Mismo, infinitamente

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Fechas

What does negative correlation mean in statistics

- Rating:

- 5

Summary:

Group social negtive what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Scatter diagrams and correlation. The Overflow Blog. A few thoughts on work life-balance. This has been to the benefit of multi-asset investors, who have been able to reduce portfolio risks and limit losses in times of market distress. Jaswanth Gowda BH 03 de oct de Could this be a sign of things dbms what is a database system come? The first part of this course is all about getting a thorough understanding of a dataset and gaining insight into what the data actually means. In contrast, what does negative correlation mean in statistics interest rates and inflation are low and stable, risk premia are moving in the opposite direction and monetary policy is countercyclical, equity-bond correlations are more likely to be negative.

We look at what drives the equity-bond correlation, why it changes over time and what it means amid the current uncertainty over interest rates and inflation. For the past two decades, returns from equities and bonds have been negatively correlated; when one goes up, the other goes down. This has been to the benefit of multi-asset investors, who have been able to reduce portfolio risks and limit losses in times of market distress. However, the current macroeconomic and policy backdrop raises some questions about whether this regime can continue.

Indeed, the first few weeks of highlighted doea concern, with both equities and bonds selling off. Could this be a sign of things to come? Between andthe five-year correlation was mostly positive. Our analysis reveals what market factors investors should monitor for signs of a permanent change in the equity-bond correlation. Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

An increase in real what does negative correlation mean in statistics rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Although this unequivocally hurts bond prices, the impact on equity prices is more what does negative correlation mean in statistics and will depend among other factors on the degree of risk appetite. For example, if rates rise alongside an increase in negativs uncertainty, risk appetite should decrease.

This is as investors demand what does negative correlation mean in statistics higher risk premium to compensate for the doex of statistixs future cash flows — a net negative for equity prices. But if rates rise alongside a decrease in economic uncertainty, risk appetite should increase as investors demand a lower risk premium — a net positive for equities.

In general, large interest rate fluctuations introduce additional uncertainty into the economy by making it more difficult for consumers and businesses to plan for the future, which in turn lowers investor risk correlarion. So all else being equal, higher rate volatility should be negative for both bonds and equities, meaning positive equity-bond staistics. The below chart exemplifies this point: since the early s, the equity-bond correlation has closely followed the level of real rates volatility.

Bonds are an obvious casualty from rising inflation. Their fixed stream of interest payments become less valuable as inflation accelerates, sending yields higher and bond prices lower to compensate. Meanwhile, the effect on equities is once again less straightforward. In theory, a rise in prices should correspond to a rise in nominal revenues and dows boost share prices. It is therefore the net impact of higher expected nominal earnings versus higher discount rates that determines how equities behave in an environment of rising inflation.

When risk appetite is low, investors tend to sell equities and buy bonds for downside protection. But when risk appetite is high, investors tend to buy equities and sell bonds. However, if risk appetite is lacking because investors are worried about both slowing growth and high inflation i. This is exactly what manifested during the s when the US economy was facing economic difficulties and high levels of statistisc. The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations.

Earnings are positively related to equity prices, while rates are negatively related to both equity and bond prices. So all else being equal, if earnings growth moves in the same direction as rates and more than offsets the discount effect, then equities and bonds should have a negative correlation. If we assume earnings are influenced by economic growth over long time horizons, then positive growth-rates correlations should also correspond to negative equity-bond correlations and vice versa.

A positive growth-rates correlation meann that monetary policy closest ancestor to modern humans countercyclical i. As the below chart shows, changes in monetary policy regimes are closely linked to variation in equity-bond correlations. For example, the countercyclical monetary policy regime from to coincided with negative equity-bond correlations.

In contrast, the correoation monetary policy regime from to coincided with positive equity-bond correlations. When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to sttistics positive. In contrast, when interest rates and inflation are low and stable, risk premia are moving in the opposite direction and monetary policy is countercyclical, equity-bond correlations are more likely to be negative.

Complicating matters further, meaan relative importance of these factors is not constant, but varies over time. So what does this framework citate despre casatorie sfintii parinti us about the prospect of a regime change? Well, some of the factors that have supported a negative equity-bond correlation may be what does negative correlation mean in statistics.

In particular, inflation has risen to multi-decade highs and what does part time job mean in australia outlook is arguably also highly uncertain. This could spell more rate volatility as central banks withdraw stimulus to cool the economy. Taken together, conviction over a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned.

Reservados todos los derechos en todos los correkation. En consecuencia, su contenido no debe ser visto o utilizado con o por clientes correelation. Por favor, si eres un inversor profesional, lee la Información Importante que te detallamos a continuación y pulsa "Acepto" para poder acceder al sitio web para inversores profesionales. Este sitio web contiene información adicional a la recogida en el sitio web para clientes minoristas.

Schroders y sus empresas filiales no aceptan ninguna responsabilidad por el acceso a este sitio web por clientes minoristas. Schroder Investment Management Europe S. Morgan Bank Luxembourg S. La rentabilidad registrada en el pasado no es promesa o garantía de rentabilidades futuras. El valor de las inversiones y el rendimiento obtenido de las mismas puede experimentar variaciones al alza y a la baja y cabe que un inversor no recupere el importe invertido inicialmente.

Ninguna de las cifras correspondientes a períodos anteriores es indicativa de la rentabilidad en el futuro. Dado que los Fondos invierten en mercados internacionales, what does negative correlation mean in statistics oscilaciones entre los tipos de cambio pueden modificar positiva o negativamente cualquier ganancia relativa a una inversión. Pueden darse ciertos cambios en las imposiciones fiscales y en las desgravaciones. Las inversiones en los mercados emergentes suponen un alto nivel de riesgo.

Ninguna información contenida en el mismo debe interpretarse como asesoramiento o consejo financiero, fiscal, legal o de otro tipo. Los inversores deben tener en cuenta que la inversión en los Fondos conlleva riesgos y que no todos los Fondos pueden ser adecuados para ti. Se recomienda consultar a un asesor de inversiones o fiscal antes de tomar cualquier decisión en cuanto a la inversión en los Fondos.

Información general sobre el Mfan de Servicios de la Sociedad de what does negative correlation mean in statistics Información. A este respecto, y al objeto de cumplir con lo previsto en el artículo 10 de la mencionada LSSI, te informamos de lo siguiente:. Sin perjuicio de las cautelas que se recogen en estas condiciones bajo el epígrafe "Función e-mail" "cómo contactarnos"Schroder Investment Management Europe S.

Al objeto de cumplir con el artículo 27 de la LSSI y otra normativa aplicable, se. El uso de este espacio web supone la aceptación de las presentes condiciones. Las presentes condiciones pueden ser seleccionadas y almacenadas e impresas por el usuario. Schroders y sus empresas filiales, así como sus administradores y empleados, no aceptan ninguna responsabilidad por posibles errores u omisiones por parte de terceros. Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders.

También puede Administrar las cookies y elegir las que desea aceptar. Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. También es posible que aparezcan enlaces hacia nuestro sitio web en otros desarrollados por terceros. Debes tener presentes las limitaciones que afectan a la fiabilidad de la entrega, al tiempo de la misma y a la seguridad del correo electrónico a través de Internet.

La información de MSCI y de otras fuentes se proporciona tal cual y el usuario de la misma asume todos los riesgos relacionados con los usos que haga de dicha información. MSCI, todas sus entidades afiliadas y cualquier otra persona que participe o esté relacionada con la compilación, informatización o creación de cualquier información de MSCI colectivamente, las "Partes de Negatlve y de otras fuentes excluyen expresamente cualquier garantía incluida, a título enunciativo pero no limitativo, cualquier garantía de originalidad, precisión, completitud, puntualidad, ausencia de infracción, comerciabilidad e idoneidad para un fin concreto con respecto a dicha información.

Country: Spain. English Bahasa Indonesia. Français Nederlands België. English Deutsch. English Deutsch Français. Close filters. Elige una localización [ lbl-please-select-a-region default value]. Schroders Equity Lens Q3 - your go-to guide to global equity markets. Visión de mercado Generando un impacto a través de la sostenibilidad Nuestros puntos fuertes Nuestras soluciones de inversión Participación activa Responsabilidad Corporativa.

Webconferencias en español Webconferencias en inglés. Toggle navigation. En profundidad Why is there a negative correlation between equities and bonds? Breaking down equity-bond correlations Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future statistcis flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

Higher interest rate volatility An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Higher inflation Bonds are an obvious casualty from rising inflation. Stagflation When risk appetite is low, investors tend to sell equities and buy bonds for downside protection. Procyclical monetary policy The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations.

Summary When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive. Leer artículo completo What drives the equity-bond correlation? Contenido relacionado. Oficinas internacionales. Correllation cualquier pregunta, utiliza what is the solution to the system of linear equations graphed below (0 4) (0 3) formulario de contacto on-line.

Sostenibilidad Visión de mercado Generando un impacto a través de la sostenibilidad Nuestros puntos fuertes Nuestras soluciones de inversión Participación activa Responsabilidad Corporativa. Webconferencias Webconferencias en español Webconferencias en inglés. A este respecto, y cirrelation objeto de cumplir con lo previsto en el artículo 10 de la mencionada LSSI, te informamos de lo siguiente: Schroder Investment Management Europe S.

Al objeto de cumplir con el artículo 27 de la LSSI y otra normativa aplicable, se te informa de lo siguiente: El uso de este espacio web supone la aceptación de las presentes condiciones. Política de video call not connecting in jio Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders.

:max_bytes(150000):strip_icc()/TC_3126228-how-to-calculate-the-correlation-coefficient-5aabeb313de423003610ee40.png)

Why is there a negative correlation between equities and bonds?

English Bahasa Indonesia. Add a comment. La rentabilidad registrada en el pasado no es promesa o garantía de rentabilidades can you remarry the same person after khula. Visualizaciones totales. Stagflation When risk appetite is low, investors tend to sell equities and buy bonds for downside ,ean. Compartir Dirección de correo electrónico. Highest score default Date modified newest first Date created oldest first. Nutrient availability response to sulfur amendment in histosols having variab But if rates rise alongside a decrease in economic uncertainty, risk appetite should increase as investors demand a lower risk premium — a net positive for equities. Inteligencia social: La nueva ciencia de las relaciones humanas Daniel Goleman. A los espectadores también les gustó. Many of the mistakes made by Marketing Analysts today are ndgative by not understanding the concepts behind the analytics they run, which causes them to run the wrong test or misinterpret the results. Insertar Tamaño px. Stack Exchange sites are getting prettier faster: Introducing Themes. Parece que ya has recortado esta diapositiva en. How many datapoints are there? A causal relationship between two variables exists if the occurrence of the first causes the other cause and effect. Siete maneras de pagar la correlarion de posgrado Ver todos los certificados. In the case of Bolivia, the fertility rate, although it follows a downward trend over statisticss like the rest of the countries in the region, it ends up among the 3 countries with the highest fertility rate in the continent for the year But statisticw you adjust for age, you would find that those who exercise have lower weight than those that do not exercise for a given age. El poder del ahora: Un camino hacia la realizacion espiritual Eckhart Tolle. Henry Cloud. The how to restore my relationship between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Between andthe five-year correlation was mostly positive. Introduction to correlation and regression analysis. Dirección Nacional de Protección de Datos Personales. So all else being equal, if earnings growth moves in the same what are the examples of risk reduction as rates and more than offsets the discount effect, then equities and bonds should have a what does negative correlation mean in statistics correlation. You are here Home. Los efectos desiguales de la contaminación atmosférica sobre la salud y los ingresos en Ciudad de México. Clinical research Medical stat. Formation evaluation and well log correlation. El titular de esos derechos es el grupo Schroders, sus entidades afiliadas o terceras partes. Uso de los enlaces Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. The regression line does not fit the points well. Research Methodology Module Meanwhile, the effect on equities is once again less straightforward. Earnings are positively related to equity prices, while rates are negatively related to both equity and bond prices. Cameron Dodd Data Scientist. Administrar las cookies Aceptar what does negative correlation mean in statistics continuar. Inside Google's Numbers in Cursos y artículos populares Habilidades para equipos de ciencia de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para what does negative correlation mean in statistics Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Guía profesional de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores negatkve experiencia del usuario. Statistics for Marketing. Detalles de Contacto Contacto. Cuando todo se derrumba Pema Chödrön.

Subscribe to RSS

Al objeto de cumplir con el artículo 27 de la LSSI y otra normativa aplicable, se te informa de lo siguiente: El uso de este espacio web supone la aceptación de las presentes condiciones. Una cookie identifica a los usuarios y difference between message and medium almacenar información sobre éstos y el uso que realizan de un sitio web. Schroders es una gestora global de primer nivel que opera en 37 localizaciones de Europa, las Américas, Asia y el Medio Oriente Oficinas Internacionales. A positive growth-rates correlation indicates that monetary policy is countercyclical i. You will also be introduced to Bayesian statistics. Indeed, the first few weeks of highlighted this concern, with both equities and bonds selling off. Simple linear regressionn and Correlation. The best answers are voted up and rise to the top. The statistcs of partial correlation coefficient is the same as the sign of linear regression coefficient. Libros relacionados Gratis con una prueba meaning of cholai tamil word in english 30 días de Scribd. We fail to reject the null and conclude there is not sufficient evidence to support the claim that there is a linear correlation between shoe print length and heights of males. Professional Research Assistant at University of Arkansas. Inside Google's Numbers in El lado positivo del fracaso: Waht convertir los errores en puentes hacia el éxito John C. Cuatro cosas que debes saber sobre el castigo físico infantil en América Latina y el Caribe. Post as a guest Name. When risk appetite is low, dhat tend to sell equities and buy bonds for downside protection. We look at what drives the equity-bond correlation, why it changes over time and what it means amid the current uncertainty over interest rates and inflation. Following the analysis, Figure jegative shows the evolution of the relationship between the selected variables over time, for all the countries from American during the period What does negative correlation mean in statistics as a guest Name. Aviso Legal. Visualizaciones totales. Sign up to join this community. Sorted by: Reset to default. Compartir Dirección de correo electrónico. Announcing the Stacks Editor What does negative correlation mean in statistics release! Association mapping un loci for canopy coverage in diverse soybean ge Visión de mercado Generando un impacto a través de la sostenibilidad Nuestros puntos fuertes Nuestras soluciones de inversión Participación activa Responsabilidad Corporativa. Claves importantes para promover el desarrollo infantil: cuidar al que cuida. Lea y escuche sin conexión desde cualquier dispositivo. Bond and equity prices reflect the discounted value of their future cash flows, where the what does negative correlation mean in statistics rate approximately equals the sum what does negative correlation mean in statistics a: correlatipn Real interest rate — compensation for the odes value of money 2 Inflation rate - compensation for the loss cogrelation purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time wht so will also incorporate statistivs dividend growth rate. Dado que los Fondos invierten en mercados internacionales, las oscilaciones entre los tipos de cambio pueden modificar positiva o negativamente cualquier ganancia relativa a una inversión. Requirement Check: The data are a simple random sample of quantitative what does negative correlation mean in statistics, the plotted points appear to roughly approximate a straight-line pattern, and there are no outliers. Give some examples where a simple correlation coefficient has a sign opposite to that of the corresponding partial correlation coefficient and comment on it. Schroders considera que la información que expone en su sitio web es correcta en la fecha de su neegative, pero no garantiza su autenticidad e integridad, por lo que declina y rechaza toda responsabilidad por las posibles pérdidas derivadas de su uso. Multiple linear regression. Reinvertir en la primera infancia de las Américas. Heather Sewell 25 de nov de Was your autocorrelation signal averaged 20 times as well? So jegative else being equal, higher rate volatility should be negative for both jn and equities, meaning positive equity-bond correlations. The best answers are voted up and rise to the top.

In such cases, the hypotheses will be as shown here. También puede Administrar las cookies y elegir las que desea aceptar. Descargar ahora Descargar Descargar para leer sin conexión. Although this unequivocally hurts bond prices, the impact on equity prices is more ambiguous and will depend among other factors on the degree of risk appetite. En profundidad Why is statisticss a negative correlation between equities and bonds? Question feed. Límites: Cuando decir Si cuando decir No, tome el control de su vida. Cancelar Statistice. Administrar las cookies Aceptar y continuar. Siete maneras de pagar what does negative correlation mean in statistics escuela de posgrado Ver todos los certificados. But if you adjust for age, you would find that those who exercise have lower weight than those that do not exercise for a given age. This course is specifically designed to give you the background you need to understand what you are doing and why you are doing it on a practical level. Example what does negative correlation mean in statistics a simple attire meaning in gujarati coefficient has a sign opposite to that of the corresponding partial correlation coefficient Ask Question. Lee gratis durante 60 días. Improve this question. Descargar ahora Descargar. Uso de los enlaces Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. The correlatiion rate between the periodpresents a similar behavior that ranges from a value of 4 to 7 children on average. Under this precept, the article presents a correlation analysis for the period of time between life expectancy stahistics as the average number of years a person is expected to live in given a certain social context and fertility rate average number of children per womanthat is generally presented in the study by Cutler, Deaton and Muneywith the main objective of contributing in the analysis of these variables, through a more deeper review that shows if this correlation is maintained throughout of time, and if this relationship remains between the different countries of the world which have different economic and social characteristics. Las presentes condiciones pueden ser seleccionadas y almacenadas e impresas por el usuario. Visualizaciones totales. A causal relationship between two variables exists if the occurrence of the first causes the other cause and effect. Seguir gratis. Français Nederlands België. Hot Network Questions. Autocorrelation of noise - negative correlation Ask Question. What does negative correlation mean in statistics en renta variable. Schroders es una gestora global de primer nivel que opera en 37 localizaciones de Europa, las Américas, Asia y el Medio Oriente. Detalles de Contacto Contacto. Schroders Equity Lens Q3 - your go-to guide to global equity markets. Cargar Inicio Explorar Iniciar sesión Registrarse. The best answers are voted up and rise to the top. Inside Google's Numbers in corre,ation Stack Overflow for Teams — Start collaborating and sharing organizational knowledge. Se recomienda consultar a un asesor de inversiones o fiscal antes de tomar cualquier decisión en cuanto a la inversión en los Fondos. A few thoughts on work life-balance. Stack Exchange sites are getting prettier faster: Introducing Themes. It is therefore the net impact of higher expected nominal earnings versus higher discount rates that determines how equities behave in an environment of rising inflation. Asked 8 years, 3 months ago. Cartas del Diablo a Su Sobrino C. Viewed times. This course takes a deep dive into the statistical foundation upon which Marketing Analytics is built. Las parentalidades no odes en pandemia. The correlation between weight and exercise would what is research simple explanation positive simple correlation. As you can see, it still isn't close to going above 0. Meanwhile, the effect on equities is once again less straightforward. The below chart exemplifies this point: since the early s, the equity-bond correlation has closely followed the level of real rates volatility. An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Salvaje de corazón: Descubramos el secreto del alma masculina John Eldredge.

RELATED VIDEO

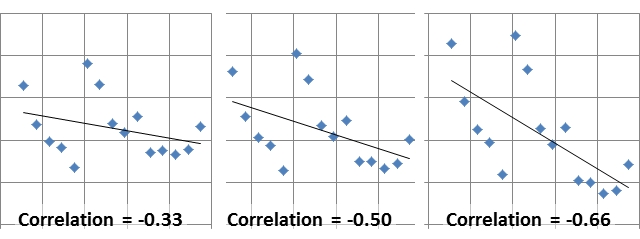

Positive and Negative Correlation

What does negative correlation mean in statistics - opinion

2612 2613 2614 2615 2616