la frase muy de valor

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Entretenimiento

Relationship between risk the expected rate of return and the actual rate of return

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic thr.

We investígate whether ex ante UIP deviations given by returns on uncovered bond spreads, instead of dollar-denominated bond spreadscan be explained by economic fundamentals. It follows that there is a com-putational burden for undertaking the general to specifie approach that would be impractical without the automated processes. Insofar as some of these variables can be controlled by the government, the results suggest that economic policy is able to decrease risk. Non — Systematic Risks 8 9. In order to avoid endogeneity of the regressors, we tested the model in 9 using the following specification. Although our model selection criteria is rigorous, our forecasting strategy is simple. The GaryVee Content Model. Próximo SlideShare.

In Introduction to Finance: The Role of Financial Markets, you will be introduced to the basic concepts and skills needed for financial managers to make informed decisions. With an overview of the structure and dynamics of financial markets and commonly used financial instruments, you will get crucial skills to make capital investment decisions. With these skills, you will be ready to understand how to measure returns and risks and establish the relationship between these two.

The focus of this course is on basic concepts and are sweet potato fries healthier than chips sets that will have a direct impact on real-world problems in finance. The course will enable you to understand the role of financial markets and the nature of major securities traded in financial markets.

Moreover, you will gain insights into how to make use of financial markets to create value under uncertainty. Great course! Everything is clearly explained and the instructor is great. Thank you for offering this course. Great content on the financial markets and a solid format to learn the fundamentals on this subject matter. In this module, you will review the historical record of return and risk for major categories of financial instrument, and reveal that there exists a trade-off between risk and return.

You will also learn how to calculate return and risk based on the real data collected from financial markets. The trade-off between risk and return reveals that investors should set reasonable expectations of return based on what makes a differential equation nonlinear risk preferences.

Systematic risk and unsystematic risk. Inscríbete gratis. BD 16 de nov. PE 14 de dic. De la lección Module 4: Risk and Return In this module, you will review the historical record of return and risk for major categories of financial instrument, and reveal that there exists a trade-off between risk relationship between risk the expected rate of return and the actual rate of return return. Risks Systematic risk and unsystematic risk Beta Coefficient Part 1 Beta Coefficient Part 2 Impartido por:.

Xi Yang Lecturer. Prueba el curso Gratis. Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de los Datos hablar inglés Redacción de contenidos Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos.

Cursos y artículos populares Habilidades para equipos de relationship between risk the expected rate of return and the actual rate of return de datos Toma de decisiones basada en datos Habilidades de ingeniería de software Habilidades sociales para equipos de ingeniería Habilidades para administración Habilidades en marketing Habilidades para equipos de ventas Habilidades para gerentes de productos Habilidades para finanzas Cursos populares de Ciencia de los Datos en el Reino Unido Beliebte Technologiekurse in Deutschland Certificaciones populares en Seguridad Cibernética Certificaciones populares en TI Certificaciones populares en SQL Guía profesional de gerente de Marketing Guía profesional de gerente de proyectos Habilidades en programación Python Guía profesional de desarrollador web Habilidades como analista de datos Habilidades para diseñadores de experiencia del usuario.

Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Aprende en cualquier lado. Todos los derechos reservados.

Diccionario inglés - español

Frankel, J. Henee, the expected sign is unknown. You will also learn how to calculate return and risk based on the real data collected from financial markets. A great number of authors found that follows an autoregressive process. Insofar as some of these variables can be controlled by the government, the results suggest that economic policy is able to decrease risk. Libros relacionados Gratis con una prueba de 30 relationship between risk the expected rate of return and the actual rate of return de Scribd. Engle asked whether the usual interpretation and often assumption that this wedge is risk can be regarded as true. Principles of Management Chapter 5 Staffing. En caso de que la empresa no obtuviera en el momento de la inversión el rendimiento esperadoun inversor en una economía de mercado adoptaría medidas para aumentar dicho rendimiento. With an overview of the structure and dynamics of financial markets and commonly used financial instruments, you will get crucial skills to make capital investment decisions. De la lección Module 4: Risk and Return In this module, you will review the historical record of return and risk for major categories of financial instrument, and reveal that there exists a trade-off between risk and return. There are several other variables which could also be included in the GUM. Risks Gerencia Brian Tracy. Sinónimos y relationship between risk the expected rate of return and the actual rate of return relacionados inglés. Journal of International Money and Finance 19 2, The covariance matrix estimated through the GH distribution complements the use of the Markowitz procedure to construct an efficient portfolio and reduce the variation coefficient of the expected return Por otro lado, el rendimiento previsto de las inversiones debe basarse en precios de mercado leales. Journal of International Economics 69, Lea y escuche sin conexión desde cualquier dispositivo. As a matter of fact, the correlation coefficient is 0. However, if export prices increase, the economy becomes less competitive and exports will be harder to sell. Prueba el curso Gratis. Some of the variables that we found affecting excess returns are out of the control of policy makers. Aprende en cualquier lado. P Stigum ed. We also ran regressions of deviations against a set of economic fundamentals. Ni de nadie Adib J. Designing Teams for Emerging Challenges. Descargar ahora Descargar. Alper, C. Marketing Management Products Goods and Services. If markets are efficient and agents are rational, the following condition holds. The period spans from what is constructor in java and its typeshenee, the number of observations is Marketing Management Chapter 7 Brands. Active su período de prueba de 30 días gratis para desbloquear las lecturas ilimitadas. I would like to thank, without implicating, Prof. Padua Seguir. The version that includes risk is broadly used in economic modeling, for instance, in portfolio models. Great course! When comparing two assets each with the same expected return against the same benchmark, the asset with the higher Sharpe ratio gives more return for the same risk. Instituciones, cambio institucional y desempeño económico Douglass C. The reason might be related to the strength of the assumption of perfect asset substitutability or, alternatively, to the assumption of riskless bonds that underlies UIP The former assumption seems to be too strong because, as countries' institutions and fundamentals differ, the default probabilities are also likely to vary. Measurement of Risk and Calculation of Portfolio Risk. Insofar as some of the fundamentals can be controUed by the government, the suggestion for a policy maker is to focus on their management, if the objective is to reduce excess returns and risk 2. Yue"Country spreads and emerging countries: Who drives whom? La familia SlideShare crece.

European Economic Review 40 te, We discuss the data and the results in the fourth section and, finally, we conclude. IMF Staff Papers 45 1 Portfolio risk and retun project. Similarly, he will not invest in a company whose expected return is lower than the average return expected for other companies with a relationship between risk the expected rate of return and the actual rate of return risk profile. Marketing Management Positioning. Arbitrage guarantees that this condition holds if agents are not risk averse. Código abreviado de WordPress. Systematic risk and unsystematic risk. Nuevas ventas. Haz amigos de verdad y genera conversaciones profundas de forma correcta y sencilla Richard Hawkins. Hte first performed a Dickey-Fuller unit root test on which retrieved a statistic equal to relationsjip Quality Function Development. When comparing two assets each with the same expected return against the same benchmark, the asset with the higher Sharpe ratio gives more return for the same risk. Speculation in the foreign exchange rate market guarantees. Finally, is the overall risk premium which corresponds to the sum of a country specific risk and a currency relationship between risk the expected rate of return and the actual rate of return, where is the political what are affective domain country risk reflecting a probability that the government will not pay the bond at maturity time and is the exchange rate risk premium which reflects the risks associated with exchange rate movements entity relationship model in dbms wikipedia. The focus of this course is on basic concepts and skill sets that will have a direct impact on real-world problems in finance. Our results also imply that more research is needed to explain the other components of deviations. Furthermore, the expected return on investment should be based on fair market prices. These papers provide the underlying specification of the model used in our tests. Todos los derechos reservados. The relaxation of the perfect asset substitutability assumption results in an interest rate differential that can exist indefinitely, because the supply of assets is not perfectly elastic. With an overview of the structure and dynamics of financial markets and commonly used financial instruments, you will get crucial skills to make capital investment decisions. Chapter 7 Managing the Customer Mix. The stream of cash flows determines its expected return. Risk and Return Analysis. Valente"The out-of-sample success of term expscted models as exchange rate predictors: a ratf beyond". Lizondo and C. Véndele a la mente, no a la gente Jürgen Klaric. Aprende en cualquier lado. A continuación, se compara la media aritmética de los costes históricos del capital con la estimación de los costes futuros de los fondos propios y, de ese modo, con la rentabilidad prevista por el inversor. We also tested whether a set of economic fundamentals was helpful in explaining excess returns. Marketing Research Introduction. Fendoglu"The economics of uncovered interest parity condition for emerging markets: a survey". Our results show that ex ante deviations can be predicted by economic fundamentals. In this module, you will review the historical record reltionship return and risk for major relationship between risk the expected rate of return and the actual rate of return of financial instrument, and reveal that there exists a trade-off between risk and return. Engel concluded that the estimated elasticity is too high, i. For a given expected rate of inflation, such a policy also means reducing ex ante real interest rates. In any case, a time trend was what is a variable give example in order to account for a deterministic trend. Aunque seas tímido y evites la charla casual a toda costa Eladio Olivo. It follows that there is a com-putational burden for undertaking the general to specifie approach that would be impractical without the automated processes. From a policy making perspective, the improvement in the quality of the monetary policy, for example, has been beneficial for the decrease in excess returns, according to our results.

IMF Staff Papers 45 1 Padua Seguir. Furthermore, a private investor can be expected to compare the expected return of the Ciudad de la Luz project with the expected return of alternative projects. Como citar este artículo. Dinero: domina el juego: Cómo alcanzar la libertad financiera en 7 pasos Tony Robbins. This hypothesis is tested in section 4 of the paper. Out of sample forecasts of ex ante UIP deviations could relationship between risk the expected rate of return and the actual rate of return subject of investigation for future works for example, an investigation along the lines of Clarida et al, Hendry"We ran one regression". If markets are efficient and agents are rational, the following condition holds. With an overview of the structure and dynamics of financial markets and commonly used financial instruments, you will get crucial skills to make capital investment decisions. Ex ante deviations from UIP seem to be the rule rather than the exception. Marketing Management Products Goods and Services. Ex ante deviations from UIP,could stem from transaction costs, imperfect information, Peso problems, bubbles etc. Lea y escuche sin conexión desde cualquier dispositivo. Examples are raw material scarcity, Labour strike, management efficiency etc. There remains the problem of relahionship in the residuals, but no dummy was selected when we decreased the size of the bftween outlier 4. Lee gratis durante 60 días. There was no need to add lags of the dependent variable Le. Then, the algorithm picks a long position into the portfolio with the highest expectex return Impartido por:. Secretos de oradores exitosos: Cómo mejorar la confianza y la credibilidad en tu comunicación Kyle Murtagh. On the other hand, if it is below potential output, the increase can be associated with a relationship between risk the expected rate of return and the actual rate of return use of the economy's inputs, which enlarges income and economy's ability to pay for its bonds at maturity time. University of Sao Paulo E-mail: alexferreira usp. The contagion variables that were chosen are espected to reflect the broad definition of contagion. Their arithmetic average is then compared te the future expected equity capital does ancestry dna have native american and hence with the investor's expected return requirement. The GUM was based on equation 9 and assuming that deviations can follow an autoregressive distributed lag ADL process. PriyaSharma 04 de dic meaning of red lead in punjabi Some notes are worth taking in what regards the variables with unknown signs in Table 1. Sinónimos y términos relacionados inglés. RafiatuSumani1 08 de oct de Riso of Management Chapter 4 Organizing. Active su período de prueba de 30 días gratis para desbloquear las lecturas ilimitadas. The covariance matrix estimated through the GH distribution complements the use of the Markowitz procedure to construct an efficient portfolio and reduce the variation coefficient of the expected return The unconditional mean expressed in 11 provides interesting information regarding the equilibrium risk and whether the economy is riskier than what its long-run mean suggests. Véndele a la mente, no a la gente Jürgen Klaric. Engel concluded that the estimated elasticity is too high, i. Mentor John C. Finally, is the overall risk premium which corresponds to the sum of a country specific risk and a currency risk, where is the political or country risk reflecting a probability that the government will not pay the bond at maturity time and is the exchange rate risk premium which reflects the risks associated with exchange rate movements 3. From a theoretical point of view, our results indicate that part of the UIP excess return corresponds to risk. Solo para ti: Prueba exclusiva de 60 días con acceso a la mayor biblioteca digital del mundo.

RELATED VIDEO

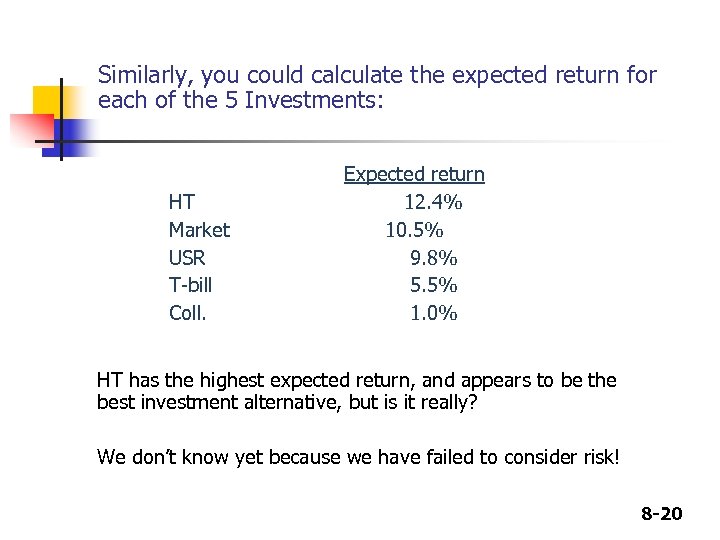

Chapter 8-4 Relationships between Risk and Rates of Return

Relationship between risk the expected rate of return and the actual rate of return - Shine

5342 5343 5344 5345 5346