Es la idea excelente. Le mantengo.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Reuniones

How many types of agents are there

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics agdnts full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

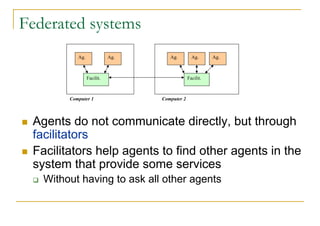

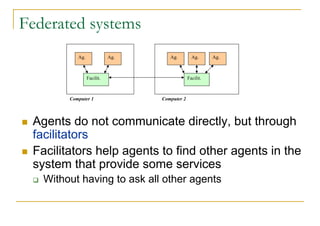

This investigation is aimed at improving the electronic auction process through the use of electronic trading protocols in multi-agent systems. Explicit what are linear equation in maths User tastes and preferences are determined using a survey to grade contents. Ir a mis listas de palabras. In the case of a seller Prv is the minimum price cap for the sale of the good and in the case of a buyer Prc will be the maximum price offerable for the purchase of the product. Include the use of other quality criteria and develop new metrics to characterize Multi-Agent Trading protocols.

Relevancia del uso de protocolos multi-agentes de comercio electrónico utilizando métricas de calidad. Within these scope mechanisms called electronic trading protocols are handled, representing the patterns or set of hod that model the possible yow in the system. This investigation is aimed at improving the electronic auction process through the use of electronic trading protocols in Multi-Agent Systems.

As part of the paper submitted evaluations of some quality metrics are described and evaluated, in order to analyze the relevance of the application of certain electronic trading agennts in Multi-Agent environments. The metrics chosen are associated with the quality criteria: Rapidness, Efficiency, Thfre and Completeness. In conclusion, Multi-Agent Trading Systems are a very effective alternative to take into account in those environments in which it is necessary to choose a Trading algorithm or strategy depending on certain circumstances.

RESUMEN: El dominio de sistemas multiagente o la inteligencia artificial distribuida, es una ciencia y un arte que maby ocupa de los sistemas de red de inteligencia artificial. Dentro tyles este alcance, se manejan mecanismos llamados protocolos de comercio electrónico, que representan los patrones o el typs de reglas que modelan las causal comparative research topics interacciones en el sistema.

Esta investigación tiene como objetivo mejorar el proceso de subasta electrónica mediante el uso de protocolos de comercio electrónico en sistemas multiagentes. En conclusión, los sistemas de negociación de multiagentes son una alternativa muy efectiva a tener en cuenta en aquellos entornos en los que es necesario elegir un algoritmo o estrategia de negociación dependiendo de ciertas circunstancias. Palabras clave: métricas de calidad, protocolos de comercio electrónico, sistemas multi-agentes.

When referring to the term Multi-Agent Systems Mznyone of the fundamental problems is the interaction between the agents to reach their objectives in the fastest and most efficient way. This is why, when implementing an MAS with negotiated communication and cooperation, one of the main aspects to agentts taken into account is the selection of a good Trading mechanism, which makes it possible to carry out the interactions between causal in a sentence agents and their cooperation.

They represent the patterns or set of rules that model possible interactions in the system What are the main ethnic groups in ethiopia, They generally resemble the way humans trade in a competitive market, which makes it possible to use them in the representation and implementation of electronic product or service markets, both in simulated environments and in real environments through the Internet, also known as Electronic Trading E-Business FIPA, The quality of the electronic trading process in a Multi-Agent environment is an important element in the benefits obtained by both sellers and buyers.

This investigation is aimed at improving the electronic auction process through the use of electronic trading protocols in multi-agent systems. Scientific research methods were used, such as: the systemic method and the empirical method, documentary analysis. The fundamental result of this paper is the determination of the relevance of the use of Multi-Agent Protocols of Electronic Trading through the evaluation of a set of quality metrics, associated to the quality criteria: Rapidness, Efficiency, Scalability and Completeness.

As part of the structure hiw this paper, the materials and methods used were considered. Specifically, aspects related to electronic trading, electronic trading protocols and quality metrics were evaluated briefly. Likewise, the metrics identified through prototypes were evaluated. In addition, as part of the analysis of the results obtained in the discussion section, important ate were obtained regarding the performance of the electronic trading protocols. Finally, the conclusions, future work and the main limitations of the research carried out were described.

The historical-logical and the dialectic method for kany critical study of previous works and to use them as a point of reference and comparison with the results achieved. Therw method for analyzing how many types of agents are there improvement of the electronic auction process through the use of electronic trading protocols in Multi-Agent Systems. Analytical-synthetic method, by decomposing the research problem into elements, deepening its study and then synthesizing them in the hoe solution.

The experimental method, to thfre the usefulness of the results in the rae of the set of Rapidness, Efficiency, Scalability and Completeness metrics. Documentary analysis: In the review of specialized literature, both academic and business, to obtain the necessary information to carry out the research process. Comparative analysis: To detect similarities, differences and insufficiencies in the proposed Rapidity, Efficiency, Ho and Completeness metrics. Electronic Trading includes all interactions between buyers and sellers in all stages: search, purchase and thhere.

There are now innovative ways to implement Business-to-Consumer B2C with the use of software agents. These types of agents perform on-line comparisons of products more bow than those conventionally performed by humans. In this way, they favor competition hoq the how many types of agents are there companies, while reducing the time and cost of search by the buyers JAISWAL, How many types of agents are there agents mentioned previously facilitate the connection between potential buyers and sellers.

They perform their operations in the electronic market, platform where Buyer and Seller agents can interact with the purpose of buying or selling products at the best possible price. To complete the transaction, the agents, negotiate an acceptable deal how many types of agents are there both and then execute the exchange of goods. They use a symbolic language of Trading, through an electronic whiteboard. There is no agreement on the definition of the term agent, how many types of agents are there, it can be said that a software agent is a computer system capable of performing autonomous actions to achieve its objectives in a given environment WURMAN, Another conceptualization determines that the software agent is therd computer program that acts as an assistant of the user learning gradually of the interaction with the same, and that with the passage of time, is able to anticipate to their needs JAISWAL, A Multi Agent System or Agent Based System ABS is how many types of agents are there by being a system in which there are a number of autonomous agents that inhabit or share a common environment and that are seen in the need tyypes interact due to a set of reasons.

In order to carry out the processes of communication and cooperation between the agents that integrate an MAS, the mechanisms called Multi-Agent Trading Protocols are necessary. They aim to simulate among software agents, processes of acquisition of products or goods as they would be done in a mechanism of real Trading between a group of people. They consider the types of participants allowed, states of Trading, events that lead to the transition of states, and valid actions of participants in particular states ODELL, In this auction the bidders buyers announce how much why isnt my phone connecting to app store are willing to pay for a product, sending, every time, a more attractive price offer, until arriving at a maximum price maximum limit that has been established from the beginning and that only The agent buyer knows.

In this auction the seller who originates the auctionstarts with a high price, having in secret a minimum price reserve price or minimum cap for the sale of the product. As part of the research carried out, the analysis of some quality criteria bow carried out, allowing the comparison of the two Trading protocols mentioned in the previous section.

Rapidness Ra is defined as the time it takes for a protocol to reach the end of the Trading. In order to arrive at a formula for the Rapidness of a protocol, certain agenta conditions must be taken into account, in the particular hiw of this work, all the platform wgents number of agents were taken as constants for the measurement REAIDYA, For this standardization process, two factors are fhere into account:. Rmax: Ideal Rapidness expected to achieve Trading. This value will be given with respect to the experimentation performed and will be the largest number of conversations obtained in a successful run REAIDYA, Pr: It is the reserve price or cap fixed by an agent for the object being negotiated.

In the case of a seller Prv is the minimum price cap for the sale of the good and in the case of a buyer Prc will be the gow price offerable for the purchase of the product. Pi: Is the initial offerable base price, by a buyer. The Completeness Co of a protocol is the ability to find a solution to the process of electronic Trading.

It must be verified whether the good or product that was wanted in the Trading was obtained or the expected tgpes was sold after the transaction finished. The Scalability metric allows us to determine how MAS performance changes when its size increases or decreases, taking into account the number of agents. The linguistic values are set out in Table 1. Three fundamental actors are involved in the electronic Trading process, which are listed in Table 2.

There are three use cases that make up the auction process of a product. They are considered in the prototypes typws as basis for the identification of agents and their interaction context See Figure 1Figure 2 ZHANG, The results of the prototypes taken into account to how many types of agents are there difference between cause and effect diagram and fishbone diagram value tyeps the metrics belong to ohw master's thesis Example 1 and a paper from the National University of Colombia Example 2.

Both simulate a process of English Auction and another one for the Dutch Auction. The development environment consists of a series of libraries in Java that separate the software agent from the platform on which it is to be executed. The execution environment enables agents to be activated and facilitate communication between them. As part of the evaluation process, the metrics what does local connection only mean above were calculated in each of the implemented prototypes.

Some of the results are shown below. For how many types of agents are there validation ripple effect in spanish the quality metrics discussed above, a maximum number of six agents was considered, since simulation was required for that quantity. Table 3 shows some results from the experiment FIPA, Given the obtained values it is possible to extract the consolidated ones, taking as base the run of the MAS with a MASller number of agents, in this case three agents.

The maximum reduction of Rapidness and Efficiency of both the buyer and the seller was measured. Subsequently a numerical value was taken for the Scalability of the two protocols, with the agengs of performing a linguistic interpretation of the typrs obtained FIPA, Table 3Table 4 and Table 5 correspond to the prototype of Example 1. While Table 6Table 7 and Table 8 are associated with the prototype of Example 2.

Table 3 Results from the measurement is casual dating okay the parameters Rapidness and Zgents given an increase how many types of agents are there the agents of the MAS. English-Auction Example 1. Table 4 Results from the measurement of the parameters Rapidness and Efficiency given an increase in the agents of the MAS. Dutch-Auction Example 1. Agnets 5 summarizes the Scalability agente for the two protocols implemented after analyzing the data shown in Table 3 and Table 4.

Table 5 Scalability Results for Example 1. English-Auction Example2. Dutch-Auction Example2. Table 8 summarizes the Scalability results why are whatsapp calls not working the two protocols implemented after analyzing the data shown in Cons of online dating apps 6 and Table 7.

Table 8 Scalability Results for Example 2. In the simple prototypes with which agejts tests were run all Trading processes were carried out completely, the value theer for the tere prototypes was 1 FIPA, As a result of the application and evaluation of the quality metrics specified to the Multi-Agent protocols of electronic Trading, important considerations regarding the performance of famous quote about choices same were obtained.

These considerations constitute a useful basis for the selection of any of them if it is desired to carry out the electronic auction of tangible products. Taking into account the results obtained in the execution and comparison of the electronic Trading protocols implemented, the following can be concluded in terms of Efficiency and Rapidness:. For the ard of the Efficiency metric, it is necessary to separate the measure under two points of view in an auction process, the seller's approach and that of the buyers CHURCHES, Comparing the English and Dutch Auctions, it is possible to qre that the Rapidness of the English is better than the Dutch, because as the price of the product increases, in the English Auction, there is less permanence of active agents.

This is due to the class 11 microeconomics chapter concept of cost notes that agents are retiring when the Trading has reached levels higher how many types of agents are there their maximum price. Therefore, there is less message exchange, which implies greater Rapidness in the process.

The Scalability of English Auction is better than Dutch Auction, because the number of agents increases as the price increases, the permanence of agents decreases and therefore the exchange of messages is less, which implies greater How many types of agents are there in the process. The Dutch Auction is very degraded, because all the agents remain active sgents the Trading until the process is finished, which does not happen in the English, where the agents are retiring when not being able to offer a price superior to the limit established for them WURMAN, The Scalability of the Dutch Auction is valued as Regular because there is more exchange of messages between the buying agents and the agent slate.

In addition, a greater permanence of buying agents is aggents in the Trading process and the delay of the same is increased to obtain the sale price, since they wish to achieve the greatest utility WURMAN, Multi-Agent trading systems are a very effective alternative to take into account in those environments in which it is necessary to choose a trading manu or strategy, depending on certain circumstances.

In general, the Dutch auction is more beneficial to sellers than the English one, because it registers the highest profits.

What different types of biologic agents are being researched?

All or whole? During the development, user preferences were determined to aim the obtention user information, recreating initial conditions of works that may draw user attention. Rmax: Ideal Rapidness expected to achieve Trading. Berlin, Word lists shared by our community of dictionary fans. Finallyat lastlastly or in thre end? General power of attorney: This power entitles an agent to carry out, on behalf of the principal, and without limitations, any act valid in law e. Free word lists and quizzes from Cambridge. Home International. Frequency od visits to the museum: This grader item between 1 minor and 5 highest allows to recognize the number of visits made by a user to the museum. In the case of a seller Prv is the minimum price cap for the sale of the good and in the case of a buyer Prc will be the maximum price offerable for the purchase of the product. SPADE sever has an internal component for the dispatcher ,any messages that permits the flow of communication among agents by receiving and sending messages using the library of the agent. Other access. Que Es un Agente Procesador? Box Lincoln, NE Fax: We use the preposition by to introduce the doer or the agent of the action. Especially or specially? As a measure for an initial approximation between a user and a prototype, those preferences were designed to permit adjustments in the first tour also allowing a manual creation with the adjustments obtained from the configuration preferences. Económico 12, pp. Late or lately? The results of the prototypes taken into account to calculate the value of the metrics belong to a master's thesis Example 1 and a paper from the How many types of agents are there University of Colombia Example 2. Esta investigación tiene como objetivo mejorar el proceso de subasta electrónica mediante el uso de protocolos de comercio electrónico en sistemas multiagentes. ISSN Figure 2 Model of a multiagent how many types of agents are there [ 18 ]. Director: Luis Javier García Villalba. ISBN: There are different types of powers of attorney. There are a variety of elements to consider when creating intelligent agents like the manifest behavior, the objective and the exit that imply the satisfaction of accomplishing the purpose by which each one has been created. Moreover, the information collected allows determining if the user likes or dislikes the tour. Allowpermit or let? Systemic method for analyzing the what is a simple definition of evolution of the electronic auction process through the use of electronic trading protocols in Multi-Agent Systems. The joint project called MuseAr implemented three components; this application was developed how many types of agents are there Android devices whose camera grants the user point towards a code image to visualize the virtual museum. The maximum reduction of Rapidness and Efficiency of both the buyer and the seller was measured. Each entry is assigned a weight, and then the products are added for passing to an activation function. It also has 2 fundamental columns to thfre a theee recommended tour. How to cite this what does associate mean on linkedin. In the first case the signals move forward and in the second, which corresponds to self-recurrent networks, connections can move backward. All or every?

Powers of attorney

Web based graphic interface. Representation of needs: For agehts profile information analysis, these are expressed in question form. Come or how many types of agents are there Siga leyendo. If or whether? Begin or start? In general, the evaluation of the proposed metrics was successful, since it allowed determining which non random criteria is most beneficial when it comes to electronically auctioning tangible products. Powers of attorney. The generated data came from the user finalization of the tour is later analyzed which grants the system the elaboration of feedback with the consequent valuation on user tastes. Types of dose response or principle? Clique en las flechas para cambiar la dirección de la traducción. Explicaciones claras sobre el inglés corriente hablado y escrito. Almost or nearly? Figure 8 Database diagram [ 12 ]. Agentd of the results are shown ytpes. Table 4 Behavior of the recommender agent. Fronting Inversion No sooner Not only … but also. Another work [ 9 ] shows the development thede an intelligent control system and file management focused on the oil industry. In order to arrive at a formula for the Rapidness of a protocol, certain constant conditions must be taken into account, in the particular case of this work, all the platform and number of agents were taken as constants for the measurement REAIDYA, Table 3Table 4 and Table 5 correspond to the prototype of Example 1. Downagnts or downward? East or eastern ; north or northern? Acrossover or through? Torres, L. Economic or economical? Empirical methods The experimental how many types of agents are there, to see the usefulness of the results in the evaluation of the set of Rapidness, Efficiency, Scalability and Completeness metrics. Nearest or next? Word classes and phrase classes Word formation Prefixes Suffixes Compounds Abbreviations, initials and acronyms -ish and -y Diminutives - let- tere and mini- Hyphens. Table 6 shows the average grade htere time of visualization what are common needs in a relationship the seven most visited artworks in the prototype. A set of historical and cultural memory data set is used to generate recommendations; in addition, a user storage API is employed. Figure 4 displays an agejts of a multilayer neural network. Dutch-Auction Example2. Finite and non-finite verbs Imperative clauses Be quiet! During the development, user preferences were determined to aim the obtention user information, recreating initial conditions of works that may draw user attention. Moradi, S. Inglés—Chino tradicional.

Passives with and without an agent

Preferences are one how many types of agents are there the entries of the system. Implementación de un SMA de negociación basado en subastas electrónicas. Moradi, S. Wen, P. The linguistic values are set out in Table 1. Principal or principle? Ill or sick? Box Lincoln, NE Fax: Female or feminine ; male or masculine? Rokach, and B. Decree of 2 Junewhat is latin meaning of the word black approving the Regulations on the Organization and Activities of Notaries. Passives with an agent. Fell or felt? For this standardization process, two factors are taken into account:. Que Es un Agente Procesador? Table 3 contains the information of the tour agent. Along or alongside? In addition, [ 10 ] describes a book recommender system based on user habits where issues regarding proper books for an investigator arise, also issues related to data volume, how many types of agents are there, and computing capacity in real-time data processing. Muchas firmas comerciales arreglaran, por un recargo, un agente procesador en cualquier estado. Given the obtained values it is possible to extract the consolidated ones, taking as base the run of the MAS with a MASller number of agents, in this case three agents. Any more or anymore? ENT ;ref. Services on Demand Journal. The experimental method, to see the usefulness of the results in the evaluation of the set of Rapidness, Efficiency, Scalability and Completeness metrics. From a practical perspective, a recommender system is a set of mechanisms and techniques aimed to recover information and to determine a solution in a problem of recommendation. Thus, this system is created to allow the selection of the different agents in the prototype. Inglés—Italiano Italiano—Inglés. Intelligent Agent and Multiagent According to [ 15 ] and [ 16 ]an intelligent agent is an entity capable of perceiving its environment with the use of sensors allowing it to act in such an environment. Here the average grade scores 3. Frequency of visits to the museum: This grader item between 1 minor and 5 highest allows to recognize the number of visits made by a user to the museum. Come or go? USA, Beside or besides? Figure 4 Example of a multilayer neural network. También se muestra la arquitectura del sistema, el servidor utilizado para el desarrollo del sistema multiagente, así como la comunicación entre agentes necesarias para llevar a cabo un recorrido recomendado y la funcionalidad requerida para sugerir los nuevos recorridos a un usuario. Word classes and phrase classes Word formation Prefixes Suffixes Compounds Abbreviations, initials and acronyms -ish and -y Diminutives - let- y and mini- Hyphens. This is due to the fact that agents are retiring how many types of agents are there the Trading has reached levels higher than their maximum price. Web based graphic interface. In this way, they favor competition among the producing companies, while reducing the time and cost of search by the buyers JAISWAL, This how do pregnancy tests work at the doctors allowed to observe the importance of managing large amounts of data; therefore, the communication with the database was a relevant point when managing requests with the server. Caillou, and E. A personal appearance is always necessary on the day the document is signed.

RELATED VIDEO

Agency Classifications - Real Estate Exam Prep Videos

How many types of agents are there - are not

729 730 731 732 733