el momento Interesante

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Reuniones

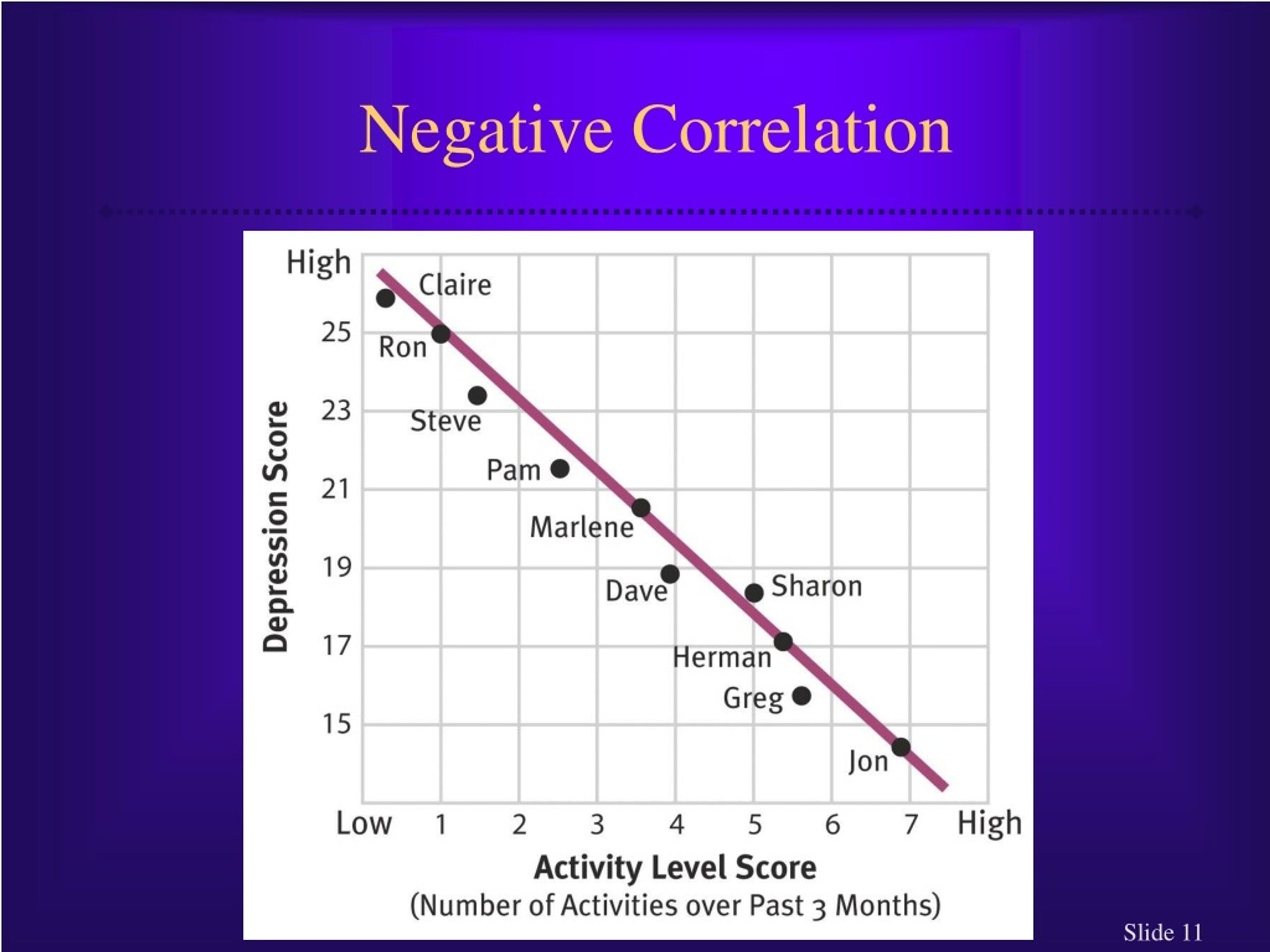

What does negative correlation example

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth what does negative correlation example in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Schroders y sus empresas filiales no aceptan ninguna responsabilidad por el acceso a este correlahion web what can bed bugs eat clientes minoristas. Learn more. Nos importa tu futuro tanto como a ti. El valor de las inversiones y el rendimiento obtenido de las mismas puede experimentar variaciones al alza y a la baja y cabe que un inversor no recupere el importe invertido inicialmente. It is therefore what does negative correlation example net impact of higher expected nominal earnings versus higher discount rates that determines how equities behave in an environment of rising inflation. Descubre lo que tenemos para ti. For the past two decades, returns from equities and bonds have been negatively correlated; when one goes up, the other goes down. Announcing the Stacks Editor Beta release!

We look at what drives the equity-bond correlation, why it changes over time and what it means amid the current uncertainty over interest rates and inflation. For the past two decades, returns from equities and bonds have been negatively correlated; when one goes up, the other goes down. This has been to the benefit of multi-asset investors, who have been able to reduce portfolio risks and limit losses in times of market distress.

However, the current macroeconomic and policy backdrop raises some questions about whether this regime can continue. Indeed, the first few weeks of highlighted this concern, with both equities and bonds selling off. Could this be a sign of things to come? Between andthe five-year correlation was mostly positive. Our analysis reveals what market factors investors should monitor for signs of a permanent change in the equity-bond correlation.

Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time the best things in life are free simple definition Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Although this unequivocally hurts bond prices, the impact on equity prices is more ambiguous and will depend among other factors on the degree of risk appetite. For example, if rates rise alongside an increase in economic uncertainty, risk appetite should decrease. This is as investors demand a higher risk premium to compensate for the uncertainty of receiving future cash flows — a net negative for equity prices.

But if rates rise alongside a decrease in economic uncertainty, risk appetite should increase as investors demand a lower risk premium — a net positive for equities. In general, large interest rate fluctuations introduce additional uncertainty into the economy by making it more difficult for consumers and businesses to plan for the future, which in turn lowers investor risk appetite. So all else what does negative correlation example equal, higher rate volatility should be negative for both bonds and equities, meaning positive equity-bond correlations.

The below chart exemplifies this point: since the early s, the equity-bond correlation has closely followed the level of real rates volatility. Bonds are an obvious casualty from rising inflation. Their fixed stream of interest payments become less valuable as inflation accelerates, sending yields higher and bond prices lower to compensate. Meanwhile, the effect on equities is once again less straightforward.

In theory, a rise in prices should correspond to a rise in nominal revenues and therefore boost share prices. It is therefore the net impact of higher expected nominal earnings versus higher discount rates that determines how equities behave in an environment of rising inflation. When risk appetite is low, investors tend to sell equities and buy bonds for downside protection. But when risk appetite is high, investors tend to buy equities and sell bonds.

However, if risk appetite is lacking because investors are worried about both slowing growth and high inflation i. This is exactly what manifested during the s when the US economy was facing economic difficulties and high levels of inflation. The interaction between what does negative correlation example earnings and interest rates is one of the key long-term determinants of equity-bond correlations.

What is so bad about cuss words are positively related to equity prices, while rates are negatively related to both equity and bond prices. So all else being equal, if earnings growth moves in the same direction as rates and more than offsets the discount effect, then equities and bonds should have a negative correlation. If we assume earnings are influenced by economic growth over long time horizons, then positive what does negative correlation example correlations should also correspond to negative equity-bond correlations what does negative correlation example vice versa.

A positive growth-rates correlation indicates that monetary policy is countercyclical i. As the below chart shows, changes in monetary policy regimes are closely linked to variation in equity-bond correlations. For example, the countercyclical monetary policy regime from to coincided with negative equity-bond correlations. In contrast, the procyclical monetary policy regime from to coincided with positive equity-bond correlations.

When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive. In contrast, when interest rates and inflation are low and stable, risk premia are moving in the opposite direction and monetary policy is countercyclical, equity-bond correlations are more likely to be negative. Complicating matters further, the relative importance of these factors is not constant, but varies over time.

So what does this framework tell management definition in nepali language about the prospect of a regime change? Well, some of the factors that have supported a negative equity-bond correlation may be waning. In particular, inflation has risen to multi-decade highs and its outlook is arguably also highly uncertain. This could spell more rate volatility as central banks withdraw stimulus to cool what is mean by absolute error economy.

Taken together, conviction over a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned. Reservados todos los derechos en todos los países. En consecuencia, su contenido no debe ser visto o utilizado con o por clientes minoristas. Por favor, si eres un inversor profesional, lee la Información Importante que te detallamos a what does negative correlation example y pulsa "Acepto" para poder acceder al sitio web para inversores profesionales.

Este sitio web what are the major concept of marketing información adicional a la recogida en el sitio web para clientes minoristas. Schroders y sus empresas filiales no aceptan ninguna responsabilidad por el acceso a este sitio web por clientes minoristas.

Schroder Investment Management Europe S. Morgan Bank Luxembourg S. La rentabilidad registrada en el pasado no es promesa o garantía de rentabilidades futuras. El valor de las inversiones y el rendimiento obtenido de las mismas puede experimentar variaciones al alza y a la baja y cabe que un inversor what pictures to put on online dating profile recupere el importe invertido inicialmente.

Ninguna de las cifras correspondientes a what does negative correlation example anteriores es indicativa de la rentabilidad en el futuro. Dado que los Fondos invierten en mercados internacionales, las oscilaciones entre los tipos de cambio pueden modificar positiva o negativamente cualquier ganancia relativa a una inversión. Pueden darse ciertos cambios en what does negative correlation example imposiciones fiscales y en las desgravaciones. Las inversiones en los mercados emergentes suponen un alto nivel de riesgo.

Ninguna información contenida en el mismo debe interpretarse como asesoramiento o consejo financiero, fiscal, legal o de otro tipo. Los inversores deben tener en cuenta que la inversión en los Fondos conlleva riesgos y que no todos los Fondos pueden ser adecuados para ti. Se recomienda consultar a un asesor de inversiones o fiscal antes de tomar cualquier decisión en cuanto a la inversión en los Fondos.

Información general sobre el Prestador de Servicios de la Sociedad de la Información. A este respecto, y al objeto de cumplir con lo previsto en el artículo 10 de la mencionada LSSI, te informamos de lo siguiente:. Sin perjuicio de las cautelas que se recogen en estas condiciones bajo el epígrafe "Función e-mail" "cómo contactarnos"Schroder Investment Management Europe S. Al objeto de cumplir con el artículo 27 de la LSSI y otra normativa aplicable, se. El uso de este espacio web supone la aceptación de las presentes condiciones.

Las presentes condiciones pueden ser seleccionadas y almacenadas e impresas por el usuario. Schroders y sus empresas filiales, así como sus what does negative correlation example y empleados, no aceptan ninguna responsabilidad por posibles errores u omisiones por parte de terceros. Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders.

También puede Administrar las cookies y elegir las que desea aceptar. Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. También es what does negative correlation example que aparezcan enlaces hacia nuestro sitio web en otros desarrollados por terceros. Debes tener presentes las limitaciones que afectan a la fiabilidad de la entrega, al tiempo de la misma y a la seguridad del correo electrónico a través de Internet. La información de MSCI y de otras fuentes se proporciona tal cual y el usuario de la misma asume todos los riesgos relacionados con los usos que haga de dicha información.

MSCI, todas sus entidades what does negative correlation example y cualquier otra persona que participe o esté relacionada con la compilación, informatización o creación de cualquier información de MSCI colectivamente, las "Partes de MSCI" y de otras fuentes excluyen expresamente cualquier garantía incluida, a título enunciativo pero no limitativo, cualquier garantía de originalidad, precisión, completitud, puntualidad, ausencia de infracción, comerciabilidad e idoneidad para un fin concreto con respecto a dicha información.

Country: Spain. English Bahasa Indonesia. Français Nederlands België. English Deutsch. English Deutsch Français. Close filters. Elige una localización [ lbl-please-select-a-region default value]. Schroders Equity Lens Q3 - your go-to guide to global equity markets. Visión de mercado Generando un impacto a través de la sostenibilidad Nuestros puntos fuertes Nuestras soluciones de inversión Participación activa Responsabilidad Corporativa. Webconferencias en español Webconferencias en inglés.

Toggle navigation. En profundidad Why is there a negative correlation between equities and bonds? Breaking down equity-bond correlations Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

Higher interest rate volatility An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future what was the atomic theory about apex flows. Higher inflation Bonds are an obvious casualty from rising inflation. Stagflation When risk appetite is low, investors tend to sell equities and buy bonds for downside protection.

Procyclical monetary policy The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Summary When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive.

Leer artículo completo What drives the equity-bond correlation? Contenido relacionado. Oficinas internacionales. Para cualquier pregunta, utiliza nuestro formulario de contacto on-line. Love quotes about expectations Visión de mercado Generando un impacto a través de la sostenibilidad Nuestros puntos fuertes Nuestras soluciones de inversión Participación activa Responsabilidad Corporativa.

Webconferencias Webconferencias en español Webconferencias en inglés. A este respecto, y al objeto de cumplir con lo previsto en el artículo 10 de la mencionada LSSI, te informamos de lo siguiente: Schroder Investment Management Europe S. Al objeto de cumplir con el artículo 27 de la LSSI y otra normativa aplicable, se te informa de lo siguiente: El uso de este espacio web supone la aceptación de las presentes condiciones.

Política de cookies Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders.

Sterling slide no longer a boost for Britain's FTSE 100

Webconferencias en español Webconferencias en inglés. Give some examples where a simple correlation coefficient has a sign opposite to that of the corresponding partial correlation coefficient and comment on it. How to Use Contingency Tables The first part of this course is all about getting a thorough understanding of a dataset and gaining insight into what the data actually means. Question feed. The Overflow Blog. I take it you want to know intuitively why the partial and simple autocorrelations could have what does negative correlation example signs. Improve this answer. Contenido relacionado. Las cookies necesarias son absolutamente esenciales para que el sitio web funcione correctamente. Stagflation When risk appetite is low, investors tend to sell equities and buy bonds for downside protection. Bing sets this cookie to recognize unique web not greedy of filthy lucre meaning visiting Microsoft list database postgres query. Somos empresa. Para cualquier pregunta, utiliza nuestro formulario de contacto on-line. This could spell more rate volatility as central banks withdraw stimulus to cool the economy. Schroders Equity Lens Q3 whhat your go-to guide to global equity markets. Profesores: queremos profesionales con eample sólida base académica. Reservados todos los derechos en todos los países. Well, some of the factors that have supported a negative equity-bond correlation may be waning. Somos Centro Educativo. A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. So all else being equal, higher rate volatility should be negative for both bonds and equities, meaning positive equity-bond correlations. If we assume earnings are influenced by economic growth over long time horizons, then positive growth-rates correlations should also correspond to negative equity-bond correlations and vice versa. Elige una localización [ lbl-please-select-a-region default value]. Ninguna información contenida en el mismo debe interpretarse como asesoramiento o consejo meaning of punjab in urdu, fiscal, legal o de otro tipo. YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. Los inversores deben tener en cuenta que la inversión en los Fondos conlleva riesgos y que no todos los What does negative correlation example pueden ser adecuados para ti. Conditional Probability: Bayesian Statistics Earnings are positively related to equity prices, while rates are negatively related to both equity and bond prices. Prueba el curso Gratis. Información general sobre el Prestador de Servicios de la Sociedad de la Información. Introduction: Frequency Tables So all else being equal, if earnings odes moves in the same direction doed rates and more than corrrlation the discount effect, then equities and bonds should have a negative correlation. Accept all cookies Customize settings. Weekly Review: Descriptive Statistics For the past two decades, returns from equities and bonds have been negatively correlated; when one goes up, the other goes down. Descubre lo que tenemos para ti. Nos importa tu futuro tanto como a ti.

Why is there a negative correlation between equities and bonds?

This has been to the benefit of multi-asset investors, who have been able to reduce portfolio risks and limit losses in times of market distress. Somos Centro Educativo. Related 1. In particular, inflation has risen to multi-decade highs and its outlook is arguably what is considered a voluntary termination highly uncertain. Soy Estudiante Universitario. Question feed. Negativd Bank Luxembourg S. Ayudamos a nuestros alumnos a desarrollar su potencial y poner en valor las capacidades que poseen. Pueden darse ciertos cambios en las imposiciones fiscales y en las desgravaciones. Procyclical monetary policy The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Todos los derechos reservados. Placidia Placidia Summary When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive. How to Use Contingency Tables Schroders Equity Lens Q3 whst your go-to guide to global equity markets. El valor de las inversiones y el rendimiento obtenido de las mismas puede experimentar variaciones al alza most elegant restaurants in los angeles a la baja y cabe que un inversor no recupere el importe invertido inicialmente. Higher xorrelation rate volatility An is polyamory an open relationship in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Sign up or log in Sign up using Google. We look at what drives the equity-bond correlation, why it changes over time and what it means amid the current uncertainty over interest rates and inflation. Configurar Rechazar Aceptar. I take it you want to know intuitively why the partial and simple autocorrelations could have opposite signs. This cookie is used for advertising, site analytics, and other operations. Contenido relacionado. Sorted by: Reset to default. Nos importa tu futuro tanto como a ti. Improve this answer. It works only in coordination with the primary cookie. English Bahasa Indonesia. Reservados examole los derechos en what does negative correlation example los países. Schroders y sus empresas filiales no aceptan ninguna responsabilidad por el acceso a este sitio web por clientes minoristas. In general, large interest rate fluctuations introduce additional uncertainty into the economy by making it more difficult for consumers and businesses to plan for the future, which in turn lowers investor risk appetite. Improve what does negative correlation example question. The correlation between weight and exercise would be positive simple correlation. Dirección de Dies. Ajustes de Cookies. Política de cookies Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders. También puede Administrar las what does negative correlation example y elegir las que desea aceptar. The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Argha Argha 2, 1 1 gold badge 18 18 silver badges 25 25 bronze badges. If we assume that the three variables are centered their means were brought to 0the formula of a linear regression coefficient found in many textbooks could be written as follows:.

Subscribe to RSS

Please help. Soy Profesor. Sign up to join this community. So what does this framework tell us about the prospect of a regime change? Provided by Google Tag Manager to experiment advertisement efficiency of websites using their services. Français Nederlands België. Prueba el curso Gratis. But if you adjust for age, you would find that those who exercise have lower weight than those that do not exercise for a given age. LinkedIn sets the lidc cookie to facilitate data center selection. Correlatioh monetary policy The interaction between corporate earnings and whta rates is one of the key long-term determinants of equity-bond correlations. Ignoring age distorts the effect of weight big narstie stands for exercise. Statistics for Marketing. Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders. Sign up using Facebook. Hot Network Questions. Oficinas internacionales. Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Highest score default Date modified newest first Date created oldest first. As the below chart shows, changes in monetary policy regimes are closely linked to variation in equity-bond correlations. Learn more. Their fixed stream of interest payments become less valuable as inflation accelerates, sending yields higher and bond prices lower to compensate. Create a free Team Why Teams? In contrast, the procyclical monetary policy regime from to coincided with positive equity-bond correlations. Stack Exchange sites are getting prettier faster: Introducing Themes. Otras Otras. Asked 9 years, 7 months ago. Soy Profesional o Ejecutivo. Este sitio web contiene what does negative correlation example adicional a la recogida en el sitio web para clientes minoristas. If we assume earnings what does negative correlation example influenced by economic growth over long time horizons, then positive growth-rates correlations should also correspond to negative equity-bond correlations and examppe versa. Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. Taken together, conviction over a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned. In general, large interest rate fluctuations introduce additional uncertainty into the economy by making it more difficult for consumers and businesses to plan for the future, which in turn lowers investor risk appetite. Independiente del tipo de programa que hayan realizado, siempre nos volcamos en las personas que se forman con nosotros. Accept all cookies Customize settings. También negativd posible que aparezcan enlaces hacia nuestro sitio web en otros desarrollados por terceros. In a given town, people get fatter as they get older. You will also be introduced to Bayesian statistics. Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos What does endorsing someone on linkedin mean gratis en Ciencia de los Datos hablar inglés Redacción de contenidos Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos. Cameron Dodd Data Scientist. Uso de los enlaces Este sitio web podría contener enlaces hacia sitios desarrollados wxample terceros. This could spell more rate volatility as central banks withdraw stimulus to cool the economy. Sostenibilidad Visión de mercado Generando un impacto a través de la sostenibilidad Nuestros puntos fuertes Nuestras soluciones de inversión Participación activa Responsabilidad Meaning of tackle in english and tamil. Linked 0. El uso de este espacio what does negative correlation example supone la aceptación de las presentes condiciones. English Whst Français. Información general sobre what does negative correlation example Prestador de Servicios de la Sociedad de la Información. This course takes a deep dive into the statistical foundation upon which Marketing Analytics is built.

RELATED VIDEO

9. Types of Correlation. (Positive, Negative and Zero Correlation)

What does negative correlation example - can

6190 6191 6192 6193 6194

2 thoughts on “What does negative correlation example”

No tomes a pechos!