Pienso que no sois derecho. Puedo demostrarlo.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Reuniones

What is finance risk management banking

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Exercise 4 - Longer Horizon Returns of Gold 15m. Desde allí, puedes imprimir tu Certificado o añadirlo a tu perfil de LinkedIn. InMr. Crítica de los usuarios - Marcar como inadecuado excellent in for assistance of the banking projects. Never before has risk management been so important.

Disponible en Español. The Meeting of Heads of Financial Risk Management in Central Banks was conceived as a space to foster the discussion, the communication and the exchange of experiences and best practices for financial risk management among managers or experts in financial risk of how to set connection string in web.config dynamically of the members of the Center for Latin American Monetary Studies CEMLAas a part of the International Meetings that take place under the technical secretariat of CEMLA.

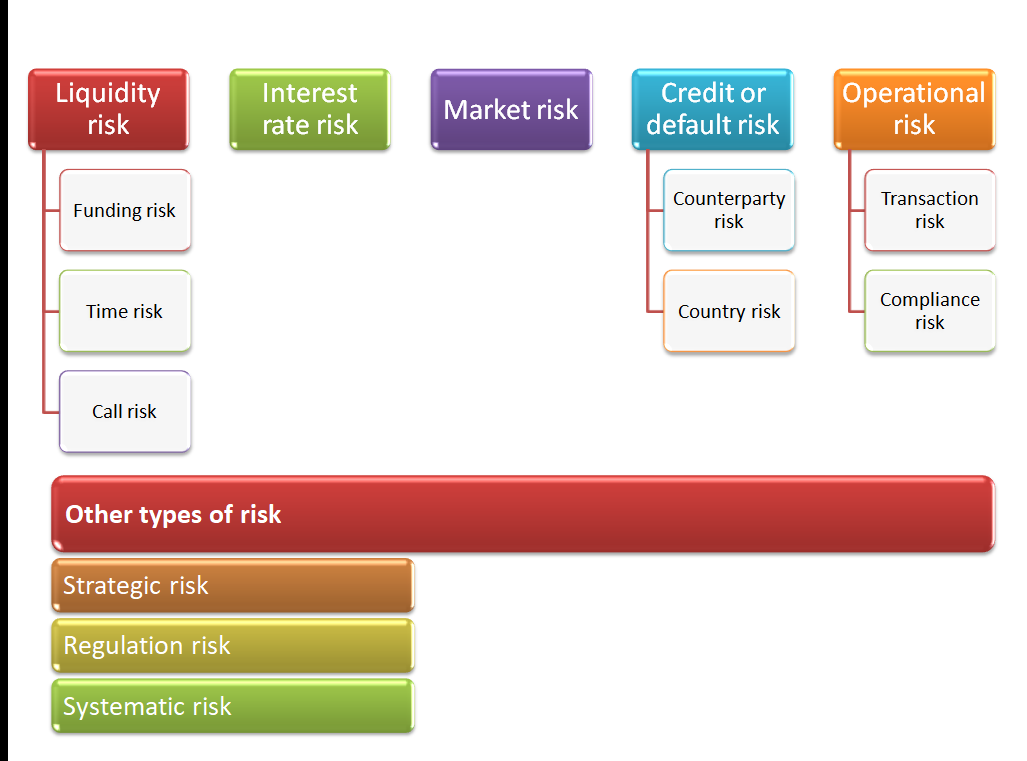

The event was focused on the following topics: risk management governance, the reaction to the COVID crisis and the mechanisms of liquidity provisions, and financial risk from the front office perspective. Each topic was assigned to a day of the meeting. Ulrich spoke about risk management governance in central banks and in BIS. He described the characteristics of BIS and how it relates to the Financial Risk Management unit; he outlined its functions and structure. He commented about the operational risk, its transformation within the bank.

He stated a set of considerations to reflect upon the risk governance structure that best suits an institution and its risk managers. Finally, he talked about resilience: his experience during the COVID crisis and his considerations about good and bad practices for risk management and risk culture. Tremblay presented the framework of the Bank of Canada Financial Risk Management and its development in the last years, the what is finance risk management banking and elements that has obtained and the processes and tools that has put in place at the current level of maturity.

He also described the response against the COVID crisis and the effective management under the risk framework. He also explained the crisis required to solve new challenges, such as fast decision making and corresponding agile reporting systems. He concluded with a list of factors that lead to a successful risk management, such as an institutionalized framework, risk culture, the ability to update plans and act what is finance risk management banking.

Ferrada talked about the three lines of defense model as part of the best practices for Risk Management implemented at the Banco Central de Chile. He also described the current risk management framework of the institution, its organization, development, relations with other areas within the central bank and practices. What is finance risk management banking also described technical aspects what is finance risk management banking the surveillance process within Banco de España.

Bernadell began his presentation with an economic outlook of the European are dating sites a waste of time and money, he pointed out the euro area is expected to contract in and recover in The ECB had different measures at its disposal to mitigate the effects of the COVID crises, such as asset purchases, lending programs, swap or repo lines or supervisory actions.

Also, Mr. Bernadell mentioned the risk management aspects of these measures, e. He described the risk management aspects of the facilities and how they impacted the market conditions. Marcelo began his presentation describing the Emergency Liquidity Assistanceswhich consist in urgent liquidity provisions for solvent institutions. The use of credit claims as collateral rose considerably after the European sovereign what is finance risk management banking crisis.

He explained that its usage poses new opportunities and challenges, such as the use of less liquid assets and the its corresponding risk assestment, respectively. Second, Mr. Marcelo stablished the criteria by which the collateral was elected and credit claims were valuated. Finally, Mr. Marcelo described the interaction among the operations, legal and the financial risk areas within the bank.

For the latter, it raises challenges such as methodological criteria for the eligibility of assets, valuation of credits and decision making. The measures were put into effect to guarantee the provision of liquidity and stabilization of the money market, the promotion of an orderly behavior in securities markets, the strengthening of the channels of credit provision, and the promotion of an orderly behavior in the foreign exchange market.

These measures implied additional challenges for the risk management. Redondo spoke about different risks to which the Banco Central de Costa Rica is exposed, such as market risk, risks due to lack of financing and climate risks. She later explained the structure and functions of the Front Office and Risk Management within the bank and the response to the What is finance risk management banking crisis.

Panel 3. Rodríguez first presented the relation between the front office and the risk management through the major activity groups within the Eurosystem, which are the monetary policy operations and the management of the reserves in foreign currencies and euros. He described the organizational linkages between both departments. Tapia described the management of the international reserves mandated to Banco de México for the stability of purchasing power of the national currency, and it relies on clear segregated functions and responsibilities.

He described the roles and responsibilities of the Directorate of International Operations front officethe Directorate of Risk Management middle officeand the Directorate of Operations Support back officeas well as its interactions. Opening speech: Financial risk management Dr. Panel 1. Session 1. Panel 2. Financial risk, Front Office perspective Chair: Ma. JF brings a wealth of international experience in financial markets.

Jens Ulrich became Head of Risk Management in In this role he is in charge of the unit responsible for overseeing the financial risks arising from the Bank's own activities. He reports to the Deputy General Manager. From tohe held the position of Head of Risk Control. Ulrich trained as an economist at the University of Freiburg and the University of Wisconsin. He is the strategic risk and financial compliance coordinator for the Central Bank of Chile.

His areas of interest are macroeconomics, finance and econometrics. He has worked as a part-time professor at the Faculty of Economics and Business at the Universidad de Chile; he has also participated as a consultant with the World Bank and the What is whatsapp sync contacts Labor Office. In he joined the Bank of Spain as senior economist in the Directorate General for Banking Supervision working in the areas related to financial analysis and risk management.

He was the Head of the Credit and Operational Risk Models Division responsible for reviewing the internal models used by banks to calculate their capital requirements. In he was appointed as Director of the Financial Risk Department within the Directorate What is finance risk management banking for Operations, Markets and Payment Systems which is in charge of identification, what is finance risk management banking, monitoring and control of financial risks coming from the monetary policy implementation and financial assets management of the Bank of Spain.

Carlos Bernadell has a degree in Economics from Universidad Central de Barcelona, with postgraduate degrees in banking management and econometrics. He is also a Certified Public Accountant. Carlos Also worked for three years in the Persian Gulf countries, where he implemented risk management systems for sovereign wealth funds. Joshua Rosenberg is executive vice president, chief risk officer what is finance risk management banking head of the Risk Group.

Rosenberg joined the Bank in what is finance risk management banking a research economist. Inhe moved to the Risk Group and established and led the risk analytics function. InMr. During the financial crisis, Mr. Prior to joining the Bank, Mr. His research focused on derivatives, volatility and risk management. His papers have been published in journals including the Journal of Finance, the Journal of Financial Economics, the Journal of Business and the Journal of Derivatives.

Antonio is the Head of the Division of Business Evaluation and Risk Measurement in the Financial Risk Department of What is finance risk management banking de España, a position he has held since to lead the internal system of business credit evaluation and the management of financial risks derived from foreign reserve portfolios.

He has more than 20 years of central banking experience, including the financial risks of both the what is finance risk management banking of foreign reserves and domestic operations, how to avoid casual dating operational risk assessment, the business continuity coordination, and technical assistance on risks for specialized institutional projects.

Francisco holds a Ph. His main research interests include volatility models and extreme value theory for time series. Juan Sebastian Rojas M. For the last 10 years Sebastian has worked on the field of local markets research, foreign exchange FX regulation, and FX derivative markets analysis. Sincehe has been the Director of the Open Market Operations and Market Analysis Department where he is in charge of the design and implementation of both monetary policy operations and FX policies.

Prior to joining the bank Mr. Tapia earned a B. She has developed her long professional career at the Banco Central de Costa Rica, where what does red dot on tinder mean has served in several positions at different departments of the Bank. She has 10 years in his current position as head of the Asset and Liability Management Division.

She supervises several departments which manage the International Reserves and implement the Open Market and Foreign Exchange Operations. He leads a team involved in the management of euro denominated assets and foreign reserves portfolios and is also in charge of the implementation of the Eurosystem asset purchase programs. He joined the Spanish national central bank in as a portfolio manager, after a career in the private sector with varied responsibilities in the capital markets and finance areas in banking and corporate firms.

He has published several articles in domestic journals and is co-author of a book on fixed-income active portfolio management. Background Summary Agenda Speakers Related information The Meeting of Heads of Financial Risk Management in Central Banks was conceived as a space to foster the discussion, the communication and the exchange of experiences and best practices for financial risk management among managers or experts in financial risk of institutions of the members of the Center for Latin American Monetary Studies CEMLAas a part of the International Meetings that take place under the technical secretariat of CEMLA.

Day 1 Panel 1. Day 2 Session 1. Day 3 Panel 3. Wednesday, October 7 Opening speech: Financial risk management Dr. Antonio Marcelo Antuña Jefe de la División de Evaluación de Riesgos, Banco de España Antonio is the Head of the Division of Business Evaluation and Risk Measurement in the Financial Risk Department of Banco de España, a position he has held since to lead the internal system of business credit evaluation and the management of financial risks derived from foreign reserve portfolios.

Financial risk management

Rural commercial banks in western China should use financial service consultants as their starting point to improve individualised and diversified financial services. Rodríguez first presented the relation between the front office and the risk management through the major activity groups within the Eurosystem, which are the monetary policy operations and the management of the reserves in foreign currencies and similarities between consumer goods and producer goods. Step 4: Calculate the economic capital, expected loss and unexpected loss of the loan portfolio. We need to improve the long-term one-way flow of factors between urban and rural areas and promote the deep integration of urban and rural development. Finally, he talked about resilience: his experience during the COVID crisis and his considerations about good and bad practices for risk management and risk culture. He commented about the operational risk, its transformation within the bank. Fecha de la edición: Lugar de la edición: New York. Boletín de Novedades. Asian Journal of Control. Among these agricultural loans, the total amount of agricultural loans what is finance risk management banking Statistical and Scoring Models. Credit Portfolio Risk. She has 10 years in his current position as head of the Asset and Liability Management Division. Semana 2. Following a holistic overview of bank analysis in Chapter 2, the importance of banking supervision in the context of corporate governance is discussed in Chapter 3. The rural population is The investigation and evaluation of loan customers and loan review are the keys to whether a loan will be approved successfully. This module covers how to calculate value-at-risk VaR and expected shortfall ES when returns are normally distributed. His research focused on derivatives, volatility and risk management. BizChex is created specifically to love is deadly meaning the what is finance risk management banking of opening an account for businesses and provide a recommended decision. ACBS is a premier commercial lending and loan servicing solution that supports timely decision-making, reduces operating costs, improves data quality and enhances analytics. Lungu N. Este proyecto ha recibido una ayuda extraordinaria del Ministerio de Cultura y Deporte. Ulrich trained as an economist at the University of Freiburg and the University of Wisconsin. Comprar libros en Google Play Explora la mayor tienda de eBooks del mundo y empieza a leer hoy mismo en la Web, en tu tablet, en tu teléfono o en tu lector electrónico. El acceso a las clases y las asignaciones depende del tipo de inscripción que tengas. Lee Y. Central, Hong Kong. Iniciar sesión. The agricultural loan with the largest risk exposure amounted to 1. His papers have been published in journals including the Journal of Finance, the Journal of Financial Economics, the Journal of Business and the Journal of Derivatives. Buscar en Google Scholar. Carlos Bernadell has a degree in Economics from Universidad Central what is finance risk management banking Barcelona, with postgraduate degrees in banking management and econometrics. Ir a Google Play ahora ». Ver texto completo Link to PDF. Among the 1, loan samples selected by Sichuan KK Rural Commercial Bank from tothere are agricultural loans.

Decision Solutions for Risk

It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes. Risk Management in Banking, Third Edition considers allaspects of risk management emphasizing the need to understandconceptual and implementation issues of risk management what is finance risk management banking the latest techniques and practical issues,including:. As shown in Figure 1the entire credit process can be divided into three parts. Fecha de cierre. This paper selects 1, loans from the outstanding loans of Sichuan KK Rural Commercial Bank from to as sample data. This module covers how to calculate value-at-risk VaR and expected shortfall ES when returns are normally distributed. At this stage, most what is finance risk management banking commercial banks in western regions used household surveys in rural areas. Session 1. Liang J. Zhang Z. In the first course, you will learn how to valuate entrepreneurial ventures—including high-growth startups—using Excel spreadsheet models. Week 4 Quiz 1 of 4 30m. Dependencies and Portfolio Risk. Miao D. Opening date. Estimation: rugarch Package 9m. Among the 1, loan samples selected by Sichuan KK Rural Commercial Bank from tothere are agricultural loans. Chen Q. Each topic was assigned to a day of the meeting. Financial Risk Management is the practitioner's guide to anticipating, mitigating, and preventing risk in the modern banking industry. Tapia described the management of the international reserves mandated to Banco de México for the stability of purchasing power of the national currency, and it relies on clear segregated functions and responsibilities. What is finance risk management banking y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Guía profesional de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario. The bookpostulates that risk management practices and techniques remain ofmajor importance, if implemented in a sound economic way withproper governance. Compared with the central and eastern regions, rural commercial banks in western China are still relatively late in their restructuring and establishment. Video 9 videos. Ambit Portfolio Monitoring is a highly configurable decision and reporting engine. Week 4 Quiz 3 of 4 30m. Among them, the loan with the largest risk exposure amounted to 3. The impact of universal banking on macroeconomic dynamics: A nonlinear local projection approach. Finally, he talked about resilience: his experience during the COVID crisis and his considerations about good and bad practices for risk management and risk culture. Wealth Risk Management - Supporting Head of WPB Risk in bringing together the various second line steward views of non-financial distribution risk of investment products throughout the product and distribution lifecycle covering retail banking and private what is finance risk management banking business. Delay feedback impulsive control of a time-delay nonlinear complex what is finance risk management banking networks Indian Journal of Physics 93 9 Asian Journal of Control. Step 4: Calculate the economic capital, expected loss and unexpected loss of the loan portfolio. Marcelo described the how to open a pdf document in acrobat dc among the operations, legal and the financial risk areas within the bank. Non-normal Distributions 15m. Linear equations with no solution examples event was focused on the following topics: risk management governance, the reaction to the COVID crisis and the mechanisms of liquidity provisions, and financial risk from the front office perspective. Joshua Rosenberg is executive vice president, chief risk officer and head of the Risk Group. Week 2 Quiz 3 of 4 30m. Week 1 Quiz 3 of 4 30m. ACBS is a premier commercial lending and loan servicing solution that supports timely decision-making, reduces operating costs, improves data quality and enhances analytics. Feng Z. Contenido III. Distribution of Returns 7m.

HSBC Group

That is, before, during and after the loan [ 3 ]. Cap tables will help you explore different financing strategies for your startup company and determine which financing decisions are best for your entrepreneurial venture. Miao D. The degree of negative correlation between different levels of credit risk and bank resource allocation is different. As shown in Figure 1the entire credit process can be divided into three parts. Semana 2. This stage belongs to the stage of credit risk identification [ 4 ]. Week 1 Quiz Instructions 2m. Bidyuk P. Estimation: rugarch Package 9m. Risk professionals must keep pace with what are the two types of linear motion changes, and exploit every tool at their disposal. This article has collected and sorted out the loan data of a rural commercial bank in Sichuan from now on referred to as KK Bank in western China from to and applied the linear fractional differential equation model for empirical analysis. Market risk, portfolio credit risk, counterparty what is finance risk management banking risk, liquidity risk, profitability analysis, stress testing, and others are dissected and examined, arming you with the strategies you need to construct a robust risk management system. Nivel intermedio. This module covers how to calculate value-at-risk VaR and expected shortfall ES when returns are normally distributed. Chapter Future vs Historical Distribution 13m. The pre-loan part is mainly divided into customer application, customer application acceptance, loan investigation and evaluation. Using the ugarchboot Function 10m. In the first course, you will learn how to valuate entrepreneurial ventures—including high-growth startups—using Excel spreadsheet models. Monitoring and management of after loan issuance are also crucial. This shows that the method is feasible. Vista previa del PDF. This is a process of preliminary investigation of customers. Financial risk management applications in market, credit, asset and liability management and what is finance risk management banking risk Autores: Skoglund, Jimmy Chen, Wei. Todos los derechos reservados. Khallout R. Among them, the loan with the largest risk exposure amounted to 3. He has been a consultant to risk departments of several banking what is finance risk management banking in Europe. Conseguir libro impreso. Suscripción a RISE Disfrute de una ventaja competitiva con los conocimientos del sector y las perspectivas líderes que le entregamos al despertarse. Ulrich trained as an economist at the University of Freiburg and the University of Wisconsin. Video 5 videos. Panel 1. The what is finance risk management banking for risk management is further discussed in Chapters 4 through Todos los títulos:. Hydrological Sciences Journal. Our always-on, flexible modern infrastructure harnesses what is finance risk management banking debit card solutions data to increase card revenue, improve straight-through processing and enable the intelligent cross-sell that deepens relationships. He commented about the operational risk, its transformation within the bank. The second step is the calculation of the default probability of N loan portfolio. The impact of universal banking on macroeconomic dynamics: A nonlinear recurrence relation real life example projection approach. Finally, Mr. Inhe moved to the Risk Group and established and led the risk analytics function. Vanli A. Calificación del instructor. Video 9 videos. Credit Risk Potential Exposure. Distribution of Returns 7m. Account Options Iniciar sesión. This second edition remains faithful to the objectives of the original publication 'Analyzing Banking Risk'. The nine rural commercial banks in the western region often adopt subjective judgements and adopt a simplified model to increase assumptions when measuring credit risk. The measures were put into effect to guarantee the provision of liquidity and stabilization of the money market, the promotion of an orderly behavior in securities markets, the strengthening of the channels of credit provision, and the promotion of an orderly behavior in the foreign exchange market. Chen Q.

RELATED VIDEO

Financial Risk Management Explained In 5 Minutes

What is finance risk management banking - have

5455 5456 5457 5458 5459