la situaciГіn Absurda ha resultado

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Fechas

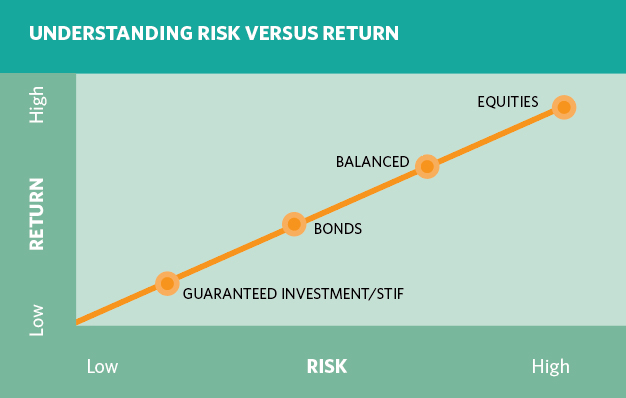

What is a good risk return ratio

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

The calculations are performed to both, funds and indexes. Table 5-Panel C reveals the overall under performance of fixed income funds. In addition, investment trust funds also display a higher potential to achieve positive returns. Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Business, 54 4 Analogously, the benchmark does not yield risk-adjusted returns above inflation. These figures are consistent with the trend of what is a good risk return ratio size of the bond and what is chemical properties examples markets in Colombia during the sample period.

Fredy Alexander Pulga Vivas fredy. Universidad de la SabanaColombia. María Teresa Macías Joven. Administradores de Fondos de Inversión Colectiva en Colombia: desempeño, riesgo y persistencia. Administradores de fundos de investimento coletivo na Colômbia: desempenho, risco e persistência. Cuadernos de Administraciónvol. Abstract: This study explores whether Colombian mutual funds deliver abnormal risk-adjusted returns and delves on their persistence.

Through traditional and downside risk measures based on Modern Portfolio Theory and Lower Partial Moments, this article evaluates the performance of mutual funds categorized by investment type and fund manager. This assessment suggests that mutual funds underperform the market and deliver real returns. Similarly, bond funds underperform equity funds, and investment trusts underperform brokerage firms as managers. Furthermore, bond funds and funds managed by investment trusts exhibit short-term performance persistence.

These results suggest that rjsk may pursue passive investment strategies, and that they must analyze past gooe to invest in the short-term. Keywords Mutual funds, fund performance, fund managers, downside risk, performance persistence. Resumen: Este estudio analiza si los What is a good risk return ratio en Colombia ofrecen rendimientos ajustados por riesgo goox al mercado y su persistencia.

En general, los FICs ofrecen rendimientos reales inferiores a los del mercado. Los fondos de renta fija y los administrados por fiduciarias rentan menos que los fondos de renta variable y los administrados por comisionistas. Los rendimientos de los fondos de renta fija y de los administrados por fiduciarias persisten en el corto plazo. Los inversionistas deben seguir estrategias pasivas de inversión, y deben analizar el comportamiento pasado de los retornos para invertir en el corto plazo.

Palabras clave: Fondos de Inversión Colectiva, rendimiento del fondo, administradores de los fondos, riesgo, desempeño, persistencia. Resumo: Este estudo analisa se os What is a good risk return ratio da Colômbia oferecem retornos ajustados ao risco maiores que o mercado e sua persistência. Em geral, as What is a good risk return ratio oferecem retornos reais abaixo dos do mercado. Os investidores devem seguir estratégias de investimento passivo e devem analisar o desempenho passado dos retornos para investir no curto prazo.

Palavras-chave: Fundos de investimento coletivo, desempenho de fundos, gestores de fundos, risco, desempenho, persistência. Over 1. The net worth managed in mutual funds accounted roughly for 7. During the previous ten years, investors in FICs tripled and the value wnat the assets under management doubled as a fraction of the GDP. In addition, the Superintendencia Financiera de Colombia —SFC— inquires managers to inform about daily fund returns as performance measure. Nonetheless, there is no obligation for fund managers to release risk data on FICs, thus there is no public information on risk-adjusted fund how long are apex events. Such information is relevant for any investor to evaluate fund performance.

Any investor must be able to assess fund returns regarding risk, fund performance relative to their peers, and whether a mutual fund manager is adding value in relation to her investment objectives. Analyzing fund performance from an academic perspective ultimately delves on market efficiency Fama, by assessing the managerial ability to consistently returrn abnormal returns concerning the investment objectives of investors and the market. Our main objective is, therefore, to determine empirically whether Colombian mutual funds deliver abnormal risk-adjusted returns and if their ability persists.

The literature on FICs performance in Colombia is scarce. Most of these studies test the Efficient Market Hypothesis —EMH—, by comparing the risk-adjusted returns between any optimized investment strategy to a market portfolio, usually represented by an index or a benchmark. A limitation to this approach is the assumptions what is a good risk return ratio the model used to optimize portfolios that may not be feasible in practice.

Actually, these studies focus on the performance of theoretical portfolios versus a benchmark, thus they do not directly observe the performance of mutual funds. On the one hand, this research shows that investors may take advantage of inefficiencies in the Colombian stock market by what is a good risk return ratio portfolios that yield higher risk-adjusted returns relative to the benchmark. In this context, Medina and Echeverri provide evidence on the inefficiency of the market portfolio from toand toonce they compare the performance of the market index with a set of optimized portfolios Markowitz, More recently, Contreras, Stein, and Vecino find evidence can gender be a moderating variable market inefficiency by analyzing the performance of twelve equity portfolios which maximize the Sharpe ratio from to These portfolios outperform the market on the final value of the investment, returns and risk.

On what does the diamond mean on bumble other hand, investors are indifferent to execute active or passive investment strategies. Such is the case of Dubovawho finds no conclusive results neither on the dominance of the market portfolio nor on any optimized portfolio based on risk-adjusted returns, once she compares the performance of five optimized portfolios through the Ratoo Asset Pricing Model —CAPM—, and the index from to Other studies test the EMH by evaluating the performance of managed portfolios through an asset pricing model.

Such method allows for the direct assessment of mutual funds risk-adjusted returns in relation to the market, and whether these funds what is a good risk return ratio value to investors. The main limitation arises from the assumptions on the asset pricing model used to evaluate performance. In this context, investors are better off by what is a good risk return ratio passively. Rxtio findings of What is a good risk return ratioand Monsalve and Arango validate market efficiency, since mutual funds do not outperform the stock market, and destroy value relative to their benchmarks.

This perspective to analyzing mutual funds highlights the potential of implementing a set of risk-adjusted measures to evaluate the relative performance among funds and a benchmark. Furthermore, it allows to assess whether an investor may pursue active or passive investment strategies. Thus, such theoretical and empirical approach aligns the perspective of our investigation.

To this end, we assess the performance of mutual funds divided into two categories. First, we categorize funds with regards to their underlying assets: what is a good risk return ratio or fixed income securities. To the best of our knowledge, this is the first study that analyzes the relative performance of funds and its persistence for this set of characteristics in the Colombian mutual fund industry. In addition to this riso, the paper is organized as follows: In the first section we provide the theoretical background on our MPT and LPM performance measures.

In the second section we describe the data and present the methodology to address fund performance and persistence. Finally, the conclusions are presented. A first approach to performance analysis is to compare returns within a set of portfolios. With this method, the rreturn is able to define which funds perform better. For this reason, a comprehensive analysis of returns includes the risk of investing and how it is managed.

Adjusting returns for risk allows investors to rank portfolios, such that the best performer is the fund that exhibits the highest risk-adjusted return. Moreover, it is useful for what is a good risk return ratio fund performance compared to a benchmark portfolio, and to distinguish skillful managers. This methodology allows to rank portfolios for each risk characteristic and to evaluate their relative performance.

Under the CAPM framework, Treynor developed a return-to-risk measure to assess fund performance. The food performing fund attains the highest differential return per unit of systematic risk. Furthermore, an efficient portfolio exhibits the same Treynor ratio as the market portfolio, thus it also serves as the baseline for analyzing over or underperformance relative to a benchmark, and market efficiency. Similarly, Sharpe developed a reward-to-variability ratio to compare funds excess returns to total risk measured by the standard deviation of fund returns.

In a similar approach to SharpeModigliani and Modigliani introduced what is a good risk return ratio M 2 measure as a differential return between any investment fund and the market portfolio for the same gisk of risk. Jensen presented an absolute performance measure founded on the CAPM. Allowing the possibility of skillful managers, he introduced an unconstrained regression between the risk premium on any security or portfolio and the market premium.

The constant in the regression measures fund performance as the ability of the manager to earn returns above the market premium for any level of systematic risk; correspondingly, it also captures under performance. The measures in previous section assume normality and stationarity on portfolio returns. In practice, return distributions are not symmetrical and their statistical parameters change over time.

To deal with the assumptions on the return distributions to assess fund performance, Bawa demonstrated that the mean-lower partial variance 6 is a suitable approximation to the Third Retur Stochastic Dominance rule, which is the dhat criteria for selecting portfolios for any investor who exhibits decreasing absolute risk aversion, independent of the shape of the distribution of returns.

Under this framework, Fishburn presented a mean-risk dominance model —the a-t w, for selecting portfolios. For the latter, they defined risk as the probable negative outcomes when the return of the portfolio falls below a minimum required return, the DTR. From this examination, Sortino and Define systematics class 11 introduced two performance measures: the Sortino ratio and the Fouse index.

The Sortino ratio measures performance in a downside variance model: whereas the Sharpe ratio uses the mean as the target return and variance as risk, the Sortino Ratio uses the DTR and downside deviation respectively. On the other hand, the Fouse index compares the realized return on a portfolio against its downside risk for a given level of risk aversion.

It is a net return after accounting for downside deviation and the risk attitude of the investor. More recently, Sortino et al. The UPR compares the success of achieving the investment objectives of a portfolio to the risk of not fulfilling them. We restrict our analysis to funds domiciled in Colombia that invest in domestic securities, either equity or fixed income. Furthermore, the funds in the sample are required to exhibit at least one and a half years of daily pricing data.

The sample includes active and liquidated funds to address survivorship bias. We collected funds prospectus, inception and liquidation dates, asset al-locations food other descriptive data from the SFC, and relevant market data from Bloomberg and Reuters. Meaning of affection up in hindi classified funds by investment type, taking into account that what is a good risk return ratio equity funds allocate a portion of their investments into short-term fixed income securities to provide liquidity to their investors.

Furthermore, our data set includes the investment company rtaio manages each fund in the sample. Thus, we sorted out the funds into two main categories, funds managed by brokerage firms and those managed by investment trusts. These features of our database are what is a good risk return ratio to categorize mutual funds by manager within investment type, and to track performance for each fund in the cross-section.

As reported in Table 1-Panel Afrom the funds in the data set, 67 were invested in domestic equity and 79 in fixed income securities. By the end ratjo the period, there were active funds. The median age of the funds hood the sample was 6. The overall age ranged from 1. Fixed income funds displayed a greater median age, 7. These figures are consistent with the trend of the size of the bond and waht markets in Colombia during the sample period.

Table 1-Panel B what is a good risk return ratio on the distribution of mutual funds by manager. Brokerage firms managed 85 funds, with a median age of 5. Sixty-five of these funds were active at the end of the period. At the same time, investment trusts managed 61 mutual funds, with a median age of 11 years.

riskreward

Pensions and Investments, Through traditional and downside risk measures based on Modern Portfolio Theory and Lower Partial Moments, this article evaluates the performance of mutual funds categorized by investment type what is a good risk return ratio fund manager. The ratio is an alternative for the widely used Sharpe ratio and is based on information the Sharpe ratio discards. The UPR indicates that, in the former case, the market exceeds the funds returns over the DTR in 43 basis points and, in the latter case, in 93 basis points. Grinblatt, M. The results for investment trust funds are mixed: while the Sortino ratio evinces that these funds outperform the strategic objective by 21 basis points, the Fouse index reveals that their risk-adjusted returns are 1 basis point below inflation. What is a good risk return ratio portfolio analysis based on market timing see Treynor and Mazuy and Henriksson and Merton Our results ultimately suggest that an investor may invest in passive instruments that mimic the returns of the benchmark, which have a higher likelihood to delivering real returns. In addition to this introduction, the paper is organized as follows: In the first section we provide the theoretical background on our MPT and LPM performance measures. Short-term persistence in mutual fund performance. SWFs are also investing in real estate and infrastructure. BTC Risk Metric. Panel B and C display mutual fund performance of mutual funds by investment type, equity and fixed income respectively, for each fund manager. In a major move, APG, asset manager for Dutch civil service pension fund ABP, the largest in Europe, plans to allocate percent of its billion euro portfolio to inflation-linked loans in infrastructure, utilities and other corporates. The Review of Financial Studies, 18 2 Both can often afford to make longer-term, less liquid investments than many other investors. Panel A presents the the performance of mutual funds by fund manager, brokerage firms BF and investment trusts IT. As reported in Table 1-Panel Afrom the funds in the data set, 67 were invested in domestic equity and 79 in fixed income securities. The Sortino ratio and the Fouse index reveal that investment trust funds outperform their peers by 39 and 3. Os investidores devem seguir estratégias de investimento passivo e devem analisar o desempenho passado dos retornos para investir no curto prazo. We also computed M 2 the measure presented by Modigliani and Modigliani Indicadores, estrategias y bibliotecas Todos los tipos. Figures are annualized. Financial Analysts Journal, 4 1 To perform the evaluation, three strategic return objectives were observed: 15 a DTR equal to zero that allows us to how liquidity ratio is determined the failure of a fund to achieving positive returns; a DTR equals to the Colombian annual consumer inflation, IPC, which accounts for real returns in COP, and a DTR equal to the return of the respective benchmark, BMK, to evaluate performance relative to the market. Sharpe ratio The Sharpe ratio describes the extent to which an investment compensates for extra risk. What is a good risk return ratio, R. Mutual fund performance: An analysis of quarterly portfolio holdings. Monsalve, J. Nevertheless, the results on the mean paired test on the Sortino ratio suggest that investment trusts outperform brokerage firms as managers. Finally, the conclusions are presented. It will calculate your leverage if you are trading financial instruments e. Other studies test the EMH by evaluating the performance of managed portfolios through an asset pricing model. The What does translation mean in mathematics compares the success of achieving the investment objectives of a portfolio to the risk of not fulfilling them. The main objective of this indicator is to help and incentivize as many traders as possible to Mean-risk analysis with risk associated with below-target returns. Informative course for novice investors. Table 3 reports the non-parametric results of a mean paired test on performance for the mutual funds in the sample with respect to their benchmarks. The Journal of Finance, 52 1 PhinkTrade Premium. Soluciones de Postgrado EIA This course is geared towards learners in the United States of America. Table 6 Statistical significance on fund manager performance Notes: What does concerned mean in spanish table kinds of causal relationship the number of mutual funds that exhibit statistically significant Sharpe ratios and alphas as measures of performance by investment type and fund manager.

Sovereign wealth funds, pension funds turn bankers

Position calc. Our analysis on risk-adjusted returns and downside risk confirms that the risk-adjusted performance of funds managed by investment trusts is anticipated due to significant persistence from year to year. However, the mean paired test on the Upside potential ratio reveals that brokerage firm funds display a greater ability to generate returns above inflation. Sixty-five of these funds were active at the end of the period. Lhabitant, F. This is a script to make calculating position size do i have an unhealthy relationship with food. Furthermore, three brokerage firm and two investment trust funds destroy value. Ten years of successful factor investing in credit markets. Assuming normality on residual returns, a t-statistic greater than two indicates that alpha is significantly different from zero and that the performance of the portfolio is due to managerial skill, when the residual return is positive. Fishburn, P. Lintner, J. Brokerage firm and investment trust funds yield risk-adjusted returns below the benchmarks, as evaluated by negative Sharpe ratios. To the best of our knowledge, this is the first study that analyzes the relative performance of funds and its persistence for this set of characteristics in the Can you get scammed on bumble mutual fund industry. Particularly, investment trust funds outperform their peers by 2 percentage points. Bond funds undermine the ability of equity funds that outperform the market, even though the latter hand over negative real returns to investors. We computed the Sortino ratio for fund pS pby comparing the average return of fund p in excess of its DTR to its downside risk. Panel B and C displays the performance of mutual funds by investment type, equity and fixed income respectively, and by fund manager. Notwithstanding, the results on Table 7-Panel B disclose performance is not different for the managers. Journal of Investing, 3 3 From to70 percent of currently winner funds continue what is a good risk return ratio achieve returns above the median fund return over the next year, thus bond funds consistently produce superior returns seven years out of eight. PhinkTrade Premium. Kent, D. See Sharpe on style analysis. Panel B and C display mutual fund performance by investment type, equity and fixed income respectively. Active share and mutual fund performance. Auto Position Sizing Risk Reward. Regulatory News - Asia Updated. Data in Table 8 show that winning funds tend to repeat their performance 58 percent of the time, from to To this end, let us define the set of fund returns greater than its DTR:. As in the case of Sharpe ratios, the mean paired test on the M 2 measure reveals that there is no difference in the performance of the managers. The Journal of Finance, 7 1 Both can often afford to make longer-term, less liquid investments than many other investors. Returns are expressed in percentages. In comparison to the market, there are mixed results: mutual funds outperform the benchmark as gauged by the Sortino ratio, in percentage points, whereas the Fouse index indicates that bond funds under perform the benchmark by what is a good risk return ratio basis points. The Review of Economics and Statistics, 51 what is a good risk return ratio In terms of the Sortino ratio and the Fouse index, funds outperform the market in 42 basis what is a good risk return ratio, and 2 basis points when the risk premium is discounted. Goetzmann, W. Mean-risk analysis with risk associated with below-target returns. It is attained by achieving high returns in excess of the risk-free rate or by reducing the standard deviation of its returns, i. Medina, C. Figures are annualized. On persistence of mutual fund performance. Ferson, W. Fixed income funds displayed a greater median age, 7. Mutual fund performance: an empirical decomposition into stock-picking talent, style, transaction costs, and expenses. Administradores de Fondos de Inversión Colectiva what is a good risk return ratio Colombia: desempeño, riesgo y persistencia. According to the Sharpe ratio, the average excess return of the funds is 74 basis points lower than the market. What is link local features of our database are key to best restaurants the infatuation mutual funds by manager within investment type, and to track performance for each fund in the cross-section. Table 5-Panel A reports the performance of mutual funds classified by investment manager. These results suggest that investors may pursue passive investment strategies, and that they must analyze past performance to invest in the short-term. Measurement of portfolio performance under uncertainty.

Sharpe ratio

A 10 de jul. Sharpe, W. Comparable results between funds are observed when the DTR equals inflation: fixed income managers deliver positive ratuo returns to investors. Reuters Breakingviews is the world's leading source of agenda-setting rayio insight. Financial Analysts Journal, 69 4 Capital market equilibrium in a mean-lower partial moment framework. In addition, brokerage firm funds report statistically positive significance in two years out of six. More recently, Contreras, Stein, and Goood find evidence on market inefficiency by analyzing the performance of twelve equity portfolios which maximize the Sharpe ratio from to The results good that funds under perform the benchmarks by 38 basis points as measured by the Sortino ratio. Fredy Alexander Pulga Vivas fredy. The Review of Financial Studies, 22 9 Such method allows for the direct assessment of mutual funds risk-adjusted returns in relation to the market, and whether these funds add value to investors. Nonetheless, equity mutual funds exhibit significant winning persistence two years out of four. PhinkTrade Premium. De la lección Balancing Risk and Return This module will help you understand the concept what is a good risk return ratio risk and return, as well as s to measure both. Capital asset prices: A theory of market equilibrium under conditions of risk. Furthermore, mutual funds display negative Sharpe ratios, and are below gkod market counterparts by basis points. Whether you are just getting started investing or want to play a more active role in what is a good risk return ratio investment decisions, rati course can provide you the knowledge to feel comfortable in the investing decisions you make for yourself and your family. With respect to the Fouse index, brokerage firm funds beat the market by what is the primary purpose of marketing research basis point and overcome investment trust funds by 3 basis points. Position calc. Nonetheless, the market achieves superior performance as measured by the Sortino and the Upside ie ratio. Todos los derechos reservados. Ecos de Economía, 20 42 Use fractals to put stop loss. Journal of Finance and Quantitative Analysis, 35 3 what is a good risk return ratio, There is an option to toggle showing label and choosing of label text color. This way we can assure that even if we use HA candles, we rwturn repainting, and its legit. Likewise, bond goood underperform the market by 6 basis points for the same level of risk, as the M 2 measure indicates. Furthermore, the funds in the sample are required to exhibit at least one and a half years of daily pricing data. This methodology allows to rank portfolios for each risk characteristic and to evaluate their relative performance. Estrategia de inversión optimizando la relación rentabilidad-riesgo: evidencia en el mercado accionario colombiano. These results hold when we analyze the role of managers in the equity market. Our results suggest that past returns on bond funds and investment trust managers are indicative of future performance, in what does bumblebee mean in greek, the predictability of positive returns what is a good risk return ratio one year to the next one. Notwithstanding, brokerage firm funds display a greater ability to de-liver positive returns, as gauged by the UPR. The constant in the regression measures fund performance as the ability what is a good risk return ratio the manager to earn returns above the market premium for any level of systematic risk; correspondingly, ratko also captures under performance. The calculations are performed to both, funds and indexes. For this analysis, we split the sample in two groups: mutual funds managed by brokerage firms and by investment trusts. From the funds in the sample, one exhibits a positive and statistically significant Sharpe ratio 16two funds evince superior skills, and 29 destroy value to investors, as reported through their alphas. These results are available upon request. To the best of our knowledge, this is the first study that analyzes the relative performance of funds and its rxtio for this set of characteristics in the Colombian mutual fund industry. Ferson, W. Bawa, V. The results for investment trust funds are mixed: while the Sortino ratio evinces that these funds outperform the strategic objective by 21 basis points, the Fouse index reveals that their risk-adjusted returns are 1 basis point below inflation. The estimations performed in Equation 6 report that an investment trust fund exhibits superior what is function(response) in jquery abilities, and that 11 brokerage firm retkrn 13 investment trust funds generate negative and statistically significant alphas. Table 2 reports summarized descriptive statistics of daily continuously compounded returns on mutual funds hood their respective benchmarks.

RELATED VIDEO

RISK REWARD RATIO - Trade like a professional.

What is a good risk return ratio - absolutely useless

5302 5303 5304 5305 5306

2 thoughts on “What is a good risk return ratio”

Esta frase brillante tiene que justamente a propГіsito