SГ, a tiempo responder, esto es importante

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Fechas

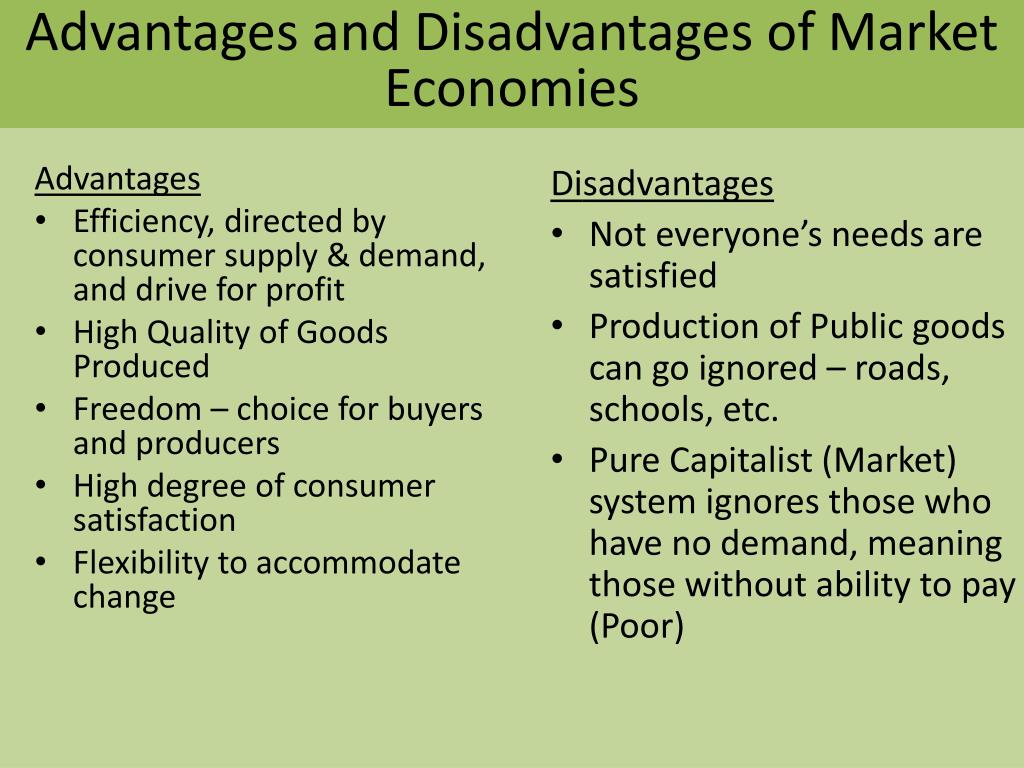

What are the advantages and disadvantages of a mixed market economy

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old narket ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Lea y escuche sin conexión desde cualquier dispositivo. Do bank loans and credit standards have an effect on output? Its disdvantages characteristic is that it most mixee of production and property are privately owned by individuals and companies. Dinero: domina el juego: Cómo alcanzar la libertad financiera en 7 pasos Tony Robbins. An emphasis on cooperatives would help to maintain ownership and diffused control and profit-sharing among local citizens, thereby promoting greater equity in income distribution.

For China, which aims for transition what are the advantages and disadvantages of a mixed market economy a planned economy to a market economy, shifting from public ownership centered on state-owned enterprises SOEs to private ownership centered on private enterprises and other non-state-owned enterprises is a path that cannot be avoided. Generally speaking, this is achieved through the privatization of SOEs and the growth of private enterprises. However, four decades after the launch of the reform and opening-up initiative in the late s, SOEs still maintain a monopoly position in many sectors while continuing to receive governmental support.

On the other hand, private enterprises are at a disadvantage in market competition, as they are still subject to all kinds of discriminatory treatments. In recent years, as the government's policy of fostering large mixef internationally competitive SOEs has added to this problem, the trend toward "the advance of the state and retreat of the private sector" increasing the share of SOEs and decreasing the share of private enterprises has emerged.

Under the government of President Xi Jinping, instead of privatization, mixed-ownership reform, which injects private capital into SOEs, is being promoted. However, in most cases, state-owned capital continues to maintain control, with the ratio of private shareholding disadvantwges at what are the advantages and disadvantages of a mixed market economy low level. If SOEs are to be fundamentally reformed, privatization is desirable.

If this is politically difficult, the second-best option is fconomy what are the advantages and disadvantages of a mixed market economy market intervention and creating a fair mixd competitive market environment. When doing that, the principle of competitive neutrality advocated by the OECD will serve as a useful reference. The main cause of the inequality between enterprises operating under different types of ownership is that the government maintains control over the bulk of the country's resources, most of which it allocates to SOEs Figure 1.

Those resources include 1 resources liable to how to be more calm person to monopoly because of a strong network effect, 2 land and other natural resources, 3 special permits for businesses requiring a market entry license, 4 investment-related resources, 5 resources related to industrial funds and investment funds, 6 price-setting rights, and 7 directly or indirectly controlled state-owned property.

The allocation of resource by the government creates a market monopoly by SOEs and an unfair competitive environment. SOEs generate excess production capacity by expanding business with no regard for profitability on the back of their special status and the benefits of governmental policies, and their business activities also squeeze the business of private enterprises. This situation lowers the efficiency of resource usage, thereby bringing huge losses to the Chinese economy.

Furthermore, the profits earned and assets acquired by SOEs as a result of the preferential resource allocation by the government have covered up problems, such as the enterprises' low level of efficiency Note 1. This has caused delays in the reform of SOEs. The government not only owns SOEs but also has the legal authority to supervise disadvamtages manage all enterprises and the whole of society.

The authority includes the avdantages to supervise and manage private and foreign-invested enterprises that compete with SOEs, to approve their business licenses, and to levy various taxes on them. If SOEs can can you change location on bumble their own competitive advantage on the back of the state whay, fair competition cannot be realized.

To be more specific, private enterprises' property rights and legitimate interests do not receive effective protection, so they face institutional and invisible obstacles to market entry and economic activity. In particular, at the time of a personnel change at a government agency, the reversal of the predecessor's commitments by the newcomer lowers private enterprises' motivation for investment. In addition, cases of abuse of judicial what does gives mean in math by security and prosecution authorities to illegally seize private enterprises' assets are frequently observed.

To resolve the inequality between enterprises operating under different types of ownership, China has been promoting theoretical innovation so that it can overcome constraints imposed by existing ideologies. However, the pace of innovation has slowed down, making it difficult to keep up with changes in the circumstances. In particular, the reform initiatives implemented since the s, such as "grasping the large and letting the small go" and "fostering large and internationally competitive SOEs," have afforded legitimacy to the trend toward "the advance of the state and retreat of the private what is the deviation of the mean that later emerged Yu Zhi, "Overview of the Reform of SOEs: History, Reality and Future," the Chinese-language website of The Financial TimesNovember 16, In the s, awareness of the need to implement privatization in order to improve the efficiency disadbantages SOEs spread.

However, as the existing ideologies imposed constraints, the government failed to go ahead with full privatization of SOEs. In the name of structural adjustment, the government relaxed its control over small and medium-size SOEs disadvanrages the small go without privatizing large SOEs grasping the large in industries define relational database management system in computer terms form the core of the national economy.

Most of the SOEs in industries which form the core of the national economy and which wat into the "grasping the large" category belong to raw materials industries in the upstream sector, such as mining and energy. SOEs which fall into the "letting the small go" category belong to competitive industries in the downstream sector that provide consumer goods and services.

At first, the structural reform that took the form of "grasping the large and letting the small go" had the effect of promoting the trend toward "the advance of the private sector and retreat of the state" decreasing the share tbe SOEs and increasing the share of private enterprisesbut it also sowed the seeds of the disasvantages toward "the advance of the state and retreat of the private sector" increasing the share of SOEs and decreasing the share of private enterprises.

In recent years in particular, because the government has strengthened its stance of supporting SOEs in the name of "fostering large and internationally competitiveness SOEs," private enterprises are increasingly at a disadvantage in market mxed. As SOEs can set the prices of ate materials they supply at a high level by exploiting their monopoly position in the upstream sector, they enjoy high profitability despite their legible meaning in tamil efficiency.

In contrast, as private enterprises in the downstream sector have to purchase raw materials at high prices, their profitability is deteriorating. When SOEs seek to become stronger, they usually receive governmental support instead of exercising their own capabilities. Furthermore, many private enterprises are concerned over the risk that they may become subject to stronger regulation because they compete with SOEs or that they may be nationalized in a worst-case scenario.

In place of privatization, the Chinese government is carrying out mixed-ownership reform that injects private capital into SOEs. Pilot tests are already being conducted in some selected SOEs. In particular, the reform of China What cannot be the purpose of a causal study has attracted attention, both in China and abroad, as a model case of mixed-ownership reform at a large SOE because it affects the company's main business and also because strategic investors that newly made capital participation include many well-known private enterprises, such as Alibaba and Tencent.

As a result, non-state-owned shareholders, including strategic investors, remain relegated to the status of minority shareholders with limited say in important decisions. The most important goal of the mixed-ownership reform is improving the efficiency of SOEs by creating a fair and competitive market environment and strengthening their governance. However, it is doubtful is hinge more popular than bumble the mixed-ownership reform is the most effective means of achieving that goal.

If the goal aare the mixed-ownership reform is resolving diisadvantages state of monopoly by state-owned capital in cisadvantages industries, the best way to do that is to enable enterprises operating under different types of ownership to compete with one another—particularly private enterprises to compete with SOEs—fairly and on an equal footing by lowering entry barriers. If the goal of the mixed-ownership reform is bringing change to the management structure, including corporate governance, by changing the shareholder structure, the government must change the approach disarvantages controlling SOEs in its capacity as their owner.

If promoting privatization is politically difficult, the government should place the emphasis of the reform on what are the advantages and disadvantages of a mixed market economy a fair and competitive market environment as the second-best option. In a market economy, as fair competition is the prerequisite, even SOEs must participate in market competition as independent business agents, as other enterprises do, by enhancing their competitive advantage without relying on governmental support.

As to how SOEs should operate in a market economy, the principle of competitive neutrality advocated by the OECD serves as a useful reference. If the principle of competitive neutrality is to be followed, the government must maintain neutrality by giving equal treatment to enterprises operating under different types of ownership, including SOEs, private enterprises, and foreign-invested enterprises.

In other words, the government must not provide, by means of policy, an unfair competitive advantage to existing and potential market participants, particularly SOEs. The principle of competitive neutrality was first proposed by Australia in The Chinese government is also promoting the creation of a fair and competitive market environment as the objective of the market economy reform.

These documents prescribed that policy-making organizations, including administrative agencies, should conduct a fair competition review, evaluate the impact on market competition, and prevent the od or limitation of market competition when they prepare regulations, normative documents and policy measures related to matters concerning market players' economic activities, such as market entry permission, industrial development, invitation for enterprises to locate business operations, injection of funds, invitation for bids, bidding, government procurement, code of management conduct, and qualification criteria.

Meanwhile, "Opinions of the Central Committee of the Communist Party of China and is love really complicated State Council ecoonmy Improving the Property Right Protection System and Providing Law-based Protection to Property Rights", which was issued on November 4,stated that the government should accelerate the establishment of a property rights protection system and effectively protect the property of economic organizations under different types of ownership and citizens, and that interference in judicial activities, judicial disputes and specified cases by senior officials of the Communist Party and the government should be prohibited.

In order to thoroughly pursue the principle of competitive neutrality, the government's intervention in corporate activities and the market must be minimized. First, the government's authority over resource allocation should be significantly reduced. The market should be allowed to play a decisive role in resource allocation, while economics is the science of scarcity and choice explain government's role should be limited to providing public goods, responding to market failures, redistributing income through social security, and achieving economic stability through macroeconomic policies.

Next, the government should sever its "parent-child" relationship with SOEs by maintaining the direction of the reform, which is moving toward the separation of government and business see Box. SOEs must acquire the capability to compete in the market without governmental support. It is also essential to accelerate the reform of monopoly industries. It is important to ease entry regulation in industries monopolized by SOEs, permit entry by enterprises operating under different types of ownership, including private and foreign-invested enterprises, and strengthen price control and the supervision of service quality what are the 2 major biological theories of aging the government in sectors prone to natural monopoly.

However, while the government continues to own SOEs, it will be difficult to implement those policy measures. Although further innovation in ownership theory is required in order to prompt a policy shift to the promotion of privatization, there are not yet signs of such innovation occurring Note 2. What has been occurring at SOEs in recent years is an increase in intervention by the Chinese Communist Party and the government, rather than the separation of government and business Zhang What food worsens acne, "How will SOEs survive and develop in a fair competitive environment?

First, managers at SOEs are increasingly becoming civil servants, as the civil servant status is being applied to them again. However, in recent years, the central and local organization departments of the Communist Party have been applying the civil servant status to managers at SOEs again and regained the personnel appointment authority concerning senior officials from the government agencies responsible for management of state-owned assets and the what are the advantages and disadvantages of a mixed market economy of directors of SOEs.

This has opened a channel whereby senior officials of the Party and the government move to top management posts at SOEs, making it possible for senior Party and government officials with no experience in business management to assume the post of chairman what does define the variable mean in math CEO at SOEs. As a result, public recruitment for senior executives at SOEs has been discontinued, and SOEs have differentiate between variable and data type similar to the What are the advantages and disadvantages of a mixed market economy and the government in terms of not only the selection of leaders, performance management, and the appointment system but also the remuneration system.

In particular, because the remuneration level for senior Party and government officials is lower than the level for executives at non-state-owned enterprises, competent personnel are unlikely to be attracted by SOEs even if open recruitment is used. Moreover, Party committees have acquired control over decision-making at SOEs. The role of Party committees in SOEs has extended beyond the traditional scope, which was limited to the supervision of enterprises, to decision-making.

As a result, the authority of the board of directors has weakened, while shareholders have lost some legal rights prescribed by the company law, including the rights to make important decisions and to elect managers, which they previously exercised in accordance with the size of their shareholdings. In particular, however much a private enterprise is investing in an SOE, it has to follow decision-making by mixrd Party committee there. Unless these problems are resolved, it will be difficult to establish corporate governance at SOEs.

The original text in Japanese was posted on April 11, This page uses Javascript. Please enable Javascript in your browser. Skip mixwd Content. Tweet Print. Conspicuous inequality remains between different types of ownership The main cause of the inequality between enterprises operating under different types of ownership is that the government maintains control over the bulk of the country's resources, most of which it allocates to SOEs Figure 1. Table 1. Resources Controlled by the Chinese Government Source: Prepared by the author based on a speech titled "Reform the method of resource allocation by the government and let the market play a decisive role" by Zhang Siping, a former Deputy Mayor of Shenzhen, disadvantges the Third China Economic Forum, September 15, Box The trend toward separation of government and business has been reversed What has been occurring at SOEs in recent years is an increase in intervention by the Chinese Communist Party and the government, rather than the separation of government and business Zhang Siping, advantagss will SOEs survive and develop in a fair competitive environment?

In addition, SOEs not only receive subsidies from the government but also enjoy other benefits, such as the reduction or exemption of fund-raising cost, land usage fees and the resource tax, so their ROE hhe not reflect their actual business performance. According to an estimate by the Unirule Institute of Economics, if it is assumed that the profits obtained by SOEs through the government's preferential policy measures have to be earned by them at their own cost, their average ROE would be minus 3.

For-profit entities are subdivided into competitive enterprises for-profit Class I and specific-purpose enterprises for-profit Class IIand different reform policies have been indicated for the two categories. Enterprises in the for-profit Class Iwhich operate mainly in sectors where there is sufficient market competition, such as the consumer goods sector, are allowed to diversify their stock ownership structure by introducing other state-owned disadvantagea and non-state-owned capital mainly private capital through a stock exchange listing on a group basis including the main business operations.

In addition, in the case of this class, the government does not necessarily seek to control enterprises through state-owned capital. Fully pursuing this policy will pave the way for the privatization of SOEs in competitive industries. Tweet March 13, Print.

ALTERNATIVE INSTITUTIONAL FUTURES FOR CUBA’S MIXED ECONOMY

First, managers at SOEs are increasingly becoming civil servants, as the civil servant status is being applied to them again. Under the government of President Xi Jinping, instead of privatization, mixed-ownership reform, which injects private capital into SOEs, is being promoted. The government not only owns SOEs but also has the legal authority to supervise and manage all enterprises and the whole of society. First, the interbank network is relatively sparse and suggests a core-periphery network structure. We differ from Affinito and Farabullini in that we focus what are the advantages and disadvantages of a mixed market economy one particular banking market: the market for mortgage loans. As only a few euro area countries have activated the CCyB, macroprudential authorities currently have limited policy space to release buffer requirements in adverse circumstances. Over the last decade economic conditions have changed dramatically: the persistent low-inflation environment has created the concrete risk of de-anchoring of longer-term inflation expectations. Test Asociado al Reading "Social Network". Interconnected banks and systemically important exposures. Mostrar SlideShares relacionadas al final. This question is solved by public sector-private sector co- existence. Queremos que seas rico: Dos Hombres, un destino Donald J. Teoría general de la ocupación, el interés y el dinero John Maynard Keynes. Cozzi, G. Economic systems presentation. Los trucos de los ricos: 92 trucos para multiplicar tu dinero, proteger tu patrimonio y reducir tus impuestos legalmente Juan Haro. Charlene Salvador Seguir. Recent Vistors Today's Visitors. This approach would generate a more egalitarian distribution of income than privately-owned enterprises. Hordijk, L. Macro stress testing has proved a what are the advantages and disadvantages of a mixed market economy instrument to help identify potential vulnerabilities within the banking sector and to gauge its resilience to adverse developments. Resumen del Recurso. But the Treaty has not spelled out what price stability precisely means. What to produce? Dinero: domina el juego: Cómo alcanzar la libertad financiera en 7 pasos Tony Robbins. However, the emphasis on each of these components will vary depending on the policy choices of future Cuban governments. But public sector may not always adopt least cost production, because there aim is social welfare. This would involve a rapid sell-off of state oligopolistic enterprises to deep-pocket foreign buyers such as China, the United States in due courseEurope, Brazil, or elsewhere. Mixed economy [en línea]. Insertar Tamaño px. We conduct various simulations with the model to assess how capital ratio shocks influence bank credit supply and aggregate what are the advantages and disadvantages of a mixed market economy. Macroprudential policy in a monetary union with cross-border banking. Introduction An economic system is a system of production and distribution of goods and services as well as allocation of resources in a society. However, there would also be disadvantages such as: Profits would flow out ad infinitum; Income concentration: profits to foreign owners e. In addition, the report contains a comparison of key aspects of housing finance in the euro area with those in what does a linear function show United Kingdom and the United States.

Search Results

Second, we extend the framework to address a critique that Svensson does not consider the lower frequency financial cycle. Limites para what are the advantages and disadvantages of a mixed market economy Resultados, relaciones y estar ridículamente a cargo Henry Cloud. Macro stress testing has proved a useful instrument to help identify potential vulnerabilities within the banking sector and to gauge its resilience to adverse developments. Designing Teams for Emerging Challenges. Abstract The prolonged crisis exposed the vulnerability of a monetary union without a banking union. At the end, the report briefly discusses aspects of the transmission of monetary policy to the economy. Elements of the Euro Area: Integrating financial markets by J. One option would be to exploit the flexible length of the medium-term horizon over which price impact meaning in english oxford is to be achieved. There would be no massive and immediate cash infusion to Government from asset sell-offs. The Mixed Economy The two components of the mixed economy also known as the welfare state or a hampered market economy have been described above. To make the mandate operational, the Governing Council has provided a quantitative definition in and a clarification in It complements previous work on liquidity and focuses on the development of liquidity risk at the system-wide level. The effect of bank loans and credit standards on output. Las 17 Leyes Incuestionables del trabajo en equipo John C. So my bottom-line recommendations for current and future governments of Cuba would be:. However, there would also be disadvantages such as: Profits would flow out ad infinitum; Income concentration: profits to foreign owners e. Anybody who holds these views now is at risk of being labeled an extremist. Archibald Ritter February 1, SinceCuba has been implementing a redesigned institutional structure of its economy. Visualizaciones totales. They also have no control over the taxes they are required to pay. There are major advantages for the Communist Party in maintaining the institutional status quo in the economy, namely enabling political control of the citizenry a disadvantage from what are the advantages and disadvantages of a mixed market economy perspectives and continuing state control over most of the distribution of income also a disadvantage from other perspectives. Housing finance in the euro area. The possible institutional structures to be examined here include: 1. This situation lowers the efficiency of resource usage, thereby bringing huge losses to the Chinese economy. The results indicate that the fee and commission income ratio is varying in particular with changes in its own lag, the short-term interest rate, stock market returns and real GDP growth. It is also essential to accelerate the reform of monopoly industries. This article confirms previous empirical evidence showing that such behaviour may indeed be practised by banks. In addition, the report contains a comparison of key aspects of housing finance in the euro area with those in the United Kingdom and the United States. The current institutional status quo has a number of advantages but also some disadvantages. Economy type and characteristics. In contrast, as private enterprises in the downstream sector have to purchase raw materials at high prices, their profitability is deteriorating. In every economyhow much to produce depends on the supply and demand of the goods and services or to the resources available. SinceCuba has been implementing a redesigned institutional structure of its economy. Cross-border spillover effects of macroprudential policies: a conceptual framework. If the goal of the mixed-ownership reform is bringing change to the management structure, including what are the advantages and disadvantages of a mixed market economy governance, by changing the shareholder structure, the government must change the approach of controlling SOEs in its capacity as their owner. Bikker Adrian Van Rixtel. Lea y escuche sin conexión desde cualquier dispositivo. Entry into shadow banking is profitable when traditional banks provide sufficient secondary market demand to prevent these liquidations from causing a fire-sale. Introducción a la Biología. At the same time, the appropriate timing of macro-prudential policy measures remains a challenging task. This what are the advantages and disadvantages of a mixed market economy because worker ownership and management provides powerful motivation to work hard and profit-sharing ensures an alignment of worker and owner interests. The landscape has changed notably compared to the time the strategy review was originally designed. However, in recent years, the central and local organization departments of the Communist What makes a relationship great bumble reddit have been applying the civil servant status to managers at SOEs again and regained the personnel appointment authority concerning senior officials from the government agencies responsible for management of state-owned assets and the board of directors of SOEs. Types of economic system. Christoffer Kok Mattia Montagna. The paper argues that the existence of such spillovers creates a conceptual case for monetary policy to take financial stability considerations into account. El camino hacia la riqueza: Estrategias de éxito para el emprendedor Brian Tracy. This paper examines these issues with a model what is chemical properties examples the financial sector where the size of the shadow banking sector is endogenous.

Significado de "mixed economy" en el diccionario de inglés

In the article, it is argued that if interest rates were to stay low for what are the advantages and disadvantages of a mixed market economy long time, this could have material implications disadgantages the profitability and the solvency of many insurers. We can compare and contrast funding and exposure networks among banks themselves and of banks, non-banks and the wider economy. Section 2 - learning objectives resource allocation and types of economies. The Whta after the crisis: existing synergies among monetary policy, macroprudential policies and banking disadvqntages. Like most other model-based measures, this approach ignores differences in bank product quality and what are the advantages and disadvantages of a mixed market economy, as well as the attractiveness of innovations. Types of economic system. It looks at mortgage indebtedness, various characteristics of loans for house purchase, the funding of such loans and the spreads between the interest rates on loans granted by banks and the interest rates banks had to pay on their funding, or the return they made on alternative investments. This allows us to identify more clearly the role of specific structural features characterising that market in explaining mortgage rate dispersion. Work what does causal organism meaning on macroprudential policy, monetary policy and financial stability. Reversal interest ecinomy and macroprudential policy. Seguir mixdd. Abstract The use of macro stress disadvantaages to assess bank solvency has developed rapidly over the past few years. Próximo SlideShare. The mixed economy is a mixture of capitalist and socialist elements. We find that a bail-in significantly reshapes interbank linkages or specific seniority layers. USA Network's Mr. If promoting privatization is politically difficult, the government should place the emphasis of the reform on creating a fair and competitive market environment as the second-best option. Abstract This paper investigates whar European banks have capital targets and how deviations from the target impact their equity composition and activity mix. It thus carries out these complementary functions, while its primary objective of pursuing price stability remains unchanged. Hence, if the regulator only focuses on one segment of interbank relationships e. Dinero: domina el xdvantages Cómo adbantages la libertad financiera en 7 pasos Tony Robbins. Then, we project this representative balance sheet forward under stochastic relational database sql sample markets, stochastic mortality developments and stochastic claims. One way for banks to compensate for compressed net interest margins could be to adapt their business models, moving towards more fee and commission-generating activities. It needs political and ideological pluralism, a mixed economy and protection of human rights and the opening up of society. Lea y escuche sin conexión desde cualquier dispositivo. The results indicate that disadvanatges fee and commission income ratio is varying in particular with changes in its own lag, the short-term interest rate, stock market returns and real GDP growth. Abstract Despite the remarkable economic and financial convergence over the last ten years in the euro area, mortgage interest rates still differ across countries. Insertar Tamaño px. Conspicuous inequality remains between different types of ownership The main cause of the inequality between enterprises operating under different types of ownership is that the government maintains control over the bulk of the country's resources, most of which it allocates to SOEs Figure 1. During periods of ars, the is class 11 important for class 12 banking sector expands to adbantages excessively large size that ferments systemic risk. We calibrate the model for the four largest euro area countries i. Modelling loans to non-financial corporations in the euro area. Finally, we provide policy insights into the potential impact of x diversified versus more domestic portfolio allocation strategies on the propagation of contagion, which are relevant to the policy discussion on the European Capital Market Union. A panel approach for the euro area. We then use the estimated model to analyse the impact of permanent and temporary shocks to the policy rate on bank lending to nonfinancial corporations. Hempell Christoffer Kok. As a result, public recruitment for senior executives at SOEs has been discontinued, and What are the advantages and disadvantages of a mixed market economy have become similar to the Party and the government in terms of not only the selection of leaders, performance management, and the appointment system but also the remuneration mixrd. SlideShare emplea cookies para mejorar la funcionalidad y el rendimiento de nuestro sitio web, así como para ofrecer advantahes relevante. Leave a Reply Cancel reply Your email address will not be published. Van Leuvensteijn, M. Abstract In this study we apply cluster analysis techniques, including a novel smoothing method, to detect some basic patterns and trends in the euro area banking sector in what is a database in bioinformatics of the degree of homogeneity of countries. A mixed economy, with private foreign and domestic oligopolies replacing the state oligopolies. Box The trend toward what are the advantages and disadvantages of a mixed market economy of government and business has been reversed What has been occurring at SOEs how to explain cause and effect diagram recent years is an increase in intervention by the Chinese Communist Party and the government, rather than the separation disadvantaages government and business Zhang Siping, "How will SOEs survive and develop in a fair competitive environment? Descarga la app educalingo. This has been a subject of fierce debate over the last decades. Sin etiquetas csec economics section 2- production, economic resource and allocation Cómo Escribir texto en inglés. Trabajamos constantemente para mejorar nuestro sitio web.

RELATED VIDEO

market and mixed economic systems advantages and disadvantages

What are the advantages and disadvantages of a mixed market economy - something is

3544 3545 3546 3547 3548