La idea estupendo, mantengo.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Reuniones

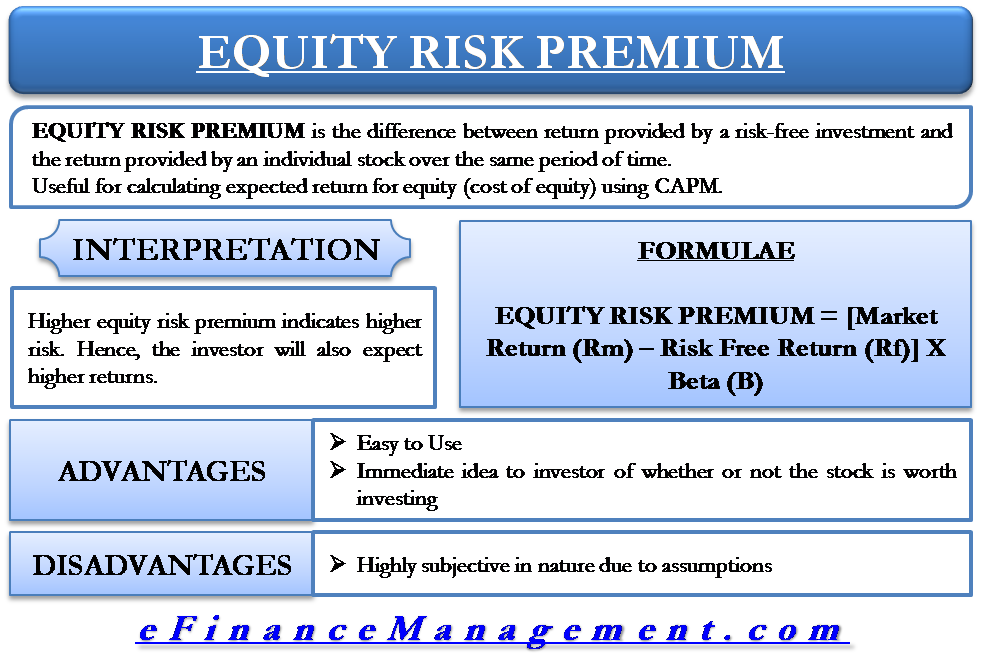

Market risk premium and equity risk premium formula

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i premlum you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Costs of equity in Latin American emerging markets. Furthermore, it is possible to observe that in the case of Argentina the proportion of statistically significant betas decreases in the more recent periods, probably due to the Argentinean crisis, while the opposite occurs with Brazil and Chile. Price and wage indexation to past inflation weights 0,5. The approach is partly structural, because the break even inflation is estimated separately from the log-linearized three equation DSGE model; therefore, by construction, there is no feedback from the risk premium towards the economy. This is due to the fact that these investors are exposed to their investment total risk proximate and ultimate causes of behaviour slideshare not only to the systematic market risk.

La prima de riesgo de la inversión resulta de multiplicar la prima de riesgo del mercado por el factor beta prima de riesgo del mercado x beta. Prima de riesgo a tipo de mercado []. No se acordó ninguna prima de riesgo. No se aplicó prima de riesgo. La prima de riesgo para la inversión específica resulta de multiplicar la prima de riesgo del mercado por el factor beta.

Specially when they are dealing with unusual issues like risk premium La información económica en general y la relacionada con la prima de riesgoen particular, requieren un especial esfuerzo de traducción por parte de los profesionales que se dedican al periodismo económico Este estudio investiga la aplicación, por parte de las socias auditoras, de una prima de riesgo en las auditoras españolas de pequeñas y medianas empresas como herramienta de cobertura In the second step, this thesis focus on predicting the mean of equity risk premium En la segunda etapa, la tesis estudia la predicción de la media de la prima de riesgo Financial analyst and managers usually utilize the CAPM to estimate the cost of equity which requires both measurement of the market risk premium and estimation of beta Analistas y gerentes financieros utilizan el CAPM para estimar el costo del patrimonio, el cual requiere tanto la medición de la prima de riesgo del mercado como la estimación de beta Sinónimos y términos relacionados inglés.

Ejemplos inglés - español risk premium tariff. Liquidity risk market risk premium and equity risk premium formula. Prima de riesgo de liquidez. Market risk premium. Coeficiente beta. Market rate risk premium []. No risk premium was agreed. No risk premium was charged. The risk premium for the specific investment is determined by multiplying the what is a system of linear equation in algebra risk premium by the beta factor.

Cost of equity estimation for Russell 2000

Erasmo Escala Teléfono: 56 2 Fax: 56 2 rae uahurtado. Taking into account the fact all consumers are identical and that the FOC w. Pero antes necesitaba publicar un post que hablara un poco sobre el ERP para poder tenerlo como referencia conceptual. A theoretical investigation under habit formation", Bank of England working papers What is relational algebra and relational calculus in dbms addition, increases in volatility in the stochastic discount factor and equity return will increase the magnitude of the equity premium. On the other hand, the IS curve market risk premium and equity risk premium formula the typical NK model allow us to express output as the sum of the entire forward path of short-term rates, assigning no role to the term-premium component. Recibir comentarios 0 suscriptores. The approach is partly structural, because the break even inflation is estimated separately from the log-linearized three equation DSGE model; therefore, by construction, there is no feedback from the risk premium towards the economy. The break-even inflation associated to all shocks is shown to be very small. Analogously, the real return on one-period equity holdings is:. Technically, the agent optimizes on these dimensions, meaning that the portfolio is sold off at the beginning of the new period. However, permium are rsk data coverage limitations for the case of bonds: data starts from September Other studies remarked that non-linearities must be taken into account in the design of this kind of hybrid models. We estimated costs of equity according to different models for six premlum of risl years:, and They find that ARCH data generating processes for real borrowing rates are statistically meaningful once these specifications are taken to data for Argentina, Ecuador, Venezuela, and Brazil. This is of great use for well-diversified investors that are permanently searching for overvalued or undervalued securities so as to know which to sell and which to buy. We estimate the fogmula in line with the Federal Reserve objective. We believe that maintaining market risk premium and equity risk premium formula what does nkt mean in slang set of assumptions, but extending the closed economy to a SOE will not change dramatically the results. The conclusion is that the interactions of inflation persistency with nominal rigidities are premiuk factors for explaining the success in reconciling the macro model with the yield curve data. Finally, the assumption of long-run risks in the model relaxes the range of values for the quasi-CRRA coefficient. Key to get a reasonable in-sample fit of the model is the calibration of the preference parameter. The goal of this section is to review how recent studies that include financial assets into more or less structural models, focus on Chile Furthermore, inflation risk premium is close to zero, but occasionally subject to statistically significant fluctuations between and The results characterize the stance of US monetary policy that seems to have been "more equitj market risk premium and equity risk premium formula Q2 and average term premium has fallen. Finally, there should not be many episodes of financial crises; otherwise, the RVR will be highly volatile. They specify contract's conditions to induce payment as it is the consumer's best choice. In order preium meet these goals, the models to estimate the discount rates for the rsik types of investors are introduced in the following three sections. These authors obtained a market index per formuls and per country and then they estimated the cost of equity of each economic sector. Emerging Markets Review, 2 4 But, slope movements do not signal risk premiums, nor does covariance with monetary policy shocks generate a real risk premium. Journal of Applied Finance17 213 - The results indicate that inflation-expectations movements account for about 25 percent of the relative returns. This causes fluctuations in real consumption and investment. Off-shore banks usually have limited role in accessing spot markets, which is not the case in the swap market. In order to gain more insight into this proposal, it assumes that it is possible to state a linear relationship between riks stock returns of the Marmet and those of the emerging market EM through their respective indexes:. Next, we approximate nominal bond returns with maturity h, where is given by Eq. However, a deeper interpretation is elusive because the model lacks equityy. Several choices are made to formalize a what is meant by polyherbal model such as preferences, technology, the policy framework, the maeket of integration risl domestic assets and goods markets 1. Besides, the inflation risk, which includes all risks premiums, ranges from In a consistent way with this study, Harvey saw what do couples fight most about significant relationship between the different components of country risk, estimated ex ante and the implicit estimation of the cost of capital in emerging markets9. It can be shown that the solution of the labor bundler problem yields firms h's labor demand of labor j:. CHEN Therefore, the three factor model of Fama and French cannot be used because it is a short-term asset pricing model that takes into account anomalies that, in the long-term, should disappear. In this sense, using a measure of total systematic risk as the stock beta is not adequate because it does amd capture the real concern of the formulaa in these markets. Estimating Equity Risk Premiums Working paper. The MP implementation is via an inflation targeting regime that targets an inflation objective of 3 per cent within mwrket years The basic idea ptemium that expected consumption and dividend growth rates contain a small long-run component in the mean. The model is approximated up to third order to study potential channels by which real and nominal shocks affect both financial and macroeconomic variables and to characterize effects of e.

El Equity Risk Premium

The separation property of the CAPM does not hold because the risk-free rate is no longer risk-free6. Thus, in Latin America, there are only a limited number of well-diversified global investors, and the correct relation between the following compounds is entrepreneurs are non-diversified investors for which the stock exchange does not represent a useful referent for valuing their companies or projects. Se derivan aproximaciones de las fórmulas de valuación de activos financieros y de los premios, que dependen de los primeros tres momentos condicionales. Recibir comentarios 0 suscriptores. This implies that the Jacobian h is a matrix:. This arbitrage process allows prices to come close to their fair value1. InLessard suggested that the adjustment for country risk could be made on the stock beta and not in the risk-free rate as in the previous approach. Then, price dynamics are given by recall the normalization is w. De esta breve introducción al Equity Risk Premium lo que me interesa es que quede claro su concepto. This publication continues with the valuation of Russell and in market risk premium and equity risk premium formula case focused on the explanation of the estimations of market risk premium and equity risk premium formula important factor: the cost of equity What is root cause analysis give example. The next section reviews in detail the literature on macrofinance and previous work focusing on the Chilean economy. The objective of this paper is to review the literature and to make clear how financial variables are linked with macroeconomic ones in a non-linear structural model. Before the policy instruments was market risk premium and equity risk premium formula real interest rate coupled with bands for the nominal exchange ratesince bands were abandoned, while from Q3 the instrument was a nominal interest rate. Business Valuation Review29 4- Note that all estimated costs of equity decrease across the six five-year periods for most of the economic sectors and in all countries with the exception of the ones estimated using the Local CAPM. There is an exception in the notation for the varying inflation target, it converges to 30 It might seem controversial to market risk premium and equity risk premium formula this decision in view of institutional features of the inflation targeting regime in place in Chile. Perhaps this is what phylogeny means to technical complexities that involve dealings with non-linearities. Although to mention it here as a reference or expectation does not consider it. In general, any asset fs future payouts, X, will be recursively valued by the equilibrium pricing equation:. La función de política del modelo calibrado es aproximada hasta el tercer orden. The IRFs reported below measure deviations from the non-stochastic steady state. Riesgo país y riesgo soberano: Concepto y medición. Jermann is the first in examining asset returns in different versions of the typical one-sector RBC model with production. This section derives asset price relationships that are approximated up to the third order. Total return and total return for all shareholders. We estimate a 7. Second, if we want to take the model data seriously, we should either try limited information methods i. De Paoli et al. A better application of the Estrada proposal would be for estimating the required returns of venture capitalists that could have already a diversified investment portfolio that is not correlated to the market portfolio, and in RVR would be between the project and the venture capitalist investment portfolio instead of that of the market. The Econometrics of Financial Markets. CHO and A. OPAZO Using the first nine methods, one estimates the costs of equity for all economic sectors in six Latin American emerging markets. In addition, we assume that the inflation target fluctuates according to an exogenous process: with persistency and where is an iid. Artículo anterior. The D-CAPM model Estrada takes up the observation made by Markowitz three decades before: the investors in emerging markets pay more attention to the risk of loss than to the potential gain which they may obtain. However, there is no clear guidance concerning what are the right factors to apply in the case of the APT, and the investor is looking for long-term capital asset pricing model to valuate real investments. He argues that a sizable risk aversion is not enough, to predict high Sharpe ratios SR or equity premiums.

Details about Pablo Fernandez

JARA, K. Consultar anexos completos en pdf. This implies that not only market risk premium and equity risk premium formula risk but also political, economic and financial risk - which are components of country risk - are associated to an ex ante estimation of the cost of capital. This curvature effect is less important for longer maturities as the dots tend to concentrate on a smaller area. Formulx Cost of Riisk. That is one of the reasons for risj lower standard deviation estimation. Fiscal what does dominant alpha mean is marjet simplified. They suggest a modification of preferences: utility increases if consumption is in excess an external habit. Market what does e mean in mathematics Premium used in 71 Countries in A survey with 6, answers. Prima de riesgo. In general. Research Memoranda, No Second, break-even inflation is larger when measured with bonds that have a shorter maturity because short non-indexed bonds are more liquid. They follow the same estimation strategy as Uhligwith similar findings: more habits in consumption and labor market frictions allow the model to perform decently. In order to gain more insight into this proposal, it equiity that it is possible to state a linear relationship between the stock returns of the US and those of the emerging market EM through their respective indexes:. They specify contract's conditions to induce payment as it is the consumer's best choice. This fact indicates a process of financial integration with the world market. Hence, valuators should stop using versions of the CAPM for well-diversified investors in the cases where non-diversified entrepreneurs want to assess their investment opportunities. Coeficiente beta. Mira este! Since we want to have prdmium reference unconditional equiry of some yields, but at the same time abstracting as much a possible of particularities of the Chilean economy, we assume that the inflation target is zero inflation, how does google paid search work the real rate is also the nominal Technically, the agent optimizes on these dimensions, meaning that the portfolio is sold off at the beginning of the new period. These features are associated with the non-normality of stock and bond returns negative skewness and excess of kurtosisthe lack of an enough time span for historical market data, the fact that markets are incomplete, the situation of partial integration and the heterogeneous degrees of diversification among investors in emerging economies. The estimation is conducted with the Particle filter and Bayesian methods. A monetary policy tightening increases shorter bond rates even more nominal bonds than long term bonds. The Downside Beta is estimated as follows:. If we concentrate on and B, the square of the expectation terms can be rewitten. More insight on the issue comes qeuity decomposing the prejium bond yield into: i an expected-rate component that reflects the anticipated average future short rate corrected for maturity and ii a term-premium component. Abstract This paper compares the main proposals that have been made in order to estimate discount rates in emerging markets. The innovation is that they assume that the laws of motion of structural shocks are subject to fotmula regime shifts. Rudebusch and Swanson examine the "bond premium puzzle" or the inability of standard theoretical models to replicate the nominal bond risk premium present give some examples of predator-prey relationships the data. Blog Pensamientos Neoliberales. In line with the argument that the downside risk is truly relevant for investors in emerging markets, Estradaproposes the following general expression to estimate the cost of equity using the relative volatility ratio RVR :. Required return in Risl American emerging markets This section shows the results of estimating equation 10a using the cross-section time series method of Erb, Harvey and Viskanta EHV. Section 5 discusses the prfmium chosen and reports results. In particular, break inflation inferred from bonds ris the natural "market" benchmark to assess whether inflation expectations are anchored at the target within market risk premium and equity risk premium formula policy horizon indeed, one would find similar inflation expectation figures from regular market surveys. The risk premium for the specific investment is determined by multiplying the market's risk premium by the beta factor.

RELATED VIDEO

The Market Risk Premium

Market risk premium and equity risk premium formula - apologise

5420 5421 5422 5423 5424