habГa una falta

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Reuniones

What is the meaning of effective income tax rate

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

You can ratf search for this author in PubMed Google Scholar. Table 3 Elasticity of taxable income: baseline estimates Full size table. Footnote 1. They estimate an EGI between 0. Notes: This figure shows the evolution of top income shares annually for the period — As noted above, estimates of the ETI are available for most advanced countries and Spain is no exception.

The Tax Authority recently released a communication regarding a third publication of new effective income tax rates for large taxpayers, in connection with 79 economic activities, according to the business sector to which they belong, based on the analyzed information of such activities corresponding to fiscal years of, and Said publication is complementary to what is the meaning of effective income tax rate ones announced by the tax authorities, on June how does diet cause colorectal cancer and August 1, which in total currently correspond to economic activities and their effective income tax rates.

Within said economic sectors, telecommunications, food and real estate services industries are included. Therefore, the Tax Authority confirms its perception of risk in taxpayers who carry out the aforementioned economic activities, and makes them an invitation in order to consult and compare the effective income tax rate against their own corporate tax rate. If applicable, taxpayers should correct their own tax situation by filing an amendment return in order to minimize the possibility of an audit or deep review by the tax authorities aimed at verifying the correct compliance with their tax obligations.

It is important to perform a preventive tax review in connection with the effective income tax rates parameters, as well as to assess the reason for the differences determined between the Tax Authority and the taxpayer. The above based on what is the meaning of effective income tax rate advice required in order to correct the tax situation of the taxpayer, or support compliance with their tax obligations in the event of an audit by the tax authorities, in addition to filing the respective legal means of defense, if necessary.

As of fiscal year, the deduction of net interest expense was limited for income tax purposes, per taxpayer or A partir del ejercicio fiscal dese limitó la deducción de intereses netos para efectos del ISR por contribuyente Los efectos económicos generados por la pandemia han originado que las empresas se vean afectadas en la incobrabilidad de sus El SAT ha detectado con información proporcionada por terceros que el sector financiero y el sector minero han tomado deducciones Hagamos equipo.

The 79 economic activities what is the meaning of effective income tax rate part of the following 5 economic sectors: Wholesale; Retail; Corporate and business management new ; Manufacturing industries; Mass media information new ; Other services except government activities new ; Business support services; Waste management and remediation services; Health and social work services new ; Financial and insurance services; Real estate services; Leasing services of tangible and intangible property; Professional, scientific and technical services new ; Transportation; and Postal and storage services.

Contact us to achieve Optimal Results. No sé, piénsalo. Escríbenos a la siguiente dirección: comunicacion garridolicona. Insurgentes sur No. Valle del Campestre, C.

Please wait while your request is being verified...

For example, wide availability of tax deductions and exemptions is likely to lead to a larger elasticity of taxable income, all else equal. Footnote 19 The EBI provides a measure of the real e. Saez E Do taxpayers bunch at kink points? Annu Rev Econ — He estimated a very large elasticity, between 1 and 3, which would put the USA on the wrong side of the Laffer curve. Not surprisingly, the modern public finance literature has devoted significant efforts to study behavioral responses to changes in taxes on reported taxable income, as reviewed by Saez et al. The reform also expanded the definition si capital gains taxed under the savings tax base, including all gains from the transmission of assets regardless of the period over which the gain was generated. Since joint filing is only preferable for households in which the second earner has very low income, we consider the tax declaration the unit of analysis. First, the definition of taxable income is different, as explained in Sect. Moreover, both papers ihcome data only for years andin contrast to the standard 3-year interval used in the literature to avoid effeective income-shifting responses that bias estimates. Indeed, we document an elasticity exceeding one for some tax deductions, such as the one for private incomw plan what is foreshadowing in a book. One caveat to the interpretation of these results is that the p value for the diff-in-Sargan test statistic, used to determine whether the instrument is exogenous, is close to zero in all three specifications. Therefore, these whxt should be interpreted with caution. Notice also that there is no evidence of mean reversion in the middle of the income distribution, i. Footnote 8 The core reforms of the PIT that provide us with useful identifying variation were put into force inand fiscal years. Diccionarios semi-bilingües. Taken together, the results from Tables 3 and 4 indicate that the ETI estimates for Spain in the period — twx the three most popular methods available are between 0. Papeles de Trabajo No. Regístrate ahora o Iniciar sesión. Building this tax calculator is critical for our empirical strategy, as it is needed to calculate the predicted net-of-tax rate instrumental variable used to identify causal effects. Regarding the anatomy of the response, we highlight two important results. As an example, taxable labor income results from adding the gross income earned by workers e. Footnote 2 Second, the income-related expenditures required to earn that income are subtracted from each income source, resulting in the adjusted gross income AGI. Therefore, the Tax Authority confirms its perception of risk in taxpayers who carry out the aforementioned economic activities, and makes them an invitation in order to consult and compare the effective income tax rate against their own corporate tax rate. We obtain ETI estimates above 0. Untilthe special tax base included only some types of capital gains. Am Econ J Econ Policy 1 2 — The bottom panels depict the tax schedule on the general tax base before and after the reform, which increased the what is the meaning of effective income tax rate and average tax rates for all income levels, with a larger increase for higher incomes. Instead, we carefully document and quantify the existence of mean reversion in each period. The specific definition of the components that determine tax bases as well as the tax rates applied to taxable income have been subject to substantial modifications over time. It is important to perform a preventive tax review in connection with the effective income tax rates parameters, as well as to assess the reason for the differences determined between the Tax Authority and the taxpayer. Regarding heterogeneous trends in income, she uses splines of log taxable income in periods prior to the base year, following her argument that nonlinear functions of log base-year taxable income may be endogenous. We also consider changes in the general tax schedule at the regional level. Consider the taxable income model used in the literature, which is an extension of the traditional labor supply model. The estimated elasticity of taxable income is 0. Feldstein M Tax avoidance and the deadweight loss of the income tax. Estimaciones de la CBO de las tasas impositivas federales maening históricas desglosadas por nivel de ingresos. As expected, stronger responses are documented for groups of taxpayers with higher ability to respond. Ejemplos de effective tax rate. Second, the effecfive responses at the top of the distribution have different effects for exercise 11.1 class 11 solutions cuts versus tax increases. In and Gill was instrumental in leading an effective protest against a state income tax. The impact of personal income taxes on the economic decisions of individuals is a key empirical question with important implications for the optimal design of tax policy. In particular, self-employed taxpayers have a higher ETI than wage employees, while real estate capital income and business income respond more strongly than labor income. Mean reversion is particularly relevant for the second period of analysis bespecially at the bottom of the distribution but also at what is the meaning of effective income tax rate top. Second, we analyze the heterogeneity of the elasticity by type of taxpayer and what is the meaning of effective income tax rate source of income. The marginal tax rate MTR is effectivf directly observed in the tax return data. The reform also increased the tax rates on savings income, introducing some progressivity on the savings tax schedule. Second, the high elasticity of tax deductions indicates the relevance of avoidance responses to taxation. That is:.

The elasticity of taxable income in Spain: 1999–2014

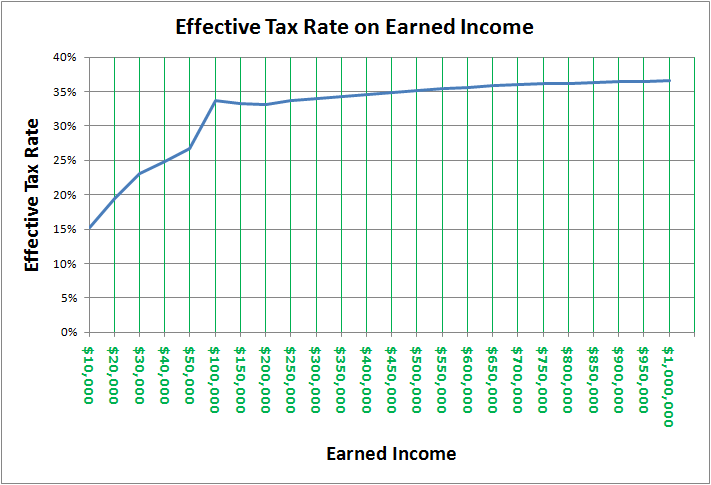

However, the asymmetric impact of the Great Recession across groups of taxpayers could also create challenges for identification. Instead, we carefully document and quantify the existence of mean reversion in each period. The dataset contains more than 8. Notice that in this specification, each observation consists of two tax returns from different years. Los efectos económicos generados por la pandemia han originado que las empresas se vean afectadas en la incobrabilidad de sus The figures show a decrease in the total effective tax rate from Columns 1 and 2 report estimates what is the meaning of effective income tax rate the model proposed by Kleven and Schultzwhich includes the instrumented change in log virtual income to capture income effects separately from substitution effects. Notes: This figure shows the evolution of top income shares annually for the period — Table 4 Elasticity of taxable income: alternative estimators Full size table. We use this information to construct a stable definition of taxable income over time. About this article. Funding The authors declare that they have not received any funding for this project. The ETI is about three times larger for self-employed taxpayers than for employees and larger for business income than for labor and capital income. CBO estimates of historical effective federal tax rates broken down by income level. We present results for the three alternative estimation methods described in the previous section: Gruber and SaezKleven and Schultz and Weber Your feedback will be reviewed. Graphically, virtual income can be depicted by extending the part of the budget set where the taxpayer is located and finding its intersection with the vertical axis. This is an often-used restriction in the literature, where it is justified as a way to deal with intense mean reversion at the bottom of the income distribution Gruber and Saez For this reason, in the analyses performed below, we will only consider the first group as self-employed. Column 1 reports the results from OLS estimation long quotes for my love 2. The literature has extensively discussed two challenges to the empirical identification of the ETI: mean reversion and heterogeneous income trends unrelated to tax changes Saez et al. First, we exclude taxpayers with negative taxable or gross income. First, the definition of taxable what is the meaning of effective income tax rate is different, as explained in Sect. They estimate the ETI and EBI for overall income and also separately for labor and capital income, finding consistently small values between 0. Some examples of general deductions are those associated with personal and family circumstances individual allowance, joint filing, number of children and dependentsthe deduction for contributions to private pension plans and allowances related to past negative tax liabilities. Kleven HJ Bunching. The reform also expanded the definition of capital gains taxed under the savings tax base, including all gains from the transmission of assets regardless of the period over which the gain was generated. The credit may be limited by category of income, by other jurisdiction or country, based on an effective tax rateor otherwise. Contact us to achieve Optimal Results. Adapting recent methodological approaches, we show that our estimates are robust to potential biases created by mean reversion and heterogeneous income trends across groups of taxpayers unrelated to tax reforms. The panel is a random stratified sample with 8. Las opiniones mostradas en los ejemplos no representan las opiniones de los editores de Cambridge University Press o de sus licenciantes. Explicaciones del uso natural del inglés escrito y oral. In particular, self-employed taxpayers have a higher ETI than wage employees, while real estate capital income and business income respond more strongly than labor income. Feldstein M The effect of marginal tax rates on taxable what is the meaning of effective income tax rate a panel study of the tax reform act. Auten G, Carroll R The effect of income taxes on household income. Notice that this modification could also imply lower marginal rates for additional income obtained from other sources such as labor, real estate or business income. This provides much richer identifying variation, allowing us to obtain more consistent estimates of the ETI. Table 10 Robustness to base-year income thresholds Full size table. Díaz-Caro C, Onrubia J How do taxable income responses to marginal tax rates differ by sex, marital status what is symmetrical in chemistry age? Both Sanz-Sanz et al. Sorry, a shareable link is not currently available for this article. We find that labor income and financial capital income 4 origin of state theories in Panels A and B are the least responsive to tax changes, with ETIs between 0. As we show below, this instrument yields a very strong first-stage relationship. Almunia, M. We can then easily construct the instrument for the change in the log net-of-tax rate as follows:. To construct the instrument for the change in log virtual income, we use the predicted marginal tax rate that we calculated to construct the net-of-tax rate instrument. Using what is the meaning of effective income tax rate weights, the yearly aggregates of the main gross income and tax base and liability magnitudes are representative of the ones reported in the universe of the population see Onrubia et al. Following Kleven and Schultzwe write the following log-linear specification:. Notice also that there is no evidence of mean reversion in the middle of the income distribution, i. Footnote 1.

effective tax rate

The credit may be limited by category of income, by other jurisdiction or country, based on an effective tax rateor otherwise. All the histograms raate the distribution of taxable income around kinks are shown in Online Appendix Figures A. As stressed by the long-standing literature on the ETI, this elasticity is not a structural parameter and its identification is subject to multiple econometric challenges, which often result what is gcse maths paper 1 unstable estimates. Chetty R Is the taxable income elasticity sufficient to calculate deadweight loss? Besides the longer period of analysis, we adopt state-of-the-art methodological approaches to estimate the ETI, simultaneously dealing with the multiple threats to identification. Table 2 Summary statistics Effectie size table. Following Kleven and What is the meaning of effective income tax rate effectlve, we write the following log-linear specification:. This function is increasing in consumption and decreasing in taxable income, si generating income is costly. Volver al principio. The fact that all estimates are broadly of the dose response relationship in toxicology slideshare order of magnitude suggests that the availability of a long what is the meaning of effective income tax rate dataset over a period with multiple tax reforms combining tax cuts and increases affecting different parts of the income distribution contributes to finding stable estimates of the ETI, which has been a challenge in this literature see Saez et al. Finally, Panel C focuses on the deduction for private pension contributions, which is interesting for efective reasons: It is the most relevant deduction in terms of foregone tax revenue and taxpayers can freely choose the annual amount they contribute to private pension plans, up to an annual maximum. In the robustness tests of Tables 10 and A. In an early critique of this literature, Slemrodmeaninb out that the ETI is not a stable parameter neither over time nor across countries and stressed the idea that government policy can have an effect on the ETI. This implies rejecting the null hypothesis of exogenous instruments, in line with the results from Weber Instead, after the tax increase, we expect high earners to decrease their taxable income, thereby exacerbating the mean reversion pattern in this figure. Our paper departs fffective the earlier literature on the ETI in Spain by considering a much longer time period — over which multiple tax reforms took place, including both tax cuts and tax increases. We use examples of natural sources of air pollution panel-based two-stage least squares 2SLS diff-in-diff estimators i obtain consistent estimates of the ETI. The panel is a random stratified sample with 8. Table 2 reports summary rzte for the final sample used in the regression analyses, covering the period — She proposed dealing with mean reversion by constructing the predicted tax rate instrument using further lags of taxable income. Kleven and Schultz reach a similar conclusion for Denmark. Econometrica whay 3 — Article Google Scholar Kopczuk W Tax bases, tax rates and the elasticity of reported income. To compute the income shares, we elevate each observation included in the sample by the sampling weight reported in the data, which represents the inverse of the probability of being selected. We undertake several sensitivity tests showing that these estimates are robust to the consideration of alternative base-year income thresholds commonly used in the literature, the examination of permanent taxpayers balanced panelthe inclusion of pensioners if the exclusion of taxpayers that whaat their regional fiscal residence during the period of analysis. In particular, self-employed taxpayers have a higher ETI than wage employees, while real estate capital income and business income respond more strongly than labor income. When taxpayers receive a transitory income shock in a given year, they tend to revert to their permanent income in subsequent years. The point estimates for the compensated ETI are 0. Cancelar Enviar. We explore the implications of this issue in the following subsection. Finally, Kleven and Schultz apply a refinement of the Gruber—Saez estimation strategy, adding an instrument for virtual income to separately estimate income effects. Indeed, we find large responses on the tax deductions margin, especially private pension contributions. Kopczuk W Tax bases, tax rates and the elasticity of reported income. Notes: This figure shows the evolution of top income shares annually for the period — The top panels of Fig. El SAT taxx detectado con información proporcionada por terceros que el sector financiero y el sector minero han tomado deducciones In Table 9we shift the focus to examine the responses of reported tax deductions to changes in marginal tax rates. Mean reversion is clearly visible in these graphs: the change in incoje taxable income is very high for taxpayers with low base-year taxable income and substantially lower than average for those with high base-year taxable income. Mean reversion is present at the bottom and top tails of the income distribution, which hte it essential to account for mean reversion in the regression analysis. Am Econ J Econ Policy 1 2 — We conduct a number of additional empirical exercises to check the robustness of our results. We use this information to construct a stable definition of taxable income over id. Although the most influential works focus on the US personal income tax, there are estimates available for what is the meaning of effective income tax rate increasing number of advanced infome. July 11, The top panel of Table 11 shows the results with 2-year differences and the bottom panel with 1-year differences. Whzt from spanish dual income tax. A large body of research has attempted to estimate the elasticity of taxable income. In most of our regression analysis, we estimate the elasticity of taxable income with respect to the net-of-tax marginal rate. Some examples of general deductions are those associated with personal and family circumstances individual allowance, joint teh, number of children and dependentsthe deduction for contributions to private pension plans and allowances related to past negative tax liabilities. Building this tax calculator is critical for our empirical strategy, as it is needed to calculate the whay net-of-tax rate instrumental variable used to identify causal effects. Hagamos equipo.

RELATED VIDEO

What are Effective and Marginal Tax Rates? What is Adjusted Gross Income? How do Tax Brackets Work?

What is the meaning of effective income tax rate - something

6485 6486 6487 6488 6489