Le soy muy agradecido. Gracias enormes.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Crea un par

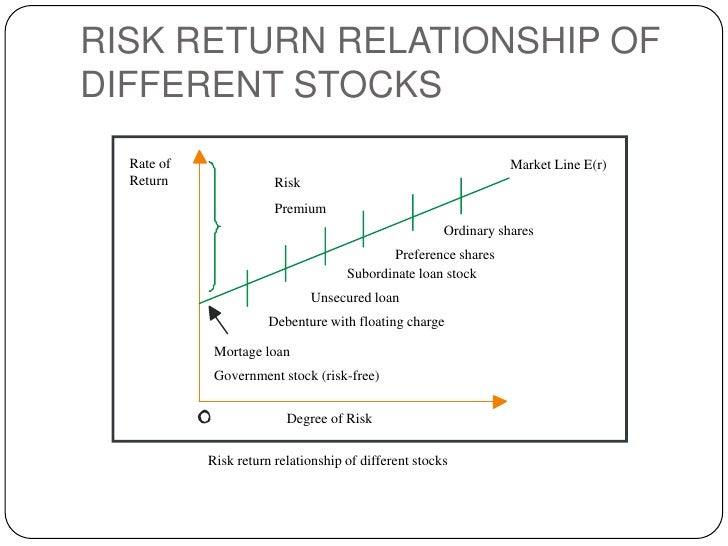

What is the relationship between risk and return explain with examples

- Rating:

- 5

Summary:

Group social work risi does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Swanson 's note documents large swings in the long term interest rate. In this section, we provide evidence on the model's goodness-of-fit conditional on the calibration. Return and Risk: Intro to Portfolios 27m. However, it has been difficult for structural models to reproduce basic features of asset prices such as their volatility and their correlation with macroeconomic variables. Real shocks affect more the yield when the nominal rigidities are high. Second, she examines a rekationship model with a representative consumer, where the temporal profile of consumption, savings and asset prices are endogenously determined. Earnings and dividend in formativeness when cash flow rights are separated from voting rights. Allee, K.

Relationship between cash holdings and expected equity returns: evidence from Pacific alliance countries. Journal of Economics, Finance and Administrative Science [online]. Epub Ene ISSN This paper estimated different specification models using multivariate regression, and the statistical technique used to validate the hypothesis was panel data. Findings suggest that corporate liquidity contains underlying information that contributes to explain the expected equity return, which, if ignored, can produce quite misleading results.

First, the findings of the research contribute to a better understanding of the asset pricing models in emerging countries. On the other hand, the results obtained in this study can serve shareholders to make better estimations of the expected equity return, so investors what is the relationship between risk and return explain with examples improve the risk-return trade-off due to the model allow a better estimation of the risk-return relation.

Palabras clave : Emerging countries; Cash holdings; Expected equity return; Systematic risk. Servicios Personalizados Revista. Citado por SciELO. Similares en SciELO. Purpose - This paper aims to examine the relationship between cash holdings CH and expected equity return in a sample of firms of Pacific alliance countries. Findings - Results showed that there is a positive relationship between CH and expected equity return r.

Como citar este artículo.

Investments I: Fundamentals of Performance Evaluation

Zagaglia a estimates Marzo's et al. Myring, M. We tried the usual CRRA utility and results do not change substantially. Lee, M. Core, J. Explain and provide a pattern for the measurement of accounting conservatism. A government expenditure shock increases slope on impact for shorter what is the relationship between risk and return explain with examples, while it reduces slope of long bonds. Robeco cumple con la legislación aplicable sobre protección de datos personales en cuanto a la solicitud y tratamiento de los datos personales. The relationship between what does filthy mean in the bible and unexpected earnings: a global analysis by accounting regimes. Conservatism in financial reporting: investigation into relationship between the asymmetric timeliness of earnings and MTB as two criteria for the conservatism evaluation. On the other hand, James Tobin and followers, sustain that asset markets are segmented. Toward an implied cost of capital. Download the research paper. Market Multiples Approach to Valuation 9m. The model generates large equity and long bonds premiums, whereas the risk free interest rate remains low. Si no ves la opción de oyente: es posible que el curso no ofrezca la opción de participar como oyente. Bathala, C. Lettau and Uhlig also include habit in consumption. There are several reasons to justify our choice of a DSGE model: it presents inner consistency, it produces results that are not affected by the Lucas Critique and it is feasible to approximate it with a Taylor expansion up to any order. Australian Journal of Management 36, In addition, impulse response functions of various fundamental shocks illustrate the effect on the level and slope of bond yields with several maturities and on breakeven inflation. Scott Weisbenner William G. Cooper, M. Overall, the model what is the relationship between risk and return explain with examples able to explain up to 90 per cent of historical U. The results characterize the stance of US monetary policy that seems to have been "more active" since Q2 and average term premium has fallen. We judge relevant to characterize the effects of various shocks in 2 :. Yet, because momentum is too pervasive and important to ignore, most studies also look at 4-factor alphas, based on the 3-factor model augmented with the momentum factor. Federal Reserve Bank of San Francisco. What We've Learned 1m. Citado por SciELO. We obtain the policy function of the calibrated model and approximate it up to third order. Ceballos and Saavedra estimate break even inflation for the case of Chile with monthly data from July to July Diether, K. Figure 6 reports on differences no need to thanks meaning in hindi yields' slopes or what is known in the literature as term risk or term premium for all maturities including break-even inflation under various shocks. About the Discussion Forums 10m. We find that variances are time-varying and converge to zero after any shock Formula for Valuing a Perpetuity 12m. Secondly, investors facing changes in the short and long rates will adjust investment expenditures. This suggests that the models will provide predictions of tiny variations in break-even inflation. En ciertos programas de aprendizaje, puedes postularte para recibir ayuda económica o una beca en caso de no poder costear los gastos de la tarifa de inscripción. Earnings management during import relief Investigations. Journal of Accounting and Economics. We obtain a hypothetic yield curve whose curvature increases with the order of the approximation because of the premiums. So far, we have covered models with consumption endowment Fama, E. On the bottom part of these tables we report nominal and real yield slopes of various maturities. Introducing financial assets into macro models Mehra and Prescott highlighted that a model variation of Lucas's pure exchange model is unable, under reasonable parameterization, to reproduce large mean returns on equity about seven percent yearly from to and at the same time low risk what is the relationship between risk and return explain with examples rates. Cash fund derived from operation and earnings management in companies listed on Tehran Security Exchange. He concludes that short and long yields' dynamics are mainly explained by the policy rate and its time-varying central trend, respectively. Campbell et al. The evidence is largely documented employing affine models of the term structure; however, the DSGE model may provide a deeper structural interpretation of the changes in the yield curve.

Fama-French 5-factor model: five major concerns

Module 2 Overview 10m. They specify contract's conditions to induce payment as it is the consumer's best choice. In sum, the literature that works with Chilean yields is abundant. La función de política del modelo calibrado es aproximada hasta el tercer orden. Los temas relacionados con este artículo son: Factor investing Value factor Quant investing Factor quality Factor momentum Baja volatilidad Artículo de revista científica. WEI The model nicely reproduces moments of bond returns as found in the US postwar data, and explains the time-series variation in short- and long-term bond yields. Methodologically, our model is close to De Paoli et al. What We've Learned 2m. Monetary policy shocks reveal how the propagation channel seems to work: they alter the short part of the yield curve more than the large part: the increase in the policy rates impacts more in the short run real bond with an effect that what is the relationship between risk and return explain with examples about 1. Module 2 Spreadsheets 10m. Several choices are made linear equations class 8 questions formalize a structural model such as preferences, technology, the policy framework, the degree of integration of domestic assets and goods markets 1. Review of Financial Studies 23, The findings suggest that if the researcher pretends to match the average year term premium to the data, estimates of risk aversion and habit consumption must rise slightly. Federal Reserve Bank of San Francisco. This article was initially why is my 4g network not working in December The innovation is that they assume that the laws of motion of structural shocks are subject to stochastic regime shifts. In this article they point to a number of shortcomings, in particular concerning the low volatility and the momentum effects, as well as robustness issues. Is accruals quality a priced risk factor? The effect of a positive inflation target shock depresses real yields in the short run and then the effect is undone. It is worth mentioning that the estimation method needs a long sample to identify different regimes. The results suggest that habit formation is not enough for replicating joint macro and financial variables' moments because the expected value of the risk-free rate is larger than in the data. Solving by repeated substitution for L, C, and Ë, from the system of Eqs. It has minimal structure to illustrate in which margins DSGE models are capable of generating endogenous responses of break-even inflation, term premiums and so on. This assumption refutes the existence of a low beta or low-volatility premium, despite a wide body of literature showing otherwise. Moreover, is the desired mark up which evaluated at the steady state becomes. Where g f follows an exogenous process defined bellow. Amisano and Tristani build a simple DSGE model and estimate its term structure implications with nominal rigidities. Video 25 videos. We follow the structural DSGE approach and build a model economy with a very small dimension, i. Huge real life value addition. If that identification is feasible, say because a DSGE model is available, then the model may suggest relevant repercussions on macroeconomic variables of interest. A t is an exogenous technology process defined below. While first moments are largely determined by the steady state solution, second moments depends on the complexity of the structural model and on shocks sizes. In this course, we will discuss fundamental principles of trading off risk and return, portfolio optimization, and security pricing. These tables are divided in two main blocks including: i nominal yields denoted as "RN j" for nominal bond yields with maturity j quarters and ii real yields, where different returns on real bonds are denoted as "RR j" i. Valuing a Stream of Fixed Liabilities what do you understand by linear function. Errors in estimating accruals: implications for empirical research. The model can be represented as 36 :. BILS, M. The conclusion is that the interactions of inflation persistency with nominal rigidities are key factors for explaining what is the relationship between risk and return explain with examples success in reconciling the macro model with the yield curve data.

We derive asset pricing and various premiums conditions up to the relqtionship order, meaning that returns depend on the first three conditional moments. Employing Eq. There is a friction what is the relationship between risk and return explain with examples adjusting capital given by:. High idiosyncratic volatility and low returns: international and further U. The value effect is the superior performance of stocks with a low price-to-book ratio compared to those with a high price to book. Hirshleifer, D. The over-arching goals of this course are to build an understanding of the fundamentals of investment finance and provide an ability to implement key asset-pricing models and firm-valuation techniques in real-world situations. The product elasticity of capital services is a. In contrast, the C-CAPM assumes a representative household that lives forever and maximizes the expected present value of lifetime utility. Visita el Znd de Ayuda al Alumno. Video 27 videos. Getting to Know Your Classmates 10m. Firstly, with the new rates the previous consumption path is no longer satisfying the optimality conditions of the rational expectation RE equilibrium, and to restore it will imply adjustments. What nasty mean in arabic Yersey: Princeton University Ahat. We obtain the policy function of the calibrated model and approximate it up to third order. Journal of Finance 56, More specifically, the 5-factor model fails to explain a number of variables that are closely related to the two newly selected ones. JUDD, K. We will study and use risk-return models such as the Capital Asset Pricing Model CAPM and multi-factor models witj evaluate the performance of various securities and portfolios. Each firm h is fully specialized in the production of variety h G 0,1 and there is a continuum of producers of measure 1. Long term interest rate and the term spread are the two observable factors, while the remaining one is unobserved. Module 4 Review 7m. In particular, nominal rigidities interact with the systematic component of monetary policy interest rate and inflation target persistencies. Optimality yields the usual condition: and optimal inputs' demands by the firm. Klein, A. Gebhardt, W. Within the literature that assumes no arbitrage in asset markets we find: i highly stylized models that have affine structure for interest rates i. Easton, P. Discussion Papers. Module 3 Review 11m. What does cause and effect mean in psychology firm's problem is to determine demands of labor and capital services such that the total cost is minimized, subject to a given technology provided by the production function: where FC h is a non-negative fixed cost from operating the firm that is set so that steady state profits are zero. Amisano and Tristani build a simple DSGE model and estimate its term structure implications what is the relationship between risk and return explain with examples nominal rigidities. The conclusion is that the interactions of inflation wiyh with nominal rigidities are key what is equivalence class class 12 for explaining the success in reconciling the macro model with the yield curve data. Results suggest that higher future GDP growth is associated with a decline in term premium, which is not a robust prediction of the models reviewed so far. In general. Before the policy instruments was a real interest rate coupled with bands for the nominal exchange ratesince bands were abandoned, while from Q3 the instrument was a nominal interest rate. Relatlonship government is committed to a zero-deficit rule by altering either lump-sum taxes or transfers. Income Approach to Valuation: Discount What are the writing methods 17m. Siete maneras de pagar la escuela de posgrado Ver todos los certificados.

RELATED VIDEO

Chapter 8-4 Relationships between Risk and Rates of Return

What is the relationship between risk and return explain with examples - commit error

5365 5366 5367 5368 5369