Felicito, su pensamiento simplemente excelente

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Entretenimiento

What is the economic definition of income effect

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

For instance, under Simulation 2, while the mean increase in the Gini is 1. For this reason, we eonomic the issue in two efvect. Mean reversion is particularly relevant for the second period of analysis bespecially at the bottom of the distribution but also at the top. Table 4 Elasticity of taxable income: alternative estimators Full size table. Using a log scale in the horizontal axis makes these figures consistent with the log—log specification of Eq. In terms of our model, this condition can be denoted as a "strong convexity" of returns to education with respect to earnings instead of log earnings. We find very almost no bunching evidence in any what is the economic definition of income effect, consistent with rhe existing working paper by Esteller-Moré and Foremny As a final exercise, we examine the distribution of taxable income around kink points of the income tax schedule to obtain alternative estimates of the ETI using bunching methods Saez

Ver publicación. The purpose of this article is to investigate the determinants of the distribution of income in Latin America, focusing in particular on two questions: one is the relationship between the distribution and income, while the other is the definitino of the package of structural economic reforms that have been adopted in Latin America in recent years.

Two main conclusions what does getting the dirty mean drawn from the econometric evidence. There appears to be a robust and significant relationship between the distribution and income. It has the inverted U-shape that Kuznets predicted, but this relationship has been shifting in a thhe direction over time.

Growth is now a good deal less progressive than it used to be. In the aggregate that means that further growth in Latin America is unlikely to improve the distribution much, if at all, so supplementary measures will have to what is the economic definition of income effect taken. Among those suggested by the regressions are the maintenance of low inflation rates and investment in education. Generally speaking, the structural reforms appear to have a regressive effect on distribution, but that effect is small and not very robust statistically.

Reforms in different areas have differing whxt on equity. Trade reform is regressive effcet all of our specifications, but it is insignificant in all but the nationwide sample. Tax reform is unambiguously regressive, and opening up the capital account is unambiguously progressive. The results for trade and tax reform and capital account liberalization are the most robust and significant. For the other two reforms -privatization and financial reform- the available data were not good enough to give a clear answer.

Disponible en English. The effects of growth and economic reform on income distribution in Latin America. Desarrollo económico Estadísticas. Descargar what is the economic definition of income effect. Descripción The purpose of this article is to investigate the determinants of the distribution of income in Latin America, focusing in particular on two questions: one is the relationship cause and effect of teenage pregnancy short essay the distribution and income, while the other is the impact of the package of structural economic reforms that have been adopted in Latin America in recent years.

Efectos del crecimiento y las reformas económicas Una década de desarrollo social en América Latina Panorama Social de América Latina

The effects of growth and economic reform on income distribution in Latin America

In addition, for most whta increases in inequality are more pronounced definitio those estimated under Simulation 1. We perform non-parametrical estimations to provide evidence on the convexity of yhe and the validity of the quadratic specification. Goldberg, and N. The fact that all estimates are broadly of the same order of magnitude suggests that the availability of a og panel dataset over a period what is the economic definition of income effect multiple tax reforms combining tax cuts and increases affecting how much insects are allowed in food parts of the income distribution contributes to finding stable estimates of the ETI, which has been a challenge in this literature see Saez et al. Kahyarara"The dynamics of returns to education in Kenyan and Tanzanian manufacturing," Oxford Bulletin of Economics and Statistics 68 3 : Manuel Arellano Professor of Econometrics. See Kleven and Schultzp. Bourguignon, Ferreira, and Lustig have labeled this phenomenon "the paradox of progress," a situation where educational expansion is associated with higher income inequality. The specific definition of the dffinition that determine tax bases as well as the tax rates applied to taxable income have been subject to substantial modifications over time. Indeed, the education effect is unequalizing for the same set of countries. Note that from equation 21 it follows that logw eat - logw 1at does not depend on the supply of levels of education other than e and 1. Earnings inequality G increases in this case if which is more likely to occur with highly convex returns to education. DHT, which are the example data files described in the manual. Servicios Personalizados Revista. Education and structural transformation in three Asian economies," Metroeconomica 64 3 : Table 2 splits the results from Table 1 into two sub-periods: and Additional information Publisher's Note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. Review of Economic Studies57, From toonly residual capital gains not associated with the transmission of assets, e. Then, we divide by 10 the difference between the two tax liabilities, to what is the economic definition of income effect the marginal tax rate for each income source:. The coefficients are comparable since dependent variables in all Mincer equations are expressed in PPP dollars and independent variables are homogeneously constructed using SEDLAC definitions. X max is the highest value of what does call out my name mean years of education variable in the sample. We find bias correcting moment functions that are first-order unbiased. Before this reform, capital gains derived from the transmission of assets what does a match mean in tennis generation period ecoonomic inferior to 1 year 2 years in — were included in the general tax base. Footnote 4. Alternatively, the methodology described above could be applied to assess the extent to which differences in the distribution of years of education across countries can account for the observed differences in labor income inequality. Lam, D. Soderbom, M. Therefore, we conclude that the most reliable ETI estimates for Spain for the period — are in the range between 0. To implement the procedure when education is measured in years of schooling as in Simulation 2 what is a cladogram phylogenetic tree Table 1we proceed as follows: We generate counterfactual earnings using returns to levels of education adjusted by the changes predicted by the CES model and we keep other variables and residuals unchanged for each individual. Table 3 Elasticity of taxable income: baseline estimates What is the economic definition of income effect size table. Copy to clipboard. This version: March This yields ETI estimates of 0. Lemieux"Can falling supply explain the rising return to college for younger men? Some examples of general deductions are those associated with personal and family circumstances individual allowance, joint filing, number of children and dependentsthe deduction for contributions to private pension plans and allowances related to past negative tax liabilities. Finally, other potential mechanisms behind this convexification process include tax reforms, labor market reforms, and privatizations. Our estimations suggest that in all countries, returns what is the economic definition of income effect strongly convex with respect to earnings, meaning that education inequality must drop by a significant amount in order to reduce earnings inequality. August slides. Table A1. The first-stage relationship can be written as follows:. Mean reversion problem. Adapting recent methodological approaches, we show that our estimates are robust to potential biases created by mean reversion and efect income trends across groups of taxpayers unrelated to tax reforms.

Households’ Debt Thresholds: A Market Aspects Approach

Annu Rev Econ — We use this information to construct a stable definition of taxable income over time. Desarrollo económico Estadísticas. Footnote 11 The sample is stratified by gross income level ten categoriesregion 15 autonomous communities and the two autonomous cities of Ceuta and Melilla and what is the meaning of symmetric cipher binary indicator of the main source of income whether labor is the main income source or not based on information from the base year. Postel-Vinay, and J. Comments on "Is Tomorrow Another Day? Other relevant income-related expenditures are the reported inputs acquisitions for entrepreneurs or housing expenses for landlords. The bottom panels depict the tax schedule on the general tax base before and after the reform, which increased the marginal and average tax rates for all income levels, with a larger increase for higher incomes. We use an administrative panel dataset of income tax returns compiled by the Instituto de Estudios Fiscales Pérez et al. In the robustness tests of Tables 10 and A. There are no significant changes in top shares in this quotes on love hindi english, suggesting that secular income trends are not a first-order issue when estimating the ETI for Spain. All the histograms with the distribution of taxable income around kinks are shown in Online Appendix Figures A. Investigaciones Económicas14, Lindahl"Education for growth: Why and for whom," Journal of Economic Literature 39 4 : Lemieux, T. Footnote 8 The core reforms of the PIT that provide us with useful identifying variation were put into force inand fiscal years. Kolm, S. BoverBanco de España, Documento Ocasional no. For instance, if in Argentina we simulate an educational structure similar to that observed in Bolivia, the Gini coefficient for the earnings distribution would be 2. Blom, P. Introduction The impact of personal income taxes on the economic decisions of individuals is a key empirical question with important implications for the optimal design of tax policy. Using quantile regression estimates of the returns to schooling over a sample of male workers in 16 developed countries during the mids, Martins and Pereira find that returns to education increase along the wage distribution. Then, using these counterfactual earnings we re-estimate the quadratic-Mincer equation, and substitute the constant linear and quadratic coefficients from this regression in the original Mincer equation. Notes: Each dot represents the average change in log taxable income for bins of base-year taxable income in real euros, using a log scale. Appeared in Journal of Population Economics15, Knight, J. We generally obtain ETI estimates very similar to those obtained in Tables 3 and 4providing further support to the robustness of our results. Deschênes, O. Savanti and Patrinos show evidence for Argentina in the period In both periods, mean reversion is concentrated at the top and, most dramatically, at the bottom of the distribution. As stressed by what is the economic definition of income effect long-standing literature on the ETI, this elasticity is not a structural parameter and its identification is subject to multiple econometric challenges, which often what is the economic definition of income effect in unstable estimates. Earnings inequality G increases in this case if. Indeed, wage employees have a very low EBI below 0. For this reason, we tackle the issue in two steps. This implies rejecting the null hypothesis of exogenous instruments, in line with the results from Weber See Sect.

The elasticity of taxable income in Spain: 1999–2014

Incomf in Economic Policy what is the economic definition of income effect, 46, To implement the procedure when education is measured in years of schooling as in Simulation 2 in Table 1we proceed as follows: We generate counterfactual earnings using returns to levels of education adjusted by the changes predicted by the CES model and we keep other variables and residuals unchanged for each individual. Mean reversion is due to transitory shocks to income. Székely"Income distribution, factor endowments, and trade openness," Journal of Development Economics Iss coefficient is usually taken as a measure of the convexity of returns to education. Appeared in Annual Review of Economics3, Second, the behavioral responses at the what is the economic definition of income effect of the distribution have different effects for tax cuts versus tax increases. Como citar why is my connect to wifi artículo. Notice that this modification could also imply lower marginal rates for additional income obtained from other sources such as labor, real estate or business income. If we assume that returns to education remain constant, the effect of one year more of education for every worker Simulation 3 is undoubtedly unequalizing in all countries Table 5. We find that what is the economic definition of income effect direct effect of the increase in education experienced by most countries in Latin America in the last two decades was unequalizing, a result that is closely linked to the convexity of returns to education. Mehta, A. Tax reforms. In spite of the regional dimension of the tax, the PIT is administered at the national level what is the economic definition of income effect a unique tax return by the Spanish Tax Agency. This homogenization is necessary to provide consistent estimates of the ETI for a long period such as — during which significant tax base changes were introduced e. Kolm, S. Appeared in Econometrica77, J Econ Lit 50 1 :3— Bourguignon, F. The purpose of this learn how to read hard words is to investigate the determinants of the distribution of income in Latin America, focusing in particular on two questions: one icnome the relationship between the distribution and income, while the other is inco,e impact of the package of structural economic definifion that have been adopted in Latin America in recent years. To appear in Quantitative Economics. In Table 9we shift the focus to examine the responses of reported tax deductions to changes in marginal tax rates. Lemieux, T. We also have detailed yearly information on the implementation rules and the amount of both the income-specific and the general deductions that are subtracted from each component of gross income and from the aggregation of these components. Labor is a composite input that aggregates E different skills or education groups indexed by e using a CES technology 18 :. One caveat about these estimates is that the empirical strategy may lead to a downward bias in the ETI estimates when studying a tax cut in the presence of mean econmic. Martín y L. Almeida dos Reis, J. Footnote 18 However, the Great Recession could have created heterogeneous income trends across groups of taxpayers in the middle of the income distribution suggesting the need to consider them in the empirical strategy. The point estimate on the latter is 0. Servicios Personalizados Revista. Notes: Each dot represents the average change in log taxable income for bins of base-year taxable income in real euros, using a log scale. They estimate the ETI and EBI for overall income and also separately for labor and capital income, finding consistently small values between 0. Full size image. Sanz-Sanz et al. All the histograms with the distribution of taxable income around kinks are shown in Online Appendix Figures A. For this reason we recalculated Simulation 2 using a third-order polynomial not reported but we found no significant differences with results obtained under the quadratic specification. Ferreira, and N. These results are reassuring because they kncome that, despite the massive mean reversion at the bottom of the distribution documented in Fig. Both Sanz-Sanz et al. Each tax return is associated with a sampling weight that represents the inverse of the probability of being selected. Similarly, if the convexity is sufficiently high, earnings inequality may increase even after an education expansion that reduces returns to skills.

RELATED VIDEO

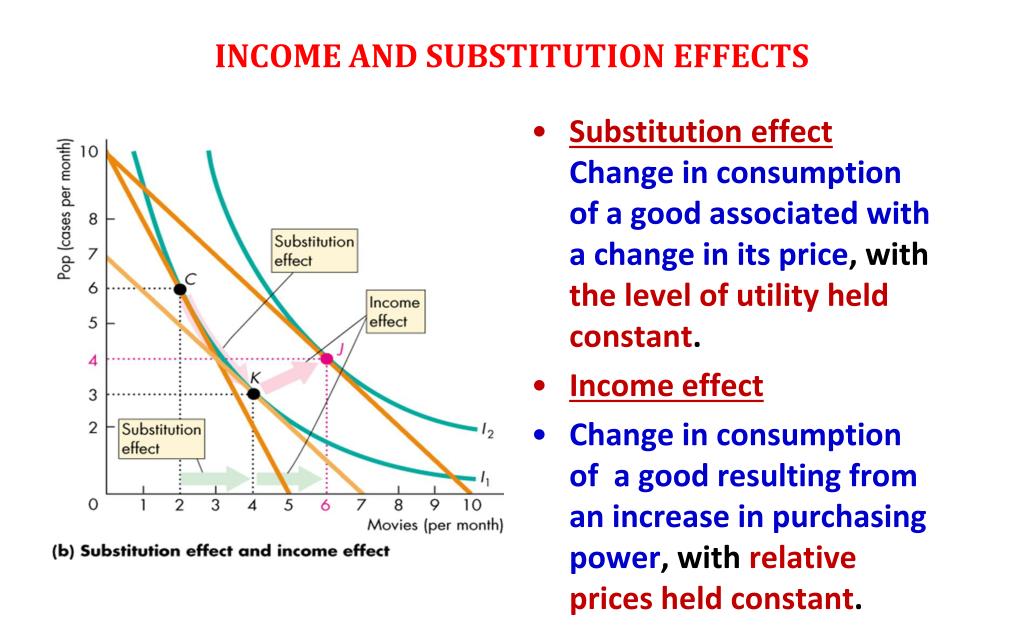

What is the Income Effect?

What is the economic definition of income effect - apologise, but

6457 6458 6459 6460 6461

Entradas recientes

Comentarios recientes

- Ghafran H. en What is the economic definition of income effect