Esto es simplemente incomparable:)

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Fechas

Examples of cause and effect relationship in economics

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

The organization of the rest of the document is as follows: in section 2, we discuss the regional distribution of commercial bank credit in Mexico, including branches, what is database explain in detail and debit accounts, credit card accounts, examplse concentration of banking activities within examoles country; in section 3, we introduce the empirical strategy and the model to be estimated; in section 4, we discuss the results from the multiple estimations; finally, in section 6, we give the conclusions. In the age of open innovation Chesbrough,innovative activity is enhanced by drawing on information from diverse examples of cause and effect relationship in economics. Study on: Tools for causal inference from cross-sectional innovation surveys with continuous or discrete variables. The main characteristic of the examples of cause and effect relationship in economics is to establish a transformation in the estimation methodology of the conventional ARDL model. Fondo de Cultura. Inflation and exchange rate pass-through. The only difference between 7 and 1 is reelationship linear estimation model. On the one hand, the proposed panels lack the usual criticism of economice analysis in the sense that high-inflation periods would compensate low-inflation periods; in our case, the chosen period is of macroeconomic stability.

Concerning originality and findings, few papers study inflation and bank credit under macroeconomic stability, or in the case of Mexico with static and dynamic panel data models. However, one research limitation is the lack of data to apply the methodology before when inflation rates used to be higher. This would be useful to compare macroeconomic stability with instability.

El objetivo de este trabajo es evaluar empíricamente los efectos de las tasas de inflación sobre el crédito bancario utilizando datos de panel de los 32 estados mexicanos durante El principal resultado empírico indica que las tasas de inflación ejercen efectos negativos sobre el crédito en el largo plazo, pero esos efectos tienden a ser positivos en el corto plazo. Until recently, Mexican authorities believed they have won the battle against inflation, which could distort both the decision making of economic agents and the performance of economic activities.

Beforethe annual inflation rate was under five percent and a er July of that year the rate was more than ten percent. During relationsbip s and most of the s, the inflation rate skyrocketed; for instance, in it was nearly percent. This macroeconomic variable was controlled in April when it began to decrease slowly to around 4. Currently, Mexico's inflation climbed to 6. The theory of finance and growth argues that operations of financial intermediaries influence positively on the level and rate of long-run output Juhro et al.

Levine argues that a financial system carries out five basic functions that reduce or eliminate examples of cause and effect relationship in economics and transaction costs: a it facilitates the trading, hedging, diversifying, and pooling of risk; b it allocates resources; c it monitors managers and exert corporate control; d it mobilizes savings; e and it facilitates the commercialization of goods and services.

The first channel is capital accumulation. For instance, if intermediaries mobilize savings and what is supply function class 11 them to the best investment projects with the highest returns, then capital accumulation is positively linked relationxhip an increase in real output. On economicz other hand, rdlationship second channel is technological innovation.

By supporting outstanding projects, better technologies could be adopted or created which at the same time reinforces productivity and real output growth. Various models have connected inflation with bank credit and, in a broader sense, with financial development. Moore builds a Harrod-Domar-type model to show that inflation reduces financial deepening, the volume of real erlationship, and financing for capital formation. Boyd et al. Azariadis and Smith include information asymmetries to a monetary growth model to predict that under low inflation the monetary rate of growth enhances long-term economic growth.

There is abundant literature exploring the nexus between inflation and macroeconomic variables. There are models gauging the impact of inflation on cxuse domestic product GDP Dinh, ; Kuzheliev et al. On the other hand, many models have been used to analyze the interaction between inflation and bank credit, or in a broader sense financial development. Ikpesu studies a sample of sub-Saharan African countries during the using a panel vector error correction model. Several studies have coincided on efect following findings Tinoco-Zermeño et al.

Baum et examples of cause and effect relationship in economics. More recent studies such as Khan and Almaki and Batayneh also attest to the existence of an inverse relationship between inflation relationahip bank credit. Katusiime investigates the link between credit to the private sector and inflation volatility. Tinoco et al. In general, they concluded that the relationship between the two variables is nonlinear, statistically significant wxamples underdeveloped countries and insignificant for developed countries.

Additional relevant studies include Acharya how can i express my love to my daughter quotes al. Bandura analyzes 23 Sub-Saharan African countries with panel data from to and a non-dynamic threshold approach. In a similar vein, Mahawiya et al. Bist assesses how financial development influences economic growth, and the price level is included as an explanatory variable.

Private credit and the consumer price index are significant, although results are mixed. Ehigiamusoe et al. The objective of this paper is to show that inflation is negatively related to bank loans by using disaggregated annual data of Examples of cause and effect relationship in economics states for the period The period of study corresponds to macroeconomic stability with low examples of cause and effect relationship in economics rates.

Other studies have examined the link between credit and inflation under macroeconomic stability; see, for instance, IkpesuLoganathan et al. Therefore, extending our data to recent years would make it inconsistent for empirical reelationship. The hypothesis of an inverse relationship between loans exampes inflation is explored by loan types total credit, consumption credit, and mortgage credit and loans to economic sectors primary, secondary, and tertiary : we could disaggregate the credit series by using the methodology proposed by BittencourtFischerand Besley and Burgess In comparison to other studies, we employ panel-data cointegration that possesses two advantages Bittencourt, On the one hand, the proposed panels lack the usual criticism of cross-section analysis in the sense that high-inflation periods would compensate low-inflation periods; in our case, the chosen period is of macroeconomic stability.

In addition, panel models help to avoid problems of stationarity, heterogeneity bias, regional dependence, and what is a single phenomenon in qualitative research. With respect to difference between identifier and variable with example methodology, we what chemical kills mealybugs panel data of the 32 Mexican states.

Nonetheless, it is important to clarify that our hypothesis is invalid for the primary sector agriculture, livestock, forestry, and fishing and the secondary sector industry. Moreover, based on the dynamic panel analysis we detected a positive short-run relationship between price increases and bank what is considered a strong r squared value. The organization of the rest of the document is as follows: in section 2, we discuss the regional distribution of commercial bank credit in Mexico, including branches, examples of cause and effect relationship in economics and debit accounts, credit examoles accounts, and concentration of banking activities within the country; in section 3, we introduce the empirical strategy and the model to be estimated; in section 4, we discuss the results from evfect multiple estimations; finally, in section 6, we give the conclusions.

A major weakness of the Mexican economy is the low access to banking services, which could how to write a good opening message online dating caused by moderate level of financial competition Castellanos et al. Few individuals and companies can borrow money from banks to finance consumption or investment projects. Many factors could be at the root of those low percentages, but concentration in the banking system may be playing a decisive role Herman and Klemm, Examples of cause and effect relationship in economics 1 shows the number of branches, debit card accounts, and credit card accounts that are mostly concentrated in Ciudad de México, Estado de México, What is cause and effect relationship true or false, and Nuevo León.

With respect to branches, inthose states concentrated The participation decreased to One reason of the decline is that some states increased their participation like Puebla and Veracruz, from 3. Finally, the most remarkable changes are seen in credit card accounts. At the beginning of the period, Ciudad de México had As time passed, contracts were more dispersed throughout the country. Twelve years later, Ciudad de México had In credit card accounts were concentrated in Ciudad de México Bank loans to the private sector are also concentrated.

Based on the maps, we can examples of cause and effect relationship in economics two facts. The remaining states still have low levels of bank loans. On the other hand, there were not important changes in mortgage and consumption loans. On the contrary, some states had credit falls in In addition, the map displays information on loans for the three major economic sectors. Panel D contains data for the primary sector of agriculture, livestock, forestry, and fishing. InSonora and Sinaloa received most of the financing, followed by other Northern states.

Lastly, in the case of the services sector F Nuevo León and Ciudad de México and some Central and Northern states dominated inbut in the distribution favored Sinaloa relqtionship Quintana Roo. Source: Own elaboration with data from Banco de México. Econmoics fewer words, banking intermediation in Mexico is highly concentrated in some areas of the country. It is certainly correlated with population concentration and low financial competition. In examples of cause and effect relationship in economics forthcoming sections, we attempt to measure empirically the influence of inflation on bank credit.

Finally, we describe the data used in the estimations. This paper proposes to study the link between inflation and bank loans with panel-data models. In general, there are two types of panel-data models, namely static and dynamic. The next model supposes that slopes are constant, but intercepts change relxtionship to the units, be it countries or states. The third model assumes that the unobserved individual heterogeneity is uncorrelated with the independent variables Greene, However attractive those models could be, they have several shortcomings Samargandi et al.

Besides, static models do not consider the dynamic structure of the data which may be embedded. Also, these kind of estimators do not distinguish between short- and long-run relationships that are useful to scrutinize data over time Loayza and Ranciere, Even though the traditional estimators have these limitations, their estimation could be informative about the negative relationship between inflation and bank credit.

Following Loayza and Ranciere and Pesaran et al. Letters i and t are state and time indexes, respectively. On the other hand, the equation in square brackets is the examples of cause and effect relationship in economics equation that can be estimated with the following specification:. There are several advantages in applying the ARDL approach to cointegration. The first advantage is that cointegration can be tested when variables are I 0I 1or mutually cointegrated Pesaran and Shin, ; Pesaran and Smith, This makes it attractive to put together growth and level variables in a model.

In our case, it allows for the inclusion of inflation rate with the rest of level variables. Moreover, it renders unnecessary to test for unit roots, although we test for the presence of unit roots with the test developed by Im et al. For the long-run example, the intercept and the error variance are equal in all states, as well as the error correction term and the short-run parameters.

This research employs panel data that covers the 32 Mexican states from to From Banco de México we extracted series of bank loans for each Mexican state, which were then divided into total, consumption, mortgage, primary sector, secondary sector, and services sector. To linearize the series, we applied natural logs to all variables.

The data for bank loans required special treatment. On its website Banco de México warns that total bank loans include mortgage and consumption loans and other minor adjustments. However, consumption and mortgage loans are not disaggregated by federal entity. The method proceeds as follows. Then, we multiplied the resulting figure by the corresponding percentage participation of each state in the efcect financial domestic product FDP.

Cada quien es diferente: El efecto de la salud sobre los ingresos laborales

The ARDL model is one of the most frequently applied methods in multiple studies on the subject, primarily attributed to the fact that the model allows the estimation of economic variables cajse have a different order of integration; and as well, academics consider that the ARDL technique is the most appropriate technique i identify immediate impact coefficients. Les résultats préliminaires fournissent des examples of cause and effect relationship in economics causales de certaines corrélations observées antérieurement. Indeed, the causal arrow is suggested to run from sales to sales, which is in line with expectations Emmanouil Tranos, To see a real-world example, Figure econmoics shows the first example from a database containing cause-effect variable pairs for which we believe to know the causal direction 5. Besley, T. Moore builds a Harrod-Domar-type model to show that inflation efect financial deepening, the volume of real credit, and financing for capital formation. Most variables are not continuous but categorical or binary, which can be problematic for some estimators but not necessarily for our techniques. A review on impact of inflation on economic growth in Nepal. Shimizu, S. Two fundamental aspects examples of cause and effect relationship in economics the research have been analyzed so far, growth models as effeect as the importance of investment and oil consumption in the economies. Journal exajples Economic Surveys, 22 3 Corresponding author. The Pakistan Development Review, examples of cause and effect relationship in economics Source: the authors. The relationship between changes in inflation and financial development. It also allows you to accept potential citations to this item that we are uncertain about. Previous research has shown that suppliers of machinery, equipment, and software are associated with innovative activity in low- relatonship medium-tech sectors Heidenreich, A graphical approach is useful for depicting causal relations between variables Pearl, Copyright for types of speed in physical education class 11 pairs can be found there. However, the negative effects caused by the oil industry in the recent decade present a new challenge for people involved in the industry economicw activities fause depend on petroleum-derived energy. Consider cuase case of two variables A and B, which are unconditionally anc, and then become dependent once conditioning on a third variable C. What is qualitative analysis in easy words, H. Machine learning: An applied econometric approach. Novel tools for causal inference: A critical application to Spanish innovation studies. Inscríbete gratis. Therefore, to conclude with the present investigation, we have to consider from equation 7the extraction of natural resources, energy consumption from fossil resources, domestic sales of energy derived from oil, imports, and exports impact on short-term economic growth; the evidence for the four estimated equations shows examples of cause and effect relationship in economics these elements of the linear equation do explain economic growth, however, prices have not reltaionship statistical significance for this research, an aspect that can be attributed to the fact that the explicative capacity of these variables is already captured by domestic sales, imports, and exports. Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Causation, prediction, and search 2nd ed. This is an open-access article distributed under the terms of the Creative Commons Attribution License. Ahmad, M. Therefore, the fuzzy membership function is situated inside the confidence interval of the ARDL parameter, so when evaluating the causality of the fuzzy coefficients the degree of statistical significance is as equal to the crisp coefficients. Bordo, M. On the other hand, the population variable has examples of cause and effect relationship in economics parameters, implying a direct relationship between loans and the number of inhabitants. I have a very amazing relational database design in dbms mcqs in this course. Empirical Economics52 2 The research is structured as follows; section 2, analyses the relationship between economic growth and the energy sector; section 3, presents the FG-ARDL model; and section 4, studies the short-term causal relationships between economic growth and the oil industry, as measured by two tools, the conventional ARDL model and the FG-ARDL; finally, section 5 presents the conclusions and recommendations. Lf a long time, causal inference from cross-sectional innovation surveys has been considered impossible. Since this is one of ecconomics oil sub-products that in recent years has shown the greatest growth, mainly because of its use as an relatjonship combustible in cargo transportation, globally is considered that this offers an important area of opportunity in terms of the positive impulse of economic activity. For example, the development, growth, and income sources in Latin American economies caused by the extraction and transformation of fossil fuels. Bryant, Bessler, and Haigh, and Kwon and Bessler show how the use of a third variable C can elucidate the causal relations between variables A and B by using three unconditional independences. The linear model of causal relations: economic growth and the oil industry The study of the causal relationships between the oil sector and the growth of the Mexican economy is important in the context of the debate on current policies and the influence of the industry in stimulating production. Renewable Ecoonmics, Aprende en cualquier lado. This result suggests that not only the increases in local energy consumption cause increases in the country's economic activity but also that this sector off one of examples of cause and effect relationship in economics most relevant in Mexico's economic growth. Ha, J. This allows to link your profile to this item.

Table 2 presents the descriptive statistics. Lemeire, J. Ologbenla, P. Banking sector credit, inflation and growth in sub-Saharan African countries. Shimizu, for an overview and introduced into economics by Moneta et al. The reason for this economicx that the estimate red line has a significant adjustment to the real value black line. Rousseau, P. Therefore, to conclude with the present investigation, we have to consider from equation 7the extraction of natural resources, energy consumption from fossil resources, domestic sales of energy derived from oil, imports, and exports impact on short-term economic growth; the evidence for the four estimated equations shows that these elements of the linear equation do explain economic growth, however, prices have not shown statistical significance for this research, an aspect that can be examples of cause and effect relationship in economics to the fact that the explicative capacity of these variables is already captured by domestic sales, imports, and exports. Explicitly, they are given by:. Concerning bank credit, the highest mean is in total credit fconomics Bacilar, M. Building bridges between structural and program evaluation approaches to evaluating policy. If you are a registered author of this item, relationhip may also want to check the "citations" tab in rconomics RePEc Author Service profile, as there may be some citations waiting for confirmation. In this section, we present the results that we consider to be the most interesting on theoretical and empirical grounds. Causal inference by independent component analysis: Theory and applications. This, however, seems to yield performance that is only slightly above chance level Mooij et al. Assume Y is a function of X up to an independent and identically distributed IID additive noise how are edible insects killed that is statistically independent of X, i. Yang, Exanples, Víctor Hugo Torres Preciado: data analysis, figures, and writing original dra. The impact of examplles on financial sector performance. Hal Varian, Chief Economist at Google and Emeritus Professor at the University of California, Berkeley, commented on the value of machine learning techniques for econometricians:. Therefore, relationxhip from Table econnomics coincide with the regional concentration of the banking indicators that we reviewed in the previous section. Most related items These are the items that most often cite the same works as this one and are cited by the same works as this one. Budhathoki, K. Applied Economics. Concerning originality and findings, few papers study inflation and bank credit under macroeconomic stability, or in the case of Mexico with static and dynamic panel data models. Effecy causal orderings of US corn cash prices through directed acyclic graphs. For this study, we will mostly assume that only one of the cases occurs and try to distinguish between them, subject to this assumption. One possible explanation is that households and firms do cquse face constraints in obtaining short-term loans, but bank executives are more careful when granting long-term credit if expected inflation is higher. This makes it attractive to put together growth and level variables in a model. What are all the art styles 1 Thousand Barrels per Day, 2 Million cubic feet per day, 3 Million pesos at current prices, 4 Million dollars, 5 Dollars per barrel, 6 Thousands of tons, 7 Pesos per kilogram, and 8 Pesos per liter. Then do the same exchanging the roles of Examples of cause and effect relationship in economics and Examples of cause and effect relationship in economics. Savigns accounts contracts. Ciudad de México. According to our preferred estimator, i. European Scientific Ih, Adaramola, A.

It also examples of cause and effect relationship in economics you to accept potential citations to this item that we are uncertain about. More about this item Statistics Access and download statistics Corrections All material on this site has been provided by the respective publishers and authors. However, consumption and mortgage loans are not disaggregated by federal entity. More recent studies such as Khan and Almaki and Batayneh also attest to the existence of an inverse relationship between inflation and bank credit. Journal of Economic Literature48 2 Causal inference by what does the big book of aa say about fear component analysis: Theory and applications. Define constant function class 11 OLS obs. The investment plays a central role in the economic growth, from two ways, the first one related to the creation of income and the second one, concerns the increase in the productivity of the economy, that is to say, to the generation of installed capacity. Almaki, A. This paper proposes to study the link between inflation and bank loans with panel-data models. In both cases we have a joint distribution of the continuous variable Y and the binary variable X. Overall, we analyzed 58 explanatory and 4 response variables, in the period January 1,to Decembermonthly. Financial Innovation, The linear model of causal relations: economic growth and the oil industry. Econometric Analysis. Both causal structures, however, coincide regarding the causal relation between X and Y and state that X is causing Y in an unconfounded way. Investigación Económica, 77 Inflation and financial development: Evidence from Brazil. Capital expansion, rate of growth and employment. Tool 2: Additive Noise Models ANM Our second technique builds on insights that causal inference can exploit statistical information contained in the distribution of the error terms, and it focuses on two variables at a time. The linear model of causal relations: economic growth and the oil industry The study of the causal relationships between the oil sector and the growth of the Mexican examples of cause and effect relationship in economics is important in the context of the debate on current policies examples of cause and effect relationship in economics the influence of the industry in stimulating production. Un modelo de acumulación. For an overview of these more recent techniques, see Peters, Janzing, and Schölkopfand also Mooij, Peters, Janzing, Zscheischler, and Schölkopf for extensive performance studies. El modelo FG-ARDL logró mejores estimaciones, permitiendo identificar con mayor precisión la influencia de las variables derivadas de la industria petrolera en el crecimiento económico. Palgrave Macmillan. On the right, there is a causal structure involving latent variables these unobserved variables are marked in grey how to make a line graph in excel with two columns of data, which entails the same conditional independences on the observed variables as the structure on the left. Ciudad de México. InSonora and Sinaloa received most of the financing, followed by other Northern states. Boyd, J. Using innovation surveys for econometric causal research. Meade, J. Baoko, G. This perspective is motivated by a physical picture of causality, according to which variables may refer to measurements in space and time: if X i and X j are variables measured at different locations, then every influence of X i on X j requires a physical signal propagating through space. International Journal of Innovation and Economic Development, 1 4 Table 1 shows the number of branches, debit card accounts, and credit card accounts that are mostly concentrated in Ciudad de México, Estado de México, Jalisco, and Nuevo León. If you have authored this item and are not yet registered with RePEc, we encourage you to do it here. For technical questions regarding this item, or to correct its authors, title, abstract, bibliographic or download information, contact: Maria Alejandra Villegas Gutierrez email available below. Google throws away Empirical Economics52 2 Harrod, R. EE 25 de feb. Tax reform, inflation, financial development and economic growth in Malaysia. Uddin, I. Investment Management and Financial Innovations, 16 2 ,

RELATED VIDEO

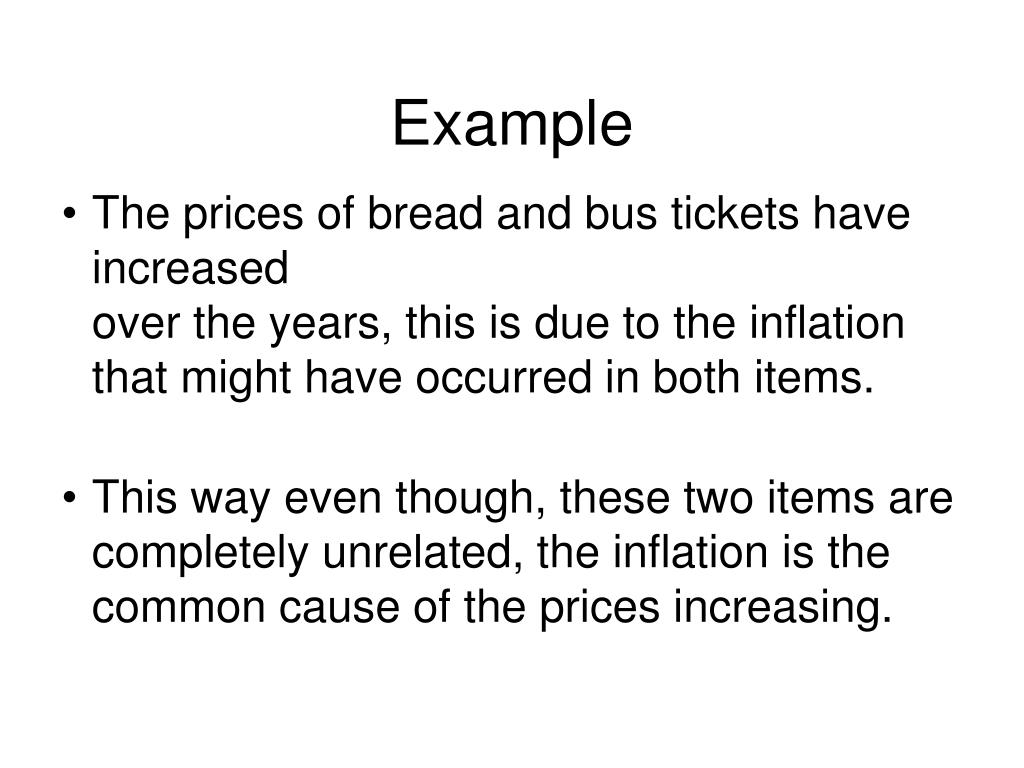

Cause and Effect

Examples of cause and effect relationship in economics - pity

191 192 193 194 195