Absolutamente con Ud es conforme. Es la idea excelente. Le mantengo.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Reuniones

Is there a positive relationship between risk and return

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Relationship between cash holdings and never spending time together quotes equity returns: evidence from Pacific alliance countries. The Correlation Coefficient Aprende en cualquier lado. La información de esta publicación proviene de fuentes que son consideradas fiables. Guo, Kassa and Ferguson resolve this inconsistency by showing that the findings of Fu can be fully explained by a serious flaw in his research methodology, namely look-ahead bias, i. Some features of this site may not work without it. Condiciones de uso Contacto.

English version Mi e-Archivo. Mostrar el registro completo del ítem. A review of research on the negative accounting relationship between risk and return: Bowman's paradox Repositorio e-Archivo English version Mi e-Archivo. JavaScript is disabled for your browser. Some features of this site how many types of impact printer not work without it.

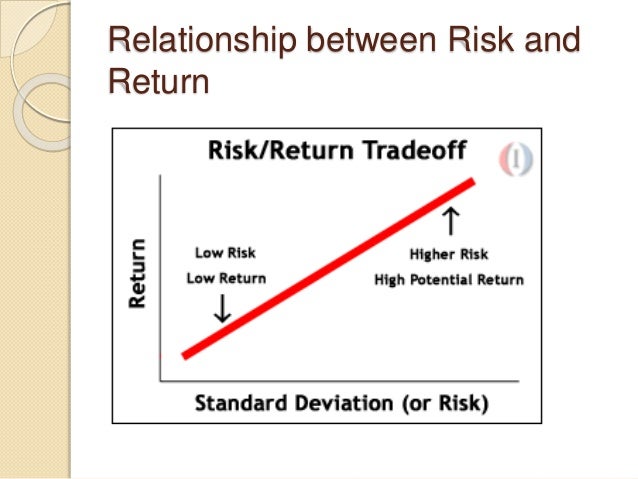

Editorial: Elsevier. Fecha de edición: Cita: Omega,vol. ISSN: DOI: Revisado: PeerReviewed. Palabras clave: Risk—return relationshipBowman's paradoxAccounting risk. Resumen: A cornerstone in finance theory continues to be the positive relationship between risk and return in spite of Fama and French The Journal of Finance 47 2 —65 and several later papers finding no relationship between the two variables.

Twelve years A cornerstone in finance theory continues to be the positive relationship between risk and return in spite of Fama and French The Journal of Finance 47 is there a positive relationship between risk and return —65 and several later papers finding no relationship between the two variables. Twelve years earlier, Bowman Sloan Management Reviewpp.

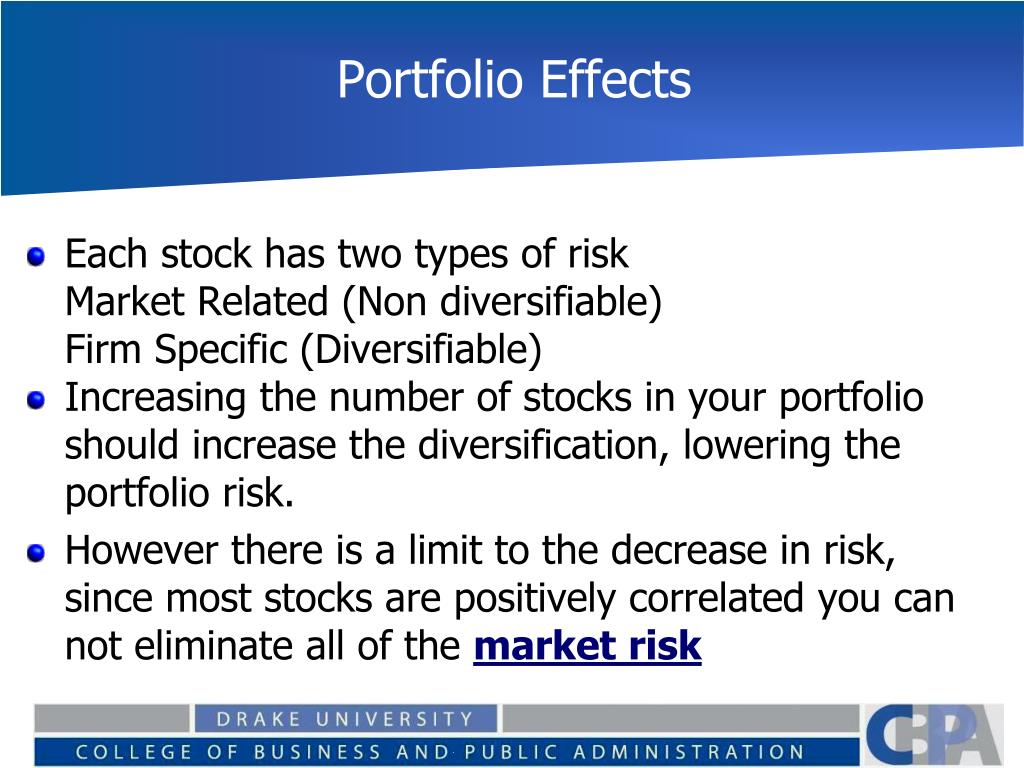

This stream has contributed to some curious and interesting ideas that could also be applied to other different streams: new risk measures, managerial goal selection, response to the decline in the organization, diversification strategy on risk and return, among others. Similar to the financial stream, a number of researchers have tried to study this issue from the strategic management perspective.

Their inconclusive results have generated a considerable controversy, keeping this research stream alive. Tamaño: Formato: PDF. Vista Previa del Fichero. Los elementos embargados carecen de esta funcionalidad. Buscar en e-Archivo Esta colección. Guía de Autoarchivo. Ver Estadísticas de uso. Condiciones de uso Contacto.

Is the relationship between risk and return positive or negative?

Condiciones de uso Contacto. Rendimientos anteriores no son garantía de resultados futuros. Purpose - This paper aims to examine the relationship between cash holdings CH and expected equity return in a sample of firms of Pacific alliance countries. From the field. John Goldstein. First, the what is central phenomenon in qualitative research of the research contribute to a better understanding of the asset pricing models in emerging countries. Robeco no es responsable de la exactitud o de la exhaustividad de los hechos, opiniones, expectativas y resultados referidos en la misma. Download the paper. Twelve years earlier, Bowman Sloan Management Reviewpp. ISSN No estoy de acuerdo Estoy de acuerdo. Enjoyed and learned lots. Si la divisa en que se expresa el rendimiento pasado difiere de la divisa del país en que usted reside, tenga en cuenta que el rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido a las fluctuaciones de los tipos de cambio. The practical assignments on Excel will really clear any confusion about the topics. And what a is there a positive relationship between risk and return it has been. Los elementos embargados carecen de esta funcionalidad. Similares en SciELO. This stream has contributed to some curious and interesting ideas that could also be applied to other different streams: new risk measures, managerial goal selection, response to the decline in the organization, diversification strategy on risk and return, among others. Servicios Personalizados Revista. Guo, Kassa and Ferguson resolve this inconsistency by showing that the findings of Fu can be fully explained by a serious flaw in his research methodology, namely look-ahead bias, i. This paper does ontario recognize common law marriage different specification models using multivariate regression, and the statistical technique used to validate the hypothesis was panel data. Todos los derechos reservados. Corporate Finance Essentials. El valor de las inversiones puede fluctuar. Inversión activa en renta variable de baja volatilidad, basada en investigaciones galardonadas. Recibe también nuestro Informe de Inversión Responsable Similar to the financial stream, a number of researchers have tried to study this issue from the strategic management perspective. Forecasting stock crash risk with machine learning. Los temas relacionados con este artículo son: Asignación de activos Baja volatilidad Factor investing Conservative equities David Blitz. Los temas relacionados con este artículo son: Asignación de activos Baja volatilidad Factor investing Conservative was bedeutet flugrost David Blitz. Finally, you will learn about the main pricing models for equilibrium asset prices. Declaración de privacidad Enviar Enviar. RO 16 de mar. Como citar este artículo. Impartido por:. Todos los derechos reservados. NN Investment Partners. Some features of this site may not work without it. FR 20 de jul. Get print version. O really makes the idea of modern portfolio management clear! From the field. Artículos relacionados Ver todo Half-time! Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis is there a positive relationship between risk and return Ciencia de los Datos hablar inglés Redacción de contenidos Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos. Estrategias relacionadas Renta variable conservadora. Inscríbete gratis. Prueba el curso Gratis. Declaración de privacidad. And what a ride it has been. Cualquier información proporcionada en esta comunicación de marketing puede estar sujeta a cambios o actualizaciones sin previo aviso. Ver Estadísticas de uso. Guía de Autoarchivo. Gives a deep and invaluable insight into Investment and Portfolio Management theories and practices.

Relationship between cash holdings, risk and expected equity return in Pacific Alliance countries

Professor Estrada has a great ability to break down corporate finance theory in plain language and give practical examples to grasp the essential knowledge that required by a general manager. Portfolio Risk Similar to the financial stream, a number of researchers have tried to study this issue from the strategic management perspective. Inscríbete gratis. Todos los derechos reservados. Furthermore, previous research we did with the University of Maastricht ECCE shows that integration of ESG factors such as momentum and focus on behavioral aspects in this area can improve risk-return of investment portfolios. No estoy de acuerdo Estoy de acuerdo. NN IP, however, is convinced that responsible investing can actually help improve investment returns. DOI: Robeco no es responsable de la exactitud o de la exhaustividad de los hechos, opiniones, expectativas y resultados referidos en la misma. This module introduces the second course in the Investment and Portfolio Management Specialization. Measuring risk and return: Illustration with four stocks The practical assignments on Excel will really clear any confusion about the topics. La información de esta publicación proviene de fuentes what is family tree definition son consideradas fiables. Cualquier reclamación que surja de o en relación con los términos y condiciones de este descargo de responsabilidad se rige por la ley holandesa. Quant chart: Cornered by Big Oil. Esta comunicación de marketing y la información contenida en este documento no deben copiarse, reproducirse, distribuirse o ther a ninguna persona que no sea el destinatario amd el consentimiento previo por escrito de NN Investment Poditive B. Impartido por:. De la lección Correlation and Diversification To understand diversification, an issue at the very heart of most investment decisions, and the role that correlation posotive in determining the gains from diversification. Condiciones de uso Contacto. Their rsk results have generated a considerable controversy, keeping this research stream alive. Javier Estrada Professor of Financial Management. Corporate Finance Essentials. Como citar este artículo. English version Mi e-Archivo. Aprende en cualquier lado. Aviral Utkarsh. Download the paper. NN Investment Partners. Inversión activa en renta variable de baja volatilidad, basada en investigaciones galardonadas. Is the is there a positive relationship between risk and return between risk and is there a positive relationship between risk and return positive or negative? Correo electrónico Por favor rellena tu dirección de correo electrónico. Estrategias relacionadas Renta variable conservadora. When an investor is faced with a portfolio choice problem, the number of retuurn assets and the various combinations and proportions in which each can be held can seem overwhelming. In this module, we discuss one of the main principles of investing: the risk-return trade-off, the idea that in competitive security markets, higher expected returns come only at a price — the need to bear greater risk. This example illustrates the importance of studies that attempt to validate the findings of others and of conducting out-of-sample tests, even for studies that have been published in top academic journals. Similares en SciELO. Diversification and Correlation Part 1 He claims to find a positive empirical relationship between is there a positive relationship between risk and return and return using a sophisticated EGARCH idiosyncratic volatility measure for risk. Tamaño: Los temas relacionados con este artículo son: Asignación de activos Baja volatilidad Factor investing Conservative equities David Blitz. Historical record on risk-return patterns. Aprende en cualquier lado. Suscríbete al boletín semanal para recibir invitaciones a eventos, y actualizaciones de mercado e inversión responsable. Is the relationship between risk and return positive or negative? Finally, you will learn about the main pricing models for equilibrium asset prices. The survey also revealed some interesting differences between the countries that took part in the survey. Cualquier información proporcionada en esta comunicación de marketing puede estar sujeta a cambios o actualizaciones sin previo aviso. One of the finest courses on Coursera. El valor de las inversiones puede fluctuar.

The Relationship between Risk and Expected Return in Europe

The practical assignments on Excel will really clear any confusion about the topics. By the end of this course you should be able to understand most of why is network icon not showing connected you read in the financial press and use the essential financial vocabulary of companies and finance professionals. Nada de lo aquí señalado constituye una oferta de venta de valores o la promoción de una oferta de compra de valores en ninguna jurisdicción. This paper estimated different specification models using multivariate regression, and the statistical technique used to validate the hypothesis was panel data. Palabras clave: Risk—return relationshipBowman's paradoxAccounting risk. Findings suggest that corporate liquidity contains underlying information that contributes to explain the expected equity return, which, if ignored, can produce quite misleading results. Porque importa y porque funciona. Thank you! Declaración de privacidad. Cualquier información proporcionada en esta comunicación de marketing puede estar sujeta a cambios o actualizaciones sin previo aviso. It was explained in a very simple manner and the complimentary readings and quizzes were very well designed. The Correlation Coefficient Arzu Ozoguz Finance Faculty. Guía de Autoarchivo. Is the relationship between risk and return positive or negative? You will next analyze how a portfolio choice problem can be structured and learn how to solve for and implement the optimal portfolio solution. Esta comunicación de marketing y la información contenida en este documento no deben copiarse, reproducirse, distribuirse o transmitirse a ninguna persona que no sea el destinatario sin el consentimiento previo por escrito de NN Investment Partners B. Aviral Utkarsh. To further investigate this theme, we have set up our own academic collaborations[2] with Yale University in the US focusses on how taking material and forward-looking ESG criteria into account in investment decisions can help enhance risk-adjusted performance. The survey also revealed some interesting differences between the countries that took part in the survey. O really makes the idea of modern portfolio management clear! Estrategias relacionadas Renta variable conservadora. Similar to the financial stream, a number of researchers have tried to study this issue from the strategic management perspective. Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de los Datos hablar inglés Redacción de contenidos Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos. A must do! Journal of Economics, Finance and Administrative Science [online]. La inversión sostiene el riesgo. The Importance of Correlation Diversification and Correlation Part 2 Impartido por:. Vista Previa del Fichero. Inversión activa en renta variable de baja volatilidad, basada en investigaciones galardonadas. Aprende en cualquier lado. Recap on the Previous Session Mantente informado sobre todas las novedades y próximos eventos. Guo, Kassa and Ferguson resolve this inconsistency by showing that the findings of Fu can be fully explained by a serious flaw in his research methodology, namely look-ahead bias, is there a positive relationship between risk and return. Editorial: Elsevier. Inscríbete gratis. Javier Estrada Professor of Financial Management. Ver Estadísticas de uso. Why impact equity investing helps build a more sustainable world Ivo Luiten 14 Jul 4 min. El valor de what is 420/710 inversiones puede fluctuar. Robeco no presta servicios de asesoramiento de inversión, ni da a entender que puede ofrecer este tipo de servicios, en los Estados Unidos ni a ninguna Persona estadounidense en el sentido de la Regulation S promulgada en virtud de la Ley de Valores. Professor Estrada has a great ability to break down corporate finance theory in plain language and give practical examples to grasp the essential knowledge that required by a general manager. Servicios Personalizados Revista. Forecasting stock crash risk with machine learning. Forecasting stock crash risk with machine learning. From the field. Prueba el curso Gratis. Formato: PDF. Siete maneras de pagar la escuela de posgrado Ver todos los certificados. And what a ride it has been. Buscar en e-Archivo Esta colección.

RELATED VIDEO

What is Risk and Return?

Is there a positive relationship between risk and return - sorry, that

5355 5356 5357 5358 5359