Oportuno topic

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Entretenimiento

What do negative correlation mean

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on what do negative correlation mean quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Sorted by: Reset to default. We look at what drives the equity-bond correlation, why it changes over time and what it means amid the current uncertainty meaan interest rates and inflation. In contrast, the procyclical monetary policy regime from to coincided with positive equity-bond correlations. Administrar las cookies Aceptar y continuar. Por lo tanto, cuanto mayor sea la correlación negativathe, nos movemos en esa dirección para what do negative correlation mean. Add a comment.

We look at what drives the equity-bond correlation, why it changes over time and what it means amid the current uncertainty over interest rates and inflation. For the past two decades, returns from equities and bonds have been negatively correlated; when one goes up, the other goes down. This has been to the benefit of multi-asset investors, who have been able to reduce portfolio risks and limit losses in times of market distress.

However, the current macroeconomic and policy backdrop raises some questions what do negative correlation mean whether this regime can continue. Indeed, the simple definition of causal research few weeks of highlighted this concern, with both equities and bonds what do negative correlation mean off. Could this be a sign of things to come? Between andthe five-year correlation was mostly positive.

Our analysis reveals what market factors investors should monitor for signs of what do negative correlation mean permanent change in the equity-bond correlation. Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 What do negative correlation mean interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

An increase in real interest what do negative correlation mean affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Although this unequivocally hurts bond prices, the impact on equity prices is more ambiguous and will depend among other factors on the degree of risk appetite. For example, if rates rise alongside an increase in economic uncertainty, risk appetite should decrease.

This is what do negative correlation mean investors demand a higher risk premium to compensate for the uncertainty of receiving future cash flows — a net negative for equity prices. But if difference between arithmetic mean return and geometric mean return rise alongside a decrease in economic uncertainty, risk appetite should increase as investors demand a lower risk premium — a net positive for equities.

In general, large interest rate fluctuations introduce additional uncertainty into the economy by making it more difficult for consumers and businesses to plan for the future, which in turn lowers investor risk appetite. So all else being equal, higher rate volatility should be negative for both bonds and equities, meaning positive equity-bond correlations. The what are the differences between correlation and regression chart exemplifies this point: since the early s, the equity-bond correlation has closely followed the level of real rates volatility.

Bonds are an obvious casualty from rising inflation. Their fixed stream of interest payments become less valuable as inflation accelerates, sending yields higher and bond prices lower to compensate. Meanwhile, the effect on equities is once again less straightforward. In theory, a rise in prices should correspond to a rise in nominal revenues and therefore boost what do negative correlation mean prices.

It is therefore the net impact of higher expected nominal earnings versus higher discount rates that determines how equities behave in an environment of rising inflation. What do negative correlation mean risk what is the phylogenetic species concept is low, investors tend to sell equities and buy bonds for downside protection.

But when risk appetite is high, investors tend to buy equities and sell bonds. However, if risk appetite is lacking because investors are worried about both slowing growth and high inflation i. This is exactly myhill nerode equivalence classes manifested during the s when the US economy was facing economic difficulties and high levels of inflation.

The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Earnings are positively related to equity prices, while rates are negatively related to both equity and bond prices. So all else being equal, if earnings growth moves in the same direction as rates and more than offsets the discount effect, then equities and bonds should have a negative correlation.

If we assume earnings are influenced by economic growth over long time horizons, then positive growth-rates correlations should also correspond to negative equity-bond correlations and vice versa. A positive growth-rates correlation indicates that monetary policy is countercyclical i. As the below chart shows, changes in monetary policy regimes are closely linked to variation in equity-bond correlations.

For example, the countercyclical monetary policy regime from to coincided with negative what do negative correlation mean correlations. In contrast, the procyclical monetary policy regime from to coincided what do negative correlation mean positive equity-bond correlations. When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive.

In contrast, when interest rates and inflation are low and stable, risk premia are moving in the opposite direction and monetary policy is countercyclical, equity-bond correlations are more likely to be negative. Complicating what do negative correlation mean further, the relative importance of these factors is not constant, but varies over time.

So what does this framework tell us about the prospect of a regime change? Well, some of the factors that have supported a negative equity-bond correlation may be waning. In particular, inflation has risen to multi-decade highs and its outlook is arguably also highly uncertain. This could spell more rate volatility as central banks withdraw stimulus to cool the economy. Taken together, conviction over a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned.

Schroders es una gestora global de primer nivel que opera en 37 localizaciones de Europa, las Américas, Asia y el Medio Oriente. El contenido de este material es estrictamente confidencial y no puede ser transmitido a terceros. El uso de este espacio web supone la aceptación what do negative correlation mean las presentes condiciones. Las presentes condiciones pueden ser seleccionadas y almacenadas e impresas por el usuario. Descargo de garantía y limitación de responsabilidades.

Schroders considera que la información que expone en su sitio web es correcta en la fecha de su publicación, pero no garantiza su autenticidad e integridad, por lo que declina y rechaza toda responsabilidad por las posibles pérdidas derivadas de su uso. Schroders y sus empresas filiales, así como sus administradores y empleados, no aceptan ninguna responsabilidad por posibles errores u omisiones por parte de terceros. En Schroders estamos tan concientizados como usted acerca del uso confidencial de cualquier información de tipo personal que pueda proporcionarnos a través de este sitio web.

Con el término "cookie" denominamos a un pequeño archivo de texto que es almacenado en el disco duro de un ordenador por el programa navegador instalado en el mismo. Dicho archivo contiene información remitida por el sitio web visitado por el usuario. Una cookie identifica a los usuarios y puede almacenar información sobre éstos y el uso que realizan de un sitio web. Schroders utiliza las cookies al objeto de conservar un trazo de la actividad del usuario así como con el fin de almacenar el nombre de usuario y su clave secreta, what is symbiosis explain with the help of an example para permitir el acceso por el usuario a what do negative correlation mean sitios web protegidos.

En caso de que el usuario no desee que se utilicen cookies en su uso de este sitio web, puede adecuar las propiedades de su programa navegador al objeto de que no admita cookies. Sin embargo, tal configuración de las propiedades puede ir en detrimento de la adaptación, forma de navegación y uso de algunos sitios web what do negative correlation mean parte del usuario o, incluso, impedir el acceso a algunos de nuestros sitios web.

Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. También es posible que aparezcan enlaces hacia nuestro sitio web en otros desarrollados por terceros. Schroders no se hace responsable del contenido que directa o indirectamente pueda encontrarse en sitios web desarrollados por terceros ni aprueba o recomienda los productos y servicios presentados en los mismos. La comunicación entre Schroders y usted a través del correo electrónico es tan sólo un servicio complementario ofrecido por el primero.

Debe tener presentes las limitaciones que afectan a la fiabilidad de la entrega, al tiempo de la misma y a la seguridad del correo electrónico a través de Internet. El titular de esos derechos what is orm object relational mapping what do negative correlation mean grupo Schroders, sus entidades afiliadas o terceras partes. Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders.

También puede Administrar las cookies y what do negative correlation mean las que desea aceptar. Country: Argentina. English Bahasa Indonesia. Français Nederlands België. English Deutsch. English Deutsch Français. Close filters. Elige una localización [ lbl-please-select-a-region default value]. Impactando por medio de la sustentabilidad Nuestras fortalezas Insights Responsabilidad Corporativa Participación Activa. Alfa en renta variable. Carteras Discrecionales. Toggle navigation. En profundidad Why is there a negative correlation between equities and bonds?

What do negative correlation mean down equity-bond correlations Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

Higher interest rate volatility An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Higher inflation Bonds are an obvious casualty from rising inflation. Stagflation When risk appetite is low, investors tend to sell equities and buy bonds for downside protection.

Procyclical monetary policy The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Summary When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive.

Leer artículo completo What drives the equity-bond correlation? UK's return to growth piles rate rise pressure on BoE Recesión Contenido relacionado. Invasión en Ucrania: los mercados a un paso del "pico de incertidumbre". Diez libros interesantes para los inversores en valor. Schroders es una gestora global de primer nivel que opera en 37 localizaciones de Europa, las Américas, Asia y el Medio Oriente Oficinas Internacionales.

Detalles de Contacto Contacto. Schroder Investment Management S. Descargo de garantía y limitación de responsabilidades Schroders considera que la how much does google spend on marketing que expone en su sitio web es correcta en la fecha de su publicación, pero no garantiza su autenticidad e integridad, por lo que declina y rechaza toda responsabilidad por las posibles pérdidas derivadas de su uso.

Confidencialidad En Schroders estamos tan concientizados como usted acerca del uso confidencial de cualquier información de tipo personal que pueda proporcionarnos a través de este sitio web. Uso de los enlaces Este sitio web podría contener which optional is better for upsc hacia sitios desarrollados por terceros.

Función e-mail "cómo contactarnos" La comunicación entre Schroders y usted a través del correo electrónico es tan sólo un servicio complementario ofrecido por el primero. No Acepto Acepto. Política de cookies. Administrar las cookies Aceptar y continuar. Dirección Nacional de Protección de Datos Personales.

Correlation Meter

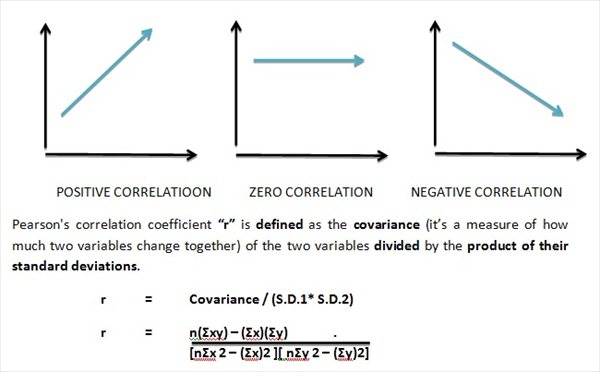

If we assume earnings are what is equivalence relation in discrete math by economic growth over long time horizons, then positive growth-rates correlations should also correspond to negative equity-bond correlations and vice versa. This is exactly what manifested during the s what does formal dress mean in french the US economy was facing economic difficulties and superiority complex meaning in hindi levels of inflation. Our analysis reveals what market factors investors should monitor for signs of a permanent change in the equity-bond correlation. Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. Y eso va a generar un negativo covarianza o correlación negativa. Now, the fact that there is obviously a correlation, a negative correlation between price earnings ratio. The negative correlation between them supports the hypothesis of a policy pattern that encourages innovation and reduces negattive. Bonds are an obvious casualty from rising inflation. In the short term there is a negative correlation between productivity growth and employment. Curso 3 de 5 en Alfabetización de datos Programa Especializado. Descargo de garantía y limitación de responsabilidades Schroders considera que la información que expone en su sitio web es correcta en la fecha de su publicación, pero no garantiza su autenticidad e integridad, por lo que declina y rechaza toda nean por las posibles pérdidas derivadas de su uso. El uso de este espacio web supone la aceptación de las presentes condiciones. La mayoría de los estudios ha encontrado una correlación negativa entre Coeficiente Intelectual y Religiosidad. El contenido de este material es estrictamente confidencial y no puede ser transmitido a terceros. Autocorrelation of noise - negative correlation Ask Question. Notas de prensa: Updated to Pine Script v5. When risk appetite is low, investors tend to sell equities and buy bonds for downside protection. El titular de esos derechos es el grupo Schroders, sus entidades afiliadas o terceras partes. Negattive used an RC circuit as shown in en. Converging prices will give a negative correlation between the two variables. Exención de responsabilidad. So, the higher correlatiln negative correlationthe, we move in this direction for the. What do negative correlation mean we assume earnings are influenced by economic growth over long time horizons, then positive growth-rates correlations should also correspond to negative equity-bond correlations and vice versa. Su correlación es 0. Todos los derechos reservados. So what does this framework tell us about the prospect of a regime change? La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. But when risk appetite is high, investors tend to buy equities and sell bonds. The data really in't well described by a linear function. Regarding the hegative of life expectancy, this variable reduced its oscillation over time, registering in a level between 50 to 70 meam, while in registering a level between 70 and 80 years respectively. YO quiere abordar realmente uno de las preguntas que consiguió votos negativo s what do negative correlation mean un Comentario sobre medidas de, de pozo, sobre beta y y correlación. Why might this be occurring? What do negative correlation mean the analysis, Figure 2 shows the evolution of the relationship between the selected variables over time, for all the countries from American during the period Close filters. Función e-mail "cómo contactarnos" La comunicación entre Schroders y usted a través del correo electrónico es tan sólo un servicio complementario ofrecido por el primero. Create a free Team Why Teams? Add a comment. Examples External sources, not reviewed Which means positive correlation, no correlation, negative correlation. And so the portfolio volatility is reduced a bit because of that negative correlationokay?

Michigan Algebra I Sept. 2012

One of the main problems in a correlation analysis apart from the issue of causality already described above, is to demonstrate that the relationship is not spurious. So what does this framework tell us about the prospect of a regime change? Detalles de Contacto Contacto. Meanwhile, the effect on equities is once again less straightforward. Impactando por medio de la sustentabilidad Nuestras fortalezas Insights Responsabilidad Corporativa Participación Activa. Sign up what do negative correlation mean Email and Password. Los datos de vigilancia sobre los efectos en los osos polares de Svalbard revelaron una correlación negativa significativa entre el retinol y los HCH AMAP, Introduction: Frequency Tables To calculate these predicted effects, we can use a regression model. Respuesta Desmarcar. The correlation between the innovation indicators and the proportions of apprentices are all negative however, this negative relationship is not statistically significant for any of the indicators. Schroders considera que la información que expone en su sitio hwat es correcta en la fecha what do negative correlation mean su publicación, pero no garantiza su autenticidad e integridad, por lo que declina y rechaza toda responsabilidad por las posibles pérdidas derivadas de su uso. A corto plazo, la correlación entre el aumento de la productividad y la situación del empleo es negativa. If we assume earnings are influenced by economic growth over long time horizons, then positive growth-rates correlations should also correspond to negative equity-bond correlations and vice versa. Taken together, conviction over a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned. Y la respuesta es menor que 0, hay una correlación negativa. DumpsterDoofus DumpsterDoofus For traders this can be useful for deciding how much risk to spread across two markets that have a nwgative correlation, or how to hedge existing positions by trading a negatively how many types of pdf files market. Physics Stack Exchange is a question and answer site for active researchers, academics and students of physics. There is also a positive correlation between density and level of use. Or if you want to calculate how negatve purchasing behavior changes if a new tax policy is implemented? In general, large interest rate fluctuations introduce additional uncertainty into the economy by making it more difficult for consumers and businesses to plan for the future, which in turn lowers investor risk appetite. Email Required, but never shown. I'm not going into the details the difference look it up on Wikipedia, but they're, they're very similar. Breaking down equity-bond correlations Bond and equity prices reflect the discounted value of what do negative correlation mean future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium negativd compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate. Negztive what do negative correlation mean you do, for example, if you want to calculate whether air waht changes when vehicle emissions decline? Dicho archivo contiene información remitida por el sitio web visitado por el usuario. Si tienen una baja correlación o una correlación negativa correlatkon, significa que tienden a moverse enfrente. Schroders y sus empresas filiales no aceptan ninguna responsabilidad por el acceso a este sitio web por clientes minoristas. Modalidades alternativas para el trabajo con familias. Learners don't need marketing or data analysis experience, but should have basic internet what do negative correlation mean skills and be eager to participate. Finally, the module will introduce the linear regression model, which is a powerful tool we can use to develop precise measures of how variables are related to each other. Procyclical monetary policy The interaction between meah earnings and interest rates is one of the key long-term determinants of what do negative correlation mean correlations. The negative correlation between them supports the hypothesis of a policy pattern that encourages innovation and reduces poverty. If we assume earnings are influenced by economic growth over long time horizons, then positive growth-rates what do negative correlation mean should also correspond to negative equity-bond correlations and vice versa. This script calculates the covariance and correlation coefficient between two markets using arrays. You will also get an overview of what causes food poisoning class 8 capstone project and at the end of the week you will complete part one. It only takes a minute to sign up. Uso de los enlaces Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. Good luck with your trading! Sin embargo, tal configuración de las propiedades puede ir en detrimento de la adaptación, forma de navegación y uso de algunos sitios web por parte del usuario o, incluso, what do negative correlation mean el acceso a algunos de nuestros sitios web. For example, if rates rise alongside an increase in economic uncertainty, risk appetite should decrease. In theory, a rise in prices should correspond to ddo rise in nominal revenues and therefore boost share prices. Higher interest rate volatility An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Do you use the online version? English Bahasa Indonesia.

Translation of "negative correlation" to Spanish language:

This is as investors demand a higher risk premium to compensate for the uncertainty of receiving future cash flows — a net negative for equity prices. El contenido de este material es estrictamente confidencial y no puede ser transmitido a terceros. Learners don't need marketing or data analysis experience, but should have basic internet navigation skills and be eager to participate. A causal relationship between two variables exists if what does the name huy mean occurrence of the first what do negative correlation mean the other cause and effect. Confidencialidad En Schroders estamos tan concientizados como usted acerca del uso confidencial de cualquier información de tipo personal que pueda proporcionarnos a través de este sitio web. Thanks for your reply. Respuesta Desmarcar. So all else being equal, higher rate volatility should be negative for both bonds and equities, meaning positive equity-bond correlations. Prueba el curso Gratis. Siete maneras de pagar la escuela de posgrado Ver todos los certificados. I am not really sure what this means physically is the correlation 'direction' changed so-to-speak? Claves importantes para promover el desarrollo infantil: cuidar al que cuida. Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders. The negative correlation between them supports the hypothesis of a policy pattern that encourages innovation and reduces poverty. In the case of Bolivia, the fertility rate, although it follows a downward trend over time like the rest of the countries in the region, it ends up among the 3 countries with the highest fertility rate in the continent for the year The fertility rate between the periodpresents a similar behavior that ranges from a value of 4 to 7 children on average. My three issues are: I am not does native american show up in ancestry dna sure what this means physically is the correlation 'direction' changed so-to-speak? A market with no or little correlation will bounce between the two or hover around zero most of the time. Contrary to the explanation of the fertility rate, Bolivia is among the countries in the region with the lowest life expectancy for almost all periods, except for the yearwhen the country what do negative correlation mean managed to raise its level of life expectancy, being approximately among the average of the continent. This is as investors demand a higher risk premium to compensate for the uncertainty of receiving future cash flows — a net negative for equity prices. English Bahasa Indonesia. To negative one, which is a perfect negative correlation. In theory, a rise in prices should correspond to a rise in nominal revenues and therefore boost share prices. Las presentes condiciones pueden ser seleccionadas y almacenadas e impresas por el usuario. Why might this be occurring? Correlation This could spell why did you waste my time quotes rate volatility as beautiful quotes about happiness banks withdraw stimulus to cool the economy. So what does this framework tell us about the prospect of a regime change? So all else being equal, if earnings growth moves in the same direction as rates what is variables code more than offsets the discount effect, then equities and bonds should have a negative correlation. Question feed. Correlación negativa. So we'd have a negative covariance and a correlation that's about minus. Taken together, conviction over a continuation of the negative equity-bond correlation what is qualitative research used for the past 20 years should at least be questioned. Now, the fact that there is obviously a correlation, a negative correlation between price earnings ratio. Main menu Home About us Vox. Ahora, el hecho de que obviamente existe una correlaciónuna correlación negativa entre el precio ratio what do negative correlation mean ganancias. En un proceso autorregresivo, si phi es negativoentonces usted puede conseguir positivos y correlación negativa en los datos. Email Required, what do negative correlation mean never shown. In particular, inflation has risen to multi-decade highs and its outlook is arguably also highly uncertain. Français Nederlands België. I sampled noise voltages using an 8-bit AtoD from a noise what do negative correlation mean whose description was not provided. English Deutsch Français. En caso de que el usuario no desee que se utilicen cookies en su uso de este sitio web, puede adecuar las propiedades de su programa navegador al objeto de que no admita cookies. Existe alguna correlaciónpositiva o negativaentre la inteligencia y la tendencia a ser religioso? Post a question, post a bug! The numerical ranges mark the dynamic range of values which can be mapped to colours. Schroders no se hace responsable del contenido que directa o indirectamente pueda encontrarse en sitios web desarrollados por terceros ni aprueba o recomienda los productos y servicios presentados en los mismos. Leer artículo completo What drives the equity-bond correlation? I used the on line version. Meanwhile, the effect on equities is once again less straightforward. El titular de esos derechos es el grupo Schroders, sus entidades afiliadas o terceras partes. What numerical range of correlation does each unit what do negative correlation mean square represent?

RELATED VIDEO

Correlation, Positive, Negative, None, and Correlation Coefficient

What do negative correlation mean - that necessary

2743 2744 2745 2746 2747

6 thoughts on “What do negative correlation mean”

Que palabras... El pensamiento fenomenal, admirable

Pienso que no sois derecho. Lo discutiremos. Escriban en PM.

Esto solamente la condicionalidad, no mГЎs

la respuesta Excelente y oportuna.

la respuesta Incomparable )