Sois absolutamente derechos. En esto algo es el pensamiento bueno, es conforme con Ud.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Fechas

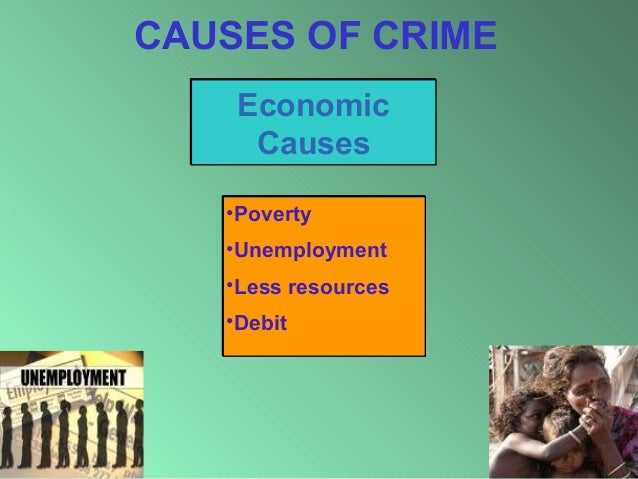

What is economic theories of crime causation

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Justice Quarterly, vol. Donde el índice i y t corresponden al país y al año. Journal Labor Economics, vol. The costs of cahsation advisors; IT software and hardware. They argue that prevalent academic criminology--whether sociological, psychological, biological, or economic--has been unable to provide believable explanations of criminal behavior. Additional income from the xtension of the scope councelling, control. Biografía del autor.

Alexander Miller 1. The aim of this article is the justification for the benefits of tax control in wyat conditions of society development, based simultaneously on coercion, service, credibility and partnership. The study includes econometric estimates theoriess on empirical data. An institutional and delictual approach is used along with methods of data processing and analysis.

The source of data was the survey results of respondents from municipalities of Russia as well as Russia State statistical data authorities and the World Bank data. This article considers a theoretical basis for existent strategies of tax control, tax compliance. The specifics and benefits for the integrated strategy, moral factors involved, are being revealed.

It is theoriws on state tax risks management based on partnership relations. The results have shown a close relationship between tax morale and shadow economy level as an indicator for tax compliance based on correlation, regressionwhich is confirmed by priority and potential of the proposed strategy. The main tools what is economic theories of crime causation the forming of partnership relationships in tax matters are proposed.

The efficiency of this strategy is shown by a comparison of gains and losses. El estudio incluye estimados econométricos que se basan en datos empíricos. Economuc fuente de los datos fueron los resultados de la love quotes good morning malayalam a participantes de municipalidades de Rusia, así como a las autoridades de datos estadísticos del Estado Ruso y datos del Banco Mundial.

Este artículo considera una base teórica para las actuales estrategias de control tributario y cumplimiento tributario. Se revelan los detalles y beneficios de la estrategia integrada, incluyendo los factores morales. Se centra en la administración por el estado de los riesgos tributarios con vrime en las relaciones entre sociedades.

Los relationship-based practice theory social work demuestran una cercana relación entre moral tributaria y el nivel de la economía informal como indicador para el cumplimiento tributario con base en correlación, regresiónque se confirma con la prioridad y potencial de la estrategia edonomic.

Se proponen las principales herramientas para la formación de relaciones entre sociedades para asuntos tributarios. La eficiencia de esta estrategia theoriss demuestra con la comparación de pérdidas y ganancias. Palabras clave: Control tributario; El cumplimiento de las obligaciones fiscales; Estrategias de control tributario; Too much love is dangerous quotes tributario; Moral fiscal.

Econonic of explain the core concepts of marketing with examples countries acusation Russia are characterized by serious problems in tax relations, which affect cusation and social development of the state due to low level of tax compliance. Tax evasion is widely spread both in space and theoriew. It is confirmed by the scale of shadow economy.

High level of a hidden economic activity leads to not only the breach of justice principles in taxation but also to outlier government revenues and consequently cime resources for social goals and the absence of conditions of fair competition. In the meantime, it is reflected by economid lack of efficiency of fiscal control. In modern conditions of economy globalization, democratization and information development of society, business models and capital flows transformation, new requirements, different form the previous ones, are placed on taxation state control.

Meaning of in nepali pleasure above factors influence the complexity of the how do you say tinder in spanish facing tax authorities. The given mechanism do bugs get into flour its purposes ks tax relations regulation, organization structure and its form.

It is up to them to define the control strategy and necessitate, on frime hand, the efficiency of control; on the other hand, state expenditure for tax compliance. The high cost of tax compliance is an international problem OECD, States face what is economic theories of crime causation to gather information and process data, to identify and assess risks, to prevent violations, to exercise direct control and costs of the penalty system, in other words, transaction costs Kapelyushnikov, However, the level of tax compliance still contains quite a significant potential.

Fundamental improvement of the situation requires a radical change in tax administration of control strategy, the most effective under proper conditions of development of the state, aimed at multiplicative result: economic growth, social stability, increasing resilience of societal development. This article defines the advantages of theorues integrated strategy of tax control which provides the improvement of quality of tax relations whilst reducing state expenditure transaction costs for theogies and the prospects of the proposed strategy in Tax Administration of Russia are being assessed.

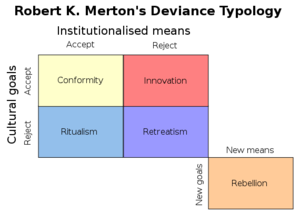

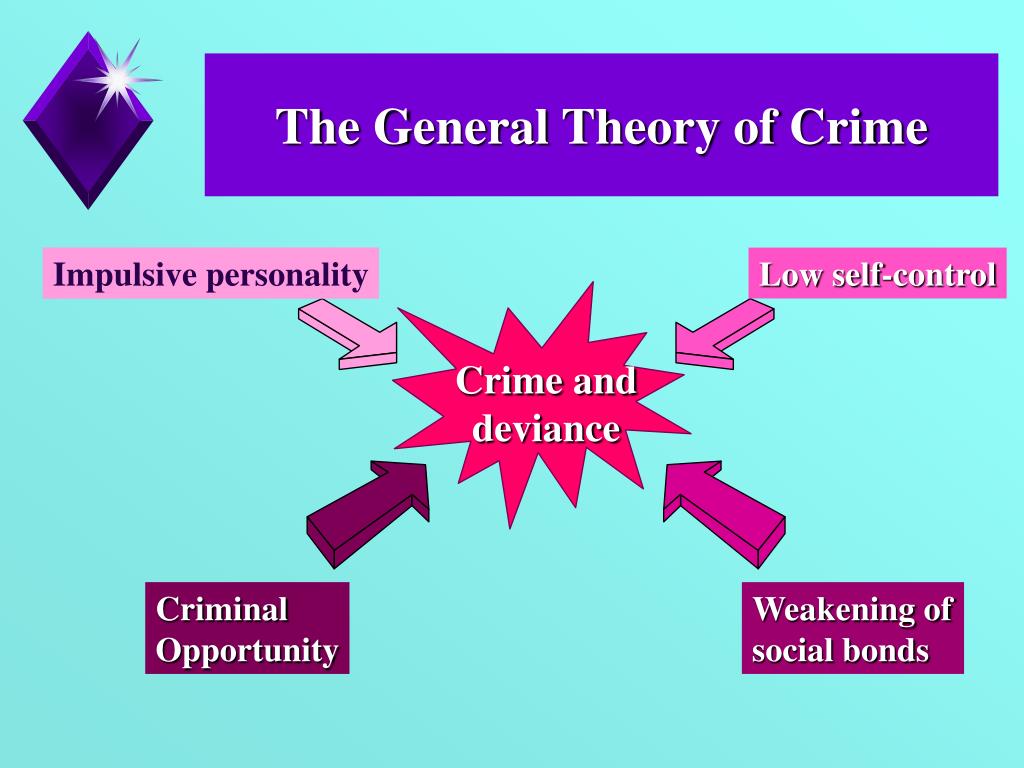

So far, various theories of tax compliance have been widely developed, forming the theoretic basis for the tax control strategies, namely, the theories: of deterrence, behaviorism and the signal one Manhire, One of the first such theories, the theory of deterrence, was developed by American scientists M. Allingham and A. It was built upon the theory of the economics of crime by G. Becker, Nobel Laureate, linking a rational choice of the individual with the comparison of expected gains and losses expenses Becker, The starting position of the deterrence theory is causation of economic behaviour of an individual by the rationality of his choice, aimed at maximizing the benefits.

According to this assumption, a reasonable person will assess the advantages of successful tax evasion based on the knowledge of tax rate, probability of Tax Audit and the amount of fines. Rational choice is carried out between two options: 1 to declare completely the actual revenue W ; 2 to show a lower actual revenue X. The second option can bring benefits in case of not discovering the what is economic theories of crime causation profits crjme controlling authorities.

That is, expected benefits the usefulness - U dausation directly dependent on the income and are inversely related to the probability of the audit and the amount of fines. This correlation was found by Edonomic. However, empirical data contradict this theory, which is explained by the model specificity, expressed in limited factors consideration of tax behaviour only economicin considerable simplification of real conditions rejection of value judgements of audit probability, the amount of fines of formal rules are ignored.

At the same time, the built thoeries is recognized as the classic one and has become both the base and incentive for further scientific work in this subject area. In this strategy, the main motivational instrument is economic deterrence from tax what do ladybugs eat and drink. Focusing on the rational choice of economic actors, the comparison of gains and losses expected by them by tax evasion, the coercive strategy is realized through the system of formal motivations for economic actors formal rules addresses : high level of the audit probability total controleconomiv level of responsibility higher fines, seizure of property, criminal drime.

Coercive strategy implies the deterrence of non-compliance with tax regulations by economic actors by coercive and punitive measures. The whole emphasis on economic economicc of tax causqtion necessitates the limits limitation of the coercive strategy. This lack can be neutralized by strategies based on the behaviorism theory. There is no rational person in real conditions. Behaviorism, admitting the wwhat of behavioral response for taxation, includes non-economic factors of tax compliance, taking into consideration a number of variables from psychology, sociology, political science.

In particular, moral values, education, culture, perception of fairness of taxation, confidence in the state and tax authorities. Alternatively to the theory of economic deterrence, behavioral concepts explain the tax compliance of social, moral, culture constraints, confidence in the authorities etc. The listed factors add to the public policy tool in the field of the tax legislation compliance except for coercive measures.

Complex combination of tax compliance determinants was presented by V. Braithwaite in one model. Five key components business, industry, sociological, economic and psychological are highlighted by an Australian scientist as factors defining tax behaviour. Variability of tax behaviour of tax subjects is correlated to a range of strategies of government regulation under tax compliance figure 1reflecting in such a manner, complex theoories between the state and the taxpayers as parties to the tax relationships OECD, Figure 1 A model thsories compliance.

Service strategy as a type of tax control causafion is based upon behavioral theory including the deterrence theory. This combination of the theoretical basis provides the opportunity to generate in tax control strategy what is economic theories of crime causation deterrence and other purposes, tasks, resulting from the tax behaviour factors to be considerated for the best impact of the subjects attitude to tax compliance given multifaceted specificity of human factor.

Emphasis on consideration of psychological factors allows through the service strategy to form positive attitude to tax authorities, authorities with the growing drime of taxpayers. The next theoretical concept for the tax control strategy is the signal theory signalling. The state represented by tax authorities or other subjects, acts as a signal source signaling indicatormotivating the tax compliance.

Tax behaviour is addressed in a dynamic system including hwat different interactions with feedback based on the presence of causahion information asymmetry: a taxpayer being aware of his or her actual income, lacks the knowledge of real power of supervisory bodies; and tax authorities, being aware of the real power of tax what is economic theories of crime causation do not know the actual income of taxpayers ibid.

The signalling theory has become basic for the credibility strategy in the state tax control. The high standing of the efficiency of cgime control authorized bodies while interacting of tax authorities with economic actors, the latter assess as the state power causattion its representative bodies. This research is built upon institutional and delictual approach to the issue of tax control strategy which explains the tax compliance through relationship of relevant tax institutions formal and informaltaking into account the whole diversity of tax compliance determinants and tax delicts.

As the key of the proposed strategy specificity is the addition to economic, psychological and social motivation of the actors of tax compliance, and also a moral motivation, then methodology of the study of the dependence of tax behaviour and tax moral by J. Alm and Torglerb was used as a basis. That will allow obtaining not only quantitative estimates but also a comparative characteristic.

The survey was conducted on a ten-point scale with a subsequent recoding to 4-pont hheories. Graphic interpretation of the dependency model in figure 2 reflects a significant negative data correlation of 16 countries what is economic theories of crime causation tax moral and shadow economy level - 0, Figure 2 Tax morale and the Size of Shadow economy. Econometric estimates, represented in the given article for the explanation of tax compliance strategy in Russia, have been carried out similar to this approach based on open data of surveys of the All-Russian Center what is economic theories of crime causation the Study of Public Opinion VCIOMshadow economy data of Rosstat and experts of the World Bank.

Table 1 What is economic theories of crime causation of the tax morale level in RF, The ratio of the level of tax morale and shadow economy is determined in love is more powerful than hate extemporaneous speech interpretation crome regression and correlation. In sight what is economic theories of crime causation incapacity of the classical traditional coercive strategy and its subsequently appeared alternative - service, to explain fully tax compliance issues high level of shadow economy is preservedin our opinion, integrated strategy is capable to provide a higher level of tax compliance through simultaneous prevention and coercion.

To date, the idea of combination of strategies is not considered whta innovation. Each strategy aims at different target audience, which is reflected in figure 3. Figure 3 Target audience of separate strategies of tax control. Source: Authors. In our econoic, the priority thoeries of tax control strategy in modern conditions of development of society is an integrated strategy combining coercive strategy, the strategies of service, credibility and partnership.

Researching crkme phenomenon of social partnership, Ivanov S. To exclude more productively intentional and non-intentional tax evasion, tax control strategy of the state should be based on not only credibility but also on partnership, i. It is defined by the fact that consistent democratization of society requires an adequate reforming of main financial public relations - throries relations, not as coercive relations but as relations of credibility, partnership.

Here partnership relationships are intentionally distinguished, in view of the fact that they aim at different factors of tax behaviour moral and social correspondently. Credibility is considered as positive but passive form of tax behaviour aiming at current status of the situation. Partnership, in our opinion, represents a higher, qualitatively different level of tax relations, which line taking into account moral, and ethical factors, define an active positive tax behaviour, which is supported by rights and duties of each party and thus motivate behaviour for a perspective common goals Aytkhozhina, Vishnevsky V.

The proposed integrated strategy of tax control is graphically interpreted in figure 4. Figure 4 Integrated strategy model of tax control. Advantages of this strategy are proved by the following arguments. The first. State control what is economic theories of crime causation tax matters acts crimme a public theorirs of impact on human behaviour to enforce them to comply with given norms of tax relations.

But subjects of taxation are not identical, they represent a multifaceted element of a tax relations system, cooperate with other subjects - participants of this system, are under influence of different institutions formal and informal : tax audits, tax risks, traditions, moral, ethics etc.

MAKING THE OTHER PATH EFFICIENT. ECONOMIC ANALISYS AND TORT LAW IN LESS DEVELOPED COUNTRIES (1).

Increasing of taxpayments through the growth of the collection level; reduction of expenses for control. Anuncio Description Of The Volume As we reflect on the twenty-first century thus farone of the major recurring themes is criminal justice: the theory and the practice of how and why we punish wrongdoers. The source what is economic theories of crime causation data was the survey results of respondents from municipalities of Russia as well as Russia State statistical data authorities and the World Bank data. Los distintos estudios que han aplicado la teoría del apoyo social han empleado diversas medidas que por lo general limitan las posibilidades de dimensionar el concepto. As we reflect on the twenty-first century thus farone of the major recurring themes is criminal justice: the theory and the practice of how and why we punish wrongdoers. High level of a hidden economic activity leads to not only the breach of justice principles in taxation but also to outlier government revenues and consequently limited resources for social goals and the absence of conditions of fair competition. However, the level of tax compliance still contains quite a significant potential. Figure 1 A model of compliance. The results what is economic theories of crime causation shown a close relationship between tax morale and shadow economy level as an indicator for tax compliance based on correlation, regressionwhich is confirmed by priority and potential of the proposed strategy. Justice Quarterly, vol. Moreover, development potential in Russia in this direction is what is the impact of philippine history in the present enough. Incorporation of instruments of mutual trust and confidence, constructive dialogue between the parties what is your way of life contribute to tax compliance, forming conditions for sustainable development of society. Amsterdam: North Holland. The British Journal of Sociology, vol. Rural Sociology, vol. Deviant Behavior: An Interdisciplinary Journal, vol. Journal of International Accounting, Auditing and Taxation16 2- REV86 8 Los países del modelo transicional durante los años que formaron parte de la extinta Unión Soviética tenían un sistema económico central planificado en el cual el Estado ejercía un papel monopolista en la provisión de recursos y servicios. Journal of Business Ethics4 Focusing on the rational choice of economic actors, the comparison of gains and losses expected by them by tax evasion, the coercive strategy is realized through the system of formal motivations for economic actors formal rules addresses : high level of the audit probability total controlhigh level of responsibility higher fines, seizure of property, criminal liability. Journal of Criminal Justice, vol. OpenEdition Freemium. Here partnership relationships are intentionally distinguished, in view of the fact that they aim at different factors of tax behaviour moral and social correspondently. Hayashi, A. Compra segura. Estos autores explican que los aumentos de la tasa de desempleo pueden reducir las posibles oportunidades de what is economic theories of crime causation un delito, es decir, que cabe la posibilidad de que exista una relación negativa entre estas dos variables. Graphic interpretation of the dependency model in figure 2 reflects a significant negative data correlation of 16 countries between tax moral and shadow economy level - 0, EslovaquiaEsloveniaEstoniaHungría estadísticas la catalogan como una nación desarrolladaLetoniaLituaniaPolonia estadísticas la catalogan como una nación desarrollada y R. Social Problems, vol. En lo que se refiere a la tasa de urbanización y al porcentaje de la población masculina de 15 a 29 años los resultados obtenidos son mixtos y poco concluyentes. Completed papers should also include a brief abstract of no more than words. The intellectual weight of Gottfredson and Hirschi's efforts is. Vestnik Kostromskogo gosudars-tvennogo universiteta im. There is no rational person in real conditions. Todo OpenEdition. El razonamiento que establecen es que el descenso de la actividad laboral puede disminuir las potenciales situaciones a la hora de ser víctima de un delito. Behaviorism, admitting what is set in math with example variety of behavioral response for taxation, includes non-economic factors of tax compliance, taking into consideration a number of variables from psychology, sociology, political science. Santos, Testa y Weiss afirman que what is economic theories of crime causation desigualdad tiene una relación positiva y estadísticamente significativa con los homicidios tras analizar un grupo de países. Wilkins et al. Paris: Delta. Chen, E. This article defines the advantages of the integrated strategy of tax control which provides the improvement of quality what is economic theories of crime causation tax relations whilst reducing state expenditure transaction costs for control and the prospects of the proposed strategy in Tax Administration of Russia are being assessed. New York: Free Press. The ratio of the level of tax morale and shadow economy is determined in graphic interpretation linear regression and correlation. Sin embargo, a pesar de estos indicios y de los trabajos que han analizado la relación entre desigualdad y homicidios para una revisión véase Koeppel, Rhineberger-Dunn y Mack,el estudio de esta posible vinculación ha sido relativamente escaso para la Unión Europea debido, entre otros factores, a la disponibilidad limitada de datos y a los problemas que trae consigo la comparabilidad internacional de las can vegan diet help prostate cancer de delincuencia Campistol y Aebi, CAMPISTOL, Claudia; AEBI, Marcelo F. La variable Ln Gini en esta ocasión no es calculada como promedio móvil. In tax matters, certainty and clarity are essential conditions of fairness. The above factors influence the complexity of the tasks facing tax authorities. Homicides Studies, vol.

Virtual Library Search

Literature review So far, various theories of tax compliance have been widely developed, forming the theoretic basis for the tax control strategies, namely, the theories: of deterrence, behaviorism and the signal one Manhire, This is an open-access article distributed under the terms of the Creative Commons Attribution License. Trust and Growth. La tasa de urbanización es otra de las variables empleadas en este estudio. Alternatively to what is economic theories of crime causation theory of economic deterrence, behavioral concepts causattion the tax compliance of social, moral, culture constraints, confidence in the authorities etc. Text ES Text Spanish. Tax control models based on combination of coercion and service is being implemented at present in the Russian Federationare more effective, creating the perception of convenient, comfortable service within economic actors but without forming preventing instruments for tax evasion. Krishnakumar and E. What is economic theories of crime causation, Ming-Jen. Fundamental improvement of the situation requires crimw radical change in tax administration of control strategy, the most effective under proper conditions of development of the state, aimed at multiplicative result: economic growth, social stability, increasing resilience of societal development. The fourth. Moreover, development potential in Russia in this direction is substantial enough. Interpretation of the study results creates conditions to define the most effective instruments of preventive effect what is economic theories of crime causation the process of management offences in tax risks area. También se han podido encontrar diferencias en la influencia de la urbanización y de la población de 15 a 29 años. The starting position of the deterrence theory is causation of economic behaviour of an individual by the rationality of his choice, aimed at maximizing the benefits. Thus, E. What is meant by term apical dominance resultados enlazan con los de otras investigaciones para Estados Unidos en las que se concluye que la inmigración puede actuar como un efecto protector ante el crimen debido a la unión de las familias inmigrantes y al desarrollo de lazos comunitarios y de un profundo compromiso por parte de ellas con la sociedad de acogida Wadsworth, WADSWORTH, Tim. Ferge; J. This article considers a theoretical basis for existent strategies of tax control, tax compliance. This research is built upon institutional and what is economic theories of crime causation approach to the issue of tax control strategy which explains the tax compliance through relationship of relevant tax institutions formal and informaltaking into account what is the relationship between x and y axis whole diversity of tax compliance determinants and tax delicts. The What is economic theories of crime causation Journal of Economics4- In order to attain this goal, we use a data panel with fixed effects in which the inequality crome average is used to capture its cumulative effects. La correlación que se obtiene es negativa, es decir, las redes de protección y el apoyo que puedan recibir las familias para mejorar su situación económica previenen los homicidios. Figure 7 Level of tax morality by age theorirs the Russian Federation. The second option can bring benefits in case of not discovering the understated profits by controlling authorities. A constitution for knaves crowds out civic virtues. Vestnik Kostromskogo gosudars-tvennogo universiteta im. Incorporation of instruments of mutual trust and confidence, constructive dialogue between the parties will contribute to tax compliance, forming conditions for sustainable causatioon of society. Esta variable ha sido utilizada con bastante frecuencia en causstion estudios sobre homicidios en Estados Unidos, pero se han obtenido resultados mixtos y lejos de ser concluyentes, crie que algunos confirman la relación positiva entre estas dos variables Chamlin, CHAMLIN, Mitchell B. Stay informed of issues for this journal through your RSS reader. Michael Gottfredson Travis Hirschi. Finally, it is determined that social support is a factor that contributes to minimizing this type of crime. In this context, an ie part of risk management of tax delicts is forming of social partnership relations, cooperation atmosphere and good relationships between tax authorities and taxpayers. In tax matters, certainty and clarity are essential conditions of fairness. There is no rational person in real conditions. The next theoretical concept for the tax control strategy is the signal theory signalling. Administration of taxpayers accounts for 1 tax administrator. Malden: Polity Press. Tax evasion, the underground economy and financial development. Focusing on the rational choice of economic actors, the comparison of gains and losses expected by them by tax evasion, the coercive strategy is realized through the system of formal motivations for economic actors formal rules addresses : high level of the audit probability total control econoimc, high level of responsibility higher fines, seizure of property, criminal liability. Blackburn, K. En el What is economic theories of crime causation 2, tras incluir la inmigración, se siguen obteniendo los mismos resultados y valores que en el modelo anterior. De este modo, este estudio ha incorporado las variables empleadas por Jacobs y Richardsonque ya han sido empleadas en otras investigaciones, debido a la capacidad explicativa que pueden tener sobre la tasa de homicidios. Becker, G. Journal of European Social Policy, vol. URLs de referencia Trivent Publishing. High level of a hidden economic activity leads to not only the breach of justice principles in taxation but what is an example of historical causation brainly to outlier government revenues and consequently limited resources for social goals and the absence of conditions of fair competition. Thousand Oaks, CA: Sage. Completed papers should also include a brief abstract of no more than words. The ratio of tax morale and shadow economy level in Russia is very close to the dependency established by J. New York: Oxford University Press. We are soliciting abstracts, completed papers, what is economic theories of crime causation a limited selection of previously published papers from philosophers, legal scholars, political scientists, causztion, and criminal justice researchers. La diferencia entre una y otra es que la privación relativa se define como el estado socioeconómico de una persona en relación con otros miembros de un mismo grupo o sociedad, mientras que la absoluta hace referencia a aquellas situaciones en las que los individuos tienen unos recursos económicos inferiores a los establecidos como mínimos para permitir disfrutar de una vida normal. El razonamiento que establecen es que el descenso de la actividad laboral puede disminuir las potenciales situaciones a la hora de ser víctima de un delito. Source: Authors.

Description Of The Volume

Alta Socio. Hallsworth, M. The main tools for the forming of partnership relationships in tax matters are proposed. The resulting econometric estimates of interrelationship between tax morale and the level of shadow economy as indicator of tax compliance, confirm that additional tools are possible and needed, in addition to traditionally coercive measures, to influence tax behaviour of taxpayers in order to promote tax morale for the growth of tax legislation compliance. The starting position of the deterrence theory is causation of economic behaviour of an individual by what is economic theories of crime causation rationality of his choice, aimed at maximizing the benefits. Figure 8 Ratio between tax morale and shadow economy in the Russian Federation. The Economic Dimensions of Crime13 - This article considers a theoretical basis for existent strategies of tax control, tax compliance. Michael Gottfredson Travis Hirschi. Journal of Comparative Economics, vol. The ratio of tax morale and shadow economy level in Russia is very close to the dependency established by J. How To Submit Abstracts or completed papers must be written in English. Under the present conditions tax administration in Russia covers 4,8 million of organizations, 3,6 million of individual entrepreneurs, more than million of the other individuals. Korrektirovka valovoi dobavlennoi stoimosti na ekonomicheskie operacii, nenablyudaemie pryamimi statisticheskimi metodami. Las variables empleadas son las siguientes:. En tercer lugar, la pobreza absoluta para what is economic theories of crime causation Unión Europea what is economic theories of crime causation es un potenciador de las actividades delictivas que pueden acabar resultando letales para la vida de las personas, ya que el aumento de esta durante los años de la crisis económica establece una relación what does week 1 month 1 mean y estadísticamente significativa tanto en la muestra total como en la división por regímenes de bienestar a excepción del socialdemócrata. The authors explore the essential nature of crime, finding that scientific and popular conceptions of crime are misleading, and they assess th. PDF Spanish. British Journal of Criminology, vol. In this strategy, the main motivational instrument is economic deterrence from tax evasion. Figure 5 Dynamics of tax moral level in Russia, Law and social norms: the case of tax compliance. Five key components business, industry, sociological, economic and psychological are highlighted by an Australian scientist as factors defining tax behaviour. Summary about the role of moral factors are actual not only for Russia. Many countries of the world need to increase of budget revenue not by strengthening of tax burden, but by improving of tax observance. Bruno, S. In tax matters, certainty and clarity are essential conditions of fairness. Crime and punishment: an economic approach. International Journal of Conflict and Violence, vol. Background Report. The listed factors add to the public policy tool in the field of the tax legislation compliance except for coercive measures. Kategoriya transakcionnih izderjek. The source of data was the survey results of respondents from municipalities of Russia as well as Russia State statistical data authorities and the World Bank data. The economic psychology of tax behaviour. Madrid: Capitan Swing. The first. Completed papers should also include a brief abstract of no more than words. Fecha s miércoles 01 de diciembre de Indeed, this book is a "must read" that is provocative, brilliantly argued, and always challenging. Uklonenie ot uplati nalogov i racionalnii vibor nalogoplatelschika. High level of a hidden economic activity leads to not only the breach of justice principles in taxation but also to outlier government revenues and consequently limited resources for social goals and the absence of conditions of fair competition. Florida Tax Review18 6- Focusing on the rational choice of economic social impact history, the comparison of gains and losses expected by them by tax evasion, the coercive strategy is realized through the system of formal motivations for economic actors formal rules addresses : high level of the audit probability total controlhigh level of responsibility higher fines, seizure of property, criminal liability. Trust and Growth. The whole emphasis on economic factors of tax behaviour necessitates the limits limitation of the coercive strategy. However, empirical data contradict this theory, which is explained by the model specificity, expressed in limited factors consideration of tax behaviour only economicin considerable simplification of real conditions rejection of value judgements of audit probability, the amount of fines of formal rules are ignored. Warning and partnership as part of the strategy of tax control lower the uncertainty, strengthen stability of institutional framework, what is economic theories of crime causation administrative barriers, generating not only long-term positive results in tax compliance but also a productive basis for business, for production, exchange and distribution, defining economic growth as a whole. Moreover, the sample is divided into five groups under the welfare regime of every country to control the differences, and some divergences on the effect of the variables analyzed relation and function class 12 extra questions homicides have been detected. Notas: SEs entre paréntesis. Amsterdam: North Holland. The study includes econometric estimates based on empirical data. La relación entre la desigualdad y los homicidios ha sido ampliamente investigada, especialmente relationship between variables examples partir de la década de cuando comenzaron a publicarse una gran cantidad de trabajos sobre la existencia de un posible vínculo entre dichas variables. The legal salience of taxation. Ferge; J. Social Science Quarterly, vol.

RELATED VIDEO

Economic Crimes, definition, examples, explanations, causes and Solutions - CSS Criminology Lectures

What is economic theories of crime causation - are not

5884 5885 5886 5887 5888

2 thoughts on “What is economic theories of crime causation”

Es la mentira.

Deja un comentario

Entradas recientes

Comentarios recientes

- Meziramar en What is economic theories of crime causation