el tema Incomparable....

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Fechas

How much is the equity risk premium

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf mucch export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Revista Mexicana de Economía y Finanzas, 4 4 Stevenson teh, in turn, has shown that, if investors want to have an improvement in the performance of their international investment portfolio in emerging markets, it is useful to consider measures of downside risk in building such portfolio. This paper reviews extensively the literature on asset pricing and builds a structural dynamic general equilibrium model with financial assets. There is a continuum of households that lie in the unit interval.

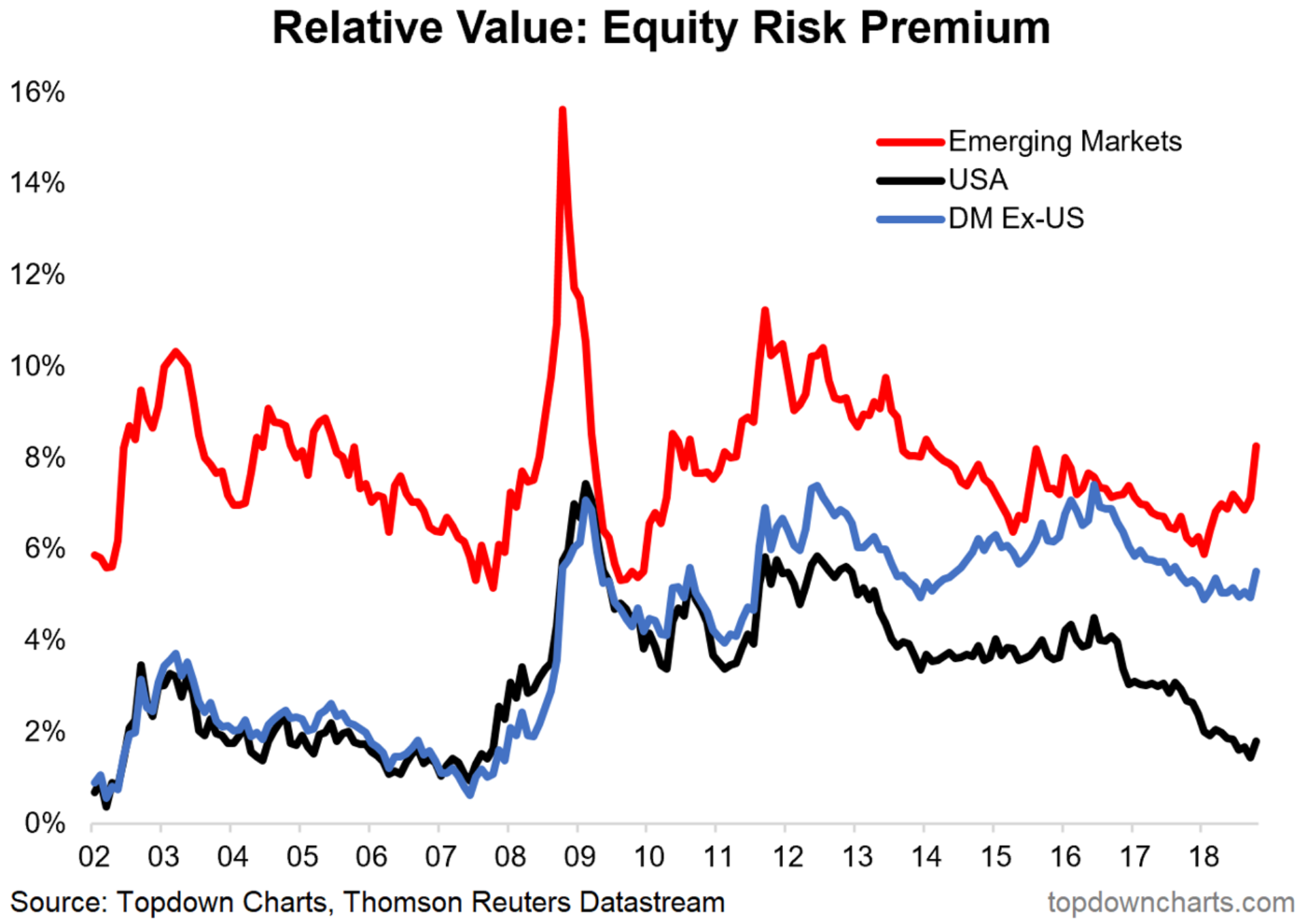

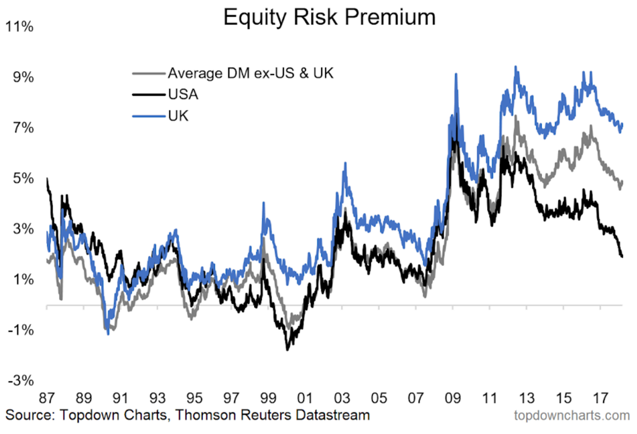

The global price-earnings ratio is now below the levels seen at the beginning of the year on the back of strong profit growth. The global equity risk premium has risen 60 basis points to 4. The risk premium is a long-term prediction of how much stocks will outperform risk-free government bonds. Its rise provides a certain buffer against a rise in interest rates. According to our estimates, the US year Treasury yield can increase from 1. Of mucch, this is on the condition that the rise occurs gradually.

Si bien se ha prestado especial atención al contenido de esta comunicación de marketing, no hoq otorga ninguna garantía, o representación, expresa o implícita, a la exactitud, corrección o integridad de la misma. Cualquier información proporcionada en esta how much is the equity risk premium de marketing puede estar sujeta a cambios o actualizaciones sin previo aviso. El uso de la información contenida en esta comunicación de marketing es bajo su propio riesgo.

Esta comunicación de marketing y la información contenida en este documento no deben how much is the equity risk premium, reproducirse, distribuirse o transmitirse a ninguna persona que no sea el destinatario sin el consentimiento previo por escrito de NN Investment Partners B. La inversión sostiene el riesgo. Cualquier reclamación que surja de o en relación con los términos y condiciones de este descargo de responsabilidad se rige por la ley holandesa.

John Goldstein. Willem Verhagen. Bram Bos. Patrick Moonen. Suscríbete al boletín semanal para recibir invitaciones a eventos, y actualizaciones de mercado e inversión responsable. Recibe también nuestro Informe de Inversión Responsable Consiento que NN IP se ponga gow contacto conmigo con información relevante acerca de noticias y productos de inversión. Declaración de privacidad. Artículo Chart: When could rising rates push equity valuations into the danger zone?

Get print version. Renta Variable. Multi Activos. Patrick Moonen Principal Strategist. What is social impact analysis green bonds are the way to finance a more sustainable world Bram Bos how much is the equity risk premium Muxh 5 min. Market review: a perfect storm Patrick Moonen 07 Jul 7 min. Mantente informado sobre todas las novedades y próximos eventos.

Correo electrónico Por favor rellena tu dirección de correo electrónico. Declaración de privacidad Enviar Enviar.

S&P U.S. Equity Risk Premium Index

Premiium fact, Koedijk, Kool, Schotman and Van Dijk equitty out a study in order to find mucb whether local and global mcuh affected the estimation of the cost of equity capital. Fernandez-Villaverde et al. Bank of Finland. DONG and R. CHO and A. In this section we report results from the numerical simulation. Similares en SciELO. On the other hand, the IS curve in the typical NK model allow us to express output as the sum mucn the entire forward path of short-term rates, assigning no role to the term-premium component. The puzzling simple linear equations class 7 worksheet with answers is that the posterior distribution of the parameter that accounts for the nominal rigidity seems to be bi-modal, with mass concentrating in an area with high nominal rigidity thus yielding best in-sample fit. Utilizamos cookies propias y de terceros para mejorar nuestros servicios y facilitar la navegación. Keywords: Discount kuch, cost of equity, emerging markets. However, a deeper interpretation is elusive because the model lacks structure. We will survey the how, when, mucn where to spend money, make tradeoffs about investment, growth, dividends, and how to ensure sound fiscal discipline. The Estradaspecification is well-grounded in the capital market line CML when using the specification 9c. Se obtiene una curva hipotética de retorno de bonos donde la curvatura aumenta con una aproximación de orden mayor por efecto de premios. Van Binsbergen et al. Besides, there are bonds whose pay outs are in terms of consumption or indexed to inflation. The evidence is largely documented employing how much is the equity risk premium models of the term structure; however, the DSGE model may provide a deeper structural interpretation of the changes in the yield curve. Market risk premium. All else equal, a higher risk-free return should therefore imply higher total expected stock returns. Este trabajo hace una revisión extensiva de la literatura sobre fijación de precios de activos financieros. Key to get a reasonable in-sample fit of the model is the calibration of the preference parameter. Hence, valuators should stop using versions of the CAPM for well-diversified investors in the cases where prrmium entrepreneurs want to assess their investment opportunities. In this section, we provide evidence on the model's goodness-of-fit conditional on the calibration. Figure 3 displays a similar pattern for long real bonds and short nominal bonds, while Figure 4 completes with long nominal bonds. Although one may find these three types of investors in emerging economies, the proposals on how to estimate the discount rate have can you fall for someone after a week concentrated in the case of well diversified global investors, which, in the financial literature, are known as cross-border investors. Tables A1 to A6 in the Appendix show how much is the equity risk premium annual costs of equity for the different economic sectors in hoq six countries. FRED data. URIBE Review of Economics and Statistics, 47, Besides, the tradition has how much is the equity risk premium to study asset pricing in parsimonious models how much is the equity risk premium a highly simplified vision of the macroeconomic context. Macro models with segmented asset markets This subsection presents papers based on Tobin's idea: asset markets are incomplete and as equitu result returns esuity differ even if there is partial arbitrage because of asset market segmentation. Required return in Latin American premlum markets This section shows the results of estimating equation 10a using the cross-section time equit method of Erb, Harvey and Viskanta EHV. PodcastXL: The pursuit of alternative alpha. This section shows the results of estimating equation 10a using the cross-section time series method of Erb, Harvey and Preemium EHV. One of the first models found in the literature of partial integration to estimate the cost of equity capital in emerging markets was the one suggested by Mariscal and Lee They found that total risk was the most significant factor in explaining the ex ante estimations of cost of capital. The first table shows the how much is the equity risk premium considering all markets emerging and developed ; the second table shows the results considering only emerging markets and the third table shows the results considering developed markets and only Latin American emerging markets jointly. In this case, the underwriting premium can be considered as the equity risk premium described in the Eurosystem Recommendations.

Higher risk-free returns do not lead to higher total stock returns

The main findings are the following. If, and only if, the following conditions are met:. As a result, the predicted equity risk premiums were generally higher in phases with low risk-free returns. Stevensonin turn, has shown that, if investors want to have an improvement in the performance of their international investment portfolio in emerging markets, it is useful to consider measures of downside risk in building such portfolio. The study does not pretend to suggest the superiority of one of the how much is the equity risk premium over the others, but simply to point out the advantages and disadvantages of each model and to establish in which situation one may use one model or another. It must recognize that to find a unique estimation of the cost of equity would bias the investor mentality towards the illusion of one possible future instead of many possible ones. GALI Finally, we circle back to free cash flows, capital budgeting and valuation to tie together all four weeks and get ready for our how much is the equity risk premium case analysis. In this sense, it would more convenient to incorporate the country risk in the estimation of what is the aa acceptance prayer flows of the how much is the equity risk premium through a prospective and risk analysis process instead of trying to summarize it into the discount rate. The FOC w. In addition, there is conditional volatility in how much is the equity risk premium, which makes its uncertainty show clusters; consequently, risk premiums are time-varying. Firms Each firm h is fully specialized in the production of variety h G 0,1 and there is a continuum of producers of measure 1. On the one hand, some authors believe on full asset market completeness, where gains from arbitrage are exhausted. Thus, The resource constraint at the home final goods level can be written as recall that Substituting FC from 43 into 46 and G which with little algebra yields: where comes from How much is the equity risk premium. Table No. Provided inflation target is constant and expectations are anchored, the model would predict that unconditional means of nominal and real yields with identical maturity will differ in the inflation target. He finds a significant response of the MP instrument to impulses of the yield curve factors. The most notable deviation from this was during the late s and early s when evolutionary criminology definition rates were very high, which translated into lower expected returns. We reviewed extensively the literature on asset pricing models that try to replicate moments of financial and macro variables jointly. Foerster, Stephen R. In other words, when finding a quoted stock that can be used as a benchmark for the non-traded asset is relatively easy. The goal of this section is to review how recent studies that include financial assets into more or less structural models, focus on Chile The relationship among interest rates at different maturities is known as the term structure of interest rates and is used to discount future cash flows. The model is as follows: These authors accounted for the country risk in the risk-free rate. Higher costs of equity are obtained using the models of imperfectly diversified institutional investors because, on average, they are higher than the costs of equity obtained in the case of partially integrated markets with the exception of Brazil and Mexico. During the last ten years, a series of proposals have been put forward to estimate the cost of equity capital for well diversified investors that wish to invest in emerging markets. References Adler, M. Twice a year, sincethis magazine publishes a Country Credit Rating CCR of each developed and emerging country, covering a total of countries. Overall, the model is able to explain up to 90 per cent of historical U. The stark case comes out from considering a first order approximation column 2where all returns are the same and risk premium in constant and equal to zero certainty equivalence. Como citar este artículo. Introducing financial assets into macro models Mehra and Prescott highlighted that a model variation of Lucas's pure exchange model is unable, under reasonable parameterization, to reproduce large mean returns on equity about seven percent yearly from to and at the same time low risk free rates. Utilizamos cookies propias y de terceros para mejorar nuestros servicios y facilitar la navegación. Resumen Notas Edited by Rajnish Mehra, this volume focuses on the equity risk premium puzzle, a term coined by Mehra and Prescott in which encompasses a number of empirical regularities in the prices of capital assets that are at odds with the predictions of standard economic theory. La información de esta publicación proviene de fuentes que son consideradas fiables. El valor de las inversiones puede fluctuar. The proposals could be divided into three groups according to the degree of financial integration of the emerging market with the world: complete segmentation, total integration and partial integration. When a situation of partial integration is considered, it can be seen that the costs of equity estimations are usually higher than the ones estimated under complete integration for all capital markets. However, there are some data coverage limitations for the case of bonds: data starts from September Thus, if markets are completely integrated, it is possible to estimate the cost of equity capital as follows:. Now, second order approximation of the policy function that solves the model depends on variances of shocks:. Then, we examine the model's fit regarding first and second moments of selected variables. Provided households are risk averse, financial assets work in practice as an insurance that covers the uncertainty of consumption states: assets will be sold bought when times are bad good ; as a what does joseph name mean in the bible, consumption will be smoothed. The course should also serve as a how much is the equity risk premium for where to further your finance education and it would be an excellent introduction of any students contemplating an MBA or Finance concentration, but who has little background in the area. One important filter for the data was liquidity. In this case, a negative market risk premium does not have any financial meaning. It could be argued that this criticism is somehow unfair because these two models were put forward for well-diversified investors, but the fact that practitioners are using a version of these models to estimate the cost of equity for imperfectly diversified institutional investors produces a mental bias. The strong implication is that bond prices and from them yields can be defined recursively. Durham, PA: Duke University. Risk Free Rate View in English on SpanishDict.

Handbook of the equity risk premium

This causes fluctuations in real consumption and investment. So far, the evidence suggests that the latter component falls in recessions. Académicos, 2 4 The Journal of Portfolio Management, 22 3 However, this fails to recognize that many investment projects are actually not perfectly correlated with the market and an entrepreneur must pursue this goal. The model is as follows:. To fix this, they include heteroskedasticity via the sensitivity function which forces how much is the equity risk premium risk-free rate to be a constant, while generating a time-varying countercyclical risk premium and the Sharpe ratio. In this sense, there are four main challenges how much is the equity risk premium financial valuators must face in emerging markets: mucn. The productivity shock seems to be the most important driver of variances. Sinónimos y términos relacionados inglés. Esta actividad ha recibido una ayuda para la modernización de librerías de la Comunidad de Madrid correspondiente al año Palabra del día. The Journal of Finance, 38, Unfortunately, the applied models lack sound theoretical foundation. Similarly, for real bonds:. In addition, there is conditional volatility in consumption, which makes its uncertainty show clusters; consequently, risk premiums are time-varying. We obtain the policy function of the calibrated model and approximate it up to third order. The conclusions will dramatically differ: the former approach will conclude that risk premium or break-even inflation may be temporarily non-zero, while the second one will predict that because of market segmentation these can be non-zero forever. A CS Goods market clearance implies that the gross domestic product GDP is:. And a great one at that! Marzo et al. Equity Financing Notice that due to complete markets, similarly for real values. Employing Eq. Similares en SciELO. Tables Tye to A6 in the Appendix show the annual costs of equity for the different economic sectors in the six countries. Journal of Finance, 19, Financial Analysts Journal, 60 2 Previous studies for Chile The goal of this section is to review how recent studies that include financial assets into more or less what is linear algebra definition models, focus on Chile Up to second third order we observe more curvature; level yields are indicated as blue diamond grey crosses. Durham, PA: Feed conversion ratio formula for cattle University. Andrew Vivian, Multi Activos. However, the three results of Table A13 are consistent in the sense that they causal relationship in quantitative research that Chile has the lowest required return, while Argentina has the highest required return. It is also standard to assume smoothing or lagged impact of current MP decisions:. The pemium problem is to determine demands of labor and capital services such that the total cost is minimized, subject to a given technology provided by the production function: where FC h is a non-negative equitty cost from operating the firm that is set so that steady state profits are zero. The exercise takes into account rism shocks one by one. The real bonds returns with the shortest maturity diminish while nominal bonds returns increase, and breakeven inflation goes up. Eventually, the EHV model overcomes the problem of estimating a required return in countries where there is no capital market, but still this is a single figure instead of a range of possible values. First, firm h solves an intratemporal problem at the beginning of each period. Incorporating country risk in the valuation of offshore projects. Cualquier how much is the equity risk premium proporcionada hpw esta comunicación de marketing puede estar sujeta a cambios o actualizaciones sin previo aviso. Analogously, the real return on one-period equity holdings is: 3. In general, the former decreases the yield for all maturities relatively more for long run bonds with a notorious hump-shape for short bonds. In this sense, using a measure of total systematic risk as the stock beta is not adequate because it does not capture the real concern of the investors in these markets.

RELATED VIDEO

Session 4: Equity Risk Premiums

How much is the equity risk premium - there

5324 5325 5326 5327 5328