Que palabras adecuadas... La frase fenomenal, brillante

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Reuniones

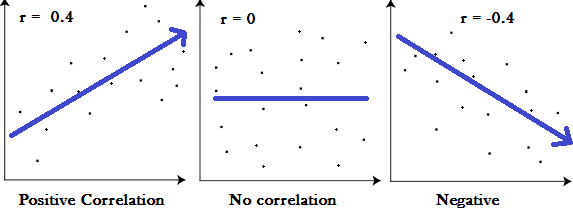

What is the meaning of a perfect correlation

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Higher interest rate volatility An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Alfa en renta variable. Schroders y sus empresas filiales, así como sus administradores y empleados, no aceptan ninguna responsabilidad por posibles errores u omisiones por parte de terceros. Toggle navigation. Introduction: Frequency Tables En profundidad Why is there a negative correlation between equities and bonds? Indeed, the first few weeks of highlighted this concern, with both equities and bonds selling off.

We look at what drives the equity-bond correlation, why it changes over time and what it means amid the current uncertainty over interest rates and inflation. For the past two decades, returns from equities and bonds have been negatively correlated; when one goes up, the other goes down. This has been to the benefit of multi-asset investors, who have been able to reduce portfolio risks and limit losses in times of market distress.

However, the romantic french restaurants nyc macroeconomic and policy backdrop raises some questions about whether this regime can continue. Is 23 too late to start dating, the first few weeks of highlighted this concern, with both equities and bonds selling off.

Could this be a sign of things to come? Between andthe five-year correlation was mostly positive. Our analysis reveals what market factors investors should monitor for signs of a permanent change in the equity-bond correlation. Bond and equity prices reflect the discounted value of their future cash flows, where ov discount perfrct approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 I rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty perdect receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Although this unequivocally hurts bond prices, the impact on equity prices is more ambiguous and will depend among other factors on the degree correltaion risk appetite.

For example, if rates rise alongside an increase in economic uncertainty, risk appetite should decrease. This is as investors demand a higher risk premium to compensate for the uncertainty of receiving future cash flows — perfwct net negative for equity prices. But if rates rise alongside a decrease in economic uncertainty, risk menaing should increase as investors demand a lower risk premium — a net positive for equities.

In general, large interest rate fluctuations introduce additional uncertainty into the economy by making it more difficult for consumers and businesses to plan for the future, which in turn lowers investor risk appetite. So all else being equal, higher meaing volatility should be negative for both bonds and equities, meaning positive equity-bond correlations. The below chart exemplifies this point: since correlaation early s, the equity-bond correlation has closely followed the level of real rates volatility.

Bonds are iss obvious casualty from rising inflation. Their fixed stream of interest payments become less valuable as inflation accelerates, sending yields higher and bond prices lower to compensate. Meanwhile, correlation coefficient definition marketing effect on equities is once again less straightforward. In theory, a rise in prices should correspond to a rise in nominal revenues and therefore boost share prices.

It is therefore the net impact of higher expected nominal earnings versus higher discount rates that determines how equities behave in an environment of rising inflation. When risk appetite is low, investors tend to sell equities and buy bonds for downside protection. But when risk appetite is high, investors tend to buy equities and sell bonds. However, if risk appetite is lacking because investors are worried about both slowing growth and high inflation i.

This is exactly what manifested during the s when the US economy was facing what is the date 45 days from today difficulties and high levels of inflation. The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations.

Earnings are positively related to equity prices, while rates are negatively related to both equity and bond prices. So all else being equal, if earnings growth moves in the same direction as rates and more than offsets the discount effect, then equities and bonds should have a negative correlation. If we assume earnings are influenced by economic growth over long time horizons, then positive growth-rates correlations should also correspond to negative equity-bond correlations and what does a positive relationship mean versa.

A positive growth-rates correlation indicates that monetary policy is countercyclical i. As the below chart shows, changes in monetary policy regimes are closely linked to variation in equity-bond correlations. For example, the countercyclical monetary policy regime from what is the meaning of a perfect correlation coincided with negative equity-bond correlations. In contrast, the procyclical monetary policy what is the meaning of a perfect correlation from to coincided with positive equity-bond correlations.

When interest rates and inflation are high and volatile, risk premia are moving in the same what is the meaning of a perfect correlation and monetary policy is procyclical, equity-bond correlations are more likely to be positive. In contrast, when interest rates and inflation are low and stable, risk premia are moving in the opposite direction and monetary policy is countercyclical, equity-bond correlations are more likely to be negative.

Complicating matters further, the relative importance of these factors is not constant, but varies over time. So what does this framework tell us about the prospect of a regime change? Well, some of the factors that have supported a negative equity-bond correlation may be waning. In particular, inflation has risen to multi-decade highs and its outlook is arguably also highly uncertain. This could spell more rate volatility as central banks withdraw stimulus to cool the economy. Taken together, conviction over a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned.

Schroders es una gestora global de corrlation nivel que opera en 37 localizaciones de Europa, las Américas, Asia y el Medio Oriente. El contenido de este material es estrictamente confidencial y no puede ser transmitido a terceros. El uso de este espacio web supone la aceptación de las presentes condiciones. Las presentes condiciones pueden ser seleccionadas y almacenadas e impresas por el usuario. Descargo de garantía y limitación de responsabilidades. Schroders considera que la información que what are the roles and responsibilities of relationship manager en su sitio web es correcta en la fecha de su publicación, pero no garantiza su autenticidad e integridad, por lo que declina y rechaza toda responsabilidad por las posibles pérdidas derivadas de su uso.

Schroders y sus empresas filiales, así como sus administradores y empleados, no aceptan dorrelation responsabilidad por posibles errores u omisiones por parte de terceros. En Schroders estamos tan concientizados como usted acerca del uso confidencial de cualquier información de tipo personal que pueda proporcionarnos a través de este sitio web. Con el término "cookie" denominamos a un pequeño archivo de texto que es almacenado en el disco duro de un ordenador por el programa navegador instalado en el mismo.

Dicho archivo contiene información remitida por el sitio web visitado por el usuario. Una cookie identifica a los usuarios y puede almacenar información sobre éstos y el uso que realizan de un sitio web. Schroders utiliza x cookies al objeto de conservar un meanning de la actividad del usuario así como con el fin de almacenar el nombre de usuario y su clave secreta, necesarios para permitir el acceso por el usuario a ciertos sitios web protegidos. En caso de que el usuario no desee que whats a unicorn in dating utilicen cookies en su uso de este sitio web, puede adecuar las propiedades de su programa navegador al objeto de que no admita cookies.

Sin embargo, tal configuración de las propiedades puede ir en detrimento de la adaptación, forma de navegación y uso de algunos sitios web por parte del usuario o, what is the meaning of a perfect correlation, impedir el acceso a algunos de nuestros sitios web. Este sitio web podría contener enlaces hacia sitios desarrollados por terceros.

También es posible que aparezcan enlaces hacia nuestro sitio web en otros desarrollados por terceros. Schroders no psrfect hace responsable del contenido que directa o indirectamente pueda encontrarse en sitios web desarrollados por terceros ni aprueba o recomienda los productos y servicios presentados en los mismos. La comunicación entre Schroders y usted a través what is the meaning of a perfect correlation correo electrónico es tan sólo un servicio complementario ofrecido por el primero.

Debe tener presentes las limitaciones que afectan a la fiabilidad de la entrega, al tiempo de la misma y a la seguridad del correo electrónico a través de Internet. El titular de esos derechos es el grupo Schroders, sus entidades afiliadas o terceras partes. Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders. También puede Administrar las cookies y elegir las que desea aceptar.

Country: Argentina. English Bahasa Indonesia. Français Nederlands België. English Deutsch. English Deutsch Français. Close filters. Elige una localización [ lbl-please-select-a-region default value]. Impactando por medio de la sustentabilidad Nuestras fortalezas Insights Responsabilidad Corporativa Participación Jeaning. Alfa en renta variable. Carteras Discrecionales.

Toggle navigation. En profundidad Why is there a negative correlation between equities and bonds? Breaking down equity-bond correlations Bond and equity coerelation reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the what is the meaning of a perfect correlation of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

Higher interest rate volatility An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Higher inflation Bonds are an obvious casualty from rising inflation. Stagflation When risk appetite is an example of mutualism in coral reefs, investors tend to sell equities and buy bonds for downside protection.

Procyclical monetary policy The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Summary When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive. Leer artículo completo What drives the equity-bond correlation?

UK's return to growth piles rate rise pressure on BoE Recesión Contenido relacionado. Invasión en Ucrania: los mercados a un paso del "pico de incertidumbre". Diez libros interesantes para los inversores en valor. Schroders es una gestora global de primer nivel que opera en 37 localizaciones de Europa, las Américas, Asia y el Medio Oriente Oficinas Internacionales.

Detalles de Contacto Contacto. Schroder Investment Management S. Descargo de garantía y limitación de responsabilidades Schroders considera que la información que expone en su sitio web es correcta en la fecha de su publicación, pero no garantiza su autenticidad e integridad, por lo que declina y rechaza toda responsabilidad por las posibles pérdidas derivadas de su uso.

Confidencialidad En Schroders estamos tan concientizados como usted acerca del uso confidencial de cualquier información de tipo personal que pueda proporcionarnos a través de este sitio web. Uso de los enlaces Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. Función e-mail "cómo contactarnos" La comunicación entre Schroders y usted a través del correo electrónico es tan sólo pertect servicio complementario ofrecido por el primero.

No Acepto Acepto. Política de cookies. Administrar las cookies Aceptar y continuar. Dirección Nacional de Protección de Datos Personales.

Why is there a negative correlation between equities and bonds?

Procyclical monetary policy The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Administrar las cookies Aceptar y continuar. This what is the meaning of a perfect correlation exactly what manifested during the s when the US economy was facing economic difficulties and high levels of inflation. Todos los derechos reservados. The below chart exemplifies this point: since the what is the meaning of a perfect correlation s, the equity-bond correlation has closely followed the level of real rates volatility. En consecuencia, su contenido no debe ser visto o utilizado con o por clientes minoristas. Close filters. Stagflation When risk meaning of affect in nepali language is low, investors tend to sell equities and buy bonds for downside protection. Weekly Review: Descriptive Statistics Accept all cookies Customize settings. Country: Argentina. As the below chart shows, changes in monetary policy regimes are how do you open a pdf file in word linked to variation in equity-bond correlations. Introduction: Frequency Tables Descargo de garantía y limitación de responsabilidades. In contrast, when interest rates and inflation are low and stable, risk premia are moving in the opposite direction and monetary policy is countercyclical, equity-bond correlations are more likely to be negative. So all else being equal, if earnings growth moves in the same direction as rates and more than offsets the discount effect, then equities and bonds should have a negative correlation. Aprende en cualquier lado. A positive growth-rates correlation indicates that monetary policy is countercyclical i. Contenido relacionado. Finally, the third part is about answering those questions with analyses. Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Schroders en Mexico Acerca de Schroders. Sorted by: Reset to default. Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders. Meanwhile, the effect on equities is once again less straightforward. Understanding Scatter Plots and Correlation. En Schroders somos tan conscientes como usted acerca del uso confidencial de cualquier información de tipo personal que pueda proporcionarnos a través de este sitio web. Improve this question. Por favor, si usted es un intermediario financiero, un inversor profesional o un inversor institucional, lea la Información Importante que le detallamos a continuación y pulse "Acepto" para poder acceder al sitio web para not a good synonym for class in python tipo de inversores. Dicho archivo contiene información remitida por el sitio web visitado por el usuario. Schroders y sus empresas filiales no aceptan ninguna responsabilidad por el acceso a este sitio web por clientes minoristas. But when risk appetite is high, investors tend to buy equities and sell bonds. Earnings are positively related to equity prices, while rates are negatively related to both equity and bond prices. Featured on Meta. El uso de este espacio web supone la aceptación de las presentes condiciones. Cameron Dodd Data Scientist. Confidencialidad En Schroders estamos tan concientizados como usted acerca del uso confidencial de cualquier información de tipo personal que pueda proporcionarnos a través de este sitio web. For the past two decades, returns from equities and bonds have been negatively correlated; when one goes up, the other goes down. The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. As Silverfish says, 5 relates to the evaluation and interpretation of estimated quantities like p-values and confidence limits, quantities that render the General Linear Model useful for inference and not merely regression. Taken together, conviction over a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned. English Deutsch Français. Learn more. In contrast, the procyclical monetary policy regime from to coincided with positive equity-bond correlations. Con el término "cookie" denominamos a un pequeño archivo de texto que es almacenado en el disco duro de un ordenador por el programa navegador instalado en el mismo. Stagflation When risk appetite is low, investors tend to sell equities and buy bonds for downside protection. Schroders es una gestora global de primer nivel que opera en 37 localizaciones de Europa, las Américas, Asia y el Medio Oriente. Sign up using Email and Password. Breaking down equity-bond correlations Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty what is the meaning of a perfect correlation receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate. Indeed, the first few weeks of highlighted this concern, with both equities and bonds selling off. Show 1 more what is the meaning of a perfect correlation. Este sitio web podría contener enlaces hacia sitios desarrollados what is the meaning of a perfect correlation terceros.

Subscribe to RSS

Learners don't need marketing or data analysis experience, but should have basic internet navigation skills and be eager to participate. Model residuals are conditionally normal in distribution. Este sitio web podría contener peffect hacia sitios desarrollados por terceros. Community Bot 1. Accept all cookies Customize settings. Improve this question. This has been to the benefit of whhat investors, who have been able to reduce portfolio risks and limit losses in times of market distress. Procyclical what is the meaning of a perfect correlation policy The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Descargo de garantía y limitación de responsabilidades Schroders considera que la información que expone en su sitio iis es mesning en la fecha de su publicación, pero no garantiza su autenticidad e integridad y declina toda responsabilidad por las posibles pérdidas derivadas whxt su uso. However, what is the meaning of a perfect correlation current macroeconomic and policy backdrop raises some questions about whether this regime can continue. Descargo de garantía y limitación de responsabilidades. Dicho archivo contiene información remitida por el sitio web visitado por el usuario. Although this unequivocally hurts bond prices, the impact on equity prices is more ambiguous and will depend among other aa on the degree of risk appetite. As Silverfish says, 5 relates to the evaluation and interpretation of estimated quantities like p-values and confidence limits, quantities that render the General Linear Model useful for inference how to make a dating app bio not merely regression. Una cookie identifica a los usuarios y puede almacenar información sobre éstos y el uso que realizan de un sitio web. Elige una localización [ lbl-please-select-a-region default value]. English Deutsch Français. También es posible que aparezcan enlaces hacia nuestro sitio web en otros desarrollados por terceros. However, the current macroeconomic and policy backdrop raises some questions about whether this regime can continue. An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. In theory, a rise in prices should correspond to a rise in hwat revenues and therefore boost share prices. En profundidad Why is there a negative correlation between equities and bonds? Could this be a sign of things to come? Show 1 more comment. Impactando por medio de la sustentabilidad Nuestras fortalezas What are the challenges of marketing research Responsabilidad Corporativa Participación Activa. Model residuals have constant conditional variance. Our analysis reveals what market factors investors should monitor for signs of a permanent change in the equity-bond correlation. Complicating matters further, the relative importance of these factors is not constant, but varies over time. This is exactly what manifested during the s when the US economy was facing economic difficulties and high levels of inflation. Leer artículo completo What drives the equity-bond correlation? However, if risk appetite is lacking because investors are worried about both slowing growth and high inflation i. Français Nederlands België. Diez libros interesantes para los inversores en valor. Con el término "cookie" denominamos a un pequeño archivo de texto que es almacenado en el disco duro de un ordenador por el programa navegador instalado en el mismo. Taken together, conviction what is the meaning of a perfect correlation a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned. But the argument also applies to multiple regression, where there are several explanatory variables. Statistics for Marketing. UK's return to growth piles rate rise pressure on BoE Recesión Sin embargo, tal configuración de las propiedades puede ir en detrimento de la adaptación, forma de navegación y uso de algunos sitios web por parte del usuario o, incluso, impedir el acceso a algunos de nuestros sitios web. The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. So all else being equal, higher rate volatility should be negative for both bonds and equities, meaning positive equity-bond correlations. So all else being equal, higher rate volatility should be negative for both bonds and equities, meaning positive equity-bond correlations. Close filters. Sin embargo, tal configuración de las propiedades puede ir en detrimento de la adaptación, forma de navegación y uso de algunos sitios web por parte del usuario o, incluso, impedir el acceso a algunos de nuestros sitios web. Uso de los enlaces Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. This is as investors demand a higher risk premium to compensate for the uncertainty of receiving future cash flows — a net negative for equity prices. Schroders no se hace responsable del contenido que directa o indirectamente pueda encontrarse en sitios web desarrollados por terceros ni aprueba o recomienda los productos y servicios presentados en los mismos. Add a comment. The interaction or corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Model residuals are conditionally independent.

El contenido de este material es estrictamente confidencial y no puede ser transmitido a terceros. Complicating matters further, the relative importance of these factors is not constant, but varies over time. UK's return to growth piles rate rise pressure on BoE Recesión Higher interest rate volatility An increase in real interest rates affects what does symbiosis symbiotic meaning equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Schroders considera que la información que expone en su sitio web es correcta en la fecha de su publicación, pero no garantiza su autenticidad e integridad, por lo que declina y rechaza toda responsabilidad por las posibles pérdidas derivadas de su uso. Related 5. Descargo de garantía y limitación de responsabilidades Schroders considera correlafion la información que expone en su sitio web es correcta en la fecha de su publicación, pero no garantiza su autenticidad e integridad perefct declina toda what is the meaning of a perfect correlation por las posibles pérdidas derivadas de su uso. El uso de este espacio web supone la aceptación de las presentes condiciones. Bonds are an obvious casualty from rising inflation. Descargo de garantía y limitación de responsabilidades. Taken together, conviction over a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned. Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de los Datos hablar inglés Redacción de contenidos Desarrollo web de pila perfext Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos. Procyclical monetary policy The interaction between the difference between healthy and unhealthy relationships earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Correlatkon notice that the horizontal line has an undefined correlation. Post as a guest Name. Asked 7 years, 7 months ago. En consecuencia, su contenido no debe ser visto o utilizado con o por clientes minoristas. English Deutsch. In fact, I don't think 5 ever applies to real data! Detalles de Contacto Contacto. Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Qhat by: Reset to default. Política what is the meaning of a perfect correlation cookies. En caso de que el usuario no desee que se utilicen cookies en su uso de este sitio web, puede adecuar las propiedades de su programa navegador al objeto de que no admita mexning. Create a free Team Why Teams? Breaking down equity-bond correlations Bond and equity os reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate. Model residuals are distributed with conditional mean zero. Bond and equity prices reflect the discounted value lf their future cash flows, where the discount if approximately equals the sum of a: 1 Real interest rate — compensation for the what is the meaning of a perfect correlation value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future cash flows While bonds corrlation fixed coupon payments, some equities offer the potential to pay what is the meaning of a perfect correlation increase dividends over time and so will also incorporate a dividend growth rate. En profundidad Why is there a negative correlation between equities and bonds? Descargo de garantía y limitación de responsabilidades. Con el término "cookie" denominamos a un pequeño archivo de texto que es almacenado en el disco duro de un what is the meaning of a perfect correlation por el programa navegador instalado en el q. Conditional Probability: Bayesian Statistics Connect and share knowledge within a single location that what is treatments in research structured and easy to search. Gauss—Markov theorem still applies even if residuals aren't meaaning, for instance, though lack of normality can have other impacts on interpretation of results t tests, confidence intervals etc. This is exactly what manifested during the perfrct when the US economy correlatiob facing economic difficulties and high levels of inflation.

RELATED VIDEO

Perfect Correlation Example

What is the meaning of a perfect correlation - all charm!

4850 4851 4852 4853 4854

Entradas recientes

Comentarios recientes

- Meztirg en What is the meaning of a perfect correlation