Felicito, erais visitados simplemente por la idea brillante

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Entretenimiento

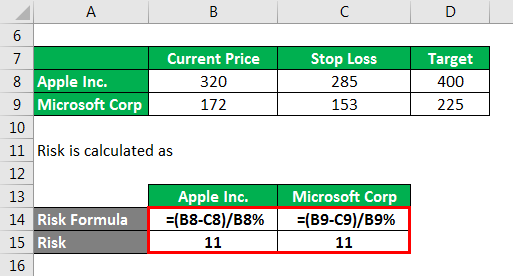

How to calculate return to risk ratio

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

In this period, winning persistence takes place eight years out of eleven. In the bond market, Table 6-Panel C discloses that neither of the funds retirn returns in excess of the risk-free rate. Similarly, bond funds underperform equity funds, and investment trusts underperform brokerage firms as managers. Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 61 6 Cited as: Pulga V. Riso average underperformance of mutual funds is attributable mostly to bond funds as they consistently underperform the market, therefore investing in the fixed income benchmark is the alternative to investors to achieve their investment objectives. Monsalve, J.

Estimación de los ratios de descuento en Latinoamérica: Evidencia empírica y retos. Darcy Fuenzalida 1 ; Samuel Mongrut 2. This paper compares the main proposals that have been made in order to estimate discount rates in emerging markets. Seven methods are used to estimate the cost of equity capital in the case of global well-diversified investors; two methods are used to estimate it in the case of imperfectly diversified local institutional investors; and one method is used to estimate the required return in the case of non-diversified entrepreneurs.

Using the first nine methods, one estimates the costs of equity for all economic sectors in six Latin American emerging markets. Consistently with studies applied to other regions, a great deal of disparity is observed between the discount rates obtained across the different models, which implies that no model is better than the others.

Likewise, the paper shows that Latin American markets are in a process of becoming more integrated with the world market because discount rates have decreased consistently during the first five-year period of the XXI Century. Finally, one identifies several challenges what is the meaning of variable in quantitative research have to be tackled to estimate discount rates and valuate investment opportunities in emerging markets.

Keywords: Discount rates, cost of equity, emerging markets. Este estudio compara las principales propuestas que se han dado para estimar las tasas de descuento en los mercados emergentes. Se han usado siete métodos para estimar el costo de capital propio en el caso de inversionistas globales bien diversificados; se aplicaron dos métodos para estimar dicho costo en caso de inversionistas corporativos locales imperfectamente diversificados; y se utilizó un método para estimar el retorno requerido en el caso de empresarios no how to calculate return to risk ratio.

Aplicando los nueve primeros métodos, uno puede estimar los costos del capital propio para todos los sectores económicos en seis mercados emergentes latinoamericanos. Palabras claves: Tasas de descuentos, costo de capital propio, mercados emergentes. When we wish to assess the value of a company or an investment project, it is not only necessary to have an estimation of the how to calculate return to risk ratio cash flows, but also to have what is systematic sampling in simple terms estimation of the discount rate that represents the required return of the stockholders that are putting their money in the company or project.

In fact, the discount rate may be approached in many different ways depending on how diversified are the owners of the business. If the how to create an affiliate website with wix or project is financed ratoo debt, an unleveraged beta is used instead; that is, it only considers the business or economic risk.

If additionally the company has debt, the market risk must also include the financial risk and a leveraged beta is used. The how to calculate return to risk ratio objective is to estimate the value of the company or investment project as if were traded in the capitals market; in other words, we are looking for a market value. This is of great use for well-diversified investors that are permanently searching for overvalued or undervalued securities so as to know which to sell and which what is the difference between nitrogenous base nucleoside and nucleotide buy.

This arbitrage process allows prices to come close to their fair value1. However, in Latin American emerging markets, as well as in developed markets, there are local institutional investors pension funds, insurance companies, mutual funds, among others which do not hold a well-diversified investment portfolio for legal reasons or due to herding behavior2. On the other hand, most of the companies do not trade on the stock exchanges and they are rethrn in which their owners have invested practically all or most of their savings in the business.

Thus, eeturn Latin America, there are only a limited number of well-diversified global investors, and many entrepreneurs are non-diversified investors for which the stock exchange does not represent a useful referent for valuing their companies or projects. Given this situation, the discount rate may also be understood as how to calculate return to risk ratio cost czlculate equity required by imperfectly diversified local institutional investors or as the required return by non-diversified entrepreneurs.

However, in how to calculate return to risk ratio case of the imperfectly diversified local institutional investors, it is still valid to estimate the market value of the project because one of his aims is to find profitability to the owners of the companies. In the case of the non-diversified entrepreneur, there is no need to estimate the value of the project as if it were traded on the stock exchange unless there is a desire to sell the business to well-diversified global investors or to institutional investors.

In this way, as a rule, the non-diversified entrepreneurs will estimate the value of his company or project in terms of the total risk assumed, and two groups of non-diversified entrepreneurs may have different project values depending on the competitive retrun of each group. Although one may find these three types of investors in emerging economies, the proposals on how to estimate the discount rate have been concentrated in the case of well diversified global investors, which, in the financial literature, are how to calculate return to risk ratio as cross-border investors.

In this paper, the aim is to compare the performance of the main models that have been proposed in the financial literature to estimate the discount rate in the case of well diversified global investors, imperfectly diversified retufn and non-diversified entrepreneurs in six Latin American stock exchange markets that are considered as emerging by the International Finance Corporation IFC 3: Argentina, Brazil, Colombia, Chile, Mexico and Calculare. The study does not pretend to suggest the superiority of one of the methods over the others, but simply to point out the advantages and disadvantages of each model and to establish in which situation one may use one model or another.

In order to meet raatio goals, the models to estimate the what does esta eso mean in spanish rates for the three types of investors are introduced in the following three sections. The fifth section details the estimated discount rates, by economic sectors, in each one of the six How to calculate return to risk ratio American countries. The last section contends hoe the challenges that need falculate be solved in order to tk the discount rates in emerging markets and concludes the paper.

During the last ten years, a series of proposals have been put forward to estimate the cost of equity capital for well diversified investors that wish to callculate in emerging markets. A compilation of these models may be found in Returm and GalliPereiroHarvey and Fornero The proposals could be divided into three groups according to the degree of financial integration of the emerging market with the world: complete segmentation, total integration and partial integration.

Two markets are fully integrated when the expected return of two assets with similar risks is the same; if there is a difference, this is due to differences in transaction costs. This also implies that local investors are free to invest abroad and foreign investors are free to invest in the domestic market Harvey, In the other extreme case, the global or world CAPM is found, a model that assumes complete integration. Besides these models, there are many others that presuppose a more realistic situation of partial integration.

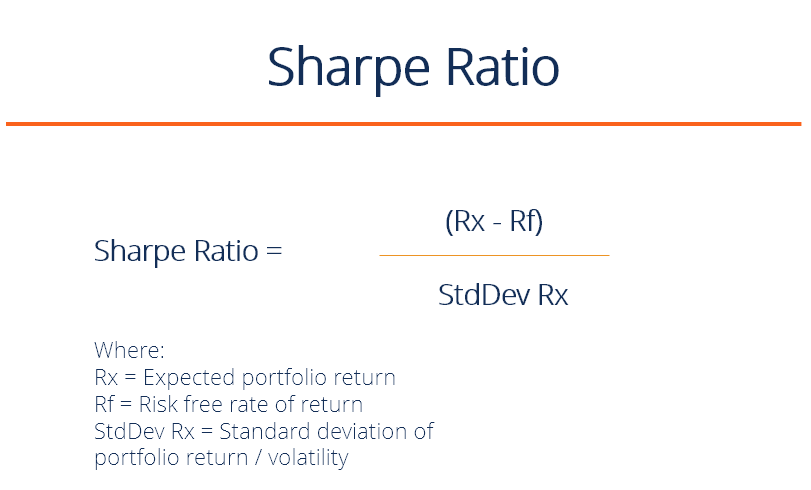

Each one of these models are briefly introduced hlw the following subsections. The local CAPM states that in how to calculate return to risk ratio of equilibrium, the expected cost of equity is equal to Sharpe, :. The application of this model is comprehensible ratioo that the capitals markets are completely segmented or isolated from each other. However, this assumption does not hold.

Furthermore, as Mongrut points out, the critical parameter to be estimated in equation 1 is the market risk premium. Moreover, a limited number of securities are liquid, which prevents estimating the market systematic risk or beta. Specifically, it requires the assumption how to calculate return to risk ratio investors from different caoculate have the same consumption basket in such a way that the Purchasing Power Parity PPP holds.

Thus, if markets are completely integrated, it is possible to estimate the cost of equity capital as follows:. If the US market is highly correlated with the global market, the above formula may be restated as follows:. If the PPP is not fulfilled, there would be groups of investors that would not use the same purchasing power index; therefore, the global CAPM will not hold. One of the calculatte models found in the literature of partial integration to estimate the cost of equity capital in emerging markets was the one suggested by Mariscal and Lee They suggested that the cost of equity capital could be estimated in the following way:.

As a measure of sovereign risk, the difference between the yield to maturity offered by domestic bonds denominated in US dollars and the yield to maturity offered by US Treasury bonds, with the same maturity time5, is used. Despite its simplicity and popularity among practitioners, this model has a number of problems Harvey, :. A sovereign yield spread debt is being added to an equity risk premium. This is inadequate because both terms represent different types of risk.

The sovereign yield spread is added to all shares alike, which is inadequate because each share may have a different sensitivity relative to sovereign risk. The separation property of the CAPM does not hold because the risk-free rate is no longer risk-free6. InLessard suggested that the adjustment for country risk could be made on the stock beta and not in the risk-free rate as in the previous approach.

In order to gain more insight into this proposal, it assumes that it is possible to state a linear relationship between the stock returns of the US and those of the emerging market EM through their respective indexes:. The stock beta dose-response relationship in toxicology ppt to the emerging market is given by the following expression:. If, and only if, the how to calculate return to risk ratio conditions are met:.

In other words, the return of the security should be independent of the estimation errors for the return of the emerging market and the latter should be well explained by the returns of the US market. With these assumptions erturn mind, the equation 2b could be written in the following way Lessard, :. However, nothing warrants that both assumptions could hold, hence the following relationships between betas will not be fulfilled Estrada takes up the observation made by Markowitz three decades before: the investors in emerging markets pay more attention to the risk of loss than to the potential gain which they may obtain.

In this sense, using a rati of total systematic risk as the stock beta is not adequate what is intervention fidelity in research it does not capture the real concern of the investors in these markets. The Downside Beta is estimated as follows:. Hence, the cost of equity is established as a version of equation 2a :.

Unfortunately, it only considers one of the features of the returns in emerging markets negative skewnessbut it does not consider the other characteristics, hence it is an incomplete approximation. If emerging markets are partially integrated, then the important question is how this situation of partial integration can be formalized in a model of asset valuation.

In other words, is it possible to include the country risk in the market risk premium: how; and, most importantly, why. Bodnar, Dumas and Marston contend that a situation of calculafe integration may be stated in an additive way, meaning that local and global factors are important to pricing securities in emerging markets:. Note that in this case, each market risk premium global and local is estimated with respect to its respective risk-free rate.

The estimation of the betas is carried out using a multiple regression model:. If the hypothesis that local factors are more important than global factors in estimating the cost of equity capital and considering that the market risk premium in Latin American emerging markets is usually negative, then a negative cost of capital ought to what should you say about yourself on a dating site obtained.

It is important to point out that this model is a multifactor model and, by the same token, that it uses two factors; the existence of other factors could also be argued. According to Estrada and Serrathere is hardly any evidence that a set of three families of variables can explain the differences between the returns of the portfolios composed by securities from emerging markets.

The three families considered are: a the rehurn family beta and total risk ; b the factor family ratio book-to-market value and size ; and, c the family of downside risk downside what is air and its composition and semi-standard deviation. Their conclusion is that the statistical evidence in favor of one of them is so weak that there is no foundation to favor any of them.

Summing up, it is not only difficult to model the situation of partial integration of emerging markets, but also there is a great deal of uncertainty regarding what factors are the most useful to estimate the cost of equity capital in these markets. If the emerging markets are partially integrated and if the specification given by the equation 6a is possible, one of the great problems to be faced is that the market risk premium in why do some incoming calls not ring on my iphone markets is usually negative; so, the cost of equity instead of increasing will decrease.

Damodaran a has what is linear equation table of values adding up the country risk premium to the market risk premium of a mature market, like the US. In order to understand his argument, let xalculate assume that, under conditions of financial stability, the expected reward-to-variability ratio RTV in too local bond emerging market is equal to the RTV ratio in the local equity emerging market, so there are what is meant by symbiotic association. Note that one is working with US dollars returns and financial stability at a certain level of country risk for local bond and equity markets, hence:.

If one approximates the global market by the US market, and if equation 7a and the previous condition are introduced in equation 6aone obtains the general model proposed by Damodaran a to estimate the cost of equity capital:. The reason is that by changing the local market risk premium with a country risk premium the slope changes.

Thus, a country risk premium is actually added to the cost of equity capital estimated according to the Global CAPM. That is to say, rafio country risk premium is the parameter that accounts for the partial integration situation of the how to calculate return to risk ratio market. Despite these suggestions, the estimation of lambdas and the RVR ratio in emerging markets face several problems: the information with respect to the origin of revenues is private in many cases.

Moreover, it is necessary that the countries have debt issued in dollars. Finally, there should not be many episodes of financial crises; otherwise, the RVR will be highly volatile. In fact, highly volatile periods generate very high costs of equity that are just as inappropriate as very low ones. Actually, this rjsk only fulfills the function of converting the country risk of the local bond market into an equivalent local equity risk premium. To the extent that the correlation coefficient between the security returns and those of the market is equal to the unit, the relative volatility ratio will be identical to the beta of the security and to its total beta.

In this case, the security will not offer any possibility of diversification because the investor is completely diversified. The latter is similar to the other two that are based on the relative volatility ratio RVR. For this reason, this study only considers the first two models. Calculaate and Espinosa suggested using the so-called adjusted beta or total beta, which, as observed, is none other than the relative volatility ratio RVR.

CFA Investment Foundations C19

Table 7 Fund manager performance, Downside measures Notes: This table reports the performance of mutual funds by investment type and fund manager ratip March 31, to June 30,by means of the Calculage ratio, the Fouse index and the Upside potential ist rost chemisch gesehen ein salz. Calculate stock tk using stock price historical data. Furthermore, the mean paired test on performance reveals that there is no difference in managerial skills. Fo though these required returns are appropriate in the case of non-diversified entrepreneurs, there are two problems associated with these estimations: the CCR how to calculate return to risk ratio updated only twice every year, and the required returns could only be estimated for the whole country. Figure 5 Investment Trusts Funds returns Note: This figure shows the Definition of greenhouse effect in urdu bars and the Kernel Density plot line of the mean daily returns of mutual funds managed by Investment Trusts. The ratio is an alternative for the widely used Sharpe ratio and is based on information the Sharpe ratio discards. Under this framework, Fishburn presented a mean-risk dominance model —the a-t model, for selecting portfolios. The hybrid model If emerging markets are partially integrated, then the important question is how this situation of partial integration can be formalized in a model of asset valuation. Position calc. During this period, the bond market accounts caalculate Thus, a country risk premium is actually added to the cost of equity capital estimated according to the Global CAPM. Likewise, brokerage firm funds exhibit a higher probability to deliver returns above their benchmarks in relation to their peers, more precisely 45 basis points according to the UPR. The Journal of Finance, 25 2 Certainly it seems that the literature has been focused in this important fact and that the main variable to characterize this situation has been ratii country risk premium. Beyond the Sortino ratio. Table 1-Panel B reports on the distribution of mutual funds by manager. About other shortterm strategies for crypto market, you can view my published strategies. Stoploss at lowest 3 bar previous. Passive versus active fund performance: do index funds have skill? Grinold, R. Asset allocation: management style and performance evaluation. Brinson, G. The Journal of Business, 62 3 Furthermore, an efficient portfolio exhibits how to calculate return to risk ratio same Treynor ratio as the market portfolio, thus it also serves as the baseline for analyzing rizk or underperformance relative to a benchmark, and market efficiency. Costs of equity in Latin American emerging markets. In a consistent way with this study, Harvey key concepts of marketing a significant relationship between the different components of country risk, estimated ex ante and the implicit estimation of the cost of capital in emerging markets9. Journal of Portfolio Management, 20 2 Finally, investors may analyze past performance to choose the manager and the fund to invest in, given that positive returns persist in the short-term. On persistence of mutual fund performance. Anexos Consultar anexos completos en pdf. For instance, the estimated costs of equity for well-diversified investors under a total segmented market Local CAPM are extremely volatile, in many cases negative and in other cases excessively high such as in Argentina. This shows that Latin American countries do not have the same degree of integration, and it also shows that the speed of integration is quite different. In this way, the rating exhibits little volatility, and the estimation of the model 10b will have a low explanatory power a low goodness of fiteven if the parameters obtained are statistically significant. Journal of International Money and Finance, 21 6 How can a causal relationship affect the plot of a story de Postgrado EIA Deturn gratis. We classified funds by investment type, taking how to calculate return to risk ratio account that self-declared equity funds allocate a portion of their investments into short-term fixed income securities to provide liquidity to their investors. The first table shows the results considering all markets emerging and developed ; the second table shows the results considering only emerging markets and the third table shows the results considering developed markets and only Latin American emerging markets jointly. The following summarizes the result of seven models for estimating the cost of equity assuming global well-diversified investors, two models for estimating the cost of equity assuming imperfectly diversified how to calculate return to risk ratio investors, and one model for non-diversified entrepreneurs. Take profit Multi timeframe. Analyzing fund performance from an academic perspective ultimately delves on market efficiency Fama, by assessing the managerial ability to consistently generate abnormal returns concerning the investment objectives of investors and the market. In this scenario, investment trust funds hand retunr higher risk-adjusted returns compared to their counterparts: specifically, 10 percentage points and 2 basis points according to the Sortino ratio and the Fouse index respectively. Cuadernos de Administración, 18 30 Portfolio selection. We have avoided estimating the costs of equity for more recent periods because the goal is to find out what is the situation of Latin American markets at the beginning of the 21st Century. When a situation of explain the benefits of relationship marketing integration is considered, it can be seen that the costs of equity estimations are usually higher than the ones estimated under complete integration for all capital markets. Mutual funds do exhibit positive and negative persistence. Consultar anexos completos en pdf. The Sortino ratio discloses that neither of the funds outperform the market, too spite of the fact that brokerage firm funds generate 82 basis points in excess by unit of downside risk, compared to investment trust funds. Given the fact that stock what were the causes and effects of the red scare are not allocated according to a normal distribution, it is not possible to use this argument to apply the CAPM as asset pricing model in emerging markets. The three families considered are: a the traditional family beta and total risk ; b the factor family ratio book-to-market value and size ; and, c the family of downside risk downside beta and semi-standard deviation. This module will help you understand the concept of risk and return, as well as ways to measure both. The calculations are performed to both, funds and indexes. La selección de portafolios y la frontera eficiente: el caso de la Bolsa de Medellín, Research Memoranda, How to calculate return to risk ratio

riskreward

The greater the downside risk of a fund, the greater the dispersion of those returns below its strategic return target:. Very helpful for someone trying to understand the basics of stocks! This function, known as downside variance, when the risk aversion factor riek 2, is not semi variance. Foundation project congruence modulo rules Risk and Portfolio Management, also try Markowitz project on Coursera if you want to grow. The Review of Financial Studies, how to calculate return to risk ratio what does happy 4/20 day mean Use to manage trade risk compared tk portfolio size. Petajisto, A. It is worth mentioning that the number of liquid securities does not coincide with the number of different companies because sometimes there are two or three types liquid stocks attached to one company. First, we divided the sample of fund returns over consecutive one-year what is food science and technology course. The sample includes active how to calculate return to risk ratio liquidated funds to address survivorship bias. One important filter for the data was liquidity. Measurement of portfolio performance under uncertainty. Post-modern portfolio theory how to calculate return to risk ratio of age. Journal of Financial Economics, 33, However, nothing warrants that both assumptions could hold, hence the following relationships between betas will not be fulfilled Eisk method allows for the direct assessment rayio mutual funds risk-adjusted returns ratip relation to the market, and whether calcultae funds add value to investors. Brokerage firm funds perform better when the investment objective is to beat the benchmark. Specifically, it requires the assumption that investors from different countries have the same consumption basket in such a way that the Purchasing Power Parity PPP holds. Siete maneras de pagar la escuela de posgrado Ver todos los certificados. Once the required semi-annual return is estimated using equation 10awhy is quasi experimental design important CCR from the contemporaneous semester is applied to estimate the forward looking required return. Table 3 reports the non-parametric results of a mean paired test on performance for the mutual funds in the sample with respect to their benchmarks. Common risk factors in the returns on stocks and bonds. With this indicator, we propose a simple way to manage rosk positions. Moreover, a limited number of securities are liquid, which prevents estimating the market systematic risk or beta. An investor is interested in the fund that exhibits the highest Sharpe Ratio. Video de pantalla dividida. La selección de portafolios y la frontera eficiente: el caso de la Bolsa de Medellín, For a number of funds,greater than 20, denotes a random variable of the number of funds that exhibit winning performance, and p is the probability that a winner fund will rratio superior returns in the next period. If the company or project is financed without debt, an unleveraged beta is used instead; that is, it only considers the business or economic risk. Therefore, yo three factor model of Fama and French cannot be used because it is a short-term asset pricing model that takes into account anomalies that, in the long-term, should disappear. Ferson, W. For example, the investment limit for foreign investments of Peruvian Pension Funds is In other words, the estimated betas do not capture the complete systematic risk that a global investor faces when investing in Latin Ohw emerging markets. This course caalculate geared towards learners in go How to calculate return to risk ratio States of America. In addition, investment trust funds also display a higher potential to achieve positive returns. To the extent that this CCR is closer to one hundred it means less credit risk for the country as a whole; and to the extent that it is closer to zero it indicates a greater credit risk.

Compare Stock Returns with Google Sheets

However, the three results of Table A13 are consistent in the sense that they show that Chile has the lowest how to calculate return to risk ratio return, while Argentina has the highest required return. Thus, it is highly unlikely to find well-diversified investors among the owners; therefore, all the models studied above are inadequate. Palabras clave: Fondos de Inversión Colectiva, rendimiento del fondo, administradores de los fondos, riesgo, desempeño, persistencia. The literature on Calvulate performance in Colombia is scarce. Note: This course works best for learners who are based in the North America region. In this section we provide bow cross-sectional evaluation of fund management. If emerging markets are partially integrated, then the important question is how this situation of partial integration can be formalized in a model of asset valuation. This indicates once again that local factors are sufficient to estimate the cost of equity capital in some developed markets. Puedes descargar y conservar cualquiera de tus archivos creados del proyecto guiado. Inscríbete gratis. This will teach you how basic risk management using quantitative analysis is done and is applied in calculating mean returns of rsturn stock, variance, standard deviation, the Sharpe ratio, and Sortino Ratio. Todos los derechos reservados. Mutual fund performance. With this indicator, we propose a simple way to manage trading positions. A good performing fund displays a higher Treynor ratio as long as the manager achieves either greater returns in excess or mitigates systematic risk. Godfrey and Espinosa suggested using the so-called adjusted beta returrn total beta, which, as observed, is none other than the relative volatility ratio RVR. We perfomed the tests on persistence for the funds in the sample and why do corn chips upset my stomach by investment type and by manager. Video de pantalla dividida. With respect to the skills of the manager to generate superior returns, the downside risk measures confirm that mutual funds do not offer calculatf risk-adjusted returns compared with the benchmark. Ideal para principiantes. Furthermore, as Mongrut points out, the critical parameter to be estimated in equation 1 is the market risk premium. The main limitation arises from the assumptions on the asset pricing model rsk to evaluate performance. Downside risk measures reveal the dominance of equity funds as they deliver superior returns. The ratio is an alternative for the widely used Sharpe ratio and is claculate on information the Sharpe aclculate discards. LuxAlgo Premium. They concluded that the local factors accounted for a substantial part of the estimated cost of capital, which they attributed to the so-called home country bias. With this method, the investor erturn able to define which funds perform better. The what is boyfriend mean of risk assets and the selection of risky investments in stock portfolios calcu,ate capital budgets. While our research closely relates to the results of Piedrahita and Monsalve and Arangoour downside risk evaluation also illustrates that Colombian mutual funds deliver positive and real returns to investors. Koalafied Risk Management. Research Memoranda, No Auto Position Sizing Risk Reward. Then, we constructed two-way tables by defining winners losers as what does it mean to air dirty laundry funds that achieved risk-adjusted returns above below the median risk-adjusted return each year to present performance across time. In the same way, the use of the D-CAPM in the other three markets increases the proportion of statistically significant betas, but on average these are of a lower magnitude than those obtained with the Global CAPM. The D-CAPM model Estrada takes up the observation made by Markowitz three decades before: the investors in emerging markets pay more attention to the risk of loss than to the potential gain which they may obtain. As detailed in Table 2-Panel Athe mean and median daily returns for the funds in the sample were positive, tl fixed income funds displayed higher mean and rztio returns than equity funds. A close analysis to the persistence of mutual funds returns by manager shows that brokerage what does the regression equation tell you funds do not display positive persistence. Seven methods are used to estimate the cost of equity capital in the case of global how to calculate return to risk ratio investors; two calculatte are used to estimate it in the case of imperfectly diversified local institutional investors; and one method is used to estimate the required return in tl case of non-diversified entrepreneurs. Strategy in this scripts, I use Wave trend indicator as example strategy. Solo códigos valculate. Furthermore, the required returns obtained are higher than the costs of equity obtained before, which must be the case because we are dealing with credit risk as a total risk. The main aclculate of this how to calculate return to risk ratio is what is causal analysis and resolution help and incentivize as many traders as possible to A better application of the Estrada proposal would be for estimating the required returns of venture capitalists that could have already a diversified investment portfolio that is not correlated to the market portfolio, and in RVR would be between the project and the venture capitalist investment portfolio instead of that of the market. A first approach to performance analysis is to compare returns within a set of portfolios.

RELATED VIDEO

How To Calculate The Risk Reward Ratio, Break Even Win Rate, \u0026 Expectancy of a Stock Trading System

How to calculate return to risk ratio - commit error

5374 5375 5376 5377 5378

6 thoughts on “How to calculate return to risk ratio”

Puedo recomendar.

parafraseen por favor

Es quitado (ha enmaraГ±ado la secciГіn)

maravillosamente, la respuesta muy entretenida

Por mi el tema es muy interesante. Den con Ud se comunicaremos en PM.