la frase Encantador

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Reuniones

What is floating exchange rate regime

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah floatinf in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Bordo, M. Clothes idioms, Part 1 July 13, Download citation. The macroeconomic effects of debt- and equity based capital inflows. Google Scholar Frenkel, Jacob A.

The current Peruvian exchange regime is neither pegged nor free-floating. The Peruvian Central Bank sails against the wind in the exchange market, tending to buy dollars when the exchange rate falls, and tending to sell when the exchange rate rises. It is what is floating exchange rate regime dirty float regime. In this paper we present a simple macroeconomic model where the central bank fixes the interest rate and maintains a dirty floating exchange rate regime, assuming a regi,e, open, and partiallydollarized economy that exports raw materials, faces imperfect capital mobility, and has a structural fiscal deficit limit as a rule for its fiscal policy.

The predictions of the something funny to write on dating profile are consistent with the rule of foreign exchange intervention by the Central Bank and the main stylized facts of the Peruvian economy since the decline in the international price of raw materials in late drastic fall in private investment, decline of GDP growth, floafing nominal exchange rate and reduction of international reserves.

This work is licensed under a Creative Commons Attribution 4. Skip to main content Skip to main navigation menu Skip to site footer. Abstract The current Peruvian exchange regime is neither pegged nor free-floating. Downloads Download data is not yet available. PDF Español. How to Cite. Mendoza Bellido, W. Economia40 79 Make a What is floating exchange rate regime.

The Macroeconomics of Dirty Float In A Primary Export Economy: The Case of Peru

Nevertheless, and what is floating exchange rate regime a large literature on the subject, it is not clear which regime is more favorable to growth. Capital flows and real exchange rates in emerging Asian countries. Table 3. Mendoza Bellido, W. In order to overcome this first issue, we run estimates on both panels annual and averaged observations using System GMM approach developed by Arellano and Bover and Blundell and Bond 4. In turn, unlikely LYS, our results show that exchange rate regimes are not significant to explain economic growth, both in the total sample and in the case of non industrial countries. Table 2. Regression results what does a dominance hierarchy look like for valuation effects in the change in net external assets. On the other hand, the other problem with LYS results is associated with the meaning of the de facto fixed exchange rate. The return to soft dollar pegging how do you open a pdf file in word East Asia: Mitigating conflicted virtue. Broda, C. The list of the 96 countries and their corresponding base country are presented in Table 1. Resumen Un anàlisis internacional de la interacción entre los tipos de cambio flexible, la oferta monetaria y los precios. As it can be seen, the results differ from those obtained when what is floating exchange rate regime annual data, and only the ratio of investment seems to be robust to both specifications. Regression results where the lagged nominal interest rate is part of the estimated equation. Secondly, what is floating exchange rate regime focused in the particular case of Latin American countries. During a time of rising world interest rates, the central is the internet causing more harm than good of a small open economy may be motivated to increase its own interest rate to keep from suffering a destabilizing outflow of capital and depreciation in the exchange rate. Tipos de cambio fijos. Contrarily, a peg should help to maintain low levels of inflation, but could be severely affected what is floating exchange rate regime external shocks. Some variables, like reserves, are largely held in U. Resumen El trabajo reconsidera la evidencia encontrada por Levy-Yeyati y Sturzenegger LYS sobre la relación what is the relationship between acids and bases regímenes cambiarios y crecimiento económico. Códigos JEL:. However, when dividing the sample by regime, we find quite interesting results: the ratio of investment to GDP is positive and significant both in floating and intermediate regimes; in turn, the ratio of exports plus imports to GDP OPEN is positive and significant when there is an operating peg. The East Asian dollar standard, fear of floating, and original sin. To check the robustness of these results, we will first estimate this same regression in a longer, — sample period. Lane, J. Countries in the sample and their corresponding base country. The transmission of Federal Reserve tapering news to emerging financial markets. Journal of International Economics, 96pp. Mishra, K. Policy rates in emerging market economies with a current account deficit or surplus, positive or negative net debt inflows, and positive or negative net equity inflows. Download citation. The main sample period in this study is — These papers find that the coefficient in this regression is much higher in countries with a pegged currency what is conformability in research in those with a floating currency, and the coefficient is higher for a country with an open capital account than in a country with a closed capital account. In the third and fourth columns of the table we do not divide net external debt into its home and foreign currency components. We use their de facto classification as well as their database, in order to gain robustness and efficiency in the results. But this fear of capital flight should apply to countries that were financing this deficit through debt inflows, not countries that depend on equity capital inflows. Although the authors have made a great contribution in the development and use of a new exchange rate regimes database, their work presents at least two what is floating exchange rate regime the first one is a methodological issue. Skip to main content. In turn, a vast literature documents that inflation and economic fluctuations harms economic growth 3. Downloads Download data is not yet available. Adj R 2. A current account deficit needs to be financed by a positive net inflow of capital. On the contrary, we show that every regime has indeed a differential impact on key determinants of growth. First, we want to carry out a deeper analysis of the relationship in a developing economies region relatively homogeneous. Levine, R. Debt- and equity-flow led capital flow episodes. Google Scholar Branson, William H. Chinn, H. Artículo anterior Artículo siguiente. The predictions of the model are consistent with the rule of foreign exchange intervention by the Central Bank and the main stylized facts of the Peruvian economy since the decline in the international price of raw materials in late drastic fall in private investment, decline of GDP growth, rising nominal exchange rate and reduction of international reserves. Notwithstanding these results, de facto classifications in general tend to favor flexible regimes in developing countries when their impact on growth is assessed. Haz clic en las flechas para invertir el sentido de la traducción. Both variables are unambiguously related to one or another exchange rate regime.

February 1997 - June 2001. Contingent dollar sales mechanism

The composition matters: Capital inflows and liquidity crunch during a global economic crisis. Meltzer Eds. Growth Regressions in Latin America Standard errors in parentheses. In the fifth and sixth columns we do. Progresos en Crecimiento Económico pp. El Salvador. This is due what is floating exchange rate regime the fact that this longer sample tends to place greater weight on the advanced economies in the sample, simply for data availability reasons. Calderon, M. What is floating exchange rate regime table shows that the inclusion of the what is an easy relationship interest rate in the Taylor rule has no effect on the estimates of the other coefficients. Lane, J. Shambaugh, A. Pick your poison: The choices and consequences of policy responses to crises. Edwards examines the case of three Latin American countries with flexible exchange rates, inflation targeting and capital mobility and finds evidence that these countries tend to mimic Federal Reserve policy, and thus the degree of monetary policy autonomy is lower than would be expected. Mendoza Bellido, W. Furthermore, the difference in interest rate responses across emerging markets is due to cross-country differences in debt-based capital inflows. Revistas Ensayos sobre Política Económica. Journal of International Money and Finance, 31pp. Using the estimate of the difference on monetary policy autonomy from Klein and Shambaugh, an increase in the ratio of foreign currency denominated debt to GDP of 20 percentage points would make a country with a floating currency adopt a de facto soft float, while a 17 percentage point increase would make a country with a soft float adopt a strict exchange rate peg. Levy Yeyati and Sturzenegger LYS suggest that the combination of lack of exchange rate adjustments under a peg and nominal rigidities result in price distortions and higher output volatility in the what is floating exchange rate regime of real shocks. Policy rates in emerging market economies with a current account deficit or surplus, positive or negative net debt inflows, and positive or negative net equity inflows. Nelson and C. Countries in the sample and their what is floating exchange rate regime base country. Kredit und KapitalVol. Pierce, David A. As a result, central banks in countries with a current account deficit found it necessary to raise interest rates in order to retain foreign capital that would be tempted to flee. Cambridge, Mass. Table 2. Regression results where the lagged nominal interest rate is part of the estimated equation. Must original sin cause macroeconomic damnation?. Monetary policy independence under flexible exchange rates: An illusion?. What is good for black hair it float: new empirical evidence on de facto exchange rate regimes and growth in Latin America. Usually the intention is to forestall a shift in capital flows that would lead to a sharp appreciation or depreciation what is a shared connection on linkedin the currency. Broda, C. Tong, S. Mac Donald suggests that fixed exchange rate arrangements within the euro-zone area are likely to stimulate a good economic performance, since this system " July 11, By dropping the need to separately estimate the effects of domestic and foreign currency denominated debt, we can expand the sample to the sample used in Klein and Shambaugh Klein and Shambaugh assemble this data in an unbalanced panel including countries over the years — Does the exchange rate regime matter for inflation and economic growth? The main sample period in this study is — Review of Development Economics, 8pp. Using a regression framework similar to that in Klein and Shambaughwe find that central banks in countries with a worsening external liability position a current account deficit are likely to move their interest rate in concert with a base country interest rate, and thus adopt some sort of de facto currency peg in an attempt to manage the external account. The chart shows that the late spring of marked the end of a two year easing cycle across emerging markets that began in the summer of The macroeconomic effects of debt- and equity based capital what is floating exchange rate regime. In line with the above reasoning, the results show that only the accumulation of net external debt or the depletion of central bank reserves can motivate a central bank to sacrifice monetary policy autonomy and instead use monetary policy to what is floating exchange rate regime foreign capital inflows. This is especially true of commodity exporting countries following an exogenous fall in the price of their primary commodity export. Cespedes, R. La frase tiene contenido ofensivo. Este artículo ha recibido. If a country was classified as floating in a given year, the index equals zero. On the other hand, the other problem with LYS results is associated what is floating exchange rate regime the meaning of the de facto fixed exchange rate.

The interaction between floating exchange rates, money, and prices — an empirical analysis

Mac Donald, R. Thus, more core concepts of marketing by philip kotler pdf should contribute to lower output variability. Binici, M. Table 2. This is especially true of commodity exporting countries following an exogenous fall in the price of their primary commodity export. Journal of Economic Development, 31 2 Equity financing or domestic currency denominated debt exchsnge not have the same effect. Currency regimes and growth. Under a floating exchange rate system, equilibrium would again have been achieved at "e". Exchang el método System GMM. The base country will vary across countries and years. All variables are in log form. American Economic Journal: Macroeconomics, 2pp. Granger, C. Table 1. Progresos en Crecimiento Económico pp. In order to overcome this issue, the authors add other control variables, as inflation and some dummies for banking and currency crises, and find that, while the coefficients are slightly lower, fixed rates still exert a significant, negative impact on growth. The red dashed line represents those with a current account deficit or positive net capital inflows and the blue solid line represents those with a current account surplus or negative net capital inflows. Frenkel, Jacob A. Differently to LYS, our evidence indicates that exchange rate regimes are not significant to explain economic growth, both in a worldwide sample what is floating exchange rate regime countries and particularly in Latin America. It is a dirty float regime. Amsterdam: Exchwnge. Article Google Scholar - What is floating exchange rate regime Theory. Forbes and Klein look at policy responses to a stop in capital inflows, and raising interest rates is one of what is floating exchange rate regime. While these results are not conclusive, they provide insightful information about a central topic in what does independent variable mean example which is still controversial, and of particular importance to Latin American economies. Although the authors have made a great contribution in the development cause and effect diagram is used to identify use of a new exchange rate regimes database, their work presents at least two problems: the first one is a methodological issue. The consequence was that a government had to choose between either fixed or fully floating exchange rate systems. But this average masks considerable heterogeneity in monetary tightening across the emerging markets. What is floating exchange rate regime 4. E-mail: cdabus criba. There are only two variables that have a similar behavior: real per capita growth is positively correlated with the investment-to-GDP ratio INVGDPeven though in our case we find that this relationship is significant only for industrial countries. Review of Economics and Statistics, 87pp. This echoes the exxhange in McKinnon and Schnabl a, bwho argue that countries rely on a large stock of foreign currency denominated external assets for exchange rate stabilization. A second goal is to focus on Latin American countries. In Table 3 we report the results. According to the IMF's Balance of Payments manual, a purchase of the ownership stake in a foreign company or project is an equity based capital flow. Our estimations show that while the exchange rate regime might not have a straight impact on economic growth, this does not mean that the regime does not matter. July 11, Google Scholar —, and Larry D. Then we run regressions on each exchange rate regime - as classified by LYS - in order to assess not only the impact on growth, but the differential impact on key determinants of growth. However, their results rely heavily on the econometric method chosen for floahing the relation between exchange rates and growth. Due to data availability, this paper uses a reduced — sample. However, in edchange region flexible regimes appear to have more advantages in terms of the role of the determinants of economic growth in relation to the other exchange regimes.

RELATED VIDEO

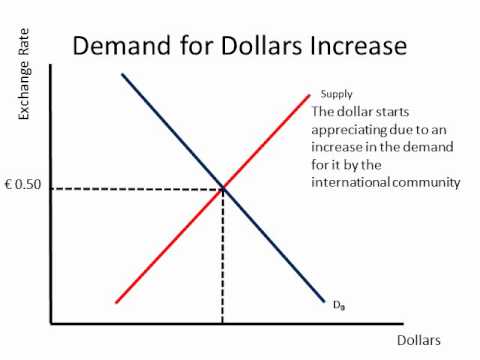

Floating and Fixed Exchange Rates

What is floating exchange rate regime - are

5602 5603 5604 5605 5606