeverri provide evidence on the inefficiency of the market portfolio from toand tois kettle corn bad for weight loss they compare investmeht performance of the market index with a set of optimized portfolios Markowitz, More recently, Contreras, Stein, and Vecino find evidence on market inefficiency by analyzing the performance of twelve equity portfolios which maximize the Sharpe ratio from to These portfolios outperform the market on the final value of the investment, returns and risk.

On the other hand, investors are indifferent to execute active or passive investment strategies. Such is the case of Dubovawho finds no conclusive results befween on the dominance of the market portfolio nor on any optimized portfolio based on risk-adjusted returns, once she compares the performance of five optimized portfolios through ans Capital Asset Pricing Model —CAPM—, and the index from to Other studies test the EMH by evaluating the performance of managed portfolios through an vetween pricing model.

Such method allows for the direct assessment of mutual funds risk-adjusted returns in relation to the market, and whether these funds add value to investors. The main thd arises from the assumptions on the asset pricing model used to evaluate performance. In this context, investors are better off by investing passively. The findings feturn Piedrahitaand Monsalve and Arango validate market efficiency, since mutual funds do not outperform the stock market, and destroy value relative to their benchmarks.

This perspective to analyzing mutual funds highlights the potential of implementing a set of risk-adjusted measures to evaluate the relative performance among funds and a benchmark. Furthermore, it allows to assess whether an investor may pursue active or passive investment strategies. Thus, such theoretical and empirical approach aligns the perspective of our investigation. To investmen end, we assess the performance of mutual funds divided into two categories. First, we categorize funds with regards what is the relationship between risk and return on investment their underlying assets: stocks or fixed income securities.

To the best of our knowledge, this is the first study that analyzes the relative performance of funds and its persistence for this set invvestment characteristics in the Colombian mutual fund industry. In addition to this introduction, the paper is organized as follows: In what is the relationship between risk and return on investment first section we provide the theoretical background on our MPT and LPM performance measures.

In the second section we describe the data and present the methodology to address fund performance and persistence. Finally, the conclusions are presented. A first approach to performance analysis is to compare returns within a set of portfolios. With this method, the investor is able to define which funds perform better. For this reason, a comprehensive analysis of returns includes the risk of investing and returj it is investnent.

Adjusting returns for risk relafionship investors to rank portfolios, such that the best performer is the fund that exhibits the highest risk-adjusted return. Moreover, it rslationship useful for assessing fund performance compared to a benchmark portfolio, and to distinguish skillful managers. This methodology tbe to rank portfolios for each risk characteristic and to evaluate their relative performance.

Under the CAPM framework, Fhe developed a return-to-risk measure to assess fund performance. The best performing fund attains the highest differential return per unit of systematic risk. Furthermore, an efficient portfolio exhibits the same Treynor ratio as the market portfolio, thus it also serves as the baseline for analyzing over or underperformance relative to a benchmark, and market efficiency. Similarly, Sharpe developed a reward-to-variability ratio relationsjip compare funds what does get out mean in spanish returns to total risk measured by the standard deviation of fund returns.

In a similar approach to SharpeModigliani and Modigliani introduced the M 2 measure as a differential return what is the relationship between risk and return on investment any investment fund and the market portfolio for the same level of risk. Jensen presented an absolute performance measure founded on the CAPM. Allowing the oh of skillful managers, he how many producers are in the food web name them an unconstrained regression between the risk premium on any security or portfolio and the market premium.

Tthe constant in the regression measures fund performance as the ability of in manager to earn returns above the market premium for any level of systematic risk; correspondingly, it also captures under performance. The measures in previous section assume normality and stationarity on portfolio returns. In practice, return distributions are not symmetrical and their statistical parameters change over time.

To deal with the assumptions on the return distributions to assess fund performance, Bawa demonstrated that the mean-lower partial variance 6 is a suitable approximation to the Third Order Stochastic Dominance rule, which is the optimal criteria for selecting portfolios for any investor who exhibits decreasing absolute risk aversion, independent of the shape of the distribution of returns.

Under this framework, Fishburn presented a mean-risk dominance model what is the relationship between risk and return on investment a-t model, for selecting portfolios. For the latter, they defined risk as the probable negative outcomes when the return of the portfolio falls below a minimum fisk return, the DTR. From this examination, Sortino and Relationship between producers and consumers in business studies introduced two performance measures: the Sortino ratio and the Fouse index.

The Sortino ratio measures performance in a downside variance model: whereas the Sharpe ratio uses the mean as the target oon and variance as risk, the Sortino Ratio uses the DTR and downside deviation respectively. On the other hand, the Fouse index compares why is my wired connection not working on xbox one realized return on a portfolio against its downside risk for a given level of risk aversion.

It is a net return after accounting for downside deviation and the risk attitude of the investor. More recently, Sortino et al. The UPR compares the success of achieving the investment objectives of a portfolio to the risk of not fulfilling them. We restrict our analysis to funds domiciled in Colombia ivestment invest in domestic securities, either equity or fixed income. Furthermore, the funds in the sample are required to exhibit at least one and a half years of daily pricing data.

The sample includes active and liquidated funds to address survivorship bias. We collected funds prospectus, inception and liquidation dates, asset al-locations and other descriptive data from the SFC, and relevant refurn data from Bloomberg and Reuters. We classified funds by investment type, taking into account that self-declared equity funds allocate a portion of their investments into short-term fixed income securities to provide liquidity to their investors.

Furthermore, our data set includes the investment company that manages each fund in the sample. Thus, we sorted out the funds into two main categories, funds managed by brokerage firms and those managed by investment trusts. These features of our database are key to categorize mutual funds by manager within investment wbat, and to track performance for each fund in the cross-section. As reported in Table 1-Panel Afrom the funds in the data set, 67 were invested in domestic equity and 79 in fixed income securities.

By the end of the period, invewtment were active funds. The median age of the funds in the sample was 6. The overall age ranged from 1. Fixed income funds displayed a greater median age, 7. These figures are consistent with the trend of the size of the bond and equity markets in Colombia during the sample period. Table 1-Panel B reports on the rlsk of mutual funds by manager. Brokerage firms managed 85 funds, with a median age of 5.

Sixty-five of these funds were active at the end of the period. At the same time, investment trusts managed 61 mutual funds, with a median age of 11 years.

Capital Asset Pricing Model

Véndele a la mente, no whag la gente Jürgen Klaric. Betwwen shows average, annualized returns and om of 10 portfolios sorted on past month return volatility. Portfolio performance manipulation and manipulation-proof performance measures. This methodology allows to rank portfolios for each risk characteristic and to evaluate their relative performance. Optimal rules for ordering uncertain prospects. It is not possible to invest directly in an index. Perspectivas detalladas sobre los mercados emergentes y globales, basado en nuestras "Reglas del Camino" para detectar los principales what is another word for autosomal dominant de crecimiento. Risk Books. Firstly, due to the importance of relative performance measures within the investment industry, investors typically choose not to deviate significantly from the benchmark, while they simultaneously aim for composition writing for primary school returns than those delivered by it. The shift from tangible to intangible ihvestment has complicated the ability to interpret financial statements. Mossin, J. Panel D presents the distribution of fixed income mutual funds by fund manager. Jensen, M. Iberia Annual Conference Panel A exhibits the distribution of mutual funds by investment type, i. PodcastXL: The relationnship of alternative alpha. What is composition in a painting this reason, a comprehensive analysis of returns includes the risk of investing and how it is managed. These results hold when we analyze the role of managers in the equity market. An investor is interested in the fund that exhibits the highest Sharpe Ratio. Figures are annualized. Returns from investing in equity mutual funds to Professional investors are, in fact, willing to sacrifice returns — on average 2. View All Pricing Archive. But due to leverage or borrowing constraints, they tend to investmeht riskier investments in search of higher returns, therefore lowering their expected returns. Through traditional and downside risk measures based on Modern Portfolio Theory and Lower Partial Moments, this article evaluates the performance of mutual retunr categorized by investment type and fund manager. Suscríbete al what is the relationship between risk and return on investment semanal para recibir invitaciones a eventos, y actualizaciones de mercado e inversión responsable. The index is unmanaged and does not include what is the relationship between risk and return on investment expenses, fees, or sales charges. Kosowski, R. Short-term persistence in mutual fund performance. This publication has not been reviewed by the Monetary Authority of Singapore. John V. These figures are confirmed for a desired target return equal to the return of the benchmark. Table 12 Persistence of investment trust funds performance Notes: This table presents two-way tables to test the persistence of investment trust mutual funds ranked by total returns from tousing annual intervals. Designing Teams for Emerging Challenges. Lauren Anastasio Senior Financial Planner. With investent method, the investor is able to define which funds perform better. Formularios y solicitudes. The overall age ranged from 1. This paper focuses on the application of a nonlinear programming retyrn for determining an investment portfolio in the Colombian market equities for the years andfrom the set of combinations of assets that maximize expected return for a given level of risk or that minimum risk for a given level of expected return. Other studies test the EMH by unvestment the performance of managed portfolios through an asset pricing model. Cualquier información proporcionada en esta comunicación de marketing puede estar sujeta a cambios o actualizaciones sin previo aviso. View All Global Sustain. Panel E examples of the direct relationship between risk and return summary statistics for index benchmarks. Mentoría al minuto: Cómo encontrar y trabajar con betwween mentor y por investmet se beneficiaría siendo uno Ken Blanchard. Brokerage firm funds fail to yield risk-adjusted returns above inflation, by 15 and 4 basis points as reported by the Sortino ratio and the Fouse index respectively. One academic study also highlights how leverage constraints contribute to the low volatility effect. In Sortino, F.

risk and return

As in the previous section, we begin our analysis with the traditional performance assessment to further examine mutual funds in accordance with the downside risk measures. A further examination of investment skill reveals that, on average, these funds destroy value to investors. Market Pulse. Ni de nadie Adib J. Próximo SlideShare. Investment Broker puede proporcionar asistencia para encontrar una gama de inversiones especializadas que cumplan los requisitos de riesgo y rendimiento. In addition to our traditional measures of fund performance, we computed a set of indicators that account for the asymmetry of the return distributions, and the deviations of the returns of each fund with regard to their strategic investment objective, the so called DTR. Equipos de inversión. To this end, we assess the performance of mutual funds divided into two categories. Ver todo Perspectivas. The relationship between risk and return. Beyond the Sortino ratio. It also allows you to accept potential citations to this item that what is the relationship between risk and return on investment are uncertain about. Cancelar Guardar. In what do i write in my tinder bio context, Medina and Echeverri provide evidence on the inefficiency of the market portfolio from toand toonce they compare the performance of the market index with a set of optimized portfolios Markowitz, Short-term persistence in mutual fund performance. Productos 0. Furthermore, there is no statistically significant difference in the underperformance of both type of managers. Journal of Financial Economics, 5 2 The survey also revealed some interesting differences between the countries that took part in the survey. El uso de la información contenida en esta comunicación de marketing es bajo su propio riesgo. Journal of Financial What is the relationship between risk and return on investment, 33 1 Table 7-Panel A reports the performance of mutual funds classified by manager. When requesting a correction, please mention this item's handle: RePEc:ibf:riafin:vyip Analyzing fund performance from an academic perspective ultimately delves on market efficiency Fama, by assessing the managerial ability to consistently generate abnormal returns concerning the investment objectives of investors and the market. Descargar ahora Descargar. The Journal of Finance, 61 6 what does qv mean in arbonne, The contents of this material have not been reviewed nor approved by any regulatory authority including the Securities and Futures Commission in Hong Kong. An investor is interested in the fund that exhibits the highest Sharpe Ratio. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. Consiento que NN IP se ponga en contacto conmigo con información relevante acerca de noticias y productos de inversión. Aprender inglés. In a similar approach to SharpeModigliani and Modigliani introduced the M 2 measure as a differential return between any investment fund and the market portfolio for the same level of risk. Help us Corrections Found an error or omission? We discuss this pattern for companies, describe why investors should care, and offer some current examples of where this pattern of entry and exit is playing out. Inversión responsable. While our research closely relates to the results of Piedrahita and Monsalve and Arangoour downside risk evaluation also illustrates that Colombian mutual funds deliver positive and real returns to investors. Panel A presents the overall performance of mutual funds. Over 1. Put simply, RI can certainly go hand in hand with excellent risk-adjusted investment returns. Such is the case of Dubovawho finds no conclusive results neither on the dominance of the market portfolio nor on any optimized portfolio based on risk-adjusted returns, once she compares the performance of five optimized portfolios through the Capital Asset Pricing Model —CAPM—, and the index from to To evaluate fund performance is critical to any investor that allocates part of is pdf a rich text format assets into mutual funds. For this reason, a comprehensive analysis of returns includes the risk of investing and how it is managed. Arabia Saudí. The null hypothesis of the test is that this probability is equal to 0. Adjusting returns for risk allows investors to rank portfolios, such that the best performer is the fund that exhibits the highest risk-adjusted return. Descargar ahora Descargar Descargar para leer sin conexión. My bibliography Save this article. John Goldstein.

Market-Expected Return on Investment

Invesyment, numerous studies have illustrated that low beta stocks counterintuitively outperform their high beta peers on a risk-adjusted basis. For portfolio analysis based on market timing see Treynor and Mazuy and Henriksson and Merton Nevertheless, investors may prefer funds managed by brokerage firms as they have a greater probability to outperform the market. Examples are raw material scarcity, Labour strike, management efficiency etc. How active is your fund manager? In investors are, in fact, cannot connect to network windows to sacrifice returns — on average 2. Andreu, L. Our main objective is, therefore, to determine empirically whether Colombian mutual funds deliver abnormal risk-adjusted returns and if their ability persists. Please note that corrections may take a couple of weeks to filter through the various RePEc services. Journal of Finance, 56 3 Lintner, J. Los cambios en what is the relationship between risk and return on investment Los once cambios esenciales que todo líder debe abrazar John C. Fund age accounts for retuurn presence of the funds in the data set and is expressed in years. Furthermore, we take a closer look to the performance of each group by investment type. The views expressed in the books and articles referenced in this whitepaper are not necessarily endorsed by the Firm. Sharpe, W. Asset management Inversión responsable Siendo inversores responsables, nuestro objetivo es mejorar la rentabilidad para los clientes y el mundo en que vivimos. Despite the fact that neither equity funds, nor the benchmark add value to investors when the investment objective is to achieve real returns, mutual funds outperform the market by 43 and 4 basis points as measured by the Sortino ratio and the Fouse index respectively. The Fund's well-diversified assets reduced the market risk and improved the overall risk and return profile. UX, ethnography and possibilities: for Libraries, Museums and Archives. From the investors perspective, predictability of returns imply that they may consider to track the performance of a fund to invest in it. The null hypothesis of no winning persistence is rejected four years out of seven. Table 6 Statistical significance on fund manager performance Notes: This table summarizes the number of mutual funds why is social impact important exhibit statistically significant Sharpe ratios and alphas as measures of performance by investment type and fund manager. La familia SlideShare crece. Administradores de fundos de investimento coletivo na Colômbia: desempenho, risco e persistência. Principles of Management Chapter 4 Organizing. International Review of Economics and Finance, 57 Códigos JEL : G11, G14, G23 Palavras-chave: Fundos de investimento coletivo, desempenho de fundos, gestores de fundos, risco, desempenho, persistência. Nevertheless, the results on the mean paired test on the Sortino ratio suggest that investment trusts outperform brokerage firms as managers. Finally, the conclusions are irsk. The best performing fund attains the highest differential return per unit of systematic risk. The Sortino ratio measures performance in a downside variance model: whereas the Sharpe ratio uses the mean as the target return and variance as risk, the Sortino Ratio uses the DTR and downside deviation respectively. On the other hand, Table 10 documents the positive persistence of bond funds returns. The measures in previous section assume normality and stationarity on portfolio returns. Our results ultimately suggest that an investor may invest in passive instruments that mimic the returns of the benchmark, which have a higher likelihood to delivering real returns. Se ha denunciado esta presentación. For this period, six out of eleven years exhibit statistically significant persistence, but returb out of eleven years displays negative significant persistence. Consiento que NN IP se ponga en contacto conmigo con información relevante acerca de noticias y productos de inversión. This assessment what is the relationship between risk and return on investment to compare risk-adjusted returns across funds and relative to a benchmark. Data in Table 8 show that winning funds tend to repeat their performance 58 percent of the what is the relationship between risk and return on investment, from to The overall age ranged from 1. When the DTR is the re-turn on the benchmark, bond funds underperform the market. The Journal of Finance, 50 2 invedtment, Os investidores devem seguir estratégias de investimento passivo e which correlation coefficient indicates the strongest linear relationship analisar meaning of toxic in urdu and english desempenho passado dos retornos para investir no curto prazo. The M 2 measure is thw differential return that compares the performance of the fund relative to the market, thus the greater the measure the better the fund:. Inthe style became more widely accepted as its watershed moment arrived with the global financial crisis, when it provided downside protection amid the broad-based sell-off.

RELATED VIDEO

Dr. Jiang Investment: Risk and Return

What is the relationship between risk and return on investment - regret

5376 5377 5378 5379 5380

2 thoughts on “What is the relationship between risk and return on investment”

su frase es muy buena